Building Better High Yield Portfolios – II

Balancing diversification and yield

May 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The higher the yield, the lower the total return on average

- Combining the highest yielding strategies leads to risky portfolios

- Combining high yielding but uncorrelated strategies is more sensible

INTRODUCTION

We previously highlighted an almost linear inverse relationship between an investment strategy’s yield and its total return (read Building Better High Yield Portfolios). Investors, especially retail, continuously sacrifice the return of capital for the return on capital.

Theoretically, investors could create dividends synthetically by holding the S&P 500 and systematically sell parts of the allocation to get a desired dividend yield (read Do-It-Yourself High-Dividend Strategies), which would have resulted in a higher total return historically and also be more tax-efficient compared to high yielding strategies. However, for most investors, this is rather abstract and they prefer traditional and alternative sources of yield.

We will continue to explore how to build better high yield portfolios in this research article.

YIELD VERSUS TOTAL RETURNS

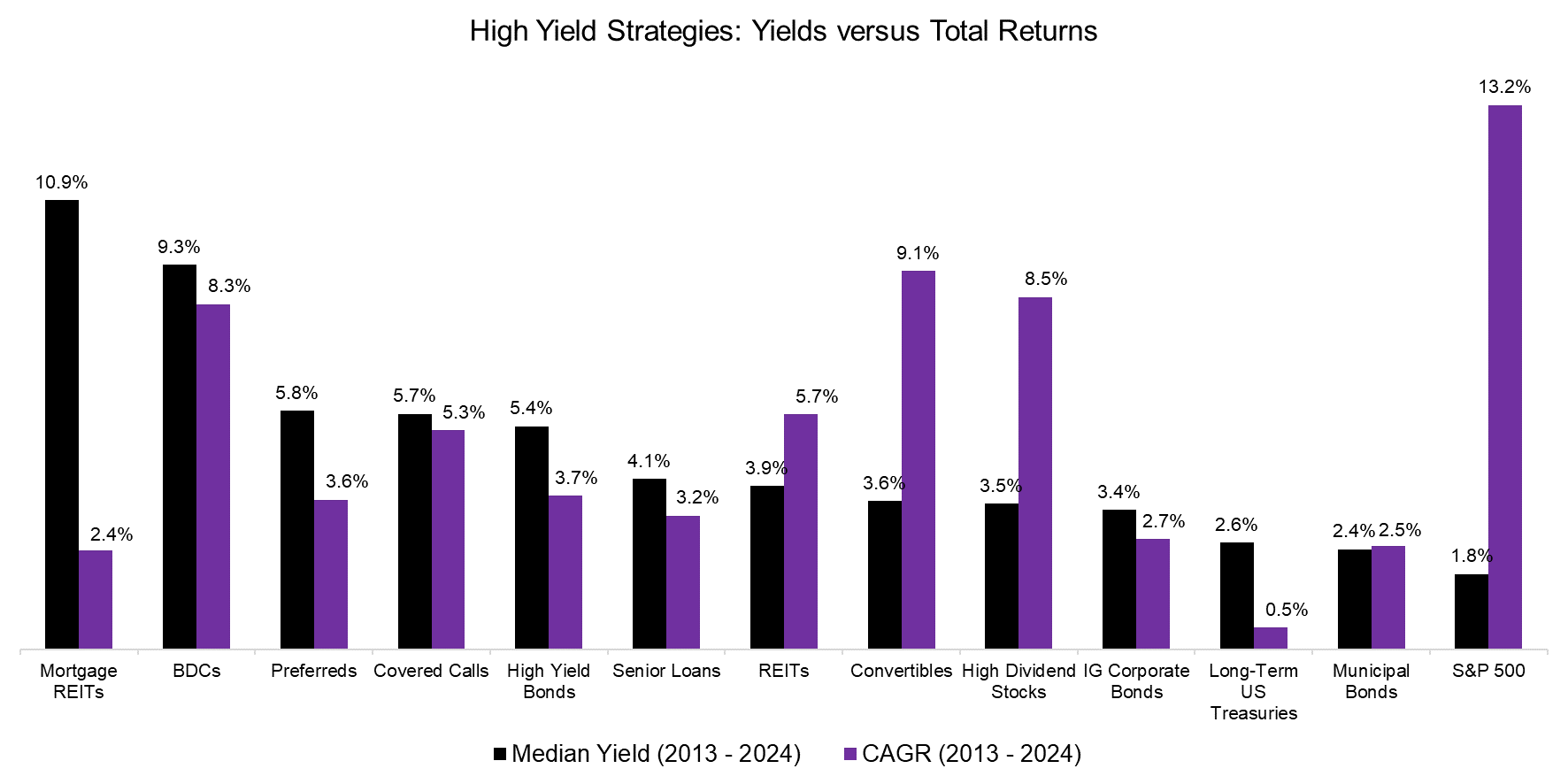

In this analysis, we include a variety of equity and fixed-income strategies and asset classes that are available as ETFs. First, we compute the CAGRs and contrast that to the median yield for the period from 2013 to 2024, which shows approximately an inverse relationship. For example, the S&P 500 had the highest return and the lowest yield, compared to mortgage REITs which exhibited the highest yield and one of the lowest total returns.

Naturally, total return is what investors should care about.

Source: Finominal

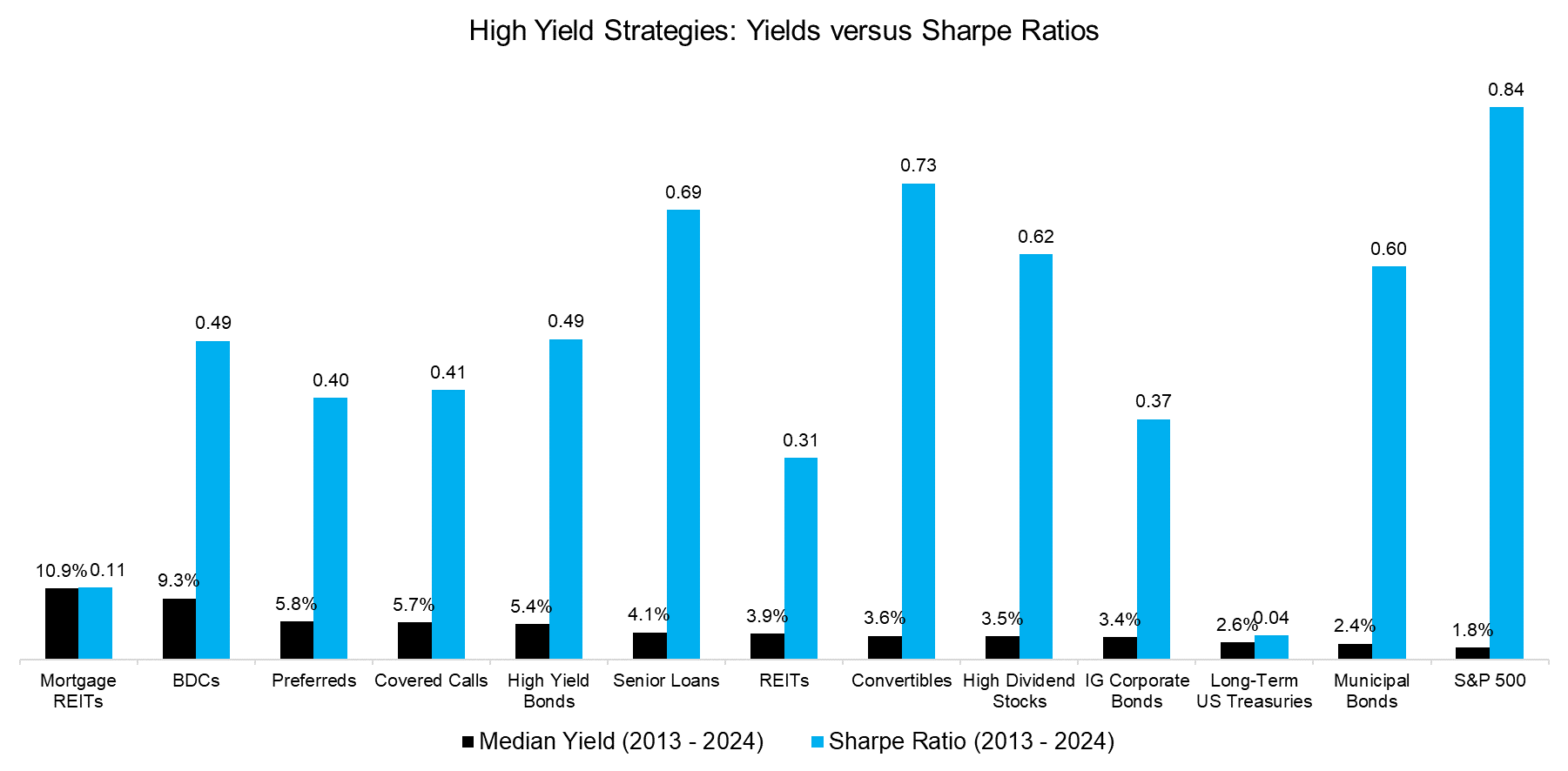

Given that many of these strategies belong to the fixed income space, we should expect lower returns than for the S&P 500 and focus on the risk-adjusted returns. However, computing these highlights that none of the 12 strategies achieved a higher Sharpe ratio than the S&P 500 in the period from 2013 to 2024.

It is worth highlighting that long-term U.S. Treasuries have generated an abysmal Sharpe ratio of essentially zero over the last decade, despite these being a staple in most investors’ portfolios. Although commonly perceived as being almost risk-free securities, they are not (read How Much Can You Lose with Bonds?).

Source: Finominal

HIGH YIELD PORTFOLIO CONSTRUCTION

So, how should investors think about constructing a better high yield portfolio?

The median yield of the S&P 500 over the last 10 years was a mere 1.8%, which is too low for the typical yield-hungry investor. We target a yield of approximately 4% over the last decade, which mostly represented a low-interest rate environment.

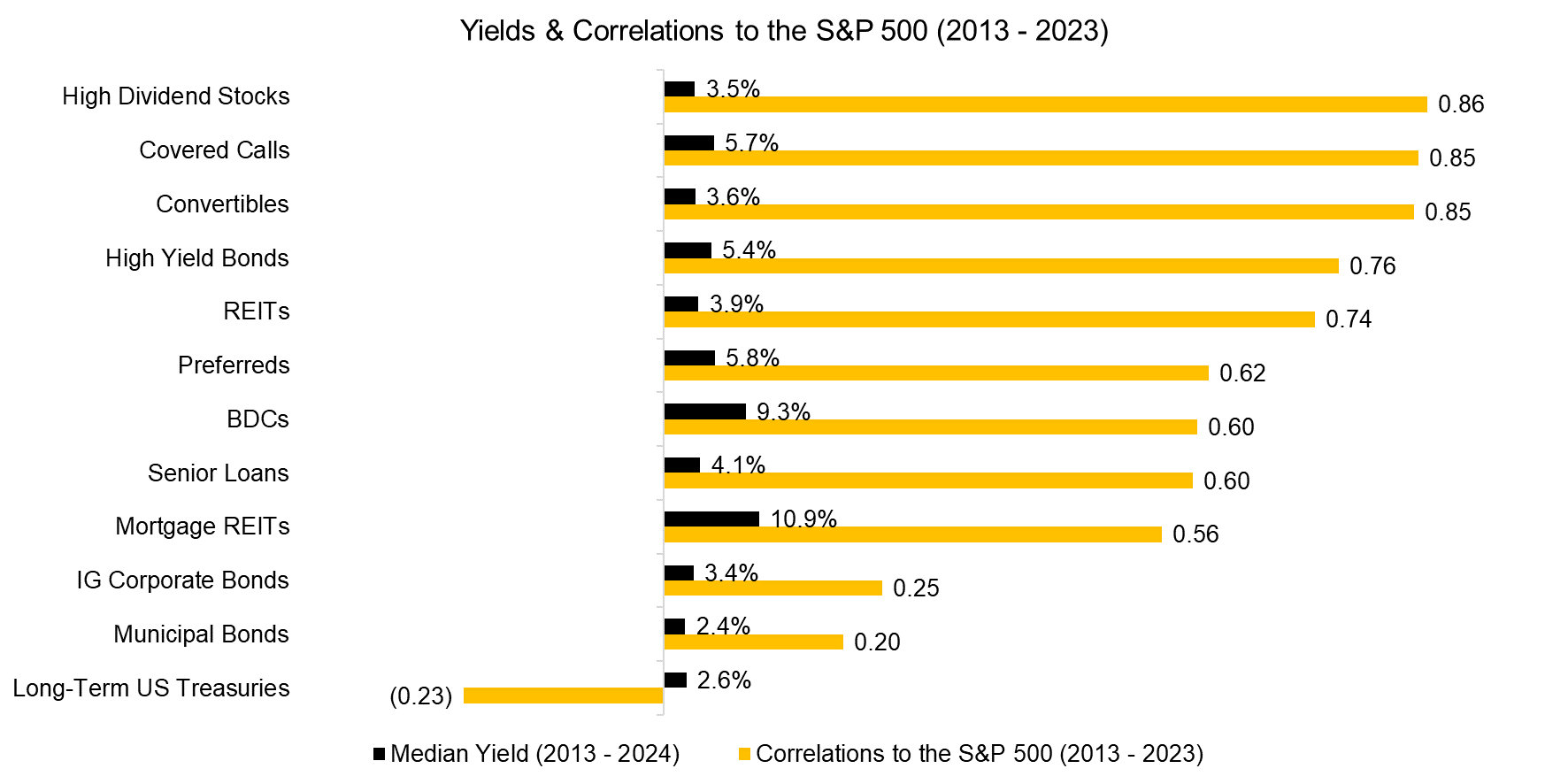

Given this constraint, we can practically exclude an allocation to the S&P 500 as it simply was too low yielding. Instead, we can select strategies like high dividend stocks and covered calls as equity proxies as they are highly correlated to the S&P 500, but offer significantly higher yields. For the avoidance of doubt, these strategies are less attractive than the S&P 500 on a stand-alone basis and investors should be keenly aware of the trade-off in Sharpe ratio for yield.

Next, we should ignore all strategies that are mildly correlated to equities, which range from convertible to municipal bonds, and seek ones that are negatively correlated to generate diversification benefits. However, only long-term U.S. Treasuries exhibit this characteristic, so we have effectively created a portfolio reminiscent of the classic 60/40 portfolio.

Source: Finominal

HIGHEST YIELD VERSUS DIVERSIFIED HIGH YIELD PORTFOLIOS

Why not simply go for a plain vanilla 60/40 portfolio, or select the strategies with the highest yields?

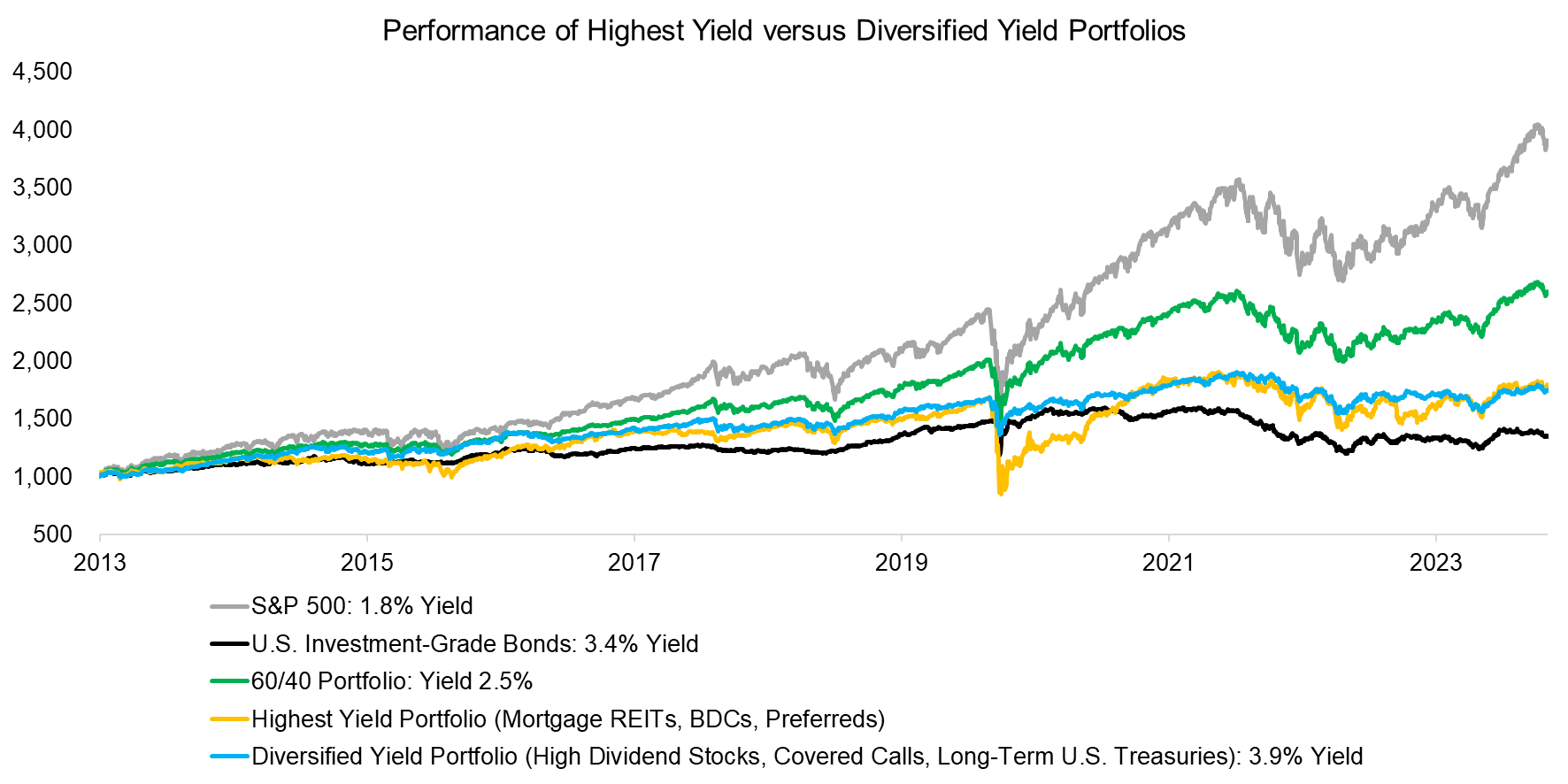

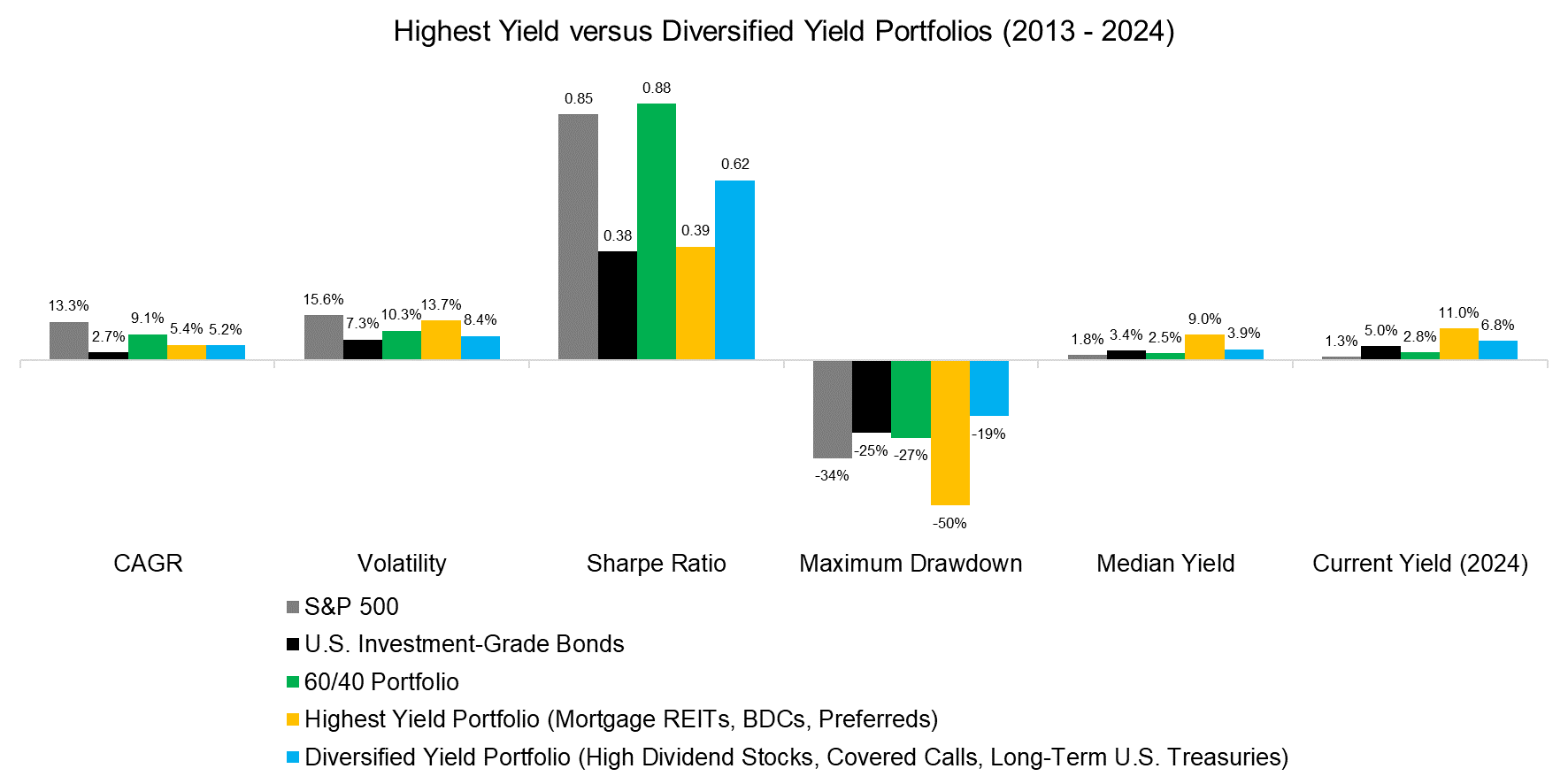

We compare the performance of the S&P 500, U.S. Investment-Grade Bonds, a 60/40 portfolio comprised of the S&P 500 (60%) and U.S. Investment-Grade Bonds (40%), an equal-weighted portfolio comprised of the three highest yielding strategies (mortgage REITs, BDCs, preferreds), and a diversified equal-weighted yield portfolio (high dividend stocks, covered calls, long-term U.S. Treasuries).

We observe that the S&P 500 generated the highest and U.S. Investment-Grade Bonds the lowest total return since 2013, while the highest yield and diversified yield portfolios generated similar returns, albeit with significantly different levels of volatility.

Source: Finominal

The risk of allocating to the highest yielding strategies becomes apparent when comparing the maximum drawdowns of the different portfolios, where the highest yield portfolio experienced the largest loss of 50% during the COVID-19 crisis in 2020.

In contrast, the diversified yield portfolio features the lowest drawdown of 19%, which simply reflects the diversification benefits of combining uncorrelated strategies. This portfolio can be challenged for having generated a lower Sharpe ratio than the 60/40 portfolio, but it also offers a significantly higher yield, especially currently, which was the objective of this analysis.

Source: Finominal

FURTHER THOUGHTS

As the global population ages, there will be more demand for yielding strategies. However, as this analysis shows, high yielding strategies are associated with higher risk, which resulted in lower risk-adjusted returns than what the stock market has generated over the last decade.

Some investors have followed the siren call of alternative fund managers marketing expensive strategies like private credit that seem to offer high yields and attractive returns, but most of these simply do not mark assets to the market, which implies understated risks and overstated returns (read A Crescendo in Private Credit?).

Investors seeking high yields should accept that there is a cost for yield, choose low-cost ETFs for getting exposure to strategies, and combine uncorrelated strategies to harvest diversification benefits. However, correlations are not stable in financial markets and the yields of strategies change frequently, so there is a case for active management in this case.

RELATED RESEARCH

Building Better High Yield Portfolios

Don’t Convert to Convertible Bonds

HY Bonds = High or Hazardous Yield?

BDCs: Better Don’t Choose?

Do-It-Yourself High-Dividend Strategies

A Crescendo in Private Credit?

CLOs – Diversifier, or another Equity Clone?

Covered Call Strategies Uncovered

Preferential Times for Preferred Income Strategies?

Analyzing Floating Rate ETFs

The Case Against REITs

The Case Against Equity Income Funds

Resist the Siren Call of High Dividend Yields

How Much Can You Lose with Bonds?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.