Factor Olympics Q3 2020

And the winner is…

October 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Momentum & Quality are leading the performance scoreboard in Q1-3 2020

- Value & Size generated negative returns, like in recent years, and Low Volatility ended a 10-year fantastic run

- 2020 is shaping up as a year of highly dispersed factor returns

INTRODUCTION

We present the performance of five well-known factors on an annual basis for the last 10 years. We only present factors where academic research supports the existence of positive excess returns across market cycles and asset classes. Strategies like Growth might be widely-followed investment styles, but lack academic support to be considered a factor and are therefore excluded (read Factor Olympics 1H 2020).

METHODOLOGY

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

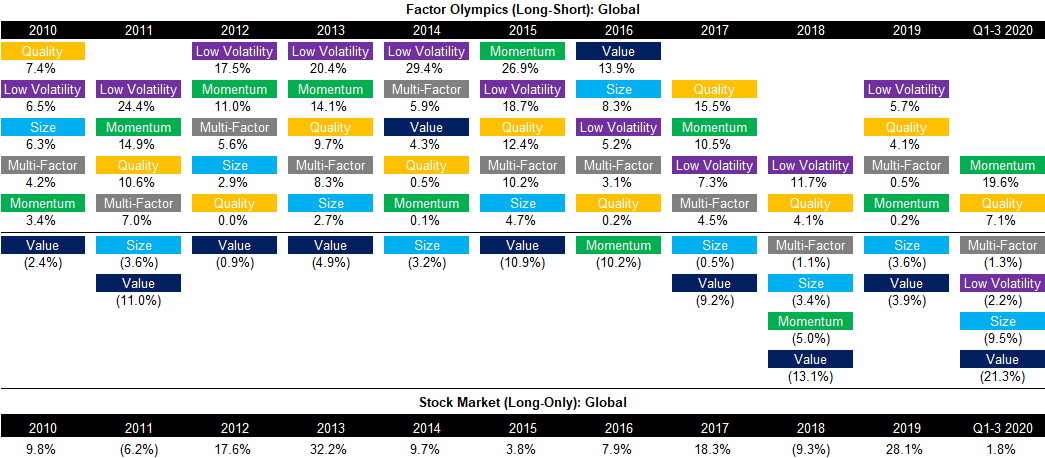

FACTOR OLYMPICS: GLOBAL

The table below shows the long-short factor performance for the last 10 years ranked top to bottom. The global series is comprised of all developed markets in Asia, Europe, and the US. Aside from displaying the factor performance, the analysis highlights the significant factor rotation in terms of profitability from one year to the next, highlighting the benefits of diversified exposure.

Diversification in factor investing is as essential as when buying stocks or bonds. However, diversification has not helped most classic multi-factor portfolios in 2020 as these tend to feature Value as a core component, which is having its worst drawdown since the tech bubble in 1999. Combining small-cap and cheap stocks, which has been a popular mutual fund category, has been hit especially hard. For example, the Russell 2000 Value Index has lost 21.5% in year-to-date 2020 compared to a gain of 5.5% for the S&P 500. Also quite notably, the Low Volatility factor posted negative returns for the first time in a decade.

Source: FactorResearch

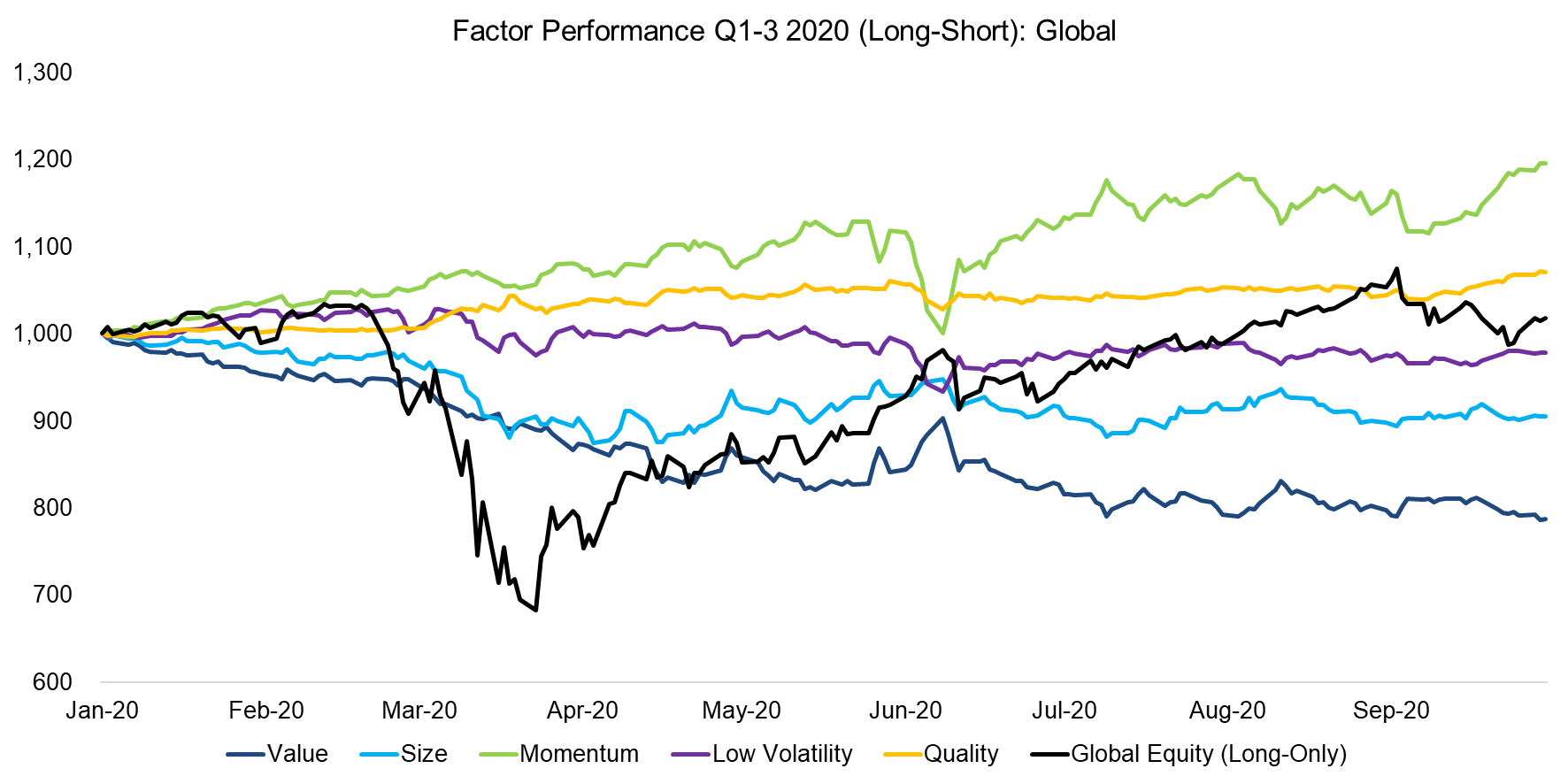

FACTOR PERFORMANCE Q1-3 2020: GLOBAL

Despite all odds, global equity markets have recouped all losses from the first and second quarters of 2020. However, in spite of the dramatic recovery and changes in our lifestyle, the trends in factor performance have continued to be relatively consistent throughout the year. It almost seems as there was no pandemic.

Momentum and Quality performed well before the onset of the COVID-19 crisis and have extended their positive returns since then. Similarly, cheap stocks are continuing to underperform with high consistency. Small-cap stocks have partially recovered their initial losses while low-risk stocks have generated flattish returns year-to-date.

There was a brief rotation towards the Value factor and away from Momentum stocks in early June 2020 as the optimism about a quick resolution of the COVID-19 crisis and a healthier economy surfaced. However, the sentiment quickly turned risk-averse again and the factor rotation collapsed.

Source: FactorResearch

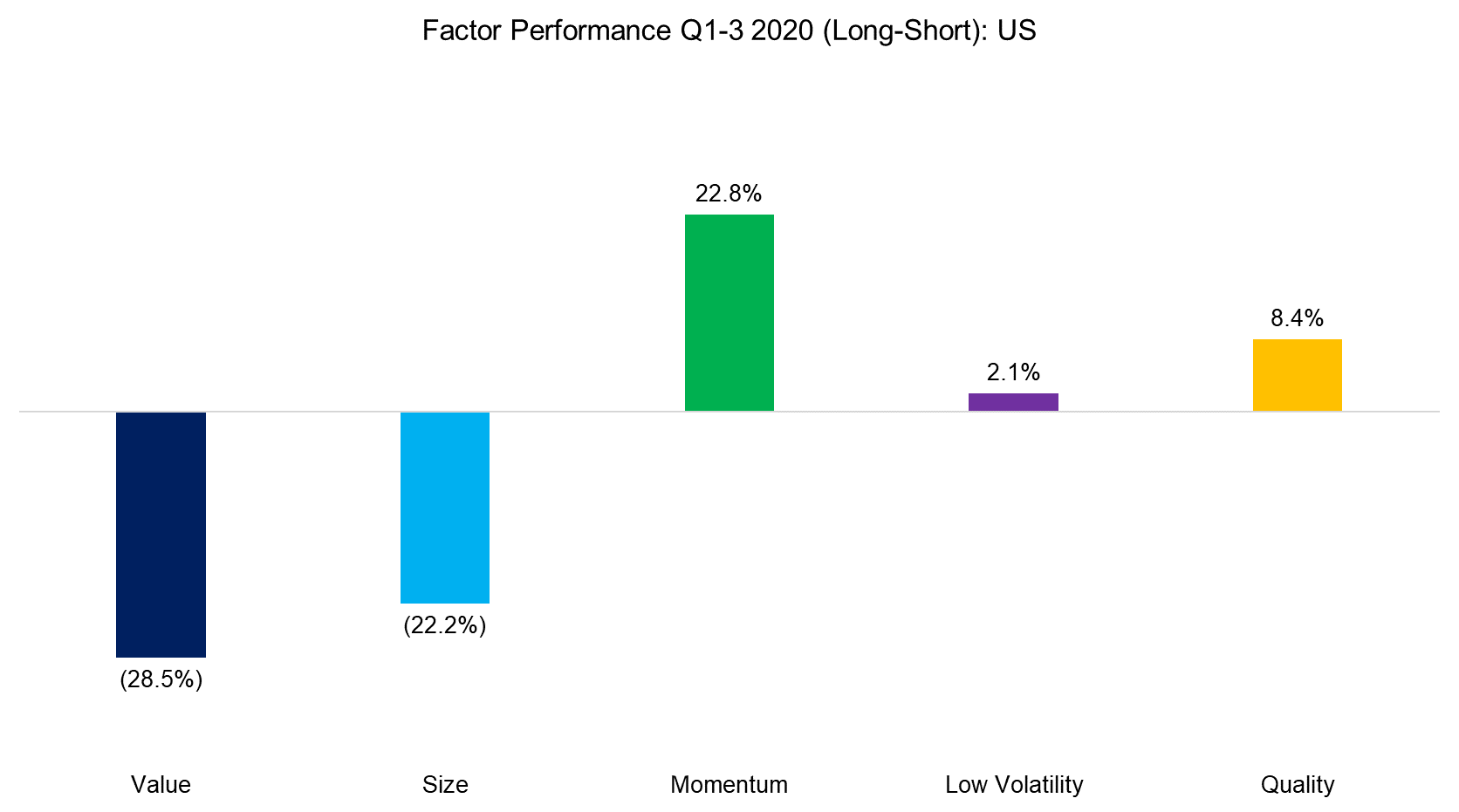

FACTOR PERFORMANCE Q1-3 2020: US

Global portfolios are significantly weighted towards the US, so it is not surprising that factor performance in the US and the global returns are much alike.

The dispersion of factor returns in the US has been high in 2020 with the Value and Size factors having had lost more than 20% while Momentum has gained more than 20%. Investors are likely used to the Value factor disappointing given more than a decade of poor returns, but the failure of Low Volatility to generate better returns during the crisis likely surprised investors. The poor performance can partially be attributed to the certain sector biases in the portfolio, i.e. long positions in unexciting, but low-risk sectors like real estate and short positions in more volatile sectors like technology. Being short Zoom or Netflix and long shopping center REITs was not helpful positioning for a pandemic, although that just reflects the nature of the portfolio construction.

Source: FactorResearch

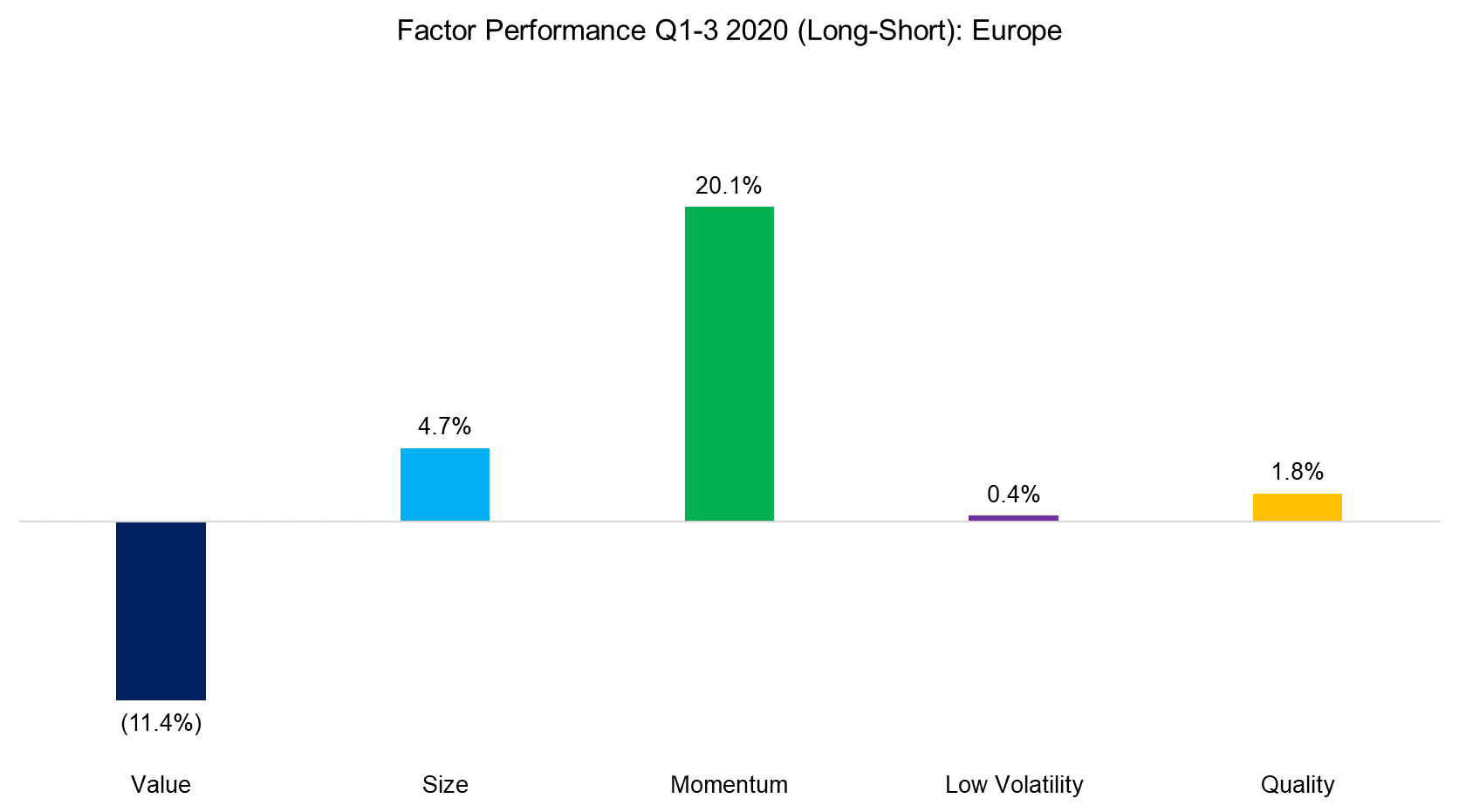

FACTOR PERFORMANCE 1H 2020: EUROPE

Factor performance in Europe is typically similar to the US in the direction of returns, which highlights that factors have the same performance drivers across markets.

However, there was a large divergence in the performance of the Size factor, which was negative in the US while positive in Europe. The difference in performance between the two markets has continued to widen in the third quarter of 2020 and is explained by the composition of the economies and stock markets. European large caps tend to be export-oriented firms that are more negatively impacted by reduced global demand for industrial goods than small caps. In contrast, large caps in the US are dominated by tech stocks like Amazon that are benefitting more than small caps from the COVID-19 crisis.

Source: FactorResearch

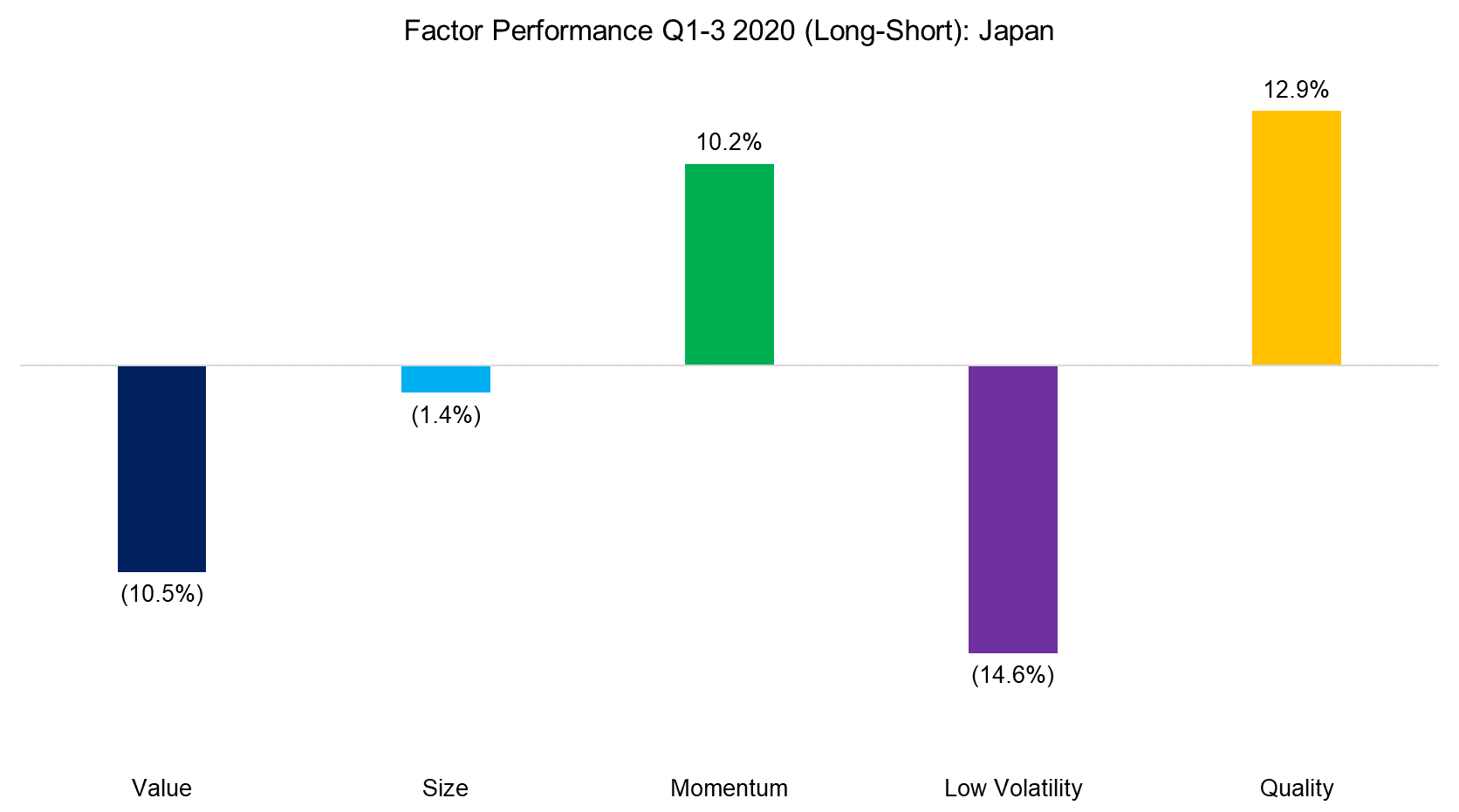

FACTOR PERFORMANCE 1H 2020: JAPAN

The long-term returns of common equity factors in the Japanese stock market have been lower than globally, but directionally the trends in performance were typically the same, e.g. Value in Japan mirrors Value globally.

If investors in the US were disappointed by the performance of the Low Volatility factor in year-to-date 2020, then Japanese investors were likely even more dissatisfied given that it even underperformed the Value factor. Even though low-risk stocks offered capital protection characteristics in previous crises like during the GFC in 2008, it is worth mentioning that no strategy works all of the time.

Source: FactorResearch

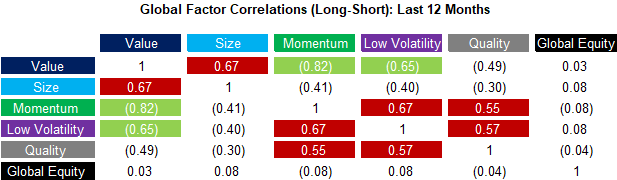

FACTOR CORRELATIONS

The correlation matrix below highlights the global one-year factor correlations based on daily data. As of the third quarter of 2020, we observe essentially two highly correlated factor groups: Value and Size versus Momentum, Quality, and Low Volatility. This correlation structure can be considered normal, e.g. Value and Momentum tend to be negatively correlated over time. However, the magnitude of the correlations is relatively high and should give investors pause for consideration if they have too much of the same exposure in their portfolios.

Source: FactorResearch

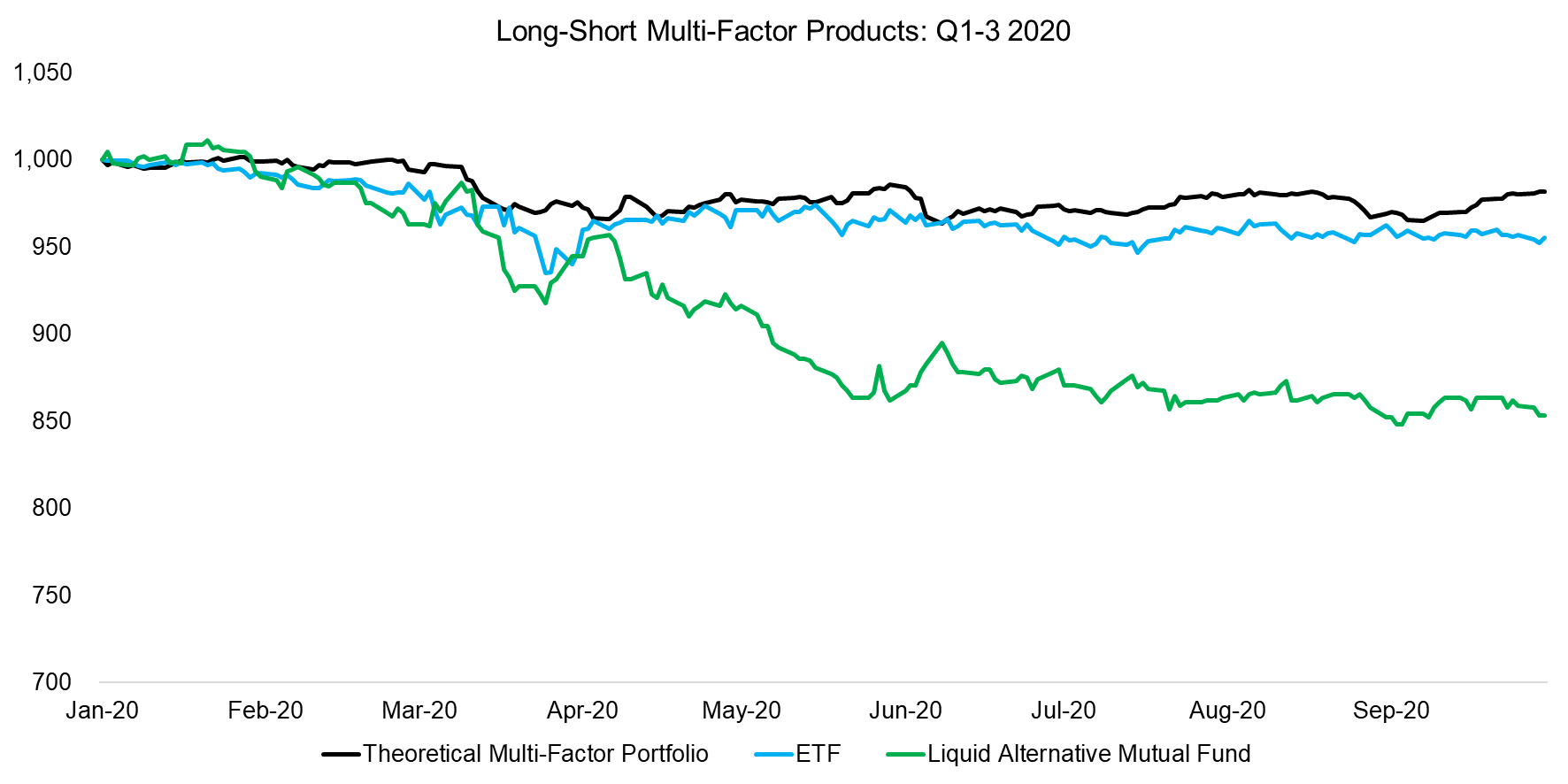

LONG-SHORT MULTI-FACTOR PRODUCTS

Finally, we analyze the performance of long-short multi-factor products, specifically one ETF focused on European equities and a liquid alternative mutual fund trading global equities. It is worth highlighting that we tracked four such products at the beginning of 2020, but two of these have been liquidated as investors redeemed most of their capital (read Multi-Factor Smart Beta ETFs).

We observe that both products have been consistently losing money since the beginning of the year, similar to a theoretical long-short multi-factor portfolio, which is after transaction costs, but before product fees. The poor performance highlights that even diversifying across factors can lead to significant drawdowns over time. Factor investing is certainly not a free lunch.

Source: FactorResearch

FURTHER THOUGHTS

There is little evidence that market timing works, although it does matter how it is attempted. Using valuations is likely the most common approach and some research, including our own, indicates that although valuations are not useful for making short-term calls on the stock market, they are informative on the long-term outlook for returns.

From this perspective, it is worth noting that the Value factor is trading between cheap to cheapest ever, depending on which metric is used for measuring the difference in valuations between the long and short portfolios. It is certainly cheaper than when we made similar comments one, two, and three years ago.

Having said this, there is other research that highlights that the Momentum investment framework can also be applied to factors, which makes a case against allocating to Value currently as the downward trend is unbroken. It would require the Value to rally significantly, or other factors to perform poorly for some time, before it becomes attractive from a Momentum perspective.

RELATED RESEARCH

How to Evaluate Smart Beta ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.