Building a Diversified Portfolio for the Long-Term

A Horse Race of Diversifying Strategies

March 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most diversifying strategies fail to provide diversification benefits when most needed

- We build a diversified portfolio via trend, multi-factor, and long volatility

- An equal-weighted approach to asset allocation is not worse than more complex approaches

INTRODUCTION

At FactorResearch, we have published more than 200 research articles on investing, which included diverse topics ranging from statistical arbitrage hedge funds to catastrophe bond investing. All research aims to provide an independent perspective based on data rather than opinions. It is a constant search for truth and knowledge.

It has also been a continuous source of disappointment, where some of the key lessons learned are the following:

- The alpha generated by mutual funds, hedge funds, and cryptocurrency hedge funds is essentially zero

- Almost all diversifying strategies do not diversify and fail when most needed by investors

- Private asset classes like private equity, venture capital, or real estate are just equity exposure in disguise and provide little value

- Bonds lose most of their appeal when interest rates are close to zero

- Almost all investments are proxies for economic growth, which can be viewed as an undiversified short volatility position

Unfortunately, this implies that 95% of the investment products available on the market do not add real value to investors. It is a negative and perhaps arrogant perspective, but based on an unbiased and thorough analysis of data.

Investing is always challenging, but perhaps more difficult now than ever. Valuations are at record highs, debt is at record highs, and demographics are negative in most countries, which will depress future economic growth. The outlook for returns is mediocre at best (read Musing about S&P 500 Valuations).

However, not investing is also not an option given moderate levels of inflation and negative real returns on cash accounts. In this research note, we will explore a diversified portfolio for the long term based on the few strategies that are backed by research and analysis.

PORTFOLIO CONSTRUCTION: THE PLAYERS

The basic components of almost all portfolios are stocks and bonds. US-based investors can try to diversify equities by selecting international or emerging market stocks, but global stock markets are highly correlated. Also, most stocks in the S&P 500 provide exposure to the global economy that reduces the diversification benefits from non-US stocks.

Bonds were stellar return contributors and diversifiers over the last four decades, but have become unattractive at the currently low yields. The expected return on a bond is essentially the yield it is bought at, which implies negative returns on many government and corporate bonds in Europe and Japan. We will exclude an allocation to fixed income in our diversified portfolio.

Given all the research we conducted, what diversifying strategies do offer true diversification and should be considered?

Three strategies come to mind:

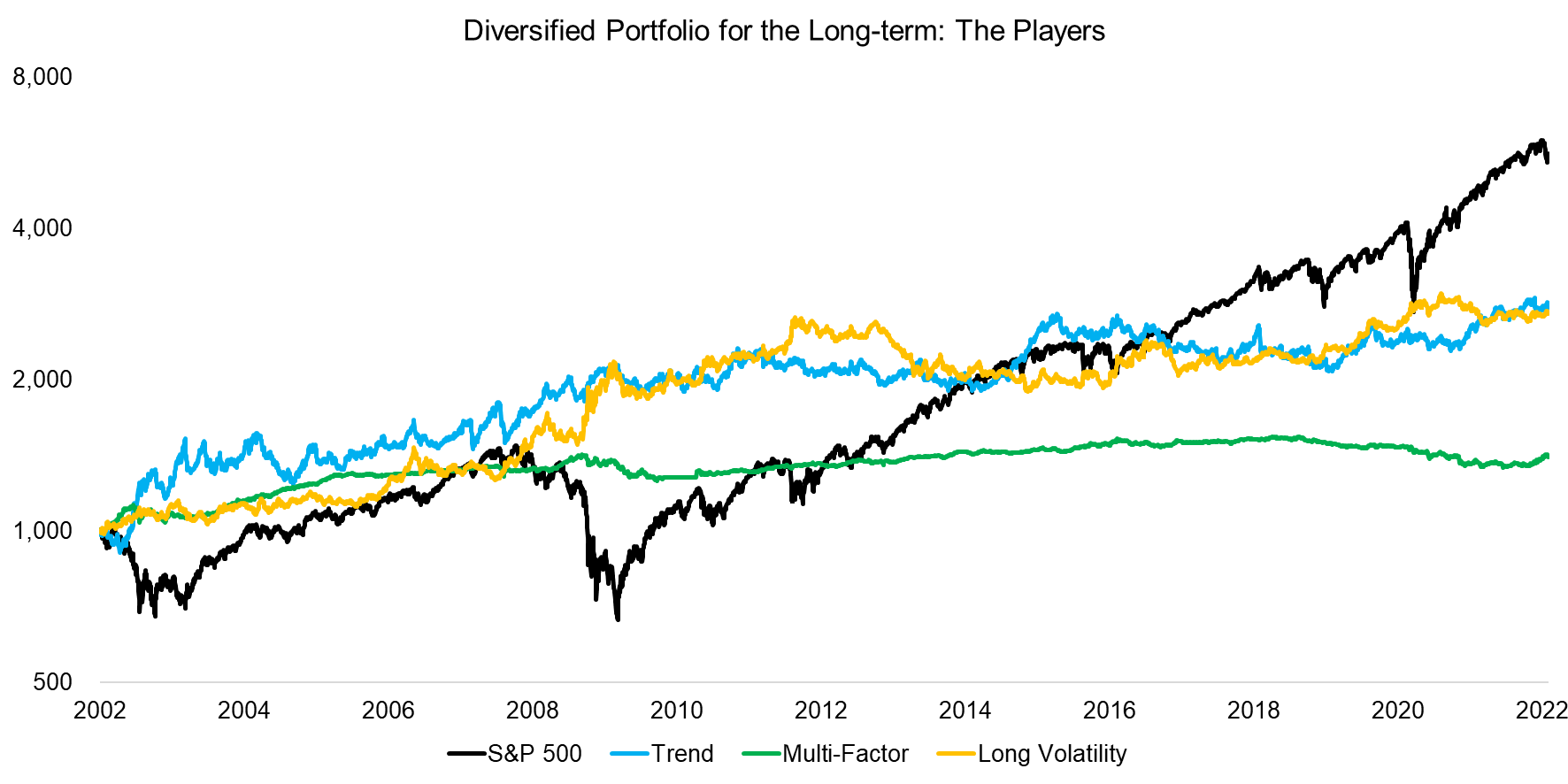

- Trend following: Pursuing systematic trend following across asset classes, which can be long or short positions. We use the SG Trend Index as a proxy.

- Beta-neutral multi-factor investing: Harvesting alternative beta from factors. We use a beta-neutral portfolio comprised of the value, size, momentum, quality, and low volatility factors. This can be done across asset classes, but we focus on equity factors.

- Long volatility: Benefiting from increases in volatility or higher levels of volatility. We use an equal-weighted combination of gold and JPY/AUD, which is a good proxy for the CBOE Eurekahedge Long Volatility Index.

We have daily data for all three strategies since 2000, which is not as long as desired, but at least captures one large and few small market cycles. We observe that the S&P 500 generated the highest return over these two decades, with the trend and long volatility generating similar returns. The factor portfolio generated the lowest return, but was also the least volatile.

Source: FactorResearch

DIVERSIFICATION POTENTIAL

As highlighted, most investment strategies marketed as diversifiers do not offer diversification benefits when needed. For example, merger arbitrage has a low correlation to equity markets when markets are calm, but the correlation spikes when stock markets crash as M&A deals fail. Another example would be senior loan ETFs, which are marketed as inflation hedging instruments uncorrelated to the stock market, but these can be simply replicated with equity exposure (2.5%) and cash (97.5%) (read Hedging Market Crashes with Factor Exposure).

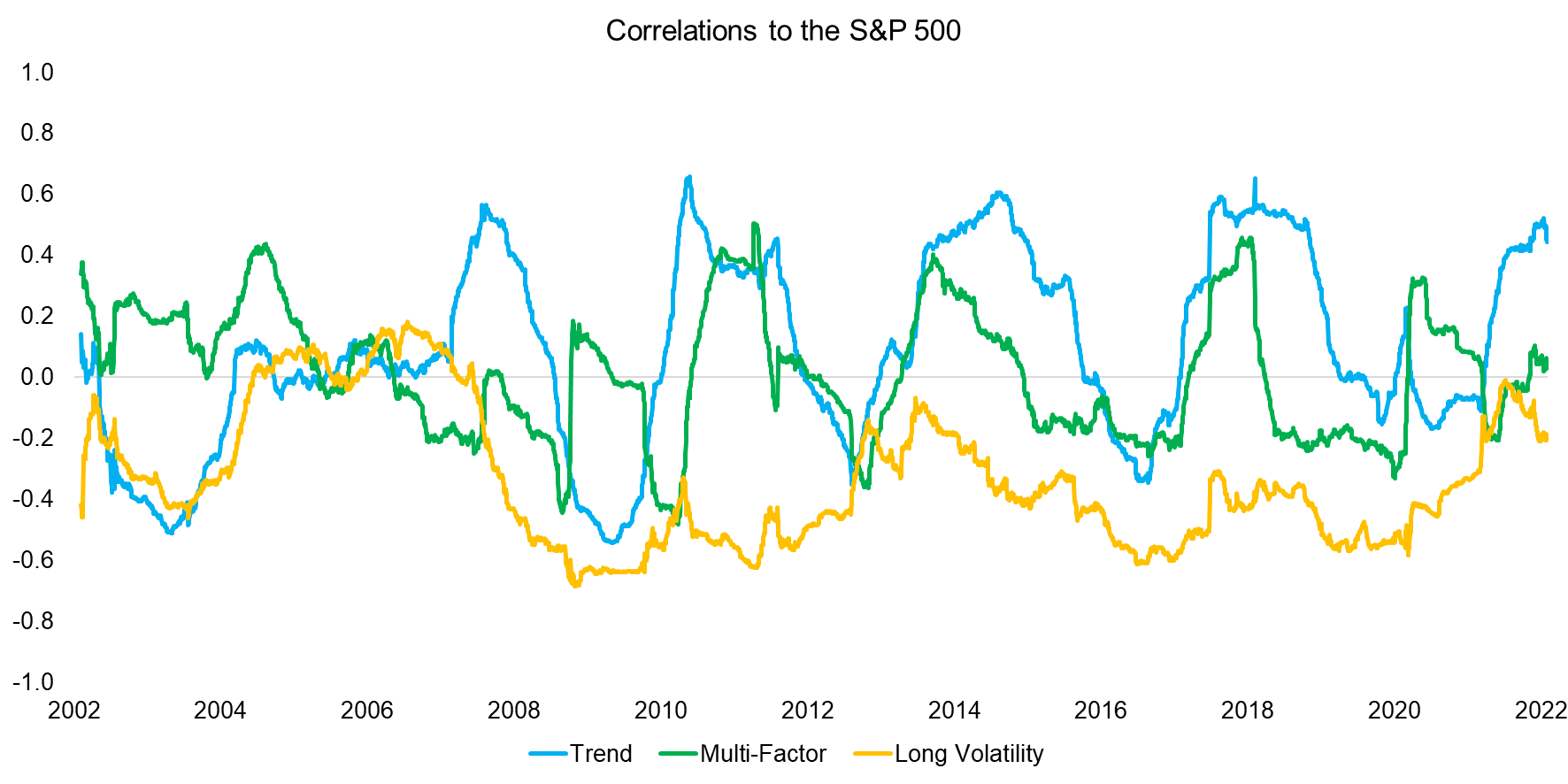

Calculating the correlation of the three diversifying strategies to the S&P 500 provides an interesting perspective. The average correlation between 2000 and 2022 was approximately zero for trend (0.1) and multi-factor (0.0), while slightly negative (-0.3) for long volatility. However, while the correlation of long volatility was consistently negative, it oscillated strongly for trend and multi-factor, which occasionally resulted in moderately positive correlations to stocks.

Source: FactorResearch

It is also interesting to note that the correlation of trend and multi-factor to the S&P 500 moved parallel at times, which questions how uncorrelated these strategies are, but this is a topic for another research note.

ASSET ALLOCATION OPTIMIZATION

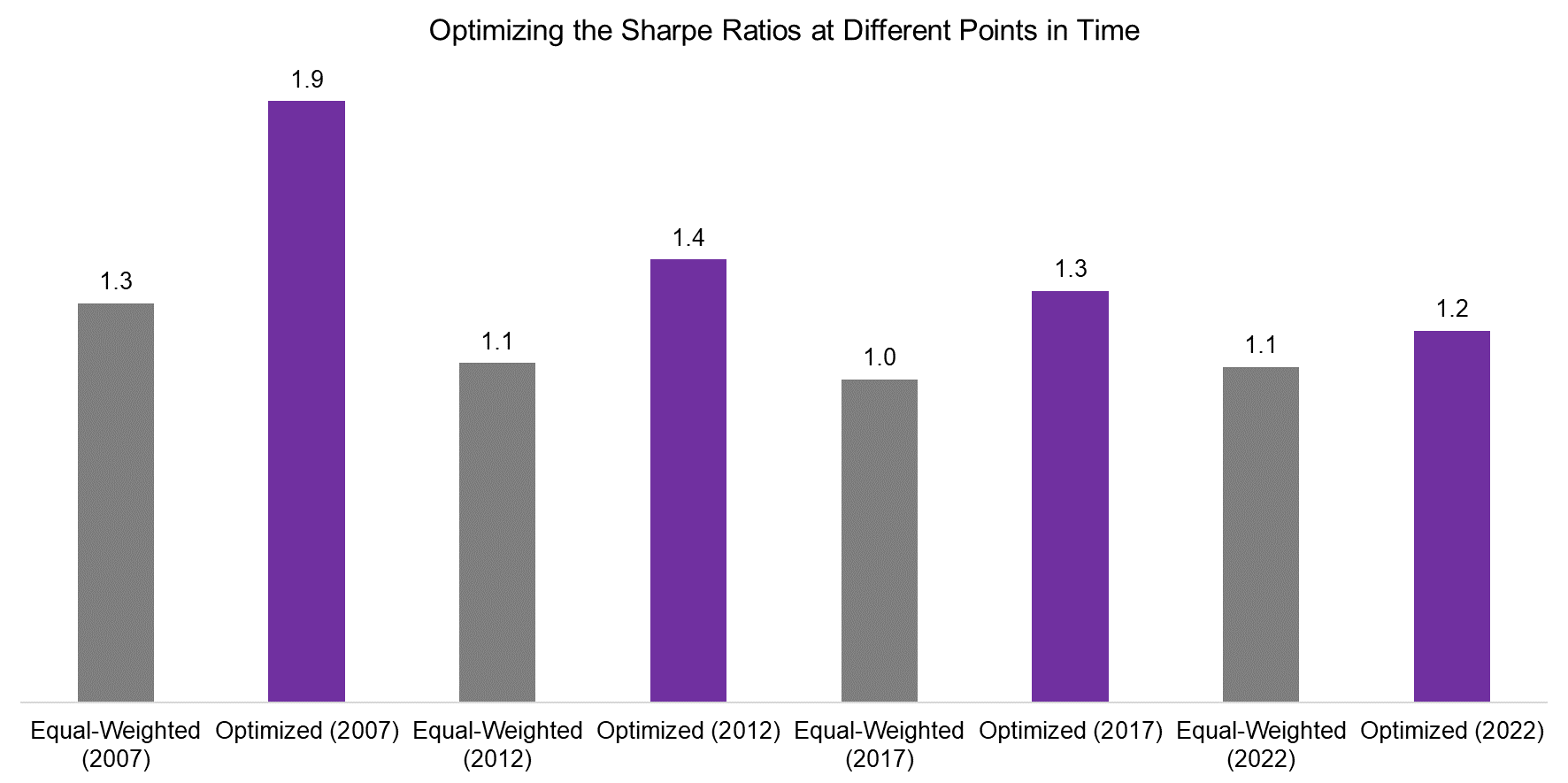

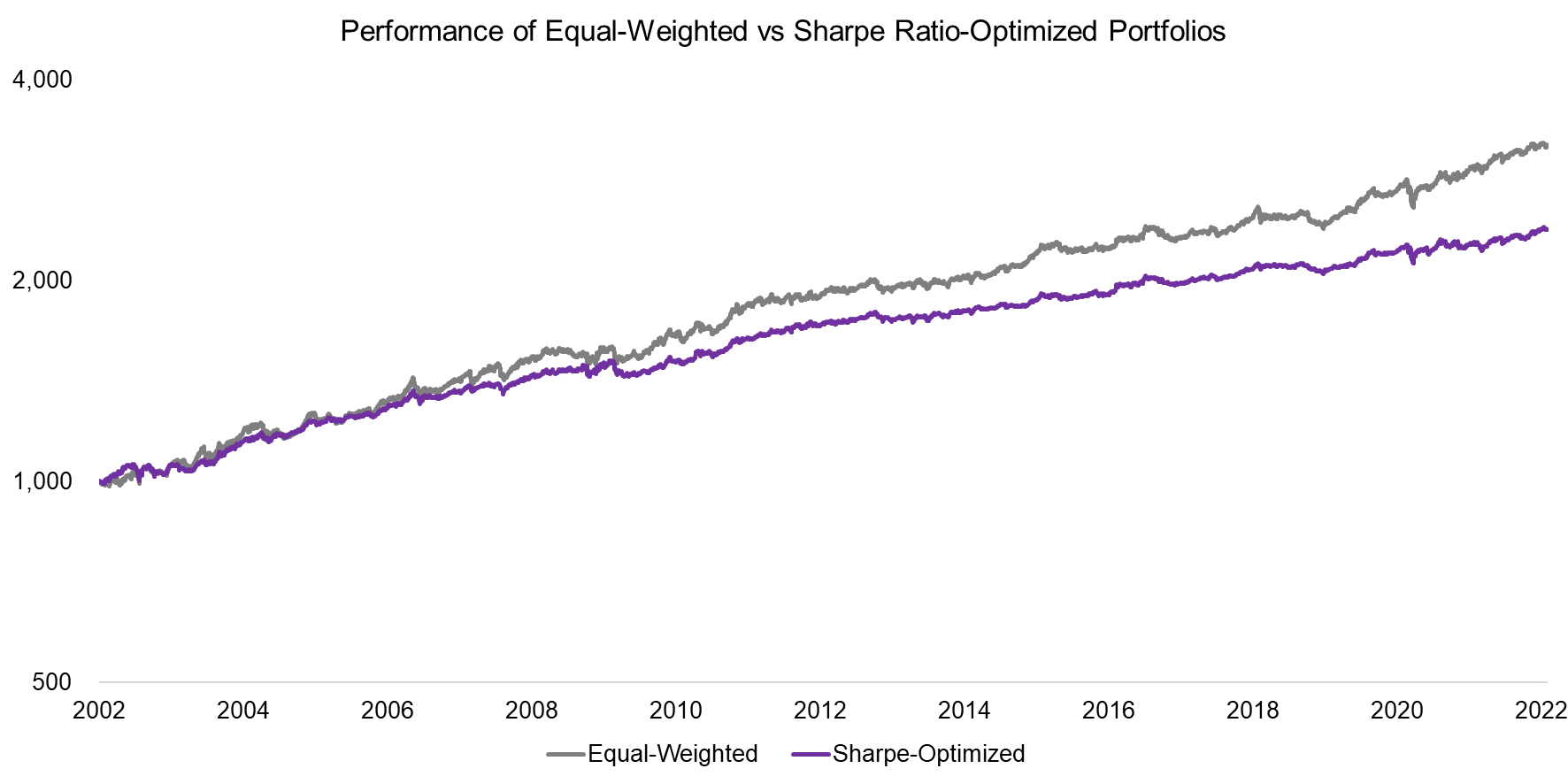

The correlations of the three diversifying strategies were acceptable on average and returns were uncorrelated to stocks during crisis periods like 2009, which raises the question of how to allocate to these. There are many asset allocation frameworks and we will only contrast two: equal-weighted versus Sharpe ratio-optimized. We are keenly aware that Sharpe optimization does not work well out-of-sample, so this is more out of intellectual curiosity rather than a strong belief in the methodology.

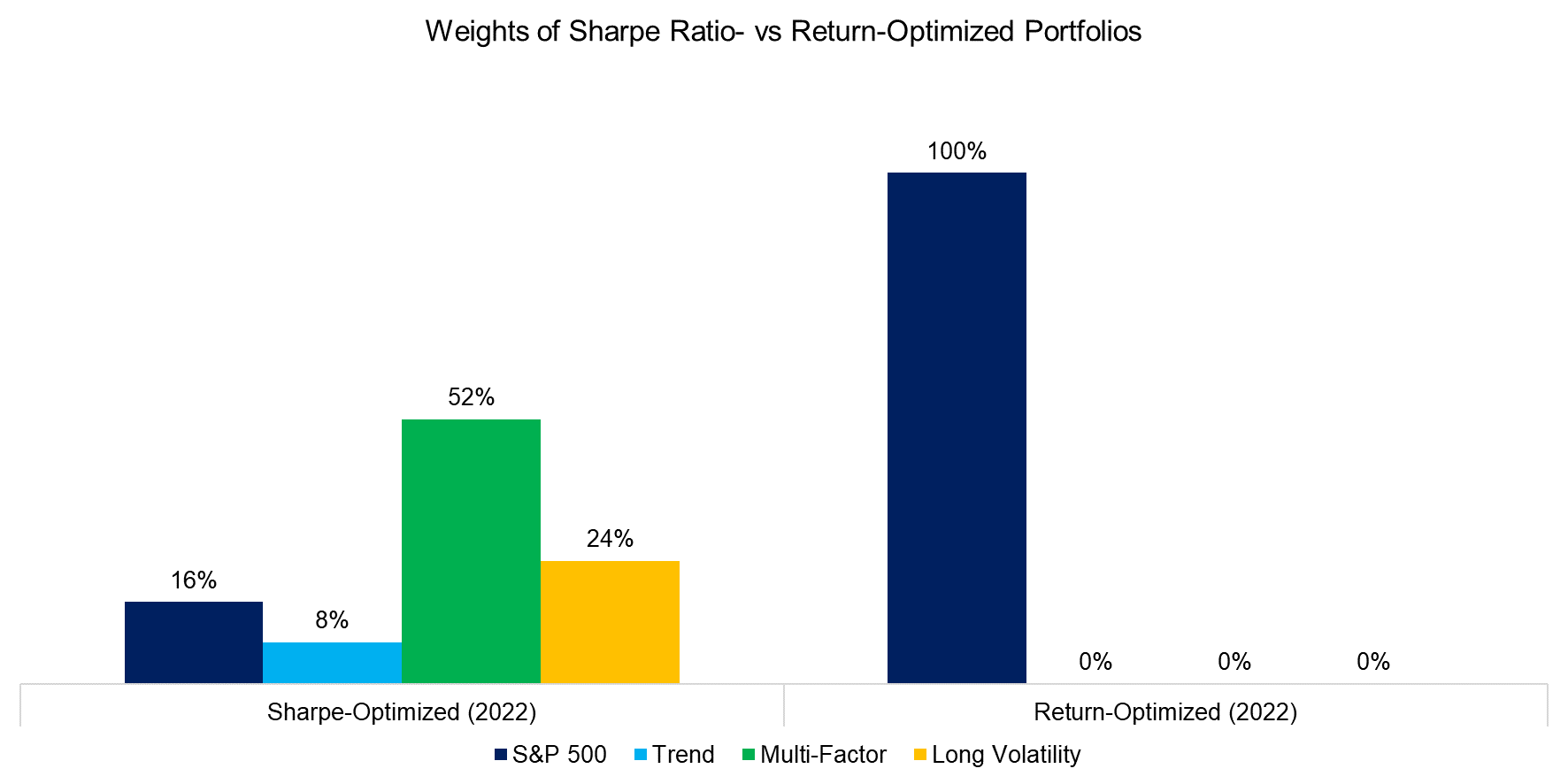

We run Sharpe ratio optimizations every five years with an increasing lookback, so in 2022 we have two decades of data. The portfolio consists of the S&P 500, trend, multi-factor, and long volatility, where no short positions nor leverage are allowed. Given that we are optimizing the weights to maximize the Sharpe ratio, we observe that the Sharpe ratio was consistently higher for the optimized than the equal-weighted portfolios.

Source: FactorResearch

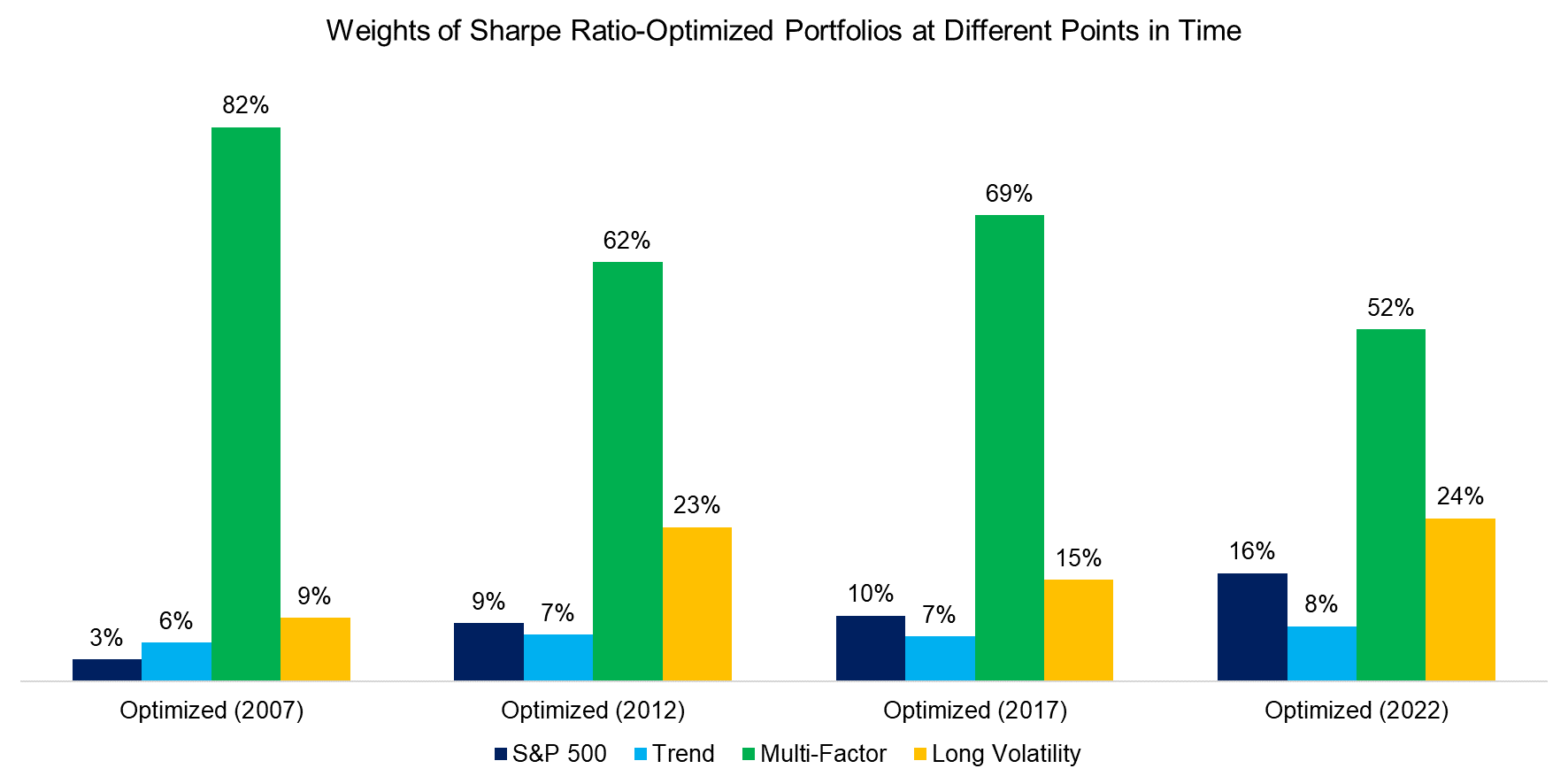

Analyzing the weights resulting from the Sharpe ratio-optimizations highlights that the portfolios were dominated by the multi-factor allocation, which had the highest Sharpe ratio (0.6) of the four asset classes. However, it is worth noting that its allocation reduced over time and the portfolio has become more diversified. The allocation to equities was remarkably small and below 20% in all scenarios.

Source: FactorResearch

Although it is great to achieve a high Sharpe ratio, most investors are primarily interested in returns. It is a poor approach to optimize a portfolio for the highest returns, but for the sake of curiosity, we run this scenario.

Somewhat unsurprisingly, a return-optimized portfolio would consist of 100% allocation to equities. Naturally, this included drawdowns larger than 50% over the last 20 years, which makes this a strategy difficult to execute for most investors. Also, given high valuations and low expected growth, the outlook for equity returns is low to negative in the medium to long-term.

Source: FactorResearch

Returning to the question of how to allocate to these strategies: the performance of an equal-weighted portfolio was comparable to that of a Sharpe ratio-optimized portfolio. However, most optimizations fail out-of-sample, so that makes little sense from the outset.

We could also consider risky parity, but that may require leverage, depending on the implementation, which introduces additional complexity. Perhaps the best approach is the simplest one, ie an equal-weighting.

The performance of such a diversified portfolio would have been highly consistent across time with drawdowns below 10%, compared to 55% for the S&P 500 during the global financial crisis. Naturally, this analysis includes theoretical returns and excludes transaction costs, so the returns do require discounting as all backtested returns.

However, it should be a portfolio that does well in various kinds of economic and market environments as it provides exposure to up and down trends of diverse asset classes, exploits human behavior, and gives equity and long volatility exposure.

Source: FactorResearch

FURTHER THOUGHTS

How easy is it to implement such a portfolio?

For institutional investors, there are few hurdles to implementation as the products are readily available. For other investors, it is more challenging, but not impossible. In the US there are ETFs that provide exposure to trend following and beta-neutral multi-factor investing. Most complicated is the long volatility strategy as there are few products available, although the strategy can be replicated via futures when taking gold and JPY/AUD as proxies.

Most challenging is that it is a forward rather than backward-looking portfolio. The equity position is reduced to a minority position and it is questionable if bonds should be included at all, with both asset classes looking great in the rear mirror.

In contrast, none of the three diversifying strategies have generated attractive returns over the last decade. Having said this, fortune favors the bold.

RELATED RESEARCH

Managed Futures: Fast & Furious vs Slow & Steady

Liquid Alt Juggernauts: Worth their Salt?

60/40 Portfolios Without Bonds

Aging & Equities: Selling Stocks for the Long-Term

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.