Are Liquid Alts more than Diluted Equity Funds?

The hidden costs of liquid alternative funds

April 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most alternative funds feature correlations to equities that are too high

- Out of a sample of 500+ alt funds, 92% did not create value

- Yet, these manage $100 billion and charge $1.1 billion fees per annum

INTRODUCTION

The saying “Ideas are cheap, but execution is everything” is a core mantra in the startup world. However, this principle applies just as much to the asset management industry, where great ideas often falter due to poor implementation.

Take liquid alternative mutual funds and ETFs, for example. They promise uncorrelated returns with daily liquidity – a compelling concept. Yet, as we’ve previously demonstrated, their returns are often more correlated than investors would prefer, offering only limited diversification benefits (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios).

In this analysis, we will evaluate all liquid alternative funds in the U.S. to see if they can clear a simple yet critical hurdle: outperforming a basic portfolio of equities and cash that offers the same risk profile.

CORRELATION ANALYSIS

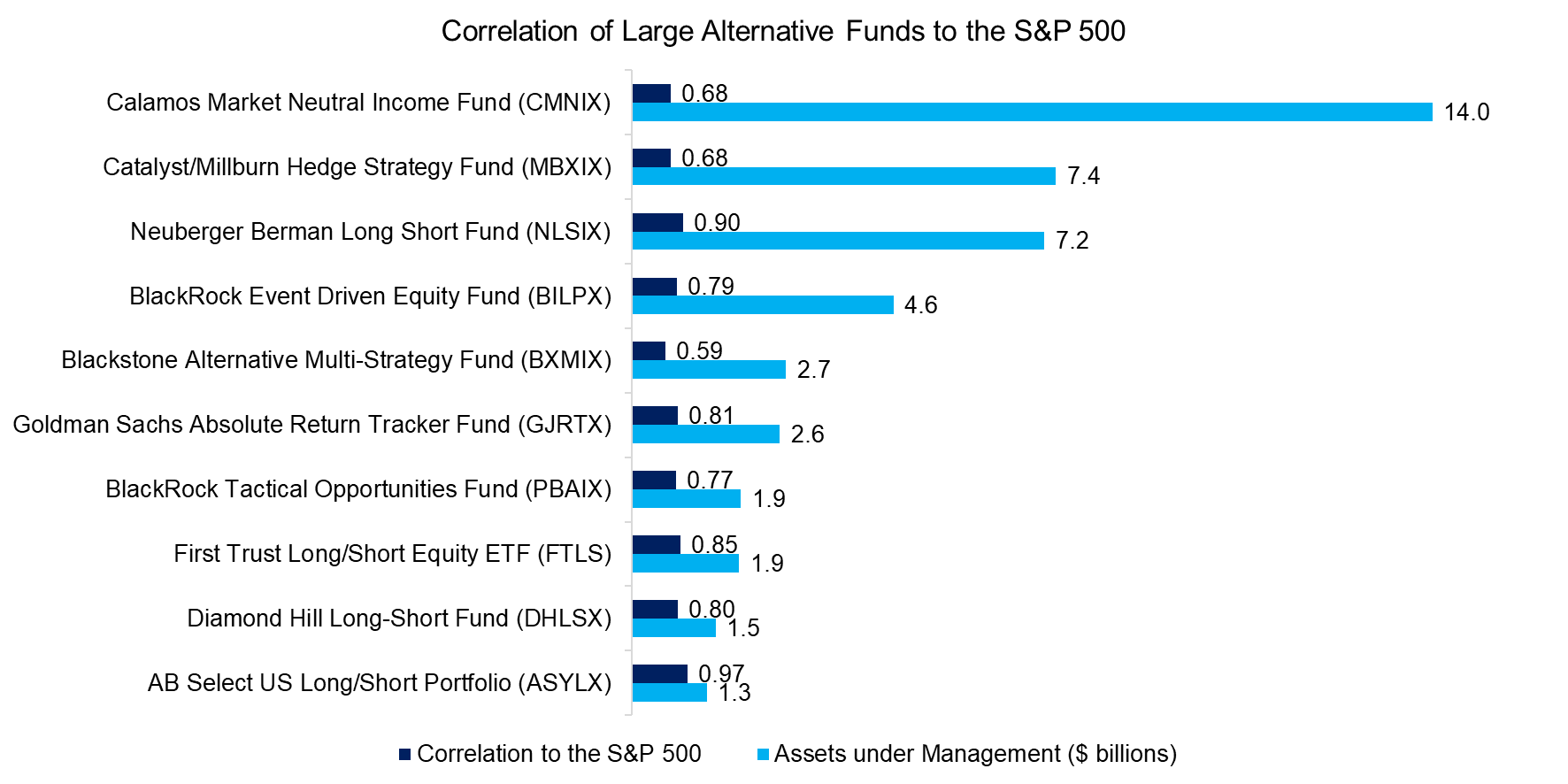

We analyze the full universe of liquid alternative mutual funds and ETFs with more than three years of track records, encompassing market-neutral, long-short, multi-strategy, and absolute return approaches. Nearly all of these 523 funds promote themselves as offering uncorrelated returns, positioning them as strong diversifiers for traditional equity-bond portfolios.

However, when we calculate their correlations with the S&P 500, the results tell a different story – 185 funds exhibit correlations exceeding 0.50, significantly limiting their diversification benefits. Below, we highlight some of the largest funds, with correlations ranging from 0.59 to 0.97.

Source: Finominal

CASE STUDY: CALAMOS MARKET NEUTRAL INCOME FUND

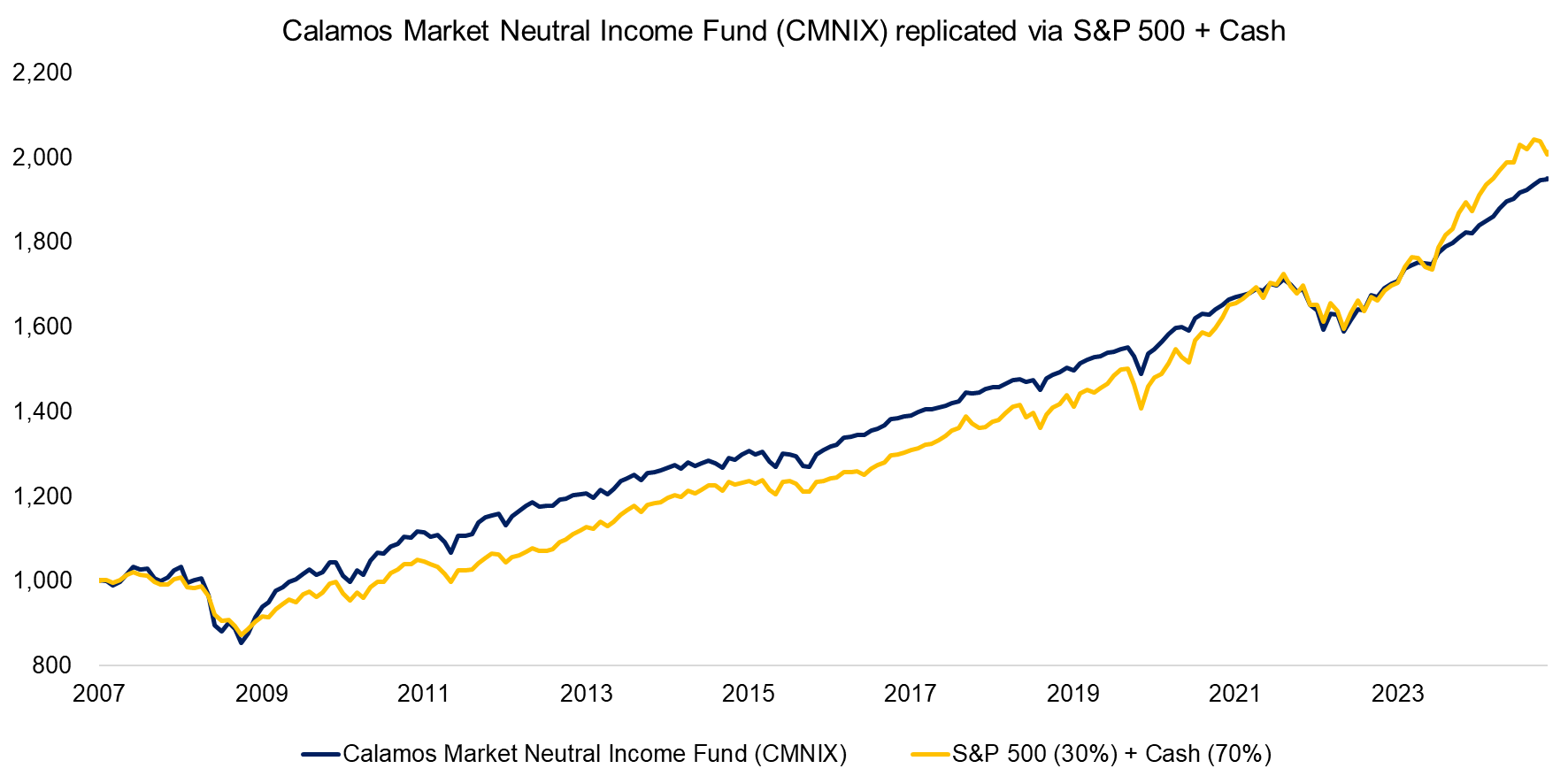

While alternative funds lose their diversification benefits when their correlations to the stock market are too high, they can still add value. A simple benchmark for comparison is a portfolio consisting of the S&P 500 and U.S. Treasury Bills.

The largest alternative fund, the Calamos Market Neutral Income Fund (CMNIX), promotes itself as a “diversification overachiever that offers benefits beyond traditional stocks and bonds”. However, since 2007, a simple portfolio of 30% S&P 500 and 70% U.S. Treasury Bills would have delivered a nearly identical return profile. The fees for the fund range between 0.89% and 1.97% per annum, but it is questionable why investors should pay such high fees for a product that is not offering anything unique.

Source: Finominal

CASE STUDY: NEUBERGER BERMAN LONG SHORT FUND (NLSIX)

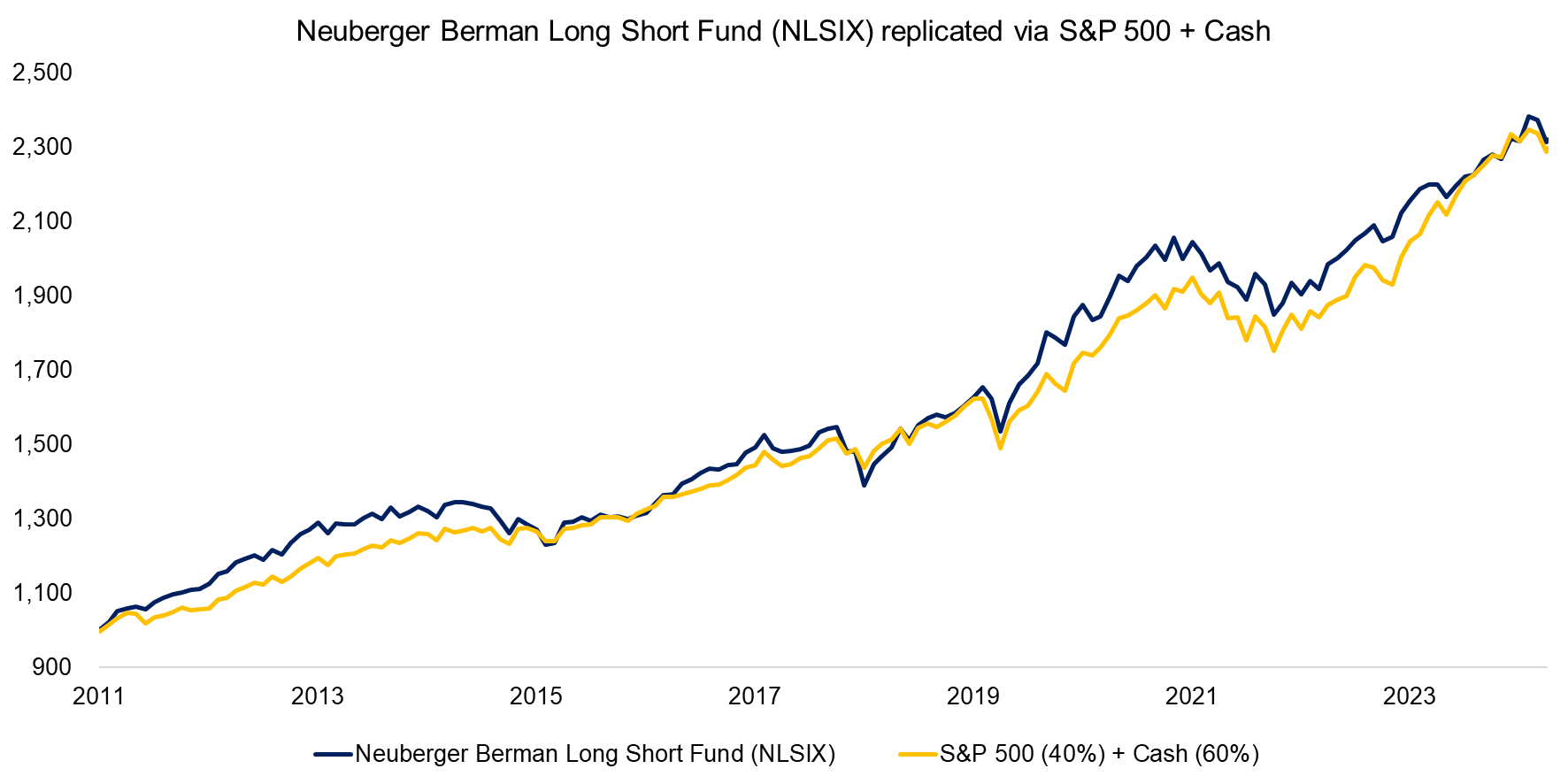

Next, we review Neuberger Berman`s Long Short Fund (NLSIX), which seeks to offer “downside mitigation relative to market indices” according to its website. Similar to CMNIX, a simple combination of the S&P 500 (40%) and U.S. Treasury Bills (60%) provided the same return profile. For a fund charging 1.30% per annum, there is just not enough value creation happening.

Source: Finominal

SUMMARY ANALYSIS

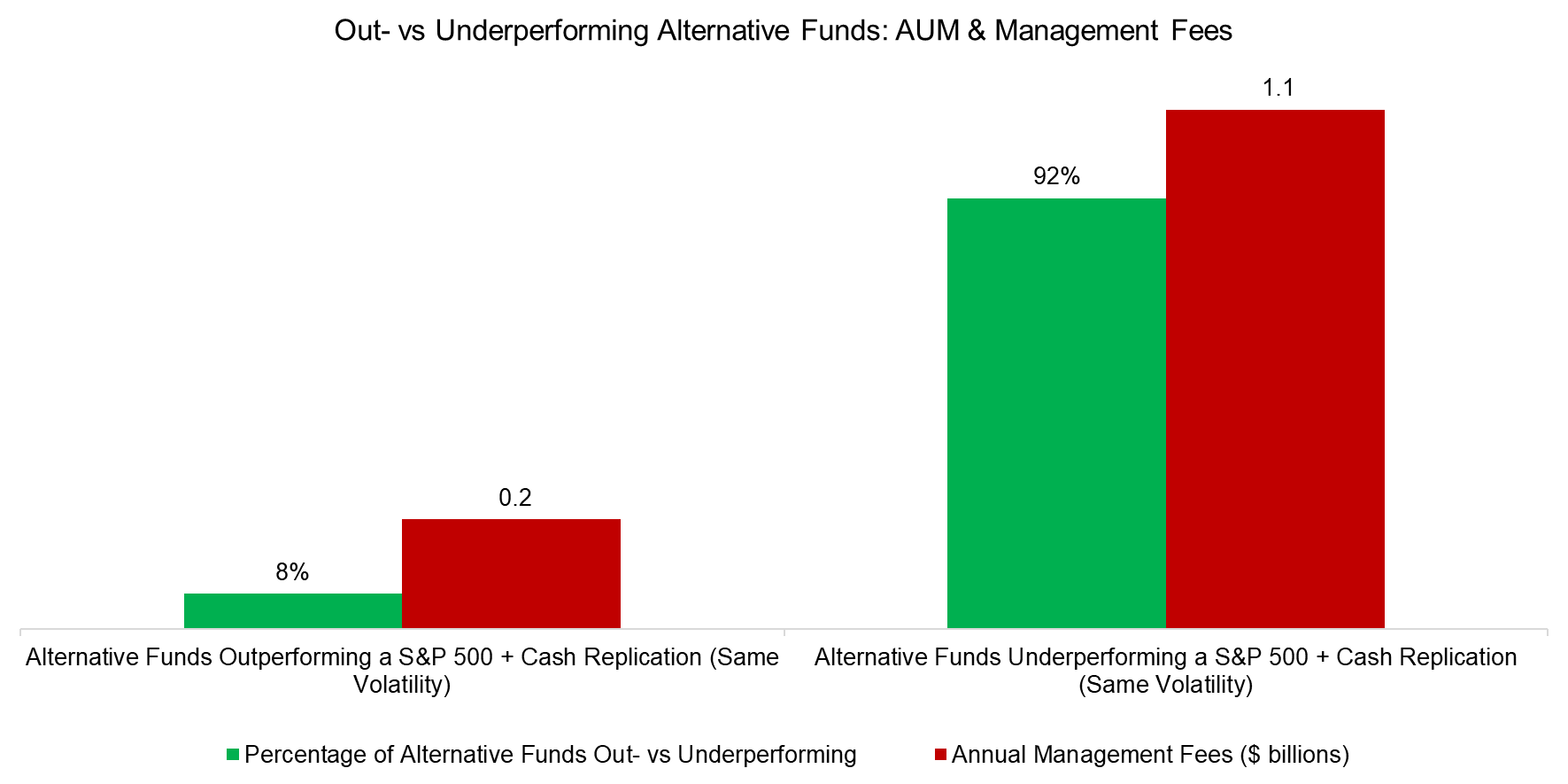

Finally, we construct a simple equity-and-cash portfolio for each of the 185 alternative mutual funds and ETFs with correlations above 0.50 to the S&P 500. Only 8% of these funds outperformed their replication portfolios at the same volatility level. The remaining 92% underperformed, yet collectively manage $100 billion in assets and charge $1.1 billion in annual fees.

Source: Finominal

FURTHER THOUGHTS

These findings might be dismissed as being solely applicable to alternative funds, where we can attribute the failure to create value to poor security selection, flawed portfolio construction, or excessive fees. However, this issue extends far beyond alternatives; it reflects a broader problem across most investment products.

With a looming global retirement crisis and underfunded pension systems, improving capital allocation is more critical than ever. This may require dramatically reducing the number of investment products available. As is often the case, less is more.

RELATED RESEARCH

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

Are Alternative ETFs Good Diversifiers?

Hedge Fund ETFs

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

Private Equity: Fooling Some People All the Time?

Venture Capital: Worth Venturing Into?

Market Neutral Funds: Powered by Beta?

Merger Arbitrage: Arbitraged Away?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.