Building a Long-Term Equity Portfolio

Market timing via factor investing

November 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- With a long-term time horizon, investors should consider alternatives to the market-cap weighted equity indices

- A valuation-based approach for creating an equities portfolio may seem more sensible

- Using EBITDA / EV yield seems to avoid some of the quality issues of other value metrics

INTRODUCTION

All the evidence points to active management providing negative alpha and most investors being best off by simply holding an ETF for their equity allocation. The cost for a market cap-weighted global equities index has become negligible and the position would only require occasional rebalancing within a diversified portfolio. Sweet and simple.

However, in the context of a long-term equity allocation, a market-cap-weighted index can be viewed as sub-optimal. Although market-cap-weighted indices like the S&P 500 have been the winning methodologies of portfolio construction over the last two decades, expanding the horizon to almost a century highlights that equal-weighted portfolios have performed better (read Equal vs Market Cap-Weighted Portfolios in Stock Market Crashes).

The downside of market-cap-weighted indices is that these often become expensive as the multiples of the largest companies tend to be above average, which has been particularly astute in recent years. Various market ratios like price-to-sales or cyclically-adjusted price-to-earnings show the S&P 500 trading at record valuations.

Adopting an equal-weighted equities portfolio will mitigate this partially, but with a long-term investment horizon, we can also consider a factor-based weighting methodology that will likely result in an even greater tracking error to standard benchmarks.

In this research note, we will create a global equities portfolio based on a value approach. The aim is to create a portfolio that is supported by academic research, easy to implement, maintain, and hold across a market cycle.

VALUE FIRST APPROACH

We define the investible universe as all stocks globally trading with a market capitalization above $1 billion, which results in almost 10,000 securities. Given the overwhelming academic evidence for cheap stocks outperforming expensive ones in the long term, we want to select stocks that are trading at low valuations (read Mapping My Mind: Value Factor).

We will ignore price-to-book and price-to-earnings ratios for stock selection as the former often represents stale accounting values and the latter is easy for management to manipulate. Instead, we select stocks on the EBITDA-to-enterprise value (EV) yield that highlights the cashflow generation ability of companies. There are downsides to using this metric as it is not applicable for banks or insurance companies that have interest as their main source of revenue, and is backward-looking, but there is no valuation metric without flaws.

First, we rank all stocks by their EBITDA yield and windsorize the top 1% to eliminate extreme yields that usually represent accounting irregularities. Then, we select the top 50 stocks and equal weight these as that represents a diversified portfolio with relatively minimal firm-risks. The resulting portfolio features companies with EBITDA yields ranging between 12% and 14%, which are still exceptionally high when compared to the iconic companies of this age, e.g. Apple sports a meager 2.5%, Amazon 1.2%, and Tesla close to 0%.

So what kind of companies are we buying?

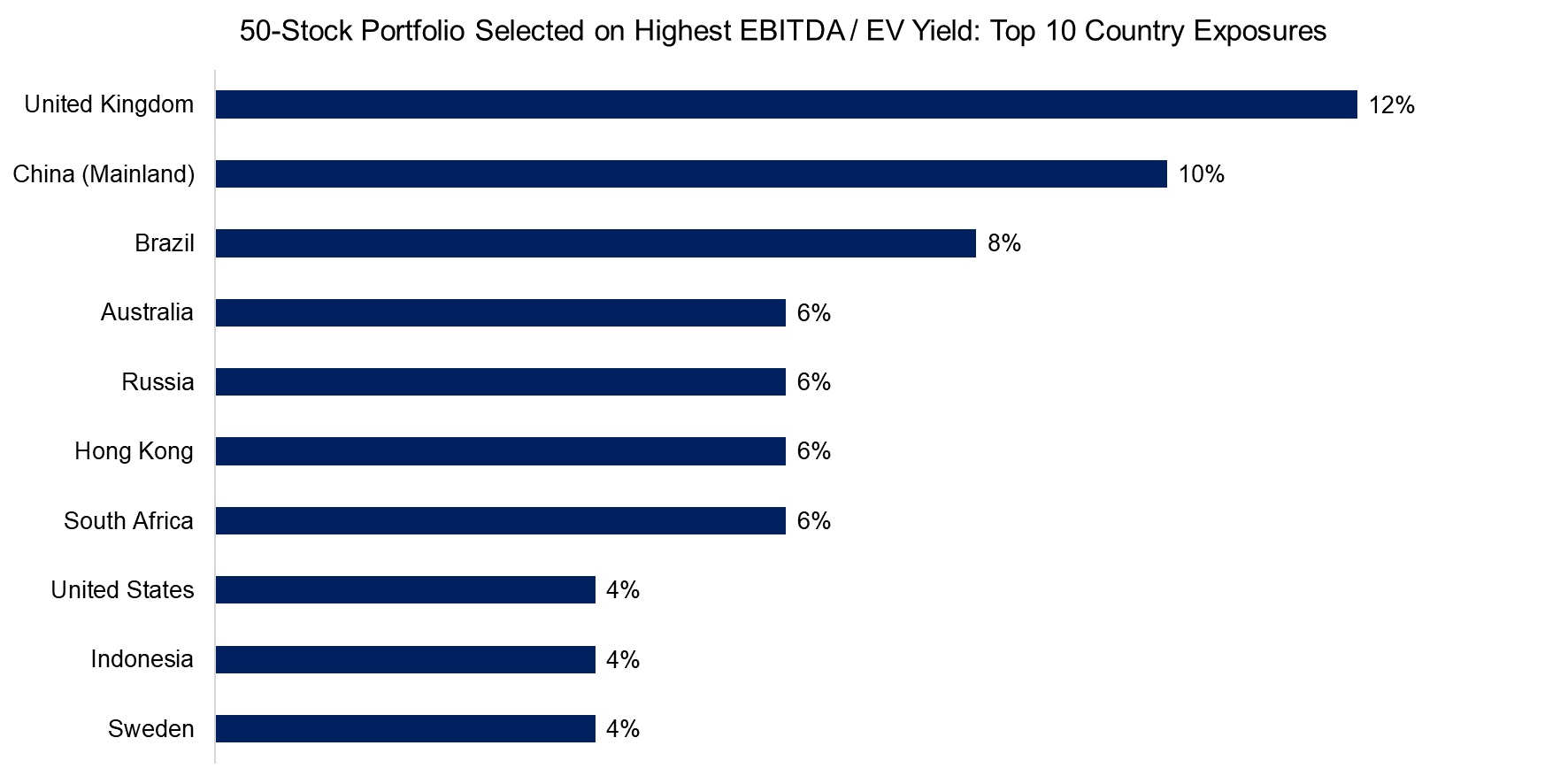

Intuitively an investor might suspect pure emerging markets exposure given the high yields, but most companies are based in the UK. However, analyzing these companies reveals that although these are headquartered in the UK, most do the majority of their business elsewhere. The list of top 10 countries is dominated by emerging markets and commodity-exporters like Australia or South Africa.

Source: FactorResearch

BREAKDOWN BY SECTORS

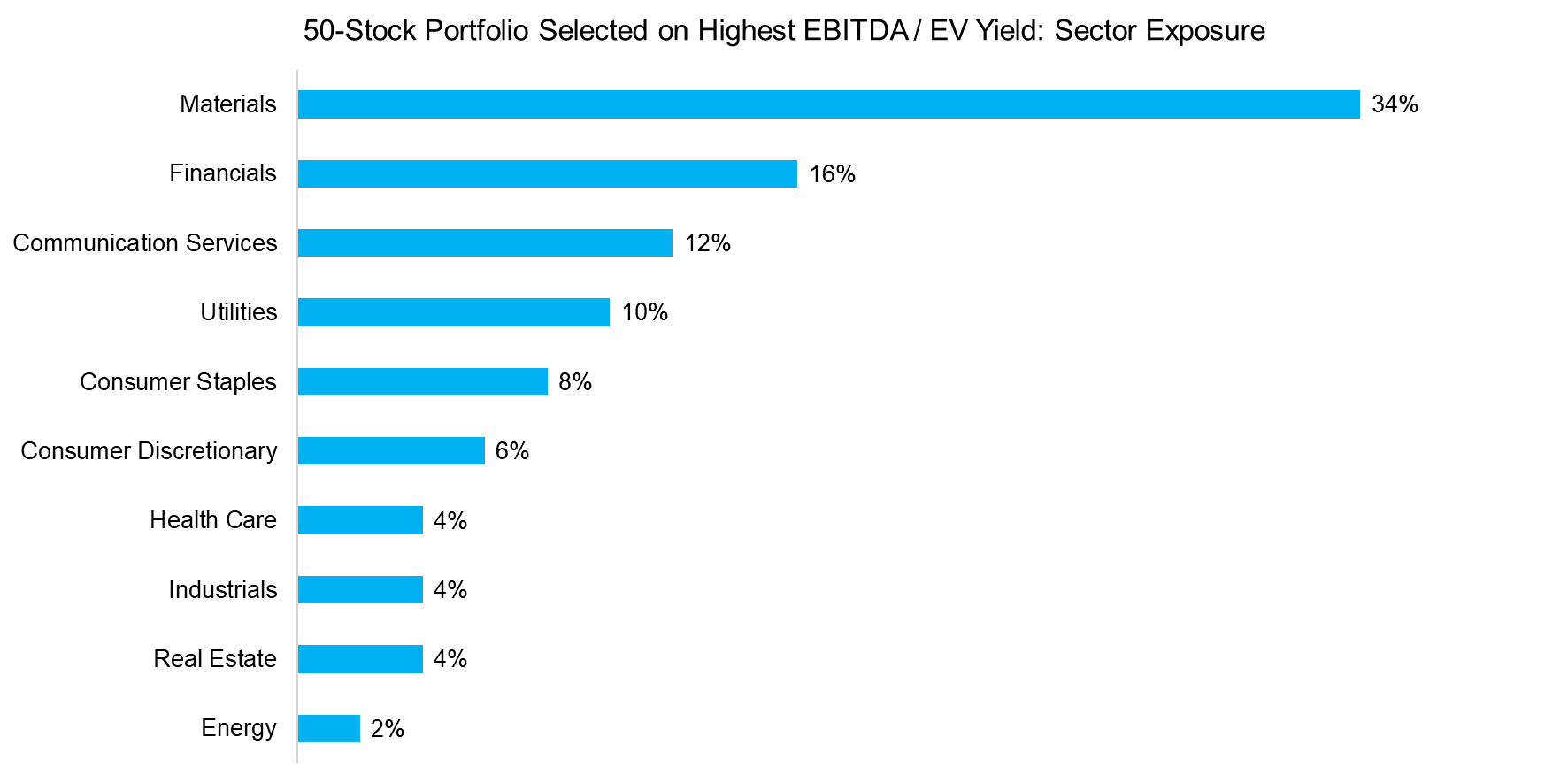

Next, we analyze the exposure to sectors as ideally we want a portfolio diversified across different types of businesses. However, we observe that two sectors, materials and financials, contributed 50% of the stocks. High exposure to financials is common in value portfolios based on price-to-book ratios, but less expected when using EBITDA yield for stock selection.

The large number of materials stocks perhaps reflects the structurally high risks of these companies. They often operate in politically unstable countries like the Democratic Republic of Congo and are heavily exposed to the commodity cycle. However, it is worth noting that the Dow Jones Commodity Index is trading at the highest level in a decade, which should provide a positive tailwind for these companies.

Source: FactorResearch

GROWTH CHARACTERISTICS

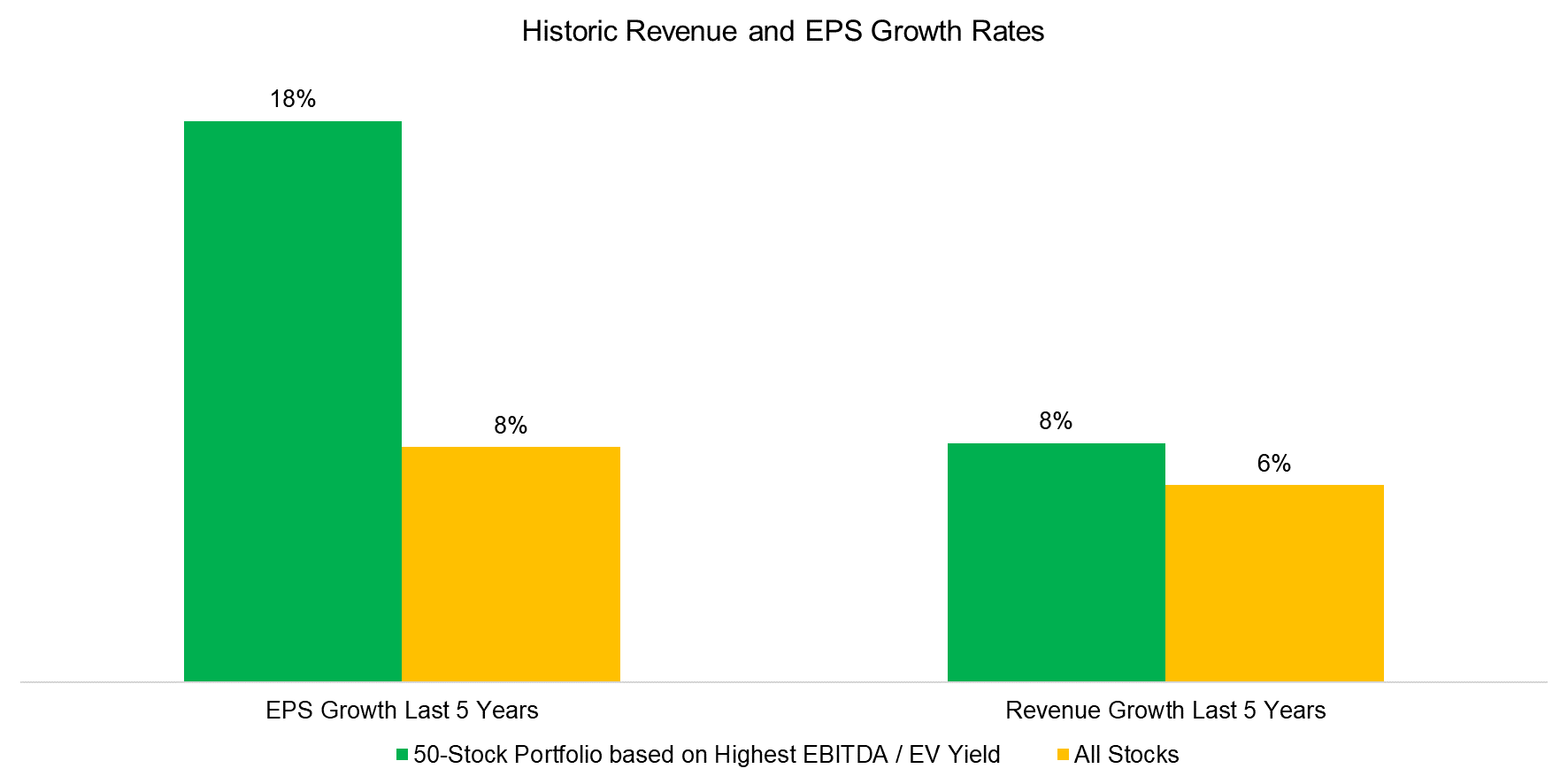

Given that we selected stocks trading at high EBITDA yields, most investors’ base assumption is that these feature low growth. In contrast, companies with high growth rates should be trading at low yields. Cheap companies are typically trading cheaply for a reason, which is often reflected in declining sales and earnings.

However, the median 5-year EPS and sales growth of the 50-stocks selected on EBITDA yield was higher than the median growth rates of all stocks. It seems compared to traditional value portfolios selected on price-to-book or price-to-earnings, these companies are not the typical value traps that represent deteriorating business with little hope for the future.

Source: FactorResearch

QUALITY CHARACTERISTICS

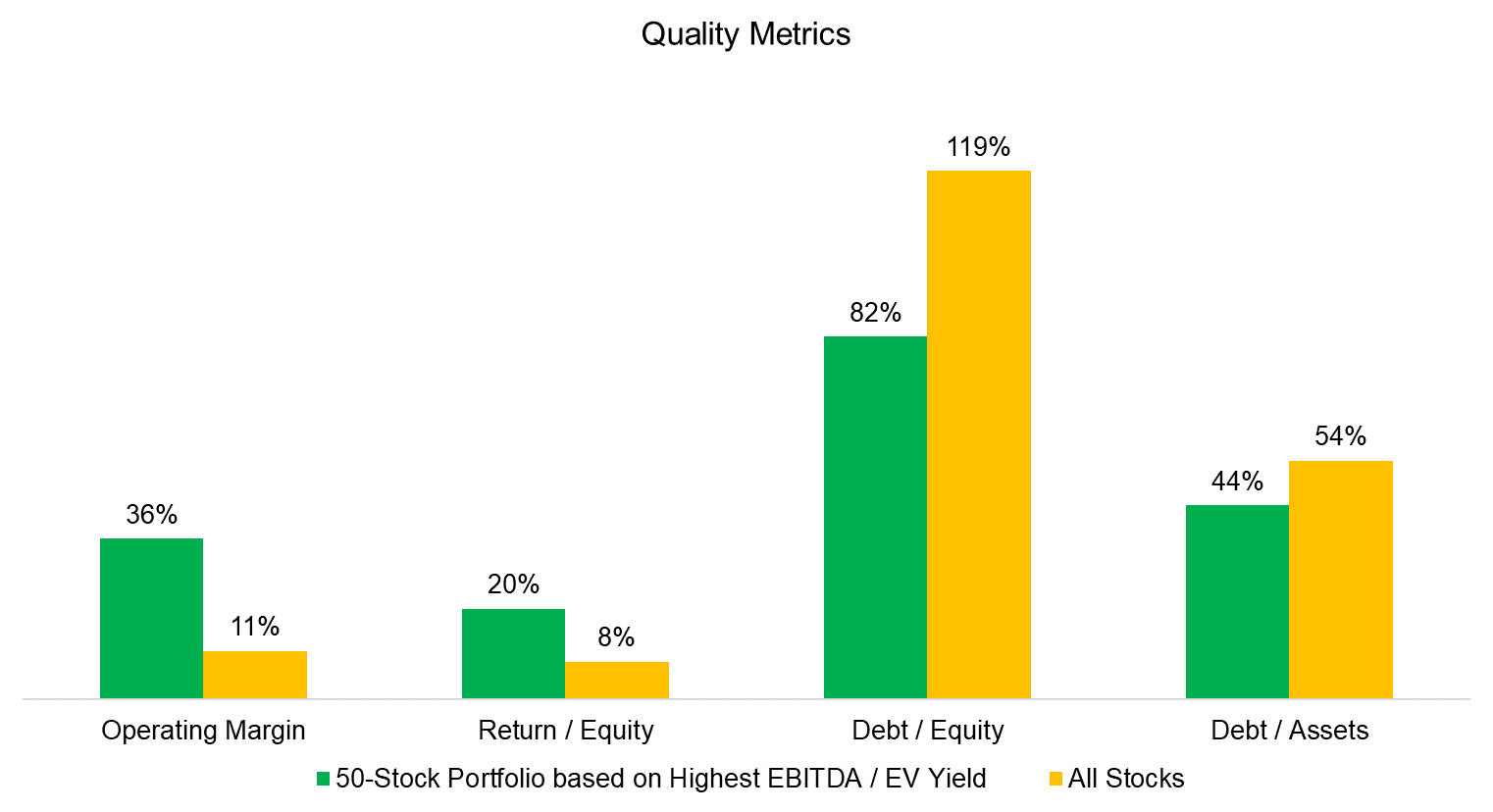

Finally, in addition to analyzing the growth rates, we should also investigate if we are buying companies that feature poor profitability or impaired balance sheets. Interestingly, operating margins and return-on-equity were higher, while debt-over-equity and debt-over-assets were lower for the portfolio selected on EBITDA yield compared to the median across all stocks.

Selecting stocks on price-to-book or price-to-earnings often returns problematic companies, while selecting stocks based EBITDA yield seems to feature companies with above-average quality characteristics. It is almost standard to add quality filters to a valuation-based stock selection process, but seems unnecessary in this case.

However, it is difficult to explain why selecting stocks based on EBITDA yield does result in a portfolio with favorable quality and growth characteristics. Furthermore, it is questionable if the results of this analysis are random given that we only selected stocks at one point in time, or if selecting stocks based on EBITDA yield structurally returns cheap companies with attractive features.

Source: FactorResearch

How did the portfolio with the highest EBITDA yielding stocks perform over the recent decade? Terrible compared to the S&P 500, as expensive stocks dramatically outperformed cheap ones, regardless of the chosen valuation metric.

We could easily have included a performance chart in this analysis, but it is questionable if an investment framework should be created while viewing past performance. Most investors would view the underperformance as the result of a poor stock selection process, or at least struggle to allocate this. Just because the S&P 500 was the best performing major stock market index over the last decade, does not mean it will be the best choice for the next 10 years.

FURTHER THOUGHTS

Are there more sophisticated ways to create equity portfolios? Certainly. For example, we could easily add other factors like momentum or low volatility. However, each of these increases the complexity of the portfolio, eg momentum leads to a higher turnover. There is beauty as well as robustness in having a simple metric for stock selection.

Cheap stocks are trading very cheaply compared to expensive ones currently. Betting on cheap stocks to outperform expensive over the next 10 to 20 years is a form of market timing, but so is every other investment decision, even buying a market-cap-weighted equities portfolio.

RELATED RESEARCH

Improving the Odds of Value Investing

60/40 Portfolios Without Bonds

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.