Replicating Capital-Efficient Funds

Unstacking returns

November 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Capital-efficient funds use leverage to cover core portfolio allocations

- The residual cash can be used for alternatives

- These funds can be replicated with leveraged ETFs

INTRODUCTION

Every day, thousands of professional and retail investors discuss individual securities and funds on platforms such as X, StockTwits, and Reddit. While some sophisticated investors purchase data from these platforms to analyze and exploit investor behavior, asset managers rarely use such discussions as a basis for product launches.

A notable exception is WisdomTree’s U.S. Efficient Core Fund (NTSX), which originated from a discussion on X about offering $1.50 of exposure for every $1 invested. The fund launched in May 2021, and WisdomTree subsequently expanded its lineup of capital-efficient ETFs, offering leveraged portfolios with exposure to gold, emerging markets, and international equities. Similarly, Newfound Research, whose founder Correy Hoffstein participated in the original X discussion, introduced its suite of Return Stacked ETFs in 2023.

The core concept behind these ETFs is to provide leveraged exposure to traditional portfolios – such as a 60/40 equities/bonds allocation – through futures or swaps. This approach allows investors to cover their core allocation using less than 100% of their capital, freeing up remaining funds for other investments like alternatives.

But can investors achieve the same exposure using leveraged ETFs alone? Capital-efficient funds charge a median management fee of 0.70%, which is expensive. Let’s explore.

CAPITAL-EFFICIENT FUNDS

Cumulatively, capital-efficient funds manage only about $3 billion, with WisdomTree’s U.S. Efficient Core Fund (NTSX) holding a 40% market share. As the largest fund with the longest track record, NTSX will serve as the case study for this analysis.

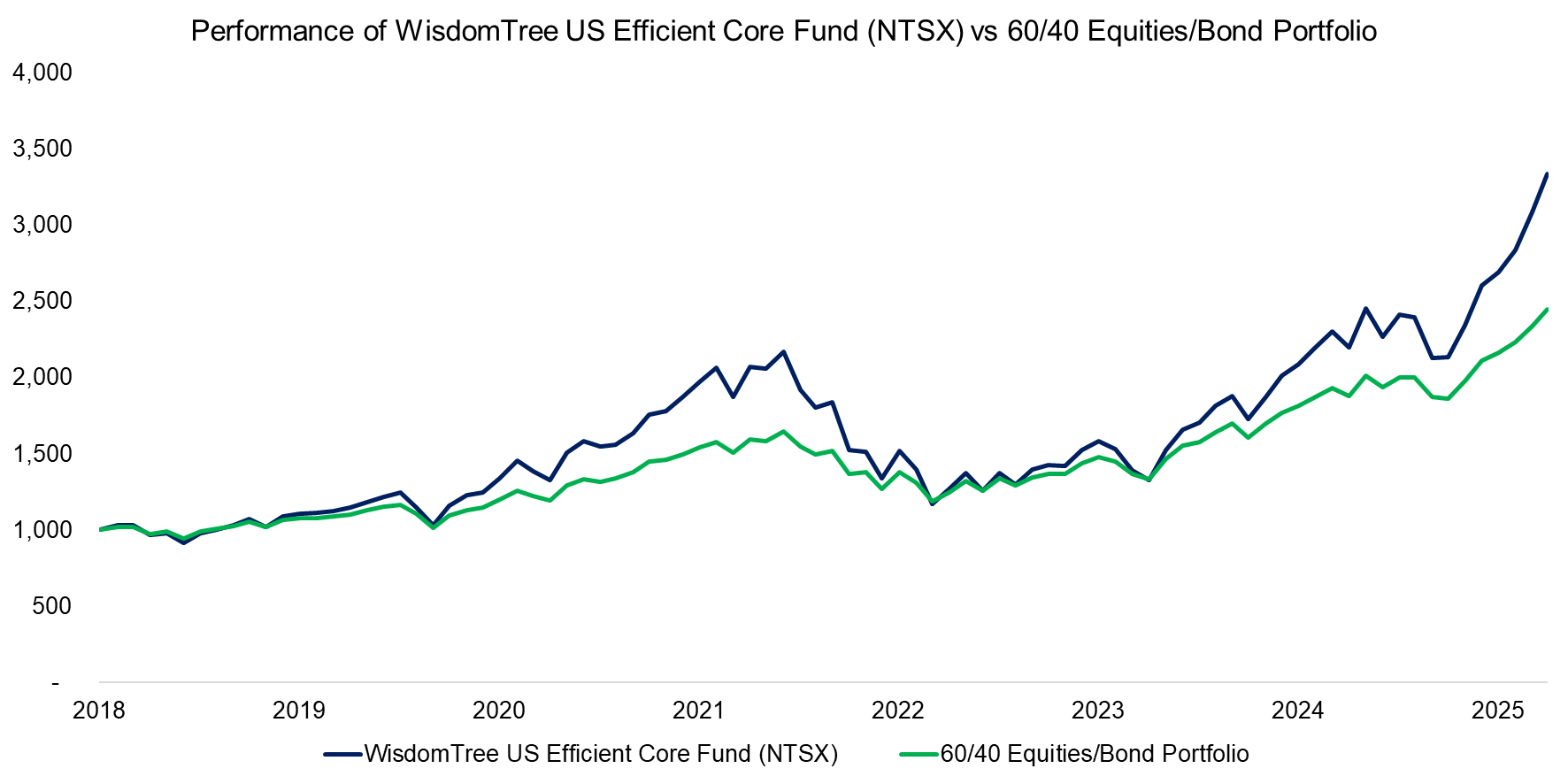

NTSX was previously known as the WisdomTree 90/60 U.S. Balanced Fund, reflecting its structure of 90% exposure to U.S. large-cap equities and 60% exposure to U.S. Treasuries – effectively providing 1.5x exposure relative to a traditional 60/40 portfolio. When benchmarked against an unleveraged 60/40 portfolio, NTSX delivers higher returns, accompanied by increased volatility, as expected. Given this, investors only need to allocate 67% to NTSX to get the exposure of a 60/40 portfolio.

Source: Finominal

FUND REPLICATION

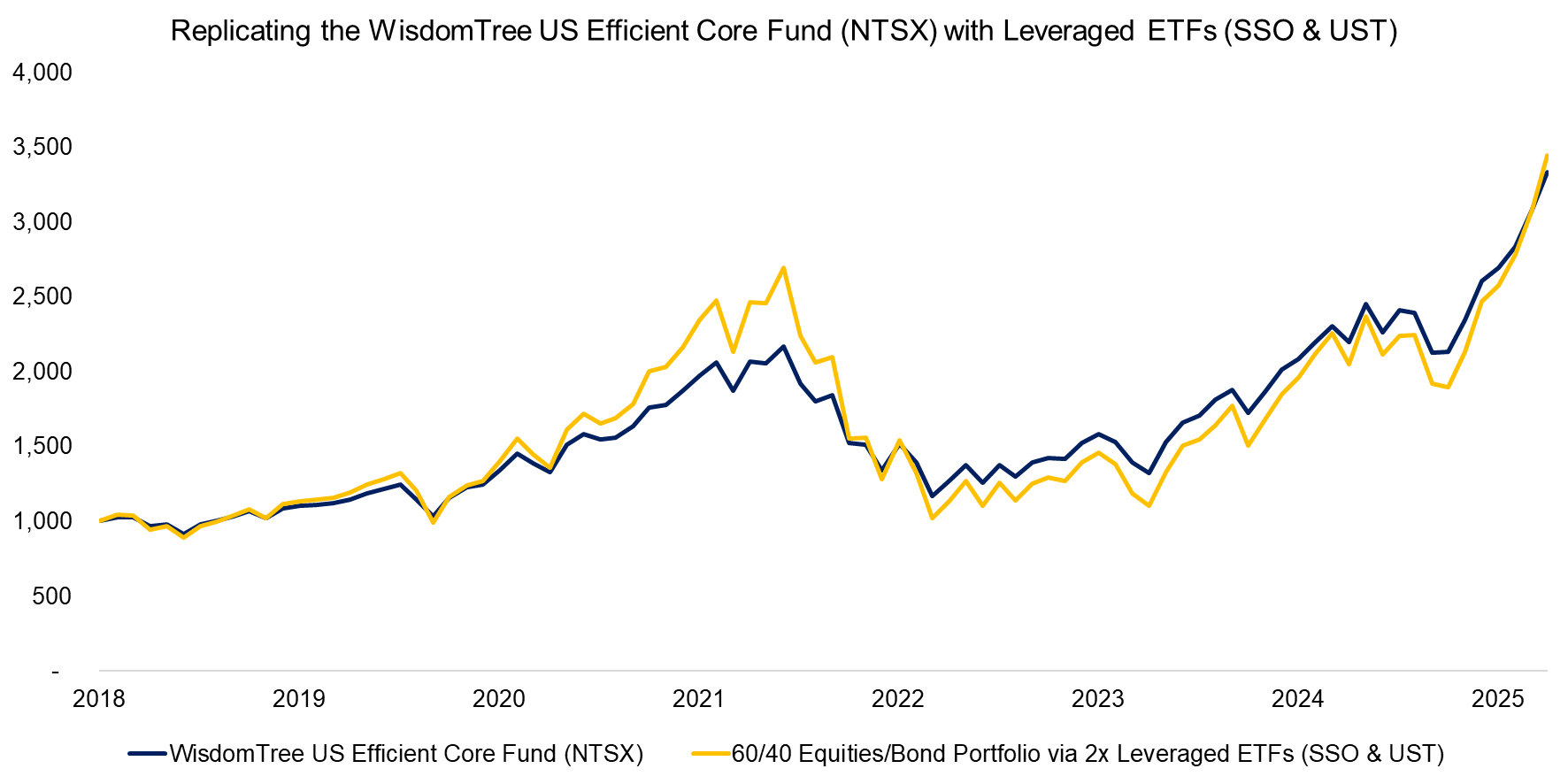

Next, we investigate whether NTSX can be replicated using leveraged ETFs. We use the ProShares Ultra S&P 500 (SSO), which provides 2x exposure to the S&P 500, and the ProShares Ultra 7–10 Year Treasury (UST), which provides 2x exposure to U.S. Treasuries. By combining these ETFs, we can approximate NTSX’s overall exposure. Over the period from 2018 to 2025, this replication closely matches NTSX’s total return, although it exhibited higher volatility.

Source: Finominal

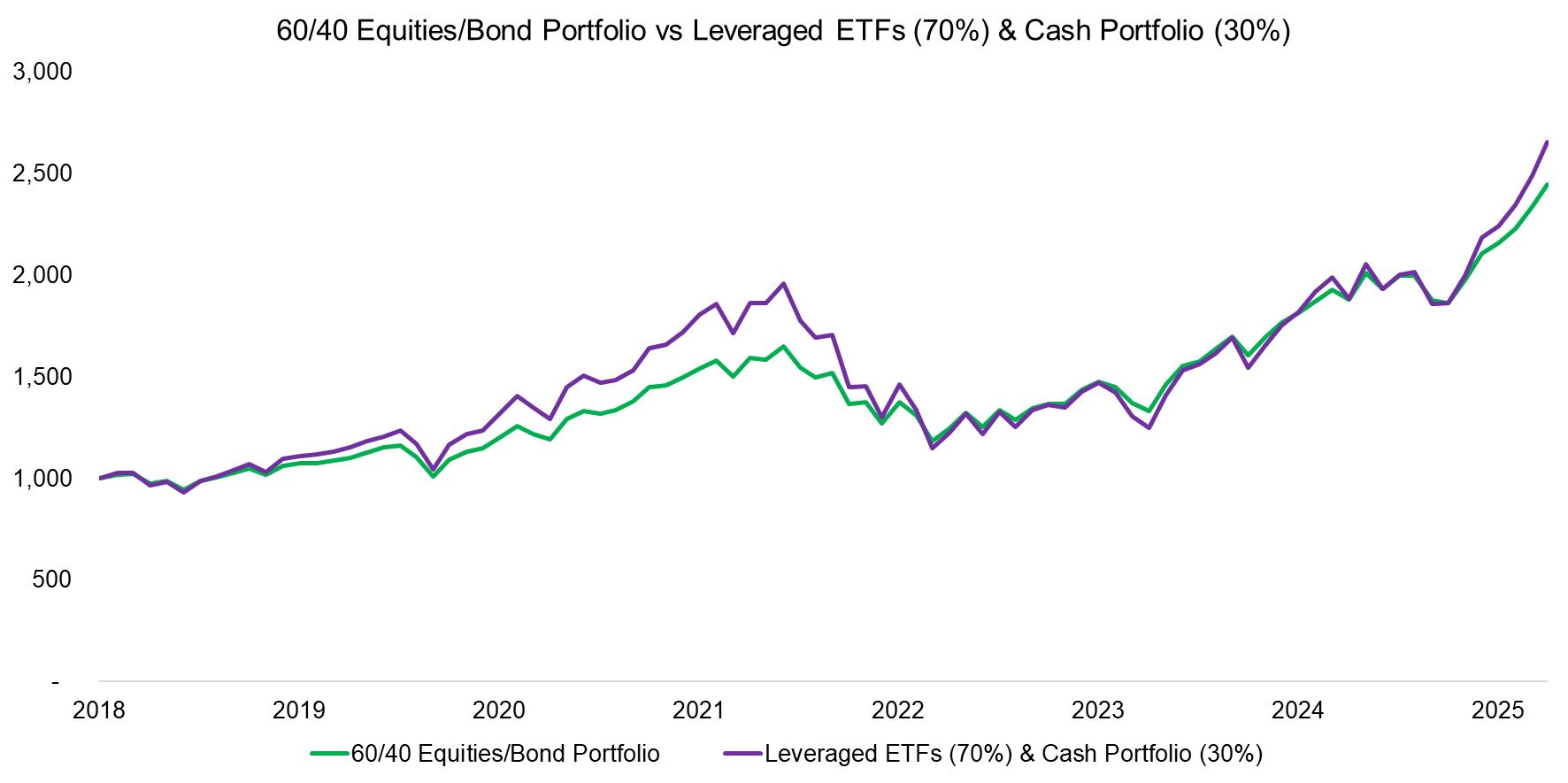

A 70% allocation to the replication portfolio of leveraged ETFs and 30% allocation to interest-bearing cash would have roughly matched the performance of a traditional 60/40 portfolio. The key advantage of using leveraged ETFs over a capital-efficient fund is the flexibility to customize the allocations between equities and bonds according to the investor’s preferences.

Source: Finominal

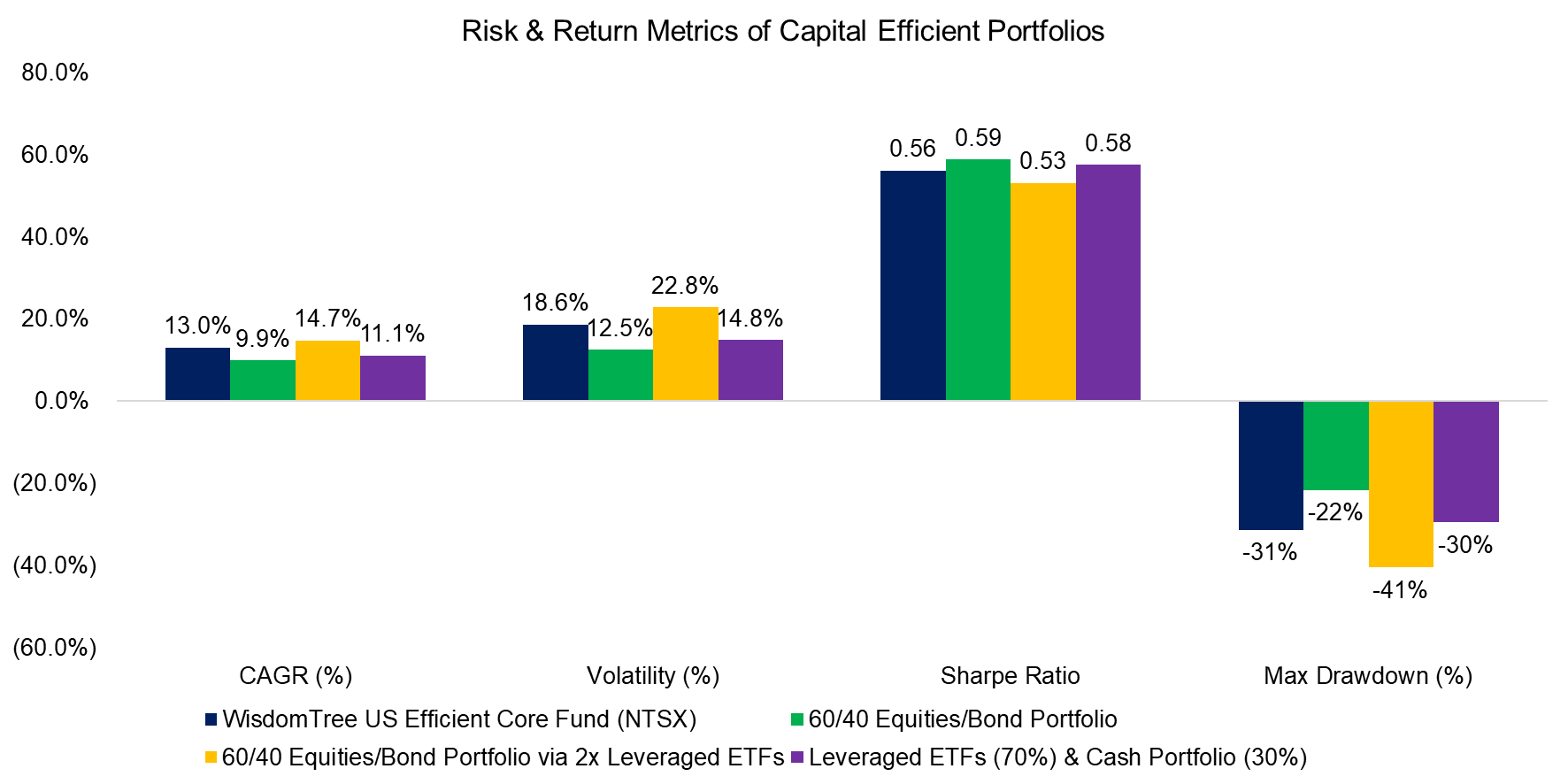

RISK & RETURN METRICS

Finally, we compare the risk and return metrics of NTSX with the portfolios. While the total returns naturally differ, the Sharpe ratios are broadly comparable. The replication portfolio exhibits a slightly lower Sharpe ratio than NTSX, at 0.53 versus 0.56, which can likely be attributed to the higher fees associated with leveraged ETFs. NTSX charges only 0.20% per annum, compared to 0.87% for SSO and 0.95% for UST.

Source: Finominal

FURTHER THOUGHTS

What’s the appeal of capital-efficient ETFs?

The main attraction of capital-efficient ETFs lies in their use of modest leverage to maintain full exposure to core equity and bond allocations while freeing up capital for additional investments. This allows investors to diversify into alternative or uncorrelated strategies without sacrificing their traditional portfolio exposure.

Given that U.S. equity valuations remain near record highs and bonds carry greater risk due to elevated public debt and persistent central bank intervention, this approach appears increasingly rational. The Return Stacked ETF suite exemplifies this concept by combining traditional market exposure with diversifying strategies such as managed futures and global macro.

RELATED RESEARCH

60/40 vs Leveraged Diversified Portfolio

60/40 Portfolios Without Bonds

What´s Better than the S&P 500?

Outperformance via Leverage

How to Combine Alternative Strategies

Are Liquid Alts more than Diluted Equity Funds?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

Private Equity: Fooling Some People All the Time?

Venture Capital: Worth Venturing Into?

Market Neutral Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

Hedging Bear Markets & Crashes with Tail Risk ETFs

Tail Risk Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.