Bank Risk Premia Indices: Unbankable?

Exploring Factor Investing Across Asset Classes

August 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Factor investing can be pursued across asset classes

- Risk premia products sold by investment banks have generated mostly unattractive returns since 2006

- The idea of risk premia indices is great, but the implementation has been poor

INTRODUCTION

Monoculture can be considered the biggest threat to our food supply and therefore our livelihood. Although our diet may seem varied, about 20 species of plants make up 90% of our food consumption. The risk for our society is that any of these vital plants can be affected by disease, which has happened plenty of times before.

For example, before the 1950s, almost all bananas sold were a variety called the Big Mike, but that was largely wiped out by a fungus, which caused significant economic issues for the Caribbean nations growing these. However, although we might miss bananas terribly if they get wiped out again, it naturally would not threaten our survival.

Much worse was the potato famine in Ireland in the 1850s that led to approximately 1 million deaths from starvation and another million to flee the country. The Irish were highly dependent on potatoes and a microorganism that likely originated in Mexico caused potatoes crops to fail on a large scale in Ireland and the rest of Europe.

For those that enjoy wine, in the late 19th century the phylloxera epidemic destroyed most of the European vineyards, which was introduced to Europe when avid botanists in Victorian England collected specimens of American vines in the 1850s. The epidemic devastated vineyards and was only tamed when hybridization allowed to introduce elements of resistance to this pest from North American grape varieties.

The adequate strategy for farmers and consumers is therefore to diversify and decrease their dependency on just a few plants. In a similar fashion, diversification is essential when investing and should be applied to plain beta as well as alternative beta. The former refers to asset classes like equities or fixed income and the latter to factor investing. The final result should be a portfolio diversified both across factors and assets classes.

Most investors are likely familiar with factor investing in equities, yet fewer are aware the same methodologies can be utilized in fixed income, currencies, and commodities, which are also called risk premia strategies.

In this short research note, we will explore factor investing across asset classes via risk premia products sold by investment banks.

PERFORMANCE OF RISK PREMIA INDICES

As investors have come to the realization that most alpha generated by mutual funds is explained by exposure to factors like Value or Momentum, the same awareness has been reached on the performance of hedge funds as most of their returns are attributed to factors from equities and other asset classes.

Post the global financial crisis in 2008, investment banks saw a business opportunity to create liquid and transparent indices that effectively offer the same exposures as hedge funds, but at a fraction of the cost. The idea was to disrupt the hedge fund universe, similar to how ETFs have disrupted the mutual fund industry.

We are going to use six risk premia indices calculated by HFR, an index provider, in this analysis. These indices are investible for institutional investors, are net of fees, and offer transparent methodologies as well as daily liquidity. They are comprised of more than a thousand individual strategies that are weighted inversely to their volatility. The strategies represent long-short and long-only portfolios of stocks, bonds, currencies, and commodities.

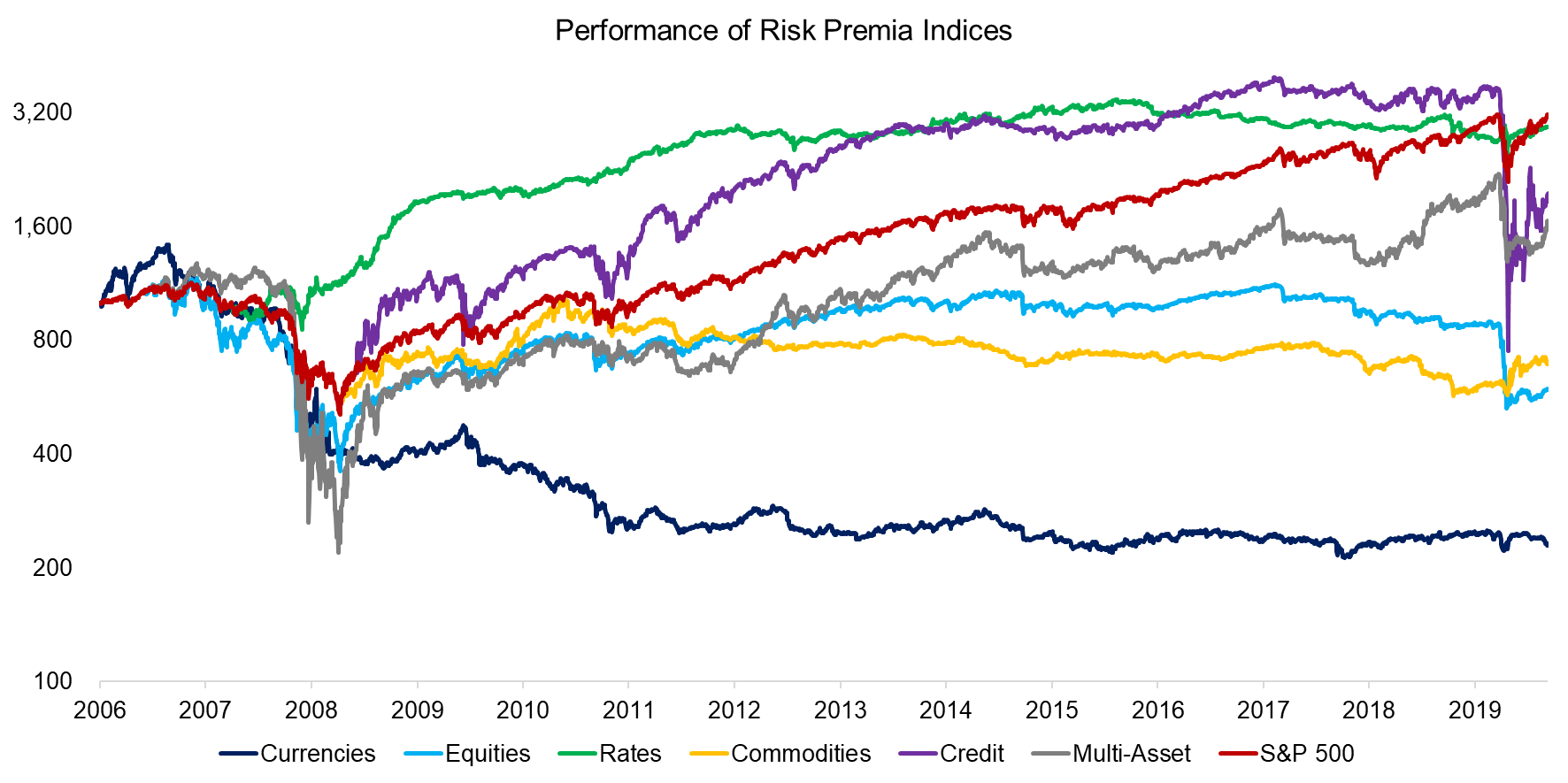

Daily returns are available for some of these indices since 2006 and highlight a rather diverse performance, except that almost all of these crashed during the global financial crisis in 2008 to 2009 and during the COVID-19 crisis in 2020. Some interesting patterns are evident from the data: Harvesting risk premia in currencies has been a consistently money-losing operation in the last 14 years (-77% total return) and has not been profitable in equities (-44%) either during this period. The fixed income space was more attractive, with both rates (+200%) and credit (+198%) generating positive returns. Commodities (+26%) was only slightly up since its index inception in 2009. This performance can help explain the push into fixed income by many quant asset managers.

Source: HFRX, FactorResearch. Risk premia indices are indexed on the S&P 500 for comparison purposes.

MAXIMUM DRAWDOWNS OF RISK PREMIA STRATEGIES

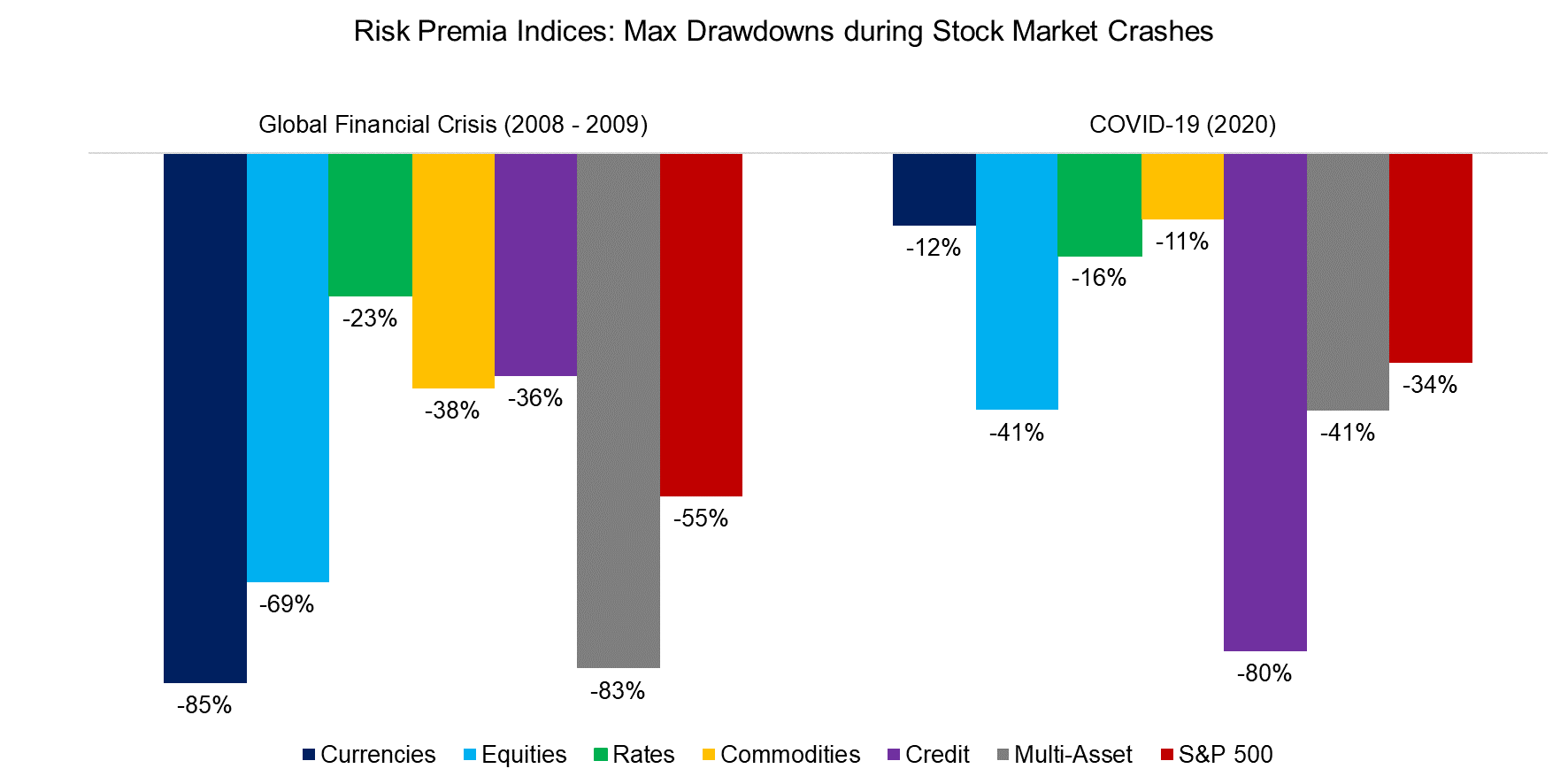

It is worth highlighting that the performance was shown on the log-scale, which makes some of the drawdowns appear less extreme than they were. Given this, we highlight the maximum drawdowns reached during the global financial crisis in 2008 to 2009 and COVID-19 crisis in 2020. We observe some truly catastrophic losses that make these risk premia practically unimplementable as investors would unlikely have stayed invested.

The currencies risk premia index lost 85% of its value, equities 69%, credit 80%, and even multi-asset 83%, during the last 14 years. Only the losses from rates and commodities were perhaps acceptable with maximum drawdowns of 23% and 38%, respectively.

Source: HFRX, FactorResearch

DIVERSIFICATION BENEFITS OF RISK PREMIA STRATEGIES

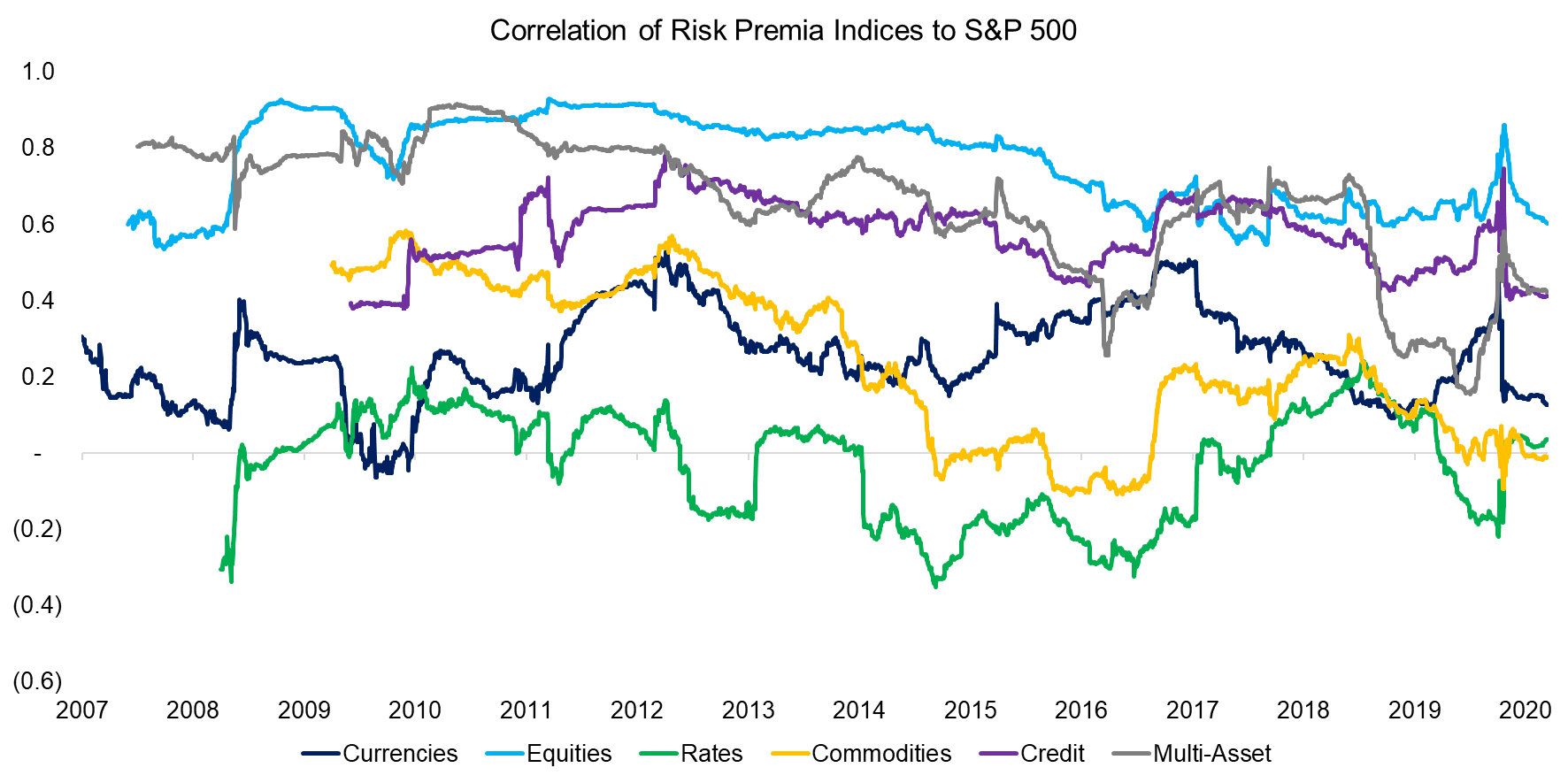

Ignoring these significant losses for a moment, it is also important to analyze how (un)correlated risk premia indices were to stock markets. Theoretically, most of these should feature a low correlation given that they mostly represent long-short portfolios or strategies from different asset classes, driven by different underlying asset dynamics.

However, equities, multi-asset, and credit exhibited correlations larger than 0.5 to the S&P 500 since 2006, which questions how helpful these strategies would have been from a diversification perspective. In contrast, risk premia in rates and commodities were more helpful in providing diversification given low correlations of 0.0 and 0.2 to the S&P 500 (read Smart Beta & Factor Correlations to the S&P 500).

Somewhat unusual, the risk premia indices in rates and commodities exhibited the same trends, which implies that investors have gotten similar exposure when investing in these rather different asset classes. It would be interesting to explore this relationship further as it suggests that some factors have the same performance drivers across asset classes.

Source: HFRX, FactorResearch

ADDING RISK PREMIA TO AN EQUITY PORTFOLIO

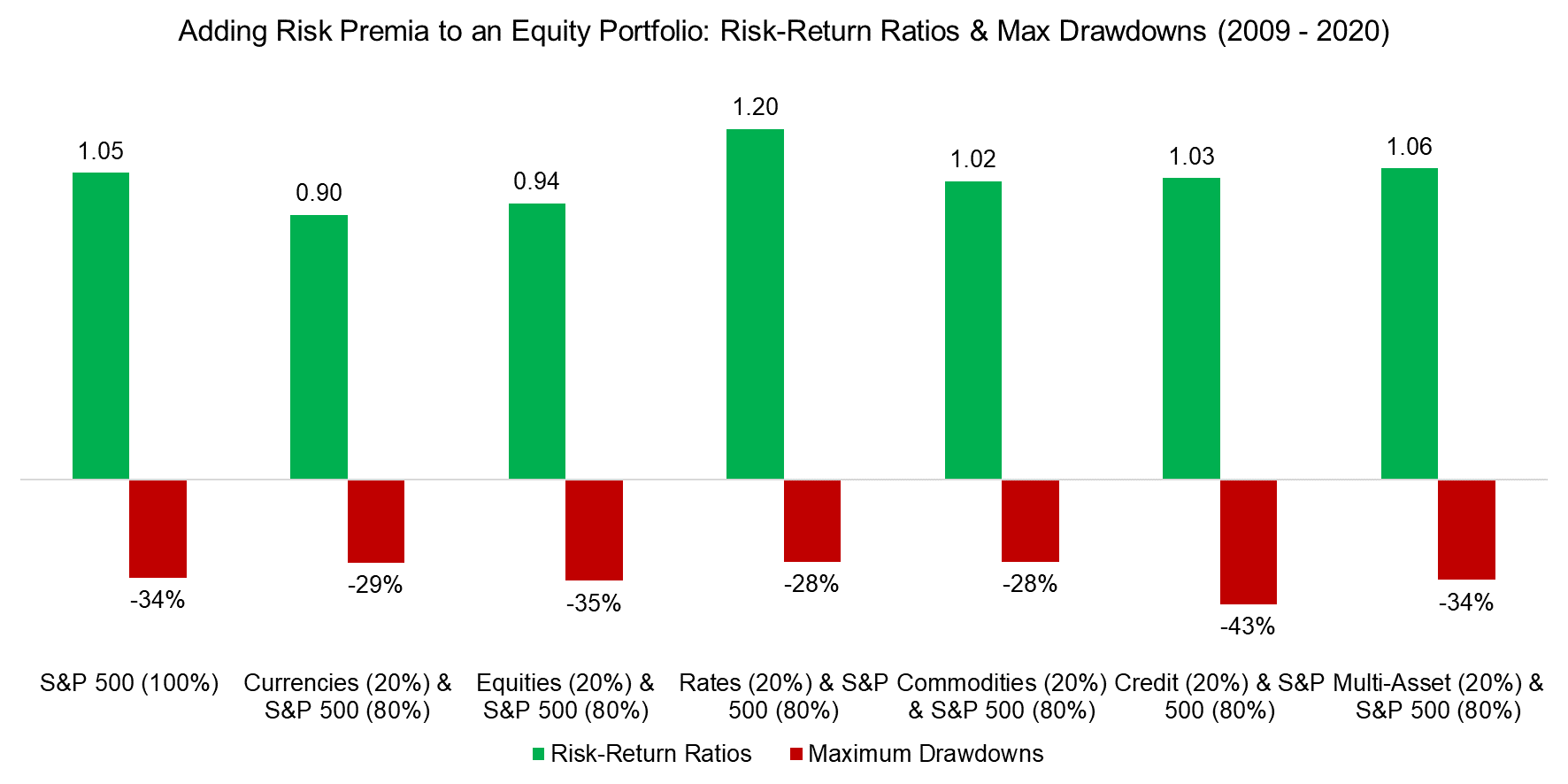

Finally, we simulate how much diversification benefits an allocation to risk premia would have yielded for an equity portfolio comprised of the S&P 500. We select April 2009 as a starting point for the analysis as that is the earliest date when all indices are available. It is worth recalling that some of these had significant negative drawdowns before that, which are therefore excluded and portray these indices in a more favorable light.

We observe that allocating 20% allocation to risk premia would have only generated moderate diversification benefits. For comparison purposes, the same allocation to a broad US bond index would have resulted in a risk-return ratio of 1.15 and maximum drawdown of 28%.

Source: HFRX, FactorResearch

FURTHER THOUGHTS

The idea of risk premia is great, i.e. offer exposure to alternative beta in low cost and liquid indices, however, the products sold by investment banks have been exceptionally poorly constructed. It is not an easy feat achieving an 80% drawdown in an index comprised of dozens or hundreds of single strategies.

Investors not discouraged by these products and this analysis can also evaluate similar ones managed by asset managers. There are liquid alternative mutual funds and even an ETF that allow all investors to allocate to risk premia across asset classes (read Liquid Alternatives: Alternative Enough?). These have less than $1 billion in assets under management and charge fees between 0.65% and 1.43% per annum, but perhaps offer a better alignment of interests than products sold by investment banks.

RELATED RESEARCH

Value, Momentum & Carry Across Asset Classes

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.