Are Low-Risk Stocks Really Low-Risk?

Why are there no funds offering exposure to the best-performing factor?

March 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

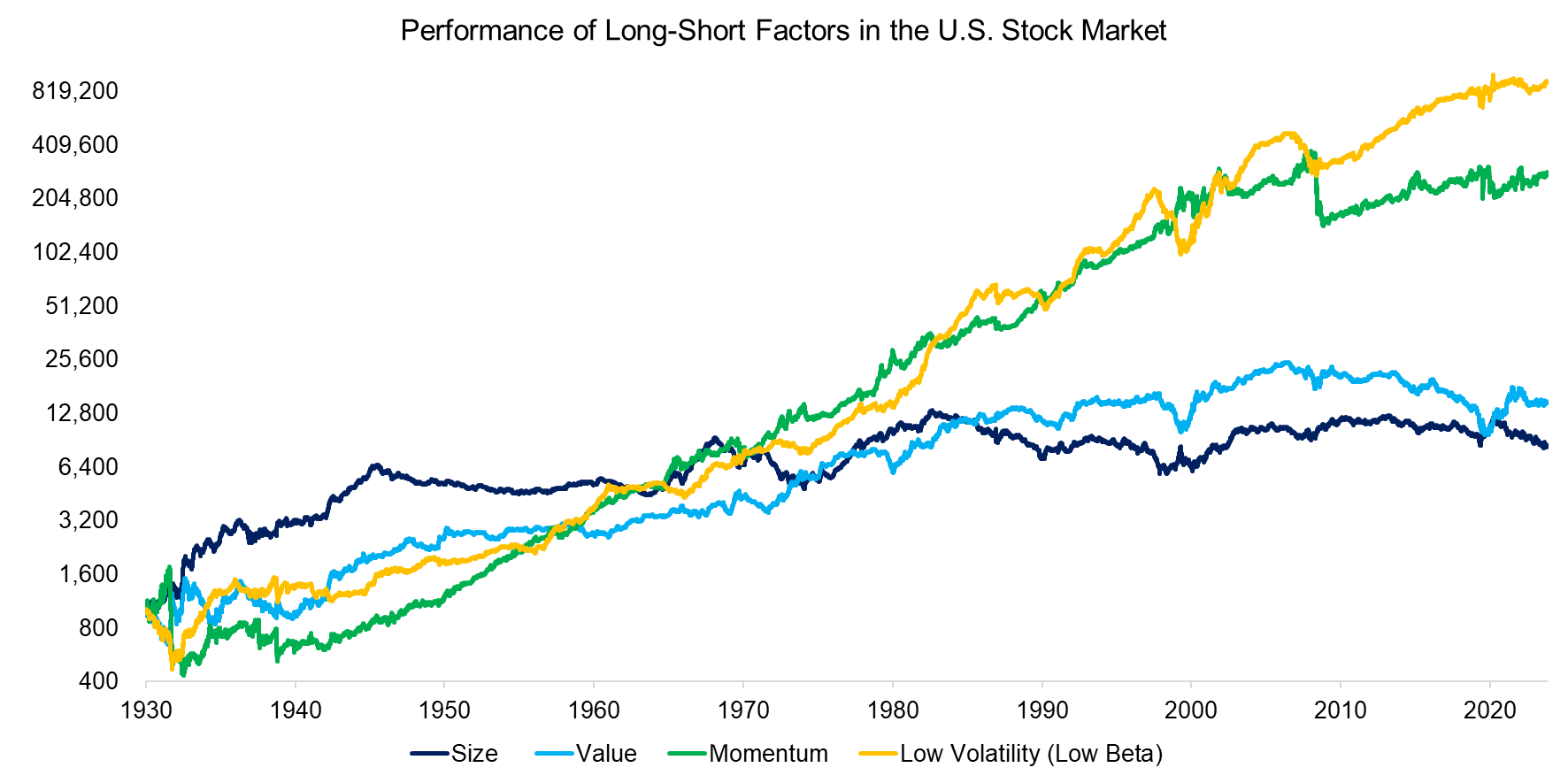

- The long-short low volatility factor generated a higher long-term return than momentum, value, or size

- However, the factor’s performance also features bear markets and crashes

- Long-only low volatility ETFs haven’t offered higher Sharpe ratios than the S&P 500

INTRODUCTION

When parents are asked who their favorite child is, the diplomatic answer is that they love all their children equally, although that may sometimes be challenging. When investors are asked what their favorite factor is, there is usually little diplomacy and one clear loser – momentum. Most investors dislike the momentum factor as they believe it is too simple to work.

However, if we review the long-term performance of long-short factors in the U.S. stock market we observe that the momentum factor vastly outperformed value and size, which are far more popular investment styles. Having said this, the low volatility did even better and generated a CAGR of 7.5%, compared to 6.2% for momentum, 2.9% for value, and 2.3% for size in the period from 1930 to 2024, based on data from AQR.

Source: AQR, Finominal

Given that the low volatility factor has generated the best returns over the last 90 years, we would expect a large universe of funds providing access to this factor. However, there is not a single fund trading in the U.S. that offers exposure to the long-short low volatility factor, and the combined assets of all long-only low volatility ETFs are less than the $128 billion that the Vanguard Value Index ETF (VTV) manages.

In this research article, we will explore some of the challenges of a low volatility factor allocation.

LOW BETA VERSUS LOW VOLATILITY FACTOR

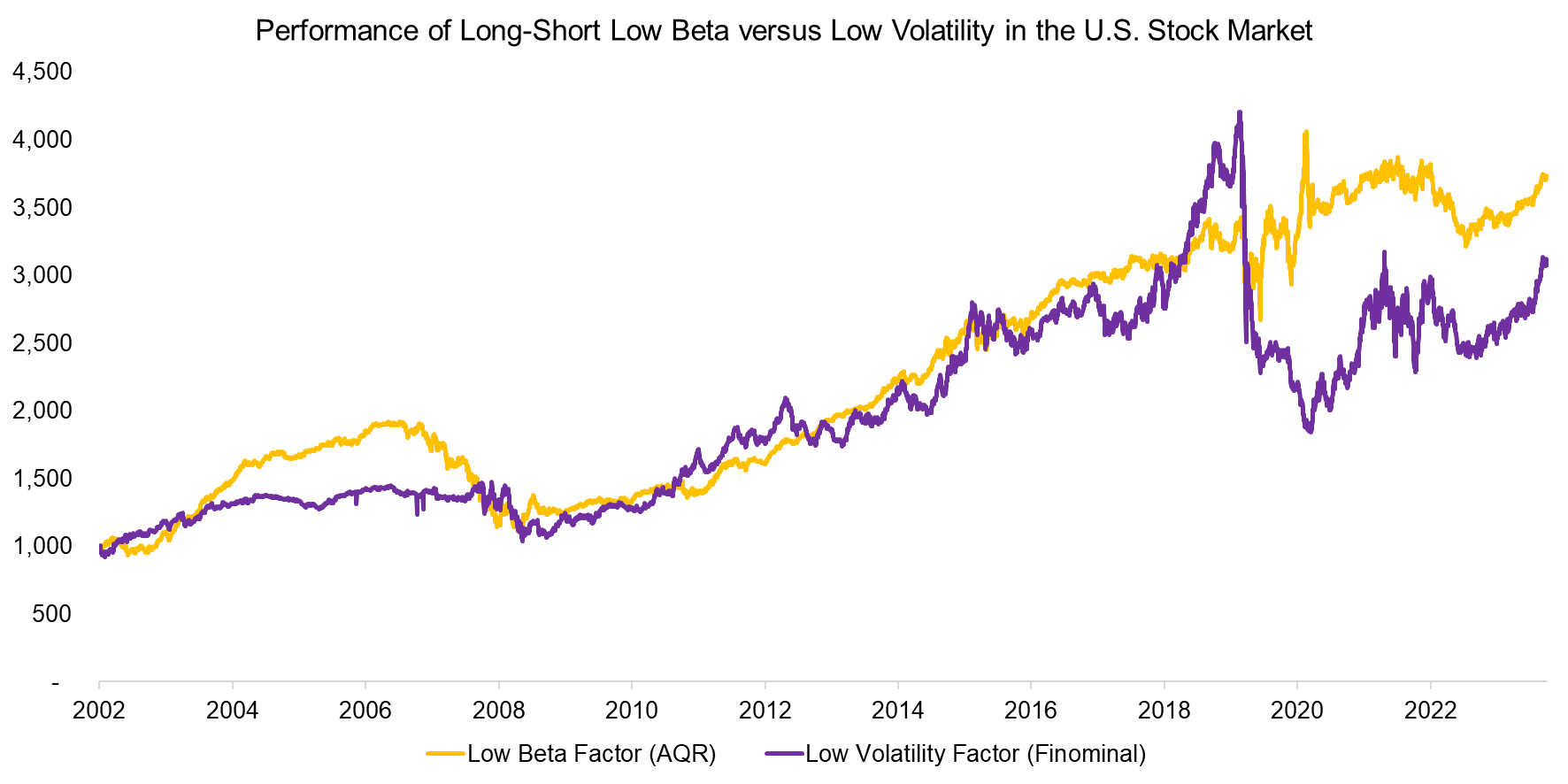

The long-term performance of the low volatility factor sourced from AQR represents the betting against beta (BAB) factor, where stocks are selected on their beta rather than volatility. Although there are some differences in performance during certain periods over the last 22 years, the broad trends were the same (read Low Volatility, Low Beta & Low Correlation).

However, we observe that the low beta factor declined by 50% in the global financial crisis in 2008, while the low volatility factor crashed by 60% during the COVID-19 crisis in 2020. Although the long-term performance of the low volatility factor is highly attractive, few investors would be able to stay invested during such challenging times.

Furthermore, both versions of the low volatility factor require leveraging the long portfolio as its beta to the stock market is below one, and these indices should be constructed-beta neutral, but the cost of financing is ignored in their calculations, which implies overstated returns.

Source: Finominal

LONG VERSUS SHORT PORTFOLIO OF THE LOW VOLATILITY FACTOR

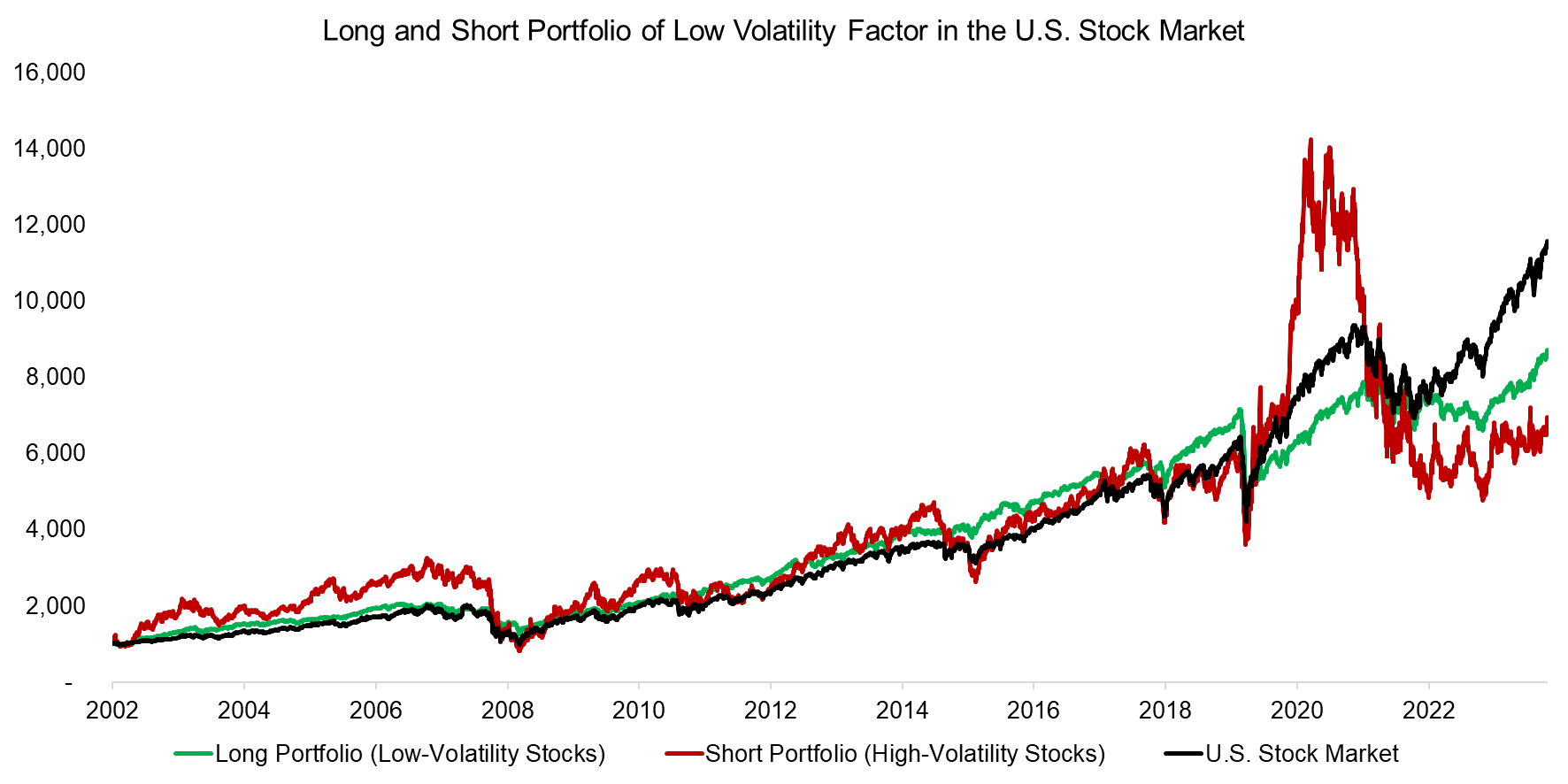

Instead of allocating to the long-short volatility factor, perhaps investors are better off by only betting on the low volatility stocks and ignoring shorting the high volatility stocks.

When review the performance of the long portfolio of the low volatility, i.e. what are often called low-risk stocks, then we observe these slightly outperformed the U.S. stock market since 2002. However, we also observe that this portfolio crashed during the COVID-19 crisis in 2020 when low-risk companies like REITs underperformed significantly (read The Dark Side of Low Volatility-Stocks).

Source: Finominal

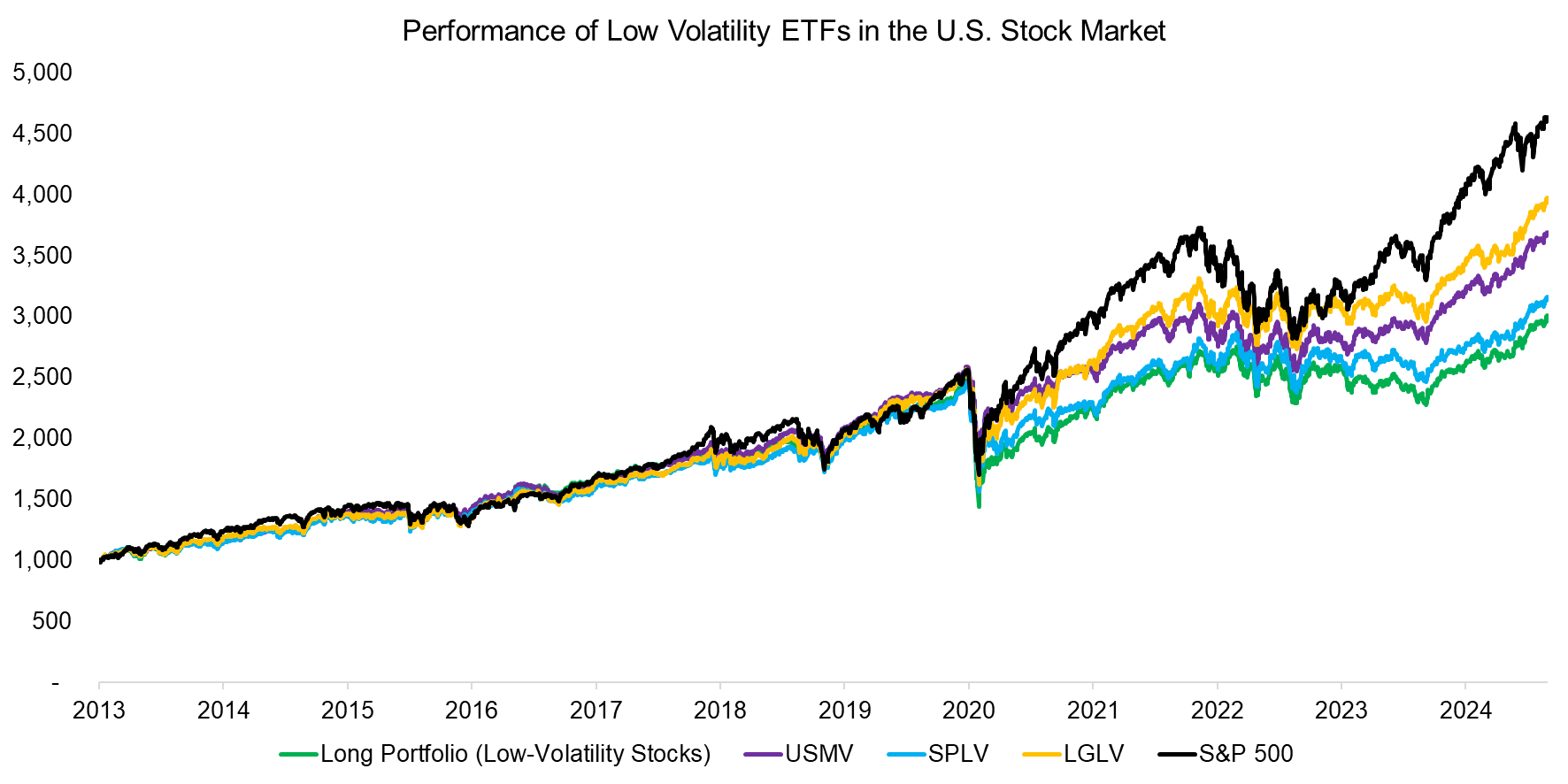

LOW VOLATILITY ETFS

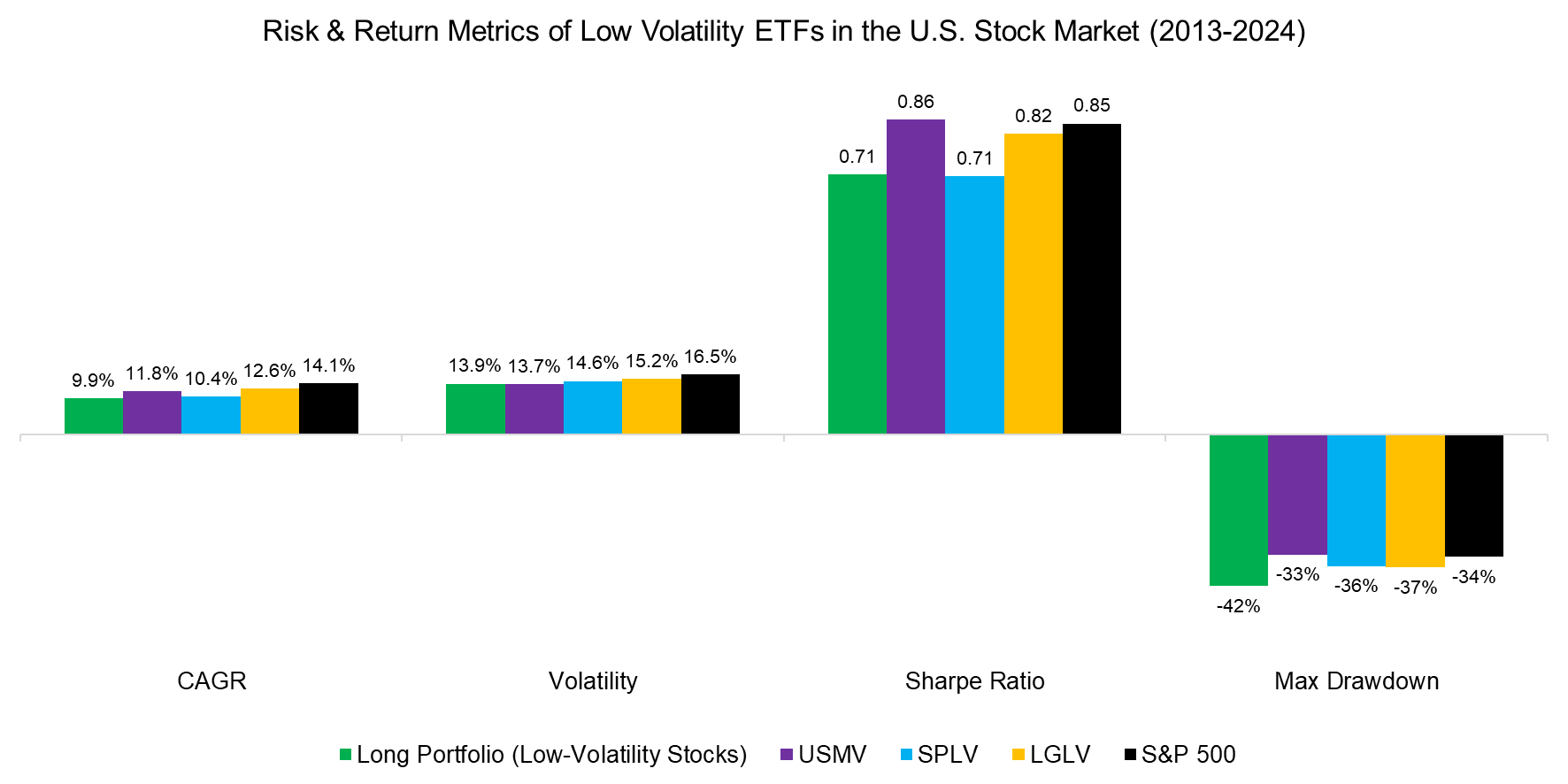

Although there are no funds that provide exposure to the long-short low volatility factor as seen in academic research, there are plenty of long-only low volatility ETFs. We compare the performance of some of the largest ETFs, namely the iShares MSCI USA Min Vol Factor ETF (USMV), Invesco S&P 500 Low Volatility ETF (SPLV), and SPDR SSGA US Large Cap Low Volatility Index ETF (LGLV) to the theoretical portfolio and the S&P 500. The analysis highlights that the theoretical portfolio and the smart beta ETFs underperformed the S&P 500 between 2013 and 2024.

Source: Finominal

However, investors typically do not allocate to low volatility stocks to outperform the stock market, but to achieve higher Sharpe ratios and lower drawdowns. Over the last decade only USMV, which represents a minimum variance rather than a low volatility portfolio, generated higher risk-adjusted returns than the S&P 500. In contrast, SPLV and LGLV feature higher drawdowns, in line with the theoretical portfolio (read Minimum Variance Versus Low Volatility).

Source: Finominal

FURTHER THOUGHTS

It is somewhat ironic that hedge funds fail to generate positive and uncorrelated returns to equities, when there is so much research that highlights how this can be easily achieved, e.g. by providing exposure the long-short volatility factor.

However, as this analysis highlights, this factor has experienced severe bear markets and crashes, making it a difficult strategy for most investors. Yet, it is worth asking why investors accept such risks when allocating to equities but not when considering diversifying strategies.

RELATED RESEARCH

Low Volatility, Low Beta & Low Correlation

Minimum Variance Versus Low Volatility

Quality versus Low Volatility ETFs

Musings on Low Volatility

Is Low Vol the New Value?

Low Vol Factor: From Obscurity to Stardom

The Dark Side of Low Volatility-Stocks

Timing Low Volatility with Factor Valuations

Checking in Buffermania

A Horse Race of Low-Beta Equity Strategies

Exploring Defined Outcome ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.