Building Better High Yield Portfolios

Balancing diversification and yield

October 2023. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- There is an inverse relationship between yield and total return

- The ideal yield strategy has a high yield, high Sharpe, and low correlation to stocks

- The yield-to-downside beta ratio enhances the strategy selection process

INTRODUCTION

@ChatGPT: “What is a rhyme that includes ‘high dividends are for suckers’?”

@Nicolas: “I’m happy to help with rhymes, but it’s important to note that the phrase ‘high dividends are for suckers’ is a negative and dismissive statement about dividends, which may not be suitable in all contexts. However, if you’d like a rhyme that includes this phrase, here’s one:”

“Though some may say, ‘high dividends are for suckers,’

Investors know, they’re more than mere pluckers.

For steady income, they’re tried and true,

In a diversified portfolio, they come through.”

Although the positive spin from ChatGPT is nice to see, it is doubtful that ChatGPT has analyzed high dividend yield strategies. For example, Global X’s SuperDividend U.S. ETF (DIV) invests in the 50 highest dividend-paying stocks in the U.S. and has managed to generate a 30% total return since its inception in 2013, compared to a 150% increase in its benchmark index namely the Russell 1000 Value Index. In this case, high dividend stocks are for suckers.

Fortunately, investors have plenty of choices when it comes to yielding strategies and do not only need to consider stocks. Ideally, such a strategy offers attractive returns on its own as well as a low correlation to equities.

In this research article, we will explore how to build a better high yield portfolio.

PERFORMANCE OF HIGH YIELD STRATEGIES

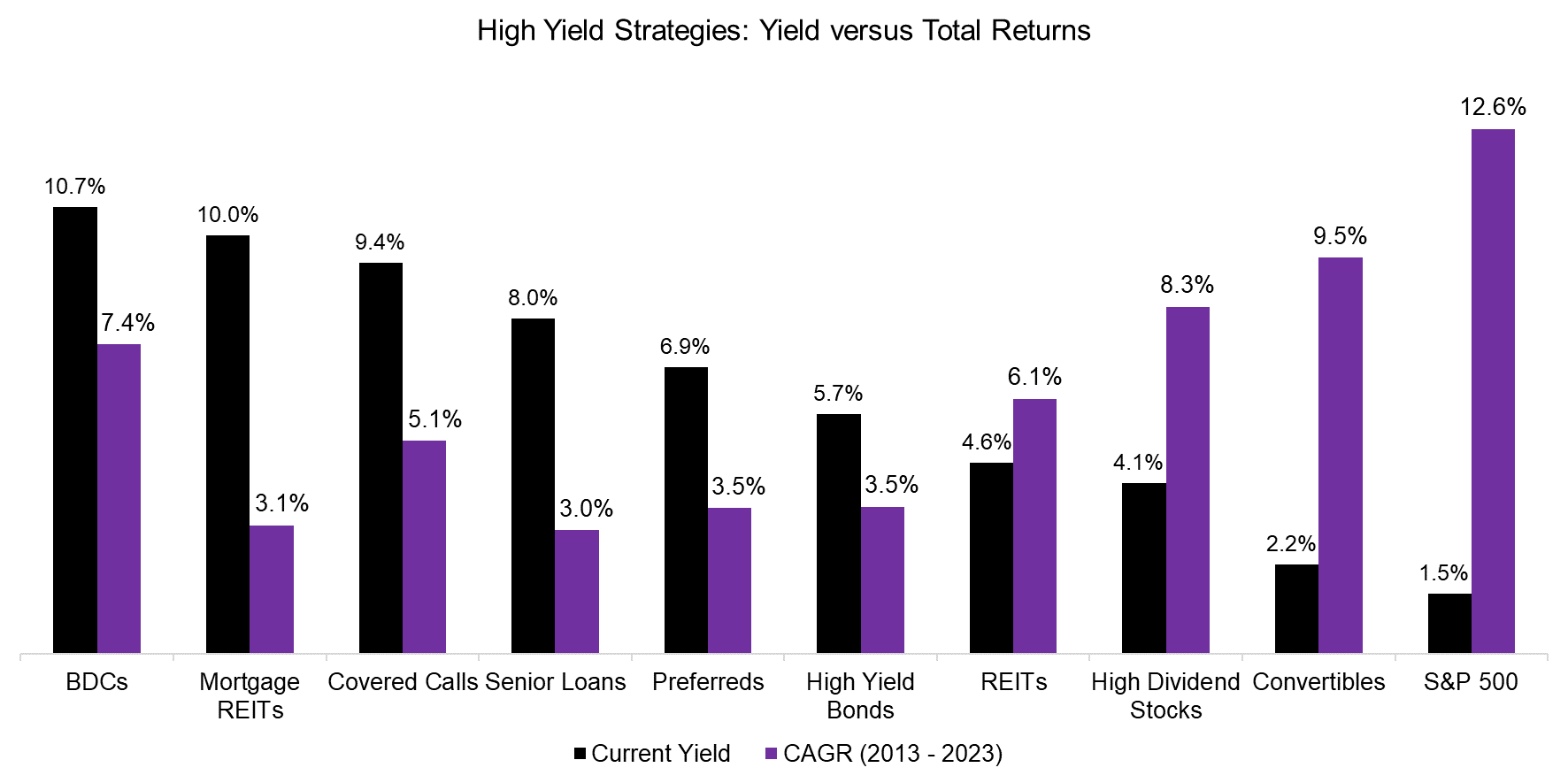

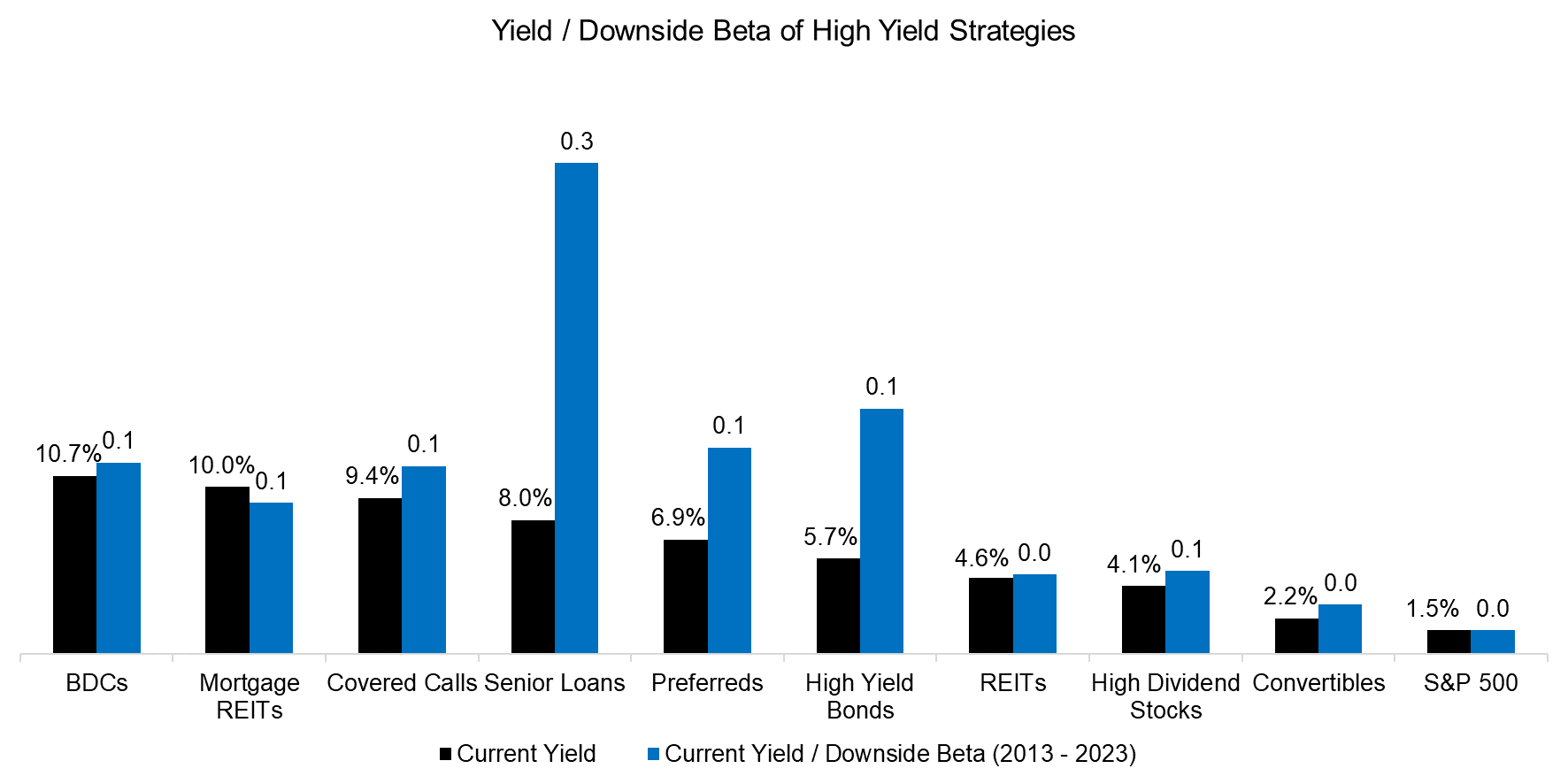

We consider nine well-known yield strategies that offer yields ranging from 2.2% for convertible bonds to 10.7% for business development companies (BDCs) (read BDCs: Better Don’t Choose?). All of these are available via ETFs at annual fees ranging from 0.08% to 11.17%.

First, we compute the CAGRs for the decade ranging from 2013 to 2023 which shows an almost perfect inverse relationship between yield and total return. The higher the yield, the lower the CAGR (read Resist the Siren Call of High Dividend Yields).

Source: Finominal

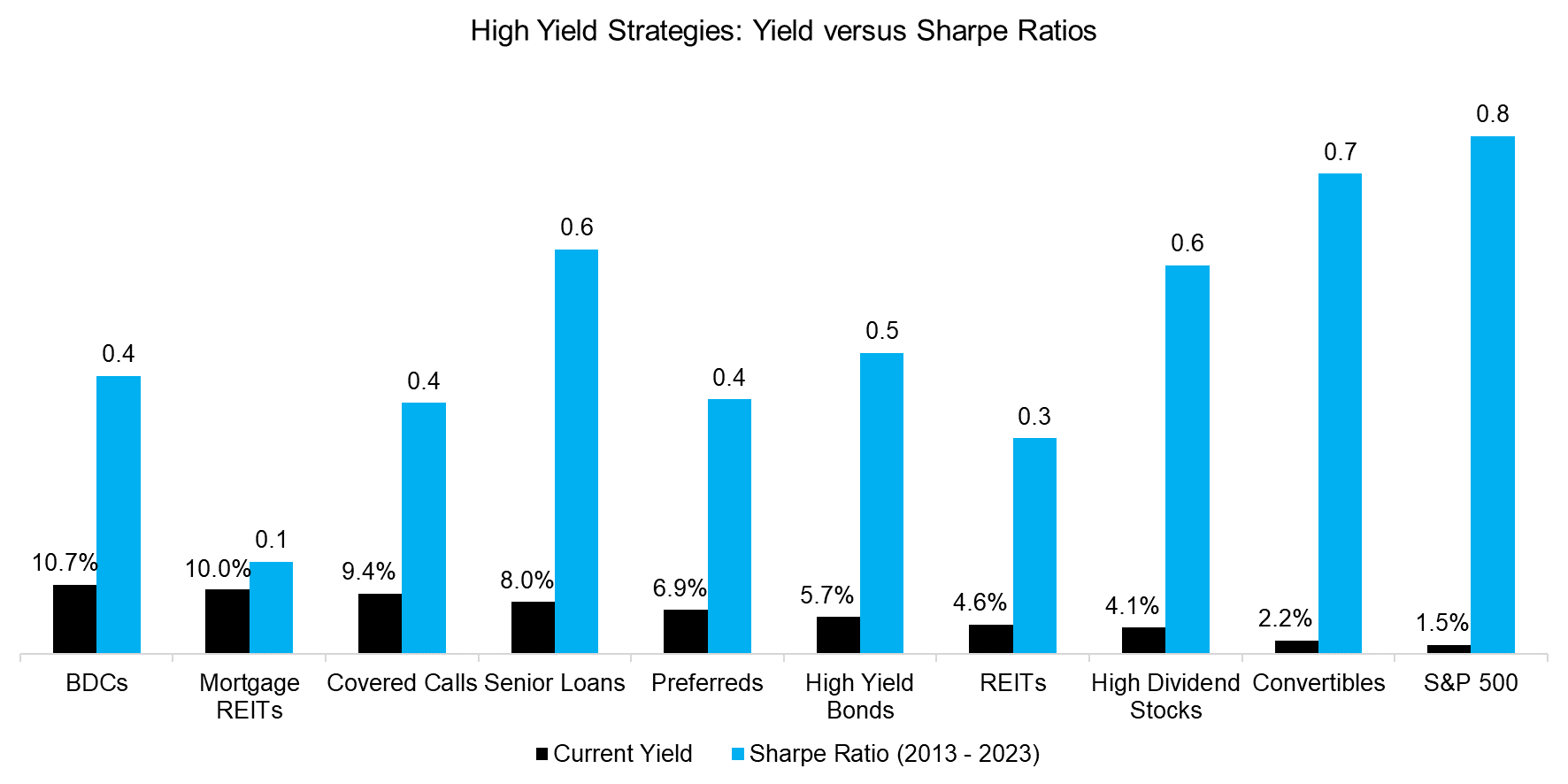

However, some of these strategies like mortgage REITs belong to the fixed income space and their returns will be lower than those of equity-focused strategies. Given this, we calculate the Sharpe ratios for all strategies for the last decade, but that also highlights that lower yielding strategies like convertibles generated higher Sharpe ratios than BDCs. It is worth noting that the S&P 500, which offers the lowest yield at 1.5%, features the best Sharpe ratio at 0.8.

Source: Finominal

CORRELATION ANALYSIS

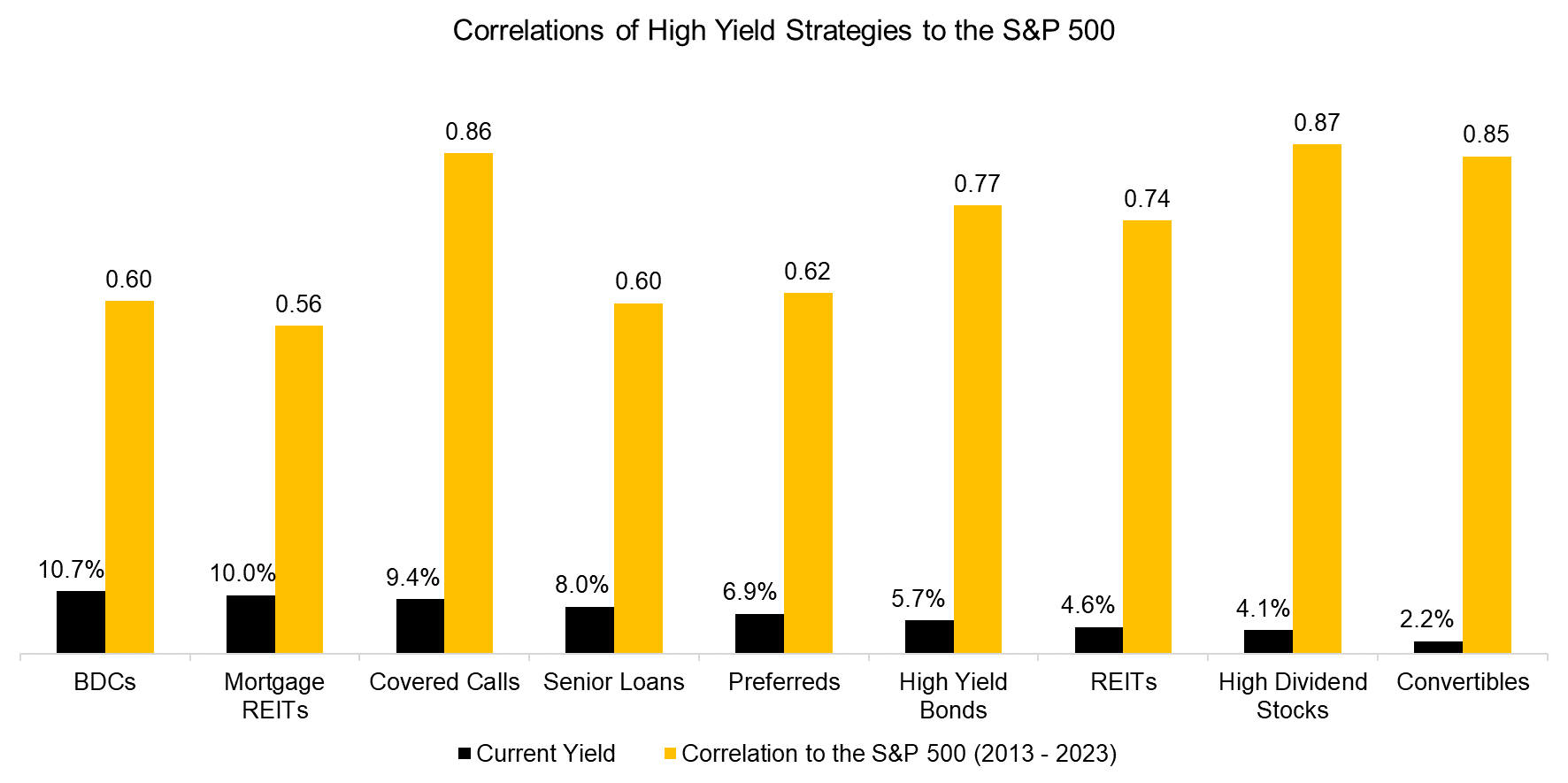

Positive absolute and attractive risk-adjusted returns are important criteria in the strategy selection process, but ideally, these returns are also lowly correlated to the stock market. Computing the correlations of the nine high yield strategies to the S&P 500 shows that all were moderately to highly correlated, which indicates limited diversification benefits.

High dividend stocks and covered call strategies featured the highest correlation at 0.87 respectively 0.86, while mortgage REITs and senior loans were least correlated, albeit still positively at 0.56 respectively 0.60.

Adding these strategies to an equities portfolio will increase the yield, but it will likely lower the return and represent more of the same risk exposure for most of these.

Source: Finominal

UPSIDE VERSUS DOWNSIDE BETAS

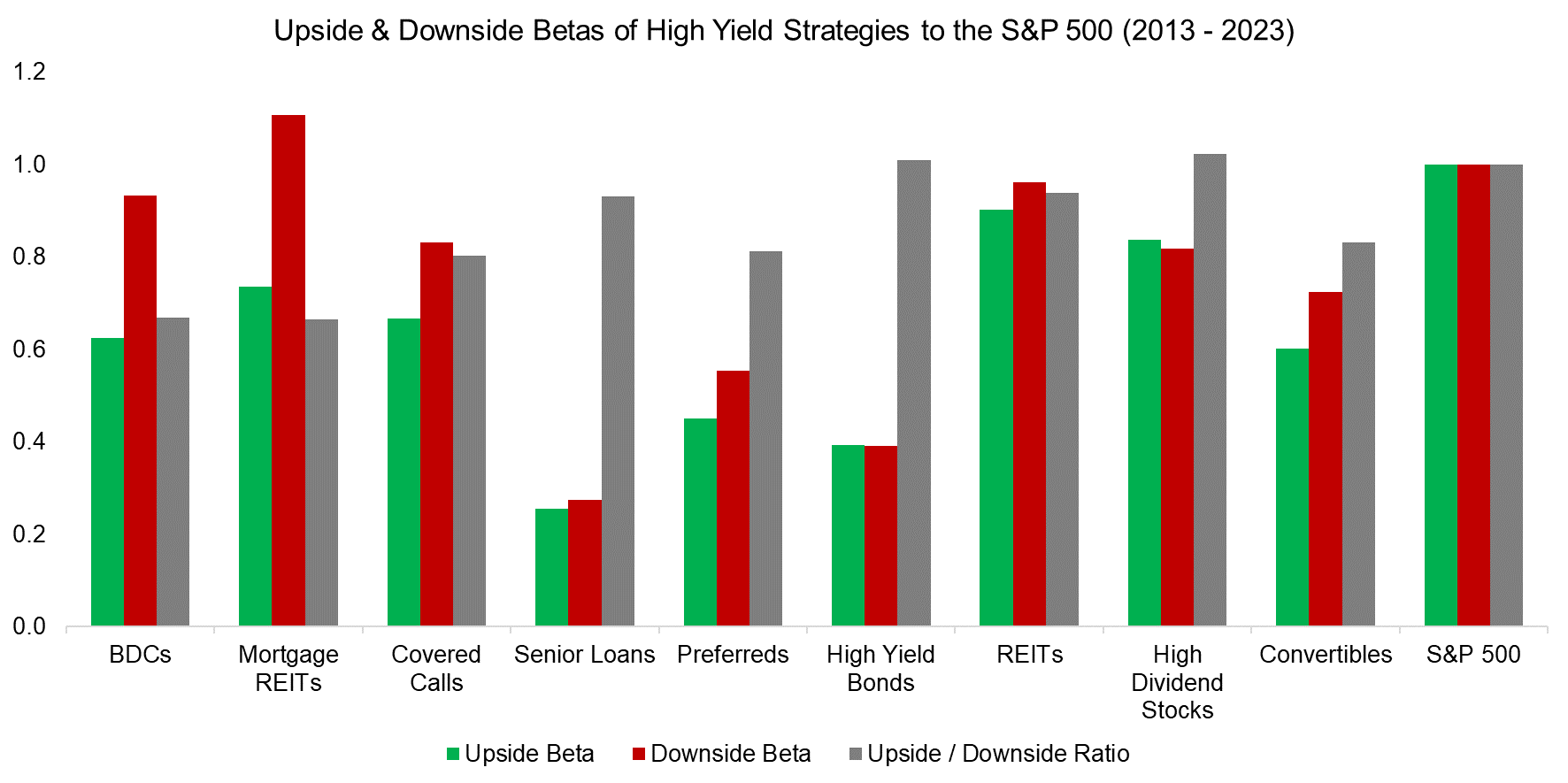

A correlation analysis can be complemented by measuring the upside and downside betas to the S&P 500. Correlations often spike in periods of crisis, which is better captured by differentiating the betas by stock market regimes.

We observe that BDCs, mortgage REITs, covered call strategies, preferreds, and convertibles lost significantly more when the stock market dropped than they gained when it increased over the last 10 years, which makes these less attractive strategies. Senior loans, high yield bonds, REITs, and high dividend stocks feature more neutral upside-to-downside beta ratios.

Source: Finominal

YIELD VERSUS DIVERSIFICATION BENEFITS

The ideal yield strategy should featured a high yield, a high Sharpe ratio, and a low correlation or downside beta to the S&P 500. However, combining these three criteria into one metric is challenging. Therefore, we focus on maximizing the yield and diversification benefits by dividing the current yield by the downside beta over the last decade, which puts senior loans into the spotlight, followed by preferreds and high yield bonds.

Source: Finominal

CREATING DIVERSIFIED HIGH YIELD PORTFOLIOS

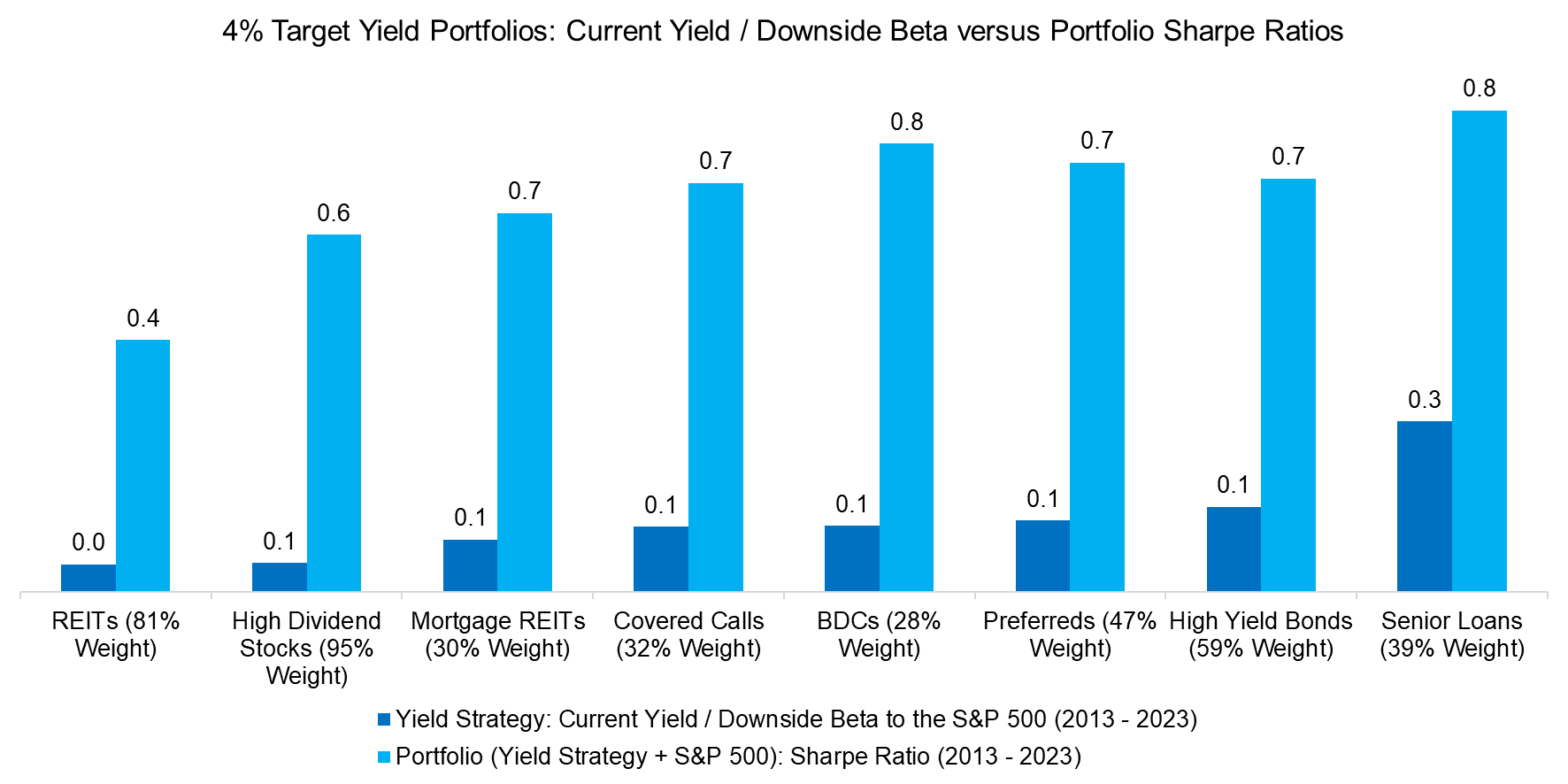

Finally, we create portfolios comprised of the S&P 500 and each of the high yield strategies with a 4% target yield.

The weights of the high yield strategies in the portfolios vary given different yields, but we observe that the yield-to-downside-beta metric would have been useful in the strategy selection process as that approximately maximized the Sharpe ratio of combination portfolios.

REITs and high dividend stocks feature the highest correlations to the S&P 500 and, therefore generated the lowest diversification benefits. In contrast, senior loans were lowly correlated and offer a high yield, therefore were more attractive when combined with equities (read Analyzing Floating Rate ETFs & The Case Against REITs).

Source: Finominal

FURTHER THOUGHTS

Some regard the sovereign wealth funds as the mightiest investors in the capital markets, but when it comes to yield, it likely is Mrs Watanabe, which is the synonym for the thousands of Japanese housewives that borrow yen and invest in higher-yielding currencies like the Australian dollar. Given the ageing global population, the desire for yield strategies will increase as people in retirement tend to prefer income over capital growth.

While this is comprehensible, investors constantly need to remind themselves that there is no free lunch and high yields do come with high risk. None of the nine yield strategies we analyzed offered higher absolute or risk-adjusted returns than the S&P 500 over the last decade.

As we pointed out before, investors can simply create dividends synthetically by selling small stakes of their equities portfolio. The return of capital does not need to be sacrificed for return on capital.

RELATED RESEARCH

Don’t Convert to Convertible Bonds

BDCs: Better Don’t Choose?

Covered Call Strategies Uncovered

Preferential Times for Preferred Income Strategies?

Analyzing Floating Rate ETFs

The Case Against REITs

The Case Against Equity Income Funds

Resist the Siren Call of High Dividend Yields

Dividend Yield Combinations

Value Factor: Improving the Tax Efficiency

Factor Exposure Analysis 101: Linear vs Lasso Regression

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.