BDCs: Better Don’t Choose?

Another strategy that trades income for capital returns

August 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

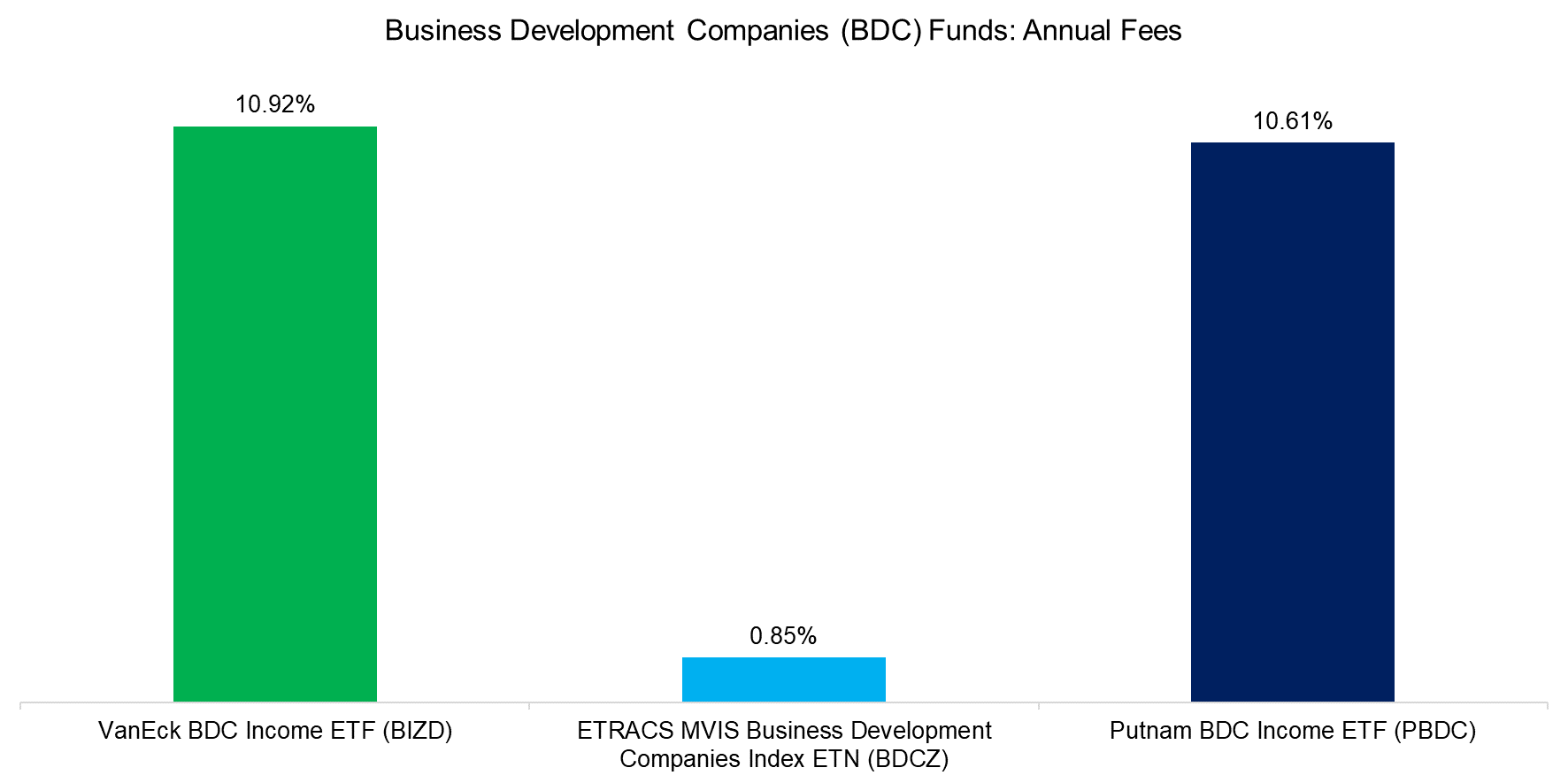

- Business development companies (BDC) funds feature 10%+ annual fees

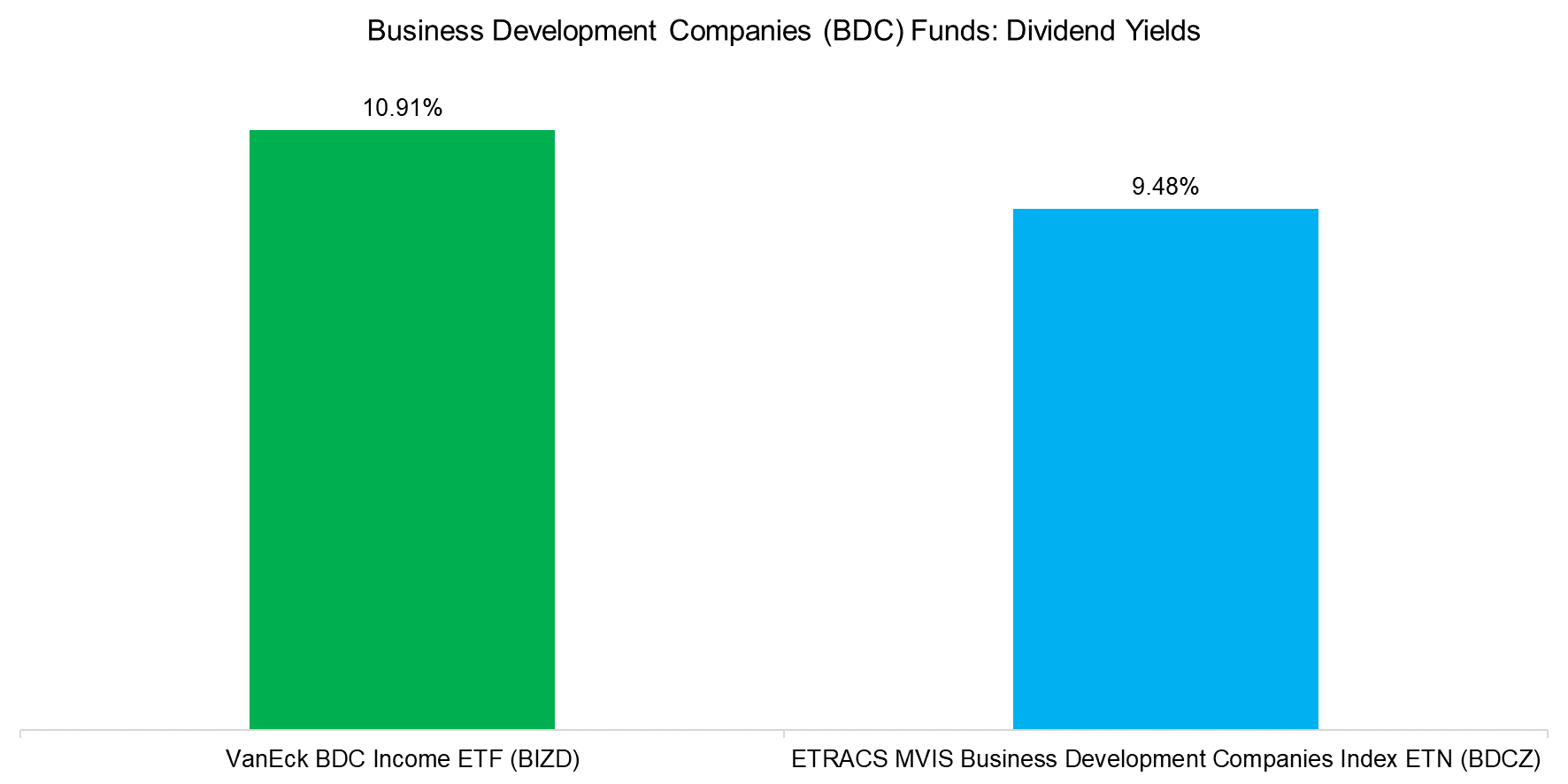

- Investors seem to be willing to accept these for similarly high dividend yields

- However, these funds underperform the S&P 500 significantly

INTRODUCTION

The most expensive investment funds tend to be ones focused on private asset classes like private equity as there are fewer regulatory disclosure requirements, but there are also some excessively expensive ETFs and mutual funds that trade public securities. We recently came across the VanEck BDC Income ETF (BIZD) that charges 10.92% per annum. The ETF issuer explains that the management fee is a mere 0.40% and that the other 10.52% can be attributed to acquired fund fees and expenses.

BIZD is managing more than $600 million of assets, so investors seem to be comfortable with paying such high fees, which is unusual given the usually fierce focus on paying the lowest fees possible.

In this research article, we will explore business development companies (BDC) funds.

WHAT ARE BDCs?

BDC funds offer exposure to diversified portfolios of publicly traded business development companies like Ares Capital, Owl Rock Capital, or the Blackstone Secured Lending Fund. These companies invest equity in and lend to private companies that are rated below investment grade or not rated at all. Stated differently, they provide capital to highly risky companies.

The BDC companies are typically externally managed by a fund manager that charges management and performance fees, which means a BDC fund like BIZD represents a fund-of-fund that features a double layer of fees.

In the US, there are two ETFs and one ETN offering investors exposure to BDCs. Both ETFs show expense ratios of larger than 10%, while the ETN only highlights its management fee, but that is misleading as its underlying securities are the same and it incurs the same expenses. We will ignore the PBDC ETF in the remainder of the analysis given a track record of less than one year.

Source: Finominal

Such high fees typically indicate that retail investors are involved as they are less fee-sensitive than institutional investors and usually don’t review the fund prospectuses that show the additional fees from investing in other funds.

Retail investors are easily lured into expensive investment products via high dividend yields, which is the case for BDC funds. BIZD offers a 10.9% and BDCZ a 9.5% dividend yield, compared to a mere 1.5% for the S&P 500.

Source: Finominal

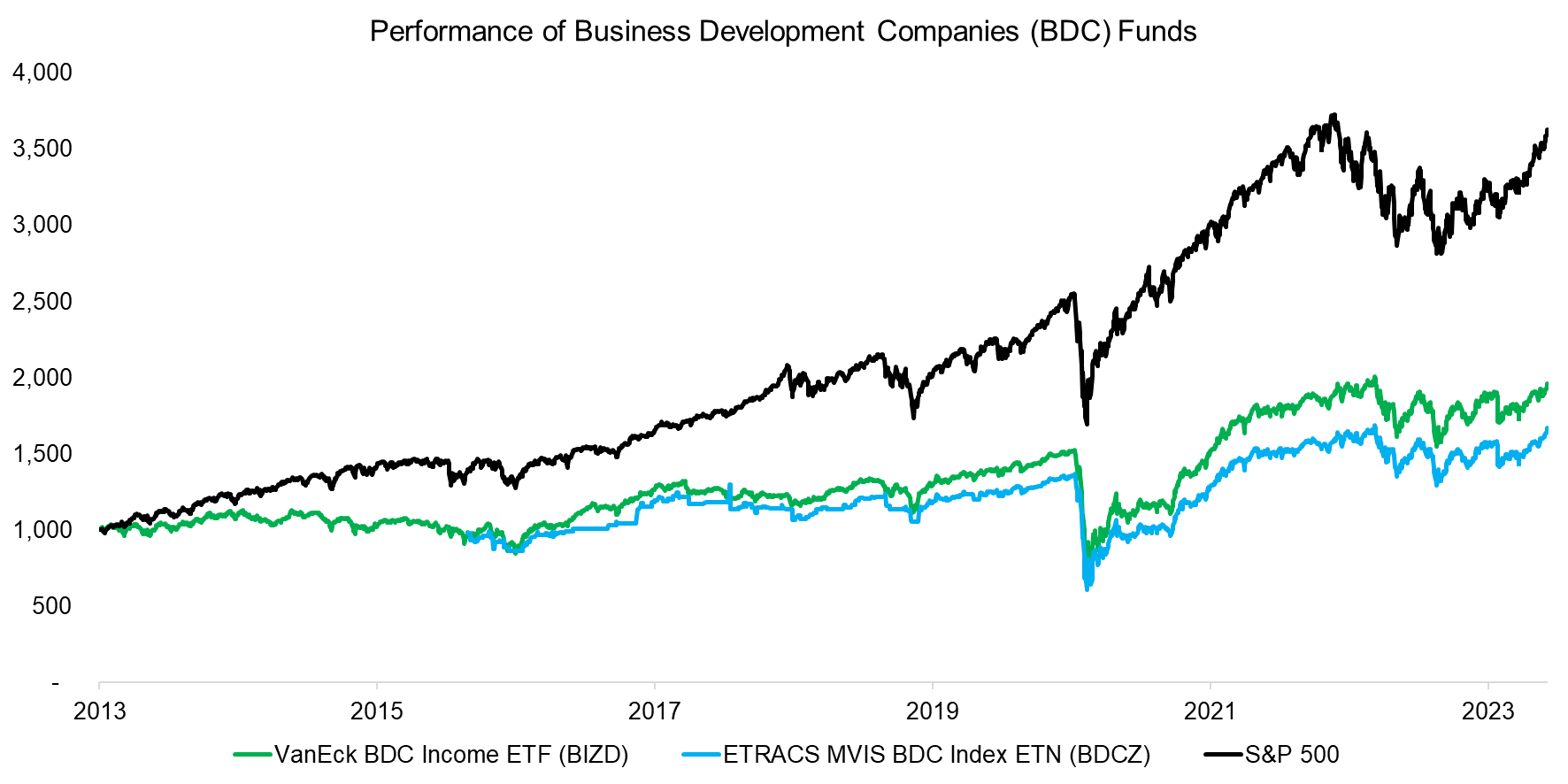

PERFORMANCE OF BDC FUNDS

Although these high dividend yields are enticing, they come at the cost of a significantly lower total return than the S&P 500. BIZD’s CAGR since its inception in 2013 was 6.7%, approximately half of the 13.1% of the S&P 500. Like many other high-yielding strategies, investors are fooled by high yields that come at the expense in lower total returns (read Resist the Siren Call of High Dividend Yields).

Source: Finominal

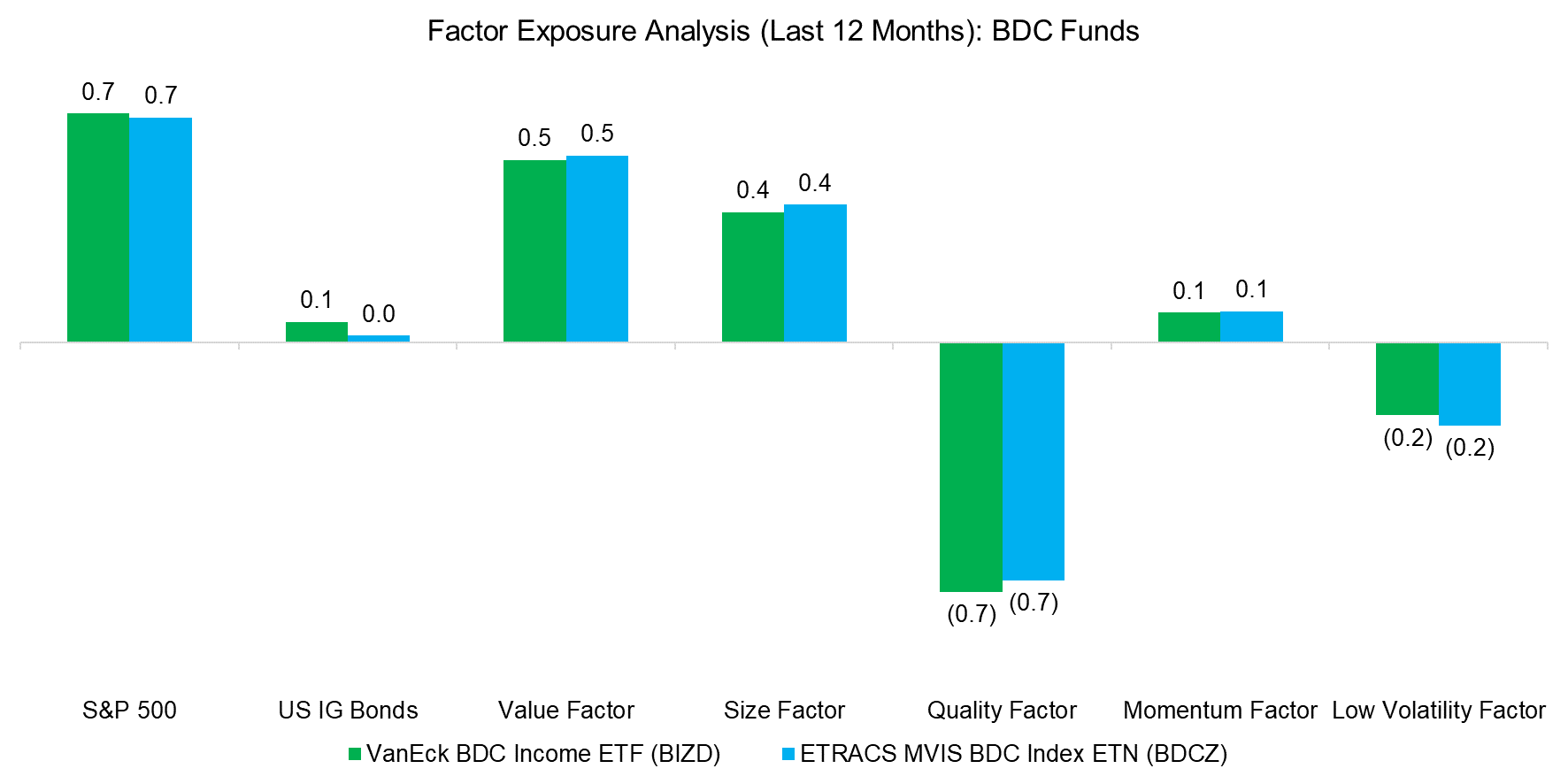

FACTOR EXPOSURE ANALYSIS

So, why are business development companies underperforming the stock market so dramatically?

Well, one reason is perhaps the excessive amount of fees that the business development companies are charging.

Another reason is revealed by a simple factor exposure analysis that highlights positive exposure to the value and size factors, but a negative one for quality. Academic research supports buying cheap small-cap stocks, the case is much stronger for ones that have strong quality features. Given that BDCs provide capital to companies that struggle to raise capital from banks or capital markets, this is not surprising. These are likely companies that have significant idiosyncratic issues like too much leverage, or belong to industries that face existential struggles.

Although BDCs represent diversified portfolios of equity and debt investments, their characteristics are not favorable and they can be viewed as value traps.

Source: Finominal

DIVERSIFICATION BENEFITS

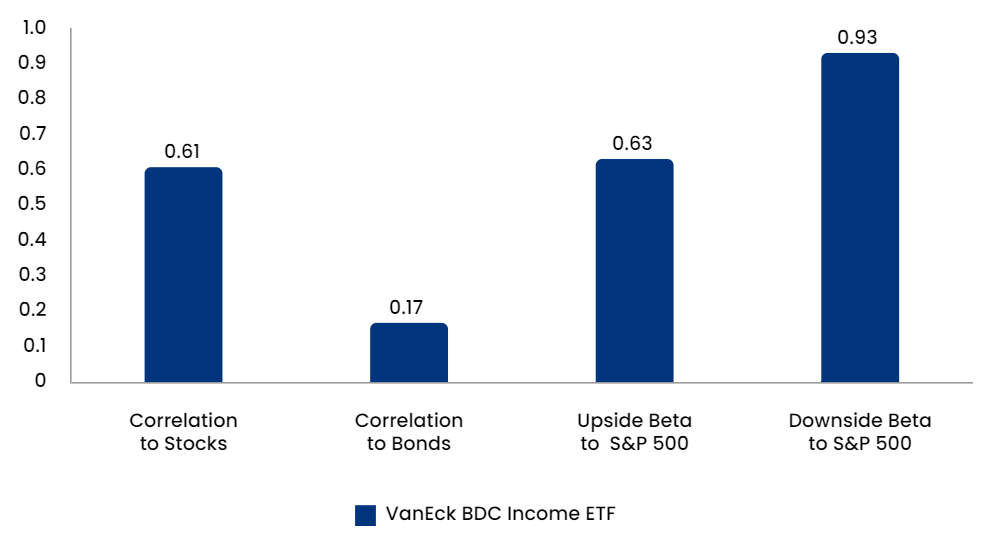

BDC funds are sometimes marketed as offering diversification benefits, but that can be challenged easily. If the economy is heading into a recession, then low-quality companies will likely suffer more than high-quality ones. The correlation of BIZD to the S&P 500 was only 0.61 over the last 10 years, but during the COVID-19 crisis in 2020 the ETF had a maximum drawdown of 55% compared to 34% for the US stock market.

The diversification benefits can be measured via the downside and upside betas to the S&P 500, which were 0.93 and 0.63 respectively. Naturally this implies that BIZD loses more when the S&P 500 declines than it profits when the stock market gains.

Source: Finominal

FURTHER THOUGHTS

BDCs, covered call strategies, high dividend stocks, preferreds, high-yield bonds, and similar instruments or strategies all lure investors with high yields, but mostly generate lower total returns than the US stock market. These do not represent a free lunch.

If a higher yield is needed than what the S&P 500 offers, then investors can create additional dividends themselves by simply selling fractions of an S&P 500 ETF, which does not result in a significantly lower total return. Furthermore, these additional synthetic dividends would be taxed as capital gains rather than as income, ie incur lower taxes.

This idea is not new, but it is surprising that asset managers have not launched ETFs that offer versions of the benchmark indices like the S&P 500 or Nasdaq with different dividend yields.

RELATED RESEARCH

Covered Call Strategies Uncovered

Preferential Times for Preferred Income Strategies?

The Case Against Equity Income Funds

Resist the Siren Call of High Dividend Yields

Dividend Yield Combinations

Value Factor: Improving the Tax Efficiency

Factor Exposure Analysis 101: Linear vs Lasso Regression

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.