Gold & Silver: Buy-and-Hold vs Trend Following

Not everything that glitters is gold

February 2026. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Gold and silver had decades of exceptionally poor returns

- Applying a trend following strategy improved their Sharpe ratios

- However, it reduced their diversification potential for equity portfolios

INTRODUCTION

Thematic investing is often best described as performance chasing wrapped in a compelling narrative. Most investors are indifferent to a good story unless it is accompanied by attractive returns. Unfortunately, mean reversion is a powerful force in financial markets, and thematic strategies tend to underperform following periods of exceptionally strong performance. This dynamic makes thematic investing a structurally weak investment approach.

This phenomenon is most evident in equity markets, where valuations impose a natural ceiling on how far stock prices can rise. Investors might recall the hype of cannabis stocks in 2018, unprofitable software companies in 2022, and metaverse stocks in 2023.

But what about assets such as gold or bitcoin? Since these assets lack clear valuation anchors, one might argue that their prices could, in theory, rise indefinitely. In practice, however, mean reversion remains observable in these asset classes.

The sharp rallies in gold and silver over the past year have prompted renewed performance chasing by investors. In this piece, we highlight the risks associated with allocating to precious metals and explore ways to mitigate them.

LONG-TERM PERFORMANCE OF GOLD & SILVER

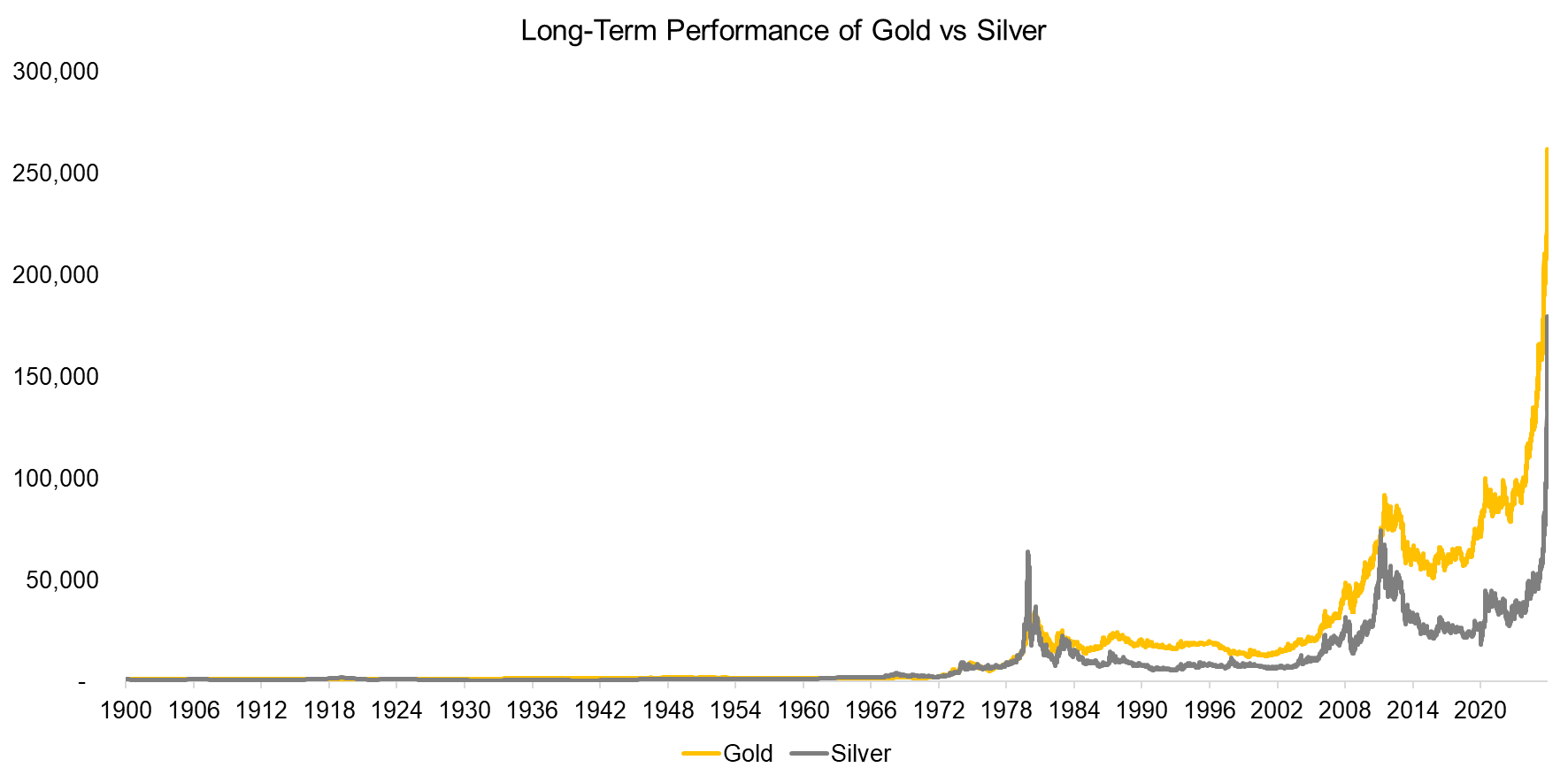

The long-term performance of gold and silver relative to the U.S. dollar shows largely flat returns from 1900 through the 1970s, followed by a boom-and-bust cycle in the 1980s. This was followed by an extended period of weak performance until the global financial crisis of 2008, which reignited investor interest in precious metals as a means of capital preservation. More recently, both metals appear to have entered a hyperbolic phase, often attributed to growing concerns about the U.S. dollar, as rapidly rising U.S. public debt undermines investor confidence.

Source: Stooq, Finominal

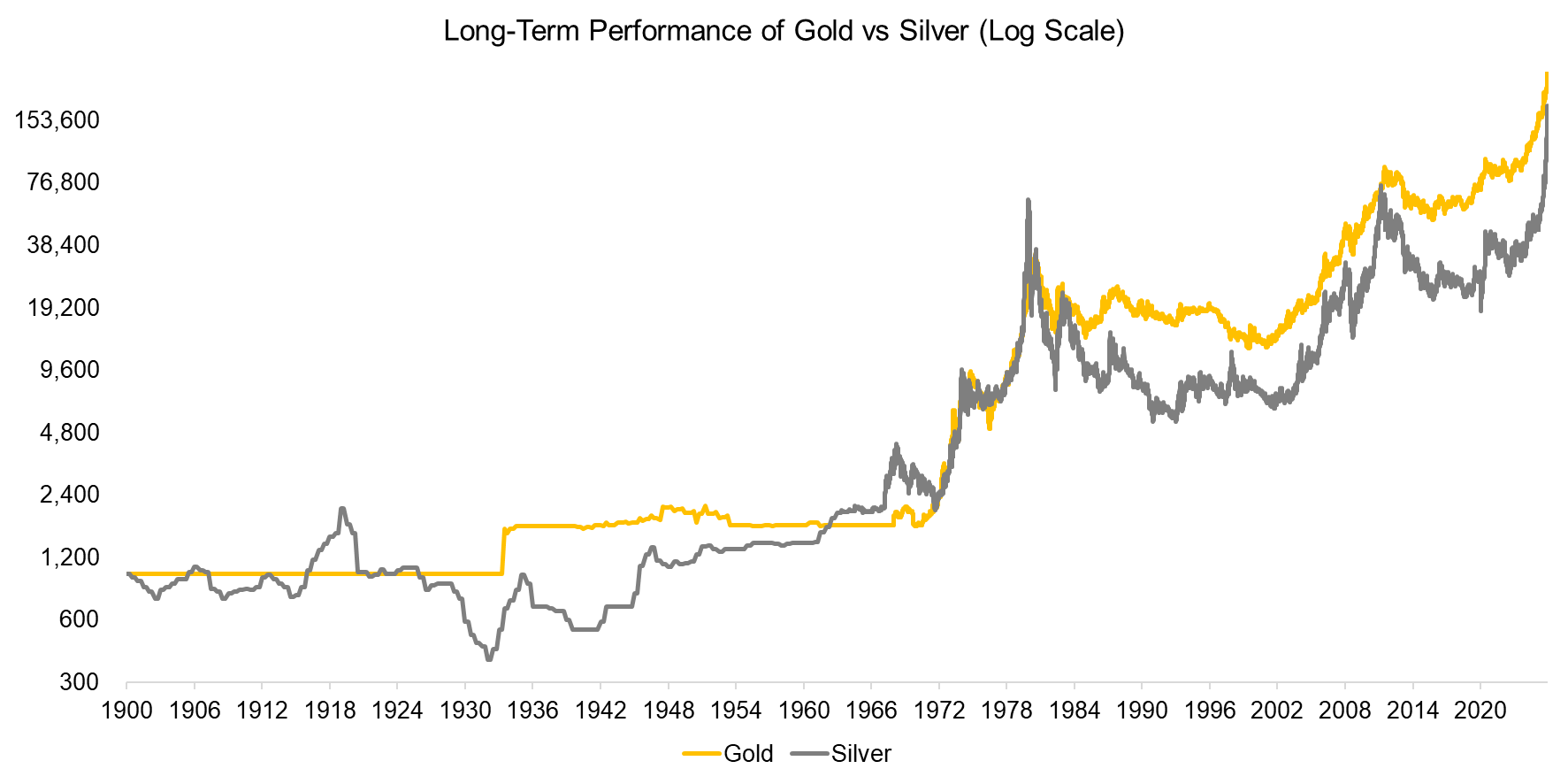

However, viewing the long-term performance on a logarithmic scale provides additional insight into the trading ranges of gold and silver. Gold exhibits a stable exchange rate against the U.S. dollar from 1900 to 1971, reflecting the period when the dollar was pegged to gold under the Bretton Woods system, which ended in 1971.

By contrast, silver experienced far greater volatility over the same period. During the Great Depression of the 1930s, investors did not view silver as a store of value, and its price reached a secular low. Over time, this perception appears to have shifted, as silver has behaved more like gold during later periods of financial stress, such as the global financial crisis.

Source: Stooq, Finominal

RISKINESS OF GOLD

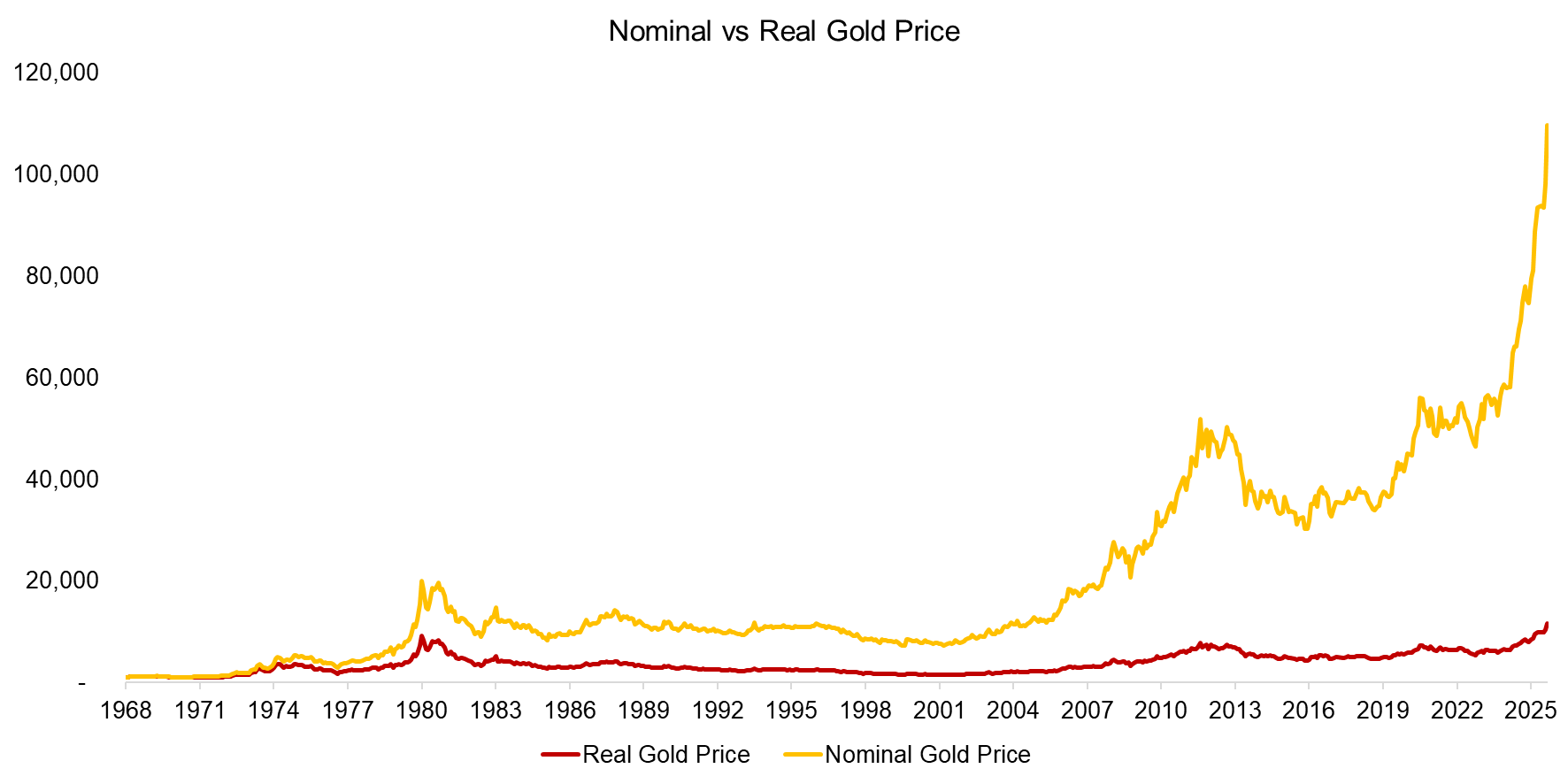

Although the long-term performance of gold and silver might make them appear to be outstanding investments today, calculating their real returns offers a more tempered perspective. Between 1968 and 2025, gold delivered a CAGR of 8.5%, but after adjusting for U.S. inflation, the real return falls to just 4.3%. Moreover, the majority of these real gains have occurred since the global financial crisis of 2008. From 1968 to 2000, the real return decreased to 1.2%.

Source: Stooq, Finominal

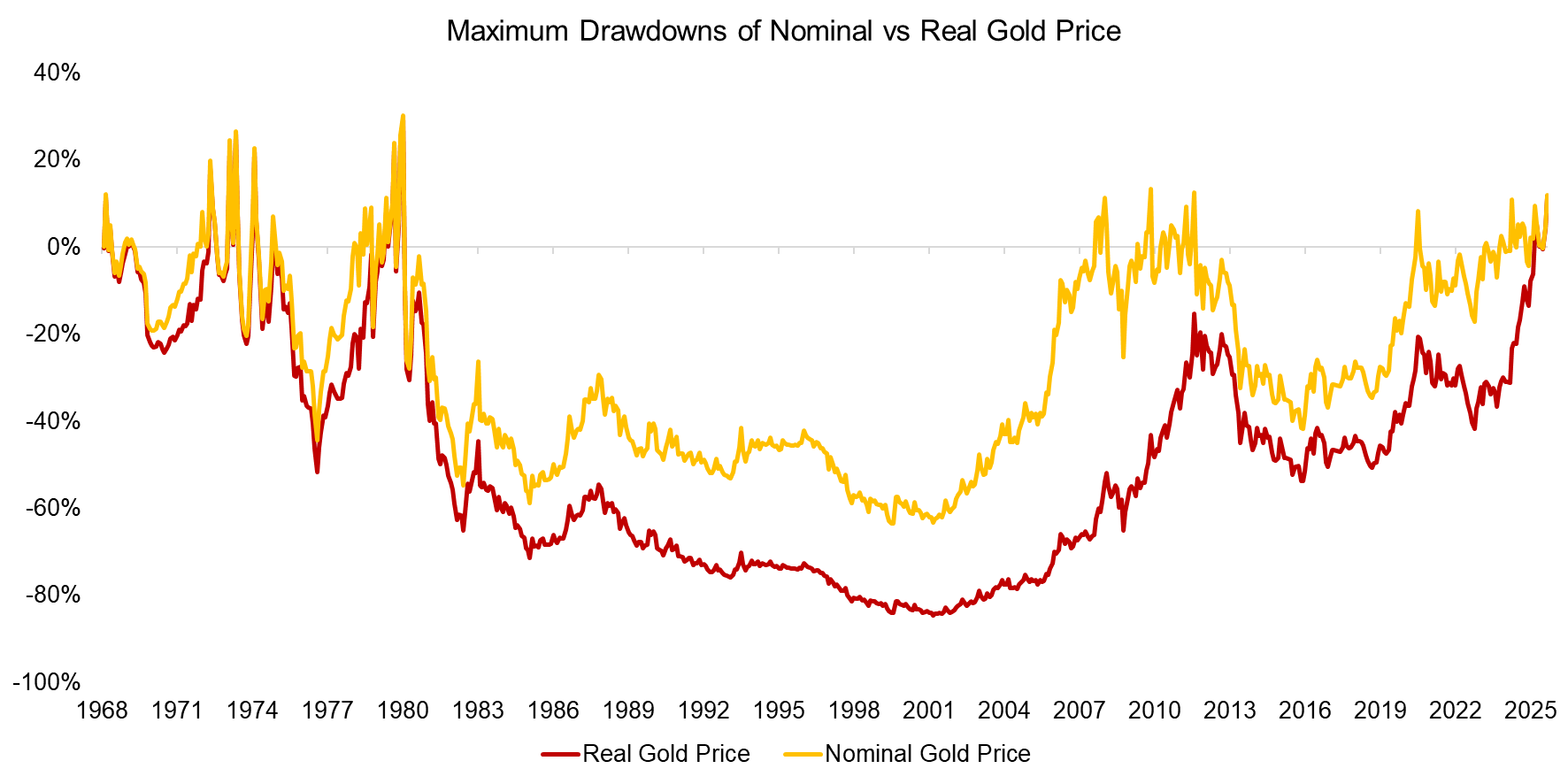

Given the nature of thematic investing, gold likely gained popularity among investors during the 1980s, as many sought assets that could keep pace with the high inflation of that period. However, when the U.S. Federal Reserve aggressively raised interest rates, holding gold – a non-interest-generating asset – became far less attractive. As inflation declined, so did the price of gold. Between 1980 and the mid-2000s, gold lost more than 60% in nominal terms and over 80% in real terms. Investors who bought gold at its 1980 peak would not have seen a positive return until roughly 30 years later, at the onset of the global financial crisis.

Source: Stooq, Finominal

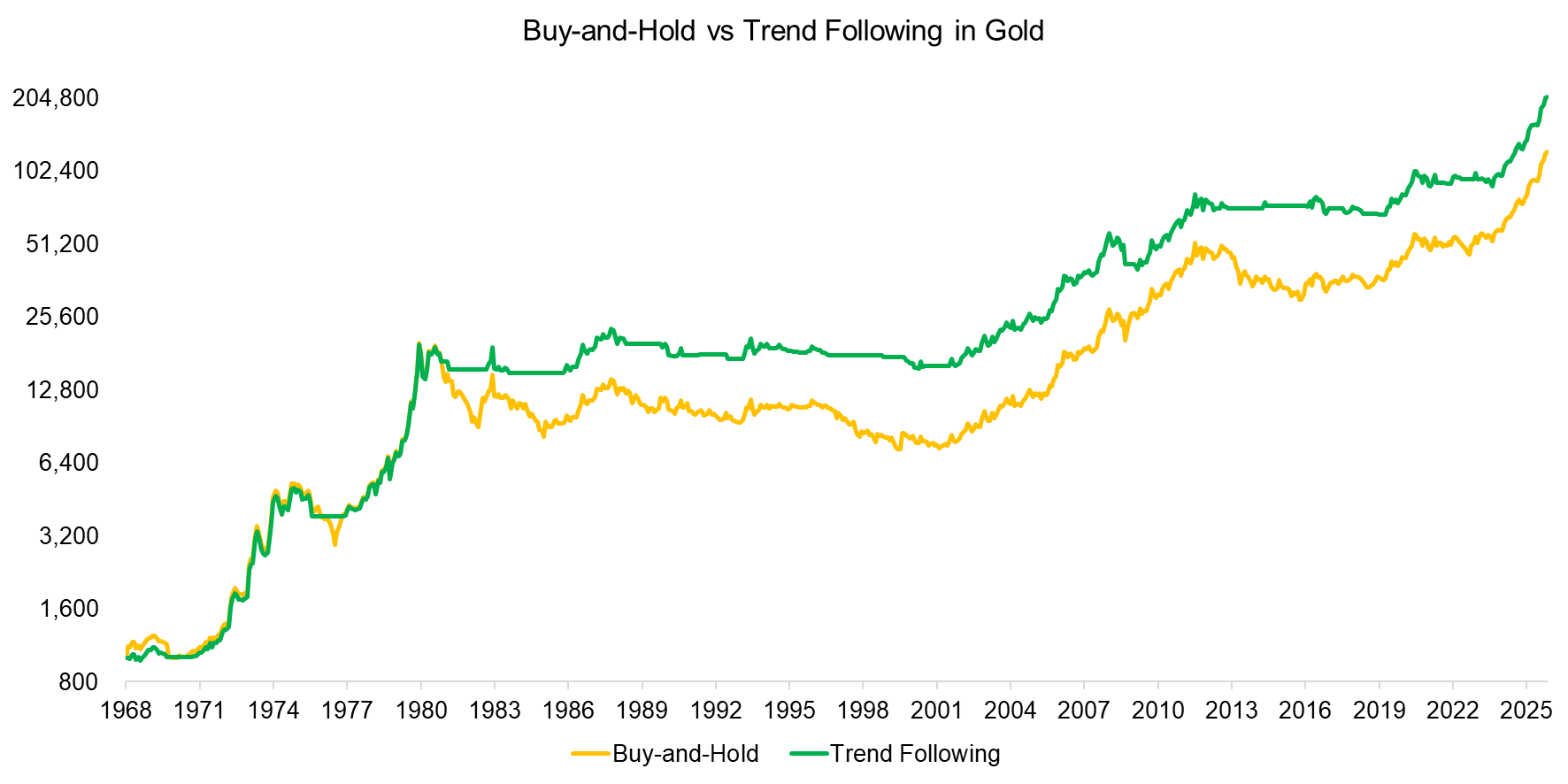

TREND FOLLOWING IN GOLD

Given the extended drawdowns in gold, a trend-following approach may be more effective than a simple buy-and-hold strategy. We evaluate a straightforward 250-day moving average rule, allocating to gold only when the trend is positive. Between 1968 and 2025, this strategy would have increased the CAGR from 8.7% to 9.7%. This analysis excludes transaction costs, but it also does not account for the possibility of investing capital in short-term U.S. Treasuries during periods when the trend was negative.

Source: Stooq, Finominal

DIVERSIFICATION BENEFITS

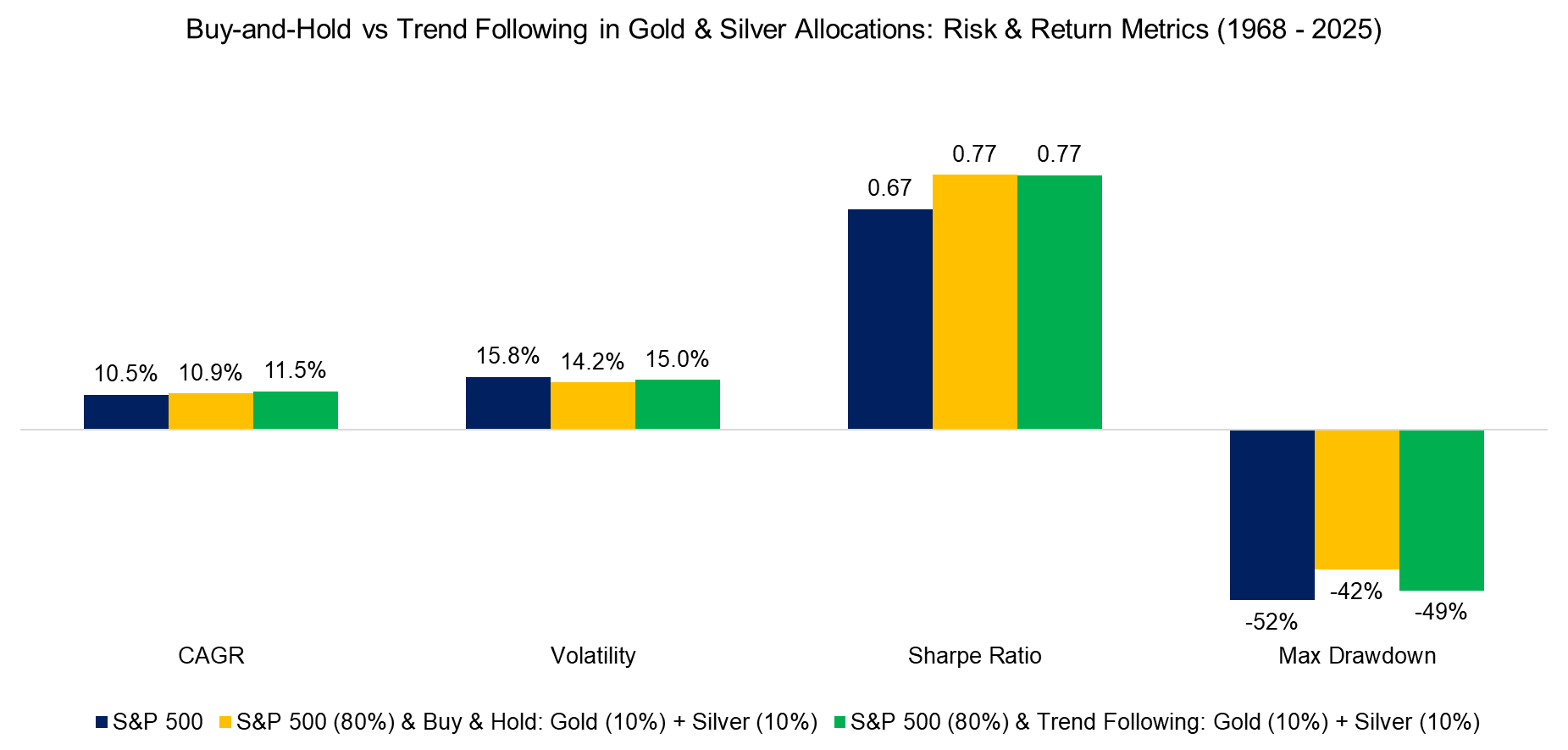

Although the long-term performance of gold and silver has been mixed, with extended periods of weak returns, investors primarily hold these precious metals for their diversification benefits.

We simulate adding a 10% allocation each to gold and silver within an equity portfolio. One portfolio follows a buy-and-hold approach with annual rebalancing, whereas the other holds only gold or silver when the trend is positive, reallocating to equities otherwise. Between 1968 and 2025, both approaches increased the portfolio’s Sharpe ratio, though there was little difference between buy-and-hold and trend following strategies. The trend following approach produced slightly higher returns but also higher volatility, likely because the portfolio lacked precious metal exposure during periods when it was most needed. Diversification functions like insurance: it is most valuable when unforeseen events occur, so it should always be in place.

Source: Finominal

FURTHER THOUGHTS

This analysis does not show a significant long-term advantage for trend-following strategies over buy-and-hold for gold and silver allocations. That said, when examining gold and silver after boom cycles, a risk-managed approach clearly demonstrates its value. For instance, gold declined by more than 50% between 1980 and 1985, whereas the trend-following strategy reduced the loss to 23.6%, and allowed capital to be redeployed elsewhere. Holding a position in the portfolio with a 50% loss is challenging, and holding such positions for decades is nearly impossible.

Rather than allocating directly to gold and silver, a more effective approach is to gain exposure systematically through CTAs and exploit bull and bear markets across multiple asset classes. Fortunately, several ETFs have been launched in the U.S. in recent years that provide access to managed futures strategies.

RELATED RESEARCH

Risk-Managed Equity Exposure III

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

Tail Risk Hedge Funds

Stock Selection versus Asset Allocation

CTAs: With or Without Trend Following in Equities?

Bonds versus CTAs for Diversification

Carry versus Trend Following

Trend Following in Equities

Trend Following in Bear Markets

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.