Bonds & The Invisible Thief

Watching Inflation Wreak Havoc in Fixed Income

June 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- US bonds generated positive total returns in most inflation regimes

- Returns were mixed when inflation was above 4%

- Real returns were strongly negative when inflation was high

INTRODUCTION

Inflation is like cancer. It largely happens out of plain sight and requires focus to be noticed. The data is not easily understood and the perspective changes frequently. The outlook is difficult to predict. And it typically ruins people’s lives, in the case of inflation, when savings are destroyed, which can happen slowly or suddenly.

Although inflation rages in some frontier markets like Venezuela, Argentina, or Iran, for most investors in developed countries, it is largely a ghost from the past. Given high levels of debt across society and, for the most part, weak demographics, the outlook for economic growth is low. In fact, deflation is more likely than inflation. Japan’s playbook seems to be on deck in many countries across the globe (for our non-US readers, in baseball the term ‘on deck’ refers to being next in line to bat).

Complicating matters, government responses across the globe to the COVID-19 crisis have massively increased global public debt. Currently, markets do not perceive this as a problem. It seems that bond vigilantes are AWOL or powerless. Naturally, investors know that ultimately there is a price to pay for printing money excessively. Plenty of countries like the Weimar Republic in the 1920s or Venezuela more recently have been down this road and it never ends well. It is simply a question of time.

Creating investment portfolios that generate or at least preserve capital through such periods is challenging. Some asset classes like commodities, especially gold, are thought to do well in such an environment. Other asset classes, like bonds, are associated with capital destruction (read Equity Factors & Inflation).

In this short research note, we will explore the performance of US bonds in different inflation regimes.

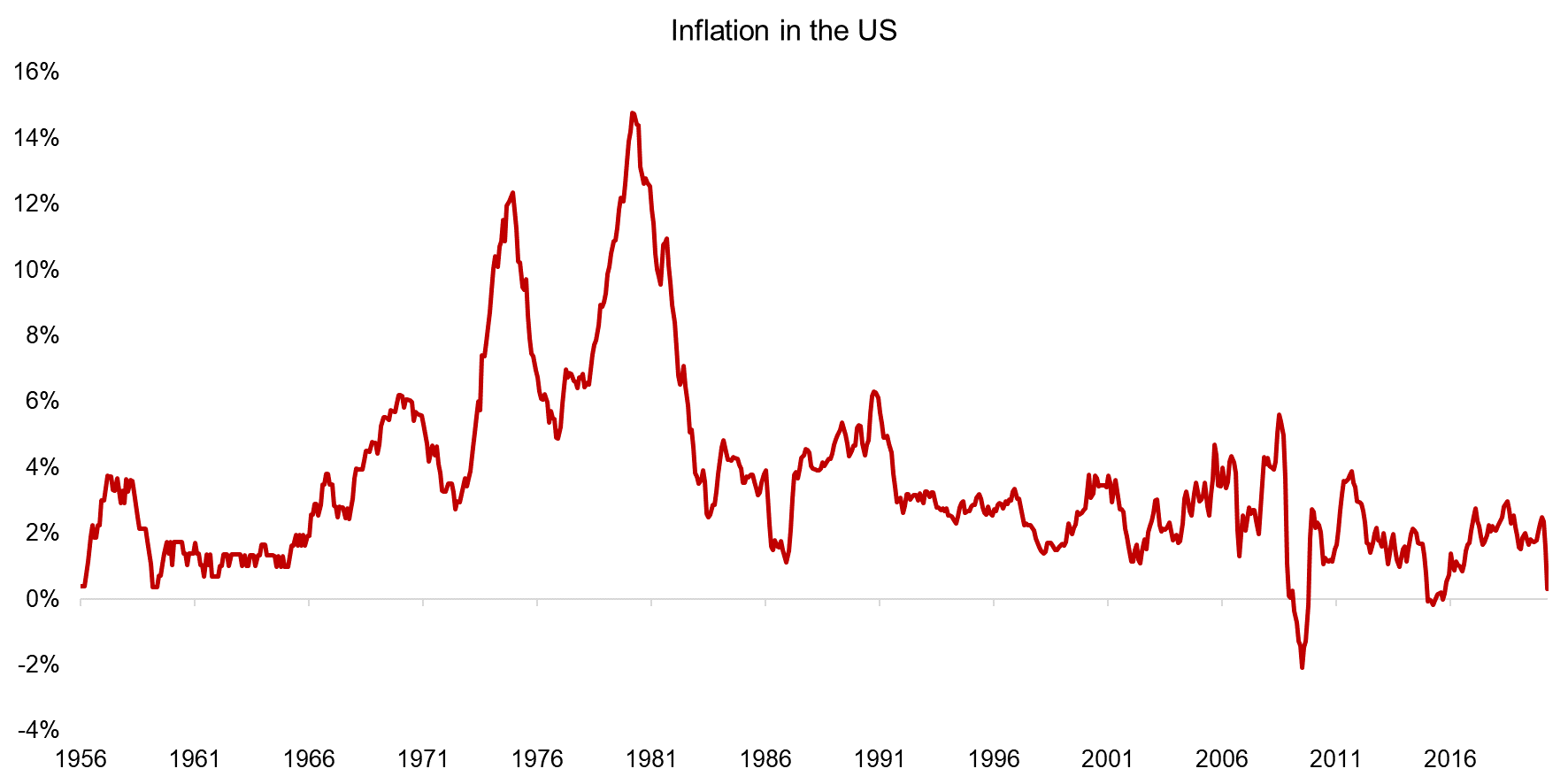

INFLATION IN THE US

Most investors in developed markets think of inflation as the annual change in prices that is typically around 2%, which is roughly the average in the US since 1990. However, even the US had significantly higher levels in the not too distant history. Inflation peaked at 14% in the US in 1980, which seems as unreal from today’s perspective as negative oil prices at the beginning of 2020.

Source: OECD, FactorResearch.

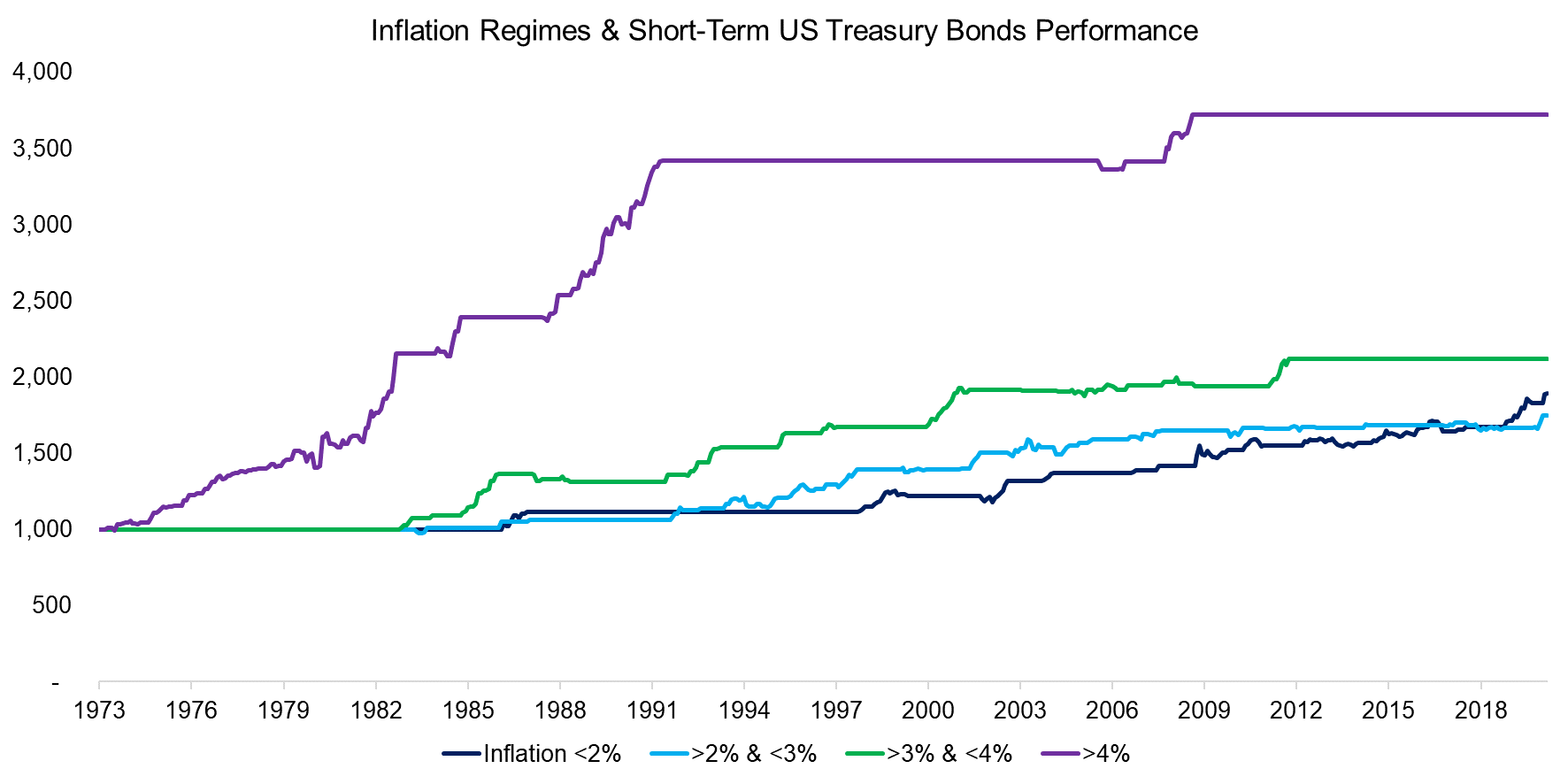

INFLATION & US TREASURY BONDS

The US Federal Reserve aims to manage inflation as one of its two mandated goals, the other being the unemployment rate. Historically that meant higher interest rates when inflation was increasing beyond the Fed’s comfort zone and lower interest rates when the economy was growing less than expected or heading into a recession.

We use the Bloomberg Barclays US Treasury Total Return index and analyze its performance across four different inflation regimes, which are approximately equally distributed in the number of days, in the period between 1973 and 2020 (read Smart Beta Fixed Income ETFs).

The analysis highlights that most of the total return was generated when inflation was above 4%, which was almost the entire period between 1973 and 1991. Given central bank policy, short-term treasury bonds follow inflation on average, which makes the return pattern intuitive. There were no significant drawdowns as the creditworthiness of the US government was spotless.

Source: Bloomberg Barclays, FactorResearch.

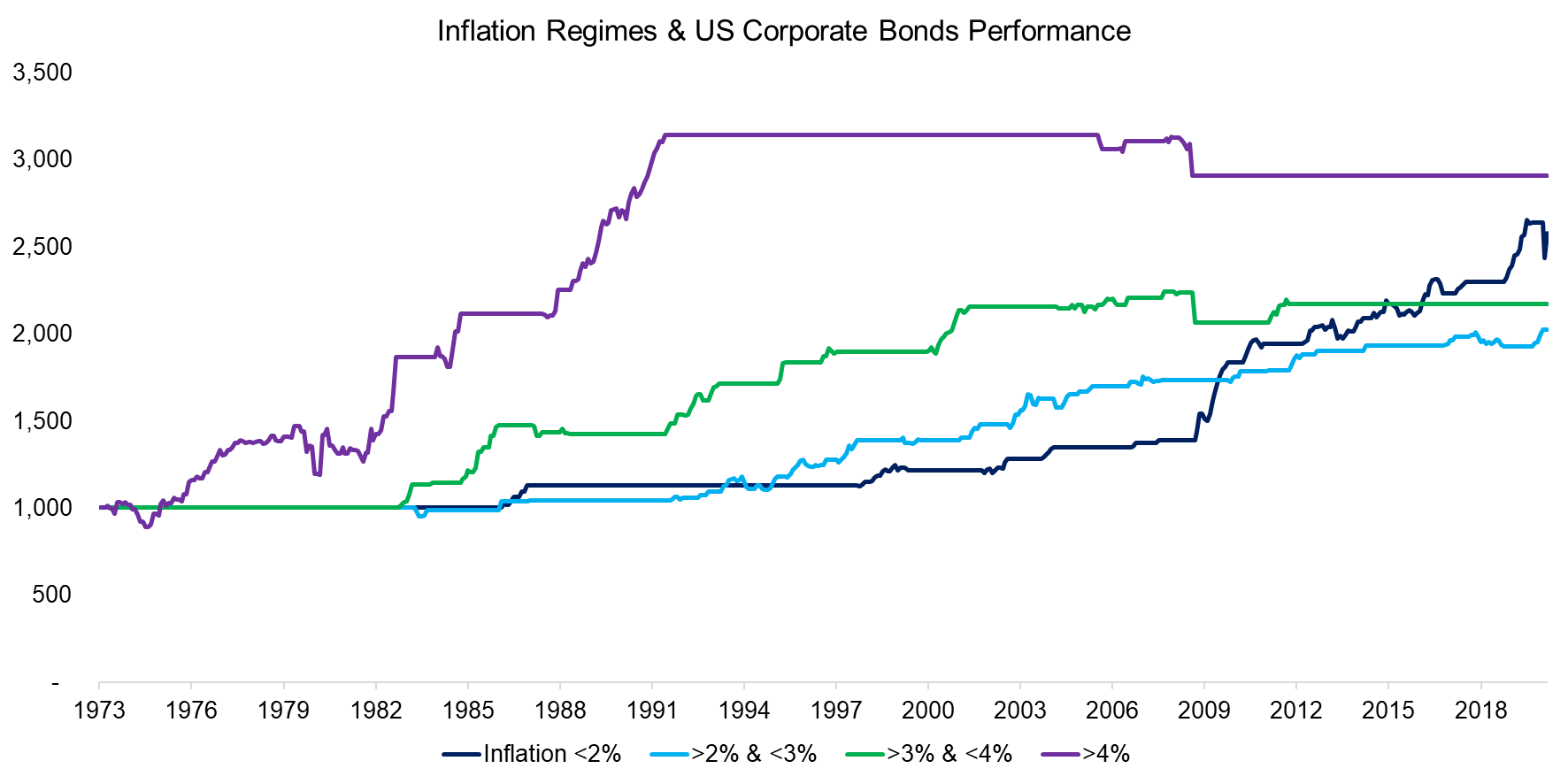

INFLATION & US CORPORATE BONDS

Moderate inflation tends to come hand-in-hand with a growing economy, whereas high inflation typically reflects demand and supply imbalances, which negatively affect governments, companies, and consumers. For example, inflation skyrocketed during the 1970s as oil production was reduced by OPEC countries in response to US support of Israel. Gas stations in the US were frequently closed or at least rationing gas sales, and many European countries restricted travel, not unlike in the current crisis.

Analyzing the performance of corporate bonds by using the Bloomberg Barclays US Corporate Total Return index highlights positive returns across different inflation regimes and approximately comparable to US Treasuries.

It is interesting to note that almost 30% of the total return in the period from 1973 to 2020 was achieved when inflation was below 2% and bond yields were low, compared to only 20% for US Treasuries. Most of this return can be attributed to the last decade, where corporate default rates were low given ultra-cheap money.

Source: Bloomberg Barclays, FactorResearch

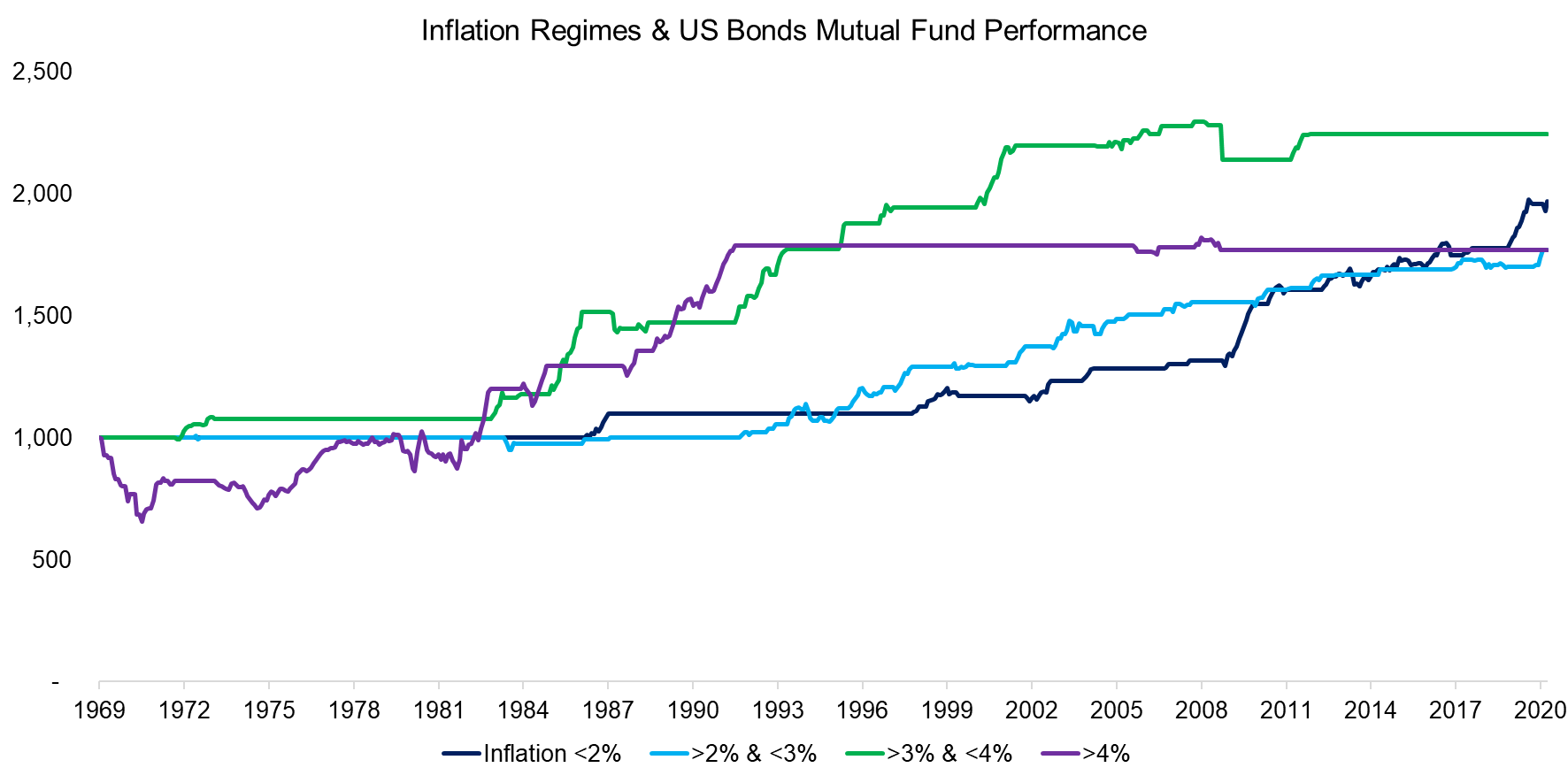

INDICES VS BOND MUTUAL FUNDS

The analysis has a weakness. The Bloomberg Barclays indices do not represent actual investment products that were available to investors since the 1970s. Fortunately, there are a handful of bond mutual funds that have multi-decade-long track records and are still trading today. These funds are actively managed and mostly held US corporate debt, although portfolios also included treasuries, mortgage and municipal debt.

We create an equal-weighted index of bond mutual funds that covers the period from 1969 to 2020, which is an additional four years of history compared to the indices. Inflation decreased from 5% in 1969 to 4% in 1972, however, the bond mutual funds experienced an almost 35% drawdown, which is unusual. It is worth noting that largely one fund, the Putnam Income fund (PNCX), which was launched in 1953, was responsible for the loss.

Furthermore, we only included only a few selected funds that are still trading today, which means our measure features a survivorship bias. Returns are therefore overstated and in reality, would have been worse for the average investor in bond mutual funds.

Source: Bloomberg Barclays, FactorResearch.

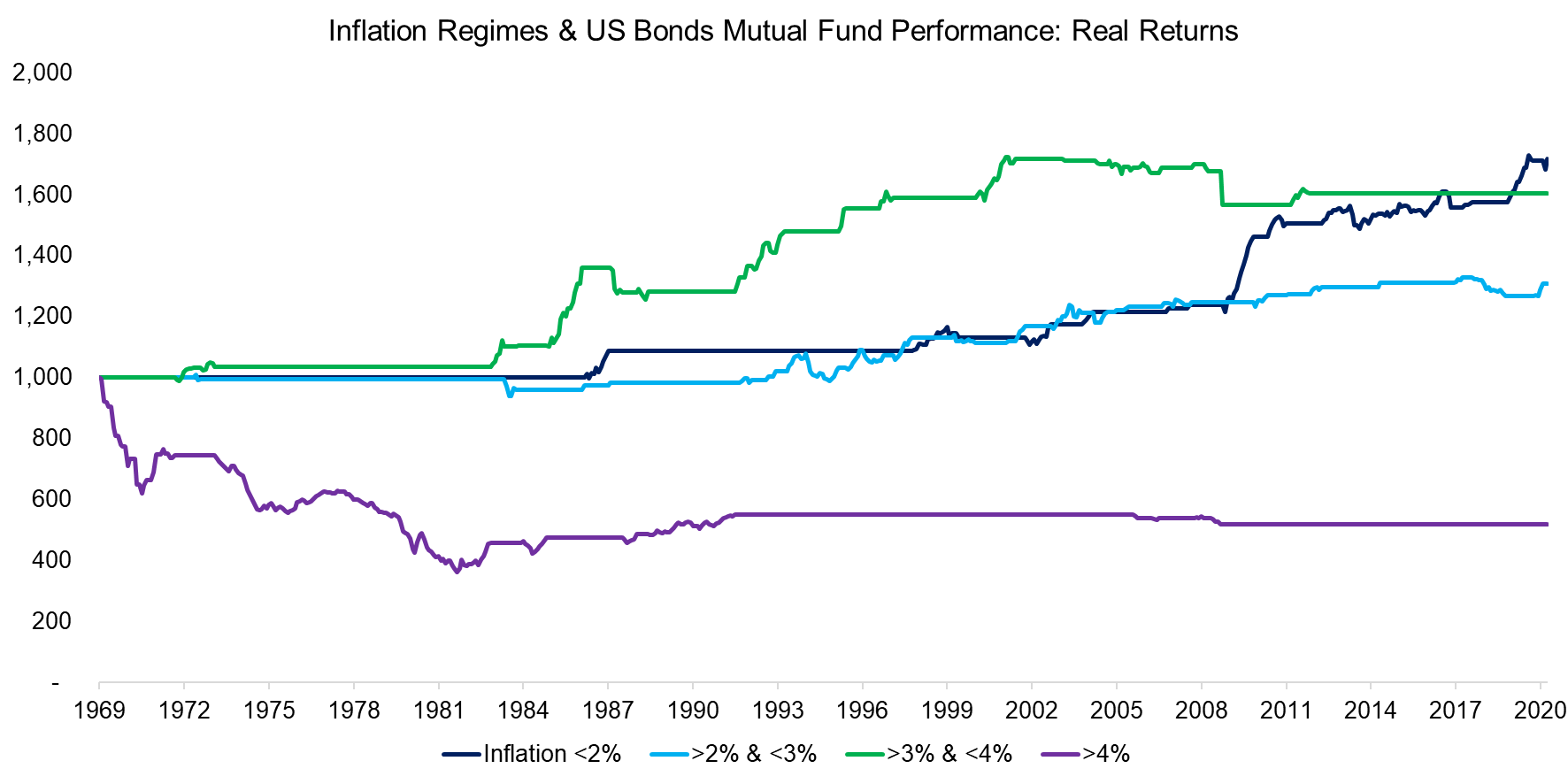

NOMINAL VS REAL RETURNS

Inflation is often called the invisible thief as few investors think in real returns. Most investors in the US assume that real returns of investment portfolios tend to be 2% lower on average as inflation expectations are typically anchored in recent history.

However, this thief can become quite destructive to a bond portfolio when inflation is rising to unprecedented levels like in the 1970s, when US bond mutual funds experienced a 60% drawdown in real returns. In contrast, real returns were positive on average in all other inflation regimes. A lot of this behavior has to do with the impact of expected versus unexpected inflation. Many articles have been written documenting their different impacts on real returns, where unexpected inflation is more damaging. In the US, most episodes of high inflation in the 1970s were unexpected and for that reason the nominal yields were incapable of matching the realized inflation, making real returns negative.

Furthermore, high inflation tends to have negative effects on consumers and businesses, which ultimately reflects in higher default rates on corporate bonds, rising the required rate of return, and reducing the price of bonds.

Source: FactorResearch

FURTHER THOUGHTS

The outlook for inflation is low based on Wall Street economists, but what could change this?

Some market participants speculate that the global economy will recover faster from the COVID-19 crisis than expected, creating supply-demand imbalances that are inflationary. Others see bond vigilantes returning to life and selling the currencies and bonds of overindebted countries, creating inflation in the process.

However, negative demographics is the sand in the machinery. Once the sand is inside, it is often impossible to get it out. The only way forward is then to replace the machine.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.