Hedging Bear Markets & Crashes with Tail Risk ETFs

Tail risk versus diversifying strategies

SUMMARY

- Tail risk ETFs have achieved similar return profiles despite different portfolios

- TAIL represents a traditional tail risk strategy, but offers limited diversification benefits

- BTAL is more diversifying, but not more than CTAs

INTRODUCTION

Although more than 3000 ETFs are trading on U.S. exchanges, the majority simply provide exposure to the stock market in various shades. Naturally, there are plenty of ETFs that track bond, commodity, or currency indexes that may diversify portfolios, but there are almost no ETFs for hedging against bear markets or crashes.

Given that investors are constantly discussing the issues of the economy and potential negative impacts on the stock market, this shortage of products is surprising.

There are only two ETFs that focus on protecting against stock market declines with track records longer than five years, which are Cambria’s Tail Risk ETF (TAIL) and AGF’s US Market Neutral Anti-Beta Fund (BTAL). TAIL charges 0.59% and manages roughly $100 million, compared to 0.45% and $250 million for BTAL. Simplify’s Tail Risk Strategy ETF (CYA) is a third product, but was only launched in 2021. Furthermore, CYA manages $2 million of assets and is likely to be delisted as the ETF declined by more than 99% since its listing.

In this research article, we will contrast TAIL versus BTAL.

STRESS TESTING PERIODS

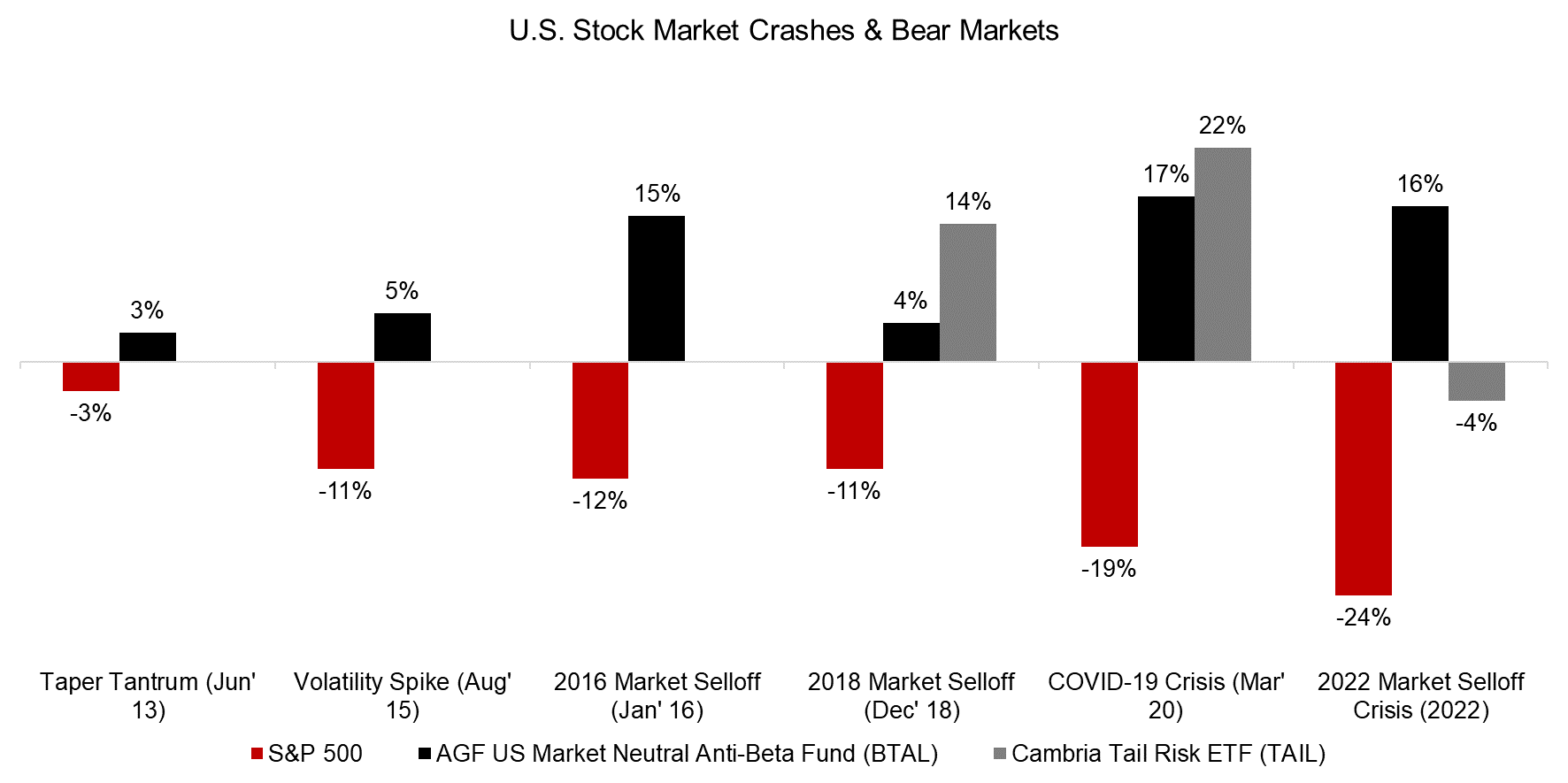

TAIL holds U.S. Treasuries and uses 1% of the assets under management per month to purchase put options on the S&P 500, while BTAL holds low-beta stocks while shorting high-beta stocks at the same time. Despite the significantly different portfolios, both strategies offered positive returns during recent times of market turmoil.

BTAL was launched in 2011 and generated positive returns in six periods where the S&P 500 declined between 3% and 24%. TAIL was listed in 2017 and generated higher returns in the market sell-off in 2018 and during the COVID-19 crisis in 2020 than BTAL, but a negative return during the bear market in 2022.

Source: Finominal

PERFORMANCE OF TAIL RISK ETFS

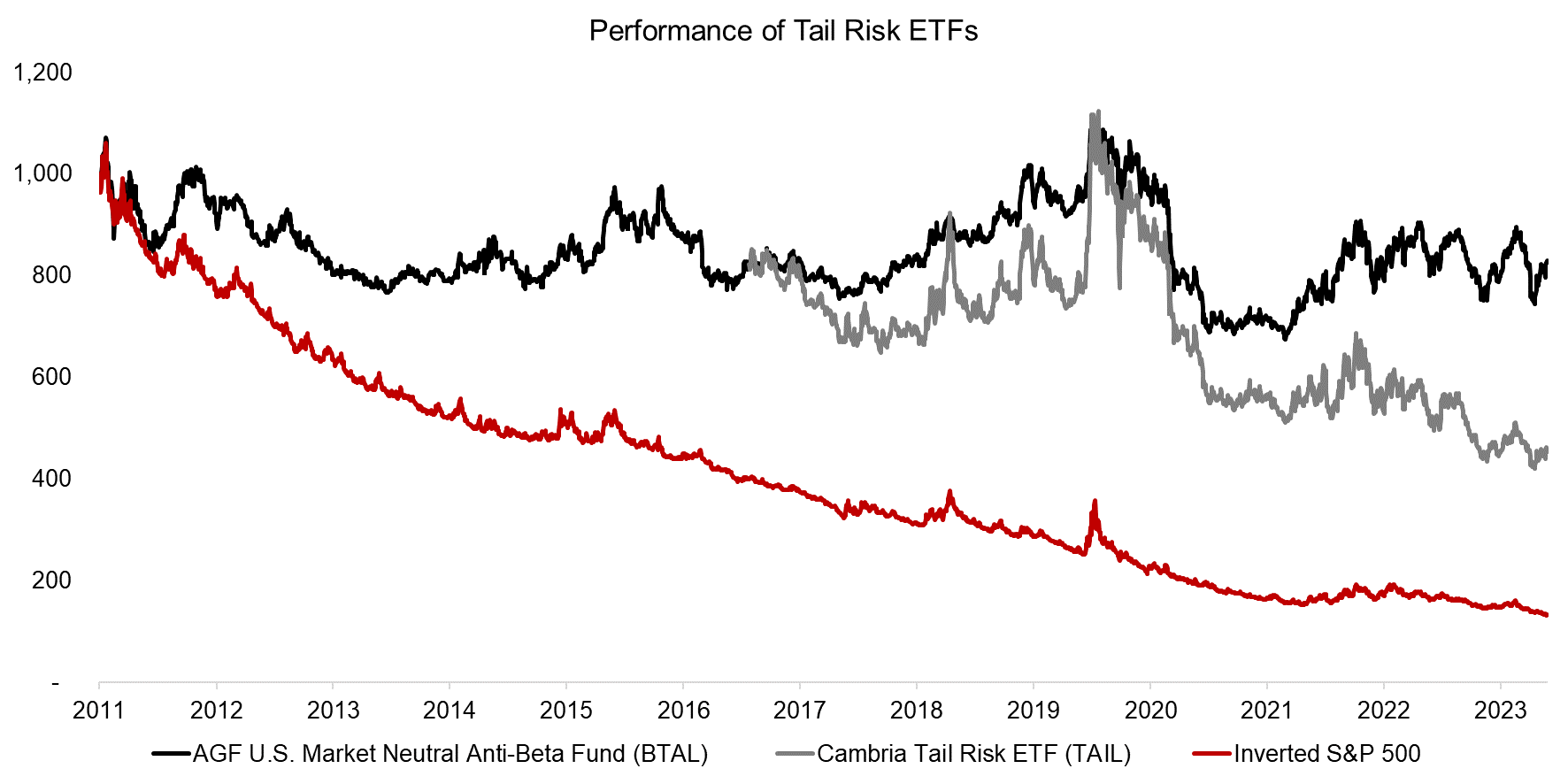

Instead of considering tail risk products, an investor could have shorted the stock market or used inverse ETFs. However, this would have been a consistently losing strategy over the last decade as the U.S. stock market was mostly in a bull market.

We observe that TAIL and BTAL also lost money steadily, but less than by shorting the stock market directly. Given the use of options, TAIL tends to generate higher returns than BTAL when stocks crash and volatility spikes, but also loses more when stocks recover, or when it’s a bear market rather than a crash.

Source: Finominal

CORRELATION ANALYSIS

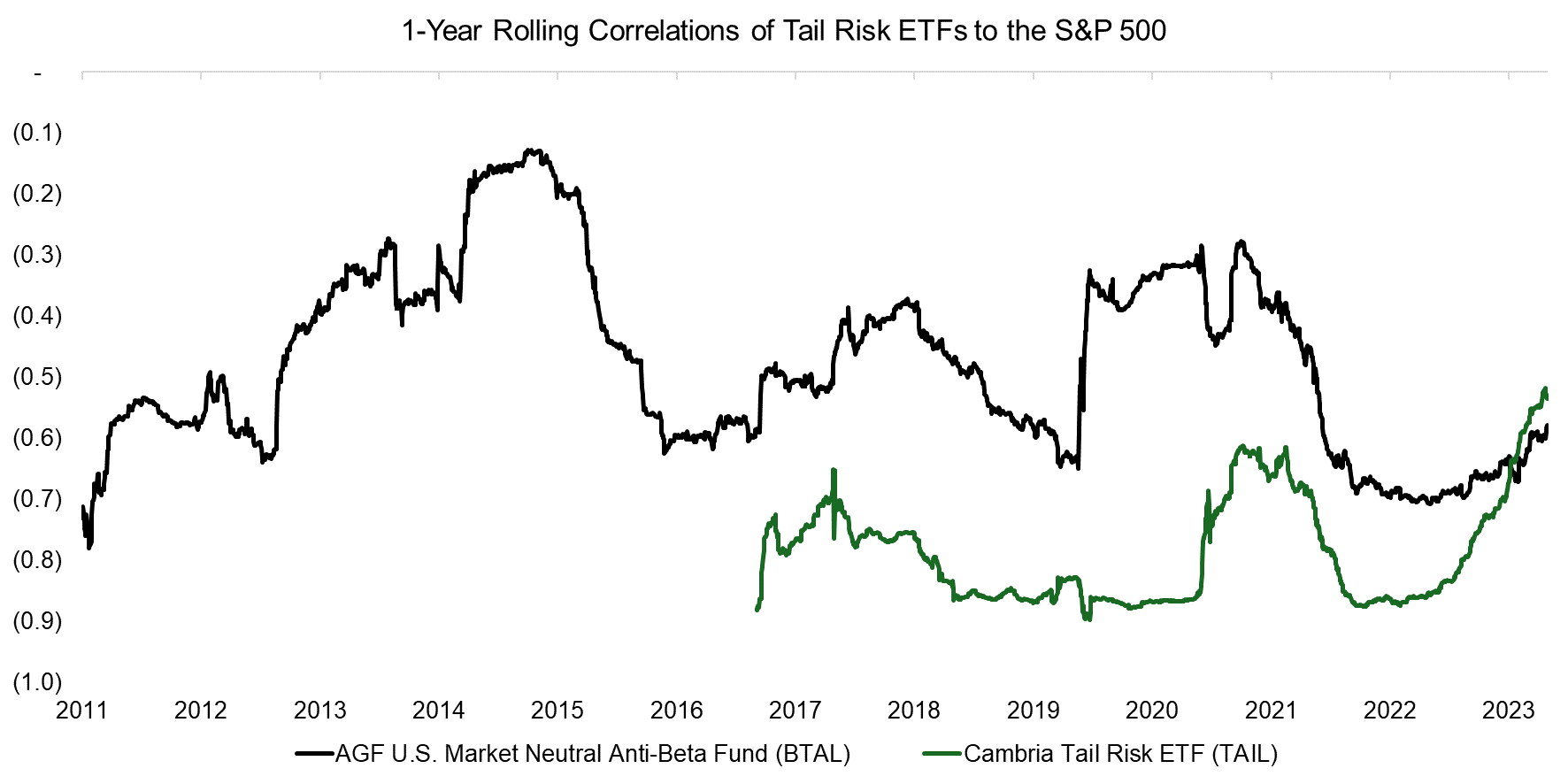

Next, we compute the one-year rolling correlations of the two tail risk ETFs to the S&P 500. We observe that TAIL was more negatively correlated to the stock market on average at -0.79, compared to -0.51 for BTAL. It is worth highlighting that TAIL’s correlation to the S&P 500 has been steadily increasing since 2022 and is at a record-high.

Source: Finominal

LOW VOLATILITY FACTOR AS A MARKET HEDGE

For the remainder of the analysis, we will focus on BTAL rather than TAIL. The average correlation of TAIL to the stock market is very negative, which implies limited diversification benefits (read Tail Risk Hedge Funds).

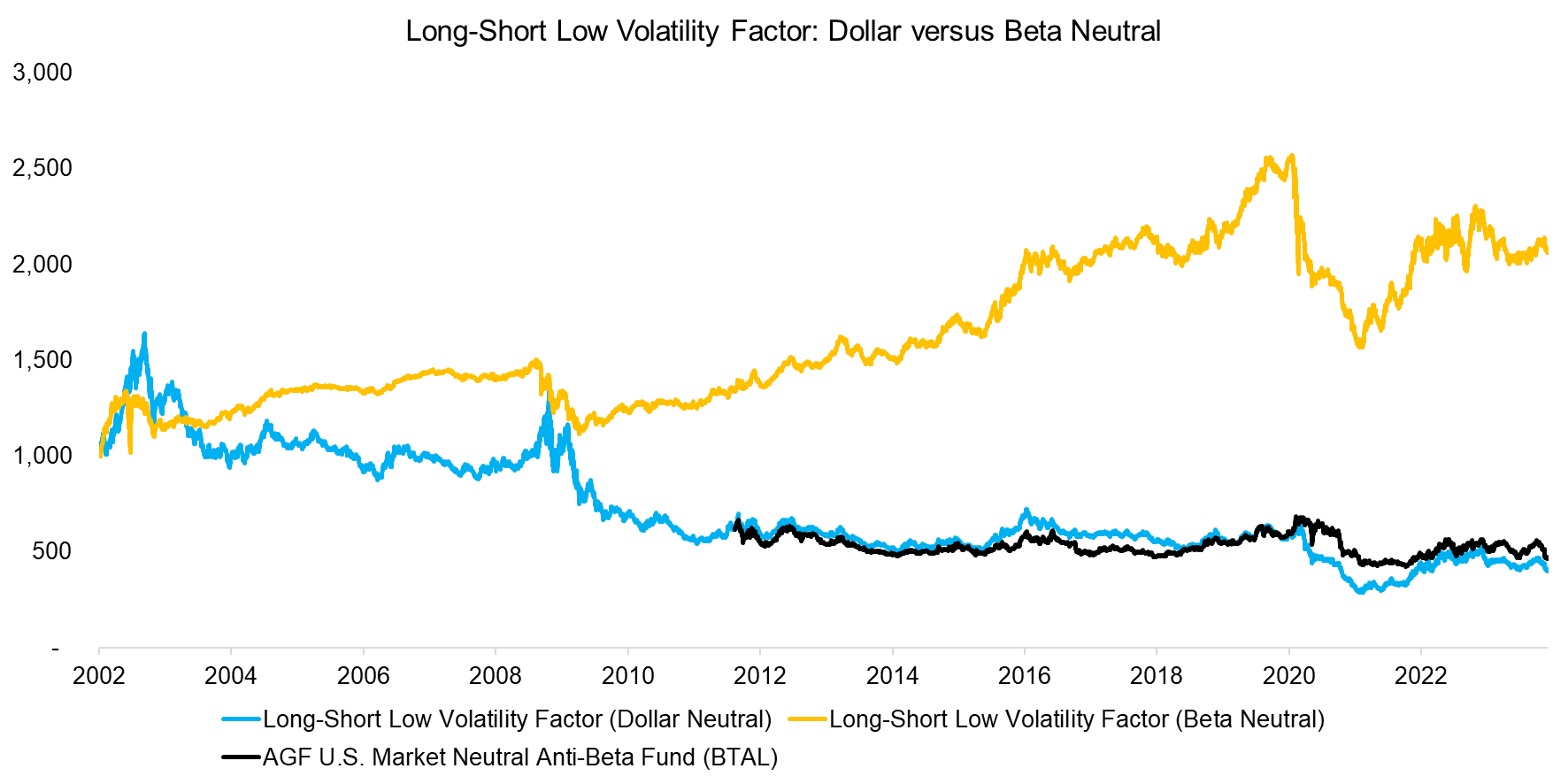

BTAL is somewhat more interesting as it can be viewed as either a tail risk or a diversifying strategy. The portfolio is simple and consists of long positions in low-beta and short positions high-beta stocks selected from the universe of the 1,000 largest U.S. stocks. We can extend BTAL’s track record by using the dollar-neutral long-short low volatility factor, which exhibited the same trends in performance.

The long portfolio of the low volatility factor had a beta of below one in the period between 2002 and 2023, compared to larger than one for the short portfolio, which implies a negative net beta and therefore represents a short position on the stock market. If the portfolio is constructed beta-neutral as per academic research, then the performance turns from negative to positive, but it loses its hedging characteristics.

Source: Finominal

QUANTIFYING DIVERSIFICATION BENEFITS

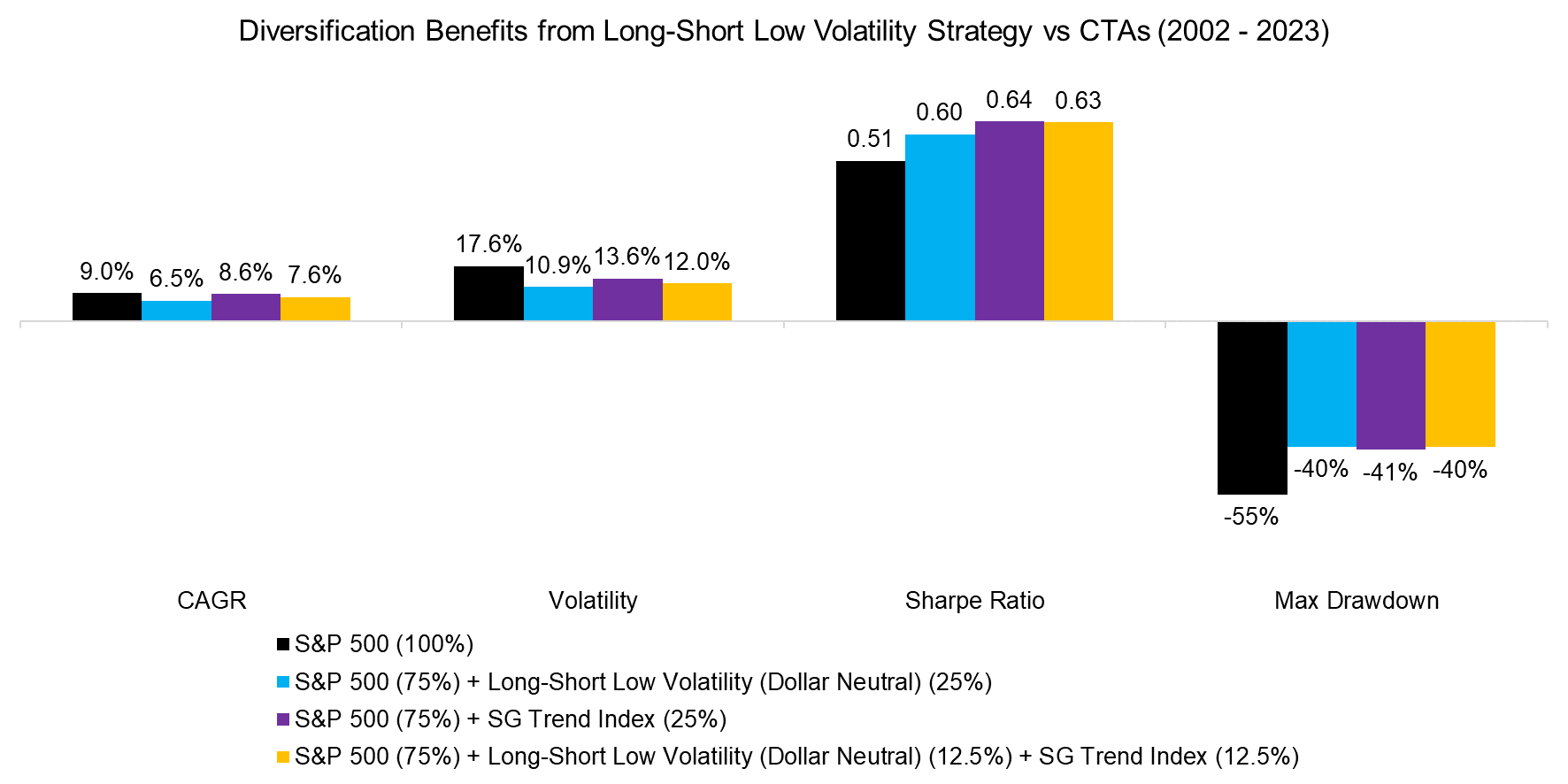

Finally, we quantify the diversification benefits by adding a 25% allocation of the dollar-neutral long-short low volatility factor to an equities portfolio. We observe that the CAGR decreased from 9.0% to 6.5% and annualized volatility from 17.6% to 10.9% in the period from 2002 to 2023, which resulted in an increase in the Sharpe ratio from 0.51 to 0.60.

As an alternative to using BTAL as a diversifying strategy, we highlight adding the SG Trend Index, which is the benchmark index for the CTA industry. We see an almost identical increase in the Sharpe ratio, but the CAGR would only have decreased from 9.0% to 8.6%.

Perhaps allocating to BTAL and the SG Trend Index would have been even better as these are lowly correlated to each other, but the Sharpe ratio did not increase further, and maximum drawdowns were almost identical (read Hedging via Managed Futures Liquid Alts).

Source: Finominal

FURTHER THOUGHTS

How interesting are TAIL and BTAL for asset allocation?

TAIL, as it’s name and ticker suggest, is a classic tail risk strategy, but therefore has a limited use case. The consistent losses make it difficult to hold for most investors over the medium to long-term and it only becomes relevant when investors expect a stock market crash, which few investors are good at predicting accurately.

BTAL has a lower bleed and can be viewed as a tail risk or diversifying strategy, but somewhat surprisingly did not manage to generate larger diversification benefits than CTAs. Having said this, CTAs do not explicitly protect against bear markets and crashes, so investors looking for a smoother ride, albeit with lower returns, may find BTAL of interest.

RELATED RESEARCH

Tail Risk Hedge Funds

Thou Shall Not Short the VIX

Hedging Market Crashes with Factor Exposure

Low Volatility vs Option-Based Strategies

Hedging via Managed Futures Liquid Alts

Volatility Hedge Funds: The Good, the Bad, and the Ugly

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.