How to Combine Alternative Strategies

Risk parity versus equal-weight

July 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Equal-weighting and risk parity are both reasonable weighting methodologies for alternatives

- This analysis does not show a clearly superior method

- Equal-weighting may be more robust out-of-sample

INTRODUCTION

Since 2017, we’ve published dozens of research articles on alternative investment strategies and found that most fail to deliver meaningful value to investors. Many simply represent diluted equity exposure, others are just money pits. A prime example is long-short equity, where the return profile of most funds can be closely replicated within seconds by combining allocations to the S&P 500 and cash (read Are Liquid Alts more than Diluted Equity Funds? and Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios).

That said, there are exceptions – strategies that have historically offered genuine diversification benefits. Examples include BlackRock’s Global Equity Market Neutral Fund (BDMIX) and AQR’s Managed Futures Strategy Fund (AQMIX). Of course, there’s always the risk that these strategies may underperform going forward; by nature, we’re analyzing the survivors.

Identifying a shortlist of promising alternative funds is only the first step. The next is determining the appropriate overall allocation to alternatives, followed by decisions on how to weight the funds within that bucket. In this research article, we focus on the two most robust weighting methodologies: equal-weighting and risk parity.

CORRELATION ANALYSIS

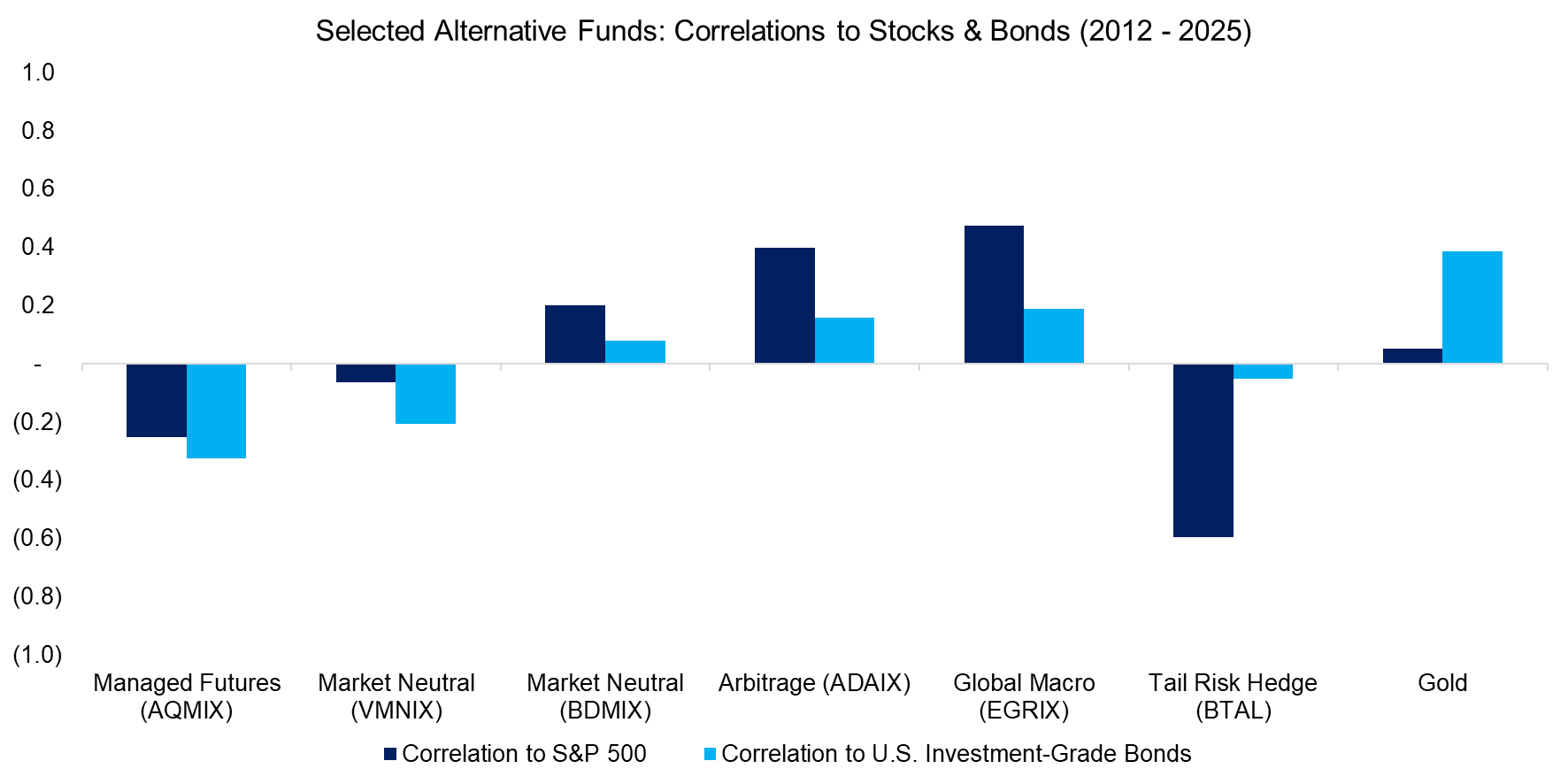

While there are thousands of alternative investment products, most can be grouped into a dozen or so core strategy types. For this analysis, we selected five funds across four strategies that historically exhibit low correlations to both equities and bonds: managed futures (AQMIX), market neutral (VMNIX and BDMIX), arbitrage (ADAIX), and global macro (EGRIX). We also include a tail risk strategy (BTAL) and gold for additional diversification.

Correlation analysis with the S&P 500 and U.S. investment-grade bonds over the period from 2012 to 2025 confirms these selections offer low correlations, ranging from -0.6 to 0.5.

Source: Finominal

EQUAL-WEIGHT VS RISK PARITY

We construct two portfolios: one consisting of the five alternative funds, and another that includes those five funds along with a tail risk strategy and gold. For each portfolio, we apply two allocation methods – equal weighting and risk parity. The risk parity portfolios are based on rolling 12-month volatility, rebalanced quarterly, and implemented without leverage.

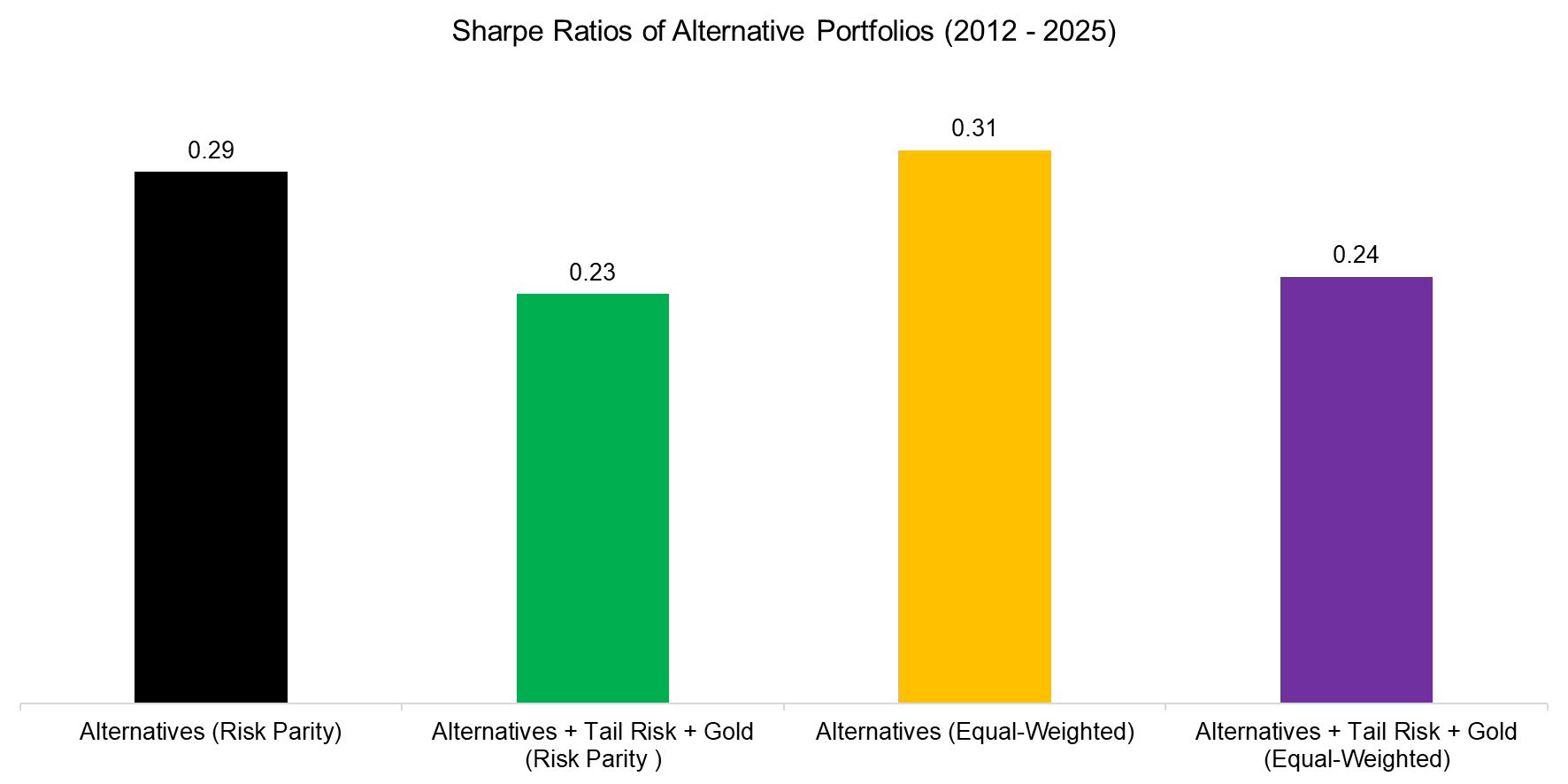

Performance comparisons of the resulting four portfolios reveal similar patterns over time but notable differences in returns. The equal-weighted portfolio comprised of the five alternative funds achieved the highest compound annual growth rate (CAGR) at 5.8%, while the lowest return – 4.0% per year – was recorded by the risk parity version of the portfolio including those two additional strategies, namely the tail risk hedge and gold.

Source: Finominal

However, when evaluating Sharpe ratios, the portfolio of the five equally weighted alternative funds delivered the highest risk-adjusted returns. Adding the tail risk strategy and gold did not enhance performance under either weighting approach. This is largely attributable to the negative performance of the tail risk strategy, which posted a CAGR of -0.6% since 2012. Given that the U.S. equity market experienced a prolonged bull run during this period, such underperformance is unsurprising (read Hedging Bear Markets & Crashes with Tail Risk ETFs and Tail Risk Hedge Funds).

Source: Finominal

CORRELATION ANALYSIS II

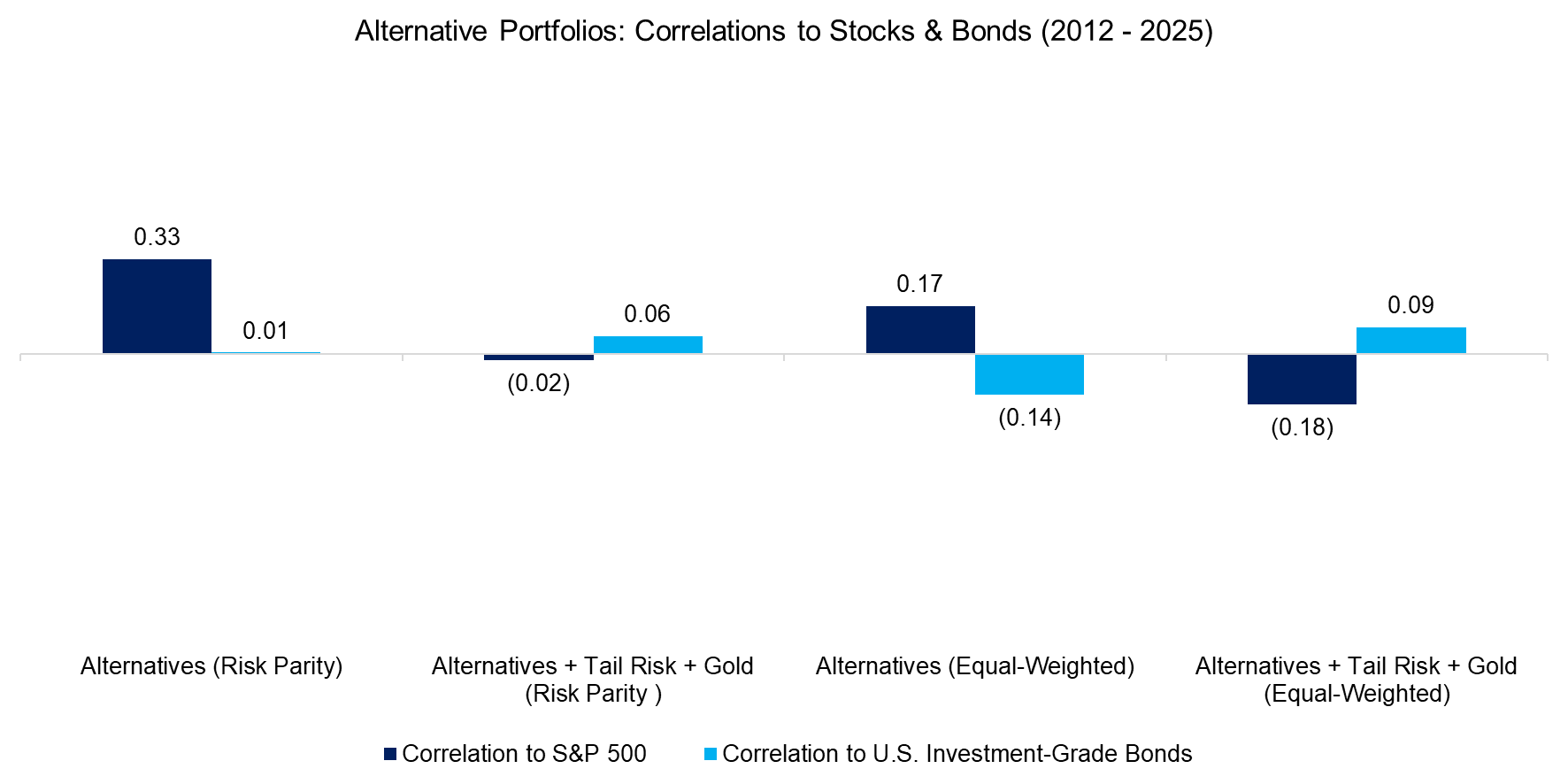

Finally, we conduct a second correlation analysis on the four portfolios, which highlights the diversification benefit of including the tail risk strategy – it reduced correlations to the S&P 500. Overall, all four portfolios maintained low correlations to both equities and bonds, indicating they would have offered meaningful diversification benefits, assuming positive returns.

Source: Finominal

FURTHER THOUGHTS

Unfortunately, this analysis does not reveal a clear advantage for either equal-weighting or risk parity when allocating to alternative strategies. This is somewhat surprising, given the significant differences in volatility across strategies – for example, managed futures tend to exhibit roughly twice the volatility of market neutral funds.

As noted in the introduction, our fund selection was limited to those with a 12-year track record, introducing a mild form of survivorship bias. One of the strengths of equal-weighting is its relative resilience to changes in underlying strategies – a common occurrence in the alternatives space – making it potentially more robust in out-of-sample scenarios.

RELATED RESEARCH

Are Liquid Alts more than Diluted Equity Funds?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

Private Equity: Fooling Some People All the Time?

Venture Capital: Worth Venturing Into?

Market Neutral Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

Hedging Bear Markets & Crashes with Tail Risk ETFs

Tail Risk Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.