Building a Long Volatility Strategy without Using Options – II

A systematic approach to creating portfolio protection

August 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Long volatility strategies can be built without using options

- Portfolios would have primarily consisted of certain currency pairs and treasury bonds

- They lack explosive returns when volatility spikes, but they also lack the bleed

INTRODUCTION

Almost all asset classes are implicitly short volatility as they are bets on the economy doing well. Occasionally there are periods like during the tech bubble in 1999 when stocks were volatile and going up, but mostly increasing volatility means markets are declining or crashing as a result of deteriorating economic conditions.

Bonds are also bets that governments and corporates are able to repay borrowed capital, which is more likely when the economy is not heading into a recession. The same applies for private equity or real estate – try selling that private company or office building when GDP is contracting.

Given this, most investors’ portfolios are not diversified properly as they lack exposure to long volatility strategies. The three core reasons for this is that i) long volatility strategies are painful to hold as they tend to lose money most of the time, ii) they lose money when almost every other asset class generates positive returns, and iii) they are complex as they usually use options in the portfolio construction.

We recently explored a naive approach to creating a long volatility strategy systematically without using options. The model was to select asset classes that were highly correlated to the VIX when the index spiked. However, our analysis was based on 13 periods in the period between 2006 and 2021, which is a limited sample size. It is also not a particularly dynamic approach (read Building a Long Volatility Strategy without Using Options).

In this research note, we will explore building a dynamic and systematic long volatility strategy.

CONSTRUCTING A DYNAMIC & SYSTEMATIC LONG VOLATILITY STRATEGY

Our framework is to select asset classes from a set of 59 indices that are highly correlated to the VIX and measure the correlation on a daily basis. Specifically, we select the top 5% of indices that were most highly correlated, which results in a concentrated portfolio of only three securities. The set of indices comprises all available asset classes – equities, bonds, commodities, and currencies.

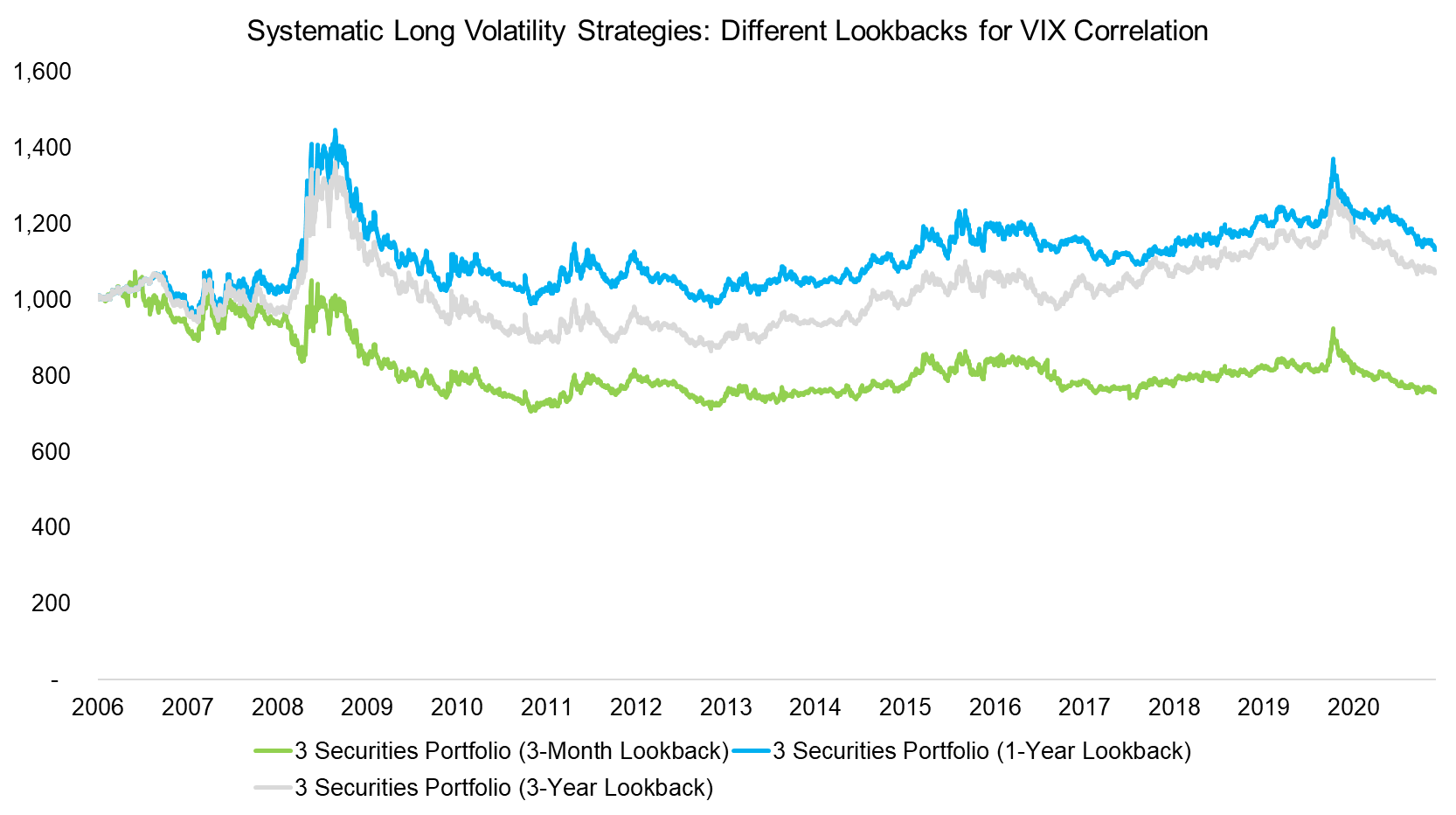

The results highlight a performance that essentially created a zero return between 2006 and 2021. However, we do observe long volatility characteristics given strong positive returns during the global financial crisis in 2009 and COVID-19 crisis in 2020. It is interesting to note that the return profile is approximately the same regardless of which lookback period is used for calculating the correlation to the VIX.

Source: FactorResearch

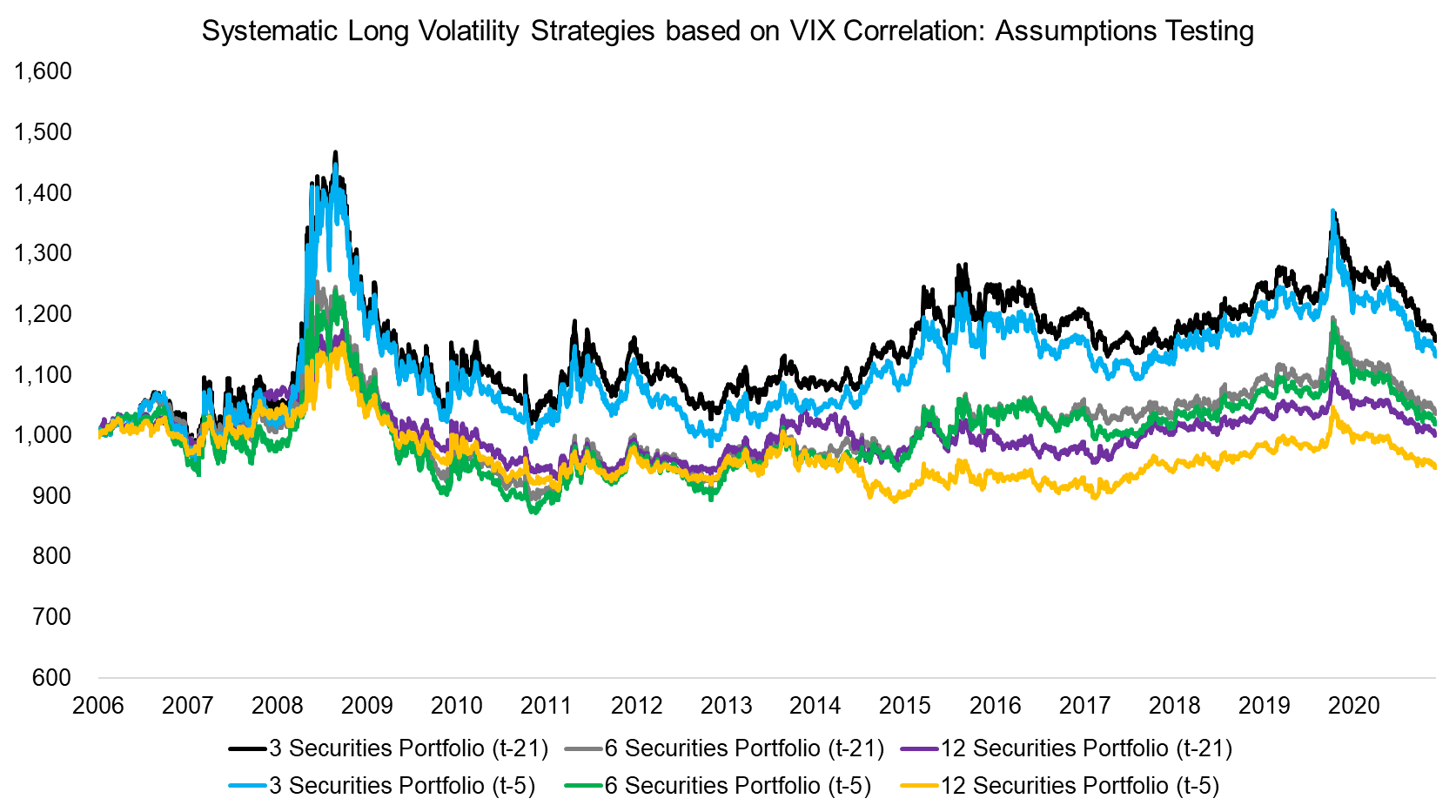

In order to further test the robustness of the framework, we change some of the other assumptions. Increasing the number of securities in the portfolio decreases the return, which is typical for quantitative strategies as portfolios become less concentrated.

In order to avoid a hindsight bias, the portfolio is rebalanced based the correlation of the VIX to the indices from last week (t-5). However, taking an even more delayed trading signal from last month does not change the results significantly.

We evaluated further changes, but none changed the return profile significantly, which highlights a degree of robustness and should be regarded as a positive attribute.

Source: FactorResearch

BREAKDOWN BY ASSETS

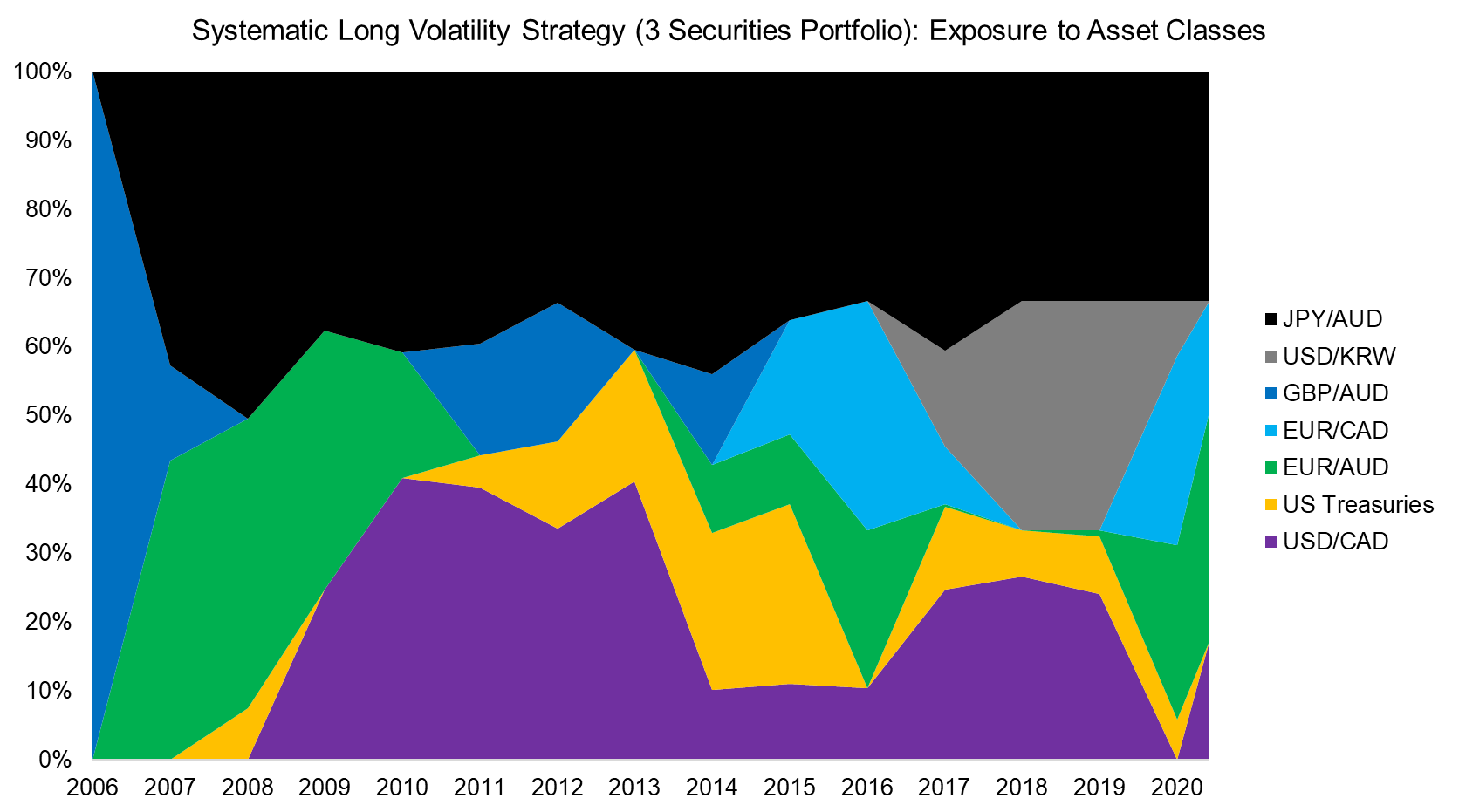

Next, we investigate what asset classes were included in the long volatility portfolio comprised of three securities. This analysis highlights that there was no exposure to commodities like gold, which is surprising given that investors often discuss gold in the context of hedging portfolios. It seems that gold is perhaps more relevant for hedging against inflation rather than against stock market crashes (read Hedging Market Crashes with Factor Exposure).

The portfolio was primarily comprised of currency pairs like JPY/AUD and USD/CAD, which represent short positions in the global carry trade, as well as bonds, specifically US Treasuries. These instruments are frequently called safety havens, so their inclusion is not unexpected.

Source: FactorResearch.

SYSTEMATIC LONG VOLATILITY STRATEGY VS VIX ETN

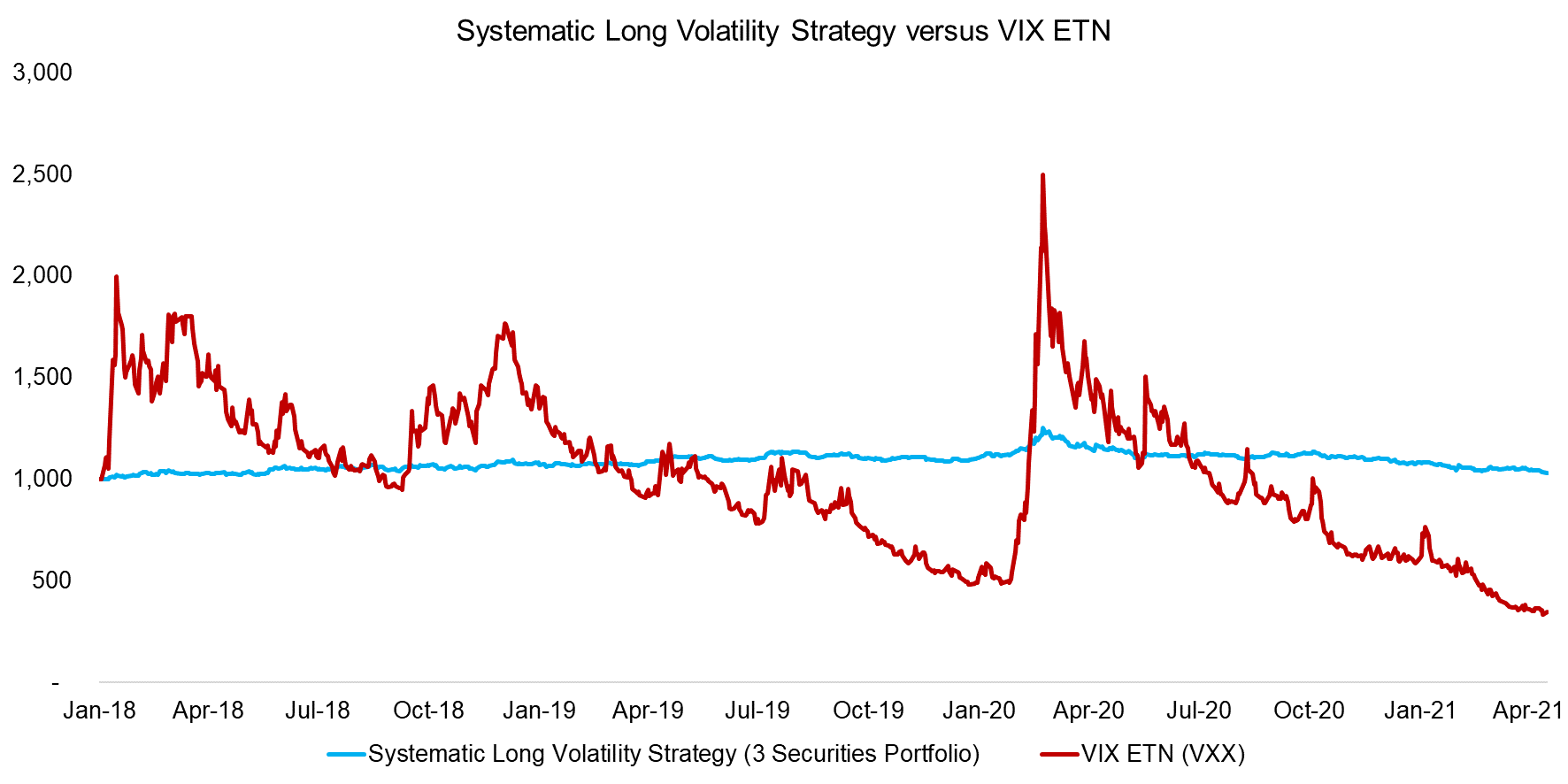

Investors could argue that there are products like VXX that provide direct exposure to the VIX, so there is no need to create a long volatility strategy systematically. Although these products exist, they are emotionally difficult to hold as they tend to generate strongly negative returns most of the time, and only occasionally positive returns. Stated differently, they exhibit strong positive skew.

Source: FactorResearch

DIVERSIFICATION BENEFITS FROM A LONG VOLATILITY ALLOCATION

The systematic long volatility strategy seems like a watered-down version of the VIX ETN. It did not lose money consistently, but it also did not produce outsized returns when volatility spiked during stock market crashes. Given this, it is questionable if the strategy is attractive to investors.

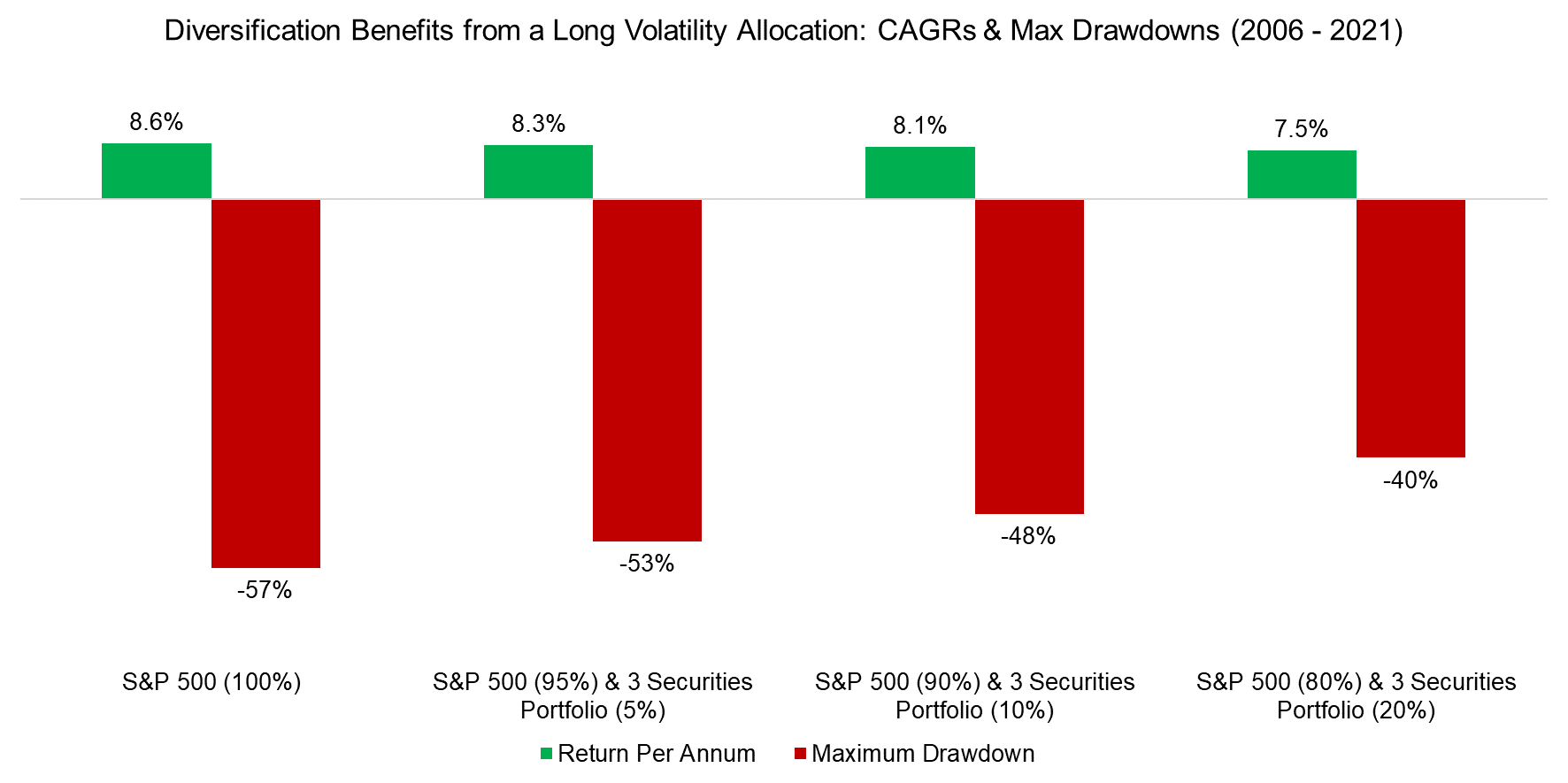

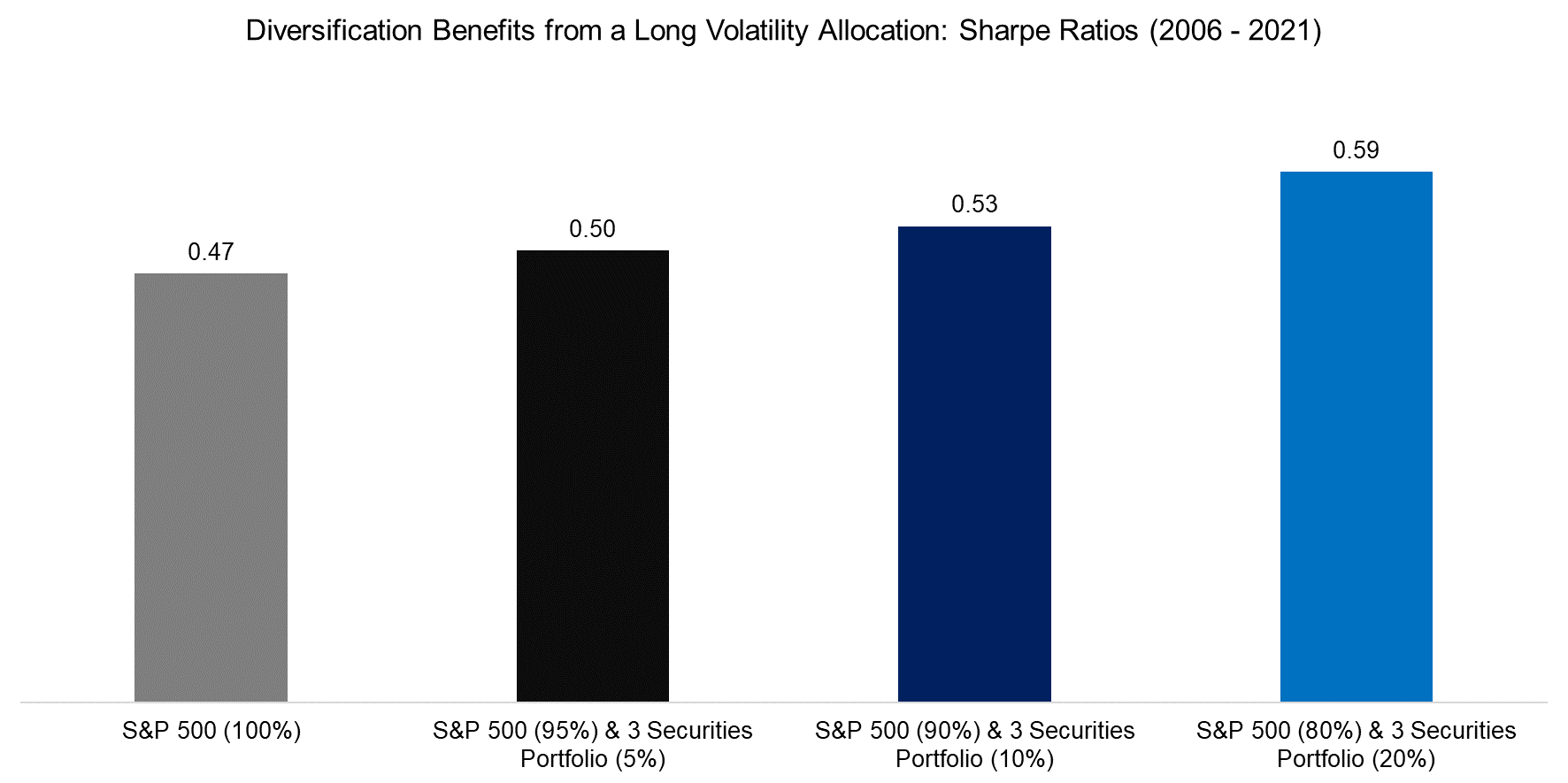

We simulate diversifying an equities portfolio with a long volatility allocation. We observe that the larger the allocation to the long volatility portfolio, the lower the return would have been. Naturally, this is expected as the S&P 500 increased significantly during 2006 and 2021, while the performance of the long volatility strategy was essentially flat.

Source: FactorResearch

However, we also observe that the maximum drawdowns decreased consistently, which highlights diversification benefits. Calculating Sharpe ratios for these combination portfolios shows that although absolute returns decreased, risk-adjusted returns would have increased.

Although investors can’t “eat” Sharpe ratios, most also can not execute a buy-and-hold strategy over a market cycle. The typical investor enters the market at peaks and sells at the bottom, driven by greed and fear. Adding a strategy that improves the consistency of returns on portfolio level and perhaps mitigates some of this behaviour seems desirable.

Source: FactorResearch

FURTHER THOUGHTS

There are a few thoughts on these results:

- It can be argued that the return profile represents rather a tail risk hedge than a long volatility strategy. Although these strategies are related, they are not the same. Tail risk strategies generate more extreme returns and only rarely positive ones, while the latter often benefit from rising as well as higher volatility.

- Given that the systematic long volatility strategy uses indices in the portfolio construction, it will exclusively be comprised futures contracts that can be leveraged efficiently. The allocation to the strategy does not need to be high if leverage is used, but it would still generate diversification benefits for an equity portfolio.

- A final thought would be to explore replacing the VIX with other risk metrics such as realized volatility or the high yield spread, which is an interesting topic for further research.

RELATED RESEARCH

60/40 Portfolios without Bonds

Creating Anti-Fragile Portfolios

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.