Managed Futures versus Market-Neutral Multi-Factor Investing

And the winner is?

July 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Managed futures and market-neutral factor investing offered uncorrelated returns to stocks

- However, these two alternative strategies exhibited similar trends in correlations to equities

- Having exposure to both does not generate superior diversification benefits

INTRODUCTION

At first glance, the universe of alternative strategies is large and full of wonders. However, deeper analysis often reveals different shades of gray rather than the colors of the rainbow.

We previously showed that the returns of private equity are highly correlated to the S&P 500 and similar in magnitude (read Private Equity: The Emperor has No Clothes), venture capital is not very different than investing in a Nasdaq ETF (read Venture Capital: Worth Venturing Into?), multi-strategy hedge funds represent diluted equity exposure (read Multi-Strategy Hedge Funds: Equity in a Different Shade?), and so on (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios).

However, there must be some strategies that are unique and offer uncorrelated returns to traditional asset classes?

Well, yes, take managed futures and market-neutral factor investing for example. These two strategies are uncorrelated to equities and fixed income, at least on average. However, even there investors need to tread carefully as it seems these two strategies are related (read Trend Following & Factor Investing – Unexpected Cousins?).

In this research article, we will contrast managed futures versus market-neutral multi-factor investing for diversifying portfolios.

MANAGED FUTURES VERSUS MARKET-NEUTRAL MULTI-FACTOR INVESTING

The SG Trend Index is the benchmark index for managed futures funds, also called CTAs or trend following funds. These aim to systematically exploit trends across asset classes via long and short positions. Given this, the portfolios vary significantly across time but tend to be uncorrelated to stock and bond markets.

In contrast, market-neutral multi-factor investing in equities is achieved by ranking stocks on various factors, typically value, momentum, quality, and low volatility. The top and bottom percentiles of that universe are then sorted into a long and a short portfolio that is constructed beta-neutral. We take Vanguard’s Market Neutral Fund (VMNIX) as a proxy for this as it represents a multi-factor portfolio as seen in academic research and has a track record going back to 1998.

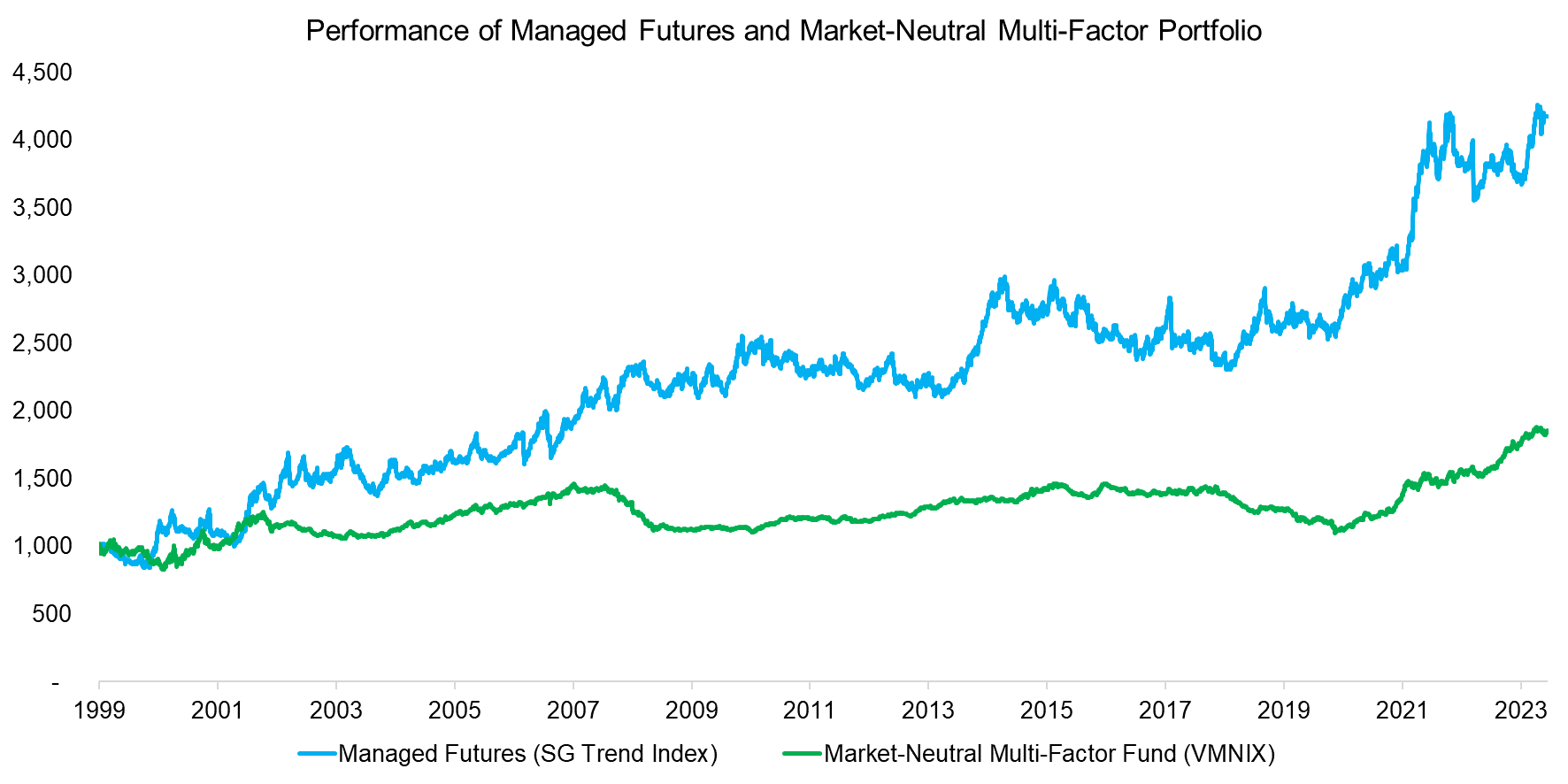

First, we compare the performance of the SG Trend Index and VMNIX, which highlights a significantly higher total return for managed futures since 1999, albeit with higher volatility. The correlation of these two alternative strategies was 0.16 over the last 24 years, which is low and suggests these could be combined to harvest diversification benefits.

Source: Finominal

CORRELATION ANALYSIS

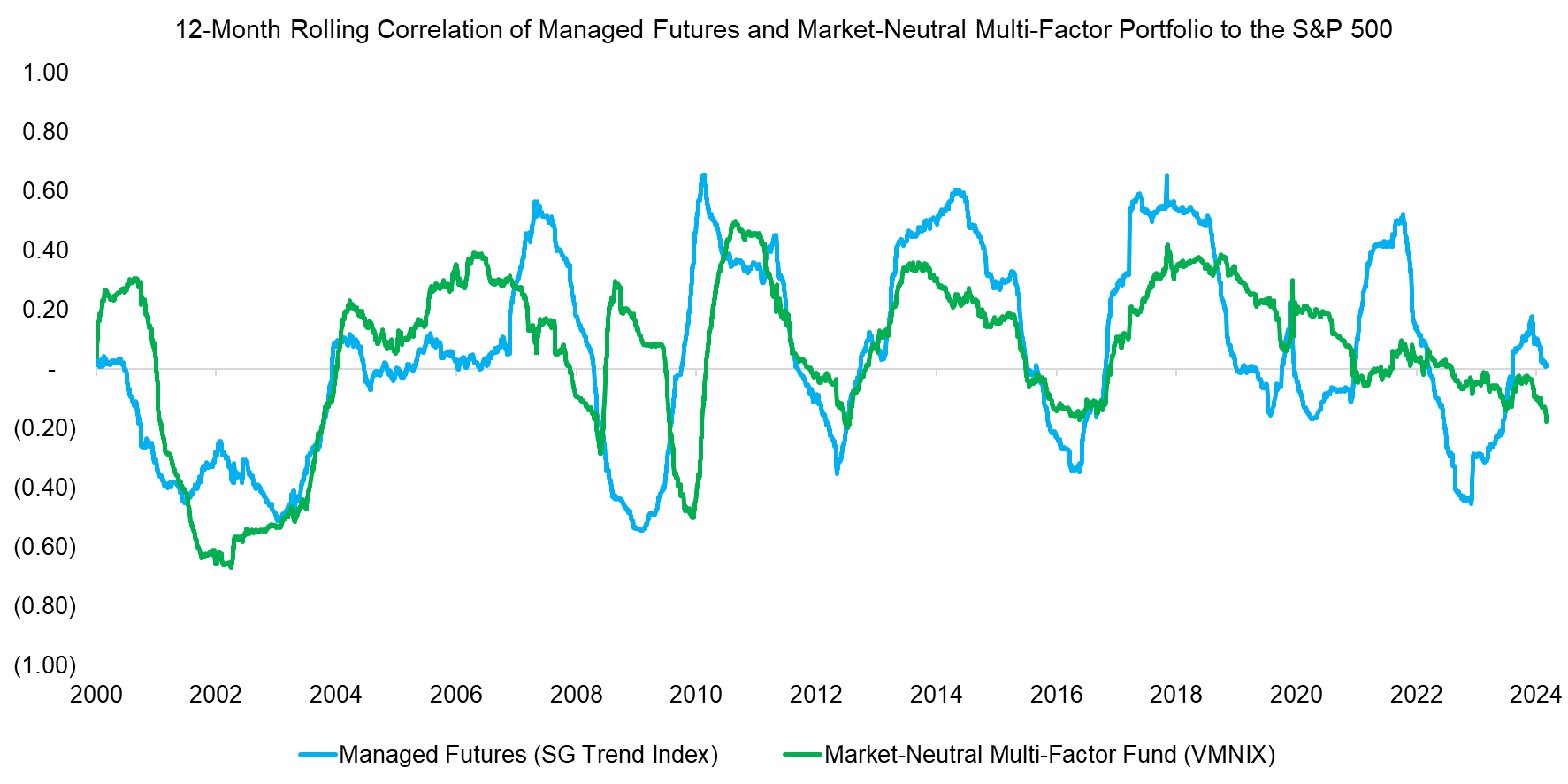

Next, we compute the 12-month rolling correlation of managed futures and the market-neutral multi-factor portfolios to the S&P 500 for the period between 2000 and 2024. On average, the correlation to equities was close to zero, which indicates that these two strategies may offer attractive diversification benefits.

However, we also note that the correlations ranged significantly and that there were plenty of periods where the trends in correlation to the S&P 500 were similar, e.g. between 2003 to 2006 and 2012 to 2019. If an investor had allocated to both these strategies, then these diversifying strategies would have provided these same exposures during these periods.

Source: Finominal

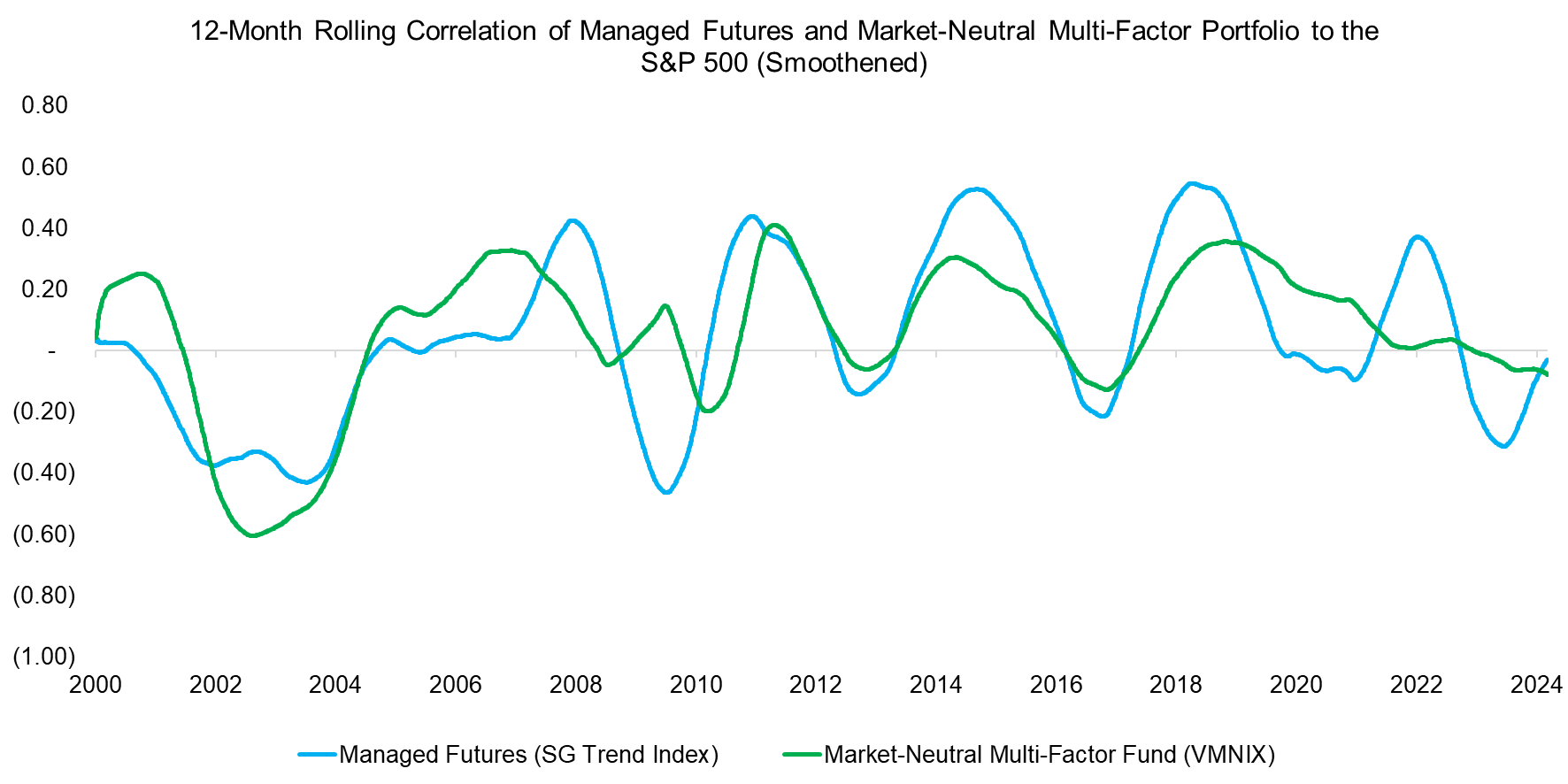

We can accentuate this relationship between managed futures and market-neutral multi-factor investing by smoothening the rolling correlation with a 12-month average. This shows that the correlation of both alternative strategies to equities frequently moved in tandem over the last 24 years.

However, we also observe that managed futures featured lower correlations during crisis periods like the global financial crisis in 2009 or the COVID-19 crisis in 2020, which indicates superior diversification benefits.

Practically a managed futures fund would be short equities and long other assets like bonds during such periods, while a market-neutral multi-factor fund tends to increase its beta, which may be negative or positive, to the market in periods of high volatility as such funds do not beta-adjust on a daily basis (read Beta in Beta-Neutral Factors?).

Source: Finominal

DIVERSIFICATION BENEFITS

Given the positive relationship between managed futures and market-neutral multi-factor investing, we evaluate which strategy would be more suitable for diversifying an equities portfolio.

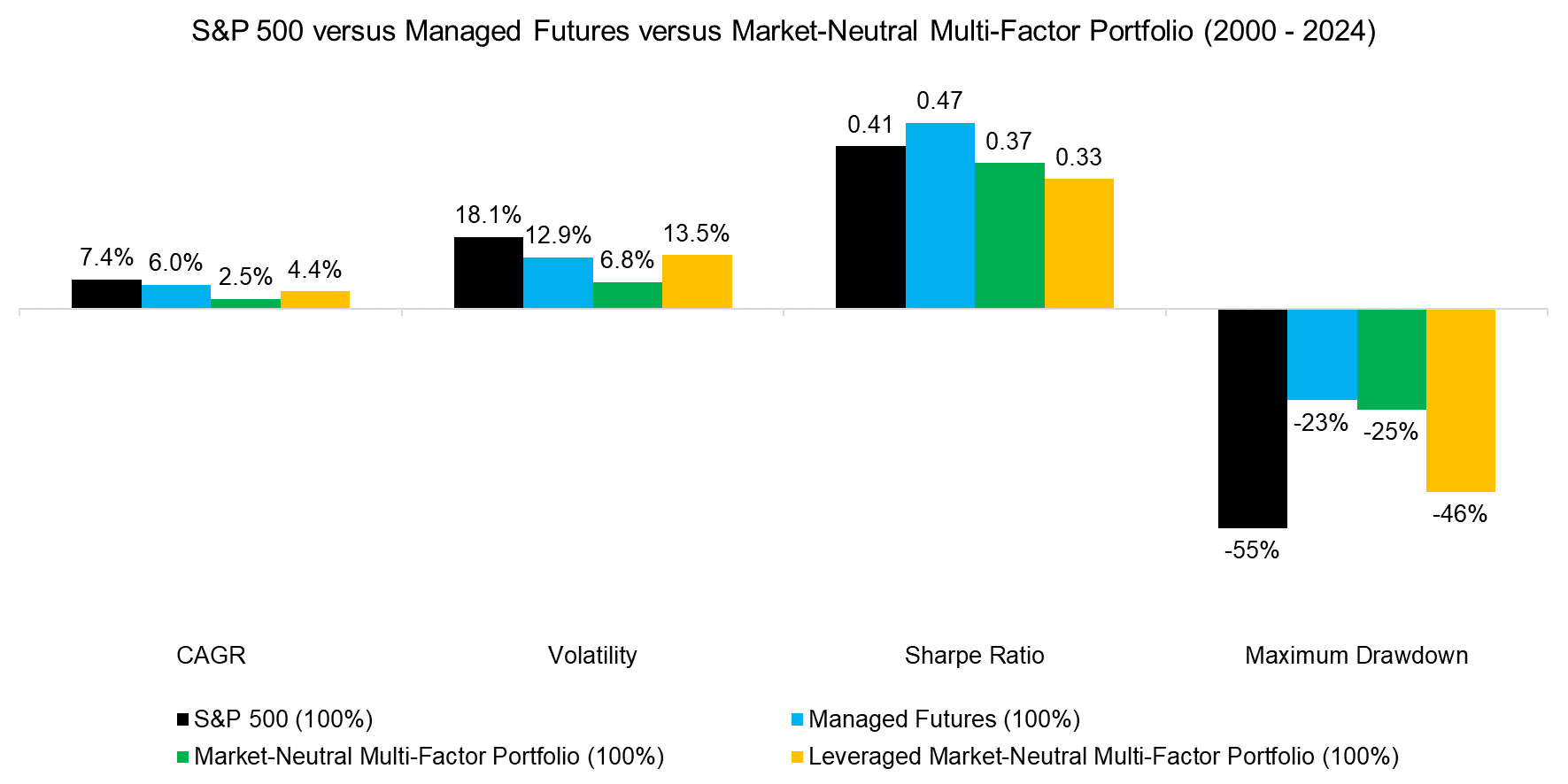

The CAGR of the market-neutral multi-factor portfolio, i.e. VMNIX, was only 2.5% between 2000 and 2024, compared to 6.0% for the managed futures funds. However, VMNIX’s volatility was also 50% lower, so we created a two-times leveraged version to make these strategies more comparable.

Source: Finominal

QUANTIFYING DIVERSIFICATION BENEFITS

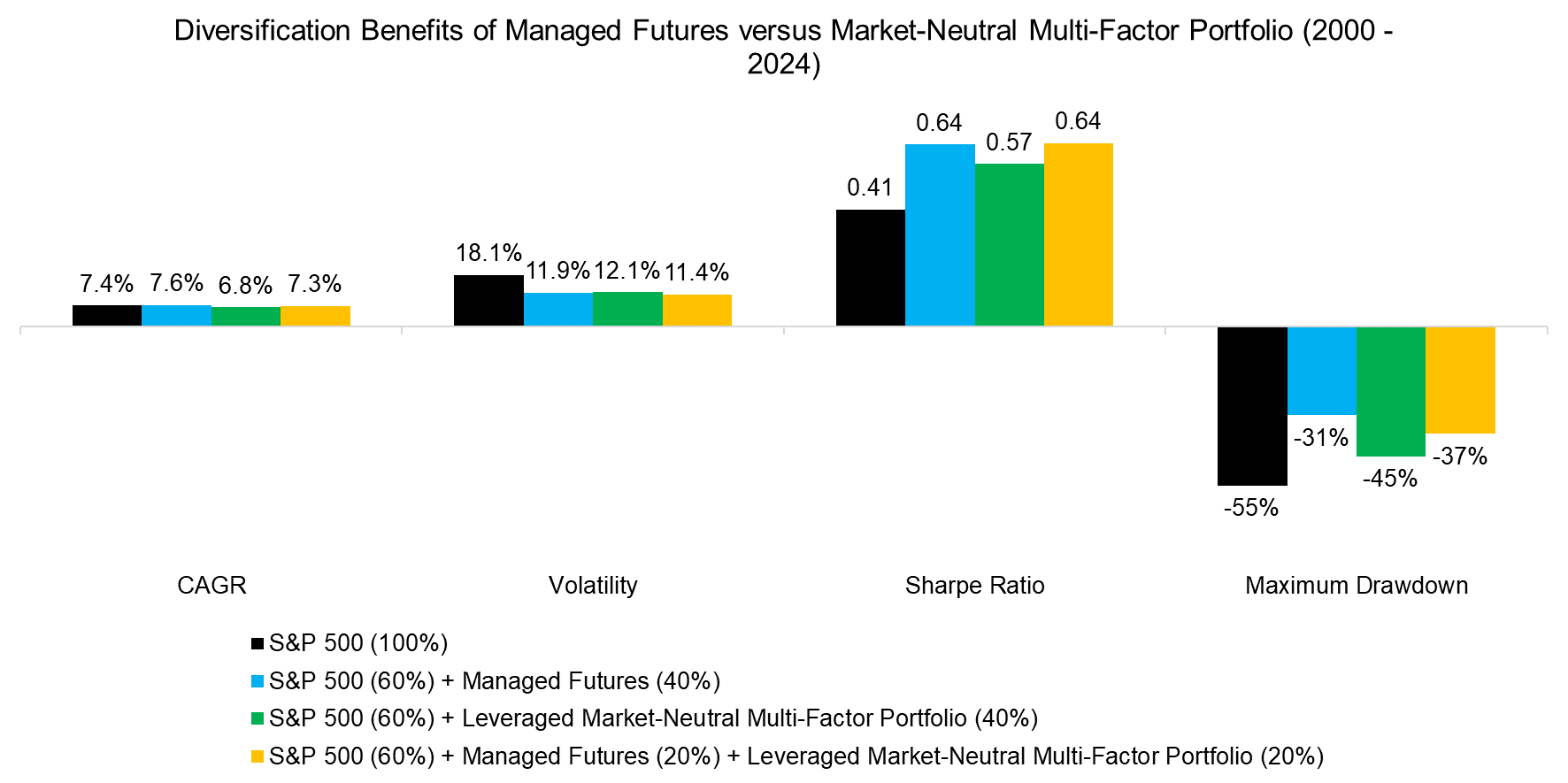

Finally, we simulate adding a 40% allocation to either alternative strategy, which may seem high from a traditional asset allocation perspective, but we recently showed that investors would have been better off over the last two decades by replacing bonds with managed futures (read Bonds versus CTAs for Diversification).

We observe that both alternative strategies would have significantly increased the Sharpe ratio of a portfolio comprised of the S&P 500 in the period from 2000 to 2024. However, as the correlation analysis suggested managed futures were more effective than a leveraged market-neutral multi-factor portfolio. Combining the two alternative strategies would have generated a similar Sharpe ratio as managed futures on a stand-alone basis, but resulted in a higher maximum drawdown.

Source: Finominal

FURTHER THOUGHTS

So, how can we explain this relationship between managed futures funds and market-neutral multi-factor factor investing?

We can analyze the correlations of single factors to managed futures, which highlights -0.16 for value, essentially zero for size and low volatility, 0.05 for quality, and 0.17 for momentum. The latter makes perfect sense as cross-sectional momentum in equities will partially replicate time-series momentum across asset classes, e.g. if oil prices are trending upward, then managed futures will go long WTI futures and the momentum factor will select energy stocks.

Given this, there might be a case for combining both alternative strategies, but perhaps best to exclude the momentum factor from the multi-factor portfolio.

RELATED RESEARCH

Factor Investing Is Dead, Long Live Factor Investing!

CTAs: With or Without Trend Following in Equities?

Bonds versus CTAs for Diversification

Carry versus Trend Following

Trend Following in Equities

Trend Following in Bear Markets

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.