Diversification with Cat Bonds?

Harvesting insurance premiums

October 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors can now access catastrophe bonds through mutual funds and ETFs

- They have offered impressive returns with minimal drawdowns

- However, they are more correlated with equities and bonds than often assumed

INTRODUCTION

The ETF universe continues to broaden, now covering nearly every conceivable investment strategy. In 2025, another niche product was launched: the Brookmont Catastrophic Bond ETF (ILS), offering investors direct exposure to catastrophe (“cat”) bonds (read Avoiding Disasters with Catastrophe Bonds?). The fund seeks to deliver positive, uncorrelated returns – the very attribute often promised, but rarely achieved, by many alternative strategies such as hedge funds.

In Europe, mutual funds dedicated to cat bonds have been available for over a decade. However, their relatively high minimum investment thresholds have limited access to larger institutional investors. Still, their track records provide a valuable basis for assessing whether cat bonds have indeed delivered on their diversification and return promises.

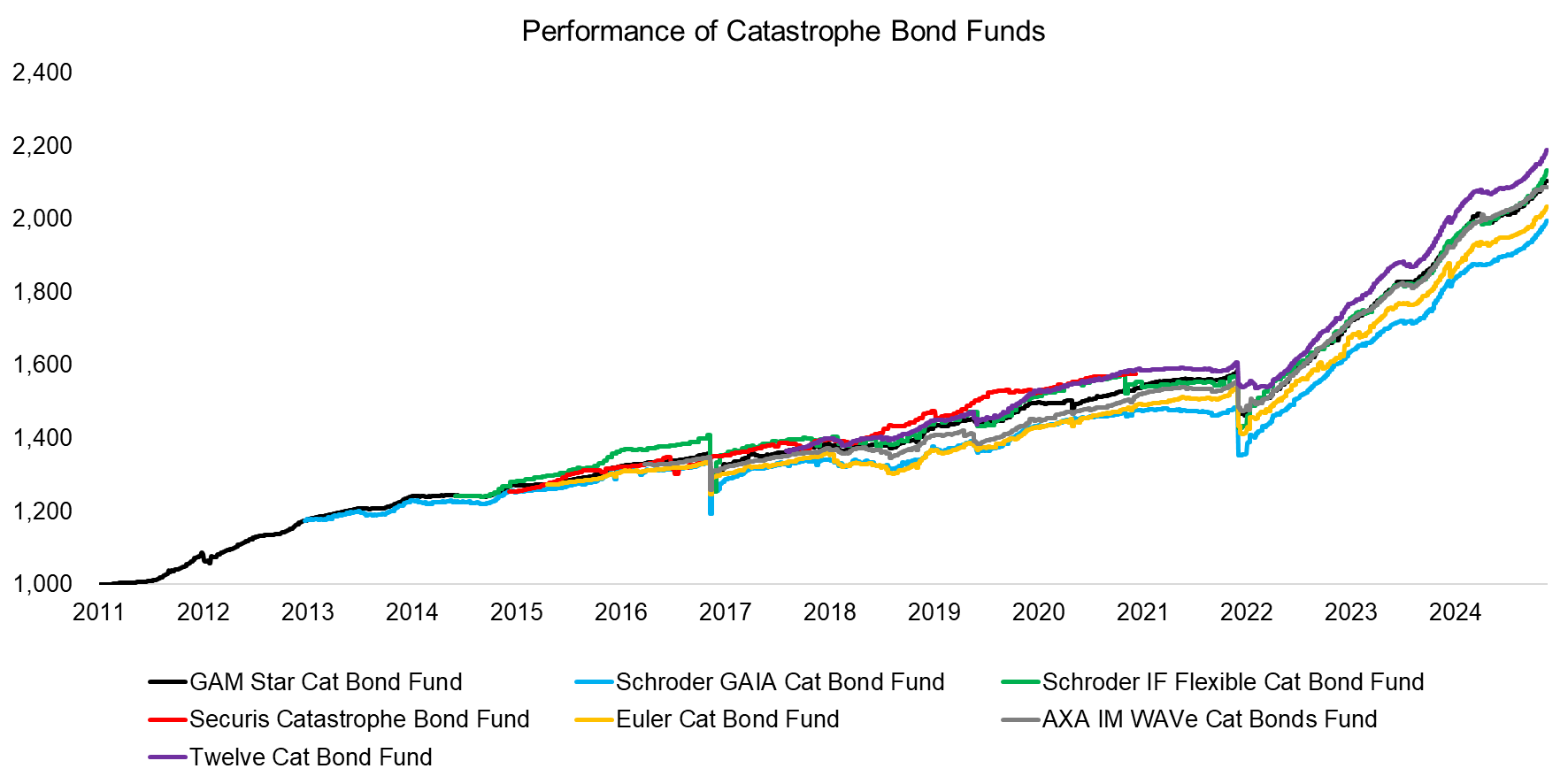

PERFORMANCE OF CAT BOND FUNDS

We focus on catastrophe bond mutual funds available to European investors, which offer track records extending back to 2011. These funds have delivered remarkably steady returns, with no single calendar year posting a loss on composite level. Notably, the sharp equity market declines during the COVID-19 crisis in 2020 left hardly a trace, suggesting diversification potential of cat bonds.

Across the seven funds examined – several managed by the same asset managers – performance has been strikingly similar. Returns and drawdowns have aligned closely, particularly in stress years such as 2017, when Hurricanes Harvey, Irma, and Maria caused major losses in the United States, and in 2022, when Hurricane Ian devastated parts of Florida. This suggests that the funds hold broadly comparable underlying cat bond portfolios.

Source: Finominal

CORRELATION ANALYSIS

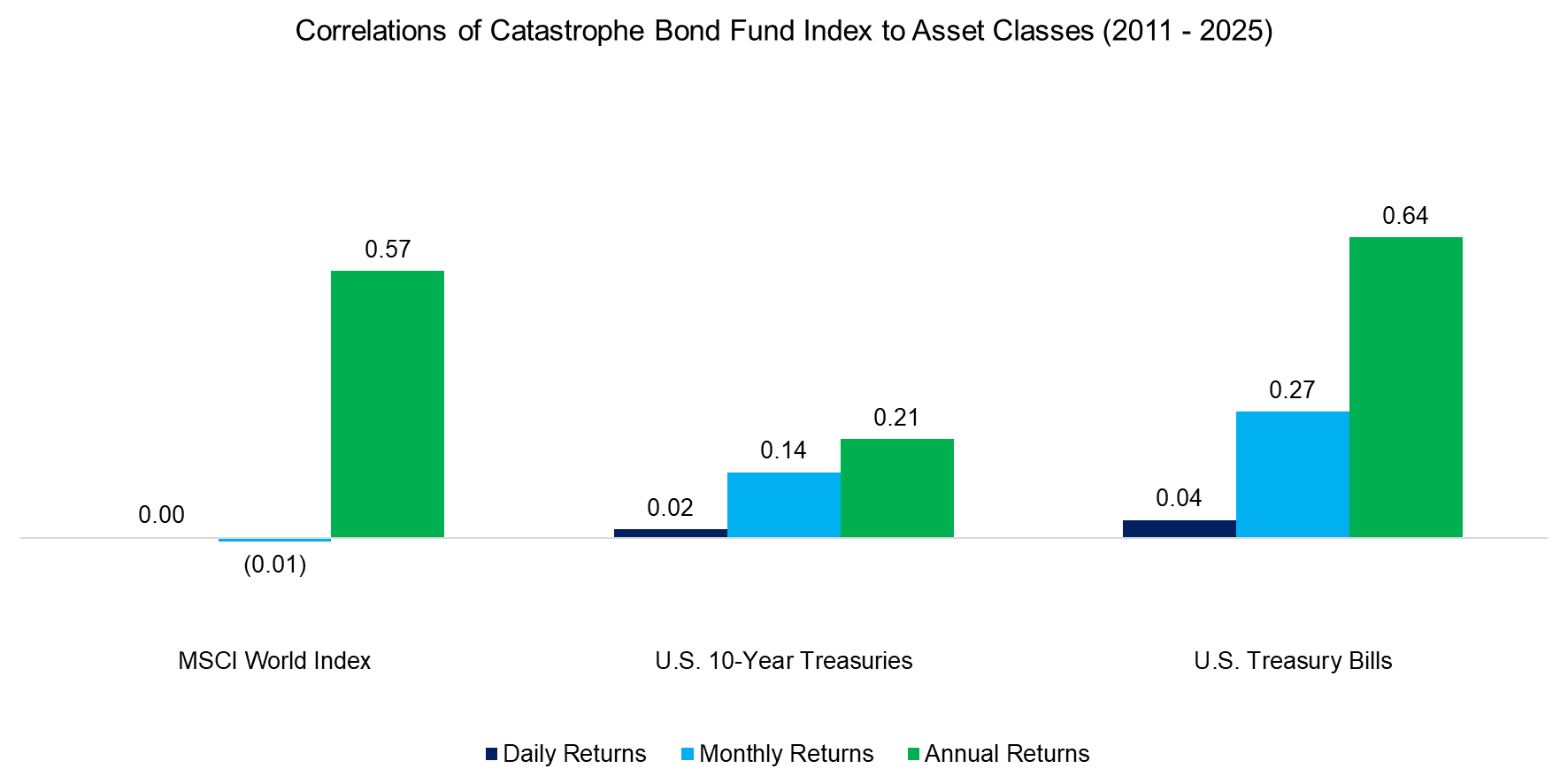

Given the strong similarity in performance across the seven mutual funds, we construct an equal-weighted index by aggregating them. To assess diversification benefits, we calculate correlations between this cat bond fund index and the MSCI World Index, U.S. 10-Year Treasuries, and U.S. Treasury Bills.

It is important to note that these mutual funds do not always provide daily price updates, reflecting the fact that cat bonds themselves are not traded daily. Given this, using daily returns to compute correlations with equities and bonds shows values close to zero.

However, when we calculate correlations based on monthly or annual returns, they increase to approximately 0.6. This indicates that, while cat bonds provide some diversification, the benefits may be more limited than often assumed.

Source: Finominal

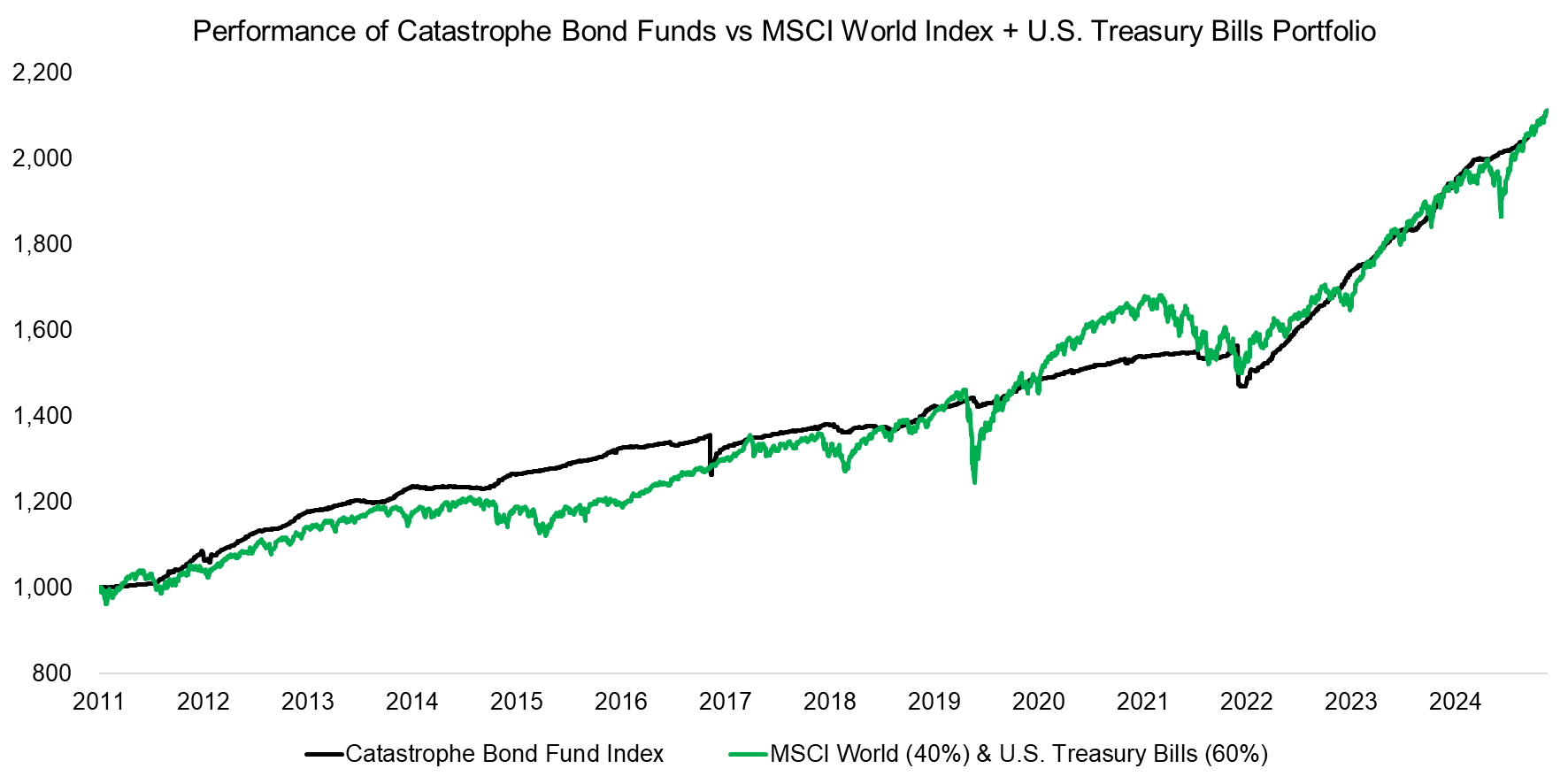

REPLICATING CAT BONDS

Given the moderately positive correlations to equities and bonds when measured using monthly or annual returns, we construct a simple benchmark portfolio with a 40% allocation to the MSCI World Index and 60% to U.S. Treasury Bills. The cat bond index exhibits substantially lower volatility than this 40/60 equities + bond portfolio, likely reflecting the use of stale prices, although the broad performance trends are similar.

Conceptually, cat bonds should behave very differently from traditional financial markets: they generate steady yields until a catastrophe occurs. Large disaster events, however, can impact the broader economy and stock markets. Moreover, the baseline yield of cat bonds is influenced by prevailing U.S. interest rates, which likely explains the moderately positive correlations.

Source: Finominal

FURTHER THOUGHTS

The performance of catastrophe bond mutual funds has been strong, and while their correlations with traditional asset classes may not be as low as once believed, they still provide meaningful diversification benefits. Given this, it is surprising that European cat bond funds have less than $20 billion in assets under management – a tiny fraction of the $1.6 trillion allocated to higher-fee, less diversifying long-short equity hedge funds. U.S. investor uptake also appears limited, as evidenced by the Brookmont Catastrophic Bond ETF (ILS), which manages just $12 million.

RELATED RESEARCH

Avoiding Disasters with Catastrophe Bonds?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

How to Combine Alternative Strategies

60/40 vs Leveraged Diversified Portfolio

60/40 Portfolios without Bonds

Global Macro: Masters of the Universe

Merger Arbitrage: Arbitraged Away?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

Creating Anti-Fragile Portfolios

The Variance Premium: What Premium?

Tail Risk Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.