Betting on Insiders

Signal or noise?

December 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Following insider trading is an intuitively appealing investment strategy

- However, the track record of such funds is abysmal

- CEOs are as poor at predicting the future as investors

INTRODUCTION

Nancy Pelosi is known for her 38-year-long service to U.S. citizens as a Democratic member of the U.S. Congress, as well as the significant amount of wealth she accumulated during that period. Her official salary as a member of Congress is approximately USD 200,000 per year, yet her joint net worth with her husband amounts to hundreds of millions of dollars.

Insider trading is illegal in the U.S., and Nancy Pelosi does not have access to insider information from publicly listed companies, so perhaps she is simply a gifted investor. Investors who want to benefit from her disclosed trades can buy the Unusual Whales Subversive Democratic Trading ETF (NANC), which tracks stocks bought or sold by Democratic members of Congress and their families. Those who also want to benefit from trades by Republicans can invest in the Unusual Whales Subversive Republican Trading ETF (GOP).

In this research article, we will review the performance of funds that track insider trading.

BREAKDOWN BY SECTORS

We focus on five U.S. mutual funds and ETFs that track insider trading: the Catalyst Insider Buying Fund (INSAX), AdvisorShares Insider Advantage ETF (SURE), Unusual Whales Subversive Republican Trading ETF (GOP), Unusual Whales Subversive Democratic Trading ETF (NANC), and Davenport Insider Buying Fund (DBUYX). These funds charge fees ranging from 0.75% to 1.53% and collectively manage nearly $500 million in assets. The number of holdings in each fund varies from 38 to 143 stocks.

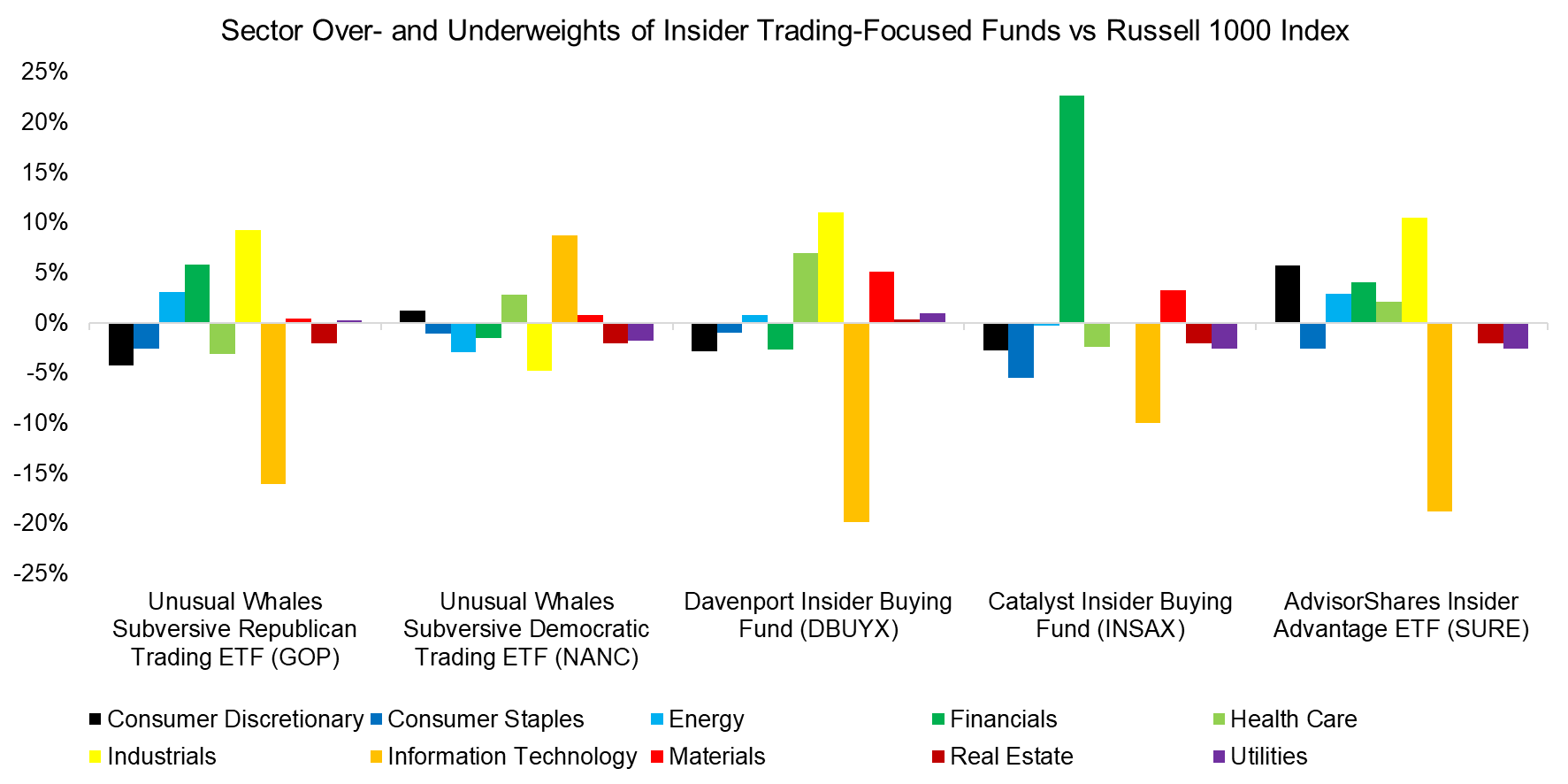

First, we examine the sector over- and underweights relative to the Russell 1000 Index, which we use as the benchmark for these funds. The analysis reveals notable deviations from the benchmark, highlighting the distinct composition of each portfolio. Four funds show significant underweights in the technology sector, three have overweights in industrials, and one fund, INSAX, carries an overweight in financials.

Source: Finominal

FACTOR EXPOSURE ANALYSIS

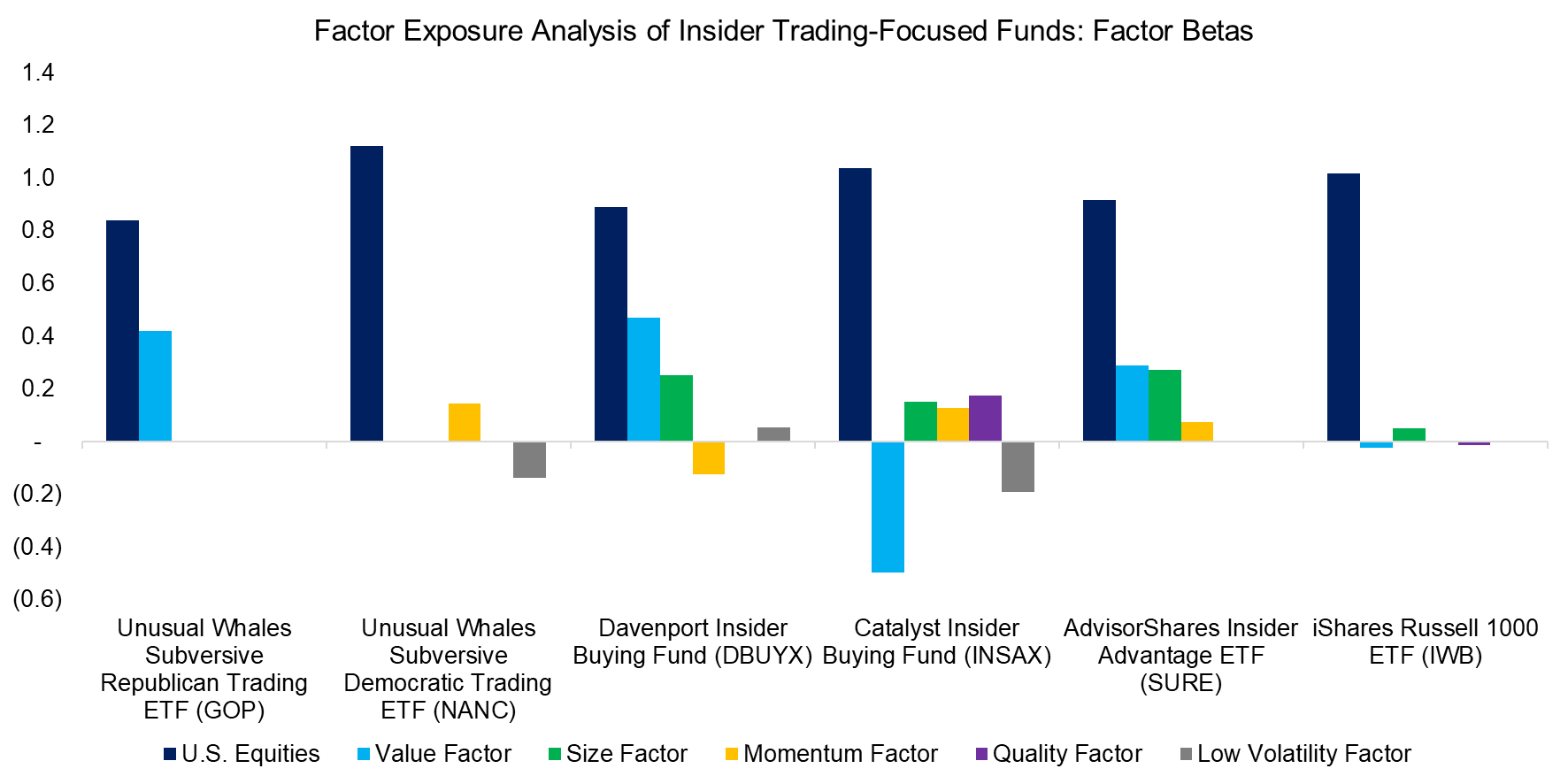

Next, we conduct a factor exposure analysis, which shows that the funds’ betas to the stock market range from 0.8 to 1.1. The most prominent equity factor is the value factor, with three funds exhibiting positive exposure and one fund showing negative exposure. It is somewhat puzzling that the funds display relatively low exposure to other common factors, since insider trading could, in theory, affect not only undervalued companies but also outperforming stocks, small-cap firms, or low-risk, high-quality companies.

Source: Finominal

PERFORMANCE BENCHMARKING

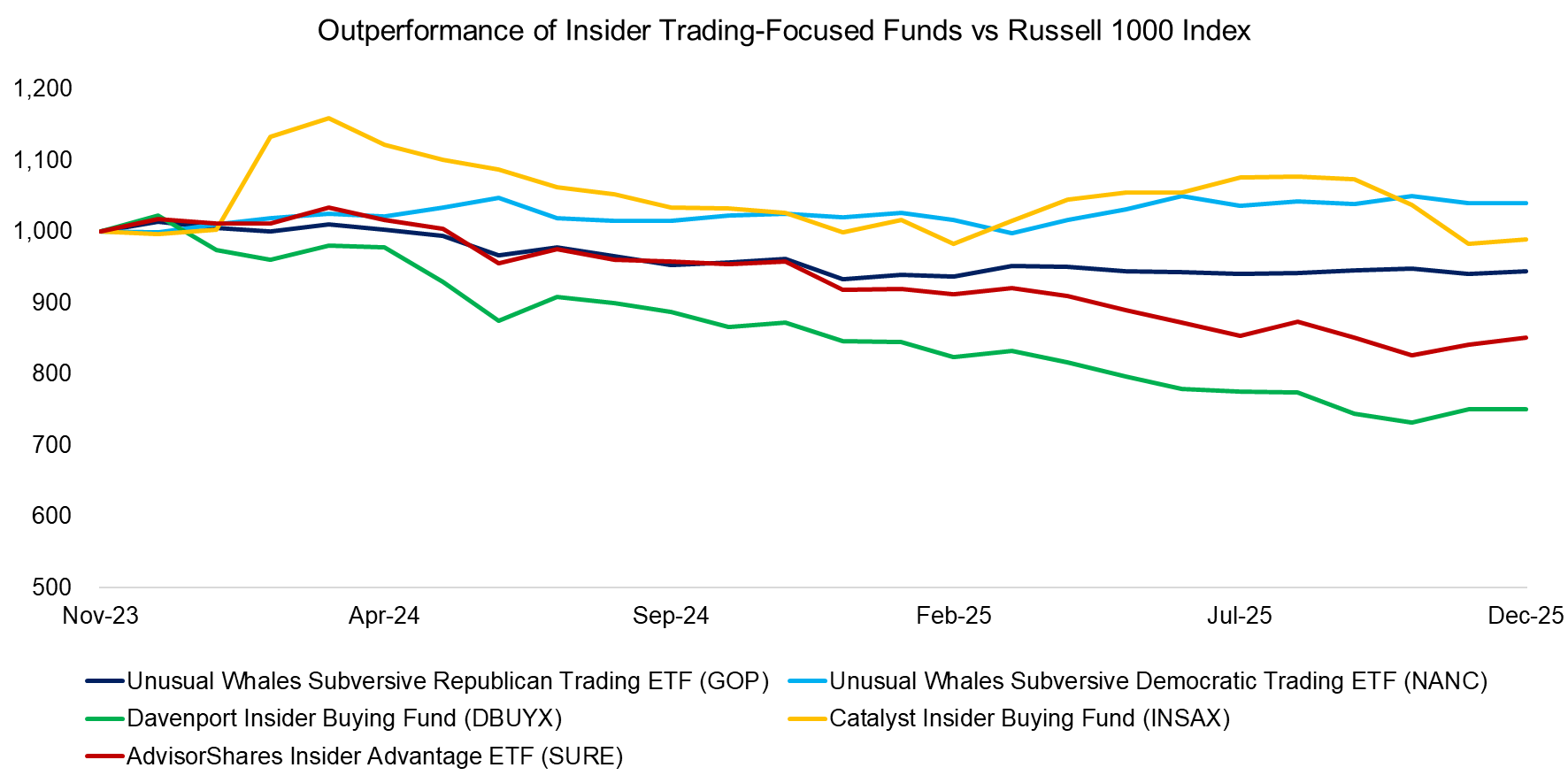

Finally, we benchmark the five insider trading-focused funds against the Russell 1000 Index. Three of these funds were launched only in 2023, so there is just a two-year period of overlapping performance data. During this period, only the Unusual Whales Subversive Democratic Trading ETF (NANC) was able to outperform the benchmark. The Davenport Insider Buying Fund (DBUYX) underperformed by 25%.

Source: Finominal

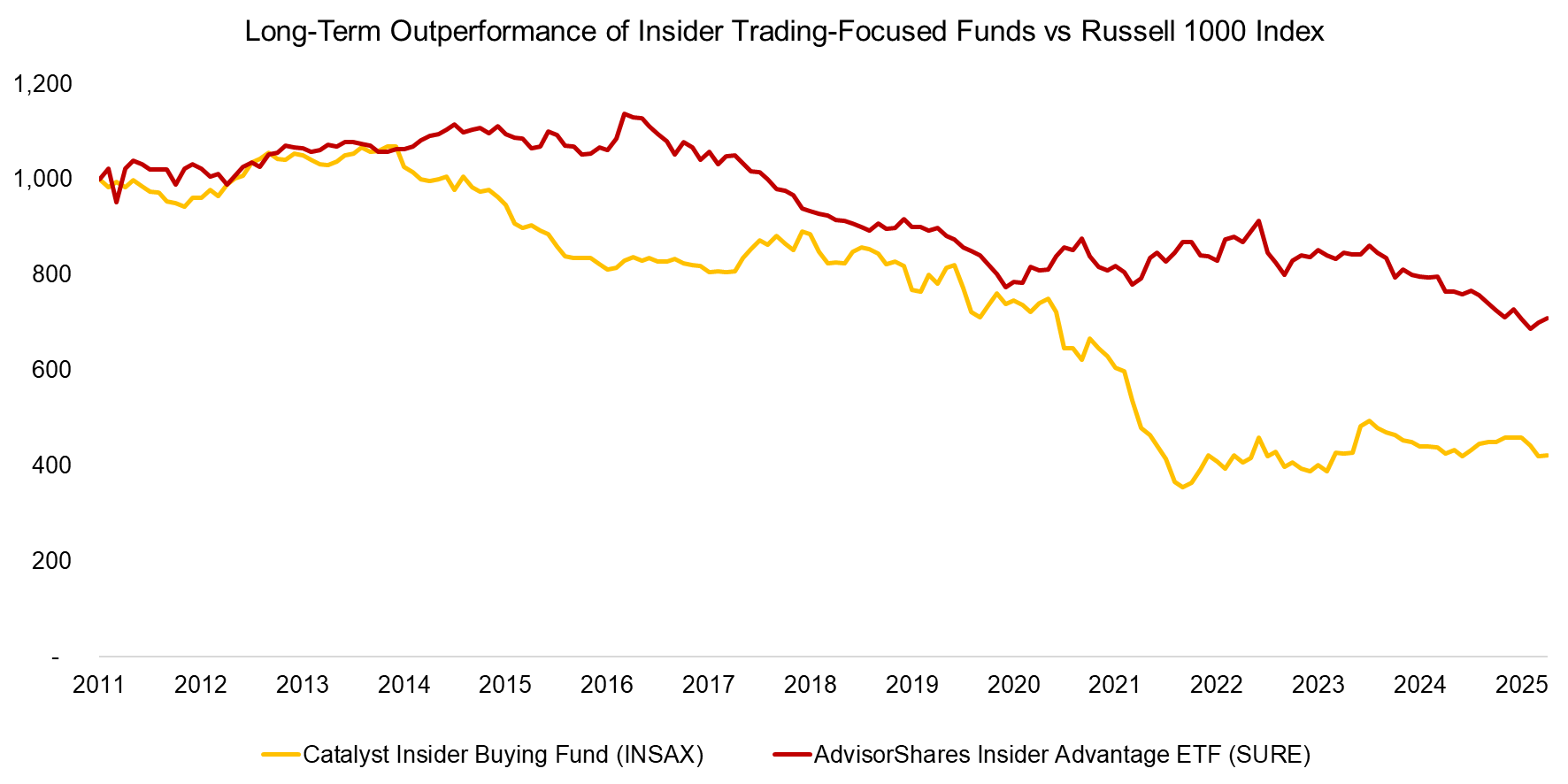

We can also assess the long-term track record by focusing on the Catalyst Insider Buying Fund (INSAX) and AdvisorShares Insider Advantage ETF (SURE), both launched in 2011. Over this period, however, both funds have significantly underperformed the stock market, with INSAX declining 58% and SURE falling 29% relative to the Russell 1000 Index.

Source: Finominal

FURTHER THOUGHTS

Following insider trades is an intuitively appealing strategy. After all, who is better positioned to assess the prospects of a company than its CEO?

In practice, however, the reality is often a complicated mess. While a CEO may have deep knowledge of their company, they are no better at predicting the future than any other investor. This helps explain why funds based on insider trading attract relatively modest assets under management and why several, such as the Guggenheim Insider Sentiment ETF (NFO) and Direxion All Cap Insider Sentiment Shares (KNOW), have ultimately been liquidated.

RELATED RESEARCH

Hitting Home Runs with AI Investing?

Smart Money, Crowd Intelligence, and AI

AI, What Have You Done for Me Lately?

Top Fee Generating, Wealth Creating and Destroying ETFs

Chasing Mutual Fund Performance

An Anatomy of Thematic Investing

Thematic Indices: Looking at the Past or the Future?

Thematic Investing: Thematically Wrong?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.