Factor Optimization via ETFs

Is a value ETF necessary to gain exposure to the value factor?

June 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Factor exposures can be acquired from various sources

- For example, energy stocks are cheaper than stocks from a value ETF

- However, these may come with additional factor exposures

INTRODUCTION

In our recent article, “The Pitfalls of Portfolio Optimization,” we demonstrated that optimizing portfolios for Sharpe ratios or target volatility often leads to disappointing out-of-sample performance. In every case, realized Sharpe ratios were lower than in-sample, and actual volatility consistently missed its target.

Another common approach is tilting portfolios toward specific factors like value or quality, either through individual stocks or ETFs. However, given the underwhelming results of traditional optimization, it’s worth questioning whether factor tilting offers a more reliable path to success.

In this research article, we investigate the effectiveness of factor optimization using ETFs.

FACTOR OPTIMIZATION

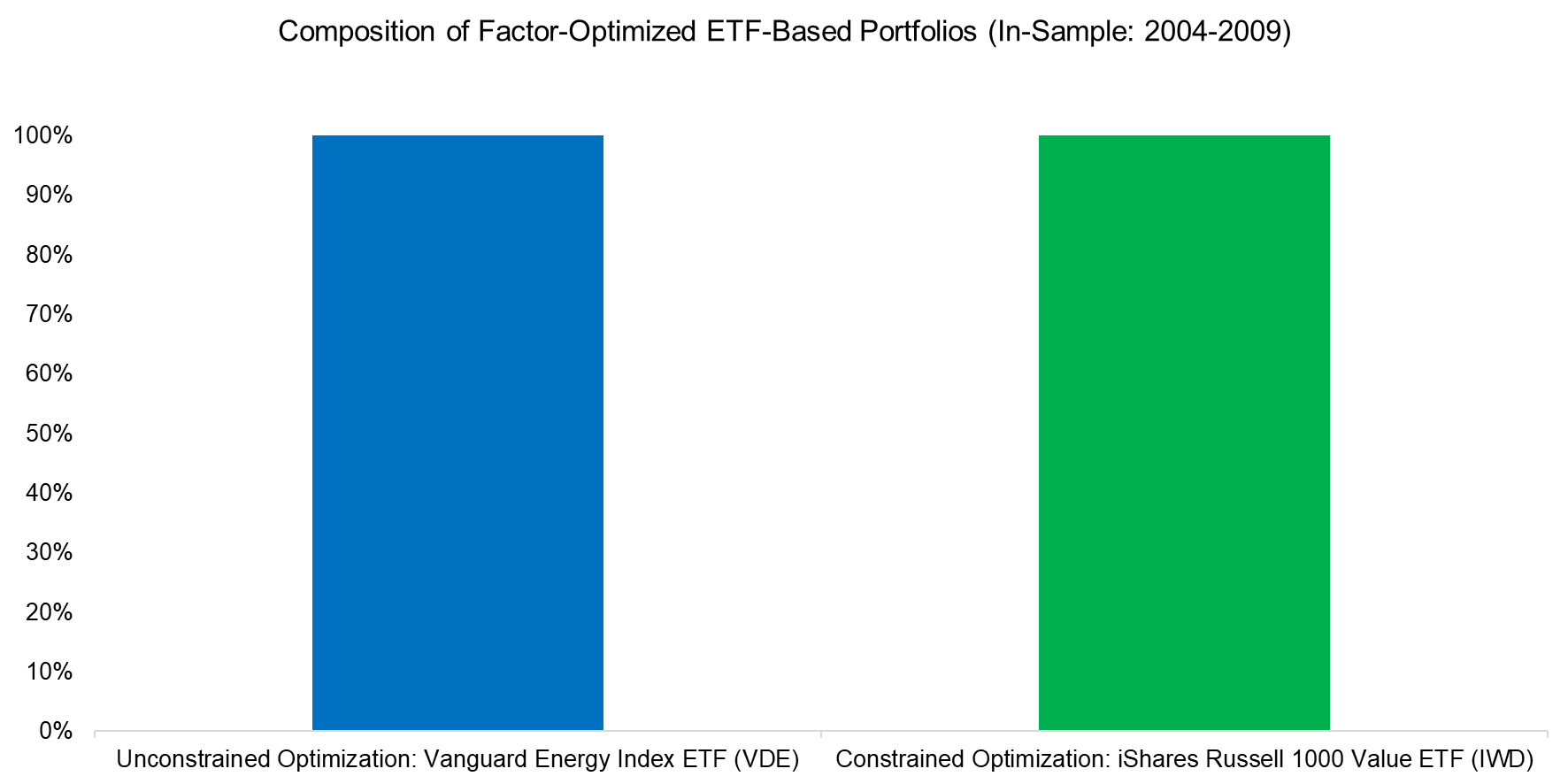

We analyze a universe of well-known asset class, sector, and factor ETFs to gain exposure to the value factor. Our approach involves optimizing for beta to the value factor by selecting one or more ETFs over rolling 5-year in-sample periods, beginning in 2004. When we allow the optimization to freely select ETFs with the highest value exposure – what we refer to as unconstrained optimization – the result is a 100% allocation to energy stocks via the Vanguard Energy Index ETF (VDE).

Given this somewhat counterintuitive outcome, we introduce a constraint by limiting the universe to asset class and factor-focused smart beta ETFs. Under this constrained optimization, the model allocated 100% to the iShares Russell 1000 Value ETF (IWD) during the in-sample period from 2004 to 2009.

Source: Finominal

CONSTRAINED FACTOR OPTIMIZATION

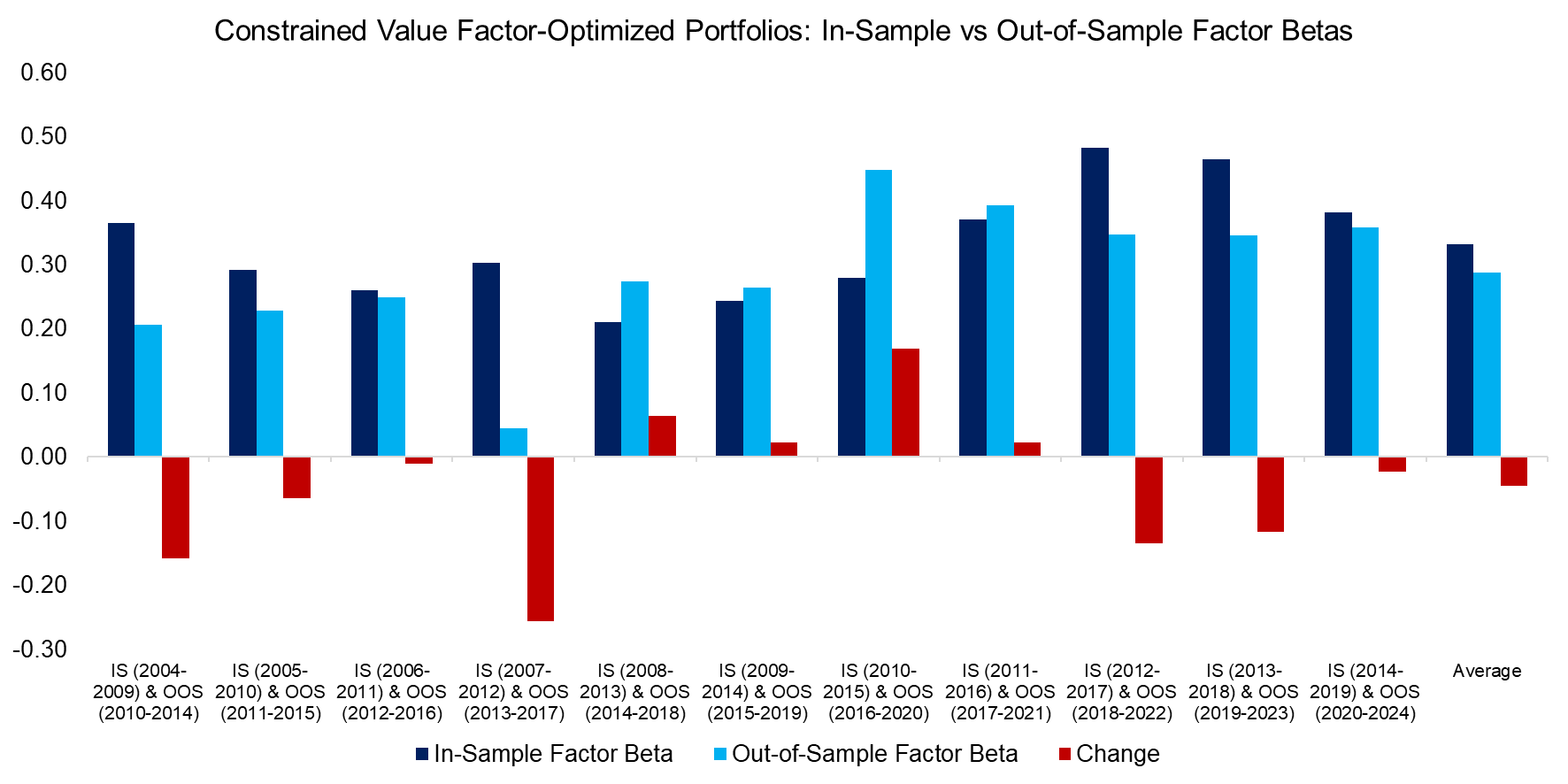

When limiting the investment universe to asset class indices and smart beta strategies for value factor exposure, the optimization process produced 11 in-sample portfolios. Each portfolio was fully allocated to a single fund: five times to the iShares Russell 2000 Value ETF (IWN), four times to the iShares Russell 1000 Value ETF (IWD), once to the iShares S&P 500 Value ETF (IVE), and once to the iShares MSCI Emerging Markets ETF (EEM).

The average in-sample beta to the value factor was 0.33, compared to 0.29 out-of-sample. Only four of the eleven portfolios showed a higher out-of-sample beta than their in-sample beta.

Source: Finominal

UNCONSTRAINED FACTOR OPTIMIZATION

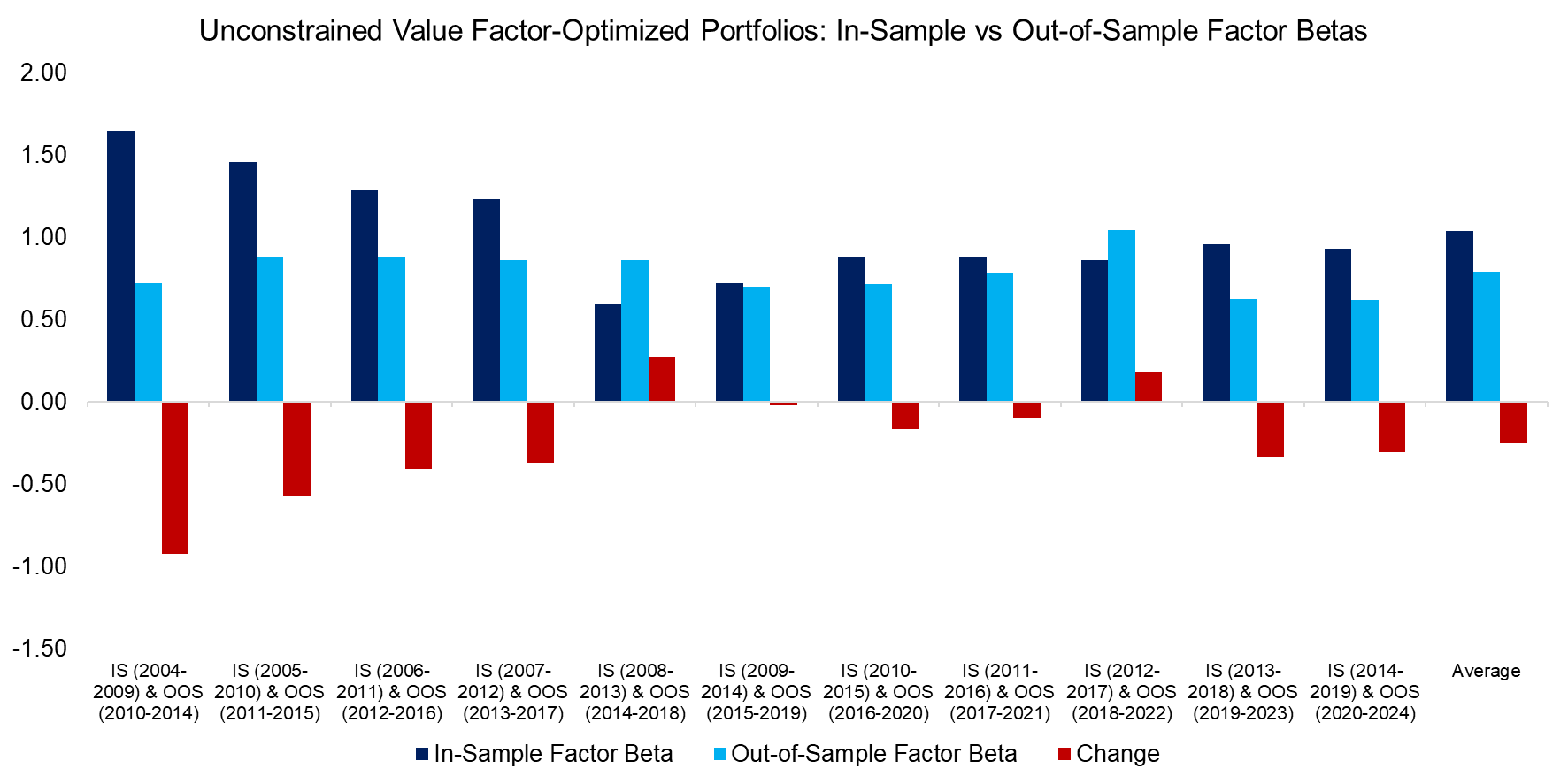

When selecting from the unconstrained universe, the optimization resulted in nine portfolios comprised of a 100% allocations to the Vanguard Energy Index ETF (VDE) and two portfolios with 100% allocations to the Fidelity MSCI Financials Index ETF (FNCL). In other words, not once during the 11 in-sample periods from 2004 to 2014 did a value-focused ETF maximize the value factor exposure.

A comparison of in-sample versus out-of-sample betas to the value factor shows that in only two instances was the out-of-sample beta higher. However, the average out-of-sample beta was 0.79 – substantially higher than the 0.29 average achieved using value-focused ETFs from the constrained universe.

Source: Finominal

ENERGY VS VALUE STOCKS

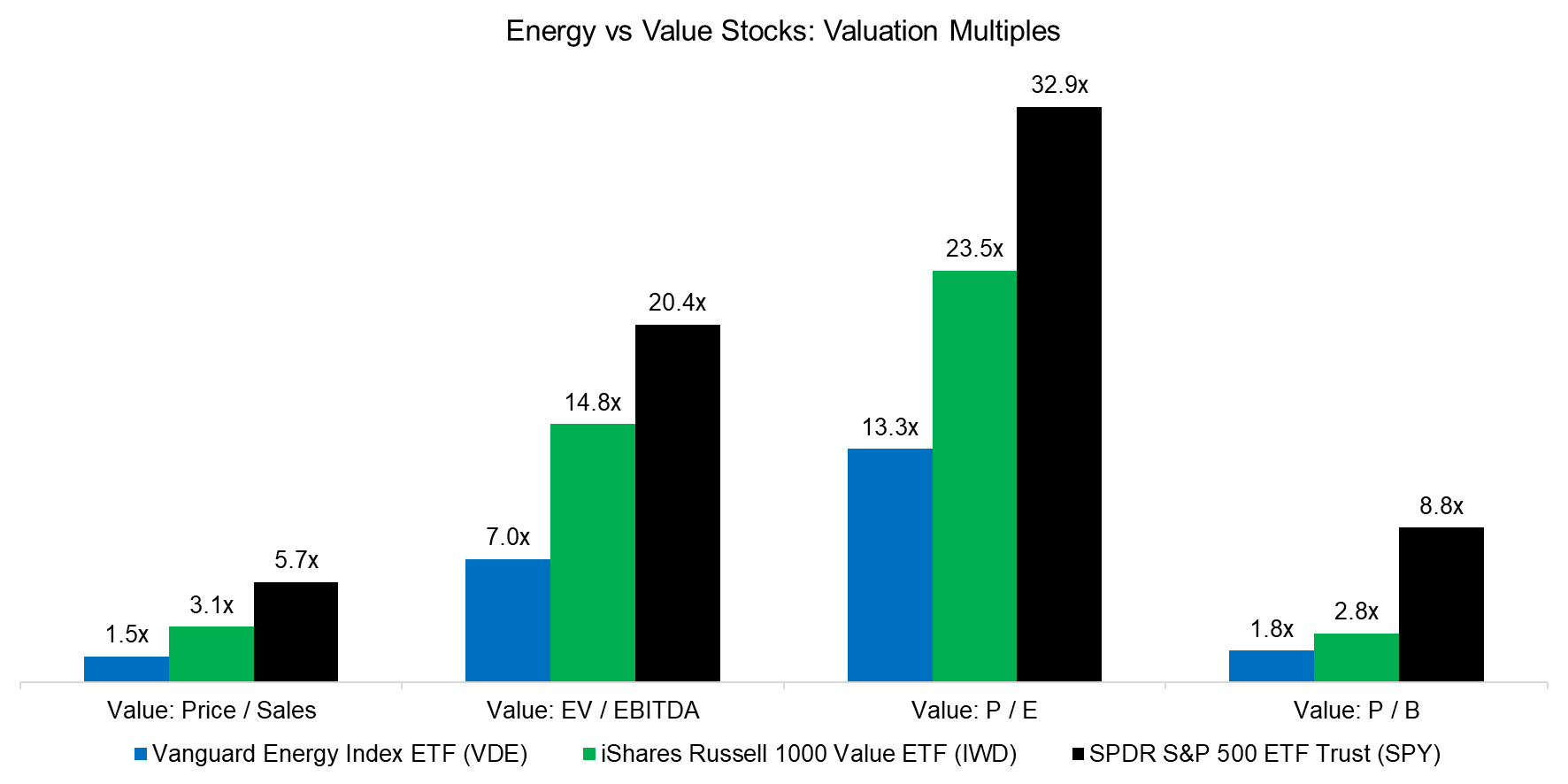

Given their higher betas to the value factor, energy stocks appear to exhibit stronger value characteristics than stocks from value-focused ETFs. A closer look confirms this: based on key valuation metrics – price-to-sales, EV/EBITDA, P/E, and P/B ratios – energy stocks are consistently cheaper than the holdings in the iShares Russell 1000 Value ETF (IWD).

Source: Finominal

UNINTENDED CONSEQUENCES

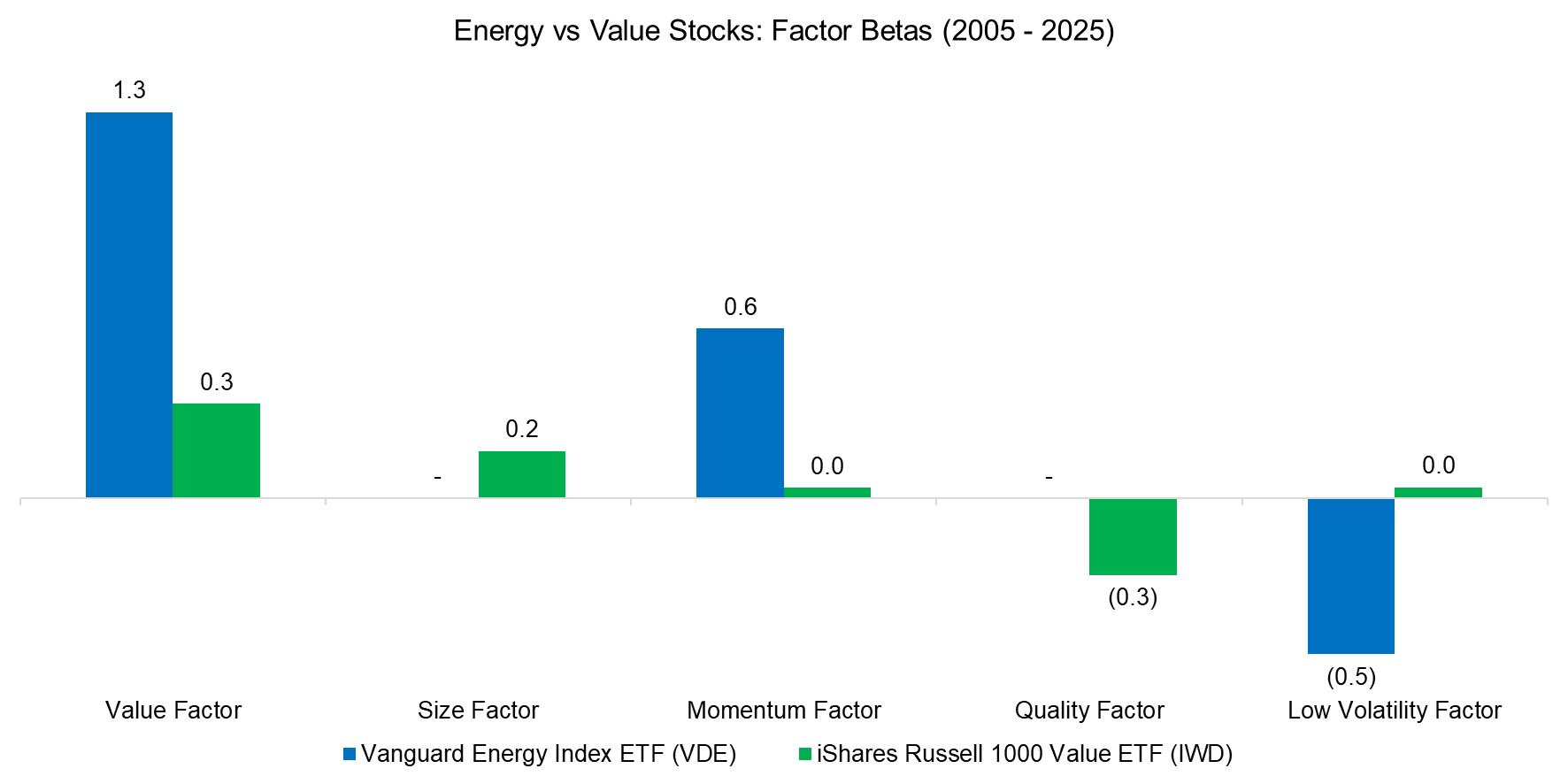

However, while energy stocks exhibit a higher beta to the value factor, they also show a positive beta to the momentum factor and a negative beta to the low volatility factor. In contrast, traditional value stocks are typically characterized by smaller market capitalizations and weaker quality attributes.

Source: Finominal

FURTHER THOUGHTS

The iShares Russell 1000 Value ETF (IWD) overweights the energy sector, with a 7% allocation compared to just 3% in the broader Russell 1000 Index. But for investors seeking targeted exposure to the value factor, should they rely on intuitive fund selections – or optimize exposure using an unconstrained ETF universe?

In some cases, unconstrained optimization may be more capital efficient. For example, a smaller allocation to the Vanguard Energy ETF (VDE) could deliver the same value factor exposure as a larger allocation to IWD. However, this efficiency often comes at the cost of unintended exposures, such as concentrated sector bets or unwanted factor tilts.

Unfortunately, there are currently no ETF products that offer pure exposure to individual factors without side effects. For investors seeking cleaner, more precise factor exposure, customized stock-based portfolios remain a better alternative to off-the-shelf smart beta ETFs (read Smart Beta ETF vs Customized Factor Portfolios).

RELATED RESEARCH

The Pitfalls of Portfolio Optimization

Smart Beta ETF vs Customized Factor Portfolios

Factor Exposure Analysis 105: Sectors versus Factors

Factor Optimization

Factor Exposure: Smart Beta ETFs vs Mutual Funds

ETFs, Smart Beta & Factor Exposure

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.