Market-Neutral versus Smart Beta Factor Investing

Don´t drop your shorts.

SUMMARY

- Smart beta multi-factor ETFs in the U.S. have consistently generated negative returns over the last 10 years

- In contrast, market-neutral multi-factor funds are at record highs

- The discrepancy can be explained by the short side contributing almost all positive returns

INTRODUCTION

Quants have been calling the period between 2017 and 2020 the Factor Investing Winter as popular equity factors like value and momentum generated consistently negative returns. Funds like AQR`s Equity Market Neutral Fund (QMNIX), which provides exposure to these factors in a long-short format, lost more than 90% of their assets under management as investors lost their faith in the strategy (read Factor Investing Is Dead, Long Live Factor Investing!).

Since then, the trend reversed as QMNIX and similar funds like Vanguard`s Market Neutral Fund (VMNIX) have reached all-time highs in 2024, proving critics wrong. However, the same can not be said about long-only smart beta multi-factor products as these have continued to produce poor performance. Somewhat ironically, investors have allocated only a few billion dollars to funds like QMNIX, but close to one trillion dollars to smart beta ETFs.

In this research article, we will compare market-neutral versus long-only multi-factor investing in the U.S. stock market.

SMART BETA EXCESS RETURNS

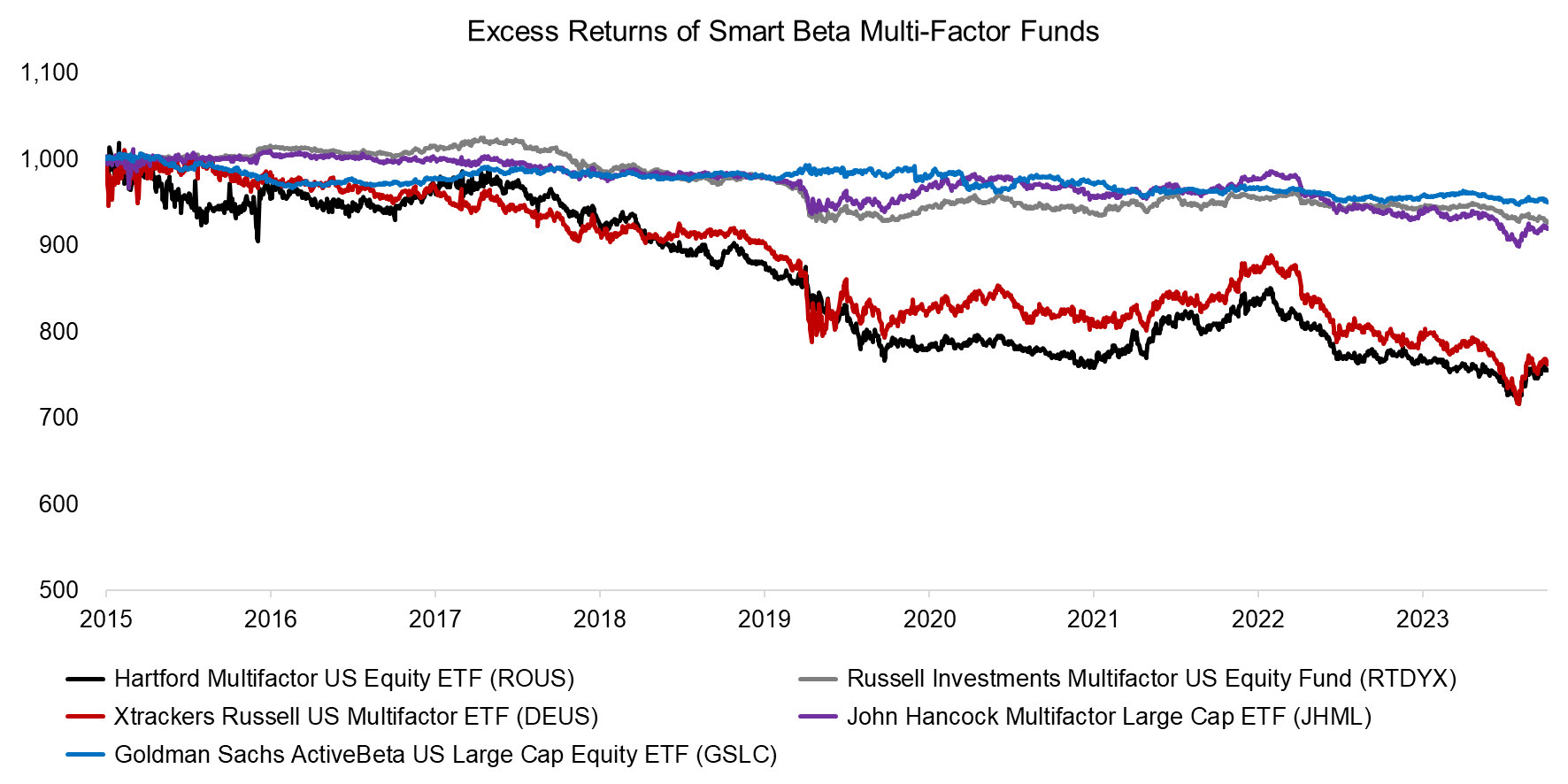

First, we compute the outperformance of five multi-factor ETFs trading in the U.S. that have a track record of almost 10 years and primarily provide exposure to value, momentum, and quality.

We observe that all five generated consistently negative excess returns since 2015. RTDYX and JHML were less volatile than ROUS and DEUS, but the trends in performance were identical, which confirms similar factor exposures. GSLC is the largest multi-factor ETF with close to $12 billion of assets under management, but it has very low factor exposures and can be considered an index tracker (read Multi-Factor Smart Beta ETFs).

Source: Finominal

MARKET-NEUTRAL VERSUS LONG-ONLY FACTOR INVESTING

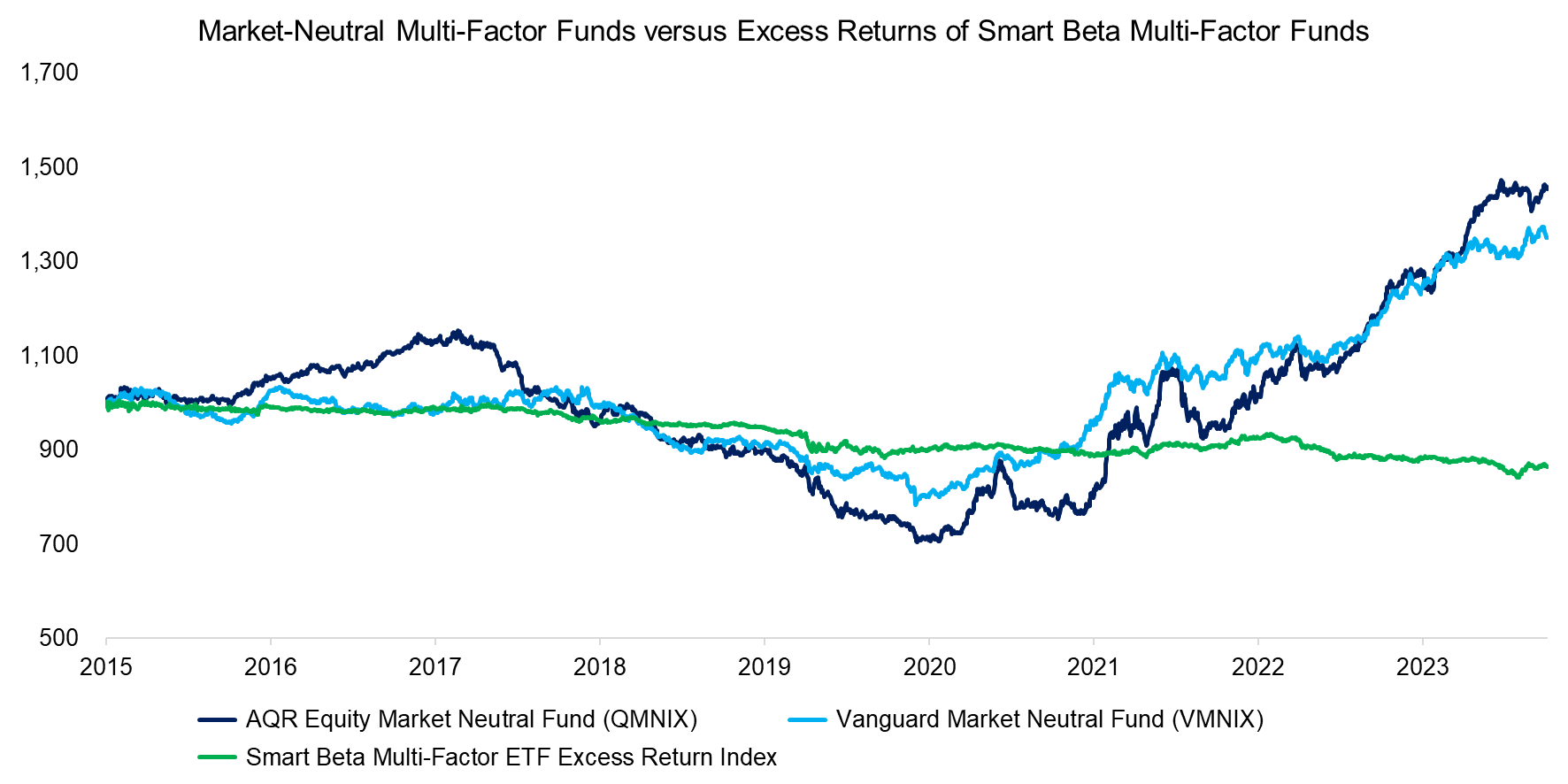

We create an equal-weighted index of the excess returns of the smart beta multi-factor ETFs and compare that to the performance of two market-neutral multi-factor products, namely AQR´s Equity Market Neutral Fund (QMNIX) and Vanguard`s Market Neutral Fund (VMNIX).

All of the products provide exposure to value, momentum, and quality factors, but portfolio construction is naturally different. The smart beta ETFs rank stocks on the factors and then weigh the most highly ranked stocks by their market capitalization, which results in products where the stock market is the dominant source of risk. The market-neutral funds also rank stocks on the factors, but then select the highest-ranking stocks for the long portfolio and lowest-ranking stocks for the short portfolio, which is then beta-adjusted to remove any exposure to the stock market.

Most investors do not want to allocate to market-neutral funds as they behave too differently from the stock market, so they opt for smart beta funds instead. However, the excess returns of smart beta multi-factor ETFs have been highly unattractive compared to those of market-neutral products, despite both types of products aiming to provide similar factor exposures (read Smart Beta: Broken by Design?).

Source: Finominal

REPLICATING MARKET-NEUTRAL MULTI-FACTOR FUNDS

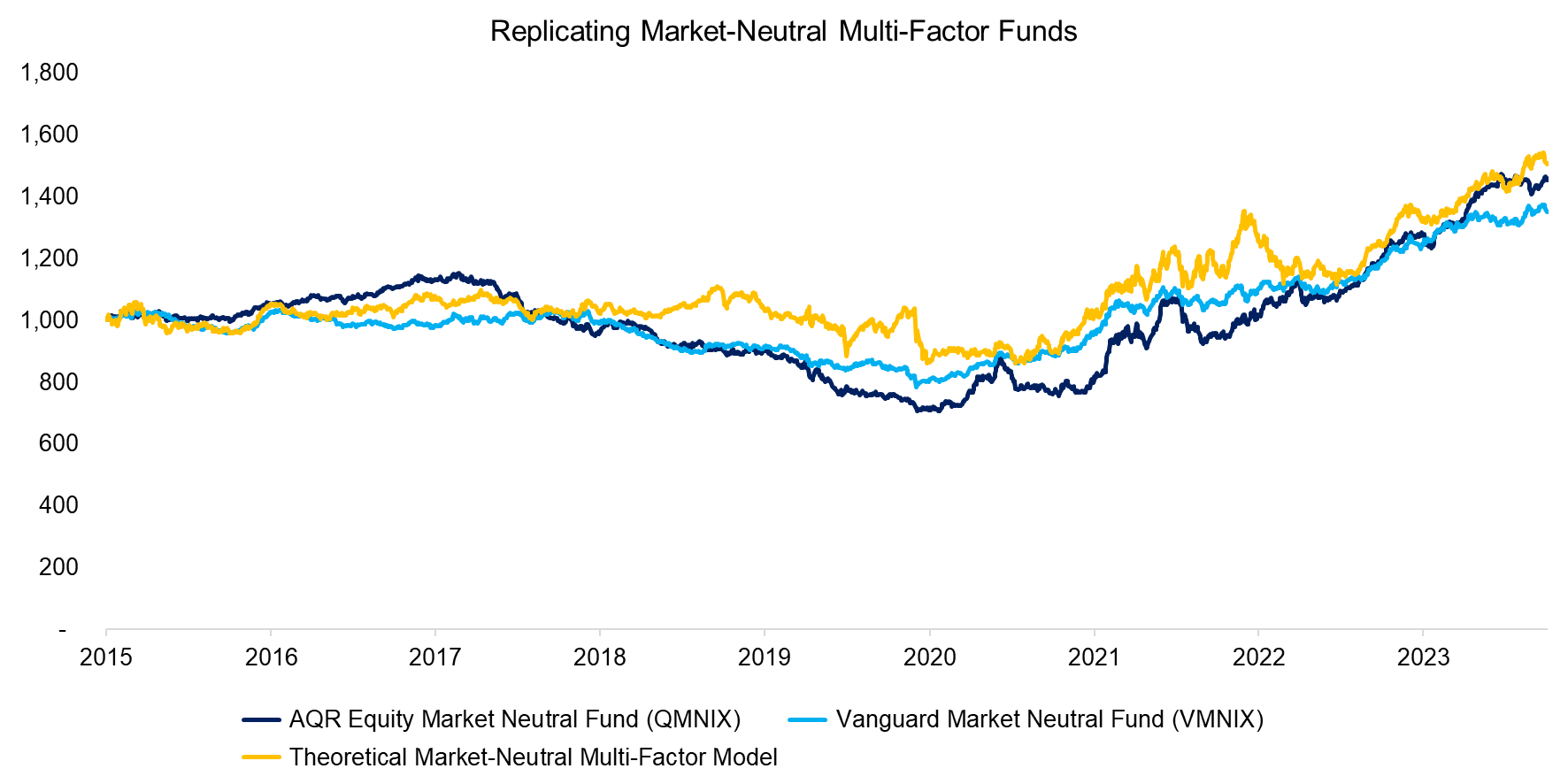

Given the large discrepancy between the market-neutral and smart beta multi-factor funds, it is worth asking if firms like AQR and Vanguard have a superior stock selection process.

AQR has published numerous practical papers about factor investing that provide valuable insights into their stock selection and portfolio construction processes. We create a theoretical market-neutral multi-factor portfolio by selecting the top and bottom 10% stocks trading in the U.S. stock market on value, momentum, and quality metrics using the intersectional model. The portfolio is rebalanced monthly, assumes 10 basis points of transaction costs, and is constructed beta-neutral.

Comparing the performance of the theoretical model versus QMNIX or VMNIX highlights similar performance since 2015. Stated differently, neither AQR nor Vanguard have a secret sauce given that we can replicate these funds relatively easily.

Source: Finominal

Given that we can replicate funds like QMNIX and VMNIX, we can also dissect their performance using our theoretical model. First, we separate the performance of the long and short portfolios, where the former consists of stocks that are cheap, outperforming, and high quality, and the latter of stocks that are expensive, underperforming, and low quality.

We observe that the long portfolio has been generating zero excess returns since 2003, and all returns can be attributed to the short portfolio. Naturally, smart beta ETFs only provide exposure to the long and not the short portfolio.

Source: Finominal

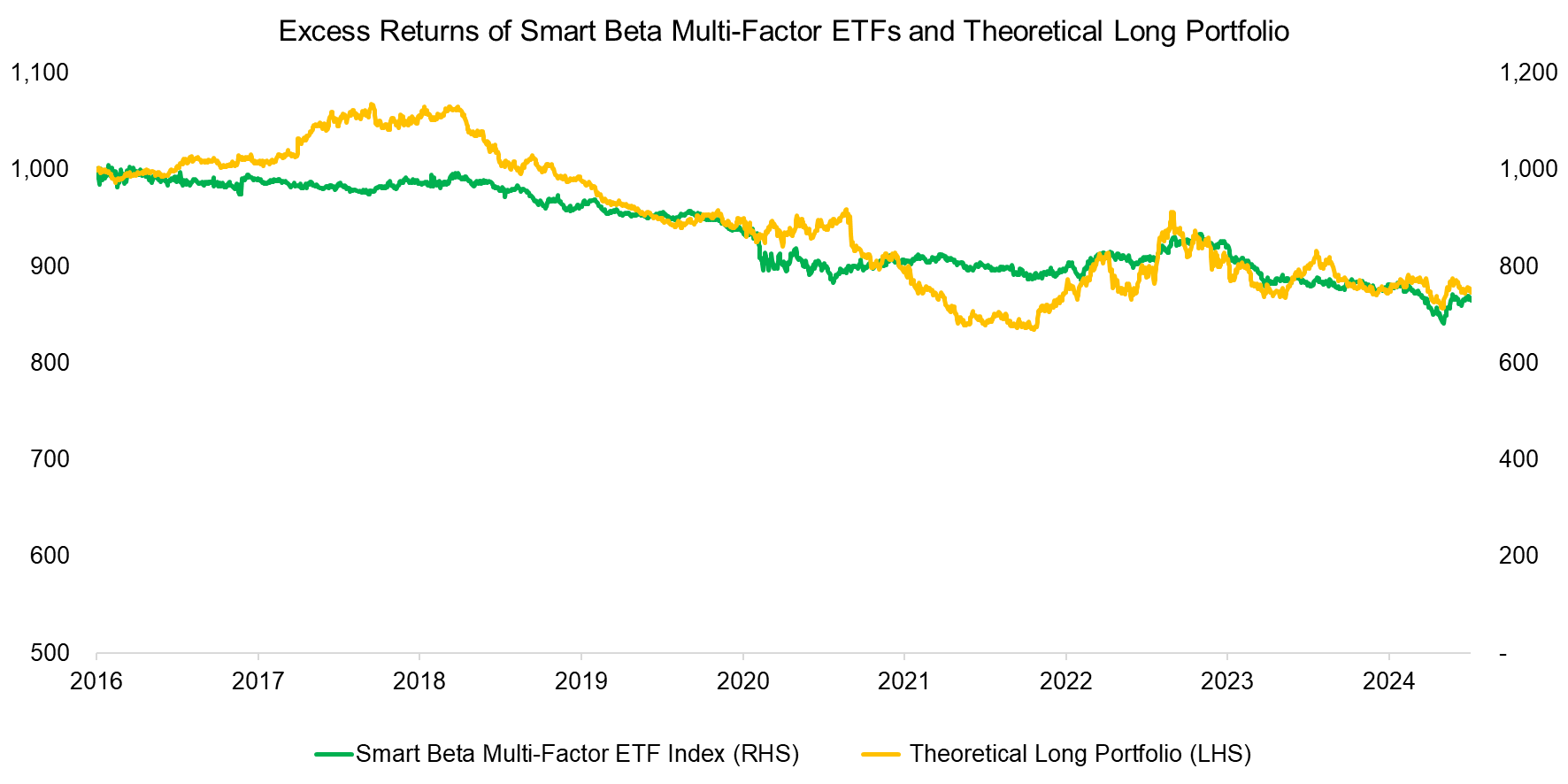

THEORETICAL LONG PORTFOLIO VERSUS SMART BETA ETFS

Finally, we compare the excess returns of the theoretical long portfolio and the smart beta multi-factor ETF index, which highlights a similar downward trajectory since 2016. The volatility of the theoretical long portfolio is significantly higher, but this is simply due to a more concentrated portfolio of stocks.

Source: Finominal

FURTHER THOUGHTS

In 2020, David Blitz, Guido Baltussen, and Pim van Vliet published a widely-read article called “When Equity Factors Drop Their Shorts” in the Financial Analysts Journal that argued that most returns from factor investing can be attributed to the long portfolio. Specifically, the abstract mentions “Portfolio tests suggest that the short legs are of limited value to most investors”, which implies that investors don`t need market-neutral products and are perfectly served with long-only implementations like smart beta ETFs.

However, in the most recent decade, it seems that the short portfolio provided all the value to investors, while the long portfolio consistently destroyed value. Better to pull those pants up.

RELATED RESEARCH

Multi-Factor Smart Beta ETFs

Factors: Shorting Stocks vs the Index

Factor Investing Is Dead, Long Live Factor Investing!

The Case Against Factor Investing

Smart Beta vs Alpha + Beta

Factor Olympics 1H 2024

Outperformance Ain’t Alpha

How Painful Can Factor Investing Get?

Multi-Factor Models 101

Combining Smart Beta Funds May Not Be Smart

Smart Beta: Broken by Design?

RELATED ARTICLES

“When Equity Factors Drop Their Shorts“, David Blitz, Guido Baltussen, and Pim van Vliet, 2020

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.