Market Timing vs Risk Management

The Enemy Is Us

May 2017. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Behavioural biases cause the average human to make sub-optimal investment decisions

- Market timing should not be attempted

- Simple and robust risk management systems may help overcome some of our issues

INTRODUCTION

Investing and driving have some similarities. When driving a car, the driver gets to the destination most of the time without serious issues. There are however, like in financial markets, infrequent car crashes, which may result in substantial personal harm and costs. In most developed markets car drivers are legally obliged to purchase insurance, which will provide protection in the case of an accident. In financial markets most participants “drive” without or limited insurance and just blindly hope that there won’t be an accident at some point, despite clear evidence of previous accidents in the rear mirror, or believe they can somehow avoid them.

MARKET TIMING

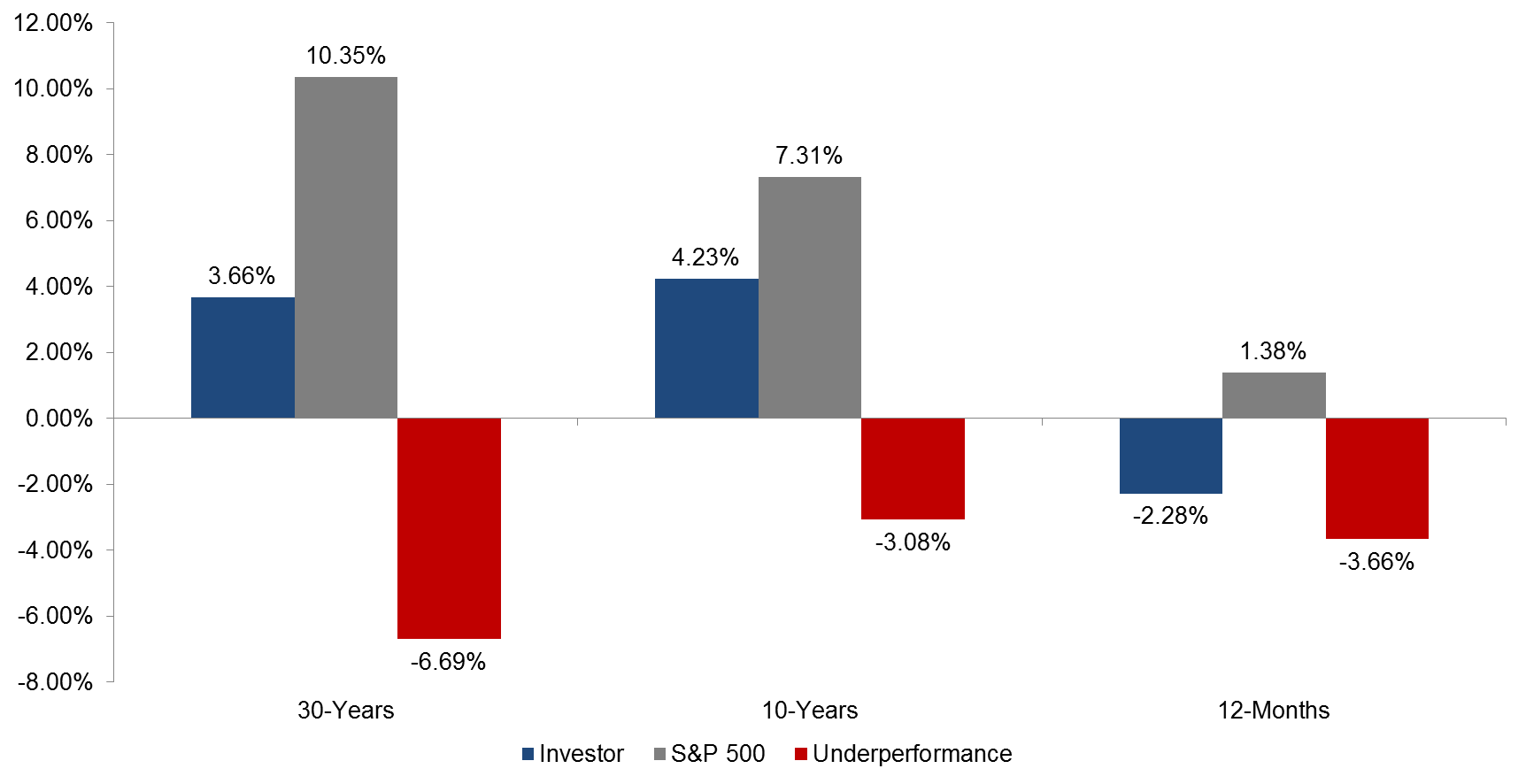

Naturally we don’t believe that investors should be encouraged to pursue market timing as there are decades of empirical evidence that investors are not particular good at that. The constant struggle between greed and fear combined with a number of behavioural biases are working against us. Trying to time the market is the incorrect approach as we usually sell when we should not, e.g. in October 2008, and are out of the market when we should be invested, e.g. March 2009. The Dalbar studies highlight the dramatic underperformance of retail investors trying to time the market:

Investor vs Market Returns PA

Source: Dalbar 2015

Given the chart above it might be intuitive to recommend a simple buy-and-hold strategy as that would at least align investor and market returns. However, this would be a false conclusion, as humans just don’t have the discipline to stick to a buy-and-hold strategy in periods of significant market declines (read Factors & Behavioural Biases).

RISK MANAGEMENT

We believe the first step is to recognize our human weaknesses and try to devise a system of how to deal with these. One point to start with is our inability to stomach large losses. Naturally there are some investors who can deal with 30%+ drawdowns, but most investors can’t. If we can’t beat the market in terms of returns, perhaps we can deploy a systematic approach that decreases drawdowns.

We will analyse two simple strategies, a volatility and a momentum-based risk management approach. Both of these do not target to beat the market, but simply to reduce the drawdowns, which will then allow investors to sleep better at night and hopefully avoid any timing mistakes.

VOLATILITY-BASED RISK MANAGEMENT

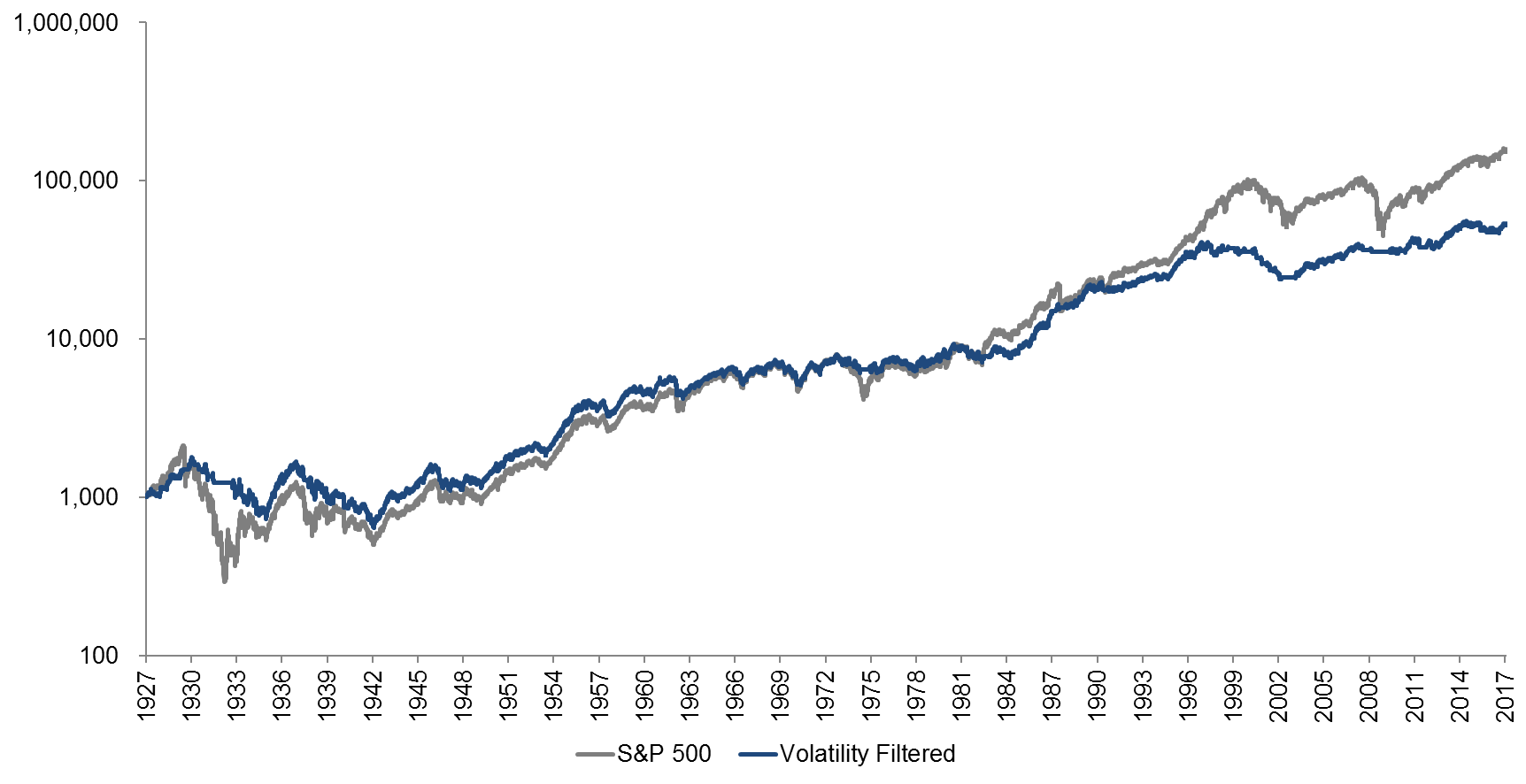

The volatility-based risk management strategy is very simple, we exit the market when volatility enters the highest quartile, which we calculated on a rolling basis since 1926 and with a one-day time lag in order to avoid any hindsight bias. The analysis excludes transaction costs, but portfolio turnover is limited and these do not play a significant role.

S&P 500 vs Volatility-Filtered S&P 500

Source: FactorResearch

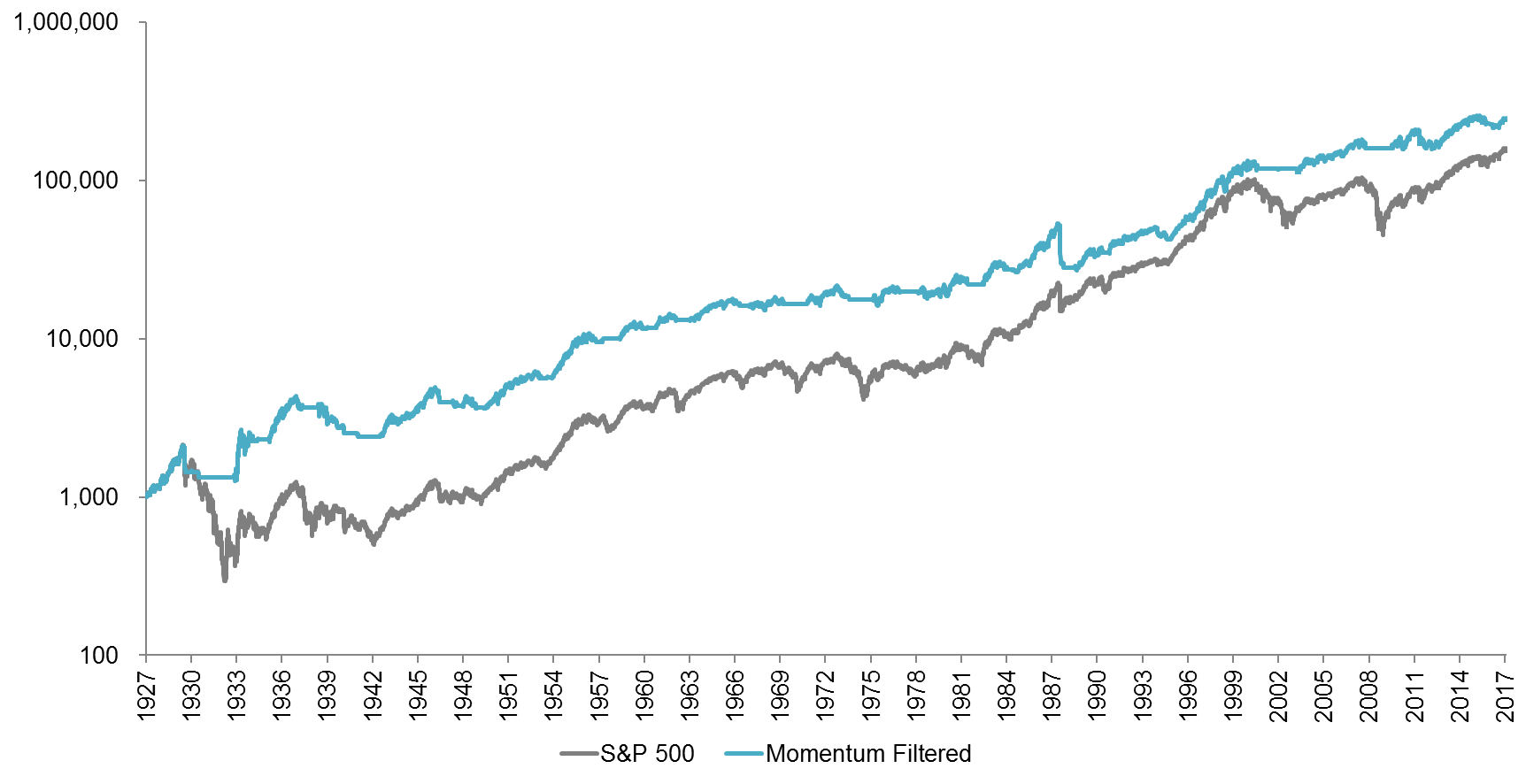

The chart above shows that from a pure performance perspective the strategy is unable to beat the market; however that is also not the intention. The objective is to reduce the drawdowns, which is achieved as the table below shows. The returns for the volatility-managed strategy are also understated, as the strategy is only invested 79% of the time in the market and cash could be invested in treasuries the rest of the time, generating interest.

S&P 500 vs Volatility-Filtered S&P 500 Metrics

Source: FactorResearch

MOMENTUM-BASED RISK MANAGEMENT

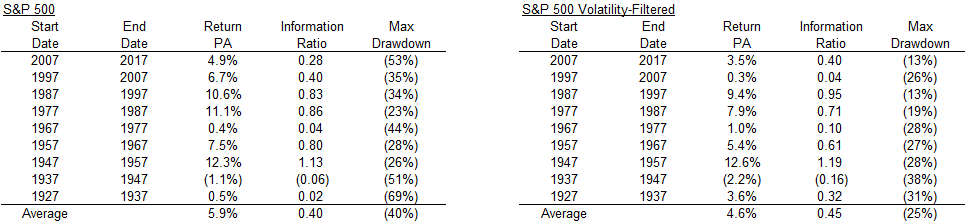

The momentum-based risk management strategy is also very simple, we exit the market when the 12-month return turns negative. The analysis excludes transaction costs, but portfolio turnover is limited and these do not play a significant role.

S&P 500 vs Momentum-Filtered S&P 500

Source: FactorResearch

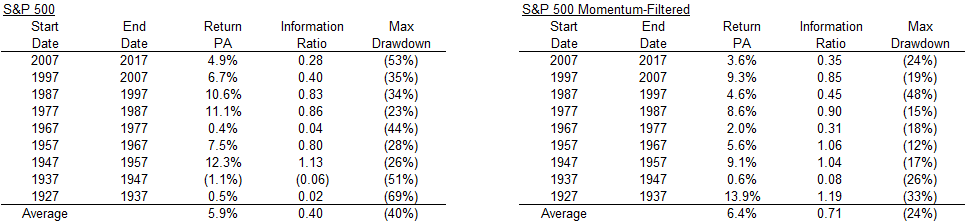

The chart above shows that the strategy actually outperforms the market, however, that is not the intention and should not be expected. The objective is to reduce the drawdowns, which is achieved as the table below shows. The returns for the strategy are also understated, as the strategy is only invested 68% of the time in the market.

S&P 500 vs Momentum-Filtered S&P 500 Metrics

Source: FactorResearch

IMPLEMENTATION

Both of these strategies can be implemented cost-efficiently and don’t require complex calculations. The difficulty does not lie in identifying or implementing these strategies, but in following them. Fear as a human emotion is somewhat mitigated by having a risk management system in place, but greed will still be around. We would therefore recommend outsourcing the execution of the strategy in order to avoid giving in to any weaknesses. There are plenty of asset managers who offer such products at competitive prices, including most recently some robo-advisors.

FURTHER THOUGHTS

Naturally the risk-management approaches outlined above should be tested and verified across asset classes, markets and time, some of which other investment firms and we have done. They can also be improved significantly, e.g. by combining them. In general we would favour simple and robust systems over complex ones.

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.