Building a Stock Portfolio for a Debt-Averse World

Expecting higher inflation, higher rates, and eventually a debt restructuring

SUMMARY

- Stocks for a low-growth & high-interest rate environment should have high-quality characteristics

- However, there are many ways to define quality stocks

- Historically quality portfolios have not generated excess returns

INTRODUCTION

Ignoring the past is one of the biggest investing mistakes. However, simply looking back and expecting that history will repeat itself is likely an equally large error.

A simple combination of stocks and bonds generated wonderful returns for most investors given that both asset classes were largely in bull markets and uncorrelated over the last few decades. However, the world is structurally changing as demographics are turning negative across most developed and emerging markets, e.g. China is expected to lose more than 600 million people over the next 80 years according to the UN Population Projections (read Aging & Equities: Selling Stocks for the Long-Term).

Given a decrease in the working-age populations, global economic growth will be lower or negative, which is not supportive of equity investments like stocks, private equity, venture capital, or real estate. However, bonds are even worse off as there will be fewer people to tax, which makes paying interest more difficult, and reduce the pool of buyers of fixed-income instruments. Ultimately, debt will need to be restructured, and Japan is likely the first major country that will undergo this painful process given that it has the oldest population and a high debt-to-GDP ratio.

Although a global debt restructuring is likely decades away, it is interesting to contemplate what asset classes are most attractive for such an economic environment. It will not be a linear path, but interest rates will eventually increase given more supply and less demand for debt. Bonds are probably the least favorable, followed by real estate and private equity as both rely heavily on debt to juice returns. Venture capital is a tiny asset class, so that only leaves public equities.

In this research article, we will explore creating a stock portfolio for a debt-averse world.

LEVERAGE AND PROFITABILITY OF U.S. STOCKS

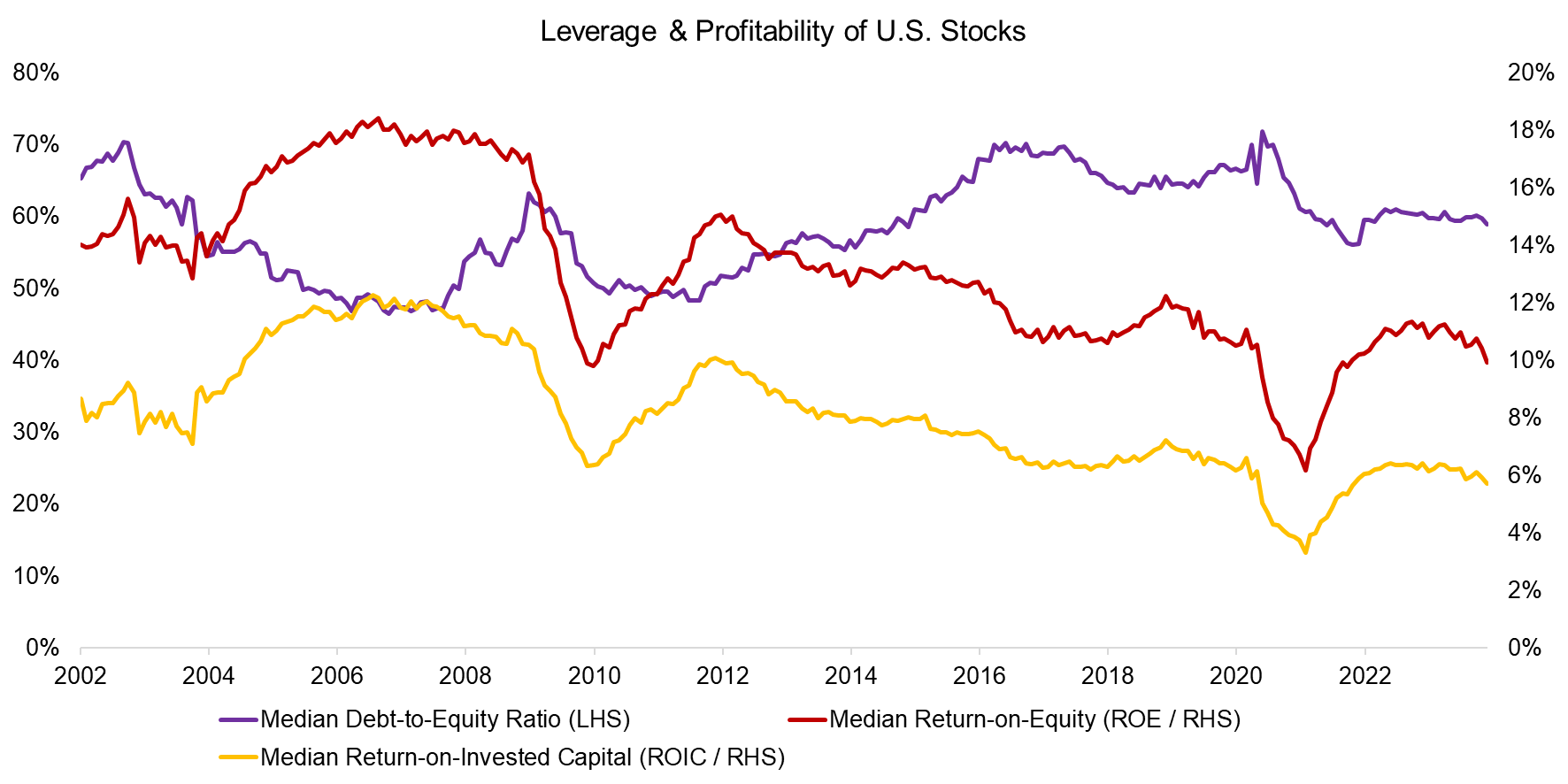

Before we move to stock selection criteria, it is worth considering if equities have become more risky over time. We compute the median leverage and profitability of the entire universe of stocks trading in the U.S. and with market capitalizations larger than $1 billion, which highlights that the median debt-to-equity (DOE) ratio has not changed significantly between 2002 and 2024. Given that interest rates have fallen and theoretically companies could carry more debt, this is surprising.

We also observe that the median return on equity (ROE) and return on invested capital (ROIC) of U.S. stocks have decreased over the last 20 years. Perhaps this can be explained by the evolution of the U.S. stock market, where technology stocks, which include many unprofitable businesses, have gained a larger market share.

Source: Finominal

STOCK CHARACTERISTICS OF QUALITY PORTFOLIOS

Stocks with quality features like low leverage and high profitability are likely the most promising for a long-term environment of low economic growth and high interest rates.

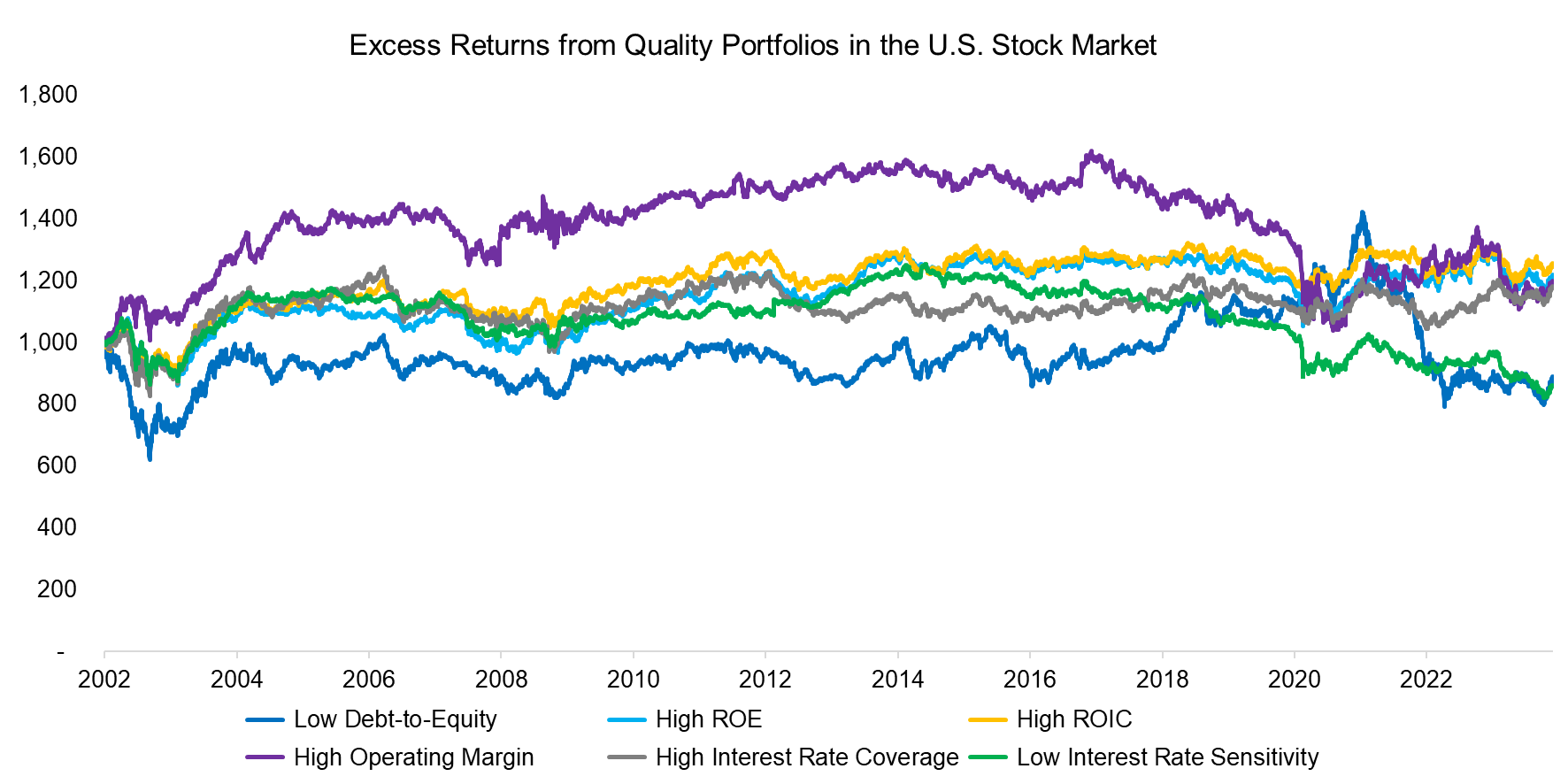

However, there are many ways of defining quality stocks and we select six metrics for this analysis. Specifically, we create portfolios by selecting the top 10% of the stocks ranked most highly on low debt-to-equity, high ROE, high ROIC, high operating margin, high interest rate coverage, and low interest rate sensitivity. Stocks are equal-weighted and portfolios are rebalanced monthly assuming 10 bps of transaction costs.

It is worth highlighting that investors should not expect excess returns from investing in quality stocks as these are everybody’s favorites. We demonstrate this by computing the excess returns of the quality portfolios compared to the U.S. stock market, which highlights that there was neither consistent out- or underperformance in the period from 2002 to 2024 (read Oh, Quality, Where Art Thou? and Quality Factor: Zero Alpha for Most Investors).

However, we do see the portfolios behaved often inversely, e.g. stocks with low leverage, aka technology companies, did far worse during the implosion of the technology bubble from 2002 to 2003 than stocks with high operating margins.

Source: Finominal

RISK & RETURN CHARACTERISTICS OF QUALITY PORTFOLIOS

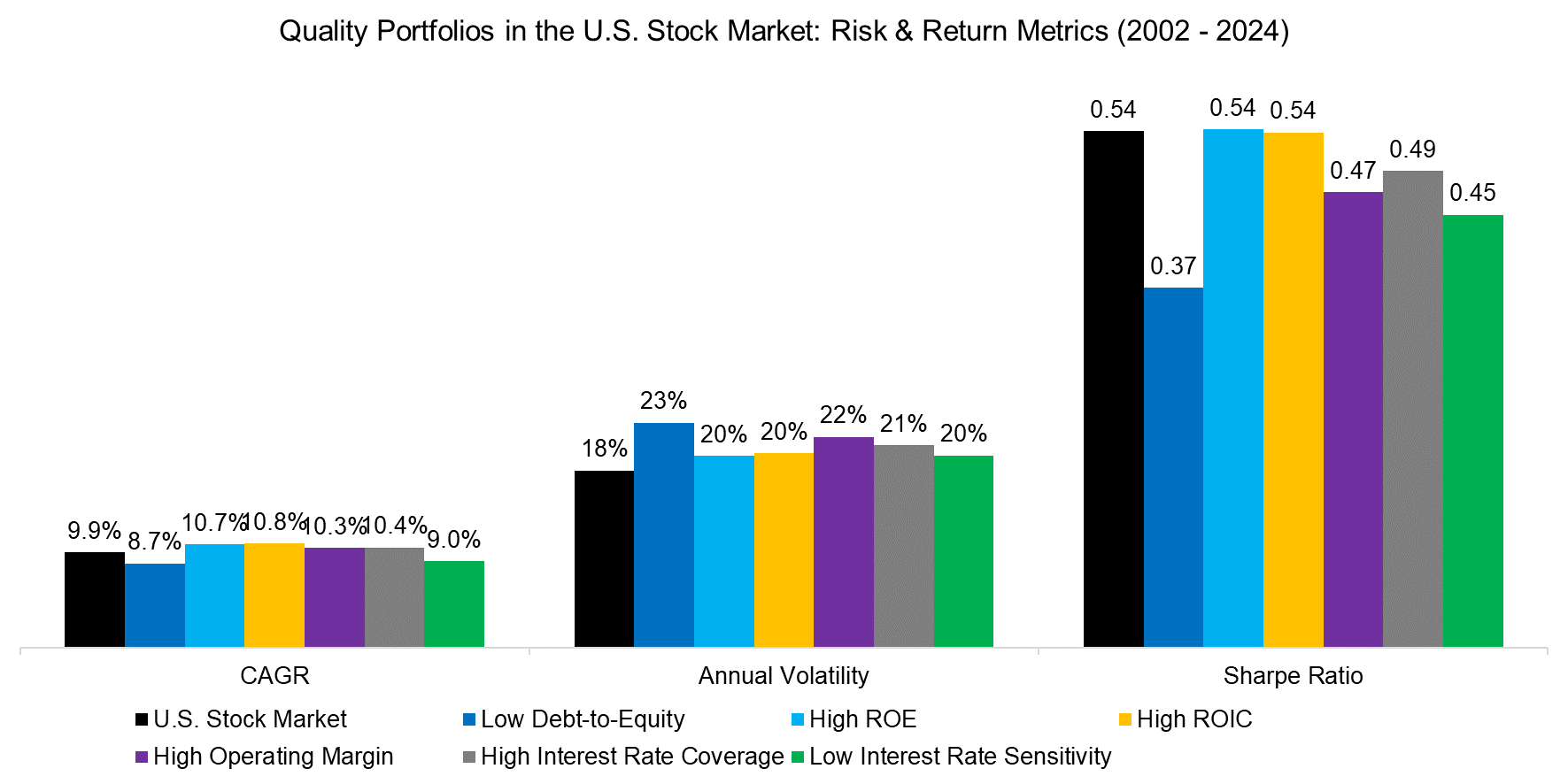

The CAGRs of some quality portfolios like high ROE stocks were higher than those of the U.S. stock market in the period between 2002 and 2024, but this should be discounted as there was no consistency in excess returns, and therefore can be attributed to lucky starting and endpoints for performance measurement.

Perhaps more surprising is that the volatility of these quality portfolios was not lower than that of the stock market, which can be explained by these being less diversified. As a result, none of the quality portfolios achieved a higher Sharpe ratio than the U.S. stock market over the last 22 years.

Source: Finominal

STOCK CHARACTERISTICS OF QUALITY PORTFOLIOS

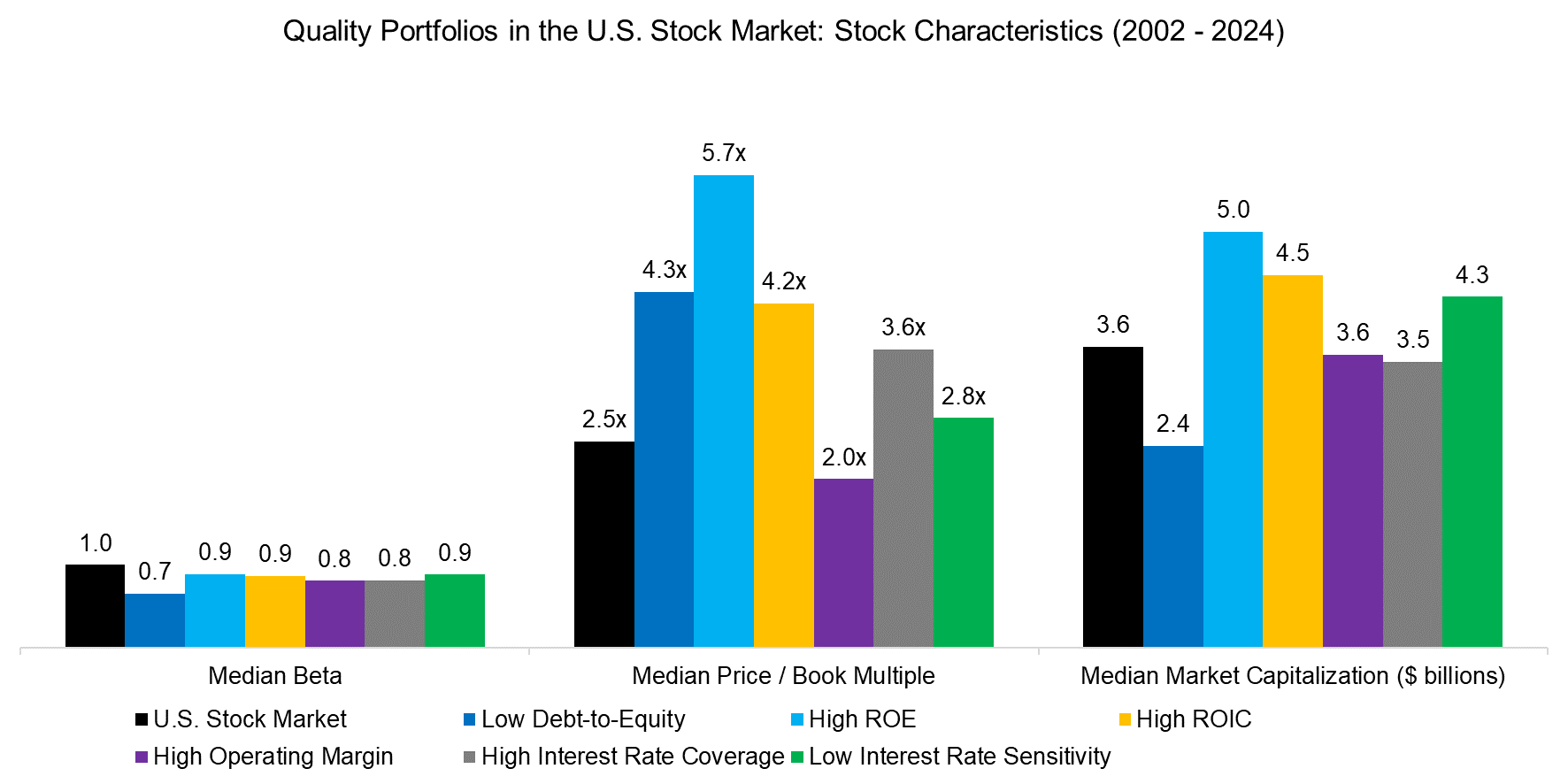

Next, we review the stock characteristics of the quality portfolios. As expected, all six feature lower betas than the stock market, and all except stocks ranked by high operating margins were more expensive when measured by price-to-book multiples. There was less differentiation by size as most portfolios featured median market capitalization similar to the entire universe.

Source: Finominal

BREAKDOWN BY SECTORS

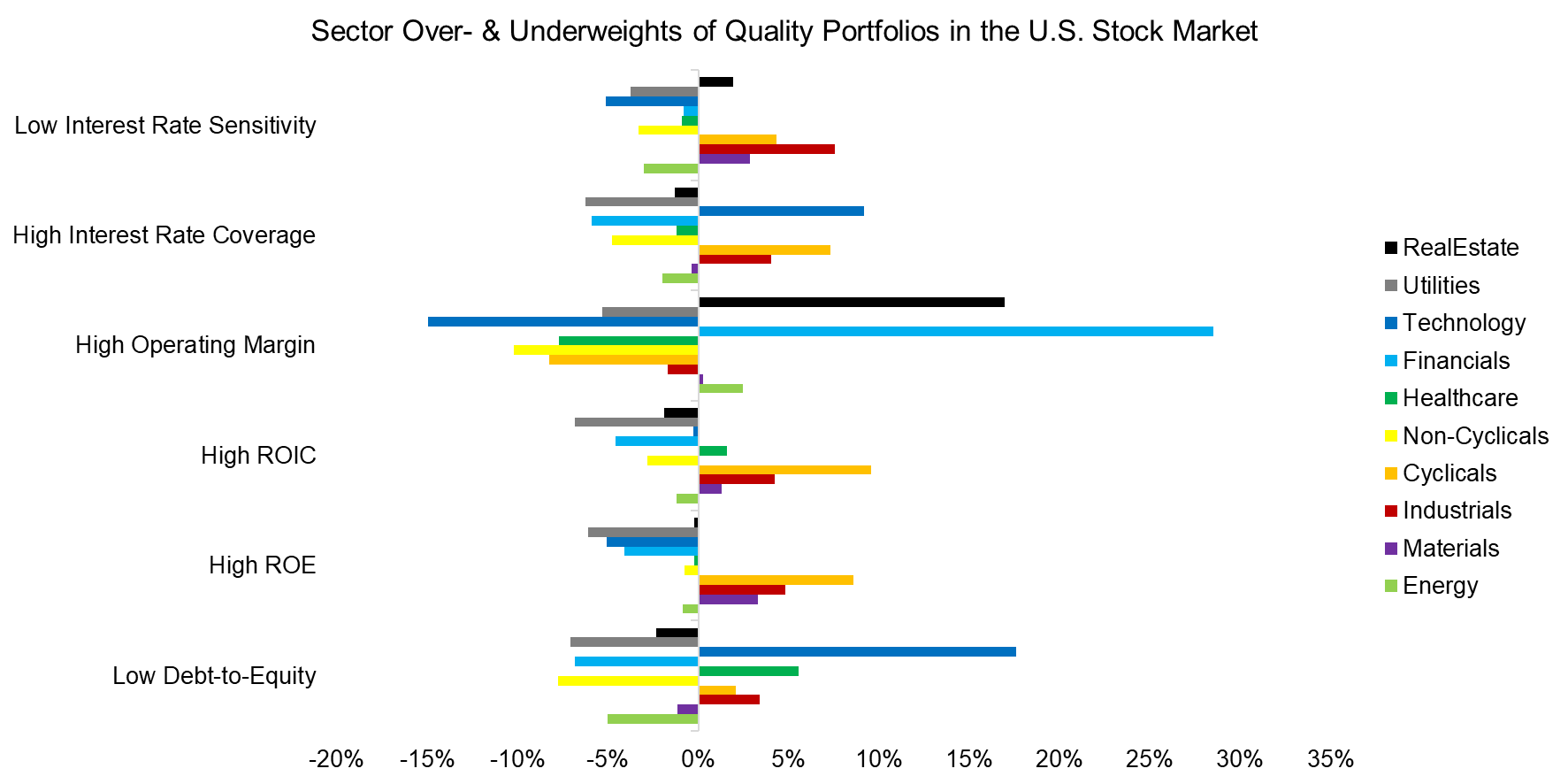

Finally, we compute the over- and underweights of the portfolios compared to the stock market. Although the portfolios may seem similar given comparable flat returns over the last 22 years, the breakdown by sectors highlights significantly different portfolios. Specifically, we observe:

- Low interest rate sensitivity: Overweights to industrials, underweights to utilities and technology

- High interest rate coverage: Overweight to technology, underweights to utilities and financials

- High operating margin: Overweight to real estate and financials, underweight to technology

- High ROIC: Overweight to cyclicals, underweight to utilities

- High ROE: Overweight to cyclicals, underweight to utilities

- Low debt-to-equity: Overweight to technology, underweights to non-cyclicals, utilities, and financials

The obvious conclusion would be to combine some of these metrics as businesses that are highly profitable and lowly leveraged even better positioned for an environment of low economic growth and high interest rates.

Source: Finominal

FURTHER THOUGHTS

So, how should investors think about constructing a stock portfolio for a debt-averse world based on this analysis?

Although shrinking populations will create havoc in our society and the global economy, its impact will be moving at a glacial pace for a long time (read Creating Anti-Fragile Portfolios).

Investors should not expect quality stocks to outperform over the long term as they are already trading at premium valuations, and only perform significantly better during bear markets or crashes. Having said this, owning a portfolio of high-quality stocks that can keep up with the stock market does offer peace of mind.

RELATED RESEARCH

Oh, Quality, Where Art Thou?

Picking Profitable Companies Can Be Unprofitable

Quality Factor: Zero Alpha for Most Investors

Value & Quality Factor Valuations

Beta in Beta-Neutral Factors?

Creating Anti-Fragile Portfolios

Aging & Equities: Selling Stocks for the Long-Term

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.