A Horse Race of Liquid Alternatives

Portfolio Protection via Liquid Alts?

June 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Investors can access alternative strategies via mutual funds and ETFs

- Most of these show moderate to high correlations to equities, which is concerning

- Bonds would have been a better diversifier in recent years

INTRODUCTION

Investing is challenging as it is complex and complicated, which requires continuous learning and updating of mental frameworks. Conflicts and contradictions are found everywhere. For example, data from the mutual fund industry shows that most funds fail to outperform their benchmarks, but investors in hedge funds allocate primarily for alpha generation as shown by the latest JP Morgan industry survey. If mutual funds do not generate any alpha, why should hedge funds? (read Hedge Fund Factor Exposure & Alternatives)

Perhaps the assumption is that hedge funds have more flexibility with regards to investing, which provides greater opportunity to generate alpha. However, they also charge high fees that directly reduce alpha. Fortunately for investors, many classical hedge fund strategies have become available in low-cost mutual fund and ETF formats, which might represent the best of both worlds.

In this short research note, we will compare liquid alternatives and evaluate the benefits of adding these to an equity portfolio.

LIQUID ALTERNATIVES UNIVERSE

We define the universe of liquid alternatives quite broadly and include classic hedge fund strategies such as long-short equity as well as option-based strategies. The key criterion is that they are available via mutual funds or ETFs and therefore accessible for all investors. We create equal-weighted indices for the different categories and have data for all strategies from 2011 onwards (read Liquid Alternatives: Alternative Enough?).

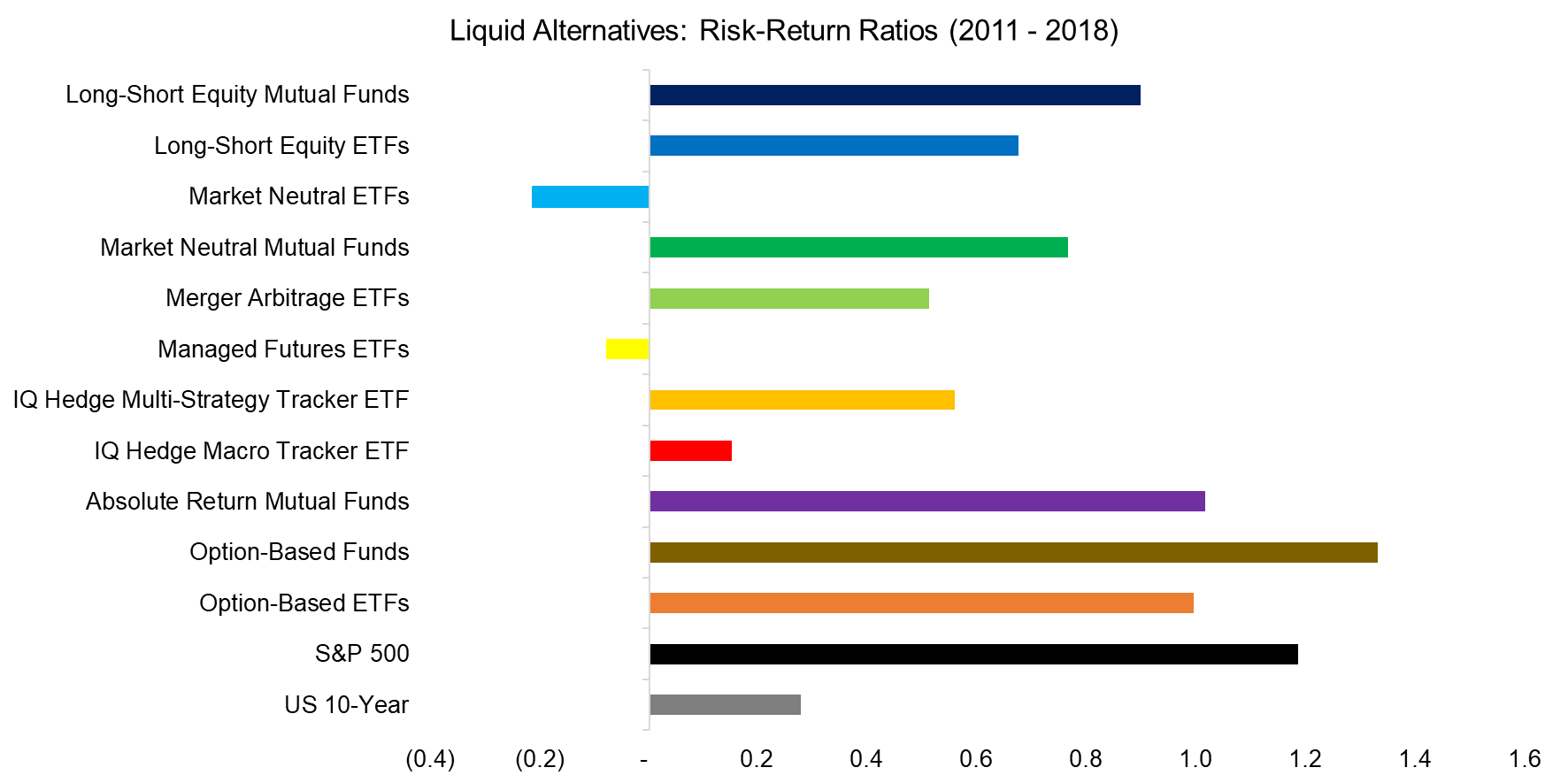

We observe that nearly all liquid alternatives generated positive risk-adjusted returns since 2011, except for market neutral and managed futures ETFs. It is somewhat unusual to see that market neutral ETFs generated negative while market neutral mutual funds generated positive returns, but this is perhaps explained by some of these indices having relatively few constituents where a single product can have a large impact on returns.

As per the JP Morgan hedge fund survey, diversification is the second most important reason why investors allocate to alternatives. Although negative risk-return ratios such in the case of the managed futures ETFs are not particularly desirable, the strategy might still be attractive if high diversification benefits are achieved on portfolio level.

Source: FactorResearch

LIQUID ALTERNATIVES IN AN EQUITY PORTFOLIO

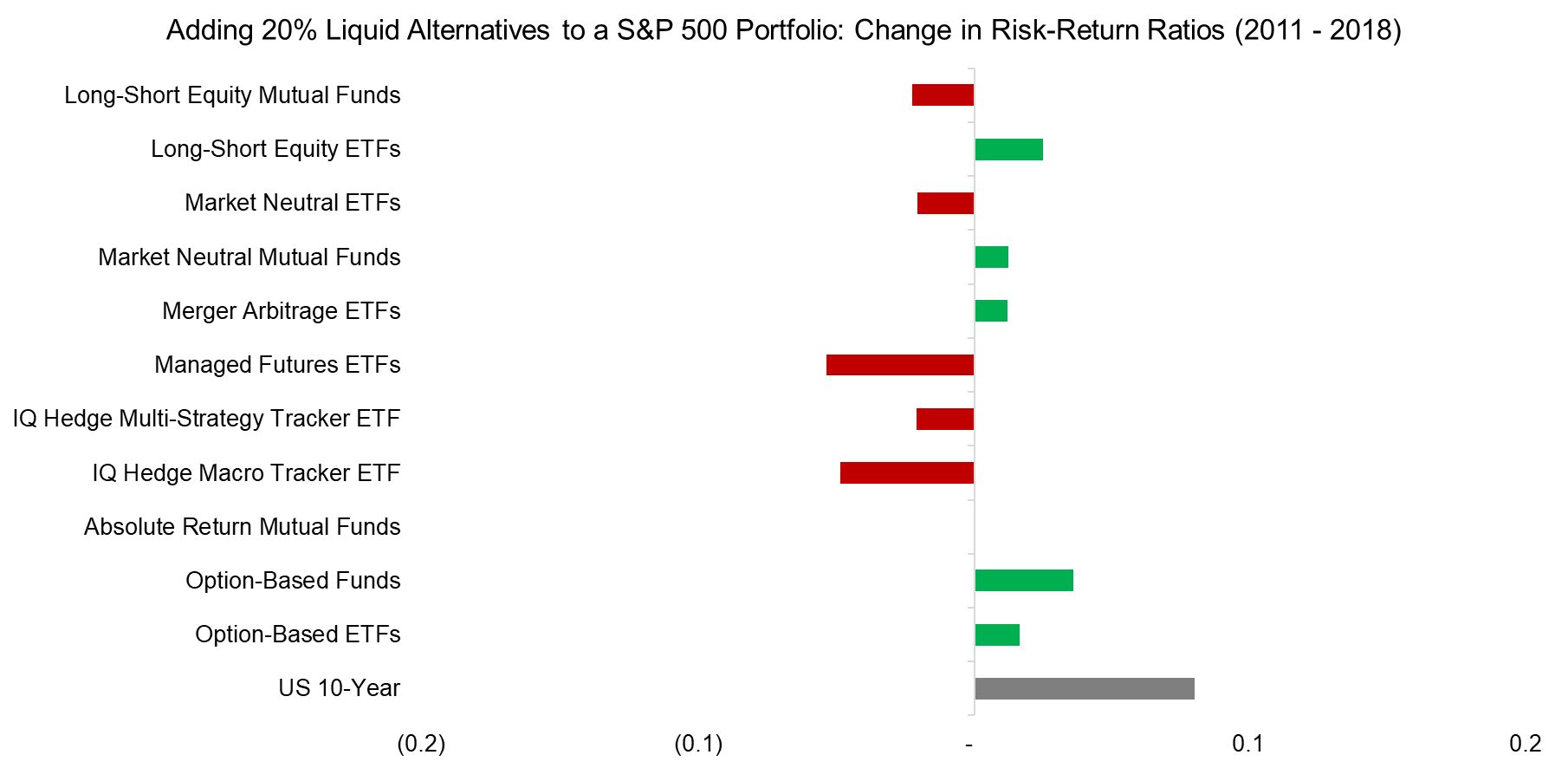

Diversification is one of the few free lunches in finance that is achieved by combining assets with low correlations in order to boost risk-adjusted returns. However, if we would have added a 20% allocation of liquid alternatives to a portfolio consisting exclusively of the S&P 500, only a few of the strategies would have increased the risk-return ratios since 2011. Even more concerning, allocating 20% to US 10-year government bonds instead would have generated the largest improvement in risk-adjusted returns.

Source: FactorResearch

LIQUID ALTERNATIVES VERSUS THE S&P 500

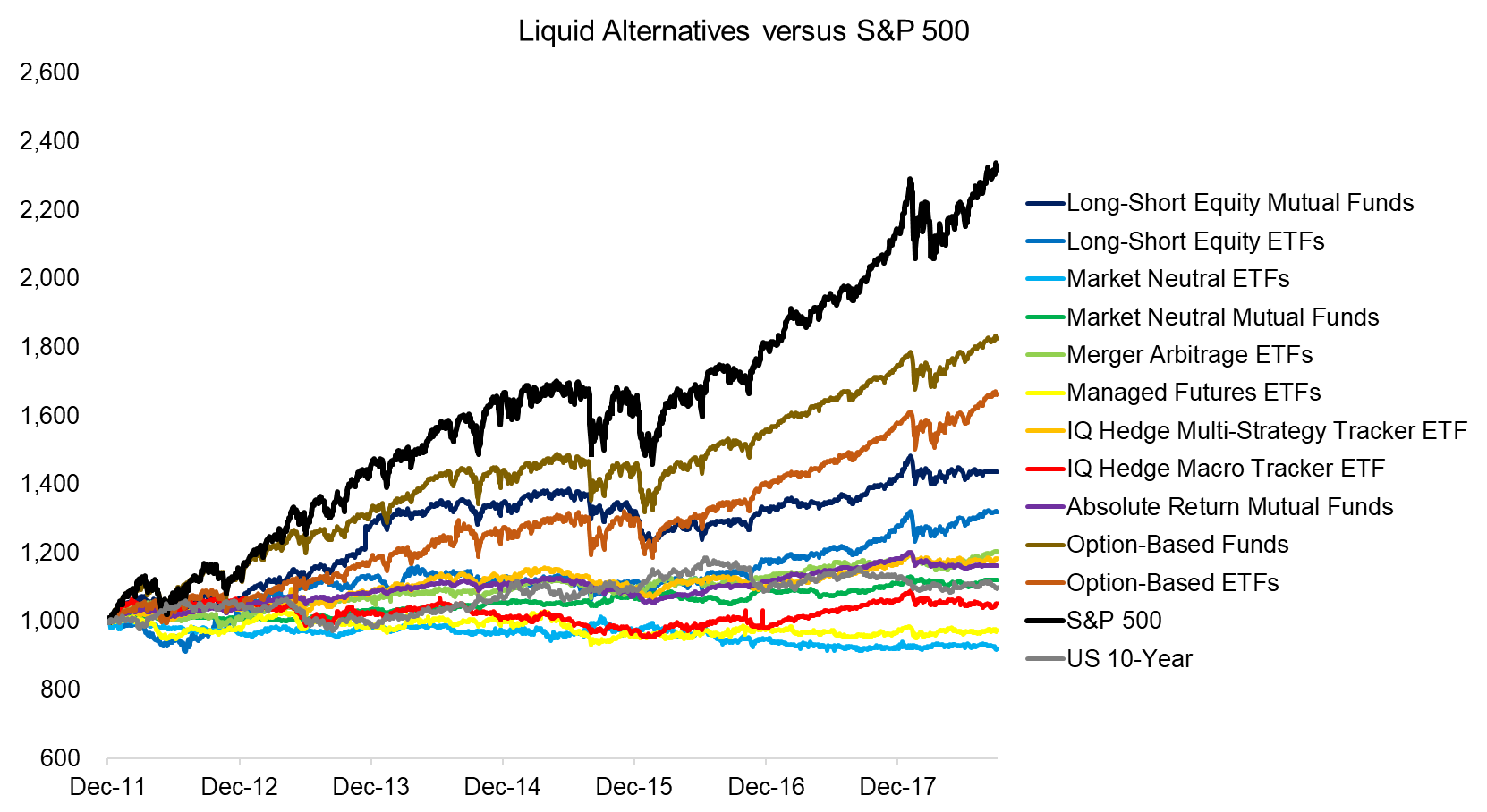

The strong performance of the S&P 500 since 2011 can partially explain why liquid alternatives did not add much value to an equity portfolio. Liquid alternatives do not aim to generate higher returns than the market, but returns that are uncorrelated to the S&P 500. It is not unusual to observe that alternative strategies seem less attractive in strong bull markets. The observation period does not include a meaningful bear market, where alternatives might have shown their strength in reducing drawdowns on portfolio level.

Source: FactorResearch

REDUCING DRAWDOWNS WITH LIQUID ALTERNATIVES?

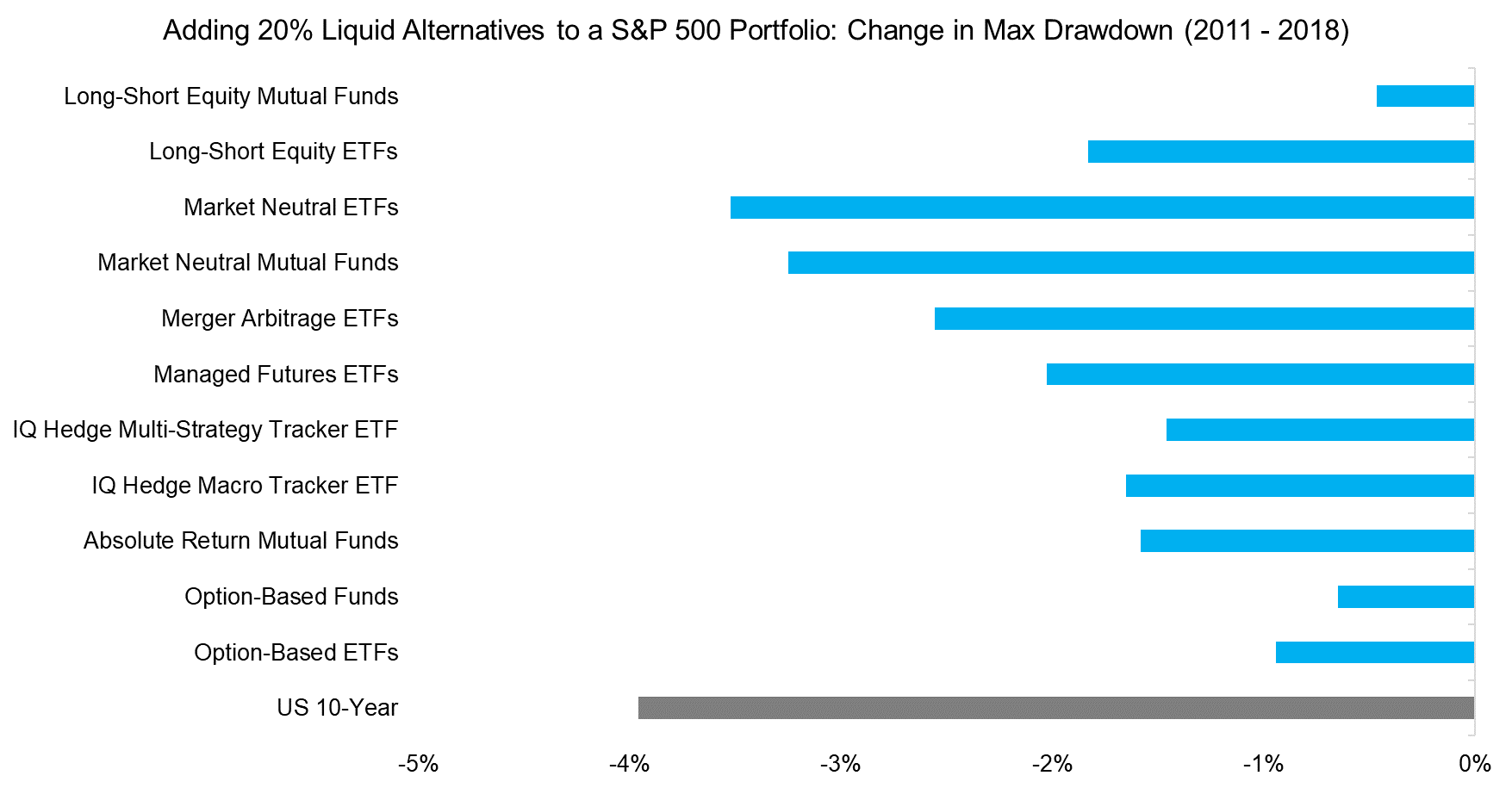

Diversification benefits can reflect in higher returns, lower risk, or hopefully both. Given the strong performance of the S&P since 2011, liquid alternatives could offer little to boost returns, but they did reduce risk. All strategies reduced the maximum drawdown of a 100% equity portfolio, which was approximately -14%.

As expected, market neutral mutual funds and ETFs, which aim to offer zero correlation to equities, performed best amongst the liquid alternatives. However, we also observe that investors would have been better off by investing in US 10-year government bonds than any of the alternative strategies, which is somewhat perplexing.

Source: FactorResearch

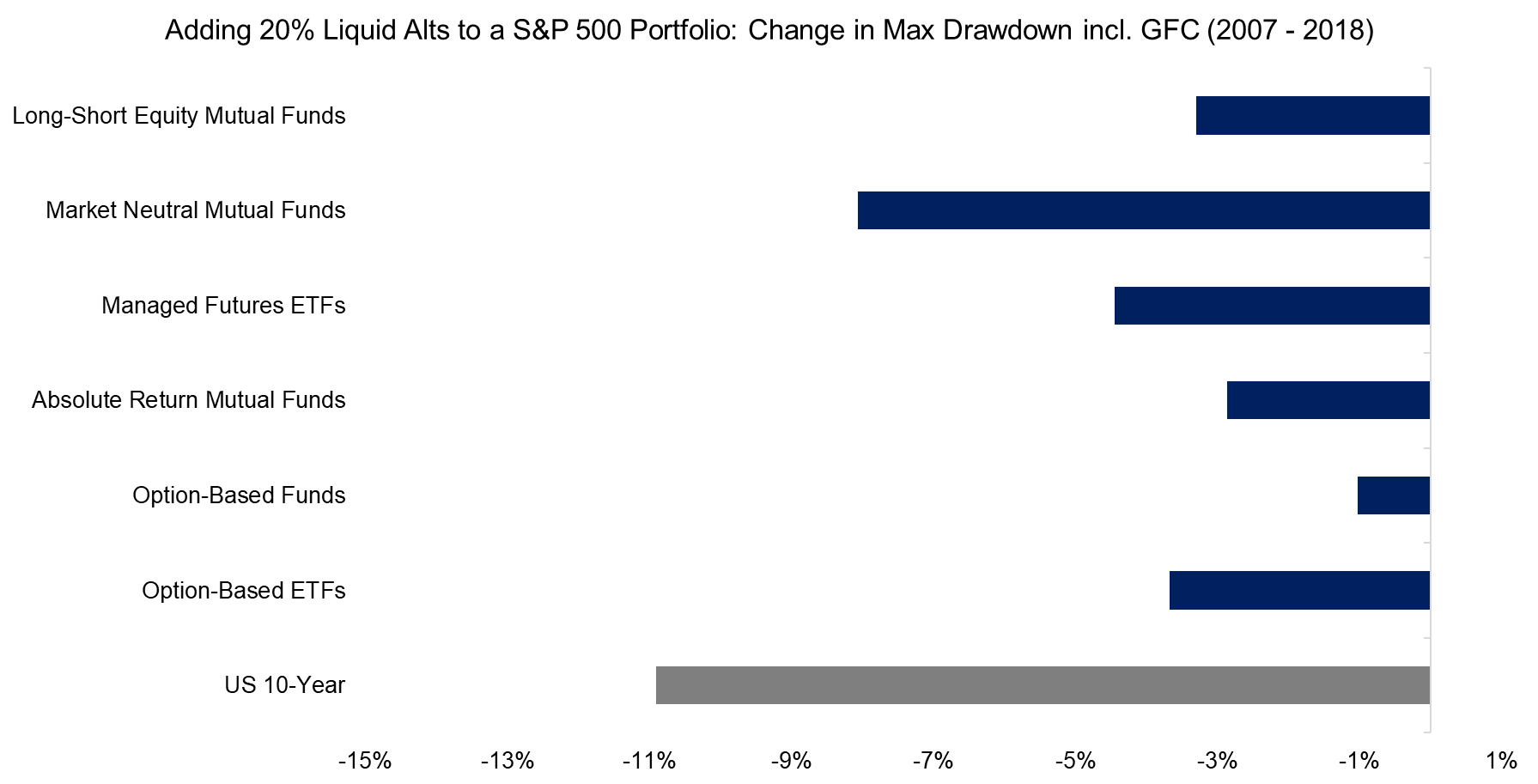

We can expand the analysis to 2007, which includes the global financial crisis, although not for all liquid alternative strategies as some lack the price history. The S&P 500 experienced a maximum drawdown of 57%, but most of the liquid alternatives available then would have only marginally reduced the drawdown. Similar to the previous results, bonds were far more effective in reducing the drawdown than any of the strategies.

Source: FactorResearch

LIQUID ALTERNATIVES: CORRELATIONS WITH THE S&P 500

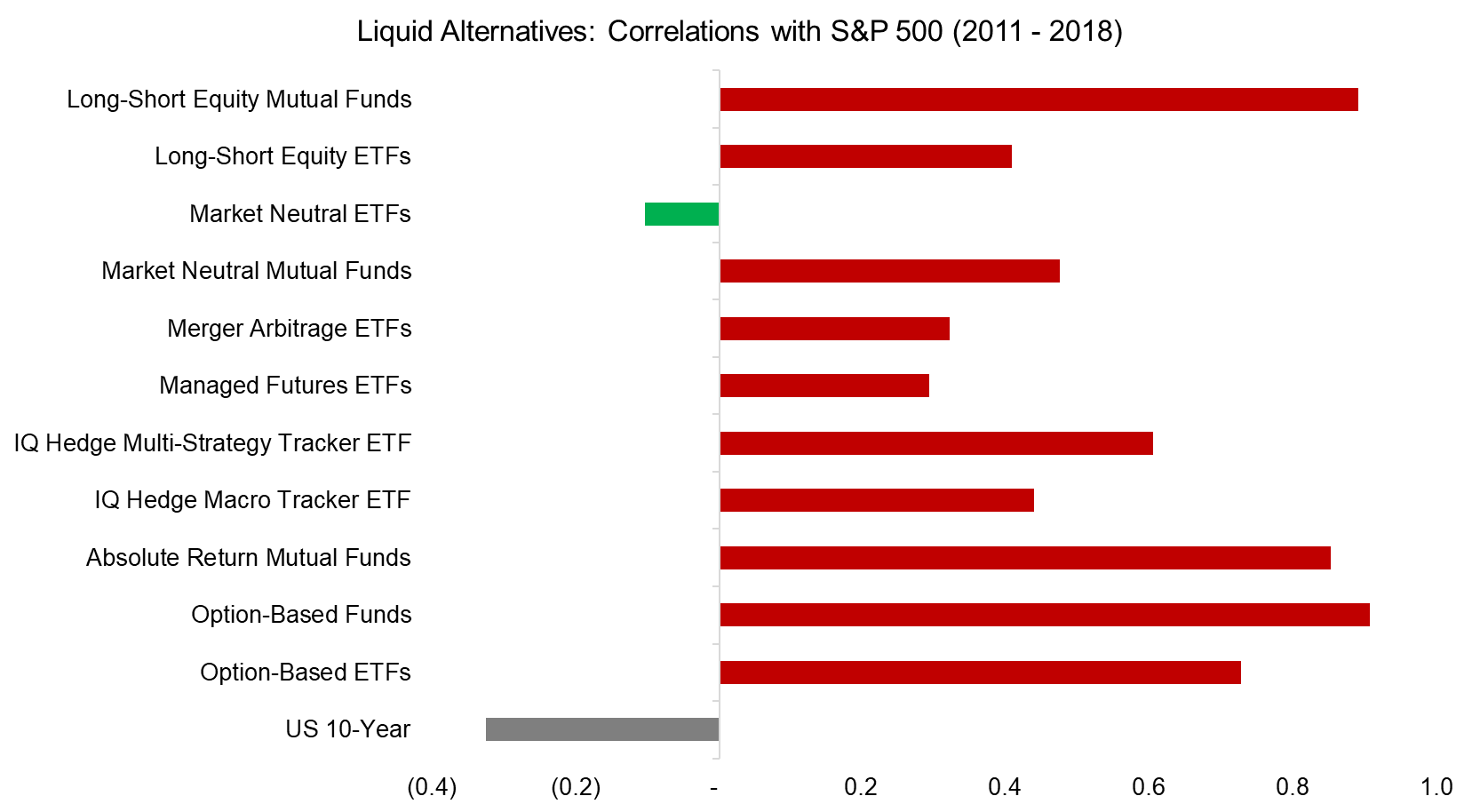

In order to get a better understanding of why liquid alternatives only marginally reduced risk, we analyze the correlations to the S&P 500. We observe that all strategies show moderate to high correlations, except for market neutral ETFs.

Although some strategies like long-short equity mutual funds are expected to have positive correlations, others like market neutral mutual funds or managed futures ETFs should not. These results highlight that liquid alternatives are simply not alternative enough, which can be attributed to suboptimal strategy design.

The negative correlation of bonds to equities explains the significant diversification benefits that investors achieved from simple 60/40 equity-bond portfolios in recent years.

Source: FactorResearch

FURTHER THOUGHTS

While ETFs are steadily capturing market share from mutual funds, liquid alternatives have been less successful in disrupting the hedge fund industry. The total assets under management in liquid alternatives in the US are approximately $350 billion, compared to more than $3 trillion in the global hedge fund industry, which has not changed significantly in recent years.

Given that most liquid alternative strategies exhibited moderate to high correlations to the S&P 500, investors might challenge their utility as they charge higher fees than plain-vanilla mutual funds and ETFs. Further product innovation is needed.

However, more importantly, liquid alternatives are complex strategies that require ongoing investors education. Adding an allocation to even well-designed strategies will likely decrease the returns of an equity portfolio, especially in bull markets, and only become value-adding in times of crisis. Unfortunately for the marketing professionals of alternative strategies, their role requires them to remind investors consistently of bear markets, market crashes, and black swan events.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.