Building Better High Yield Portfolios – III

Balancing diversification and yield

June 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most yield strategies generated lower returns and Sharpe ratios than the S&P 500

- Furthermore, most of these are highly correlated to the U.S. stock market

- Optimization can help to select yield strategies that maximize diversification benefits

INTRODUCTION

Imagine you’ve just left your job and are looking to replace your lost income with yield from your investment portfolio. A financial advisor pitches you a compelling idea: a fund that selects the 50 highest dividend-paying U.S. stocks, all screened to be less risky than the average stock. Monthly distributions, just like your old paycheck – what’s not to like?

Enter Global X’s SuperDividend U.S. ETF (DIV), which does exactly that. Yet over the past 12 years, it delivered a disappointing 3.6% compound annual growth rate (CAGR), compared to the S&P 500’s 13.5%. The reality is that many yield-focused strategies struggle to produce attractive absolute or risk-adjusted returns. Investors often end up sacrificing return of capital in pursuit of return on capital.

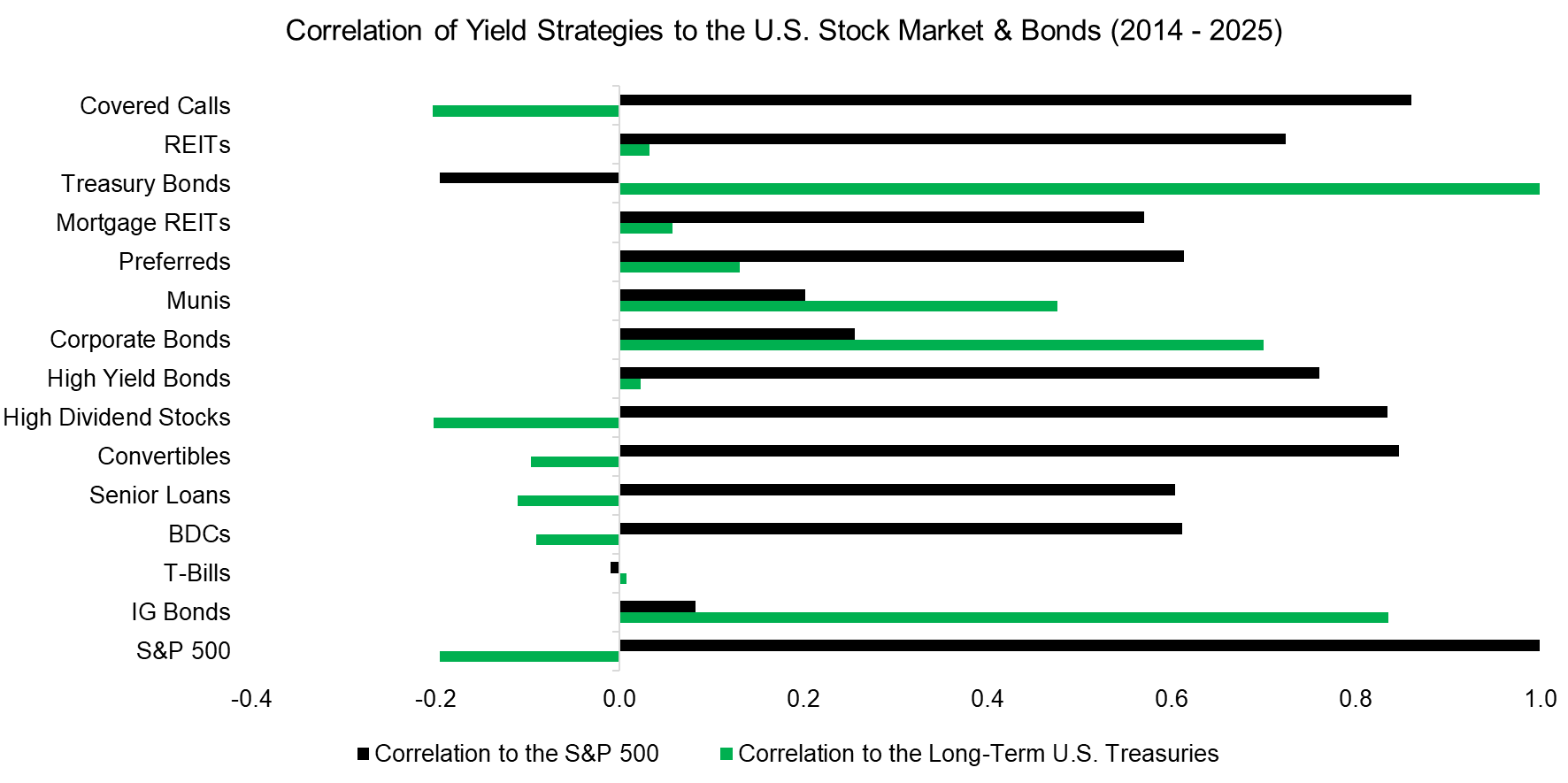

But even identifying a high-yield strategy with solid fundamentals isn’t enough – it also needs to diversify the broader portfolio. Unfortunately, popular income strategies like high-dividend stocks, covered calls, REITs, and convertibles are all highly correlated with equities, making them less effective for diversification than fixed income alternatives.

In this research article, we’ll evaluate which yield strategies best complement portfolios ranging from fully equity-based to pure fixed income.

YIELD VERSUS TOTAL RETURNS

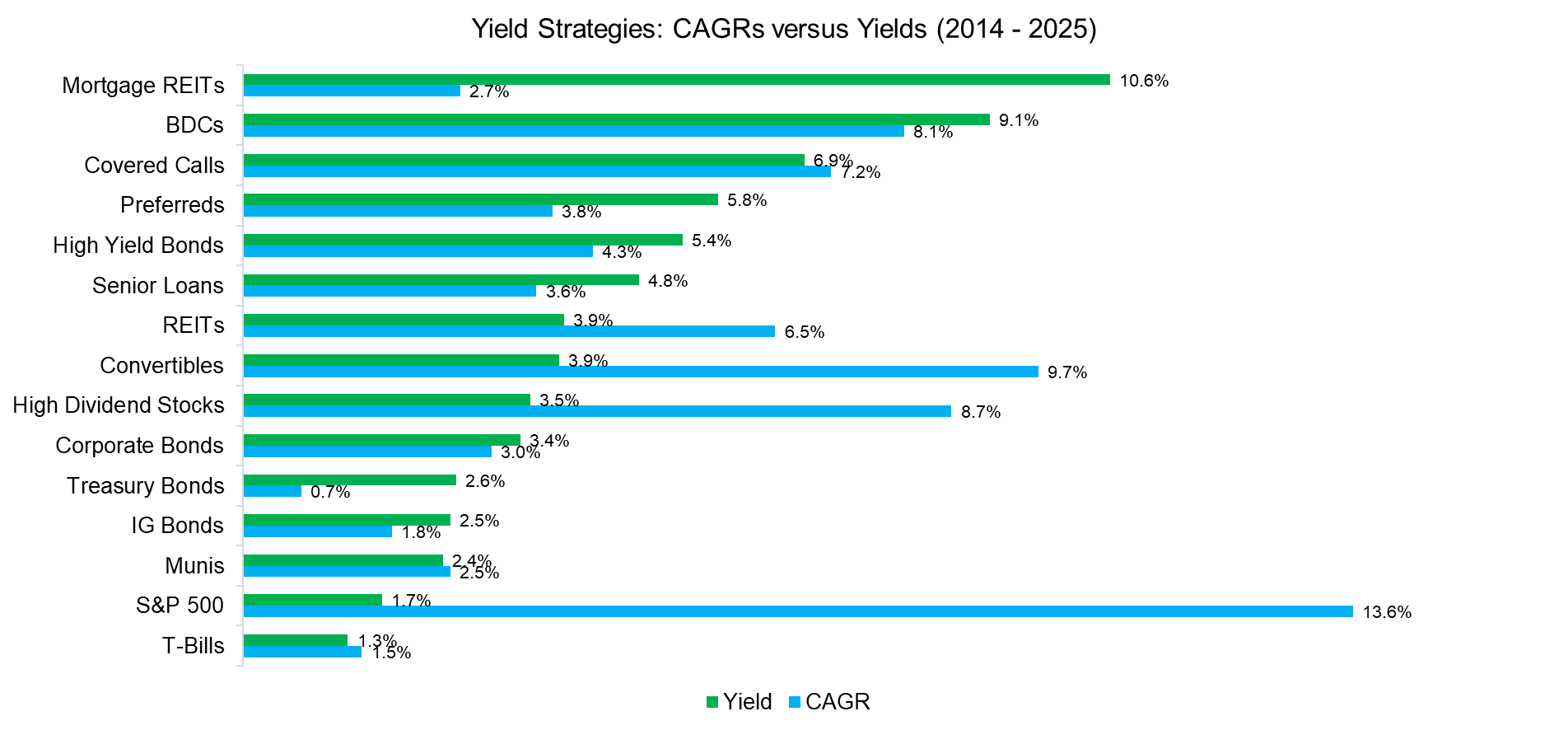

As we noted in earlier research (read Building Better High Yield Portfolios & Building Better High Yield Portfolios – II), some of the highest-yielding strategies have delivered remarkably poor total returns.

For example, mortgage REITs offered an average yield of 10.6% from 2014 to 2025, yet achieved a meager 2.7% compound annual growth rate (CAGR). Business Development Companies (BDCs) fared better, yielding 9.1% and generating a CAGR of 8.1%. Still, both underperformed the S&P 500, which delivered a far superior 13.6% annualized return over the same period, albeit at 1.7% dividend yield.

Source: Finominal

YIELD VERSUS SHARPE RATIOS

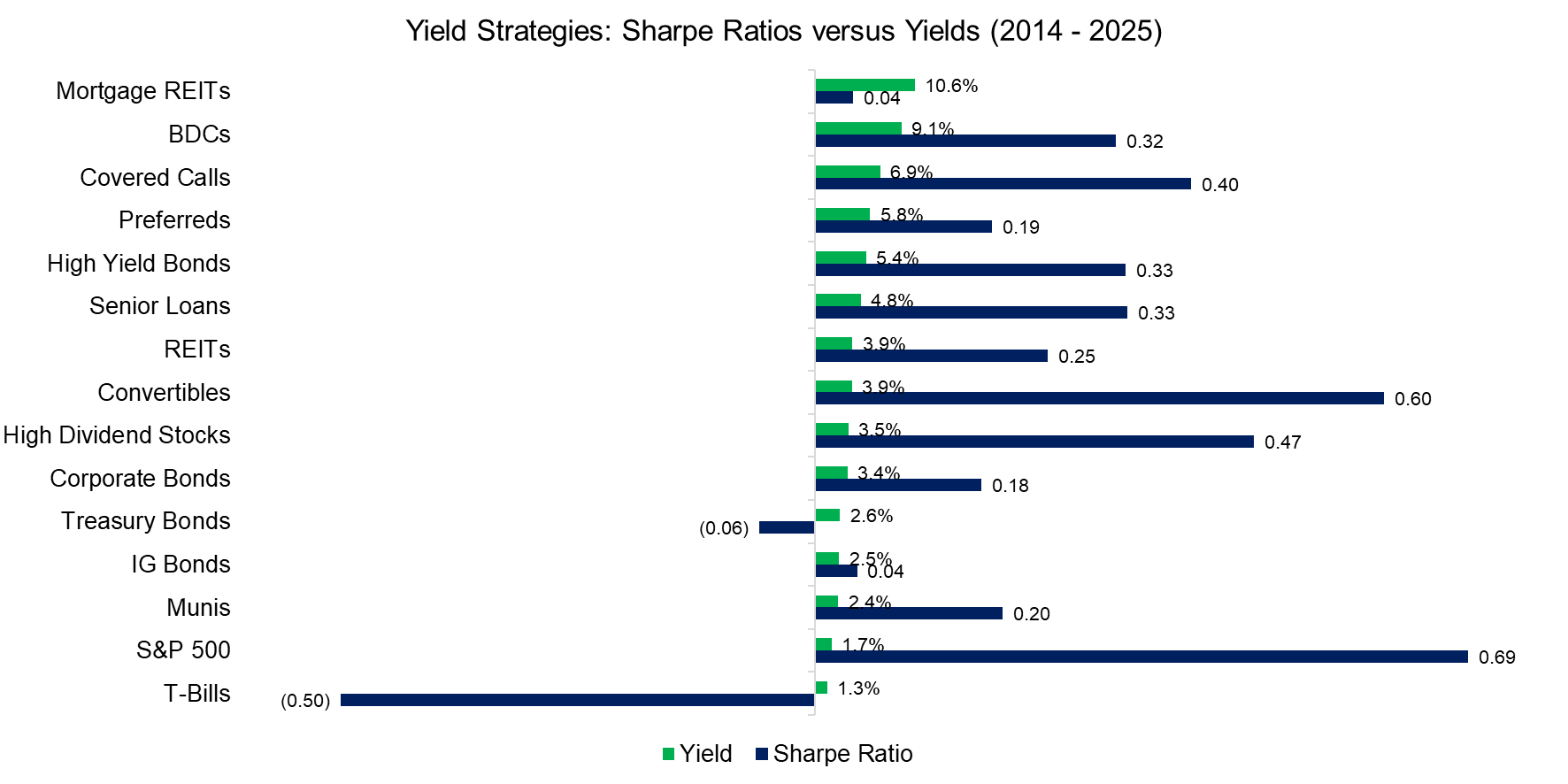

Naturally, comparing the total returns of equity and fixed income strategies is misleading due to their fundamentally different risk profiles. To account for this, we focus on risk-adjusted returns using the Sharpe ratio.

On this basis, most core fixed income strategies – such as Treasuries and corporate bonds – delivered low to even negative risk-adjusted performance. Notably, the Sharpe ratio for T-Bills was negative from 2014 to 2025 when using the Fed Funds Rate as the risk-free benchmark.

Source: Finominal

YIELD STRATEGY SELECTION

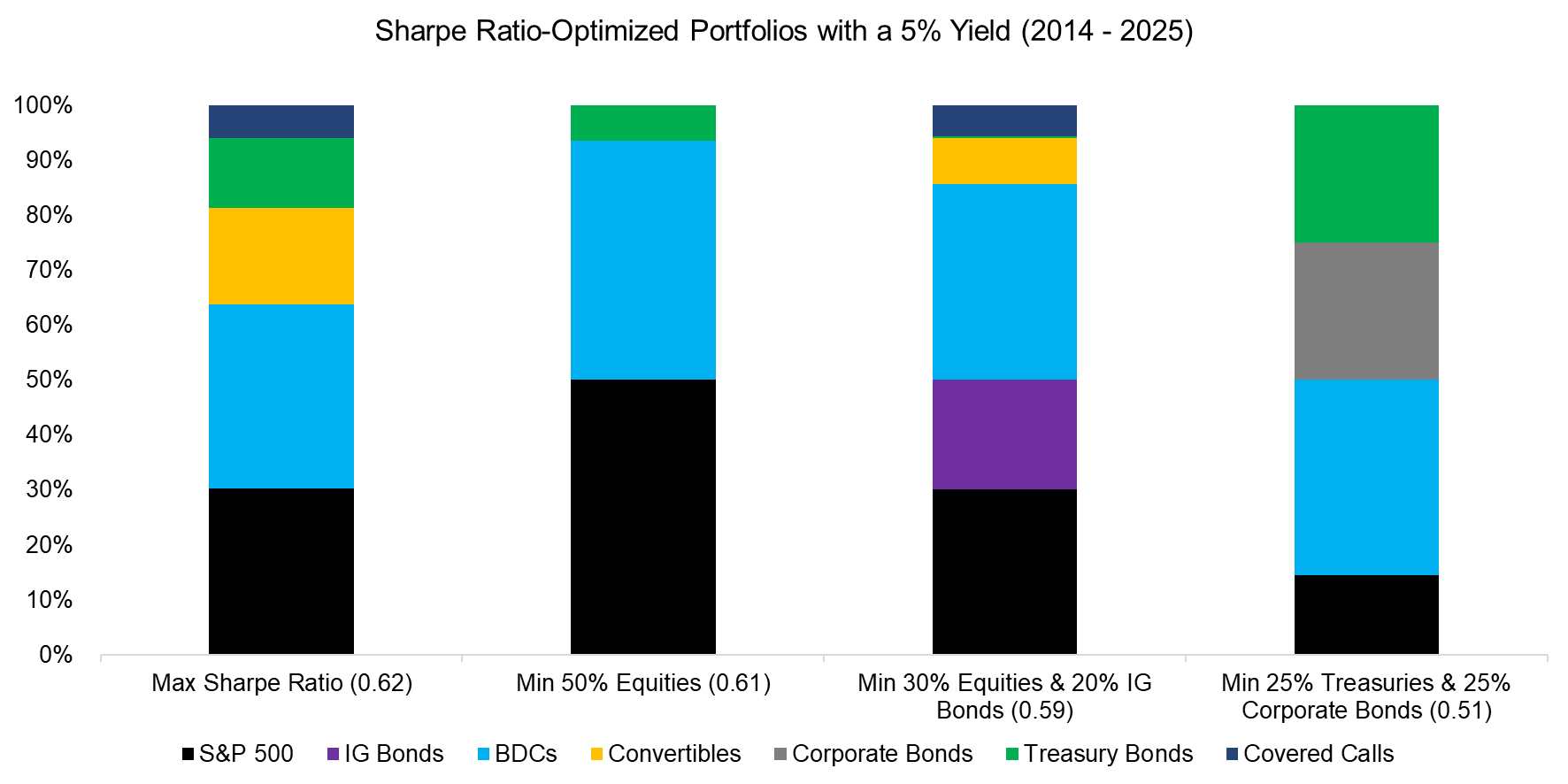

Next, we turn to portfolio optimization. Using the strategies discussed earlier, we construct four portfolios that maximize the Sharpe ratio while targeting a 5% yield. The portfolios vary by constraint:

- An unconstrained portfolio

- A portfolio with a minimum 50% allocation to the S&P 500

- One with at least 30% in the S&P 500 and 20% in investment-grade bonds

- A more conservative mix with a minimum of 25% allocated to long-term U.S. Treasuries and 25% to corporate bonds

All four optimized portfolios achieved similar risk-adjusted performance, with Sharpe ratios ranging from 0.51 to 0.62, while maintaining the 5% yield target over the 2014 to 2025 period. Despite the differing constraints, there were common themes: each portfolio included allocations to the S&P 500, BDCs, and U.S. Treasuries. Additionally, convertibles and covered call strategies appeared in two of the four portfolios.

Source: Finominal

Notably, none of the four optimized portfolios included mortgage REITs, preferreds, municipal bonds, high yield bonds, dividend yield strategies, senior loans, or T-Bills. This exclusion is largely explained by their unattractive Sharpe ratios – such as in the case of mortgage REITs – or their high correlation with equities or traditional fixed income, as seen with high dividend stocks.

Source: Finominal

FURTHER THOUGHTS

This analysis may be subject to criticism due to its relatively short 12-year lookback period, during which fixed income strategies have underperformed – largely due to the sharp rise in interest rates over the past five years. However, with global public debt reaching potentially unsustainable levels in many countries, inflation may remain elevated, posing challenges for fixed income investments going forward.

The key takeaway is that selecting yield strategies should prioritize both yield maximization and risk-adjusted returns. This necessitates tailored, customized portfolios. Simply allocating to the highest-yielding strategies – such as DIV – has proven ineffective and leads to poor performance.

RELATED RESEARCH

Building Better High Yield Portfolios – II

Building Better High Yield Portfolios

Don’t Convert to Convertible Bonds

HY Bonds = High or Hazardous Yield?

BDCs: Better Don’t Choose?

Do-It-Yourself High-Dividend Strategies

A Crescendo in Private Credit?

CLOs – Diversifier, or another Equity Clone?

Covered Call Strategies Uncovered

Preferential Times for Preferred Income Strategies?

Analyzing Floating Rate ETFs

The Case Against REITs

The Case Against Equity Income Funds

Resist the Siren Call of High Dividend Yields

How Much Can You Lose with Bonds?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.