A Review of Global Macro Mutual Funds

Investable, but uninvestable.

September 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Global macro mutual funds have too much equity exposure

- High Sharpe ratios do not imply high diversification benefits

- Diversification benefits were low

INTRODUCTION

No investing role is more interesting than being a global macro fund manager. Anything can be traded, either long or short. There is no benchmark and portfolio construction is typically down to the fund manager. The only ask of investors is to make money and provide uncorrelated returns that offer diversification benefits. This can´t be too difficult given the flexibility of the mandate, can it?

We previously analyzed the track records of global macro fund managers using indices from HFR, Credit Suisse, and Eurekahedge, where we concluded that these funds provided diversification benefits (read Global Macro: Masters of the Universe?), but also often offered similar exposures to managed futures (read CTAs vs Global Macro Hedge Funds).

However, these indices aggregate the returns of global macro hedge funds that are usually domiciled offshore and not available to most investors. Some of these managers have launched their strategies in the mutual fund format to broaden their investor base.

In this research article, we will evaluate global macro mutual funds.

UNIVERSE OF GLOBAL MACRO MUTUAL FUNDS

We define our universe as all mutual funds in the U.S. that are classified as macro funds by our data providers, which are 43 funds managing $35 billion of assets. The median management fee is 1.13% per annum.

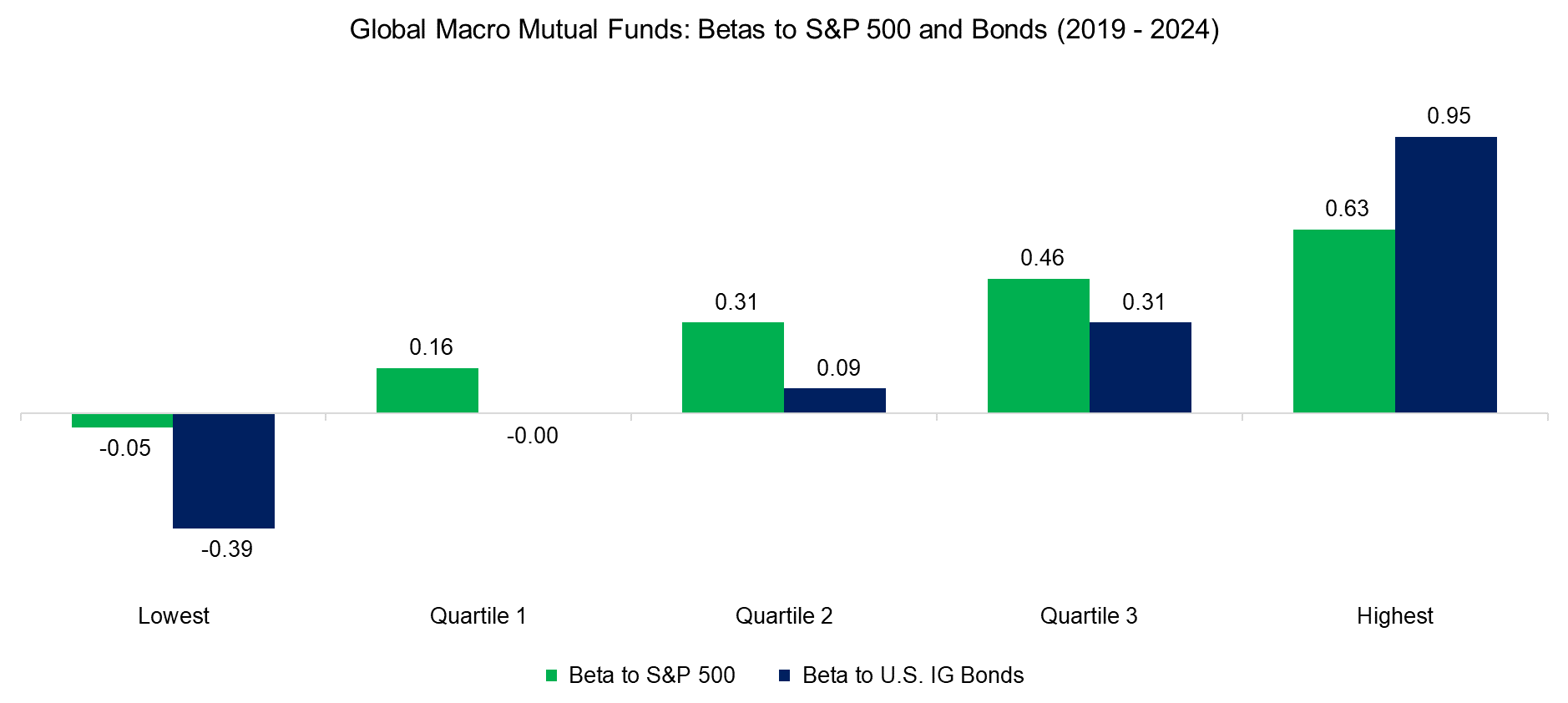

First, we run a returns-based factor exposure analysis to compute the betas to the S&P 500 and a U.S. Investment-Grade Bond index. We observe that some of these global macro funds are essentially equity and bond proxies, which implies no diversification benefits for a traditional 60/40 equities/bonds portfolio.

Source: Finominal

Next, we remove all funds that have betas larger than 0.3 or smaller than -0.3 to equities or bonds given that we want uncorrelated returns to traditional markets. This reduces our universe of 43 mutual funds to 12, namely Invesco Macro Allocation Strategy Fund (GMSKX), Eaton Vance Global Macro Absolute Return Fund (EIGMX), DWS Global Macro Fund (MGINX), Toews Hedged Oceana Fund (THIDX), BlackRock Tactical Opportunities Fund (PCBAX), LoCorr Macro Strategies Fund (LFMIX), MFS Global Alternative Strategy Fund (DVRIX), Allspring Absolute Return Fund (WARAX), GMO Benchmark-Free Allocation Fund (GBMFX), First Trust Multi-Strategy Fund (FTMIX), Eaton Vance Global Macro Abs Return Adv Fund (EGRIX), and Guggenheim Macro Opportunities Fund (GIOIX).

These 12 funds manage $12 billion of assets, but Guggenheim´s Macro Opportunities Fund (GIOIX) dominates this with $6 billion of assets under management.

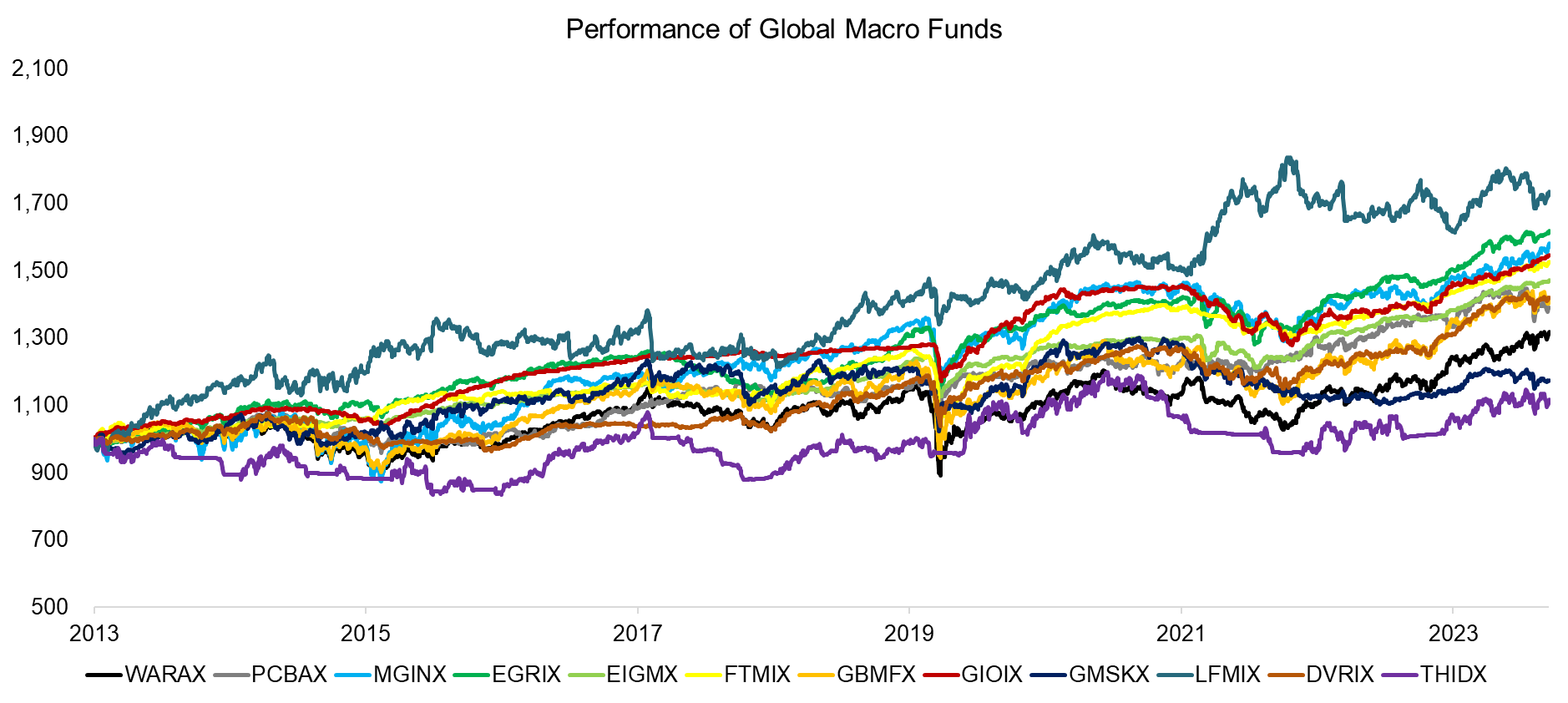

We plot the performance of these funds for the last 10 years, which highlights CAGRs ranging from 1.01% to 5.3%. However, the trends in performance were often similar, which is surprising given the range of instruments these funds can trade.

Source: Finominal

GLOBAL MACRO FUNDS VERSUS STOCKS AND BONDS

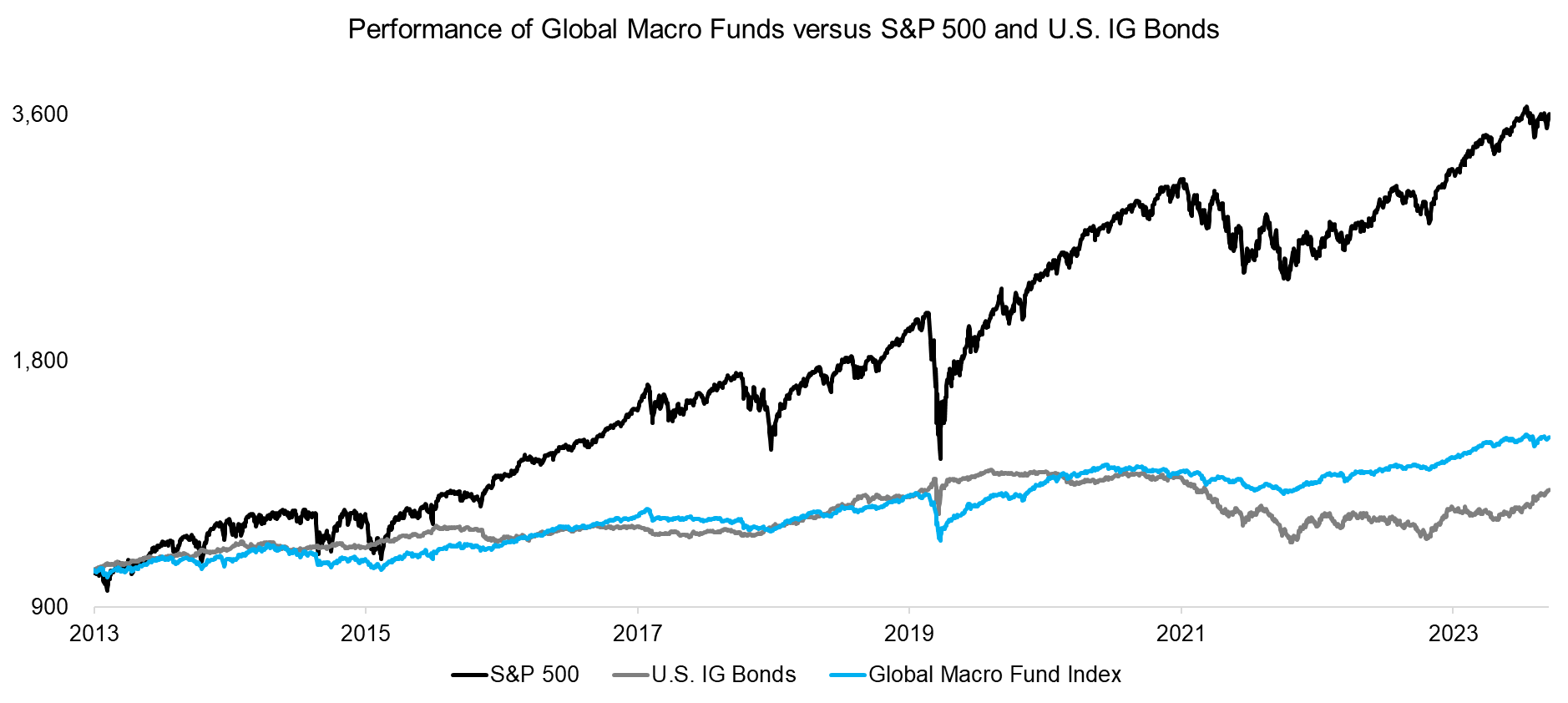

Given that the global macro funds’ performance trends were similar, we created an equal-weighted index of the 12 funds and compared this to the S&P 500 and U.S. Investment-Grade Bonds index. The performance of the global macro fund index seems significantly different from that of the bond index, but there seems to be overlap with the S&P 500; for example, both declined during the COVID-19 crisis in 2020.

Source: Finominal

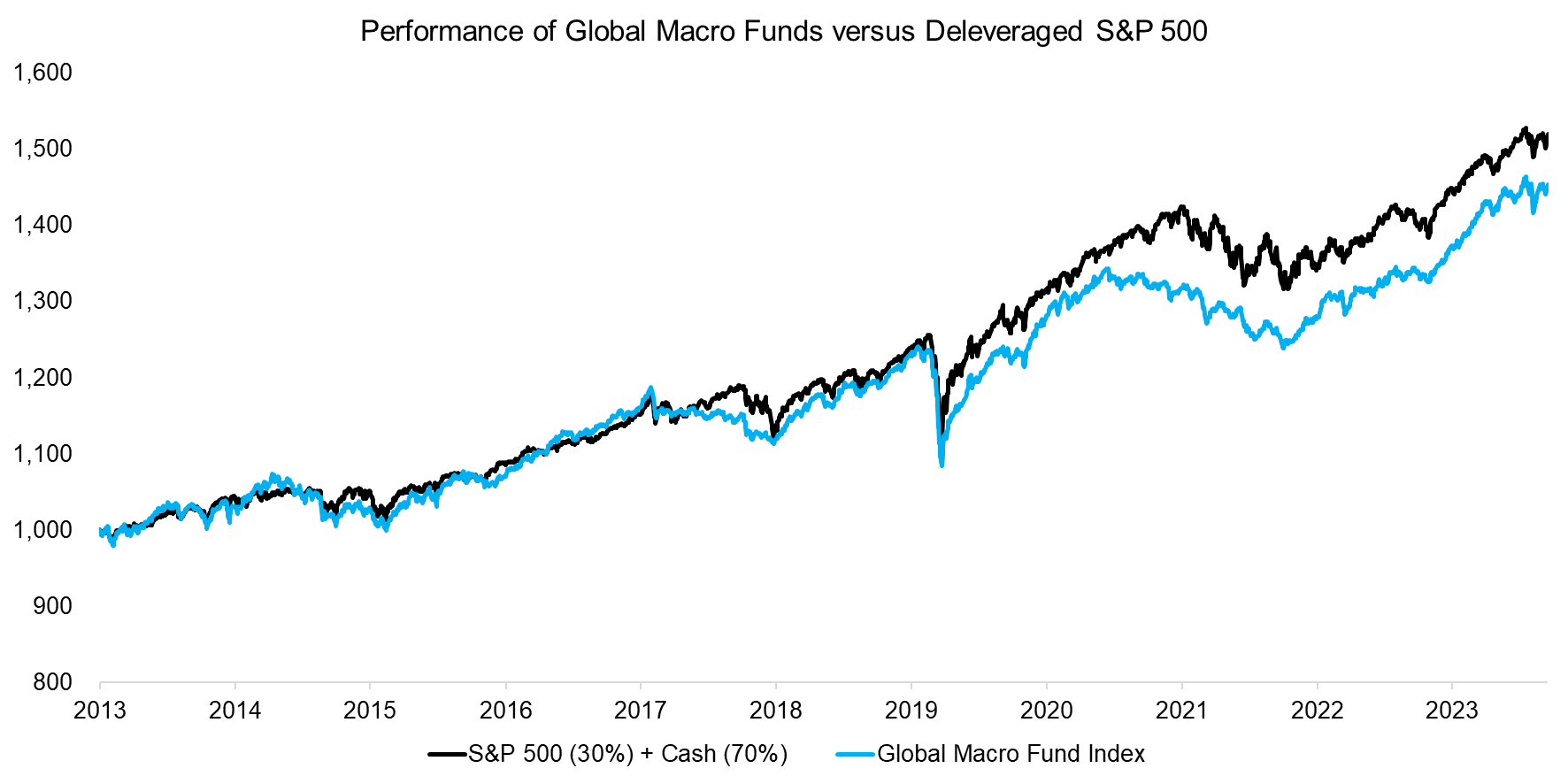

We create a deleveraged version of the S&P 500 that allocates 30% to the S&P 500 and 70% to non-interest-bearing cash. Unfortunately, this deleveraged S&P 500 index is almost identical to the global macro fund index, which is remarkable given that we removed all funds with high betas to the stock market.

Stated differently, global macro managers are simply providing diluted equity exposure, which does not offer diversification benefits.

Source: Finominal

QUANTIFYING DIVERSIFICATION BENEFITS

Although these funds do not provide diversification benefits on aggregate, perhaps some selective ones do. As previously described, the two requirements of global macro fund managers are to make money and provide uncorrelated returns.

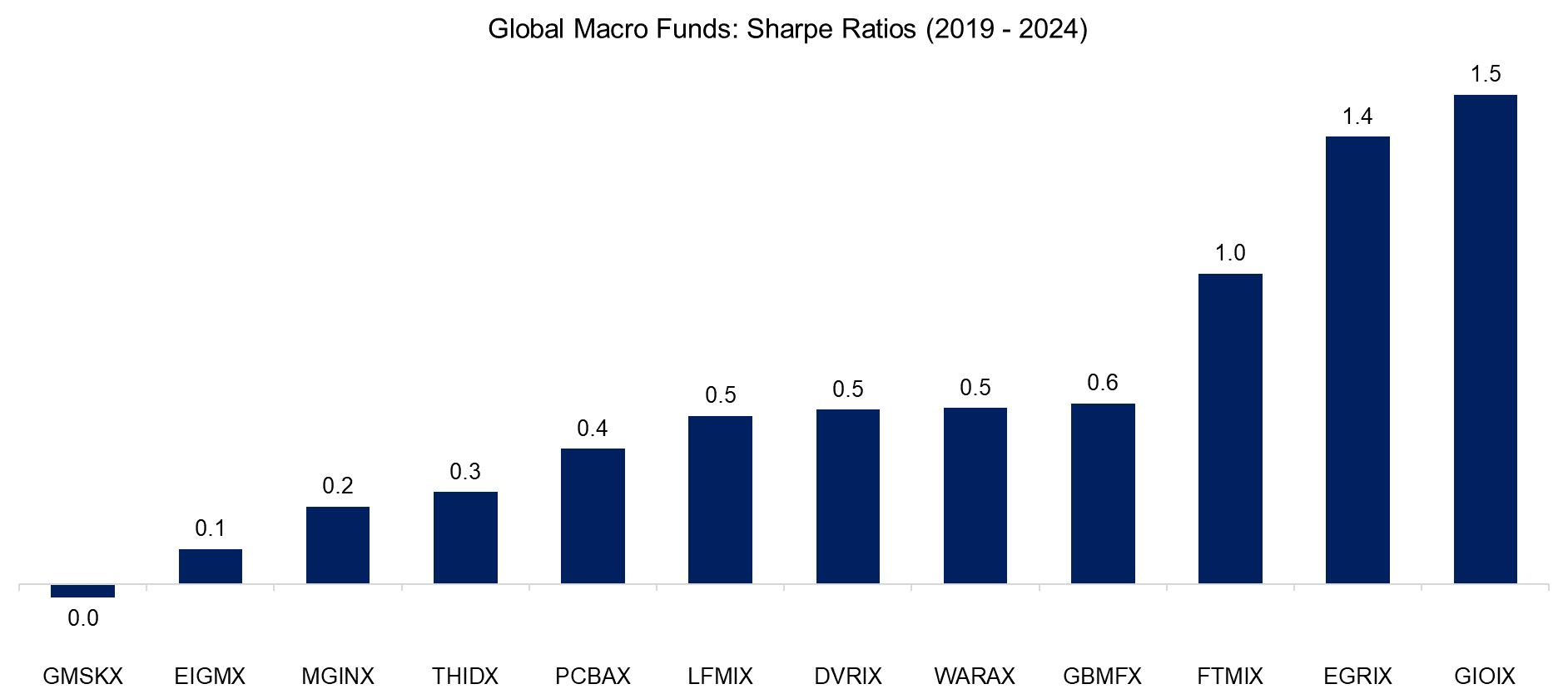

We evaluate the first criteria but focus on risk-adjusted rather than absolute returns. Over the last five years, all except one fund generated positive returns, albeit with various degrees of magnitude and volatility, which results in Sharpe ratios ranging from 0 to 1.5. It is worth highlighting that the fund with the highest Sharpe ratio is Guggenheim´s Macro Opportunities Fund (GIOIX), i.e. the one with the largest assets under management.

Source: Finominal

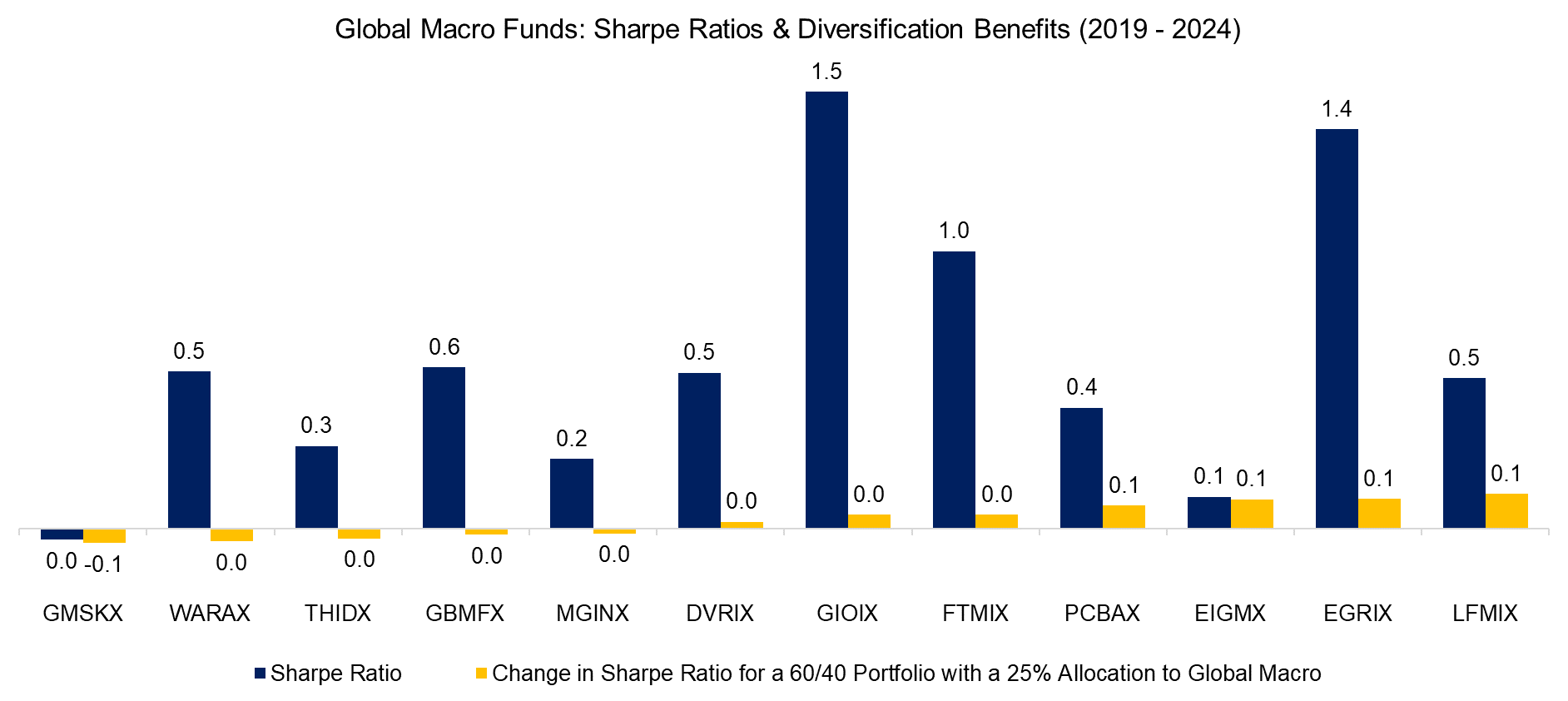

It seems that investors simply allocate to the global macro funds with the highest Sharpe ratios, but are ignoring that returns should be uncorrelated to generate diversification benefits. We evaluate this by simulating a 25% allocation of a global macro fund to a 60/40 equities/bond portfolio with quarterly rebalancing.

Unfortunately, this highlights that none of the global macro funds did significantly increase the Sharpe ratio of a traditional portfolio, and more importantly there does not seem a relationship between the Sharpe ratio of a fund and its diversification potential. For example, the LoCorr Macro Strategies Fund (LFMIX) only generated a Sharpe ratio of 0.5, but provided higher diversification benefits than GIOIX with a Sharpe ratio of 1.5.

Source: Finominal

FURTHER THOUGHTS

The low diversification benefits of the global macro mutual funds can be attributed to these having equities as their primary performance driver, which is naturally not what they should offer. Unfortunately the same applies to other hedge fund strategies, especially long-short equity, merger arbitrage, and multi-strategy funds.

Worse, the funds we reviewed are the ones that have not been liquidated, so we are dealing with survivorship bias. It seems selecting a useful global macro fund is as challenging as running one.

RELATED RESEARCH

Global Macro: Masters of the Universe?

CTAs vs Global Macro Hedge Funds

Multi-Strategy Hedge Funds: Jack of All Trades?

Multi-Strategy Hedge Funds: Equity in a Different Shade?

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Equity Market Neutral Hedge Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

Hedge Fund ETFs

Replicating Famous Hedge Funds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.