Inflation-Themed ETFs: Part II

As complicated as inflation

SUMMARY

- Inflation-themed ETFs have heterogeneous portfolios

- However, commodities and oil have been better inflation hedges

- And offer higher diversification benefits

INTRODUCTION

In November 2021 we analyzed inflation-themed ETFs (read Inflation-Themed ETFs: As Complicated as Inflation) and concluded that there were relatively few products on the market given the typical importance of inflation in investors’ minds.

Since then, inflation remained high in developed markets and almost reached 10% in the U.S. in 2022, which has led to more product launches. Given the passage of time, we can now better analyze the products’ track records and their ability to protect investors against inflation, which we do in this follow-up article.

INFLATION MEASURES

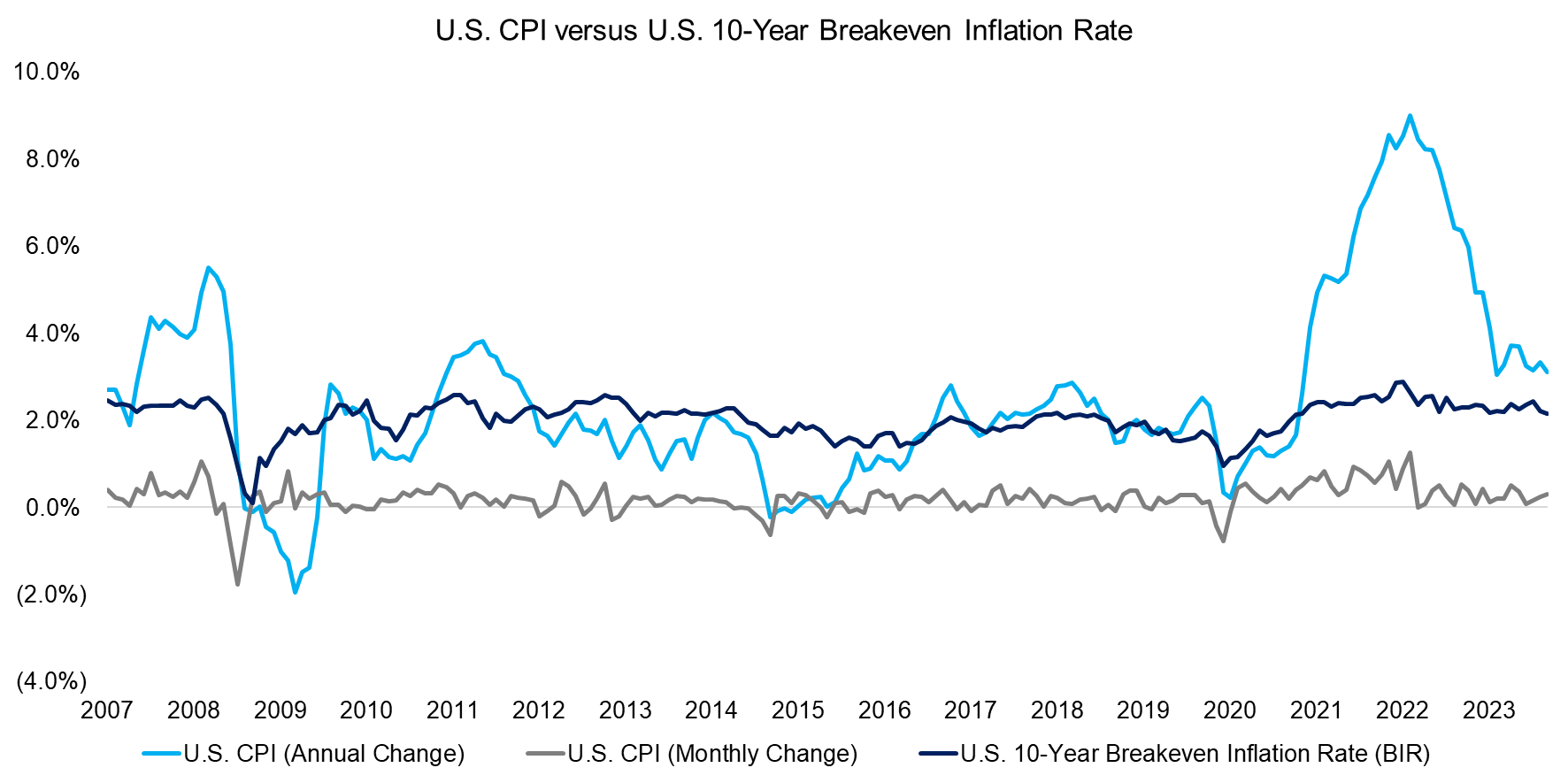

Most people equate inflation with the change in prices and there are many official and unofficial methodologies for measuring this. We use the U.S. Consumer Price Index for All Urban Consumers (“CPI”) and U.S. 10-Year Breakeven Inflation Rate (“BIR”) in this analysis. BIR is supposed to represent the expected inflation, but exhibited the same trends as the monthly change in CPI in the period from 2007 to 2024.

Source: St. Louis Fed, Finominal

CORRELATION TO INFLATION

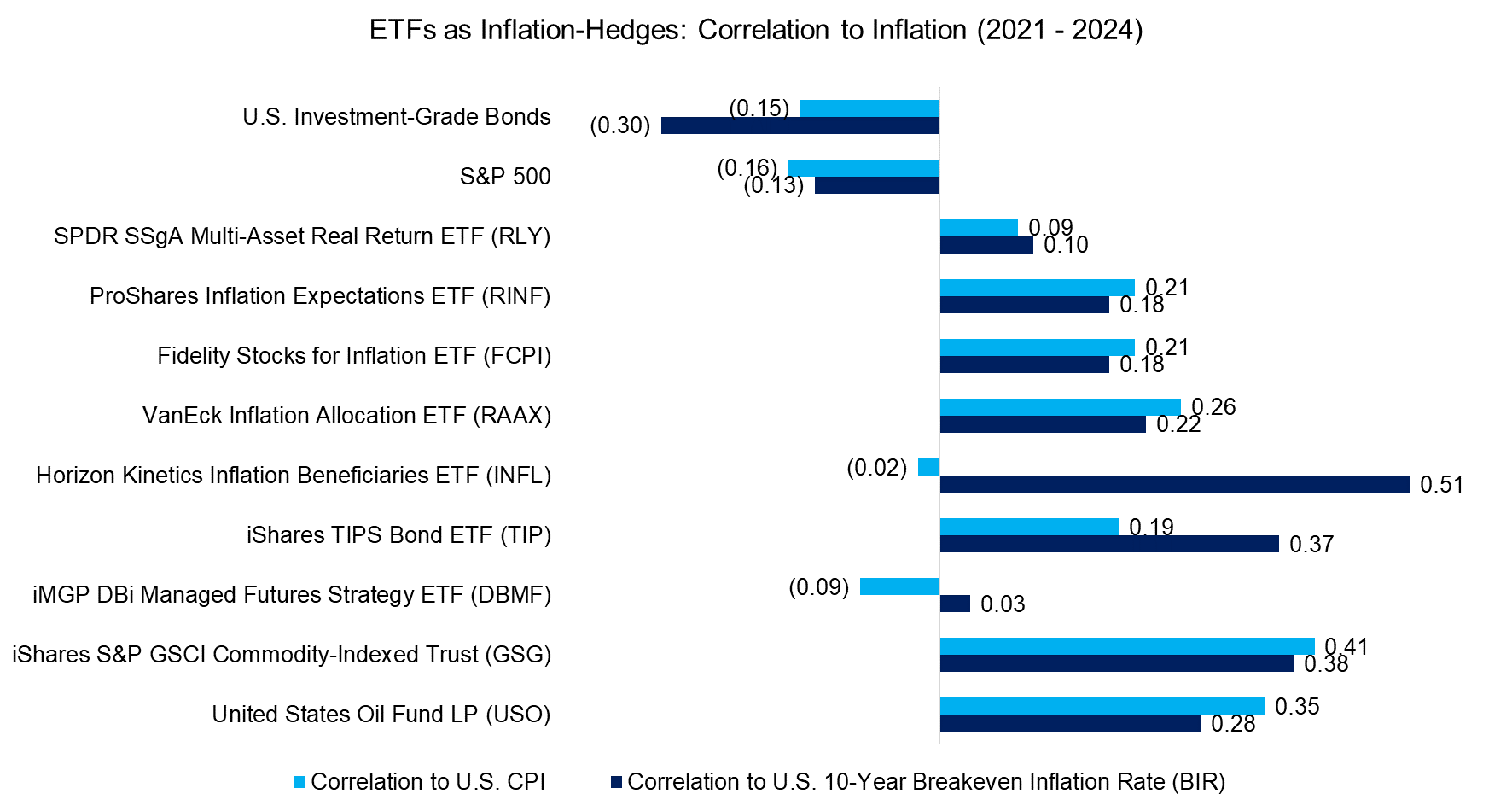

We focus on inflation-themed ETFs that have at least three years of track record trading in the U.S. stock market, which results in a universe of five products (RLY, RINF, FCPI, RAAX, INFL). We also include other strategies that are often used to hedge portfolios against inflation, namely treasury inflation-protected securities (TIPS), commodities, and oil. We also included a managed futures fund, which is not typically considered in the context of inflation, but such funds can go long commodities, oil, or gold, so could provide inflation-hedging characteristics as a by-product of the trend following strategy.

First, we compute the correlation of these ETFs, as well as that of the S&P 500 and U.S. Investment-Grade Bonds, to CPI and BIR, which highlights that stocks and bonds featured negative correlations to both inflation measures in the recent period from 2021 to 2024. In contrast, we observe that most of the inflation-themed and related strategies featured positive correlations.

However, some products like INFL and the managed futures strategy (DBMF) show positive correlations to BIR, but negative correlations to CPI, which is confusing and difficult to explain. Overall, commodities (GSG) and oil (USO) provided the highest and most consistent correlations to the two inflation measures.

Source: Finominal

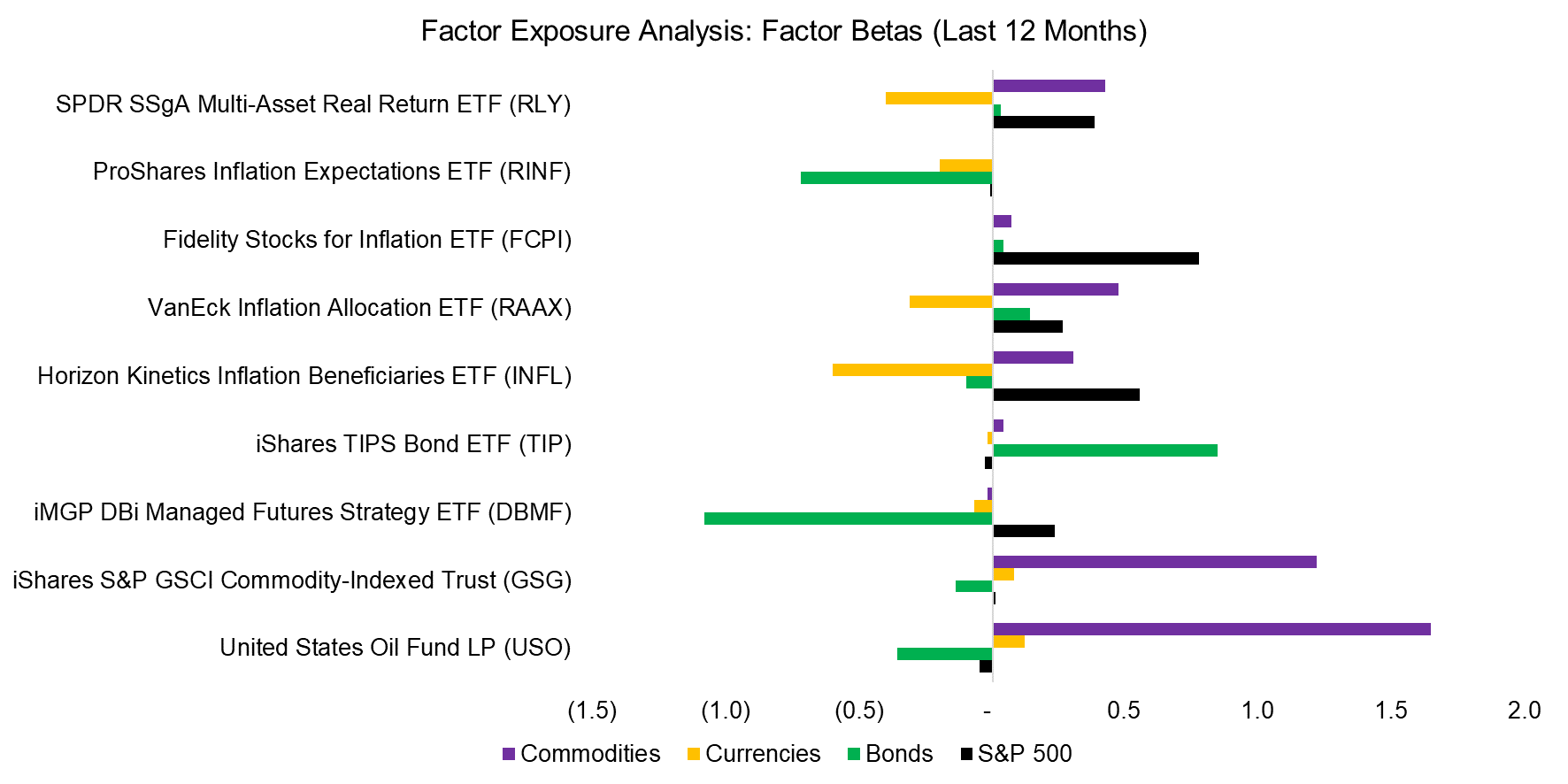

FACTOR EXPOSURE ANALYSIS

Next, we run a factor exposure analysis using asset class indices, which highlights that all ETFs have substantially different portfolios that likely explain their different correlations to inflation. It is worth noting that the positive betas of RLY, FCPI, RAAX, and INFL to the S&P 500 imply lower diversification benefits than when considering adding commodities or TIPS.

Source: Finominal

QUANTIFYING DIVERSIFICATION BENEFITS

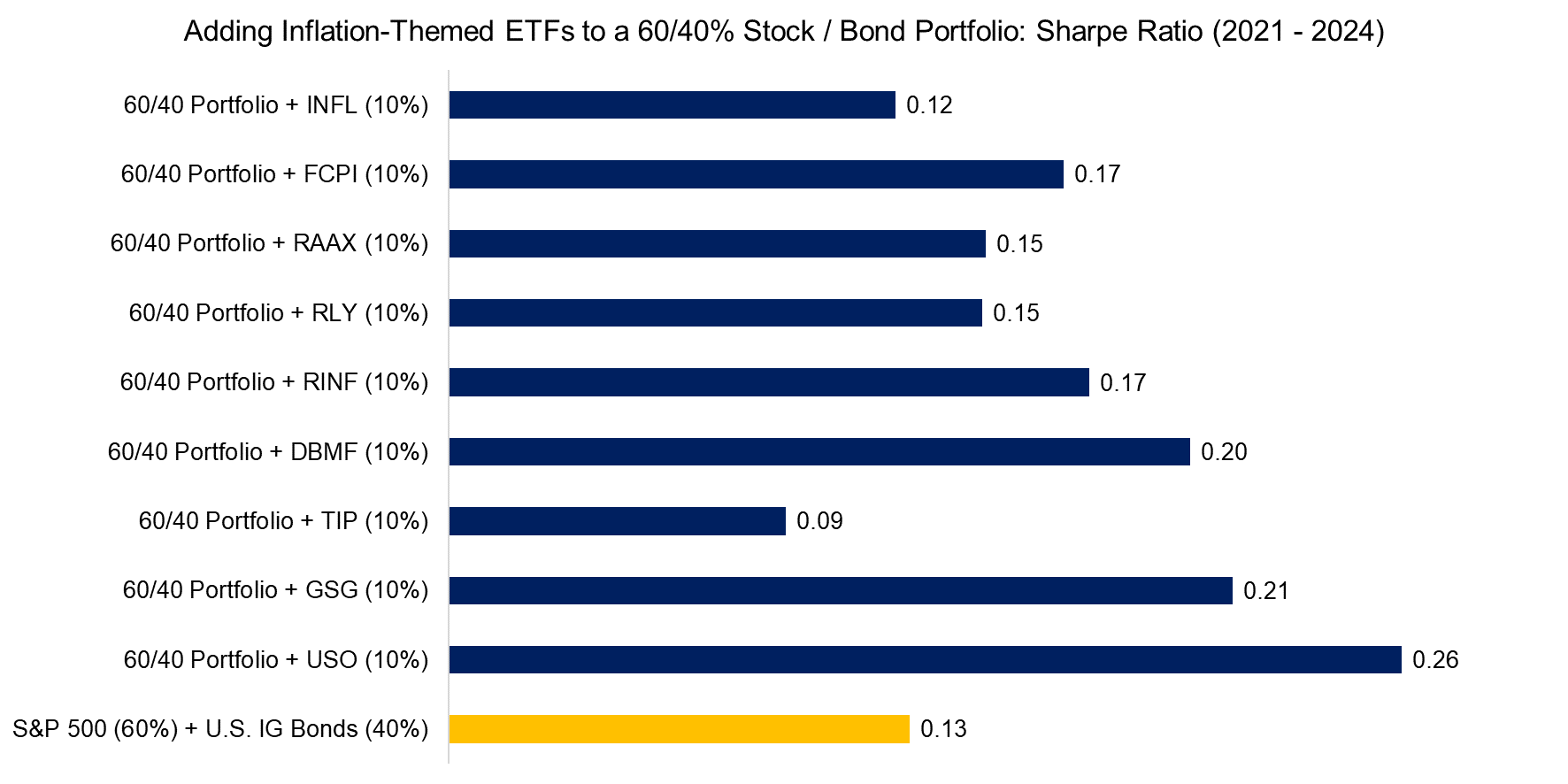

Given that inflation was high during the last three years, we can simulate the impact of adding inflation-themed and related ETFs to a portfolio comprised of equities (60%) and investment-grade bonds (40%).

We observe that a 10% allocation would have increased the Sharpe ratio in all combination portfolios, except when adding the iShares TIPS Bond ETF (TIP). This fund declined by 12.3% in 2022, compared to a loss of 12.8% for investment-grade bonds, which is ironic given that its name states that it protects against inflation (read Inflation-Linked Bonds for Inflationary Periods?).

However, we also observe that adding commodities, oil, or the managed futures fund would have increased the Sharpe ratio more than the inflation-themed ETFs, which we can attribute to these providing fewer diversification benefits given their equity exposure.

Source: Finominal

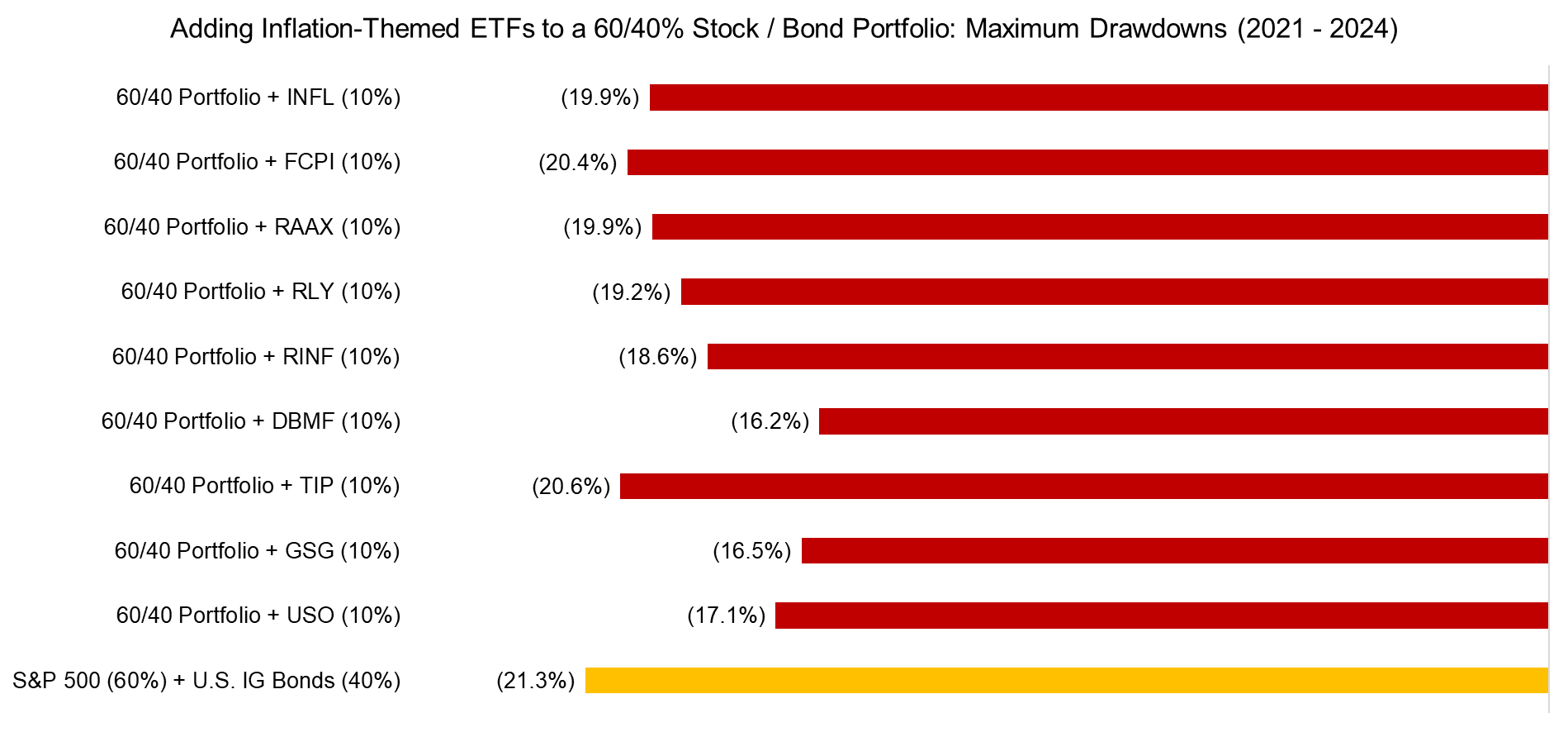

In addition to reviewing the Sharpe ratios of the combination portfolios, we can analyze the maximum drawdowns over the last three years. The classic 60/40 portfolio had a maximum drawdown of 21.3% in 2022 when stocks and bonds declined simultaneously, largely due to rising inflation and interest rates.

Adding any of the inflation-themed and related ETFs would have decreased the maximum drawdown, but commodities, oil, and managed futures were most effective, as reflected in the highest Sharpe ratios. In contrast, TIPS were the least effective (read How Much Can You Lose with Bonds?).

Source: Finominal

FURTHER THOUGHTS

Although the universe of inflation-themed products has increased in recent years, this analysis highlights that traditional hedges like commodities are better instruments for protecting against inflation as they offer higher diversification benefits.

However, the long-term track record of commodities is poor, eg the Goldman Sachs Commodity Index (S&P GSCI Index) is trading at the same level as 15 years ago, despite the war in Ukraine and the rise in commodity prices.

No one knows if inflation will remain high, trend even higher, or decline. Investors are likely better served with a strategy that can exploit rising as well as declining inflation, where managed futures are likely the best product.

RELATED RESEARCH

Inflation-Themed ETFs: As Complicated as Inflation

Myth-Busting: Equities are an Inflation-Hedge

Myth-Busting: Money Printing Must Create Inflation

Equity Factors & Inflation

Inflation-Linked Bonds for Inflationary Periods?

Building an Inflation Portfolio Using Stocks

Building an Inflation Portfolio Using Asset Classes

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.