Active Share vs Tracking Error

Does more active management lead to higher outperformance?

September 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Active funds need to become active to justify their fees

- There is no relationship between being more active & outperformance

- Regardless if measured via active share or tracking error

INTRODUCTION

Fund managers are paid to outperform, which means they must differ from their benchmarks. For years, many could stay close to benchmarks, hugging them closely, but the rise of ETFs and improved analytics has made that approach harder. To justify meaningful fees, managers now need to be truly active.

Greater activity, however, is a double-edged sword: it increases the potential for both strong outperformance and significant underperformance. The most common ways to measure this activity are active share and tracking error.

This article explores how these two metrics influence fund managers’ ability to outperform.

ACTIVE SHARE & OUTPERFORMANCE

We consider all equity mutual funds and ETFs trading in the U.S. as our universe. For each fund, we algorithmically select an appropriate benchmark index and exclude any fund with an below 0.7 relative to its benchmark, resulting in a universe of approximately 2,500 funds.

Next, we calculate each fund’s active share, which measures the percentage of holdings that do not overlap with the benchmark. For instance, a fund with an active share below 10% is considered an index hugger, as its portfolio closely mirrors the benchmark.

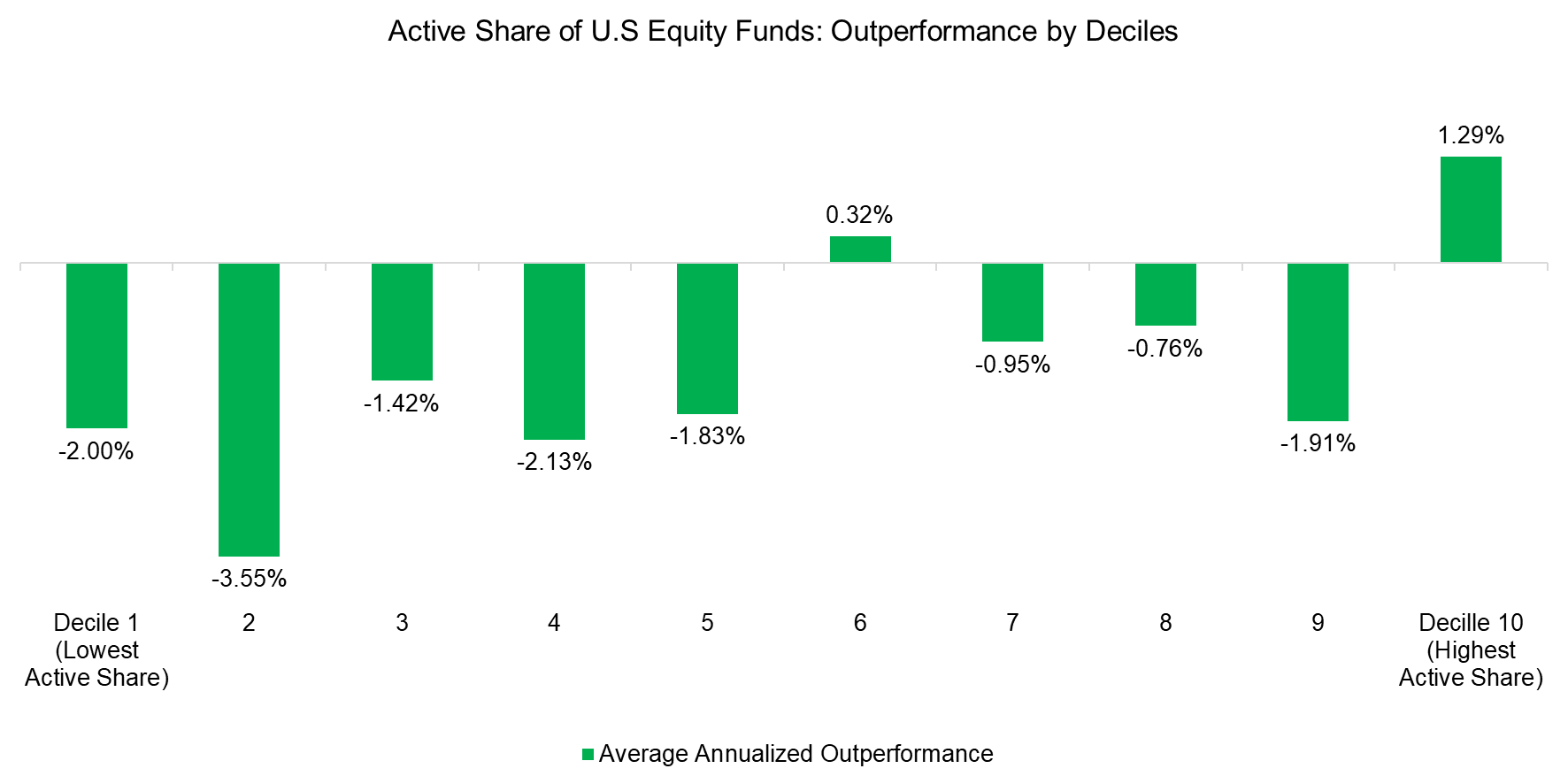

We then sort funds into decile portfolios based on active share and compute their average outperformance relative to the benchmark. While higher active share theoretically offers greater opportunity to outperform, we observe that the average fund underperformed and that there is no clear relationship between active share and outperformance.

Source: Finominal

TRACKING ERROR & OUTPERFORMANCE

Tracking error captures how closely a portfolio’s performance aligns with its benchmark index. More precisely, it is the standard deviation of the difference between the portfolio’s returns and the benchmark’s returns over time. To examine this, we replicate the earlier analysis and sort funds into deciles based on their tracking errors.

The results largely mirror those observed with active share: on average, funds underperformed, and there is no consistent relationship between tracking error and outperformance. While funds in the 10th decile (those with the highest tracking errors) outperformed, we view this as a product of randomness rather than a meaningful pattern – especially given that funds in the 9th decile underperformed.

Source: Finominal

FURTHER THOUGHTS

Although these results hardly encourage fund managers to take on more active risk, do they really have an alternative?

In practice, not much. Active managers need moderately high fees to sustain their businesses, yet investors are no longer willing to pay for portfolios that closely resemble an index but cost more than a passive ETF.

Since no investment strategy guarantees consistent success and investor patience is limited, the market will likely see a surge of new products with higher tracking errors and greater active share. Most of these will underperform and eventually be liquidated. Yet, a select few will succeed, prompting investors to revisit the search for fund managers who can truly add value.

RELATED RESEARCH

Outperformance Ain’t Alpha

Outperformance via Leverage

Higher Volatility, Higher Alpha?

Less Efficient Markets = Higher Alpha?

Alpha Generation: Equity Generalists vs Sector Specialists

Smart Beta vs Alpha + Beta

Evaluating Metrics for Fund Selection

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.