Market Neutral Hedge Funds: Diversification or Overpriced Beta?

Replicating equity market neutral funds

January 2026. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equity market neutral generated positive and uncorrelated returns since 2008

- However, the performance can be replicated with low-cost asset class ETFs

- On average, there has not been much value creation

INTRODUCTION

The most intense global talent wars today are unfolding in two areas: artificial intelligence and multi-strategy hedge funds. Yet the compensation gap between them is striking. Firms such as Meta are offering AI engineers pay packages that far exceed – often by multiples – the compensation awarded to portfolio managers at leading multi-strategy firms like Millennium and Citadel.

Both sectors are attracting exceptional talent because they are performing well or are expected to do so. Most AI-focused companies, including OpenAI, remain deeply unprofitable, in stark contrast to the large multi-strategy hedge funds, which continue to generate substantial profits.

However, profitability is not the same as value creation. As we have previously shown, the average multi-strategy fund largely delivers diluted equity-like exposure – returns that investors could replicate on their own with relative ease (read Multi-Strategy Hedge Funds & Replication ETFs & Multi-Strategy Hedge Funds: Jack of All Trades?).

In this article, we revisit equity market neutral strategies, which offer one of the clearest lenses for evaluating value creation within the hedge fund industry. These strategies aim to deliver uncorrelated returns, making them the most direct benchmark for assessing whether hedge funds truly add value beyond market beta.

PERFORMANCE ANALYSIS

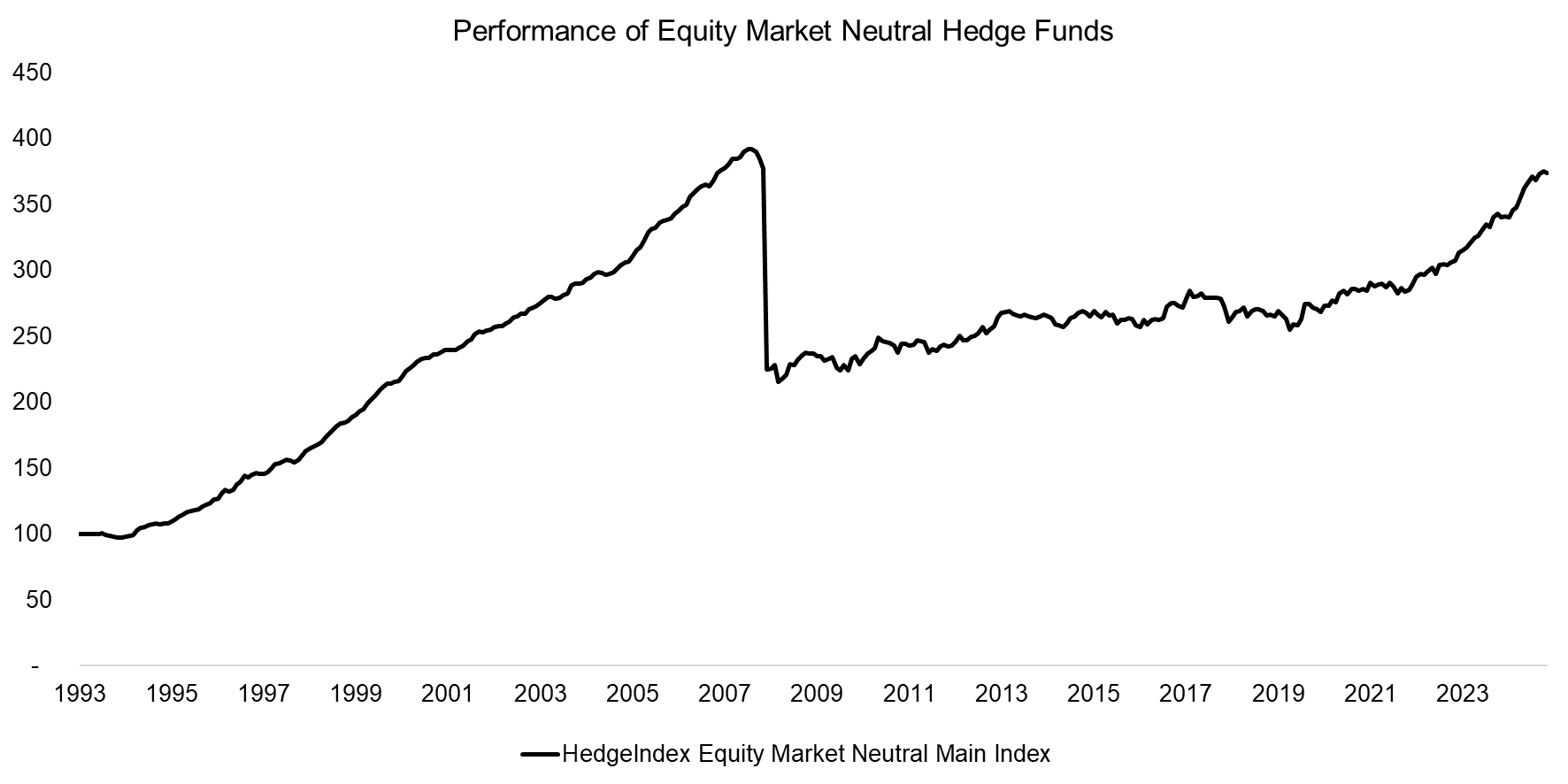

We use the HedgeIndex Equity Market Neutral Main Index as the benchmark for equity market neutral hedge funds. Originally created by Credit Suisse, the index is now marketed by Mast Investments. It is primarily composed of hedge fund managers employing long and short equity strategies, with approaches ranging from statistical arbitrage to fundamental stock selection. The current list of constituents includes 20 funds, featuring well-known market neutral vehicles such as the MW Market Neutral TOPS Fund.

The index history dates back to 1993, and two distinct periods are evident. From 1993 to 2008, the index exhibited relatively smooth returns. This was followed by a sharp downturn during the 2008 global financial crisis, after which returns moderated somewhat. The 2008 crash can be attributed to the collapse of Bernie Madoff’s $65 billion Ponzi scheme, which resulted in substantial losses for investors.

Source: Mass Investments, Finominal

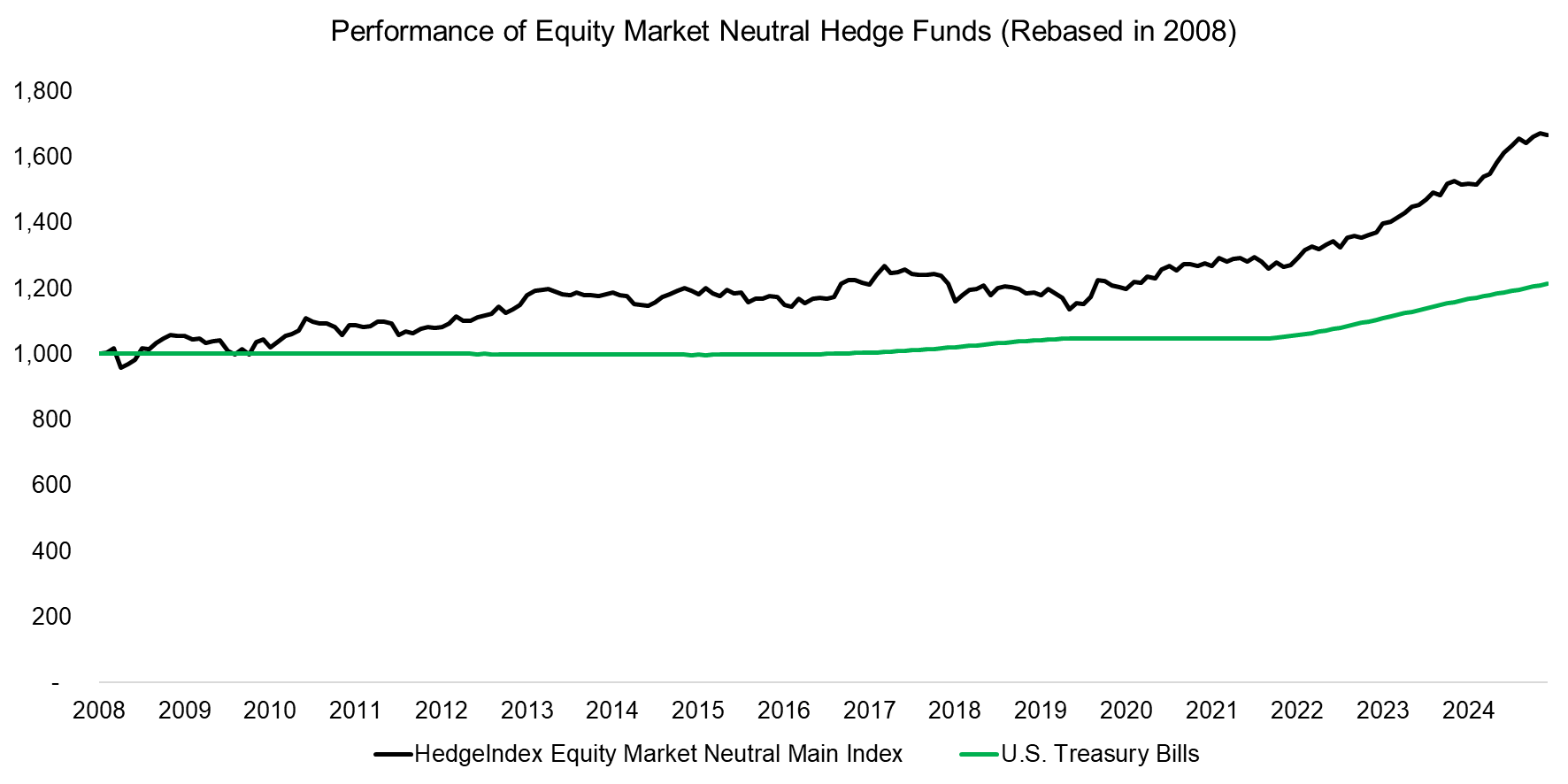

Since the index included Madoff’s Ponzi scheme, pre-2008 returns are unreliable and should be disregarded. We therefore rebase the index to the end of 2008, which reveals returns barely beating U.S. Treasury Bills. After 2021, performance improved noticeably, coinciding with a rise in interest rates.

Source: Mass Investments, Finominal

FACTOR EXPOSURE ANALYSIS

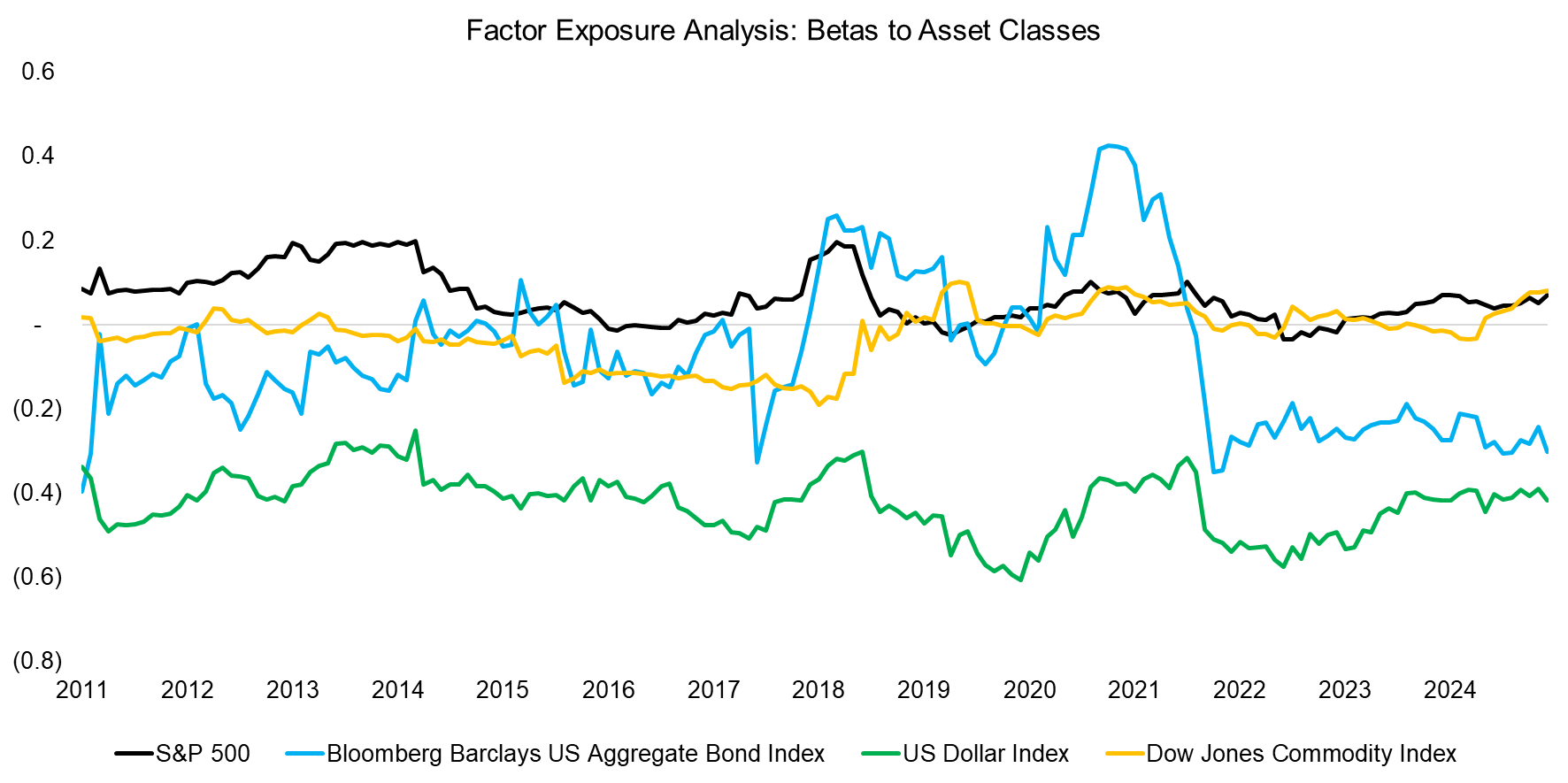

Next, we conduct a returns-based factor exposure analysis on the index to identify the drivers of equity market neutral fund performance. We find that the beta to the S&P 500 was low but positive. Exposure to U.S. investment-grade bonds was slightly negative, while exposure to the U.S. Dollar Index was consistently negative, reflecting international holdings. The regression yields an R2 of 0.76, indicating a reasonably strong fit.

Source: Finominal

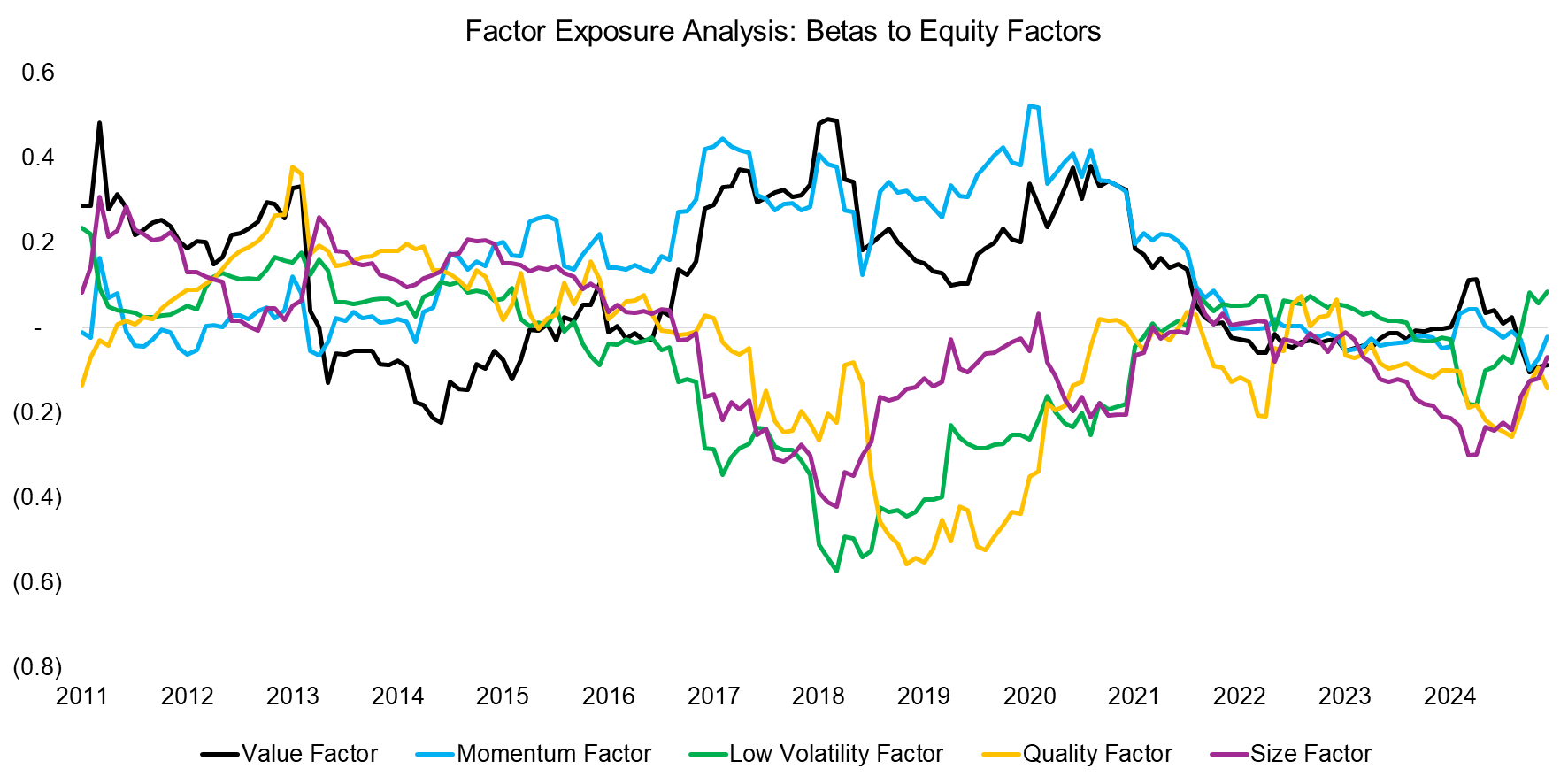

The factor exposure analysis also reveals shifts in investment strategies over time, as evidenced by varying betas to equity factors. On average, the index exhibits positive exposure to value and momentum factors, and negative exposure to low volatility, quality, and size factors.

Some constituent funds pursue traditional factor-based approaches, with value and momentum as core elements. The style drifts can largely be attributed to changes in the index composition, as hedge funds have relatively short lifespans.

Source: Finominal

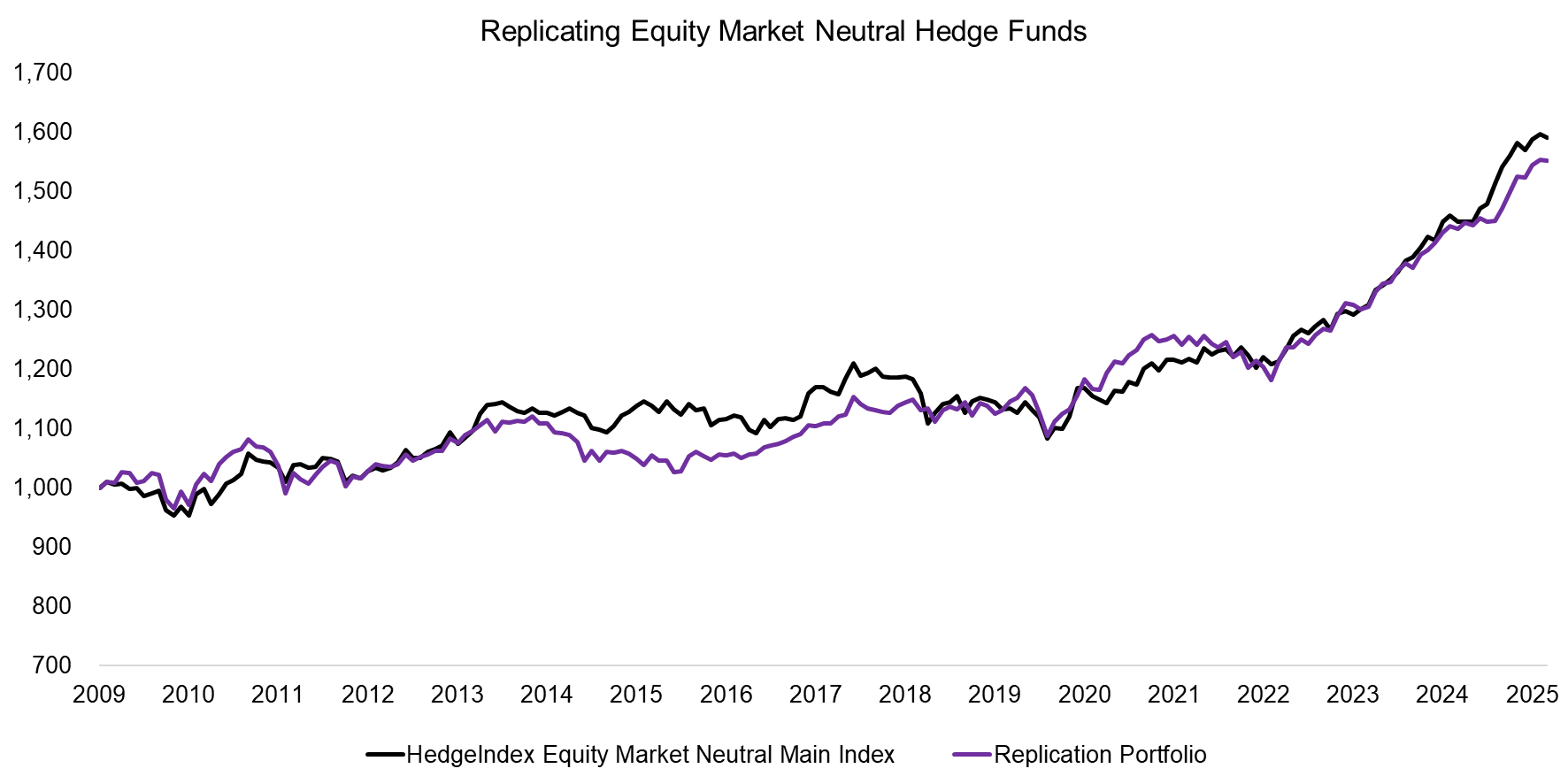

HEDGE FUND REPLICATION

Based on the factor exposure analysis, we attempt to replicate the equity market neutral index using four ETFs: State Street SPDR Bloomberg 1–3 Month T-Bill ETF (BIL, 40%), Invesco DB US Dollar Index Bearish Fund (UDN, 30%), SPDR S&P 500 ETF Trust (SPY, 20%), and ProShares Short 20+ Year Treasury (TBF, 10%). Together, these ETFs approximate the index’s asset class exposures.

The replication is straightforward. While the correlation with the index is modest at 0.6, the portfolio captures similar performance trends and total returns. The annual cost of maintaining this portfolio is a mere 0.39%.

Source: Finominal

FURTHER THOUGHTS

Equity market neutral funds seem to create value by generating positive, uncorrelated returns, making them useful for diversifying traditional equity-bond portfolios. However, the HedgeIndex Equity Market Neutral Main Index, like other hedge fund and private market indices, is affected by survivorship bias: poorly performing funds stop reporting, inflating returns and understating risk. Research suggests that returns are overstated by 2% to 5% per annum. Additionally, since the index can be replicated using four asset class-ETFs at a 0.39% cost, this suggests that, on average, these funds create very little incremental value.

RELATED RESEARCH

Market Neutral Hedge Funds: Powered by Beta?

Multi-Strategy Hedge Funds & Replication ETFs

Multi-Strategy Hedge Funds: Jack of All Trades?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

Global Macro: Masters of the Universe?

Merger Arbitrage: Arbitraged Away?

Hedge Fund ETFs

Replicating Famous Hedge Funds

How to Combine Alternative Strategies

Are Liquid Alts more than Diluted Equity Funds?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

Hedging Bear Markets & Crashes with Tail Risk ETFs

Tail Risk Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.