Thematic versus Momentum Investing

Performance chasing with a narrative versus systematic performance chasing

October 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Thematic products underperform the stock market on average

- The exposure to the momentum factor was low to negative recently

- Systematic performance chasing beats performance chasing with a narrative

INTRODUCTION

Space: the final frontier. Where no man has gone before….

Well, wealthy folks can now go there by booking a ticket with Virgin Galactic. It will not be deep space and it could be debated if that is space at all as it is merely a trip to earth’s orbit, but it will be on a space shuttle and passengers will experience zero gravity.

For people that can not afford the $450,000 ticket price but want to bet on the final frontier becoming the gateway for our civilization, they can invest in ETFs like the ARK Space Exploration & Innovation ETF (ARKG) or Procure Space ETF (UFO). These provide exposure to companies engaged in this space (pun fully intended).

Asset managers have made capital markets more exciting by launching hundreds of such thematic products that allow investors to speculate on topics ranging from artificial intelligence to the metaverse. However, exciting products are not necessarily wise ones. Also, thematic investing does sound like momentum investing.

In this research article, we will explore the differences between thematic and momentum investing.

PERFORMANCE OF THEMATIC INVESTING

Instead of aggregating all thematic products, we will focus on 10 themes in this analysis. We randomly select the themes from the ETF universe, where each thematic index is constructed by using at least two ETFs. Cumulatively these products manage close to $20 billion of assets and charge an average management fee of 0.61%.

The issue with thematic investing is that most investors only care about them if the narrative is supported by performance. There is nothing more seductive to investors than a great story combined with outsized returns.

However, this leads asset managers to launch many themes throughout the year as they do not know which one will outperform. They just need to be ready with marketing materials when that does occur.

Essentially, thematic investing is like venture capital: out of 10 products launched, six will fail and be liquidated quickly, three will financially break even, and hopefully one will be the star that attracts enough assets to make the strategy profitable (read Thematic Investing: Thematically Wrong?).

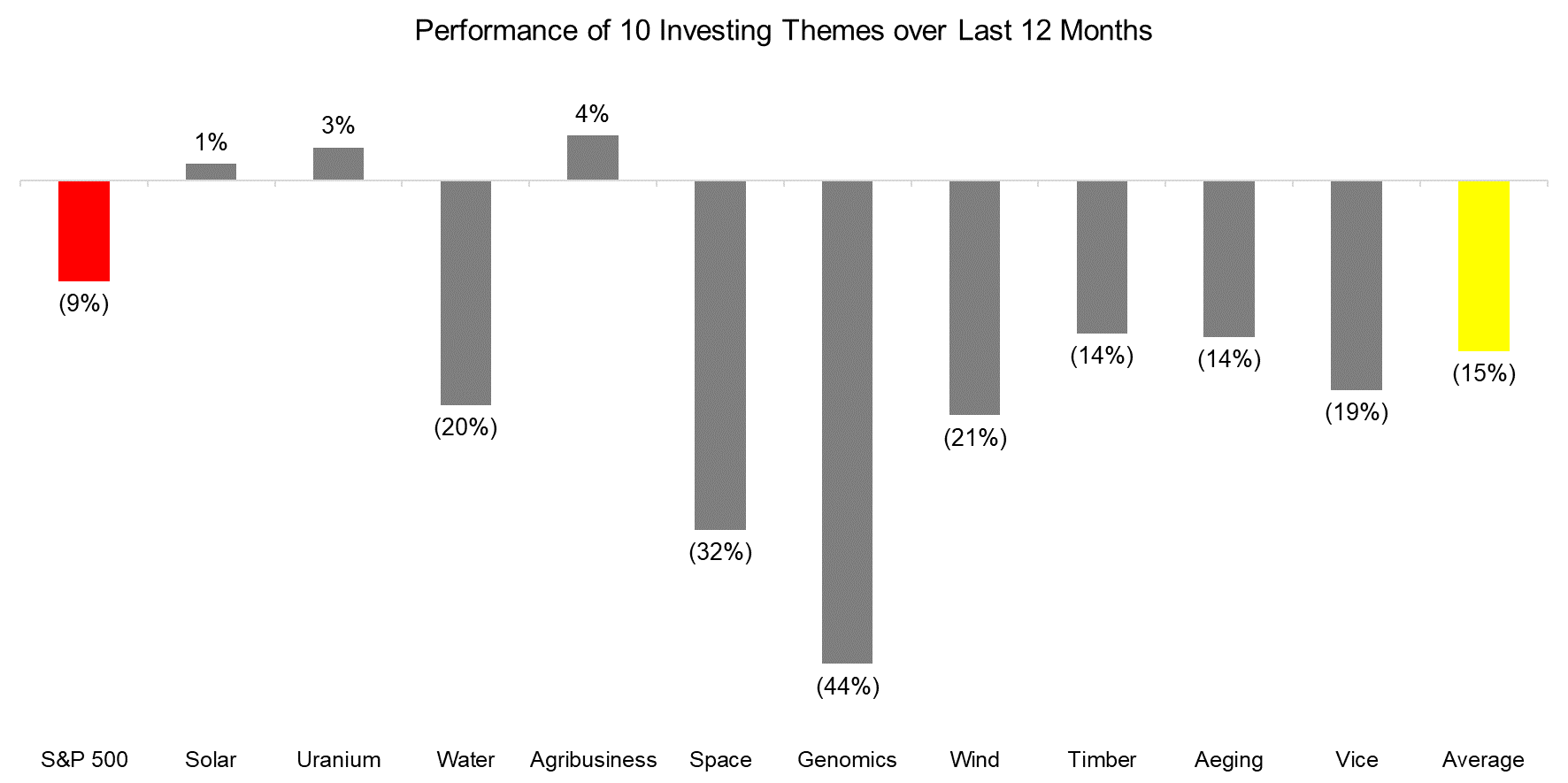

The performance of the 10 themes over the last 12 months approximately reflects this return distribution as they underperformed the S&P 500 on average. Seven generated significantly worse, and three better returns.

Source: FactorResearch

FACTOR EXPOSURE ANALYSIS

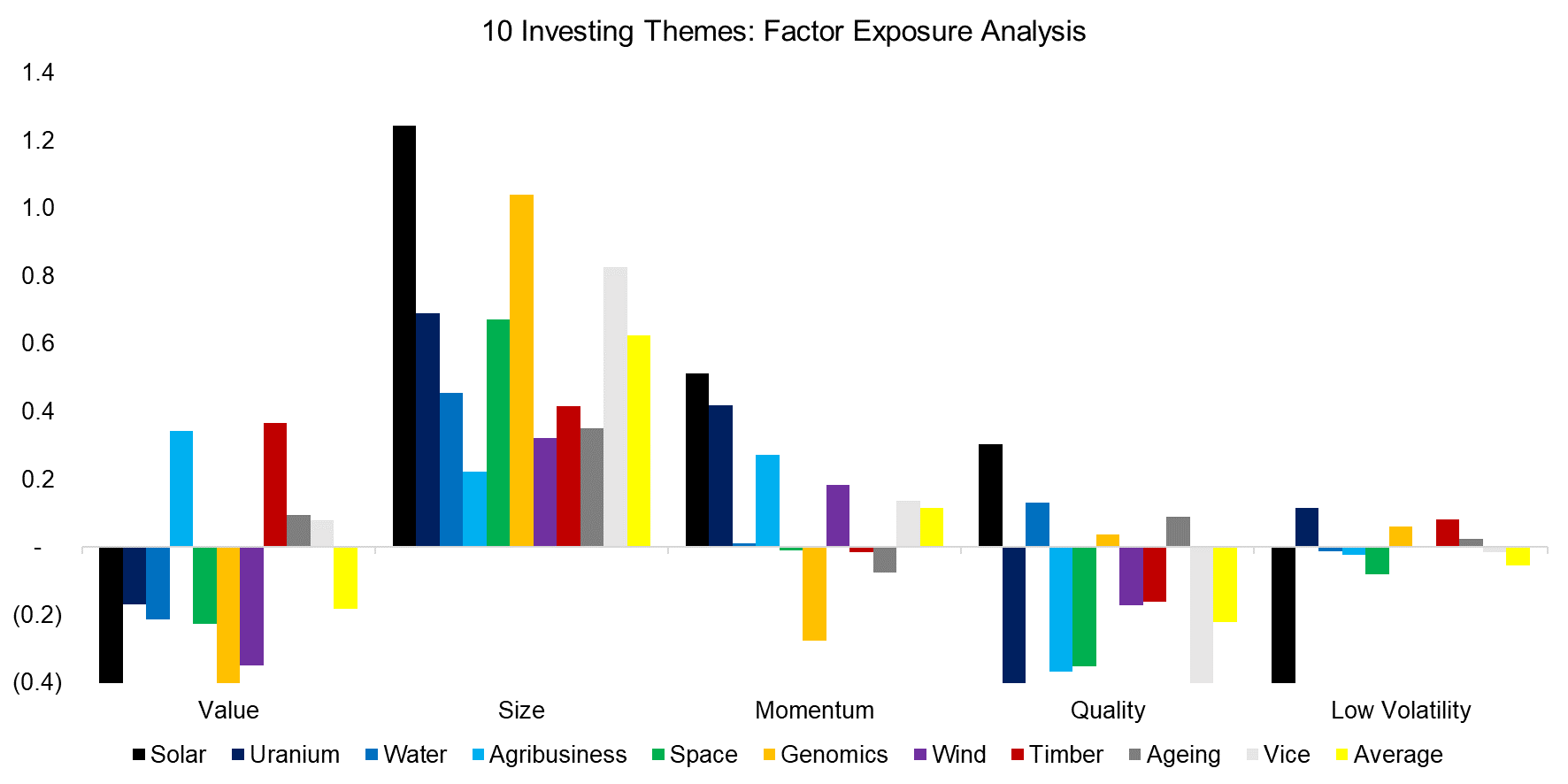

In order to get a better understanding of the performance drivers of these themes, we conduct a factor exposure analysis against five factors recognized by academic research via a simple regression analysis.

We observe that on average there was negative exposure to the value and quality factors, and positive exposure to size and momentum. Stated differently, the average portfolio is comprised of expensive, but outperforming small-caps that feature low-quality characteristics.

Some themes have more extremes factor betas than others, eg solar versus agribusiness. The R2 varied and ranged from 0.4 for solar to 1.0 for ageing, which implies some of these themes are driven by idiosyncratic rather than systematic factors.

Source: FactorResearch

THEMATIC VERSUS MOMENTUM INVESTING

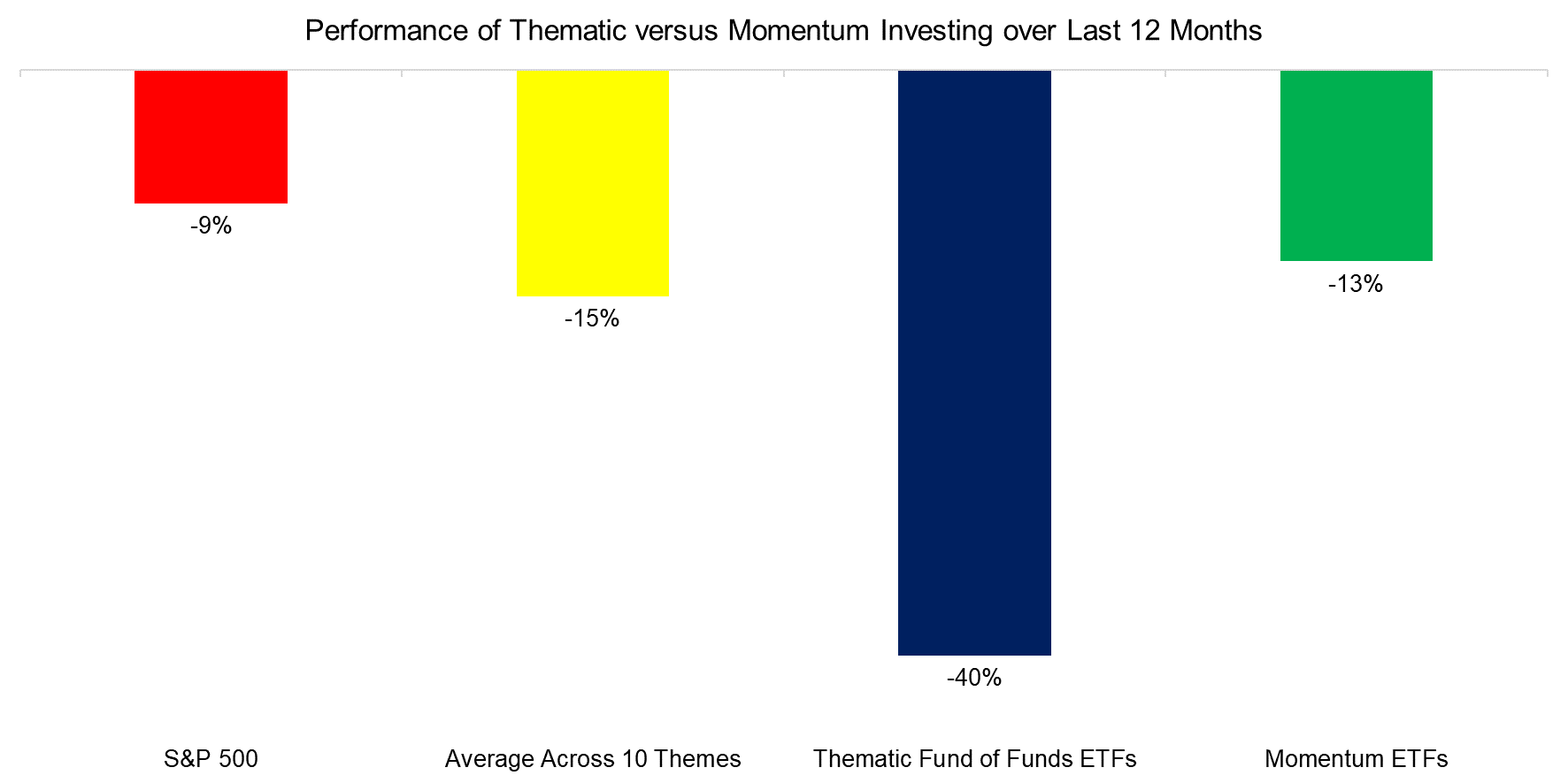

Next, we compare the performance of thematic versus momentum investing over the last 12 months. Given that it is so difficult for the average investor to select the winning themes, there are funds of thematic funds. These allocate to various themes based on discretionary or systematic investment frameworks.

We observe that thematic investing, regardless if calculated as the average across the 10 themes or chosen by fund managers, underperformed the S&P 500 and simple momentum ETFs. The latter simply pick the best-performing stocks, regardless of their affiliations to sectors or factors (read Momentum Variations).

We only used one year of performance data in this analysis, which can easily be challenged. However, it also shows how risky thematic investing can be over even short periods. Few investors have the discipline to stick to severely underperforming investing strategies.

Source: FactorResearch

The exceptional poor performance of funds of thematic funds is especially surprising as the assumption would be that these fund managers are skilled at selecting the right themes.

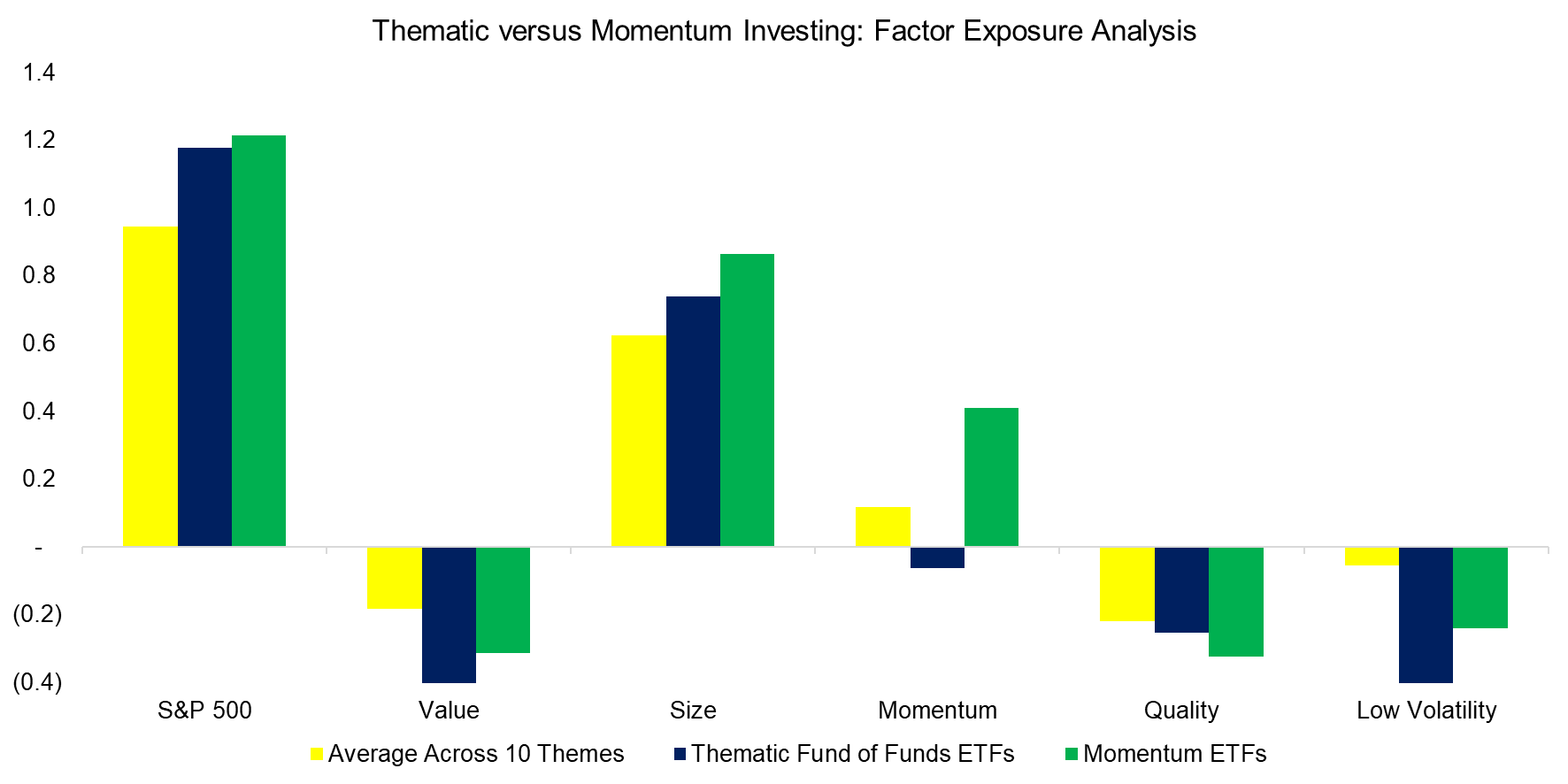

We run another factor exposure analysis that highlights that there is some overlap between thematic and momentum investing. Both feature negative exposure to the value and quality factors, as well as positive exposure to the size factor. However, thematic funds have low or negative exposure to the momentum factor, which explains their poor performance over the last 12 months.

The funds of thematic fund managers have been betting primarily on tech stocks, which can be inferred from the negative value and momentum factor betas. As growth stocks have underperformed value stocks recently, this has created substantial losses for their investors.

Source: FactorResearch

FURTHER THOUGHTS

Betting on space companies is akin to betting on railroad companies in the 1840s in the UK and Ireland, which is one of the early stock market bubbles that is well documented. It is certain that our civilization’s future lies amongst the stars, and the companies that will transport us there will be massive corporations.

However, actual space travel for a meaningful part of humanity may be decades away, similar to the genomics revolution that will transform our bodies, or artificial intelligence making our lives significantly easier.

If asset managers are unable to select the winning themes, it is highly unlikely that the average investor can. Given this, it is much better to pursue momentum investing, which at times may include stocks from exciting industries. Boring and simple, but effective.

RELATED RESEARCH

An Anatomy of Thematic Investing

Thematic Indices: Looking at the Past or the Future?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.