Analyzing Floating Rate ETFs

Useful for navigating a rising rate environment?

January 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Floating rate ETFs pursue differentiated strategies

- Some of them are highly correlated to equities, limiting any diversification benefits

- The correlation with interest rates and inflation has been low

INTRODUCTION

Despite the consensus on high inflation being transitory in 2021, the five-year, five-year forward inflation expectation rate in the US remains stubbornly above 2%. Investors that hoped to be able to avoid the repositioning of their portfolios for higher inflation are forced to reconsider their asset allocation frameworks. High inflation tends to result in rising interest rates.

Last year, we analyzed inflation-themed ETFs and concluded that these were quite diverse in portfolio construction, but that the correlation to inflation has been relatively low. Then we analyzed ETFs that are marketed as instruments for a rising interest rate environment, where portfolios were similarly heterogeneous. Only ETFs with exposure to financial services companies and short bond positions offered a positive correlation to interest rates (read ETFs for Rising Interest Rates).

Investors concerned with high inflation or rising interest rates can also consider ETFs holding floating rate securities, which we analyze floating rate ETFs in this research note.

ETF UNIVERSE

We focus on floating rate ETFs traded in the US, which is a universe of 18 instruments. The first fund was launched in 2017 and the increase in ETFs has been consistent across time with each year one or two more products coming to the market.

Floating rate instruments typically pay a base rate like LIBOR or SOFR plus a spread, so investors’ expectation is that there is minimal interest rate risk. These ETFs can be categorized into four types:

- Investment grade floating rate ETFs

- Collatorized loan obligation (CLO) ETFs

- Senior Loan ETFs

- Variable Rate Preferred ETFs

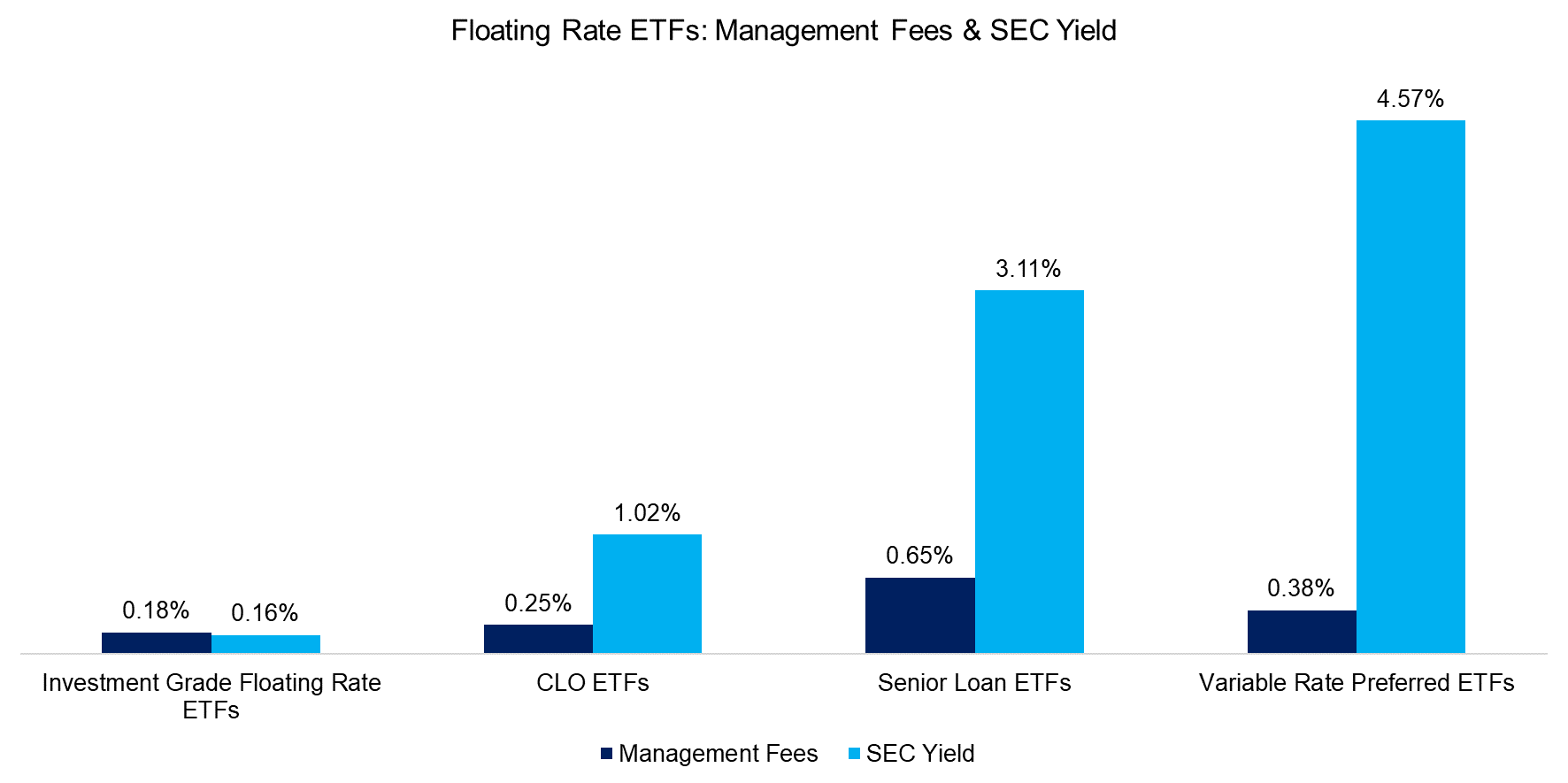

FEES & YIELDS

The categorization can be done by the product name or the yield given significant differences. Investment grade floating rate ETFs exhibit negative to barely positive yields, CLO ETF yields are approximately 1%, senior loan ETF pay more than 3%, and variable preferred ETFs offer yields above 5%.

The management fees charged by the ETFs are based on their yield, risk profile, as well as launch date. Given that the ETF market is relatively saturated, newer products tend to charge less and compete on price.

Source: FactorResearch

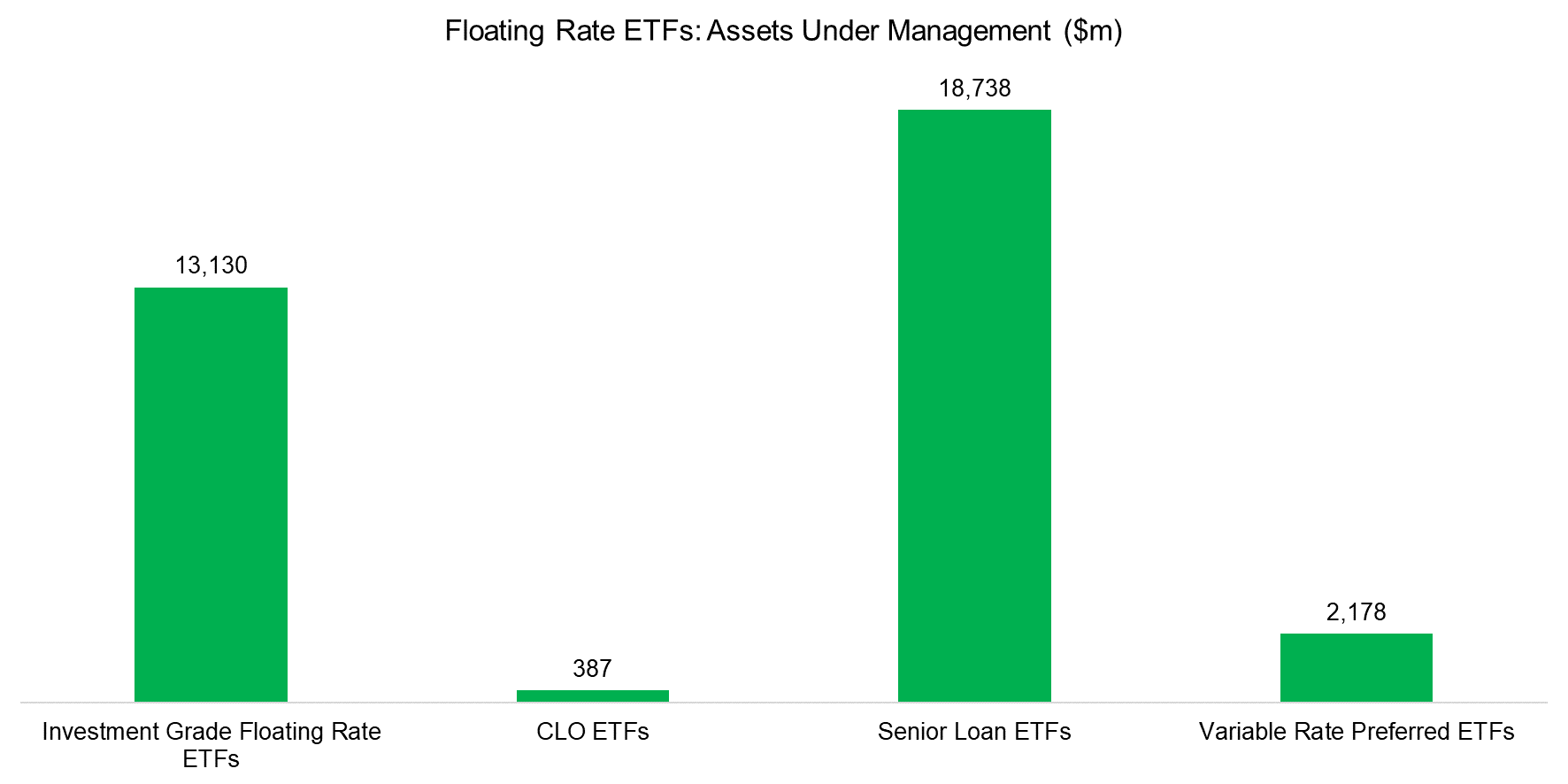

COMMERCIAL SUCCESS

The cumulative assets under management of floating rate ETF in the US are $33 billion, which can be almost evenly attributed to investment grade floating rate ($13 billion) and senior loan ($18 billion) ETFs.

There are only two CLO ETFs and these have only been launched in 2020, perhaps due to the stigma that CLOs gained from the global financial crisis. There are also only two variable rate preferred ETFs that cumulatively manage $2 billion, although one has a track record going back to 2014.

Source: FactorResearch.

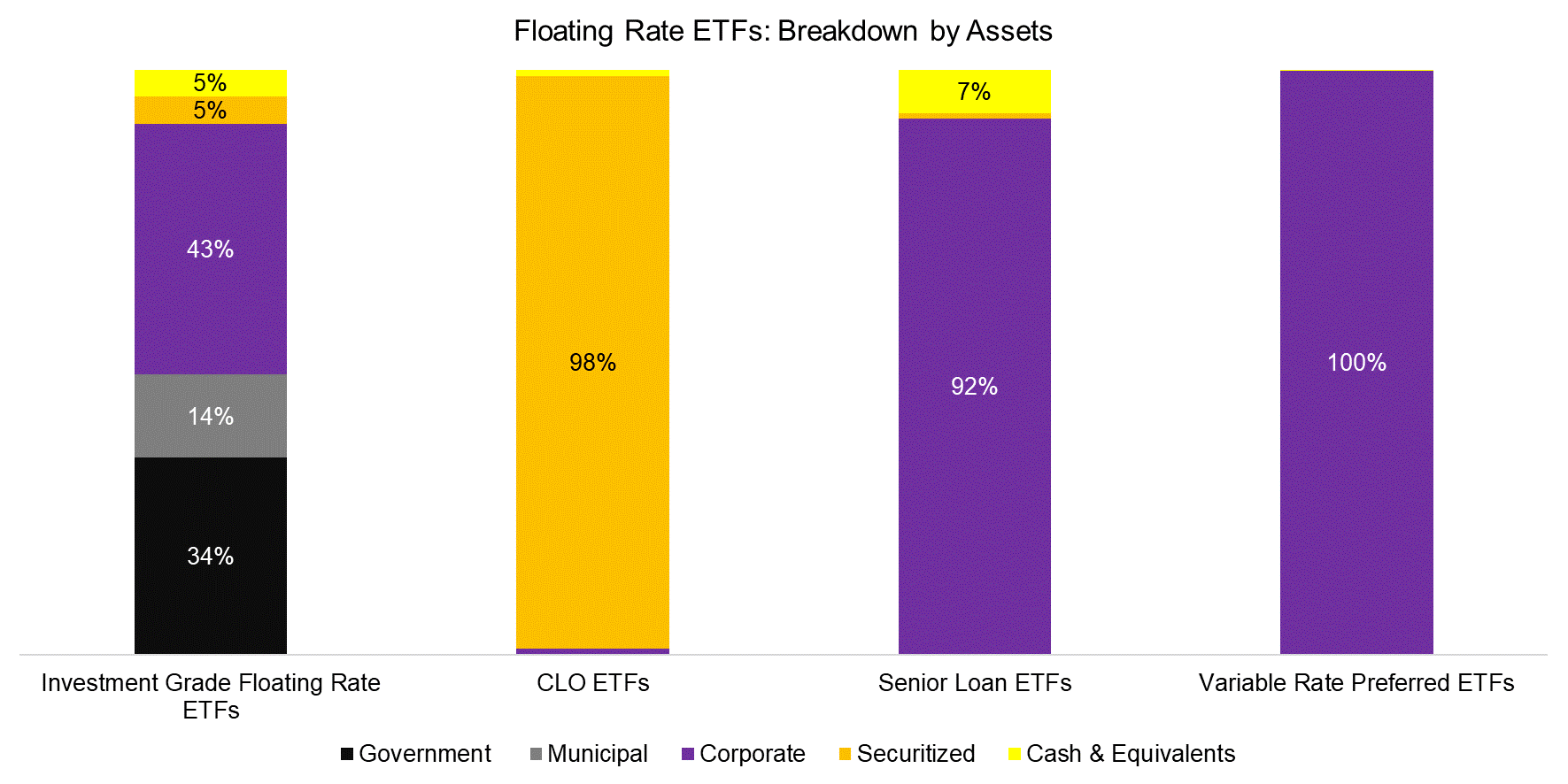

BREAKDOWN BY ASSETS

The heterogenous yields can be explained by different portfolios. Investment grade floating rate ETFs have the most diverse porfolios, which can be comprised of US government, municipal, or corporate fixed income instruments. CLO ETFs exclusively hold securitized debt, while senior loan and variable rate preferred ETFs hold corporate debt.

Source: FactorResearch

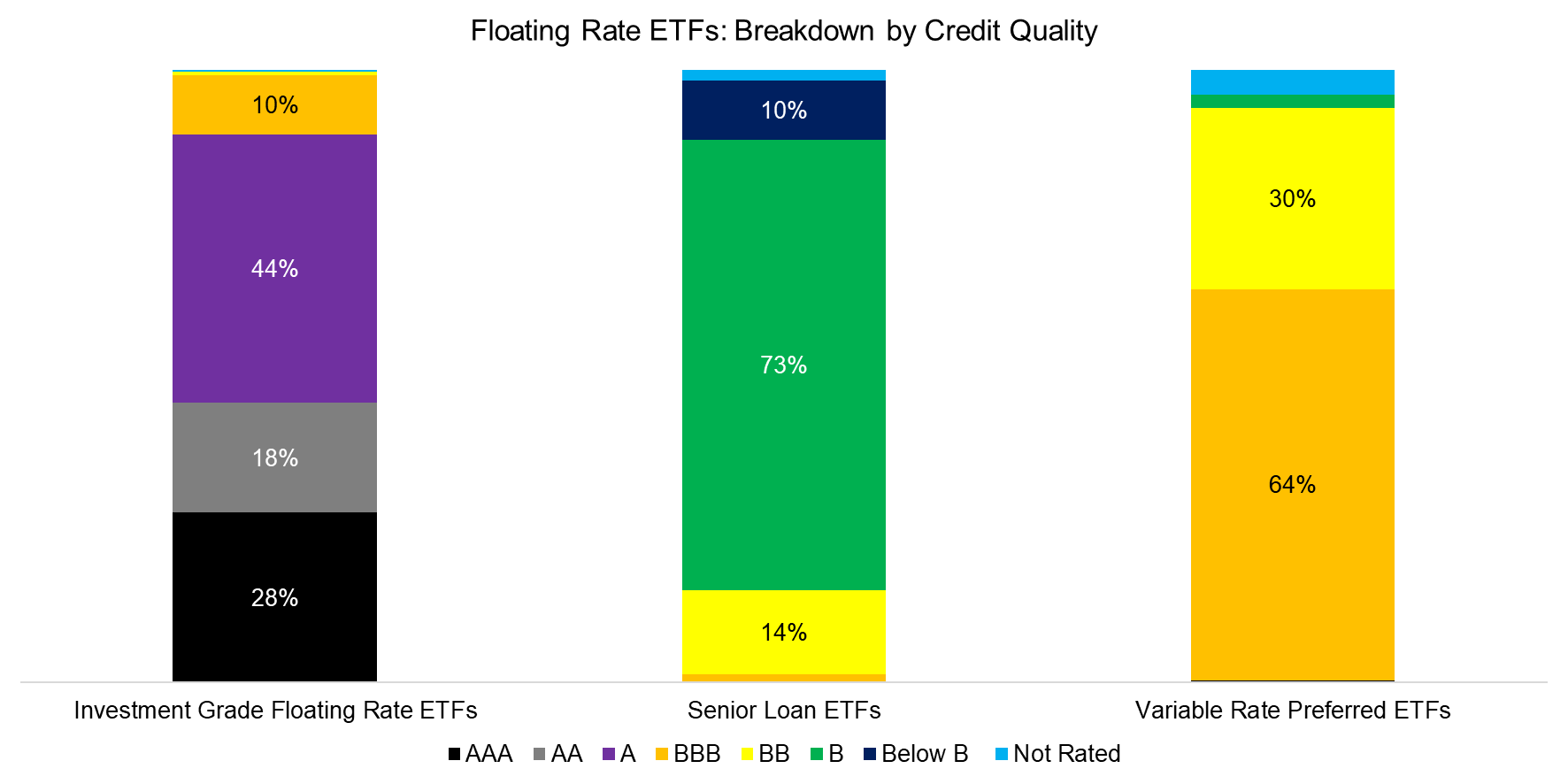

BREAKDOWN BY CREDIT QUALITY

Analyzing the credit quality of the floating rate ETFs highlights their different investment strategies. Investment grade floating rate ETFs, as per their name, hold investment grade instruments. Senior loan ETFs invest primarily in B-rated debt, while variable preferred ETFs offer slightly better credit quality, despite higher yields.

Source: FactorResearch. Not sufficient data on the credit quality for CLOs available.

PERFORMANCE OF FLOATING RATE ETFS

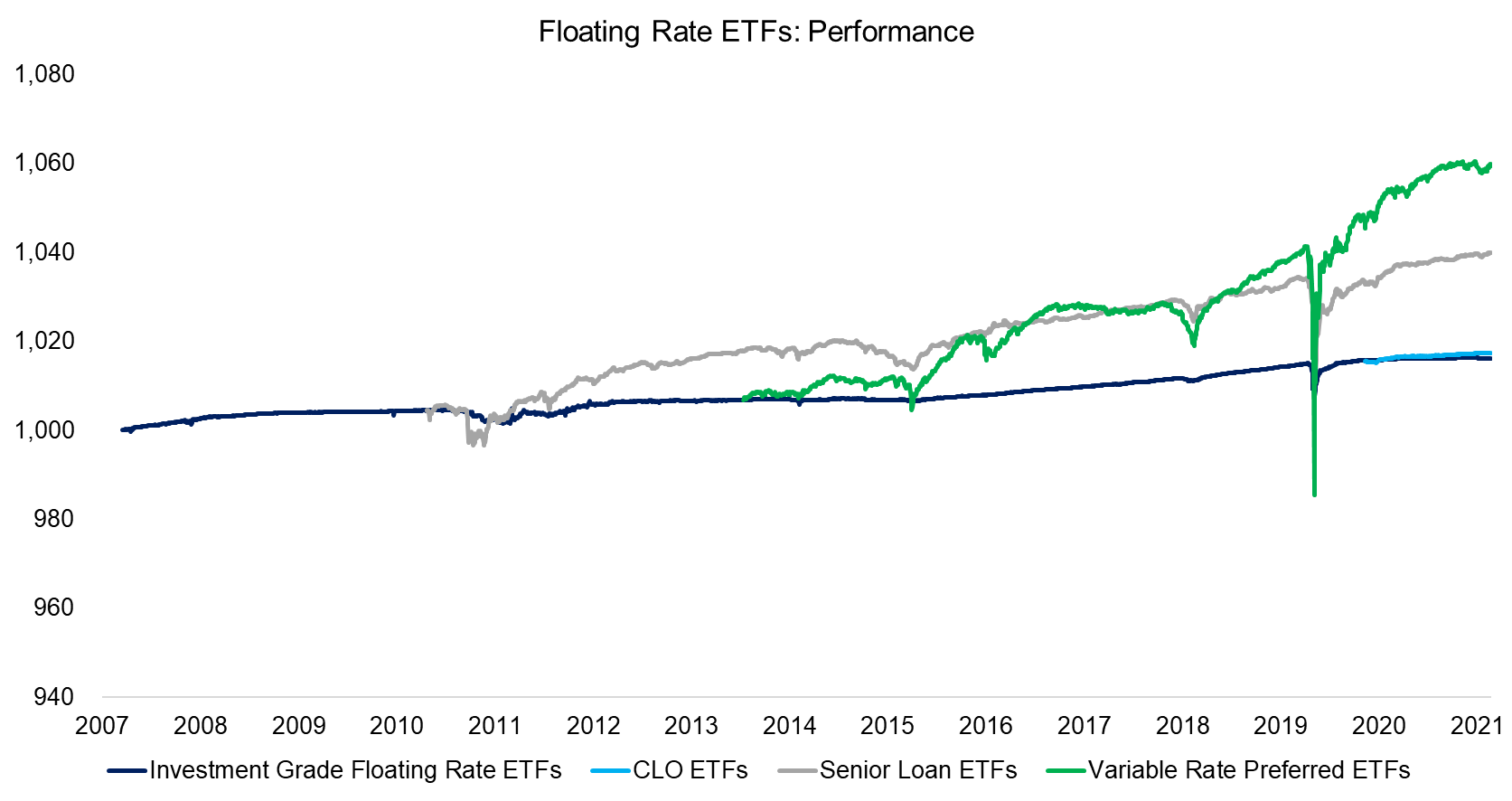

Given that the first floating rate ETF was launched in 2007, there is a meaningful track record for analysis. We create equal-weighted indices for each of the four categories, which highlights an extremely flat performance of investment grade floating rate and CLO ETFs. Essentially, these can be viewed as money market instruments. The return has been very low given consistently declining interest rates, but the risk has also been minimal.

In contrast, senior loan and variable rate preferred ETFs exhibited significantly higher volatility and drawdowns during the COVID-19 crisis in March of 2020, where the indices lost 2.2%, respectively 5.4%.

Source: FactorResearch

CORRELATION TO EQUITIES, BONDS, AND INFLATION

The drawdowns of some of these floating rate ETFs during crisis times may concern investors as that indicates a lack of diversification benefits for an traditional equity-bond portfolios.

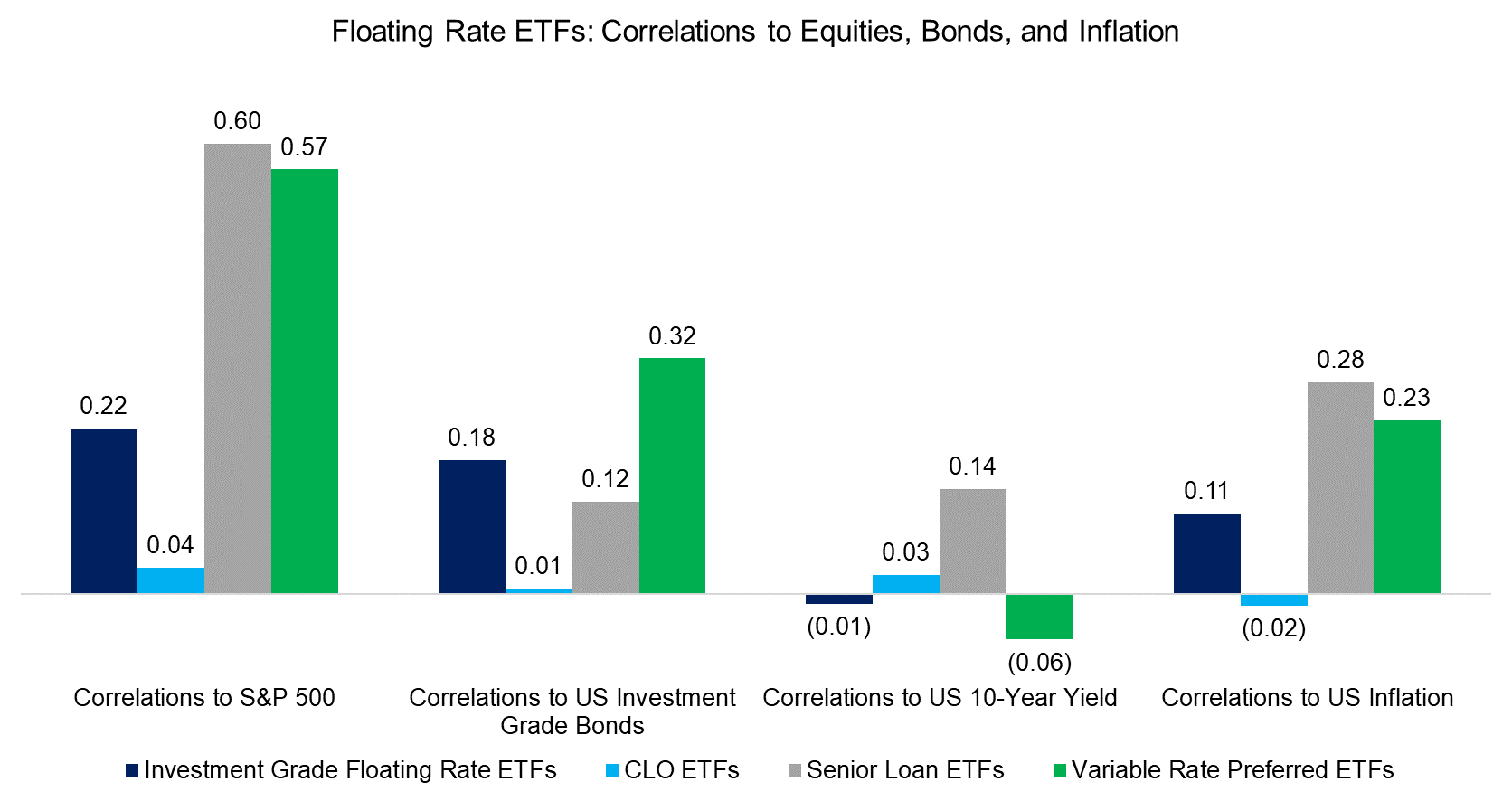

We calculate the correlations to US equities, investment grade bonds, bond yields, and inflation. As indicated by the performance analysis, senior loan and variable rate preferred ETFs feature high positive correlations to the S&P 500, which can be explained by underlying portfolios, ie below investment grade corporate bonds that behave similar to equity. If a company experiences corporate stress due to firm-specific or industry reasons, then this can easily spread to its bonds, loans, and preferred instruments.

It is worth highlighting that none of the four categories of floating rate ETFs features high positive correlations to the US 10-year or inflation, which is somewhat surprising. Even if the spread component of the floating rate instrument remains constant, the base rate, eg LIBOR, should move with bond yields (read Factors & Interest Rates).

Source: FactorResearch

REPLICATING SENIOR LOAN ETFS

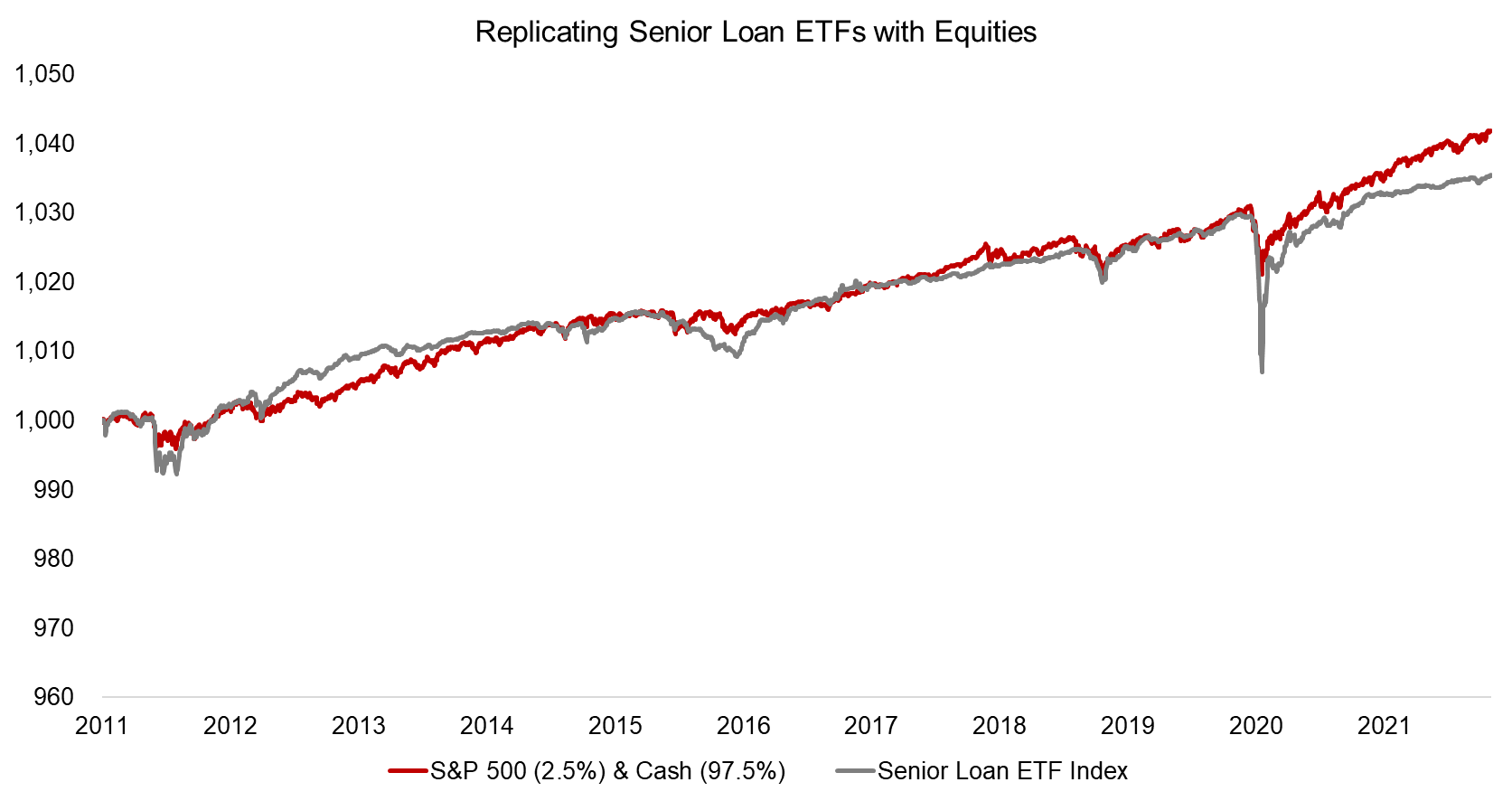

The high correlation of senior loan ETFs to equities should give investors concern as it indicates simply more equity exposure. We can accentuate this point by attempting to replicate the performance of senior loan ETFs since 2011 with equities.

We construct an index comprised of the S&P 500 (2.5% allocation) and non-interest-bearing cash (97.5%), which tracked the performance of the senior loan ETFs closely over the last 10 years.

Source: FactorResearch

FURTHER THOUGHTS

So, what value do floating rate ETFs offer to investors?

Unfortunately, this analysis does not provide a concise answer to this question. Investment grade floating rate and CLO ETFs may serve as money market instruments, but the yields range from -0.17% to 1.04%, which basically implies negative real returns when considering that inflation was above 6% in 2021.

The investment case for senior loan and variable rate preferred ETFs is even less clear. They offer higher yields than the less risky floating rate ETFs, but just represent diluted equity exposure. Like most hedge fund strategies, they fail to provide meaningful diversification benefits and therefore have no place in a sound asset allocation framework.

RELATED RESEARCH

Inflation-Themed ETFs: As Complicated as Inflation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.