A Horse Race of Low-Beta Equity Strategies

Low beta is not low risk

February 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Not all low-beta strategies offer lower risk than the stock market

- Most have generated lower Sharpe ratios than the stock market

- Most underperform simple equities & treasury combinations

INTRODUCTION

The core concept behind long-short equity hedge funds is to provide lower risk than the broader stock market while delivering reasonable returns. However, due to high fees and the challenges of navigating highly efficient markets with limited alpha opportunities, these funds often resemble diluted equity exposure (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios).

Instead of engaging in the costly and time-intensive process of manager selection and monitoring, investors can achieve similar outcomes by replicating long-short equity hedge funds through straightforward equity-cash combinations, which are both cheaper and more efficient (read Replicating Popular Investment Strategies with Equities + Cash).

While long-short equity hedge funds have largely failed to meet their objective of delivering superior Sharpe ratios compared to the stock market, they do serve a niche purpose: catering to investors who prefer to avoid seeing significant portfolio drawdowns on their statements, even if it means opting for a product that offers little more than a blend of the S&P 500 and cash.

In this research article, we will analyze long-short equity hedge funds available through ETFs and explore comparable low-beta strategies.

PERFORMANCE OF LOW-BETA STRATEGIES

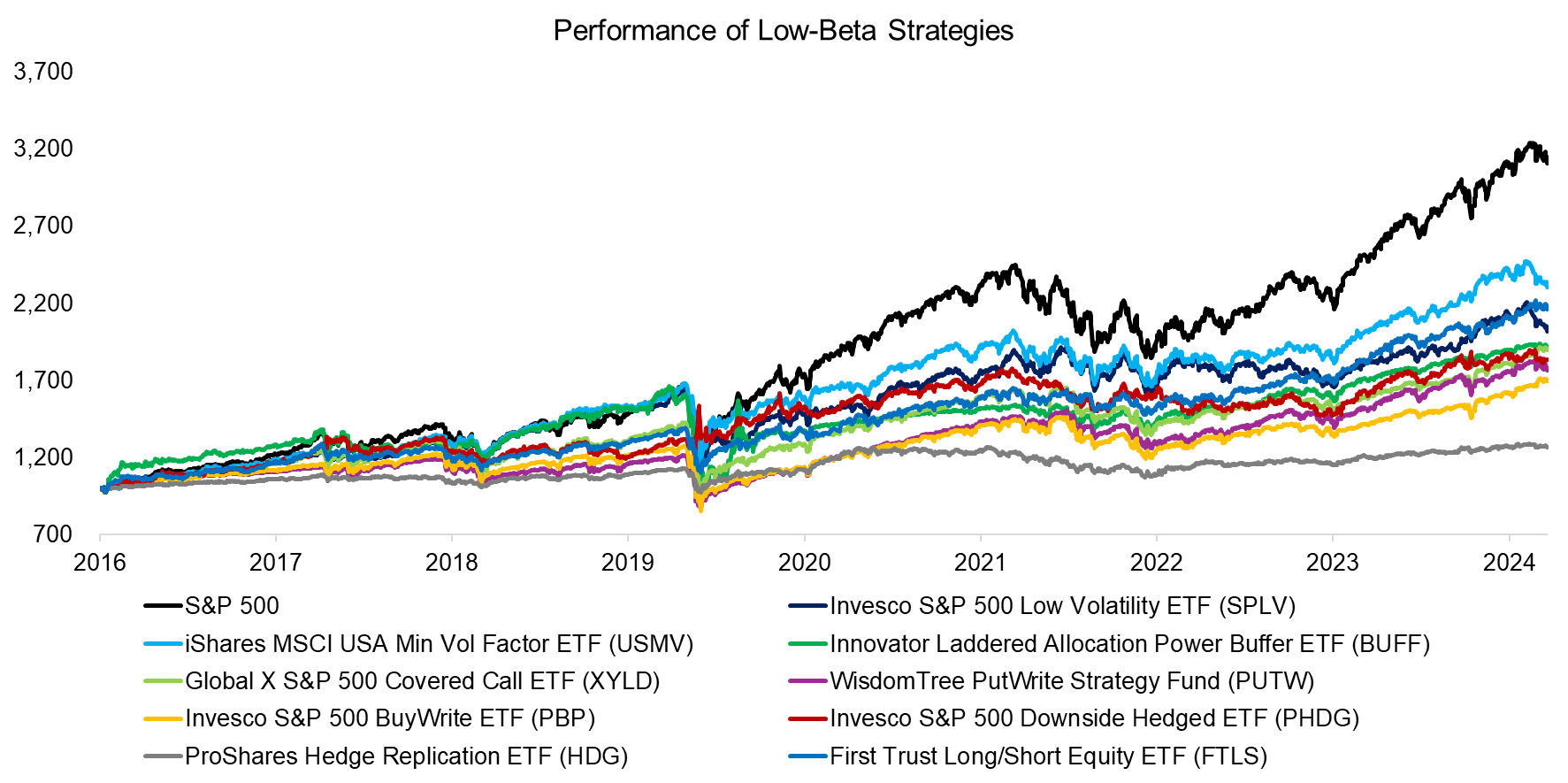

We analyzed the following low-beta strategies: Invesco S&P 500 Low Volatility ETF (SPLV), iShares MSCI USA Min Vol Factor ETF (USMV), Innovator Laddered Allocation Power Buffer ETF (BUFF), Global X S&P 500 Covered Call ETF (XYLD), WisdomTree PutWrite Strategy Fund (PUTW), Invesco S&P 500 BuyWrite ETF (PBP), Invesco S&P 500 Downside Hedged ETF (PHDG), ProShares Hedge Replication ETF (HDG), and First Trust Long/Short Equity ETF (FTLS). These strategies have assets under management ranging from $26 million for HDG to $22 billion for USMV, with expense ratios varying between 0.15% (USMV) and 1.46% (FTLS).

Each of these strategies is positioned as providing reduced downside risk compared to the broader stock market. However, this downside protection comes at a cost. Our analysis reveals that all these strategies underperformed the S&P 500 during the period from 2016 to 2024. Notably, HDG generated a compound annual growth rate (CAGR) of 2.9%, translating into negative real returns after accounting for inflation.

Source: Finominal

CORRELATIONS & BETAS TO THE S&P 500

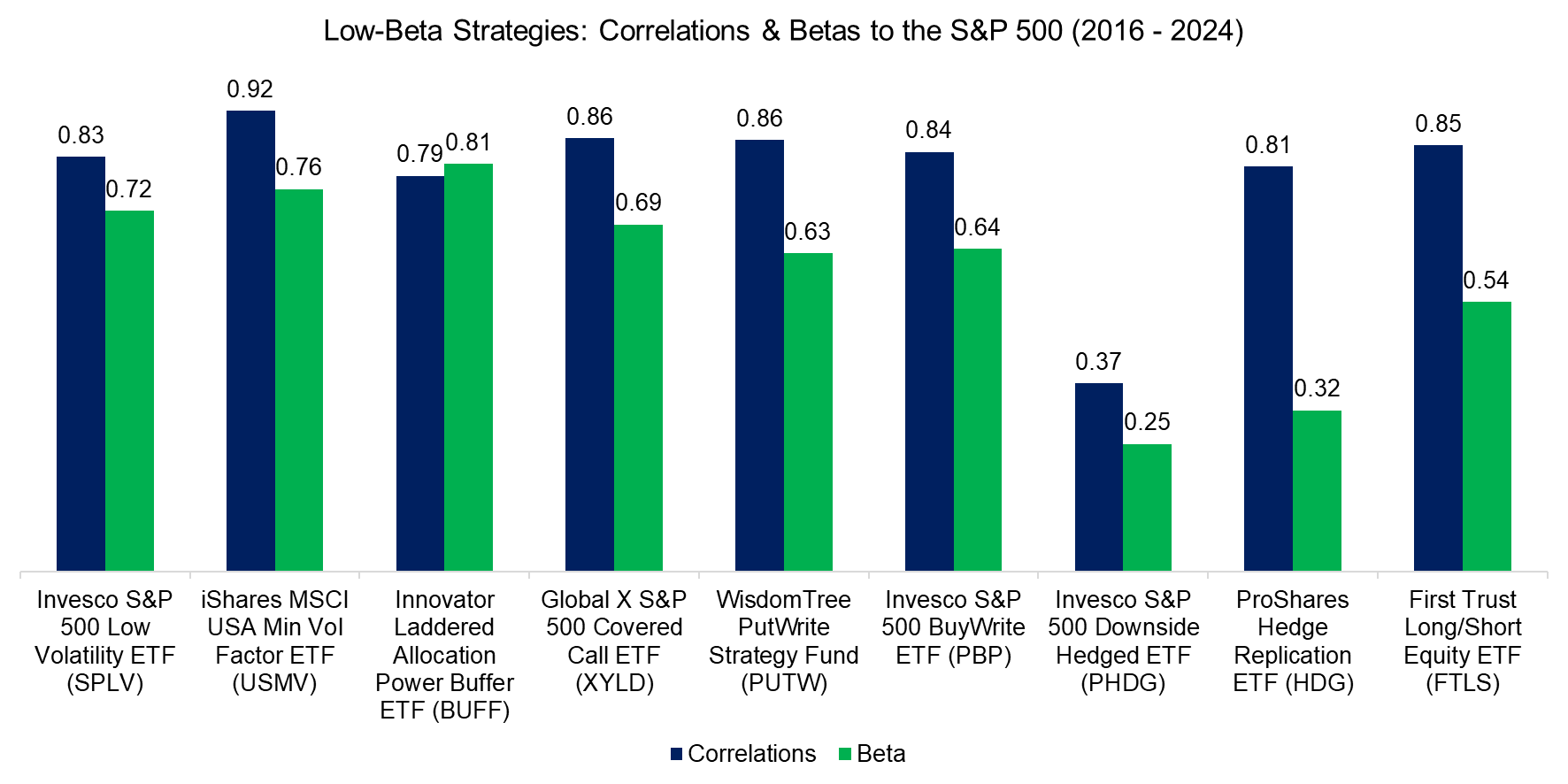

Next, we review the correlations and betas of these strategies to the S&P 500. The analysis shows that most of these are highly correlated to the stock market with correlations north of 0.8. Only the Invesco S&P 500 Downside Hedged ETF (PHDG) differentiates itself with a low correlation of 0.37 and beta of 0.25, which can be attributed to the ETF using VIX futures in the portfolio construction to hedge its portfolio.

Source: Finominal

RISK & RETURN METRICS

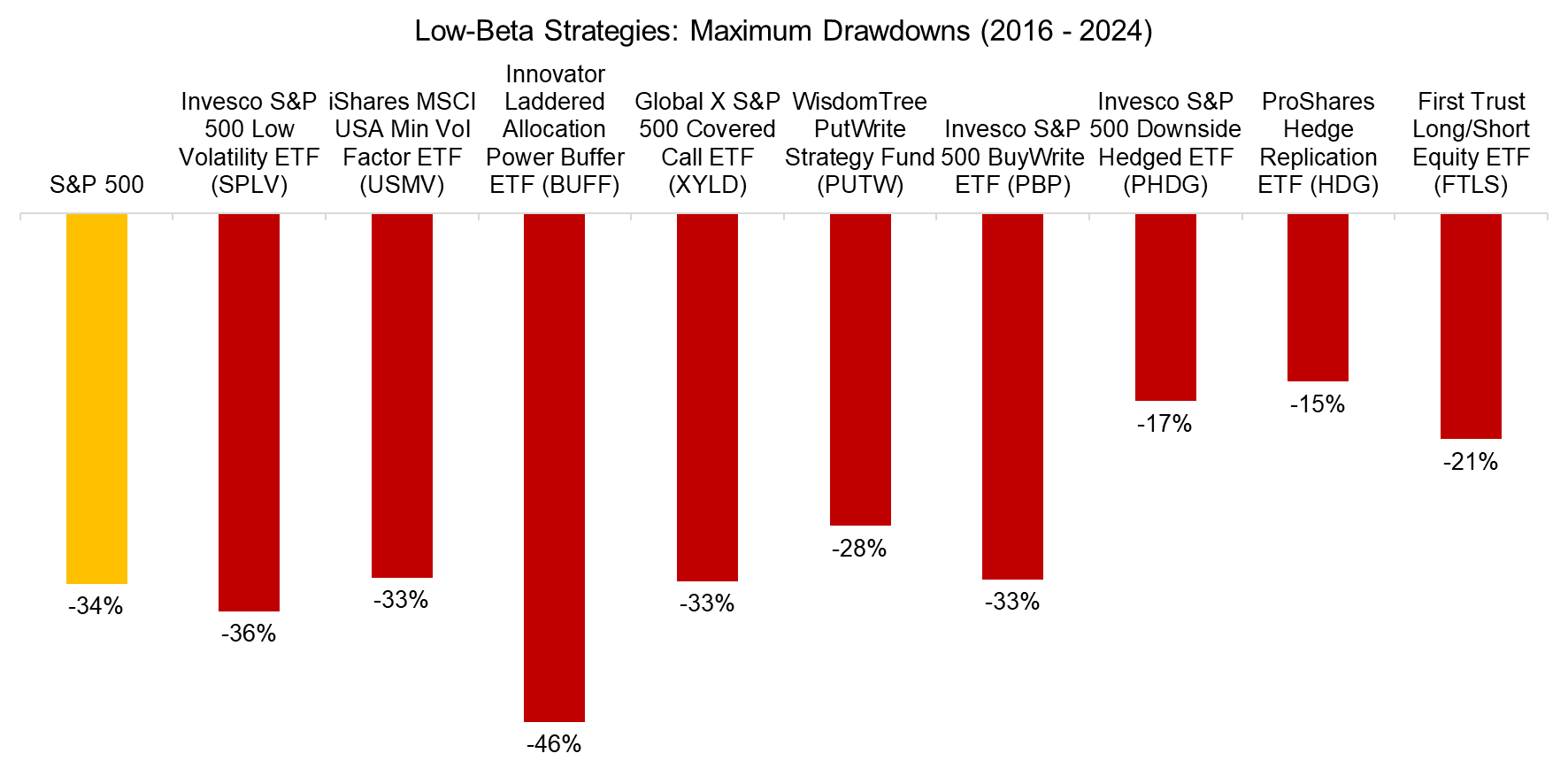

Investors naturally anticipate that low-beta strategies will deliver smaller drawdowns than the broader stock market. However, only four of the eight strategies examined managed to meet this expectation. Notably, the Innovator Laddered Allocation Power Buffer ETF (BUFF) was particularly disappointing, suffering a 46% loss during the 2020 COVID-19 crisis—significantly worse than the S&P 500’s 35% decline.

Source: Finominal

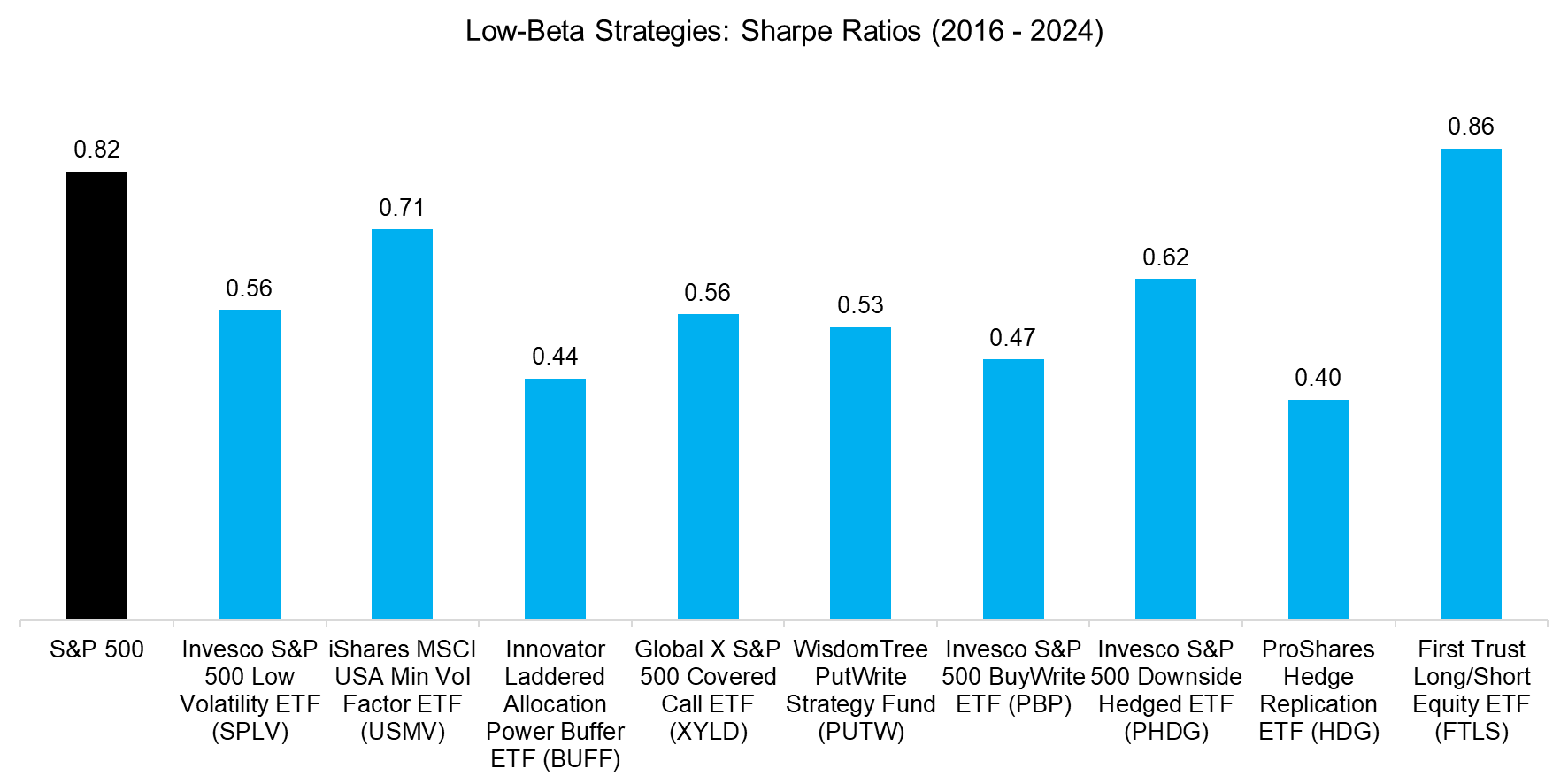

The ProShares Hedge Replication ETF (HDG) experienced the smallest drawdown between 2016 and 2024 but also delivered the lowest CAGR, resulting in the lowest Sharpe ratio (0.40) among all the strategies. Notably, all low-beta strategies underperformed the S&P 500 in terms of Sharpe ratio (0.82), with the sole exception being the First Trust Long/Short Equity ETF (FTLS) (0.86).

Source: Finominal

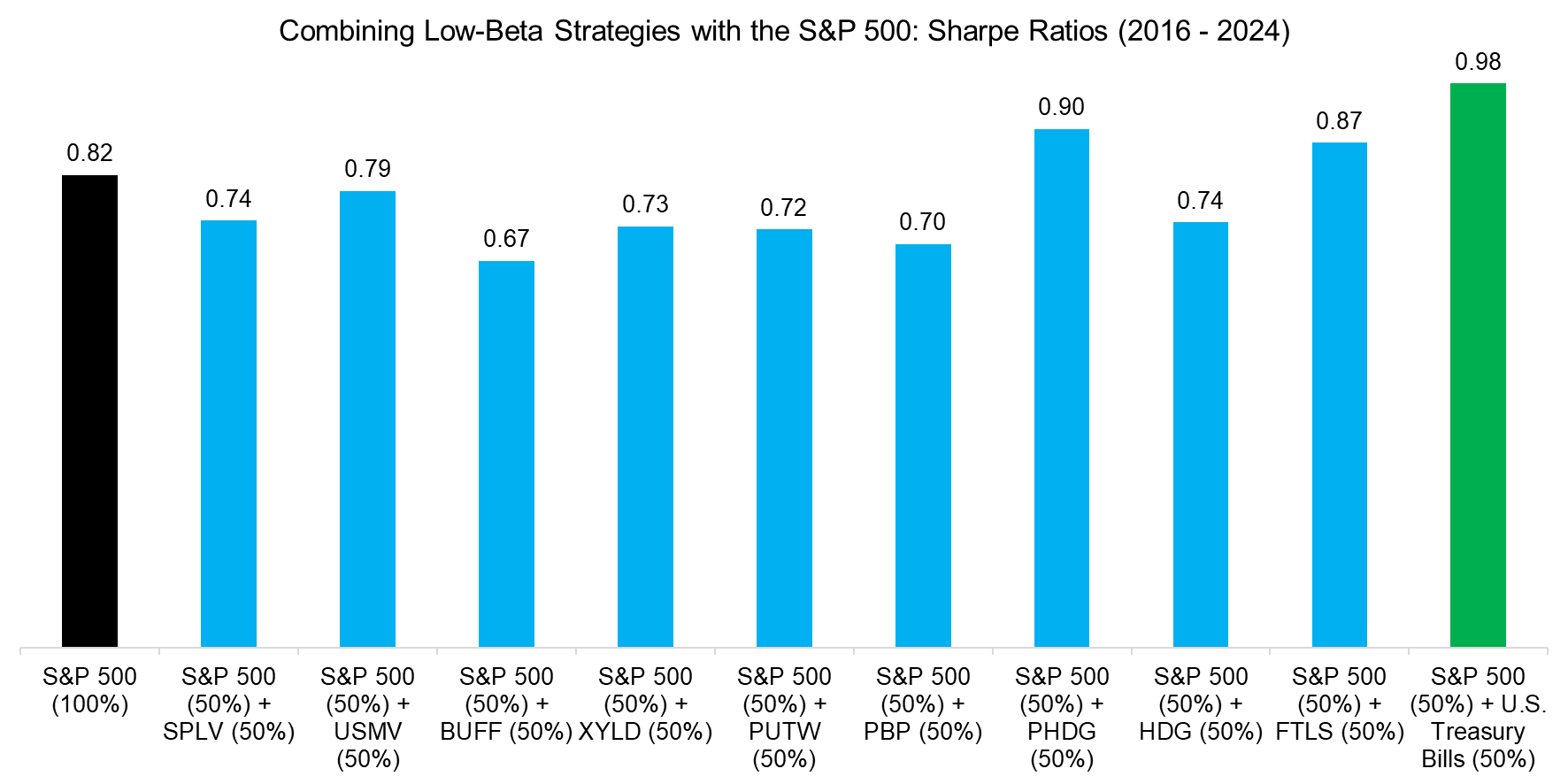

QUANTIFYING DIVERSIFICATION BENEFITS

Lastly, we assess the diversification benefits of incorporating low-beta strategies into an equities portfolio. An equal allocation across all low-beta strategies and the S&P 500, with quarterly rebalancing, reveals that only the Invesco S&P 500 Downside Hedged ETF (PHDG) and the First Trust Long/Short Equity ETF (FTLS) would have enhanced the portfolio’s Sharpe ratio.

In contrast, a simulated allocation of 50% to U.S. Treasury Bills results in a significantly greater improvement in the Sharpe ratio compared to adding any of the low-beta strategies.

Source: Finominal

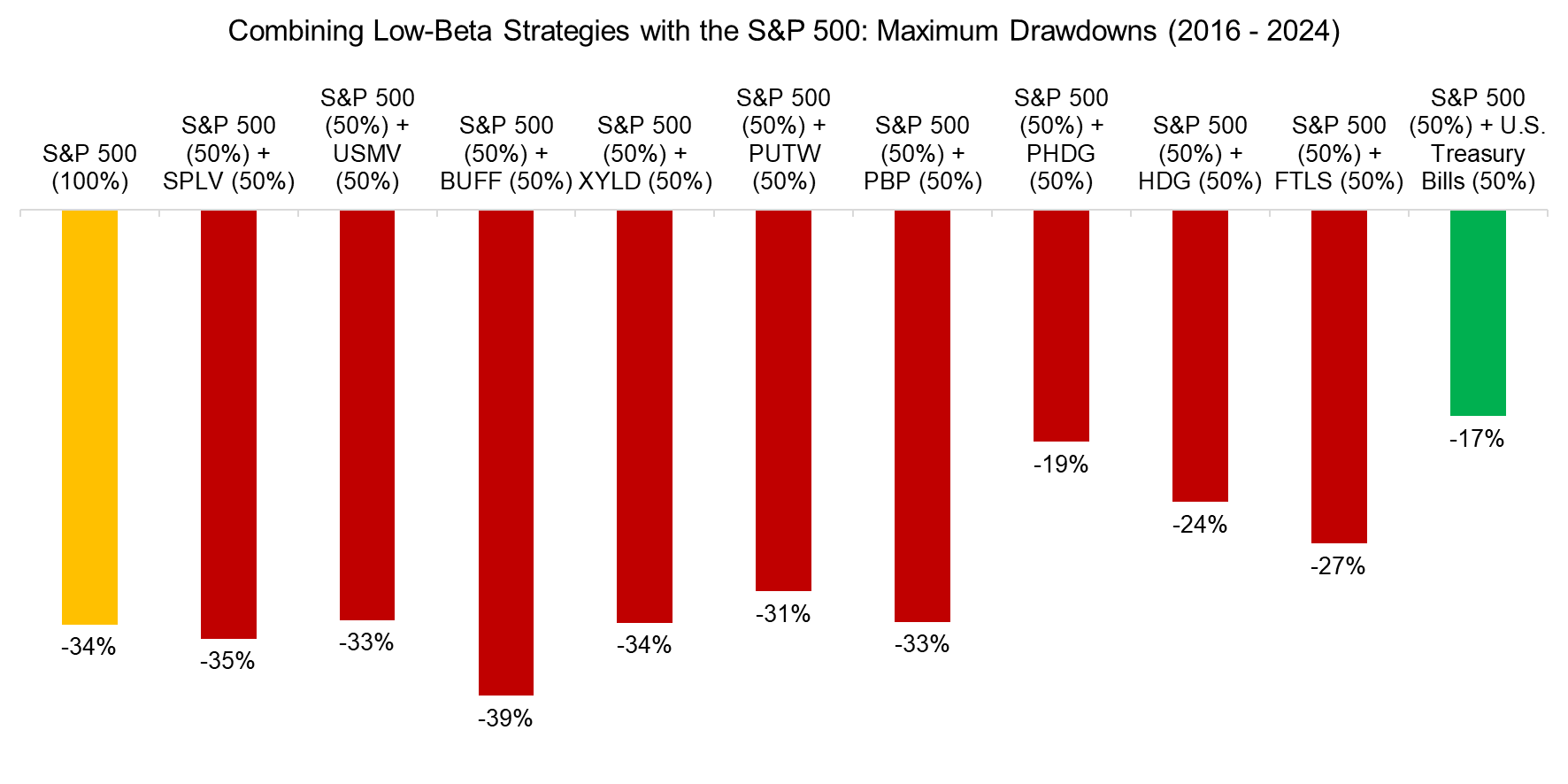

Three of the combination portfolios achieved significantly lower drawdowns than the S&P 500. However, none matched the level of drawdown reduction offered by a straightforward allocation to U.S. Treasury Bills.

Source: Finominal

FURTHER THOUGHTS

Investors typically expect low-beta strategies to offer lower risk than the broader stock market. However, in this sample of diverse strategies, fewer than half have delivered meaningful risk reduction, and all but one have produced lower Sharpe ratios.

As is often the case in the asset management industry, investment products may not perform as advertised. Investors should remain cautious of concepts that appear too good to be true.

RELATED RESEARCH

Replicating Popular Investment Strategies with Equities + Cash

Exploring Defined Outcome ETFs

Option-Based Strategies: Opt In or Opt Out?

Covered Call Strategies Uncovered

Low Volatility vs Option-Based Strategies

Hedge Funds versus Hedge Fund Replication ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.