Bonds versus CTAs for Diversification

Better to lend, or follow the trend?

June 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Although yields are higher, bonds have also become riskier

- Bonds and CTAs have generated similar diversification benefits since 1999

- Applying a trend following overlay for equities was accretive in Europe and Japan

INTRODUCTION

In May 2021 we made the case that bonds have become less useful in asset allocation given low to negative expected returns based on low yields, and could be replaced with liquid alternatives like managed futures, market-neutral multi-factor products, or long volatility strategies. The article was well timed as bonds fell in value in 2022 when inflation forced central banks to increase interest rates (read 60/40 Portfolios Without Bonds).

The expected return for bonds has improved as bond yields have increased, but so has the issuer risk. Rising interest rates mean governments need to pay more interest when refinancing their debt, which typically leads to larger budget deficits that are financed with more debt. At some point, governments will need to restructure their debt as the number of bond buyers is steadily decreasing given declining populations, e.g. China is expected to lose 600 million citizens over the next 80 years (read Aging & Equities: Selling Stocks for the Long-Term).

Naturally, such a scenario might still be decades away, but it is interesting to contemplate replacing bonds with alternatives. In this research article, we will contrast bonds versus managed futures, which are also known as CTAs or trend following funds.

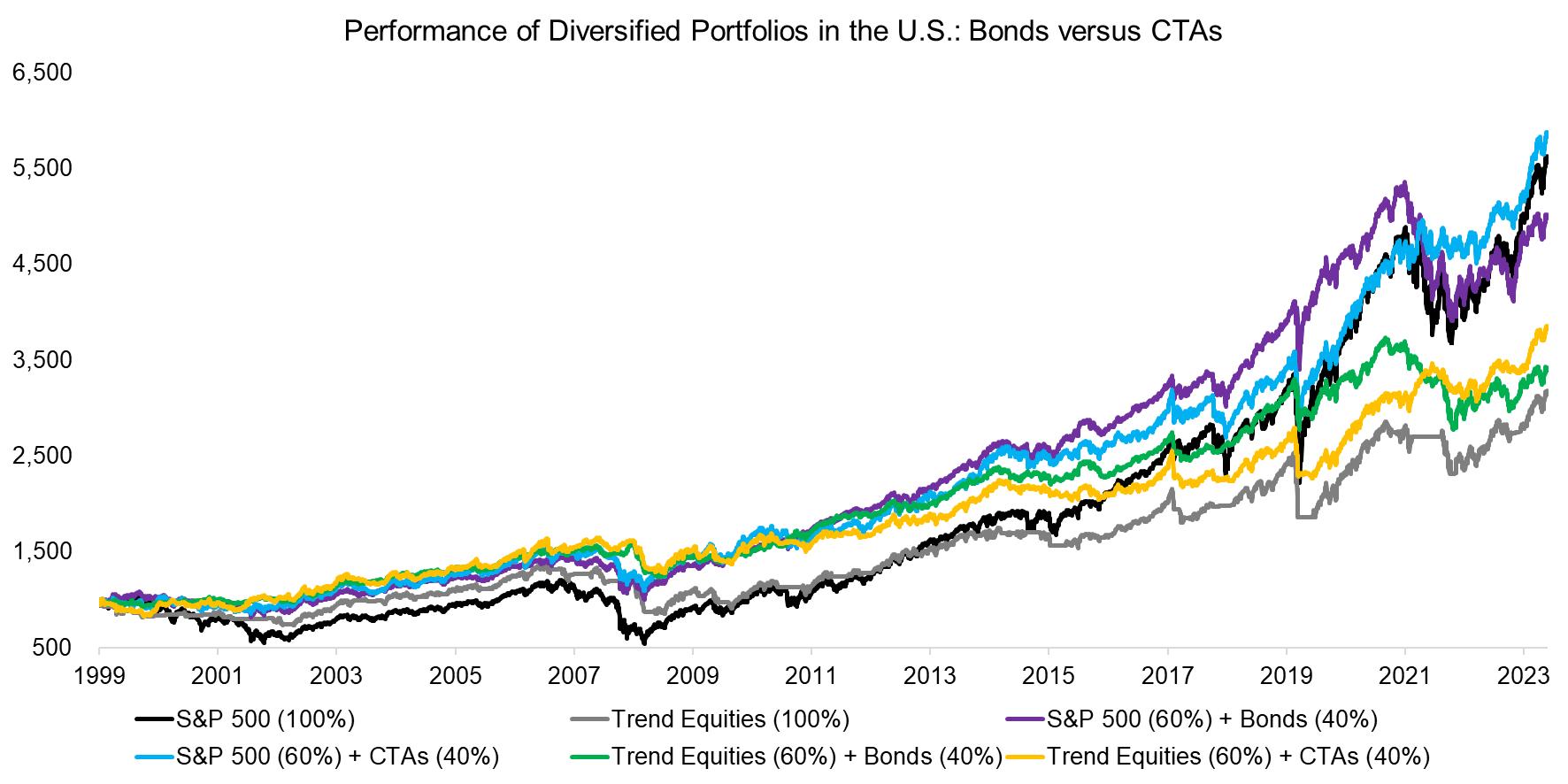

PERFORMANCE OF DIVERSIFIED PORTFOLIOS IN THE US

We will use the S&P 500, U.S. long-term government bonds, and the SG Trend Index as proxy for managed futures funds as core building blocks for portfolio construction in this analysis. Furthermore, we create a trend equities strategy that allocates 100% to the S&P 500 if the 12-month return is positive measured every month, otherwise 100% is allocated to short-term U.S. Treasury bills (read Risk-Managed Equity Exposure II).

We create various portfolios assuming quarterly rebalancing that highlight that a combination of the S&P 500 (60%) and managed futures (40%) achieved the highest total return from 1999 to 2024, followed by the S&P 500. The traditional portfolio of a 60% allocation to the S&P 500 and a 40% allocation to bonds performed also well, while all portfolios with trend equities generated lower returns.

Source: Finominal

It is worth highlighting that starting points matter in this kind of analysis, e.g. we selected 1999 as the year when the SG Trend Index was launched. Naturally, this coincides with the tech bubble imploding shortly thereafter, so the S&P 500 returns are slightly muted compared to selecting 2002 as a starting point.

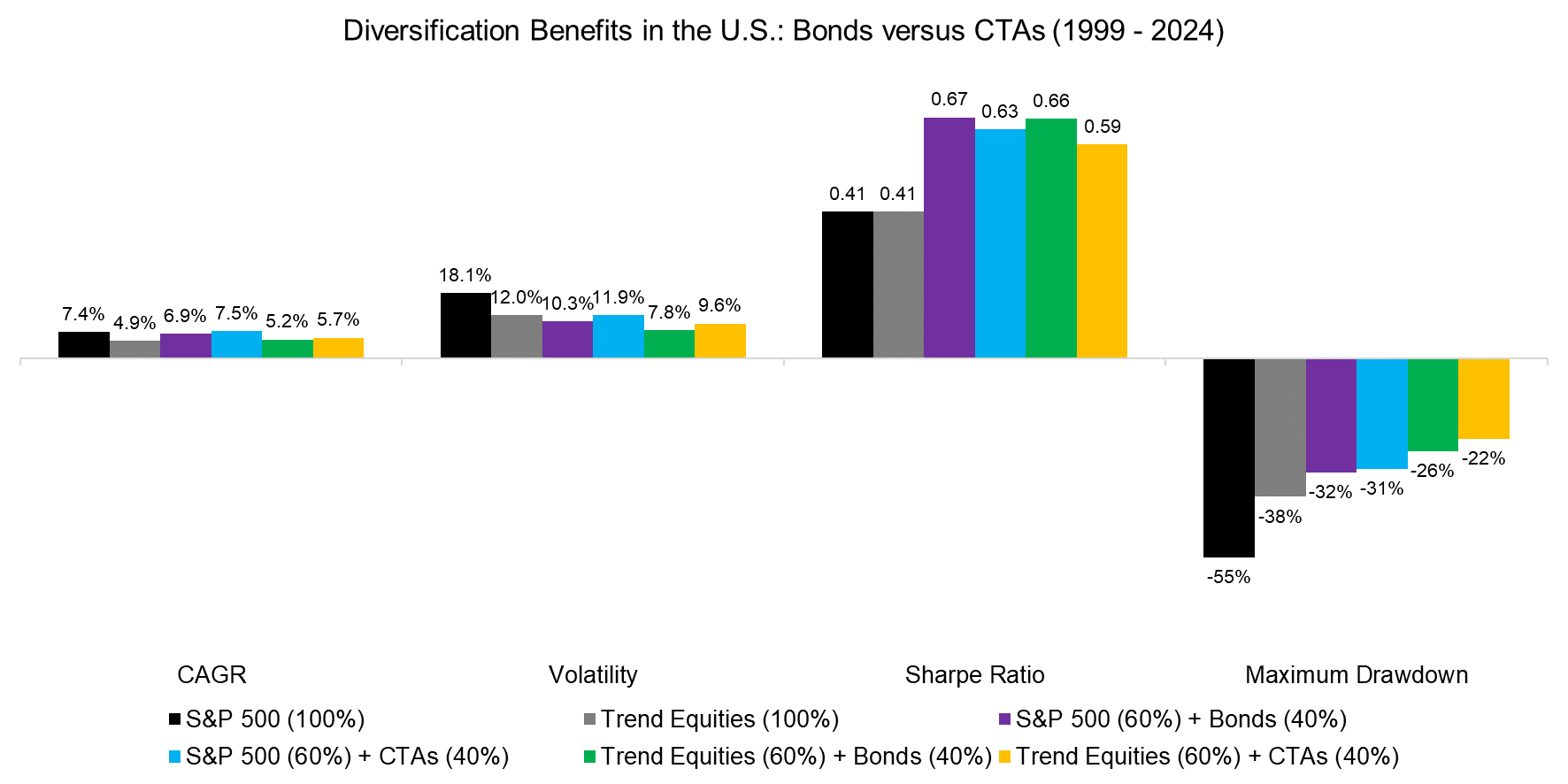

Moving from absolute to risk-adjusted returns highlights that allocating 40% to bonds or CTAs would have significantly increased the Sharpe ratio of a portfolio comprised exclusively of the S&P 500. The core aim of the trend equities strategy is to reduce drawdowns, which it has achieved.

Source: Finominal

DIVERSIFICATION IN TIMES OF MEDIOCRE EQUITY RETURNS

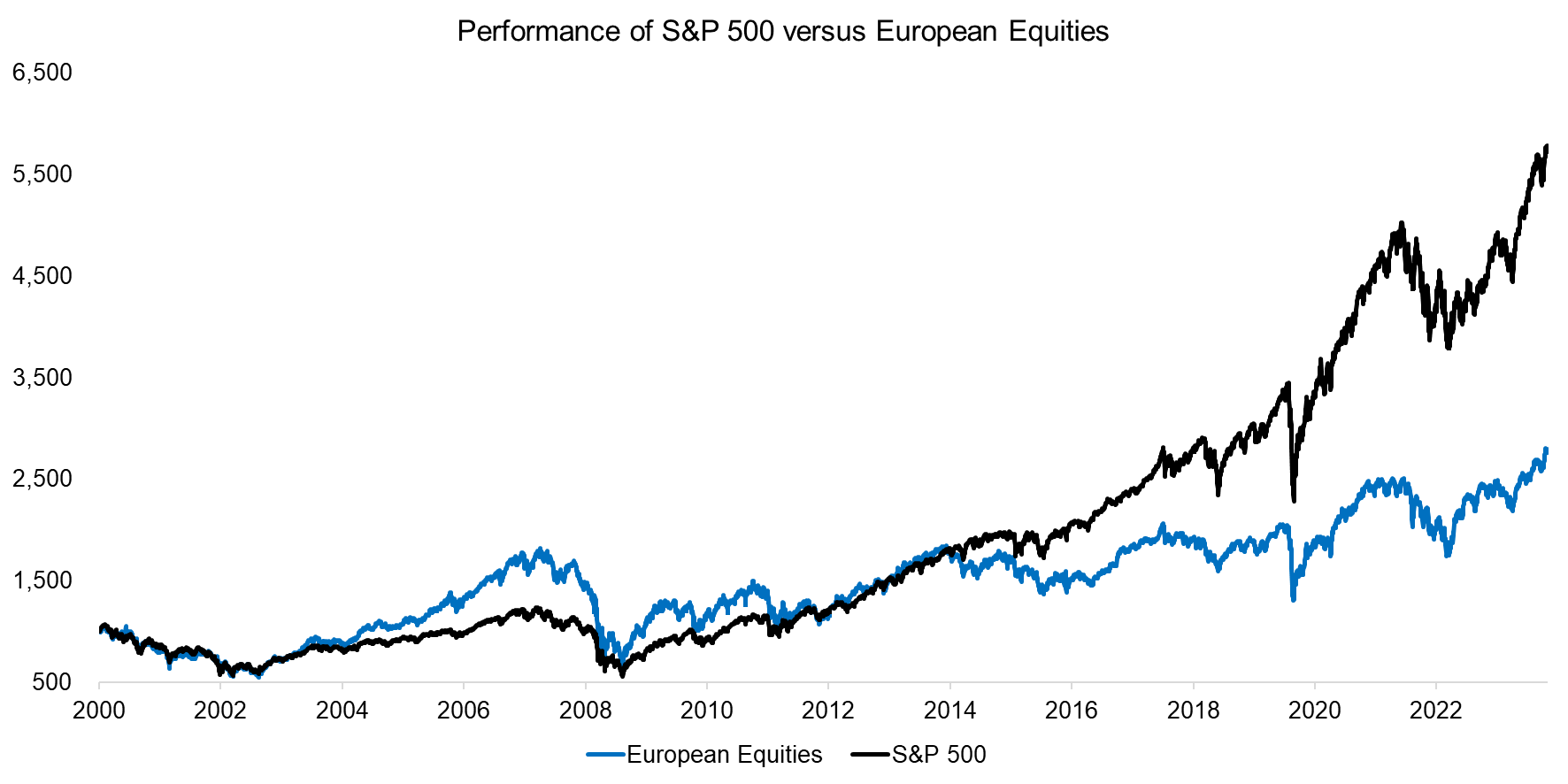

Recently a paper making the case for 100% allocation to equities created a stir and pushback from firms like AQR that strongly believe in diversification. Unfortunately, many U.S. investors do not see the argument for much diversification given that the S&P 500 has performed so strongly over the last decade. An investor could look back and point out that American capitalism has survived the housing and COVID-19 crises, and will also do going forward.

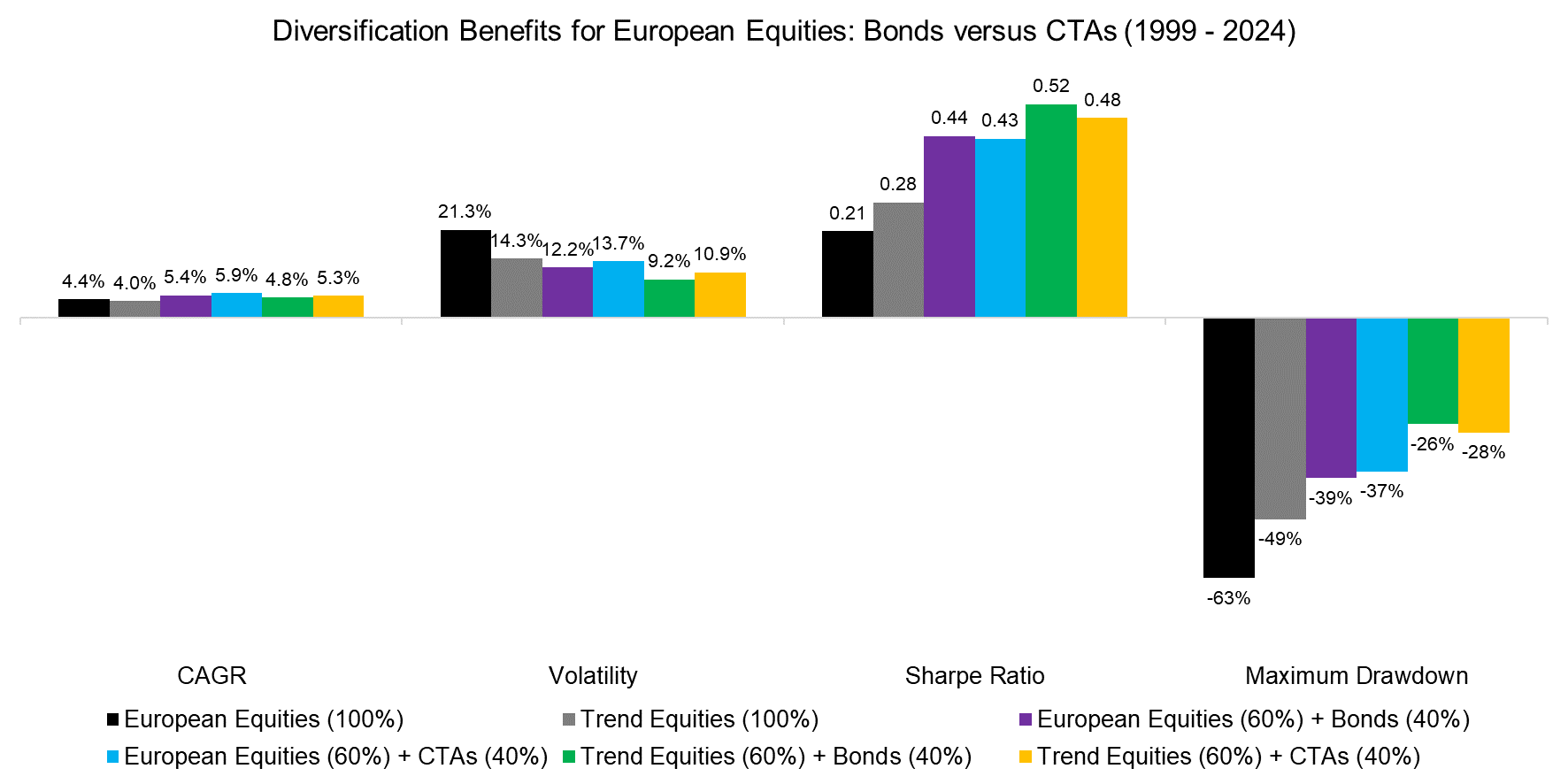

Although that is true, the returns have been rather exceptional, e.g. the European stock market has only generated a CAGR of 4.4% compared to 7.6% for the U.S. stock market since 2000.

Source: Finominal

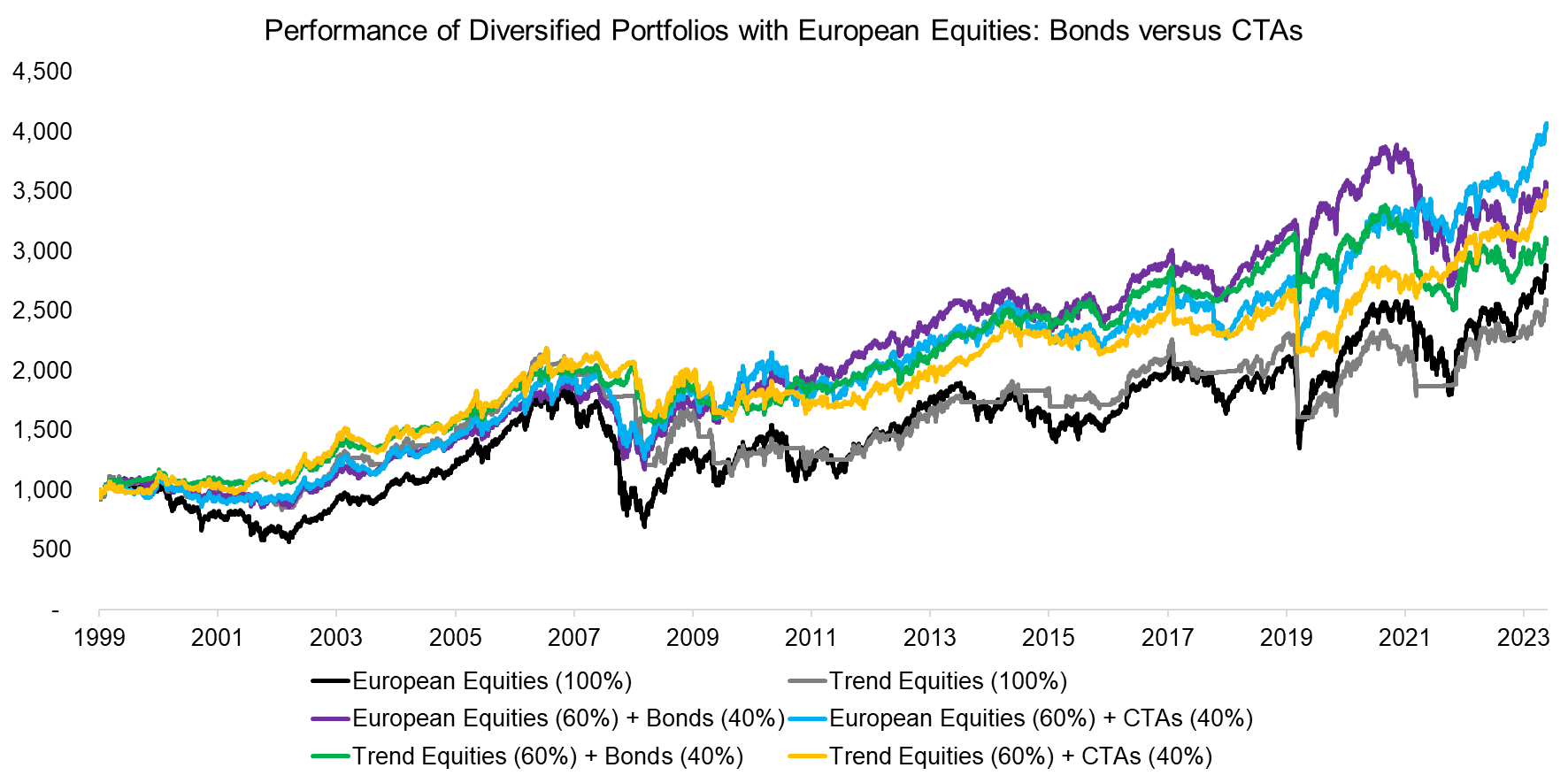

Next, we rerun the diversified and trend equities portfolios but replace the returns of the S&P 500 with those of a European stock market index that tracks the largest 350 European stocks by market capitalization. The idea is to evaluate diversification benefits when stock market returns are poorer, which may well be the case for the U.S. going forward given high valuation multiples. The higher the multiples, the worse the long-term expected returns.

We observe that diversifying into bonds and CTAs generated significant benefits for investors as all diversified portfolios produced a higher total return than the European stock market over the last 24 years. Furthermore, the trend equities strategies performed much better than in the U.S. and almost generated the same return as the market.

Source: Finominal

Computing the Sharpe ratios highlights that the European stock market exhibits the lowest ratio, while the diversified portfolios with trend equities generated the highest ones. Applying a trend following filter on equities is less effective in markets with strong performance, especially ones that feature sharp sell-offs and quick recoveries that occurred frequently during the last decade, but the approach pays off when the market trades range-bound or during a bear market like the GFC.

Source: Finominal

DIVERSIFICATION IN TIMES OF POOR EQUITY RETURNS

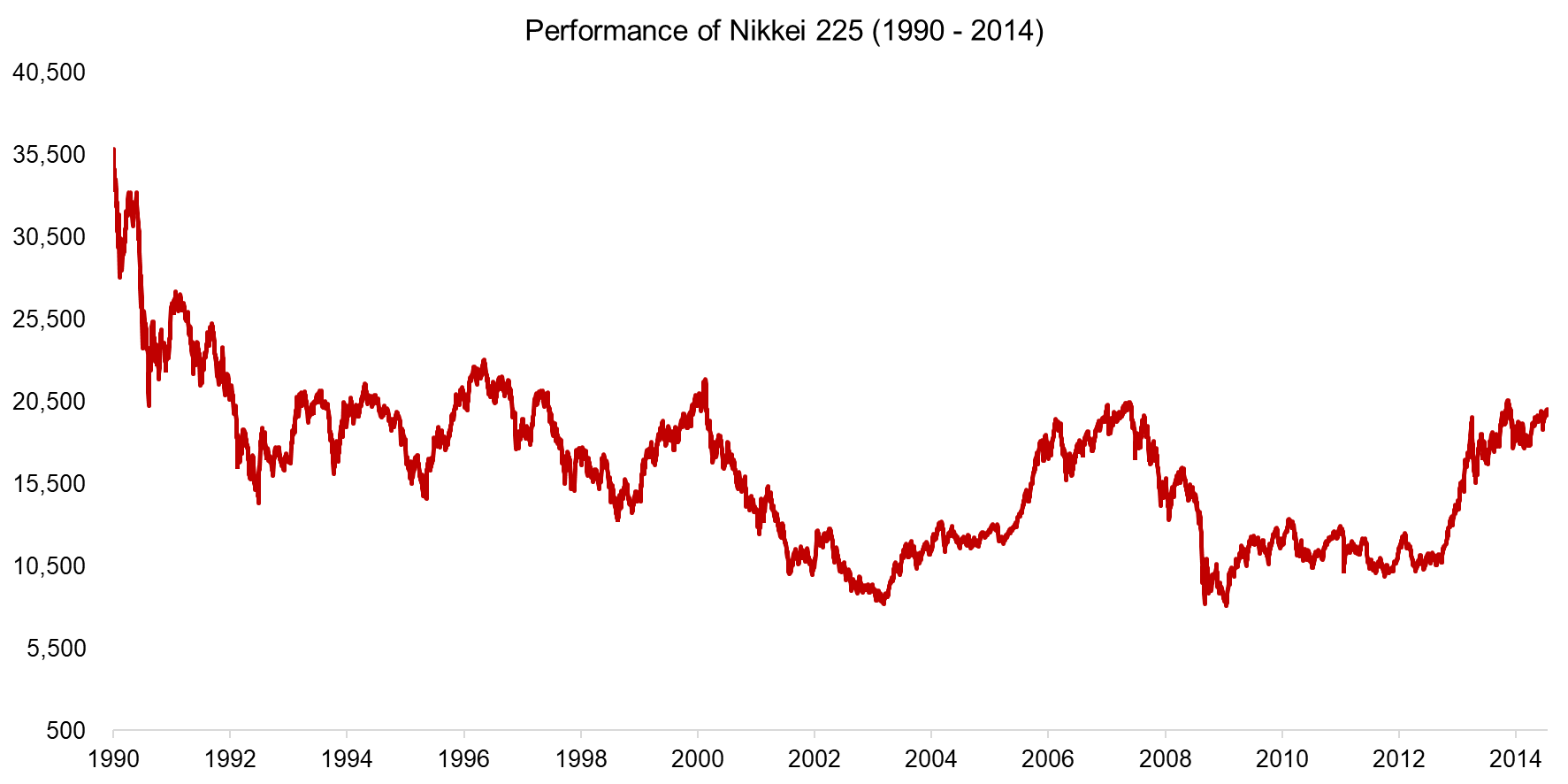

We can also evaluate the diversification benefits of bonds and CTAs in an extended bear market. Japan experienced a significant housing and stock market bubble in the 1980s that imploded in 1990 and was followed by decades of poor returns.

Source: Finominal

We again recreate the diversified portfolios and trend equities strategies but replace the returns of the S&P 500 with those of the Nikkei 255 of the period between 1990 and 2014. For the avoidance of doubt, we simply want to evaluate diversification benefits when stock market returns were poor for an extended period.

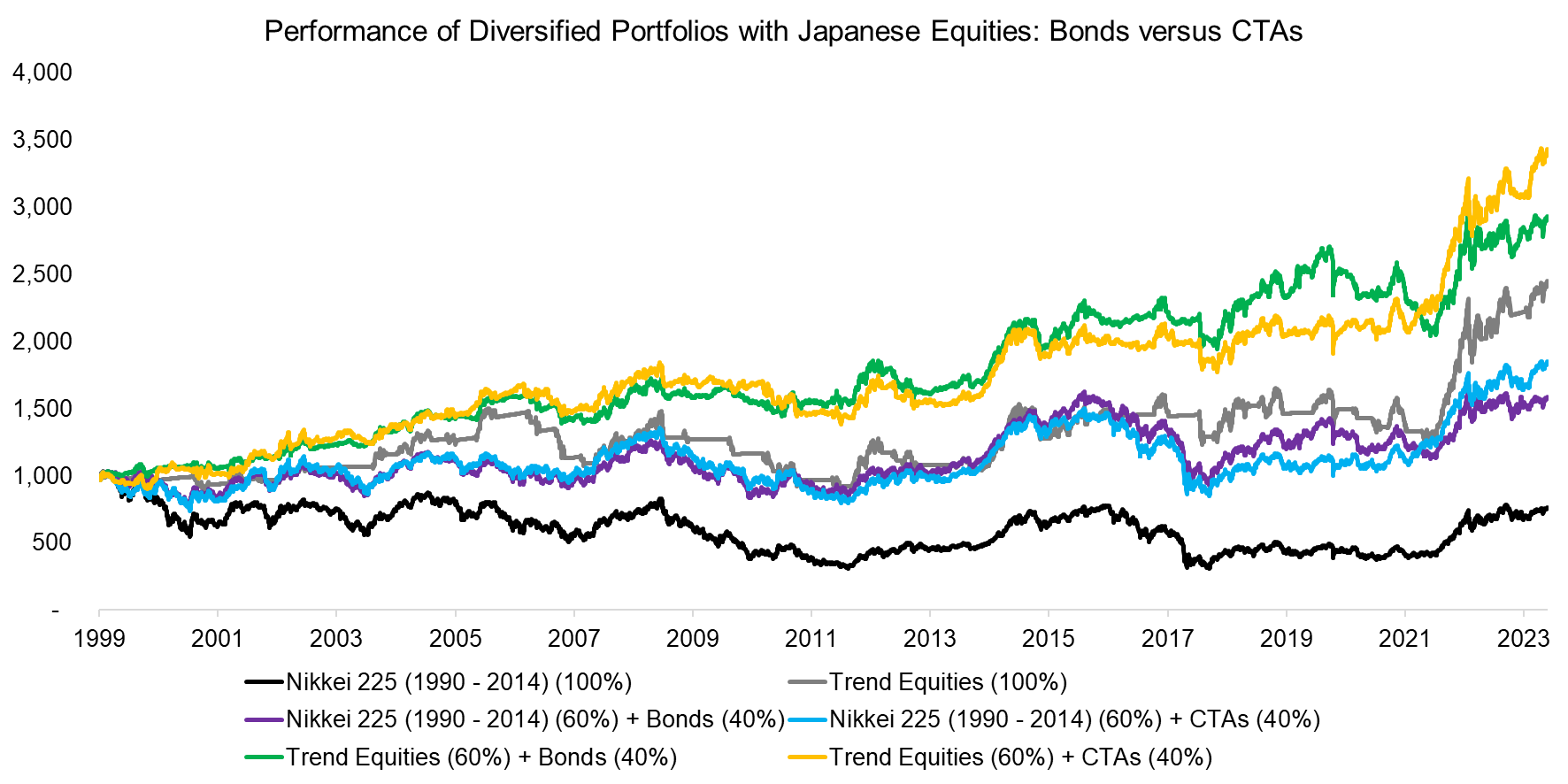

Similar to the results using the European stock market, we observe that all diversified portfolios generated higher total returns than the Japanese stock market. However, more striking is that the trend equities strategy on a stand-alone basis and when combined with bonds or CTAs performed well.

Source: Finominal

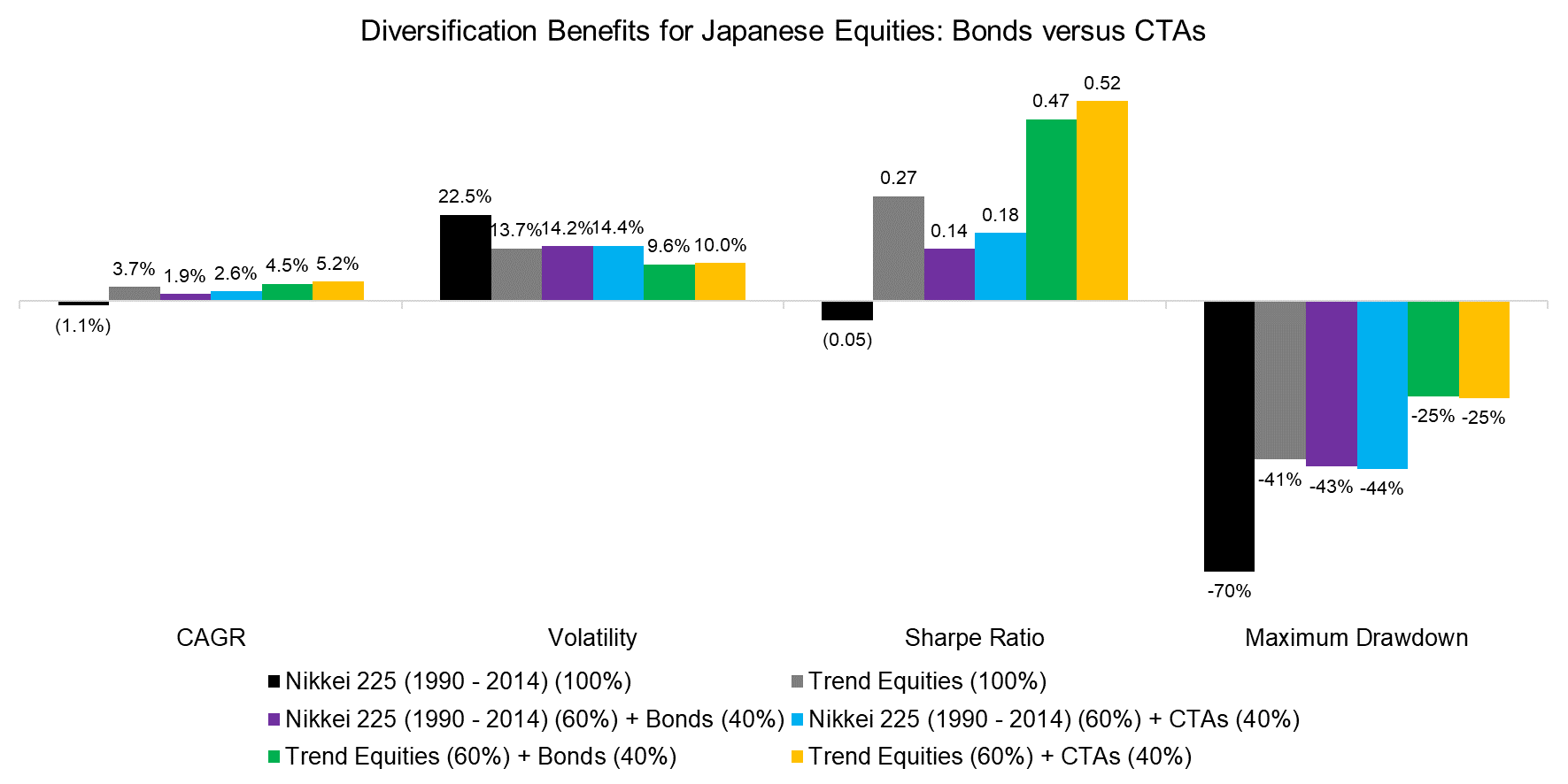

The benefits of applying a trend following filter to equities become apparent when reviewing the Sharpe ratios and maximum drawdowns in the simulation using the Japanese stock market returns from 1990 to 2014.

Source: Finominal

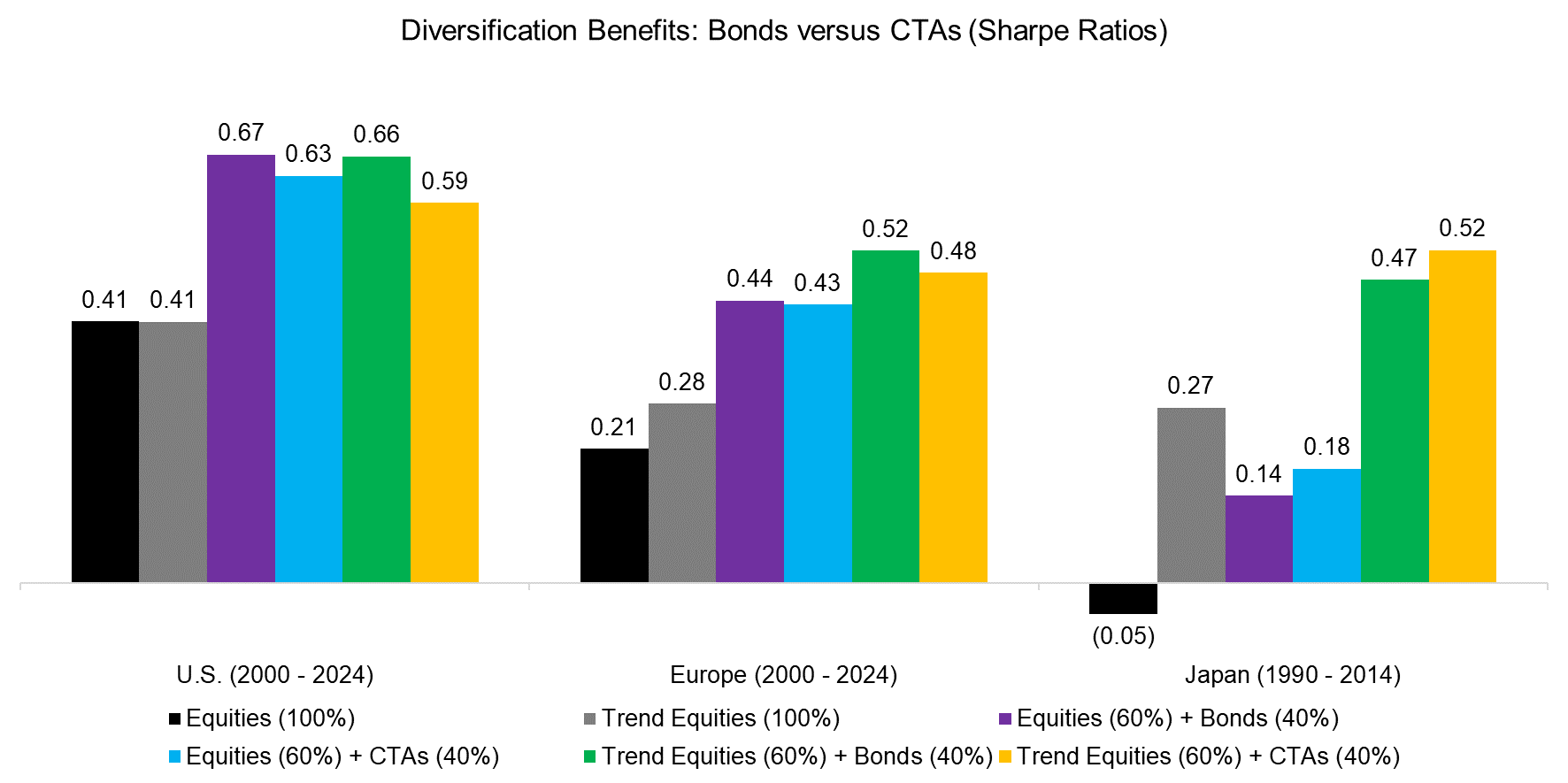

Finally, we contrast the Sharpe ratios of the various portfolios across the three regions where we notice that there was not much difference between using bonds and CTAs for diversification. More meaningful was using a trend following methodology for the equities allocation, which was more accretive the worse the stock market returns were.

Source: Finominal

FURTHER THOUGHTS

Overall, it seems that investors could have already replaced bonds with CTAs and achieved similar absolute and risk-adjusted returns over the last two decades. However, it is worth recalling that bonds have largely been in a bull market throughout that period and that bonds will become riskier going forward given record levels of debt and declining populations.

Investors can consider allocating to bonds and CTAs, but managed futures funds trade fixed income securities, so that could result in doubling up in the same risk exposures. Along the same line of argument, it might be advisable to select CTAs that do not allocate to equities.

To a degree, investing in CTAs can be viewed as acknowledging that we do not know where asset classes like bonds, currencies, or commodities are headed and represent a systematic way to exploit bull and bear markets across these. Better to be humble than stumble.

RELATED RESEARCH

Trend Following in Equities

Trend Following in Bear Markets

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

60/40 Portfolios Without Bonds

Aging & Equities: Selling Stocks for the Long-Term

How Much Can You Lose with Bonds?

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure I

REFERENCED ARTICLES

Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice, Anarkulova et al, 2023

Why Not 100% Equities, ARQ, 2024

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.