60/40 vs Leveraged Diversified Portfolio

Leverage can cut both ways

August 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Leverage is usually a destructive feature in investment products

- However, using leverage with diversified portfolios can help achieve specific investment objectives

- Bonds are not necessarily needed in asset allocation when considering alternatives

INTRODUCTION

When CalPERS announced in November 2021 that it would use a modest amount of leverage to boost its private equity exposure, the move drew sharp criticism from some investors who viewed it as excessively risky.

Yet, many of those same investors are eager to gain access to large multi-strategy hedge funds like Millennium and Citadel, which routinely use 5x to 10x leverage. So why does this form of leverage raise fewer concerns?

The key distinction lies in the nature of the underlying strategies. Private equity is still equity – leveraging it amplifies returns, but also directional risk. It’s a concentrated bet. In contrast, multi-strategy hedge funds diversify across numerous uncorrelated alpha streams, where the failure of one strategy has limited impact on the whole.

In short, leverage can magnify gains – or losses. In this article, we explore how it can be used effectively to pursue specific investment objectives.

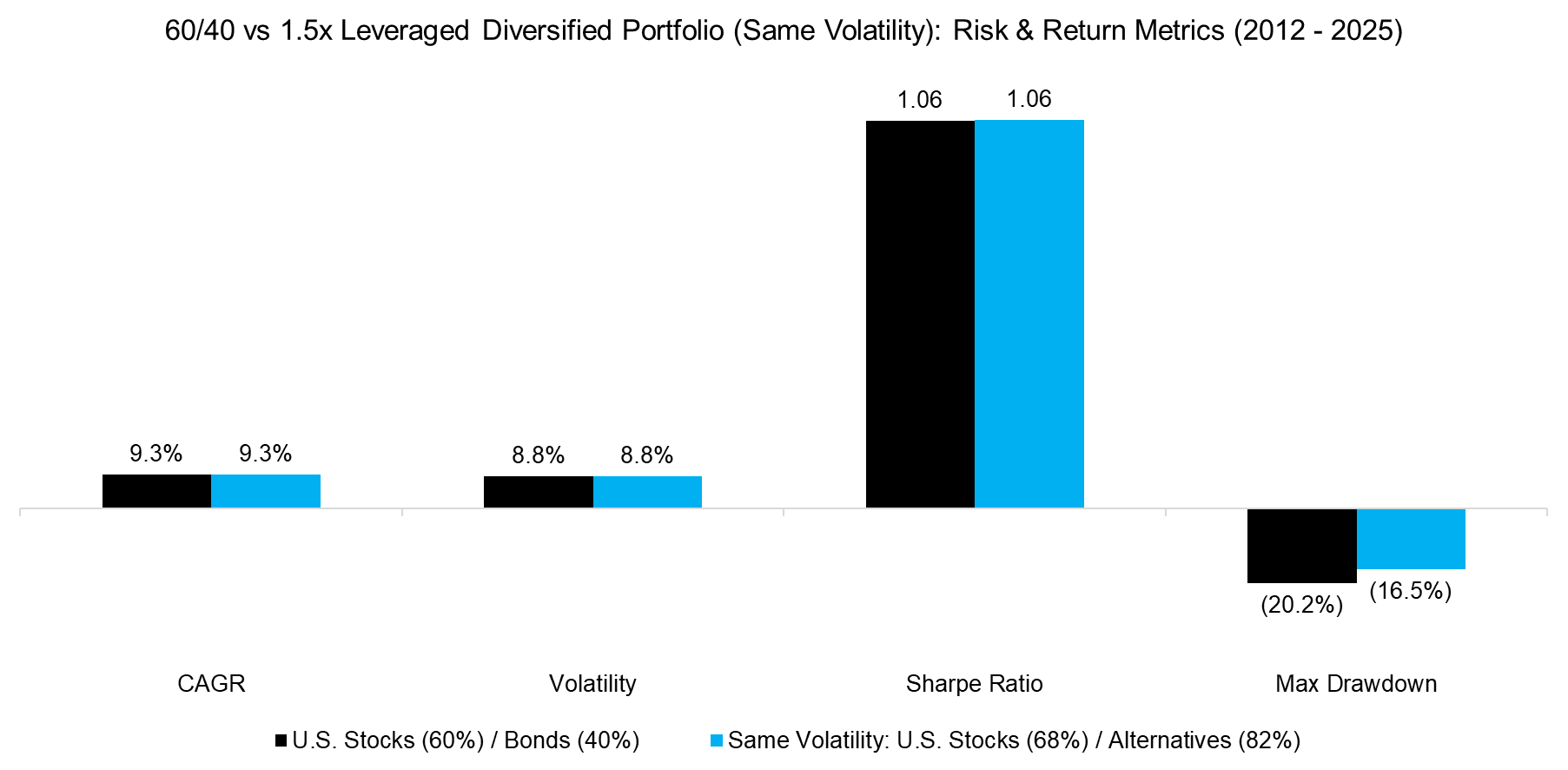

60/40 vs LEVERAGED DIVERSIFIED PORTFOLIO: SAME VOLATILITY

We construct a diversified portfolio using a range of alternative strategies, including: AQR Managed Futures Strategy Fund (AQMIX), Vanguard Market Neutral Fund (VMNIX), BlackRock Global Equity Market Neutral Fund (BDMIX), AQR Diversified Arbitrage Fund (ADAIX), Eaton Vance Global Macro Absolute Return Fund (EGRIX), AGF U.S. Market Neutral Anti-Beta Fund (BTAL), and SPDR Gold Shares (GLD) (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios). We also allow the S&P 500 and U.S. investment-grade bonds to be used in the optimization process.

To ensure a fair comparison with a traditional 60/40 portfolio (comprised of U.S. equities and investment-grade bonds), we target the same level of volatility. The portfolio is rebalanced monthly and employs 1.5x leverage, with the cost of leverage assumed to be the U.S. Federal Funds Rate plus 2.5%. Using this framework, we optimize the portfolio to match the volatility and return of the 60/40 benchmark, thereby achieving the same Sharpe ratio.

Source: Finominal

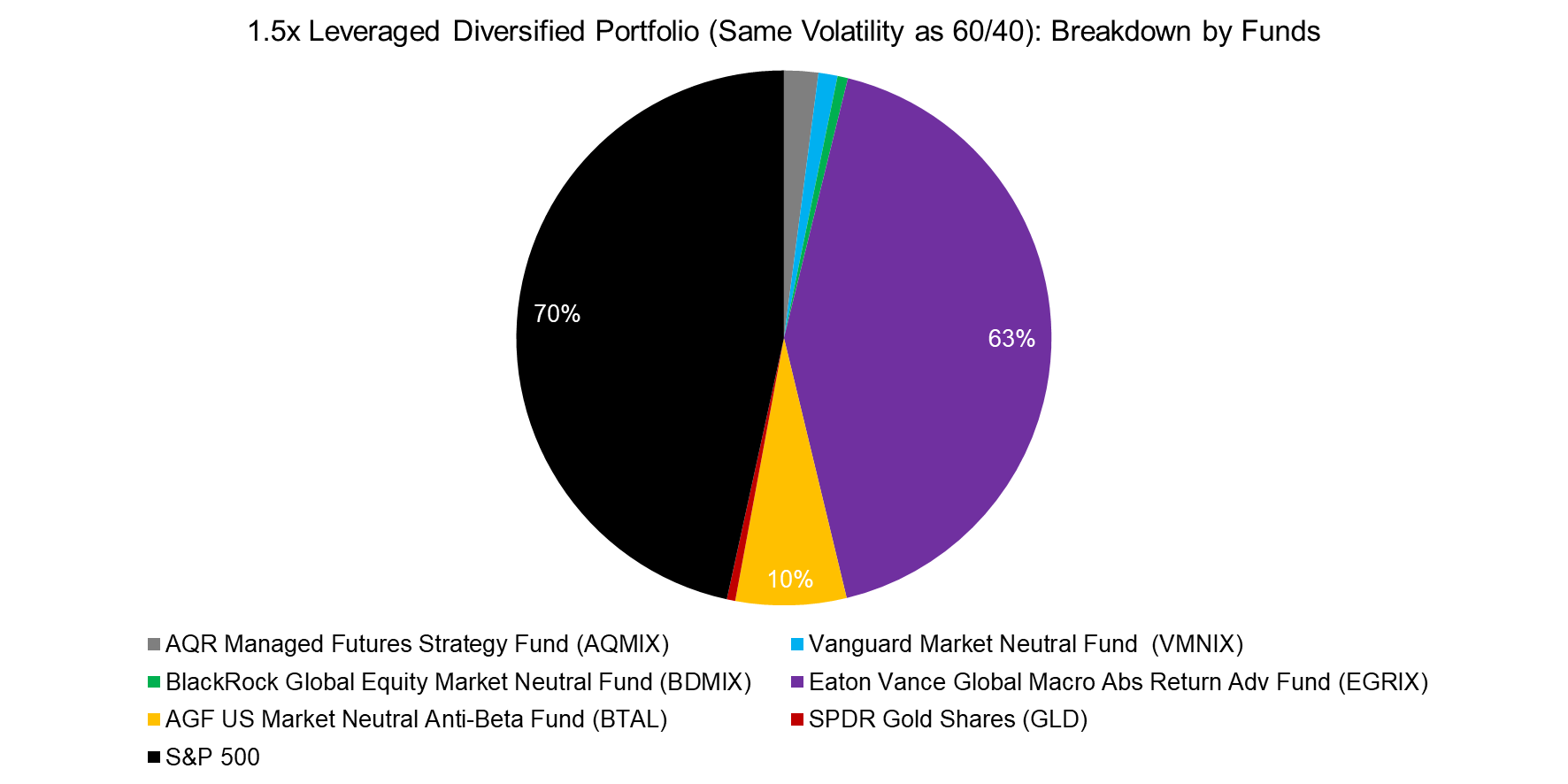

However, upon examining the holdings of the 1.5x leveraged diversified portfolio, we find that while 70% is allocated to the S&P 500, there is no allocation to bonds. Instead, the second-largest position is in the Eaton Vance Global Macro Absolute Return Fund (EGRIX) at 63%, followed by a 10% allocation to the AGF U.S. Market Neutral Anti-Beta Fund (BTAL).

Source: Finominal

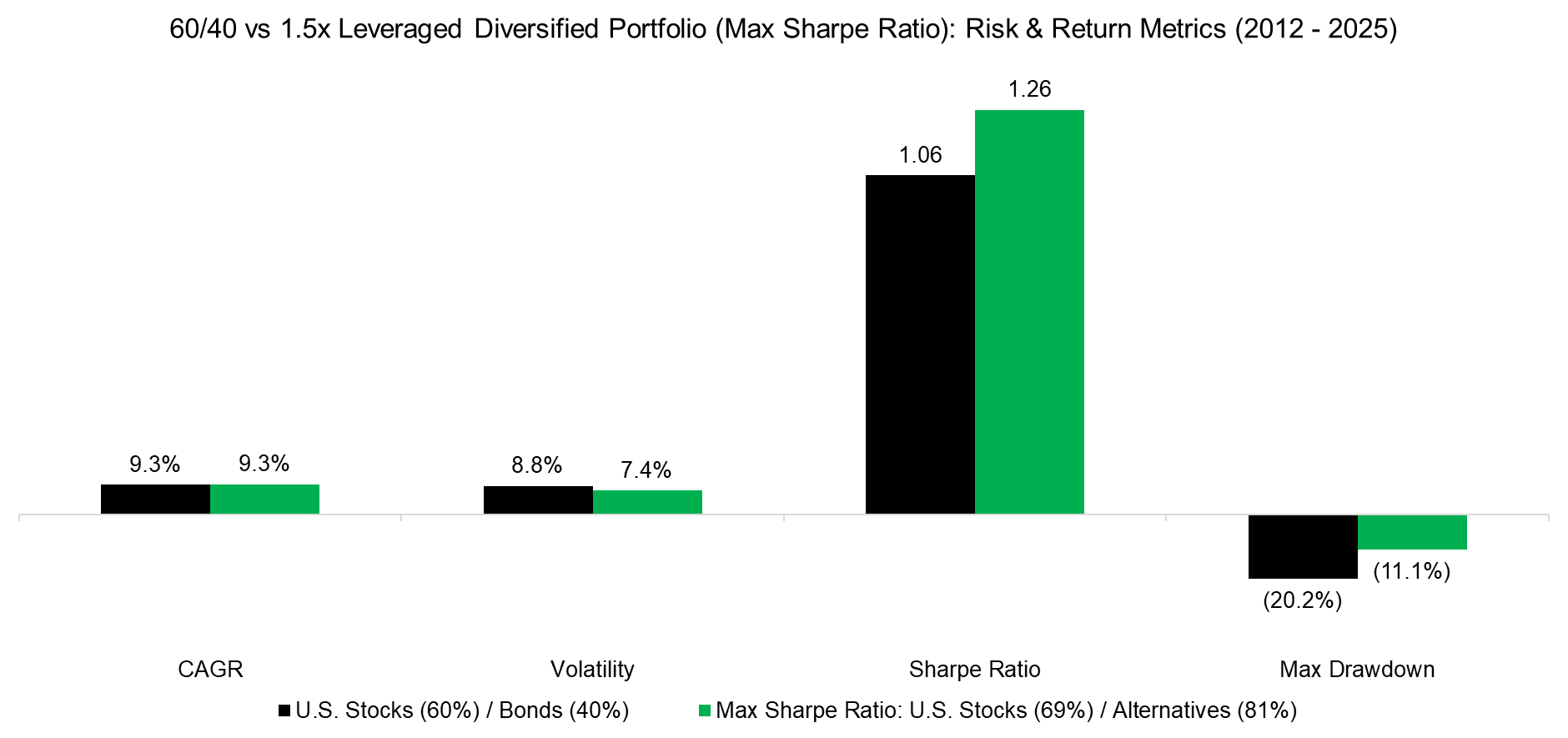

60/40 vs LEVERAGED DIVERSIFIED PORTFOLIO: MAX SHARPE RATIO

Next, we optimize the portfolio for the highest possible Sharpe ratio, using a combination of alternative funds, the S&P 500, and investment-grade bonds. We impose a constraint that the portfolio must match the 60/40 portfolio’s CAGR of 9.3%. Under this constraint and with 1.5x leverage, the Sharpe ratio improves from 1.06 to 1.26. Additionally, portfolio volatility drops from 8.8% to 7.4%, and the maximum drawdown improves significantly – from -20% to -11%.

Source: Finominal

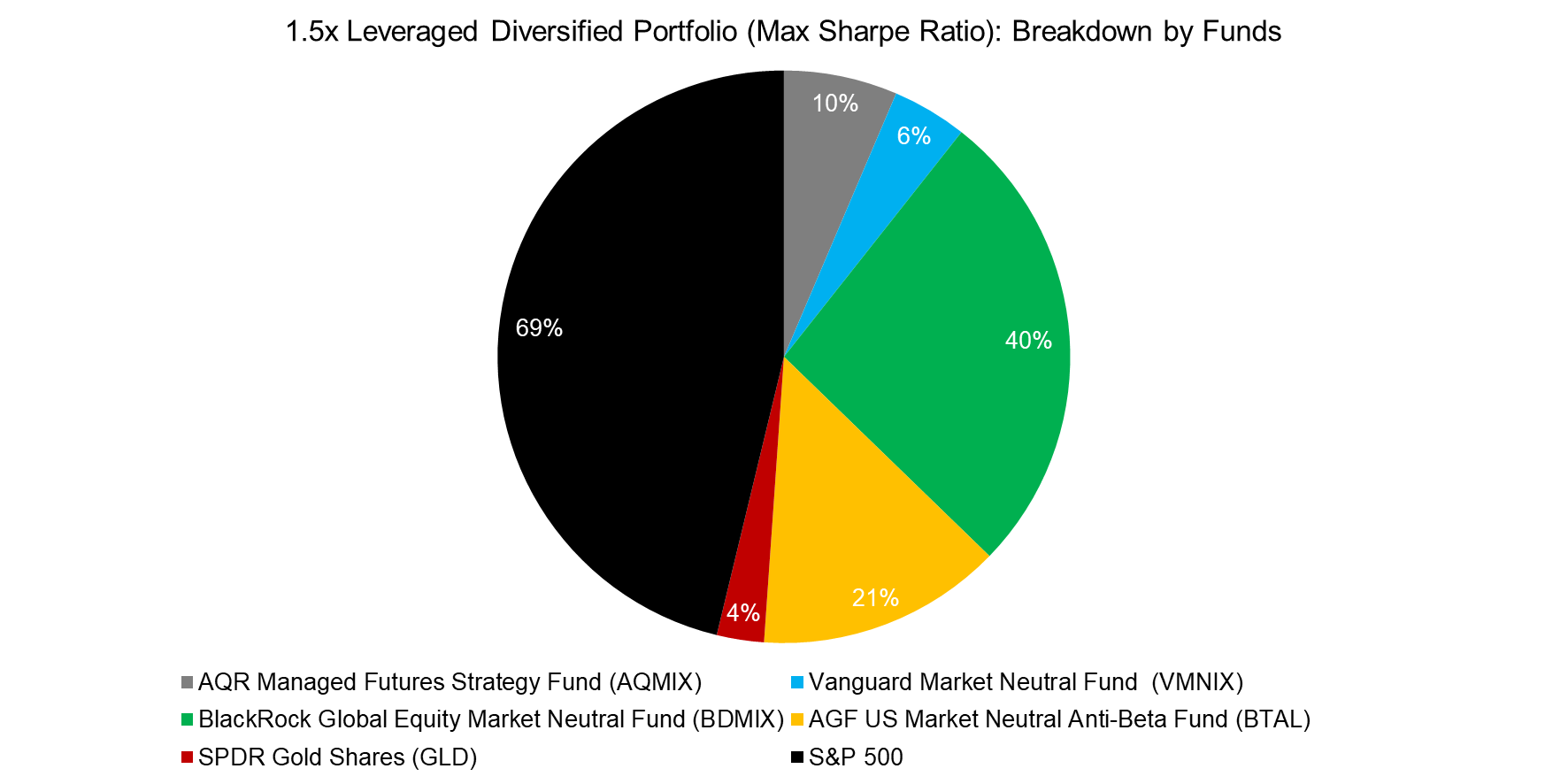

Maximizing the Sharpe ratio led to a notable shift in portfolio composition. The allocation to the S&P 500 remained at approximately at 70%, while exposure to alternative strategies became more diversified. The BlackRock Global Equity Market Neutral Fund (BDMIX) received the second-largest allocation at 40%, followed by a 21% allocation to the AGF U.S. Market Neutral Anti-Beta Fund (BTAL). Once again, the portfolio included no allocation to bonds.

Source: Finominal

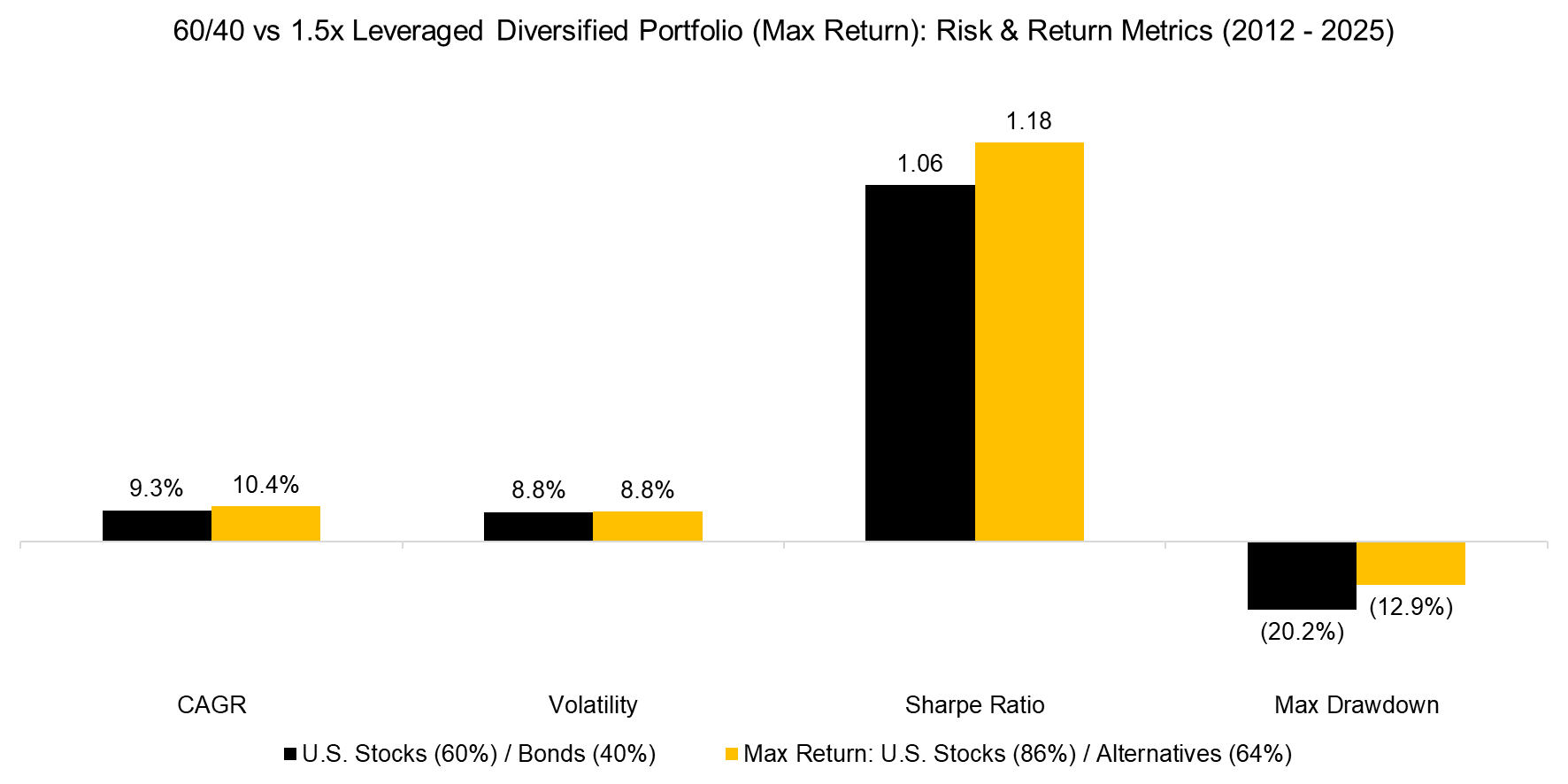

60/40 vs LEVERAGED DIVERSIFIED PORTFOLIO: MAX RETURN

Finally, we maximize the portfolio’s return, increasing it from 9.3% in the traditional 60/40 portfolio to 10.4%, while maintaining the same volatility of 8.8% and applying 1.5x leverage. With risk held constant and returns improved, the leveraged diversified portfolio achieves a higher Sharpe ratio than the traditional portfolio.

Source: Finominal

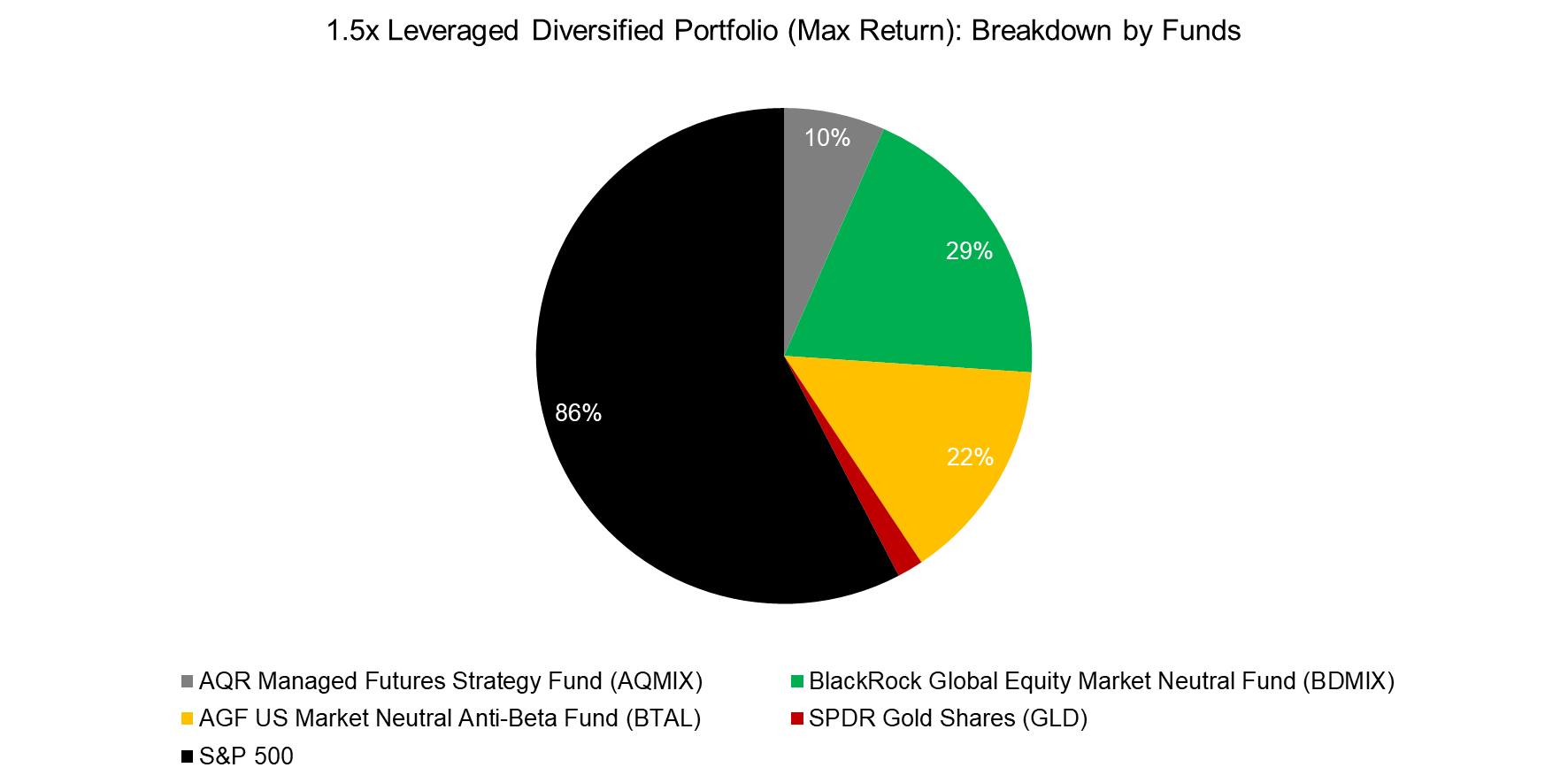

In this scenario, the allocation to the S&P 500 rose to 86%, bonds remained excluded, and the BlackRock Global Equity Market Neutral Fund (BDMIX) and AGF U.S. Market Neutral Anti-Beta Fund (BTAL) held the second and third largest allocations at 29% and 22%, respectively.

Source: Finominal

FURTHER THOUGHTS

This analysis is not without limitations. Using funds with track records exceeding a decade introduces survivorship bias, and as highlighted in The Pitfalls of Portfolio Optimization, there is often a meaningful gap between in-sample and out-of-sample performance in such optimization exercises.

That said, our fund selection was not based on historical performance, but rather on their ability to represent distinct, uncorrelated return streams – similar to the approach taken by multi-strategy hedge funds. As such, the findings still offer useful insights: when applied thoughtfully, leverage can help achieve specific investment objectives, and traditional bond allocations may not be essential in modern portfolio construction (read 60/40 Portfolios Without Bonds).

RELATED RESEARCH

The Pitfalls of Portfolio Optimization

60/40 Portfolios Without Bonds

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

What´s Better than the S&P 500?

Outperformance via Leverage

Complexity is the Enemy of Investing

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.