Private Equity Managers vs Private Equity Funds

Is it better to bet on Blackstone or with Blackstone?

September 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Private equity managers have performed worse than private equity funds

- However, both have underperformed global equities over the last 20 years

- And they were highly correlated to equities, offering limited diversification benefits

INTRODUCTION

KKR’s co-founder Henry Kravis is a billionaire, as are Blackstone’s Stephen Schwarzman, Apollo’s Leon Black, and Thoma Bravo’s Orlando Bravo. The roster of private equity titans who have amassed vast fortunes is long. By contrast, it is rare to find the names of private equity fund investors appearing on billionaire lists. Put differently: where are the customers’ yachts?

This raises a key question: for an investor looking to allocate to private equity, might it be more rewarding to invest in the management companies rather than in the funds themselves?

In this research article, we examine the performance of private equity managers versus their funds.

PRIVATE EQUITY MANAGERS VS PRIVATE EQUITY FUNDS

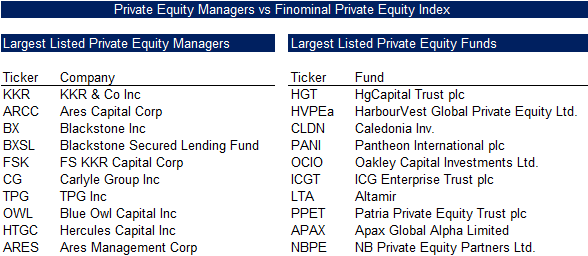

We construct an equal-weighted index of private equity managers using three ETFs: the Invesco Global Listed Private Equity ETF (PSP), the Whitewolf Publicly Listed Private Equity ETF (LBO), and the ProShares Global Listed Private Equity ETF (PEX). These ETFs provide exposure to publicly traded private equity firms. The dataset extends back to 2006, though at that time only a handful of top-tier firms were listed. Today, however, most of the industry’s largest players – including KKR, Blackstone, Apollo, Ares, Carlyle, and TPG – are publicly traded.

For private equity funds, we rely on the Finominal Private Equity Index, which tracks listed private equity funds primarily traded on the London Stock Exchange (LSE). This index offers daily return data, a valuable feature given that private equity funds traditionally report performance only on a quarterly basis. The universe includes established names such as HgCapital, ICG, and Apax (read Private Equity Without the Lag).

Source: Finominal

PERFORMANCE BENCHMARKING

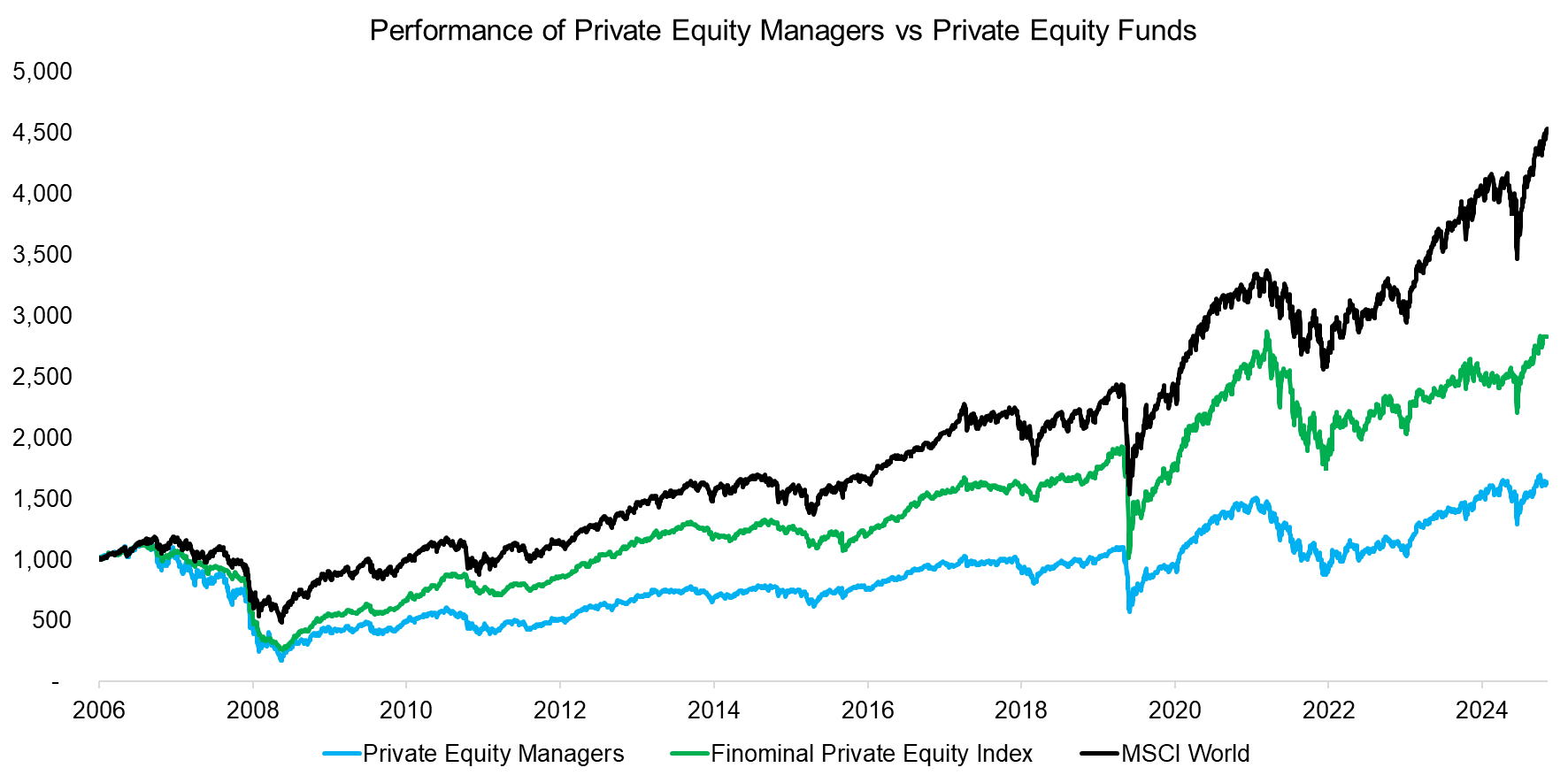

We compare the performance of private equity managers, the Finominal Private Equity Index, and the MSCI World Index. Since 2006, global equities have delivered the strongest returns, outperforming private equity funds, which in turn have outperformed the shares of private equity managers.

Source: Finominal

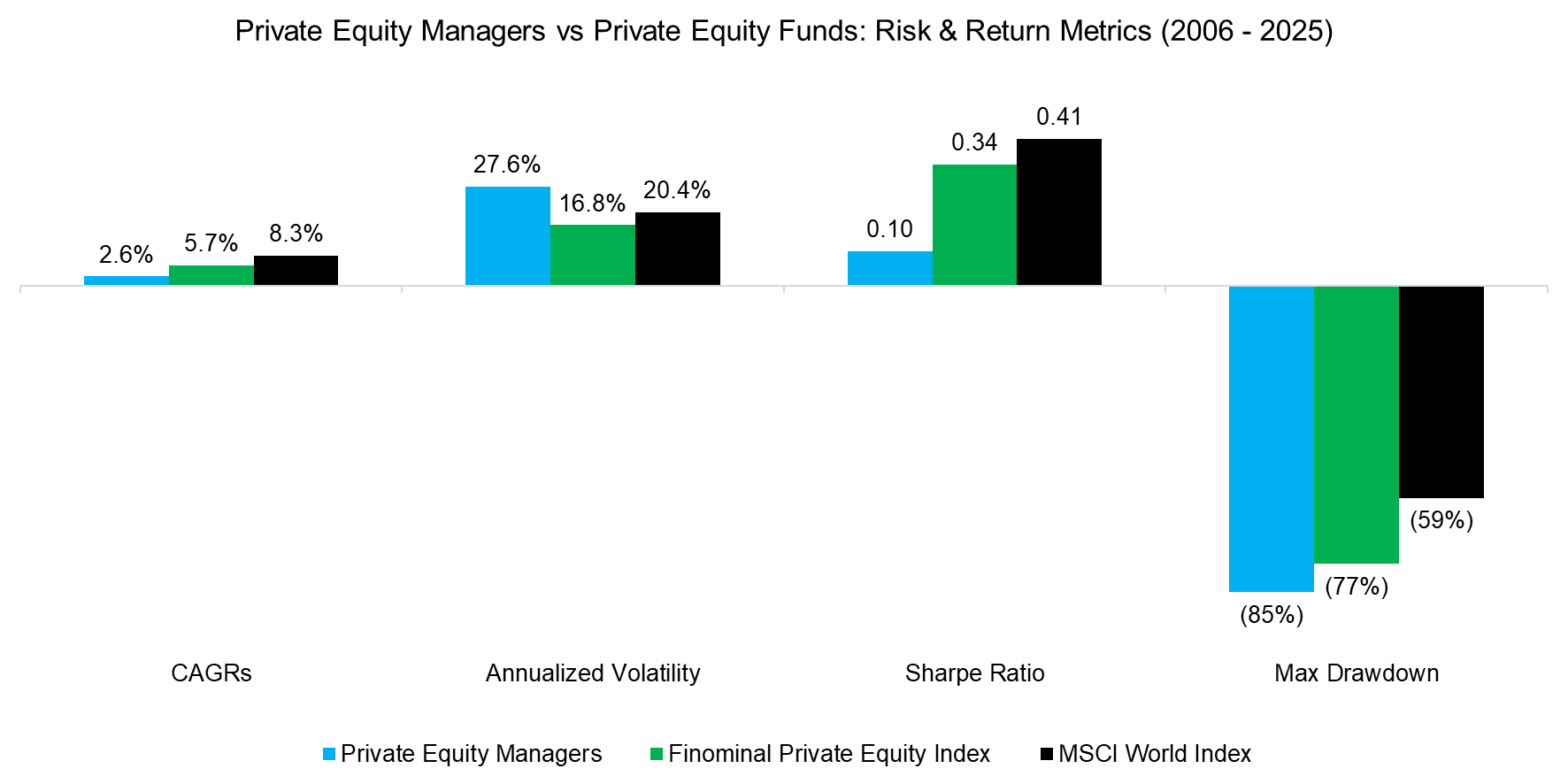

Examining risk and return metrics from 2006 to 2025 reveals that private equity fund managers delivered the weakest performance, characterized by the lowest CAGR, the highest volatility, and the deepest drawdowns.

Source: Finominal

The weak performance of private equity fund managers can be partly attributed to the index historically containing only a few stocks, some of which – like the now-delisted Fortress Investment Group – suffered steep losses during the global financial crisis.

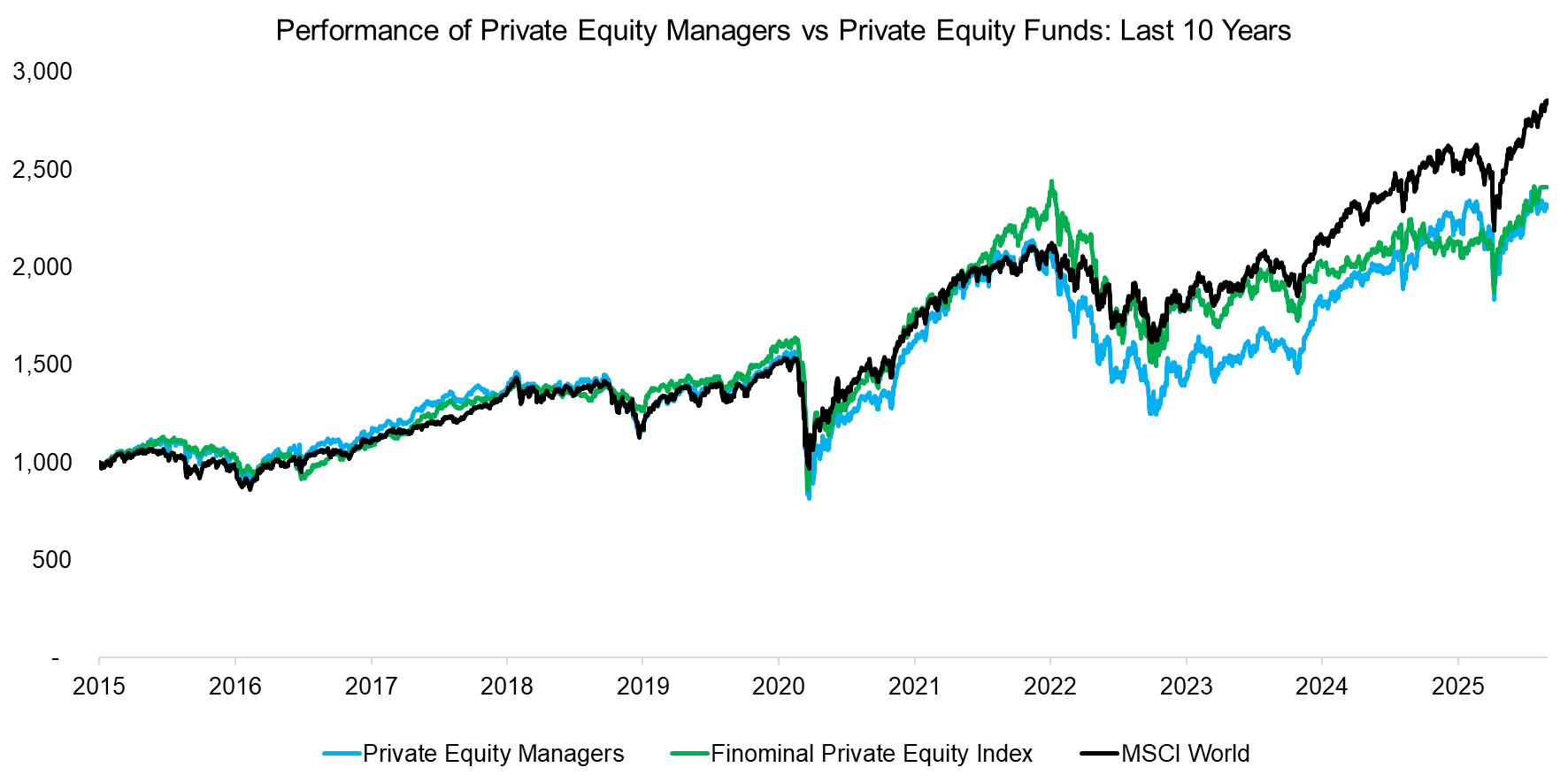

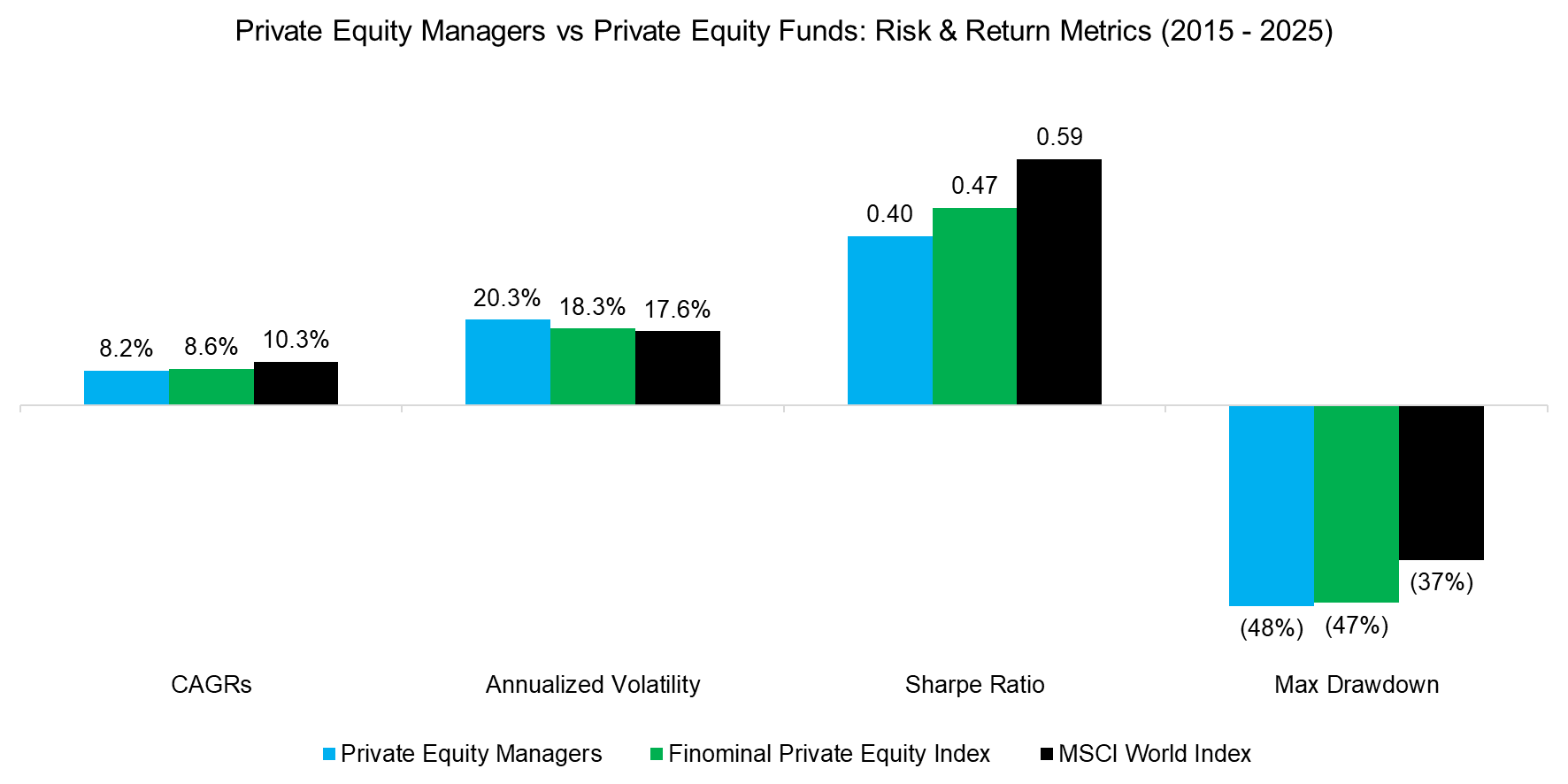

When the indices are rebased to 2015, performance across all three becomes more comparable. Over the past ten years, the MSCI World Index delivered the highest returns and the strongest Sharpe ratio, although much of this outperformance is concentrated in the last two years, driven primarily by the strong performance of the “Magnificent 7” stocks.

Source: Finominal

Although the returns of private equity managers and funds have become more aligned with those of the MSCI World Index, they have remained lower and exhibited greater volatility, leading to reduced Sharpe ratios over the past decade. In addition, their maximum drawdowns were higher.

Source: Finominal

CORRELATION ANALYSIS

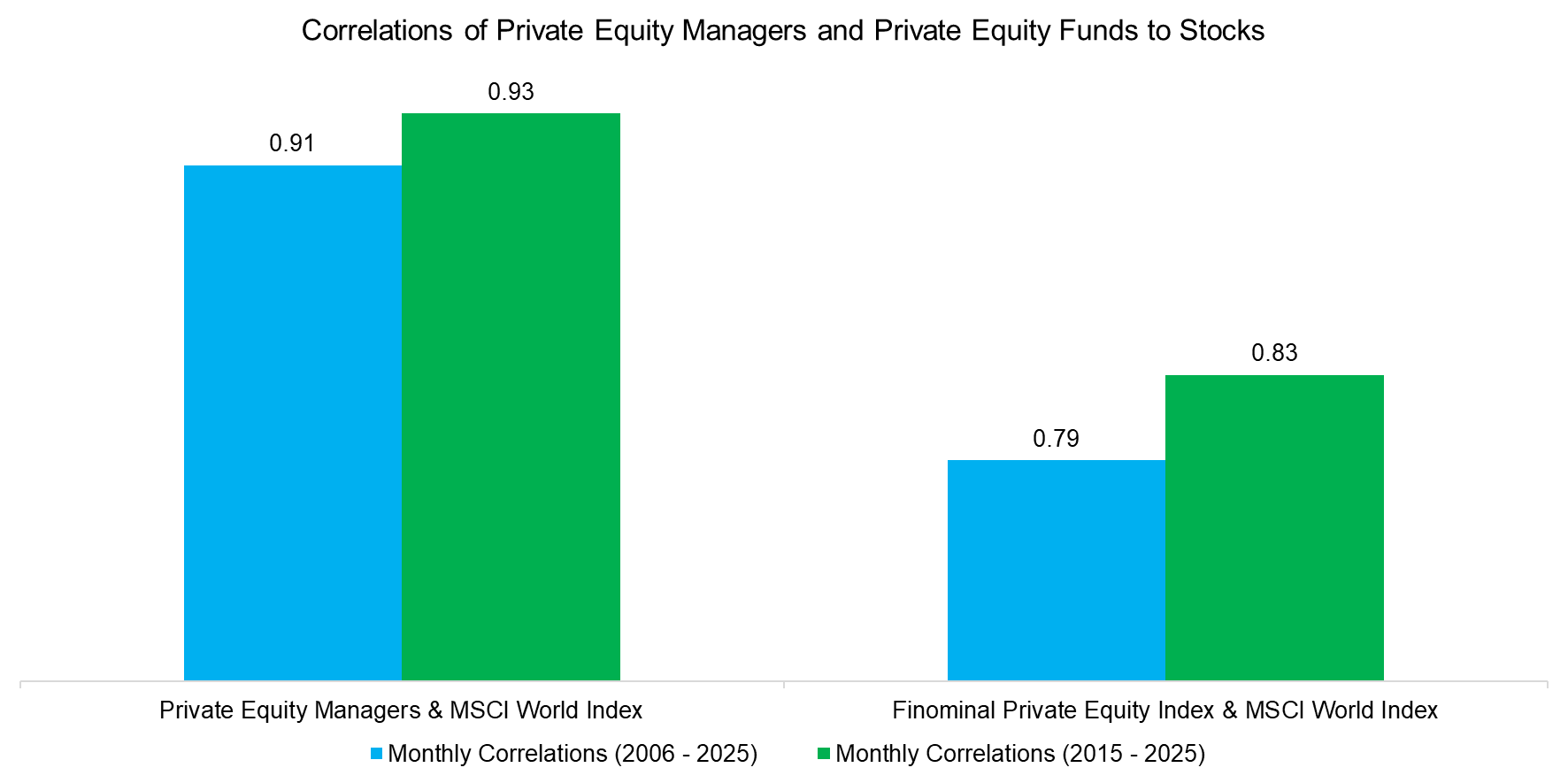

Finally, we calculate the correlations of private equity managers and funds with equities. While funds are typically marketed as providing uncorrelated returns, the correlations proved to be high – 0.79 over the past 20 years and 0.83 over the past 10 years. This clearly indicates that private equity funds offer limited diversification benefits.

Source: Finominal

FURTHER THOUGHTS

Consistent with our previous research on private equity, this article confirms that private equity offers no inherent performance advantage over equities. Despite the industry’s assets under management swelling to over $6 trillion, the returns delivered by listed private equity managers have been mediocre. The primary beneficiaries appear to be the employees of the management firms, rather than the shareholders or investors in their funds.

RELATED RESEARCH

Private Equity Without the Lag

Private Equity: The Emperor has No Clothes

Private Equity: Fooling Some People All the Time?

Private Equity Is Still Equity, Nothing Special Here

The Case Against Private Markets

Listed Private Equity ETFs: The Real Deal?

Venture Capital: Worth Venturing Into?

BDCs: Better Don’t Choose?

The Case Against REITs

A Crescendo in Private Credit?

Do Activist Investors Create Value?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

What´s Better than the S&P 500?

Outperformance via Leverage

Complexity is the Enemy of Investing

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.