Can Value Investors Do Good?

Combining ESG and Value Investing

February 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- ESG factors underperformed the Value factor and market since 2009

- Integrating ESG in Value investing decreased returns, but increased risk-return ratios

- Residual ESG factors are likely to generate negative returns given the focus on stakeholders, not shareholders

INTRODUCTION

Value investors frequently comment on how challenging the strategy has been in recent years. However, the CEOs of companies that traded at low valuation multiples likely had much tougher jobs. Value stocks typically trade cheaply for reason, e.g. due to declining sales, a lack of strategy, or too much leverage. In the worst case, it might be a combination of these. Corporate management has to tackle these issues while hoping to have the support of their shareholders.

The recent trend toward better environmental, social, and governance (ESG) standards is unlikely to be appreciated by CEOs in battle-mode. ESG tends to consume additional time and money, which are precious resources when companies are restructuring and potentially face bankruptcy.

Given this, it is questionable if Value stocks can rank high on ESG. In this short research note, we will explore combining traditional Value and fashionable ESG investing.

METHODOLOGY

We focus on the Value and ESG factors in the U.S. stock market and include only stocks with a market capitalization of greater than $1 billion. Value is defined as a combination of price-to-book and price-to-earnings multiples. ESG data is available since 2009 and categorized into four major groups: Citizenship, Environmental, Employees, and Governance. We create long-only portfolios by ranking the top 10% by the factor and weight stocks by their market capitalization. Portfolios are rebalanced quarterly and each transaction incurs costs of 10 basis points.

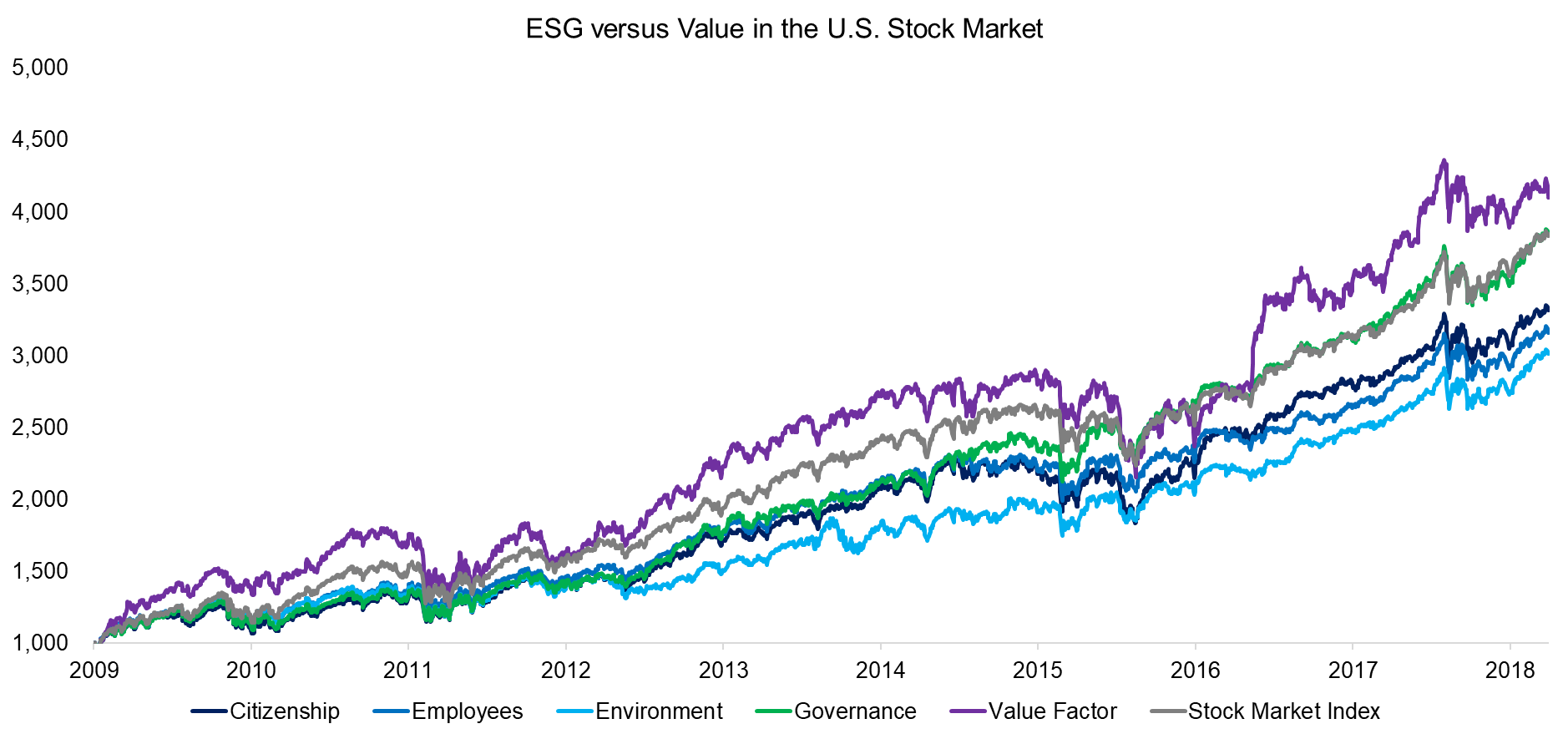

ESG VERSUS VALUE FACTORS IN THE U.S. STOCK MARKET

We contrast the performance of ESG and Value factors, which highlights that ESG factors underperformed Value and the market since 2009. Investors might be surprised that Value outperformed the market in this analysis, but that can be explained by a concentrated portfolio and the starting point in 2009. Value experienced a significant drawdown in the global financial crisis and we are essentially witnessing a rebound of the strategy. The starting point is based on ESG data only becoming available in 2009 for a meaningful number of stocks (read Value Factor – Comparing Valuation Metrics).

The lack of performance of ESG factors, except for Governance, which generated similar returns to the market, is likely a disappointment for investors seeking to allocate capital to good corporate citizens.

Source: FactorResearch

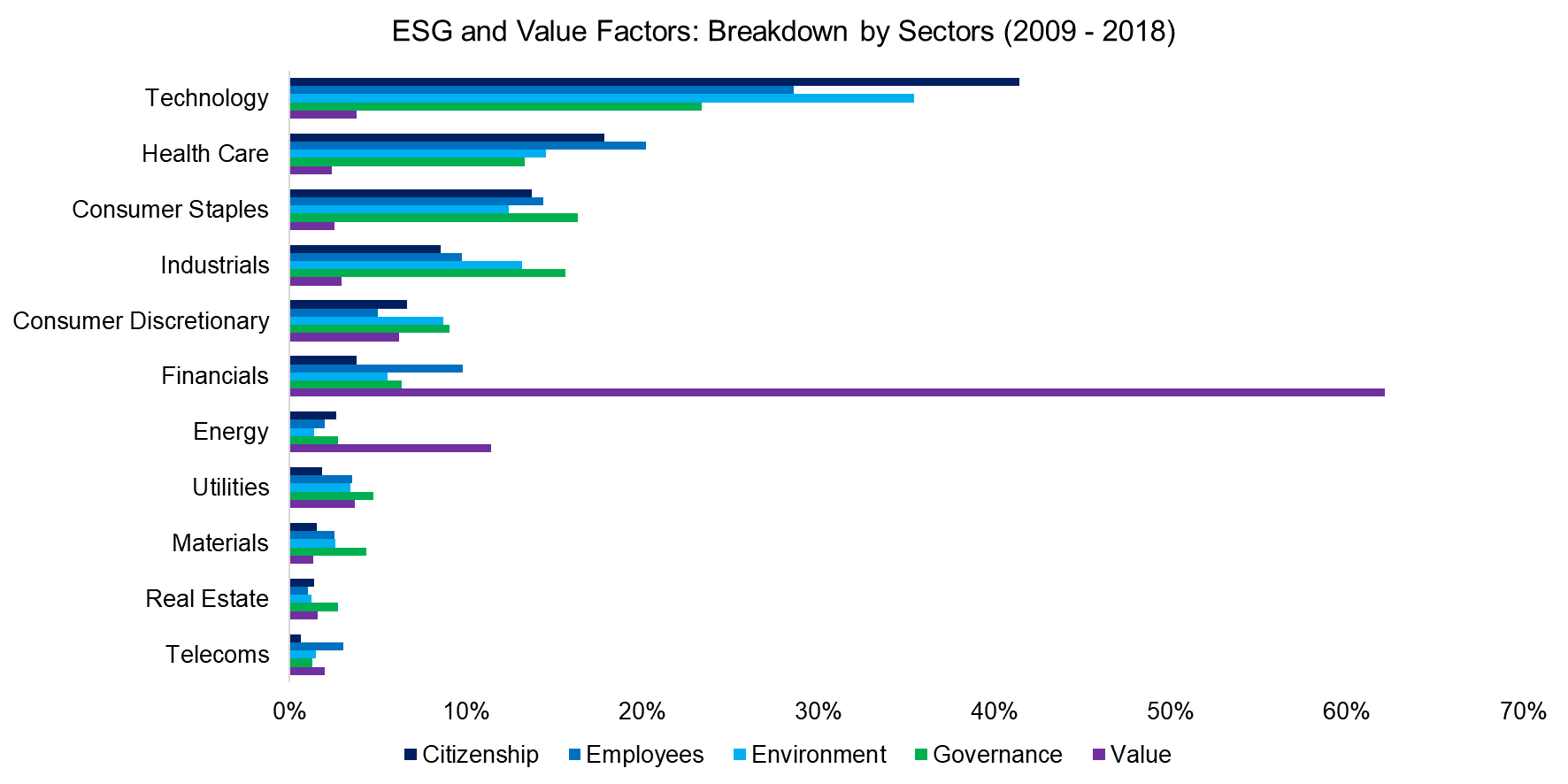

ESG AND VALUE FACTORS: BREAKDOWN BY SECTORS

In order to get a better understanding of the factor drivers, we provide a breakdown by sectors. We observe that the ESG factors exhibited relatively homogenous exposure to sectors and were overweight Technology, Health Care, and Consumer Staples stocks.

The large contribution of stocks by the Technology sector can be explained by most of these companies selling products and services that pose few environmental issues, e.g. compared to an energy company fracking for oil in Texas. Technology companies have also been forced to compete intensely for employees as skilled staff has been a limited resource in the sector. Treating employees well, engaging with the community, and offering high corporate governance standards are helpful for attracting and maintaining talent. For example, Google included a “Don’t Be Evil” clause in its code of conduct until recently.

In contrast, the Value portfolio was effectively a bet on Financials, which traded cheap on price-to-book and price-to-earnings multiples over the last decade. Financials rebounded significantly in 2009, which partially explains the outperformance of the Value factor.

Source: FactorResearch

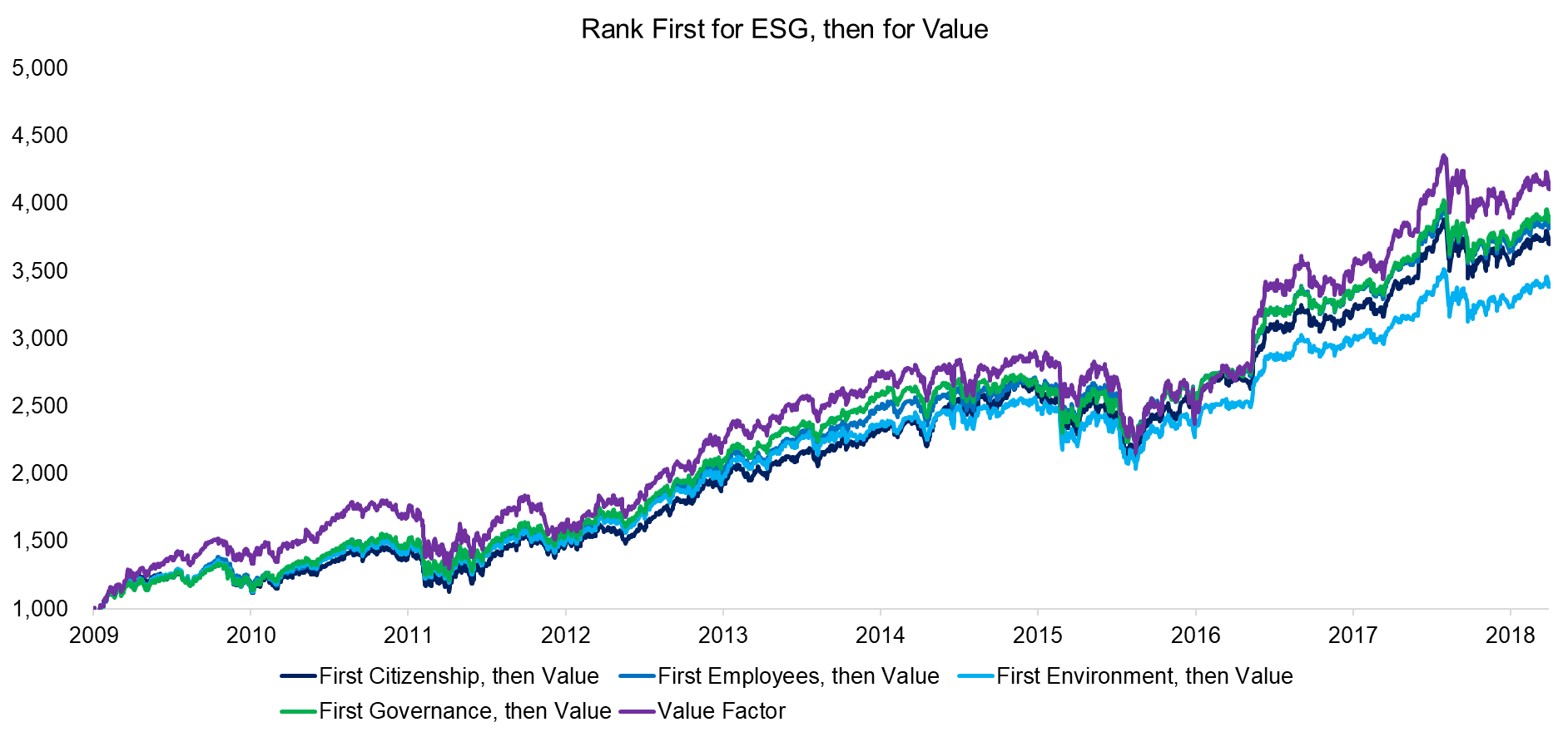

COMBINING ESG AND VALUE INVESTING

There are several approaches to creating multi-factor models and we utilize the sequential model, which ensures that we have the definitive exposure to the factors that we desire. First, we rank all stocks in the U.S. stock market by their ESG scores and create a portfolio of the top 50%. Then we rank this portfolio by the Value factor and select the top 30%, which results in a portfolio of approximately 250 stocks that rank high on ESG and are trading relatively cheaply (read Factor Allocation Models).

We observe that the ESG-Value portfolios slightly underperformed the Value factor, which is somewhat expected given that the ESG factors generated lower returns than Value on a stand-alone basis.

Source: FactorResearch

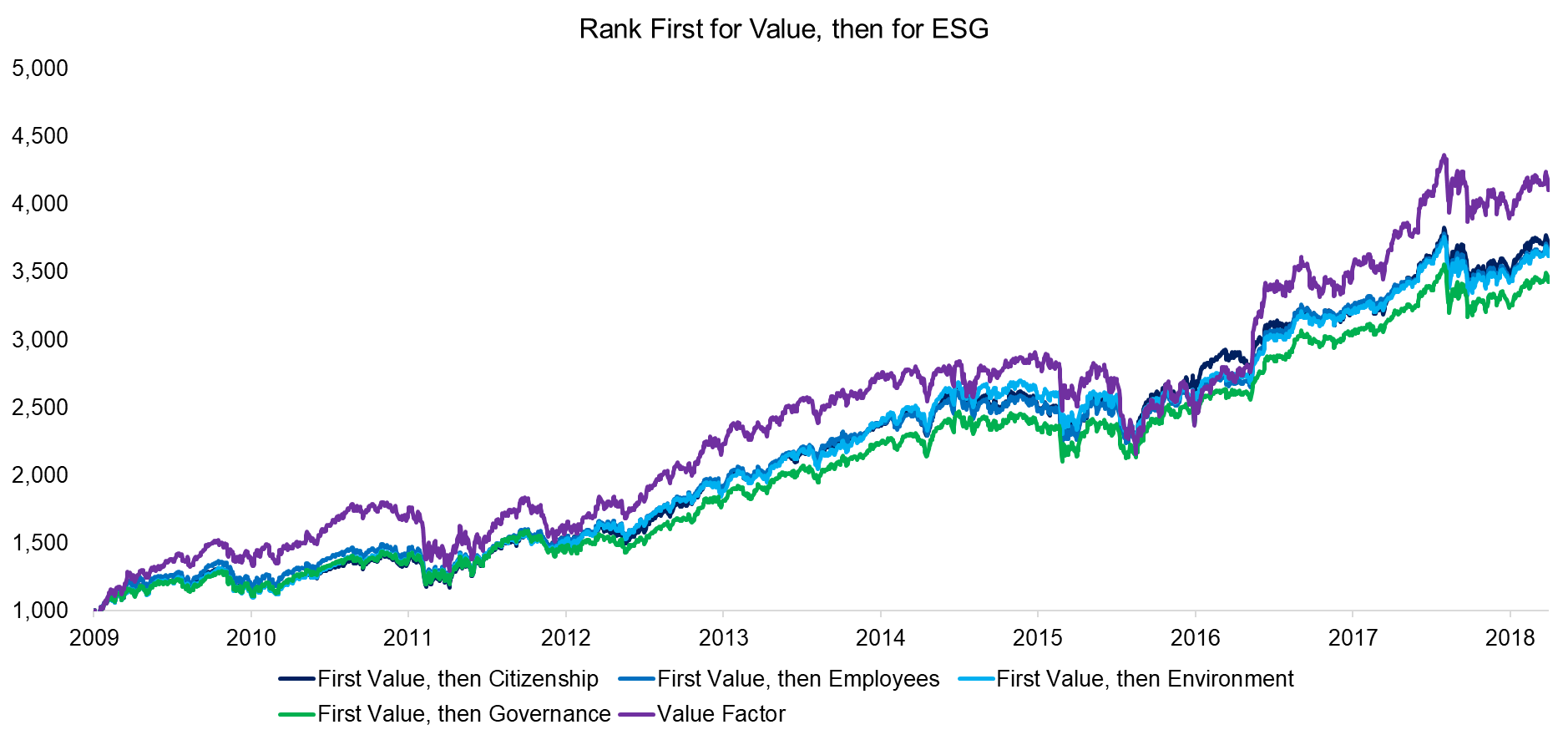

The sequence of factors matters in the sequential model, therefore we create further multi-factor portfolios by first ranking for Value, then for ESG. The resulting stocks will therefore definitely be cheap and should also rank highly on ESG. We again observe that the Value-ESG portfolios underperformed the Value factor and more than the ESG-Value portfolios shown above.

Source: FactorResearch

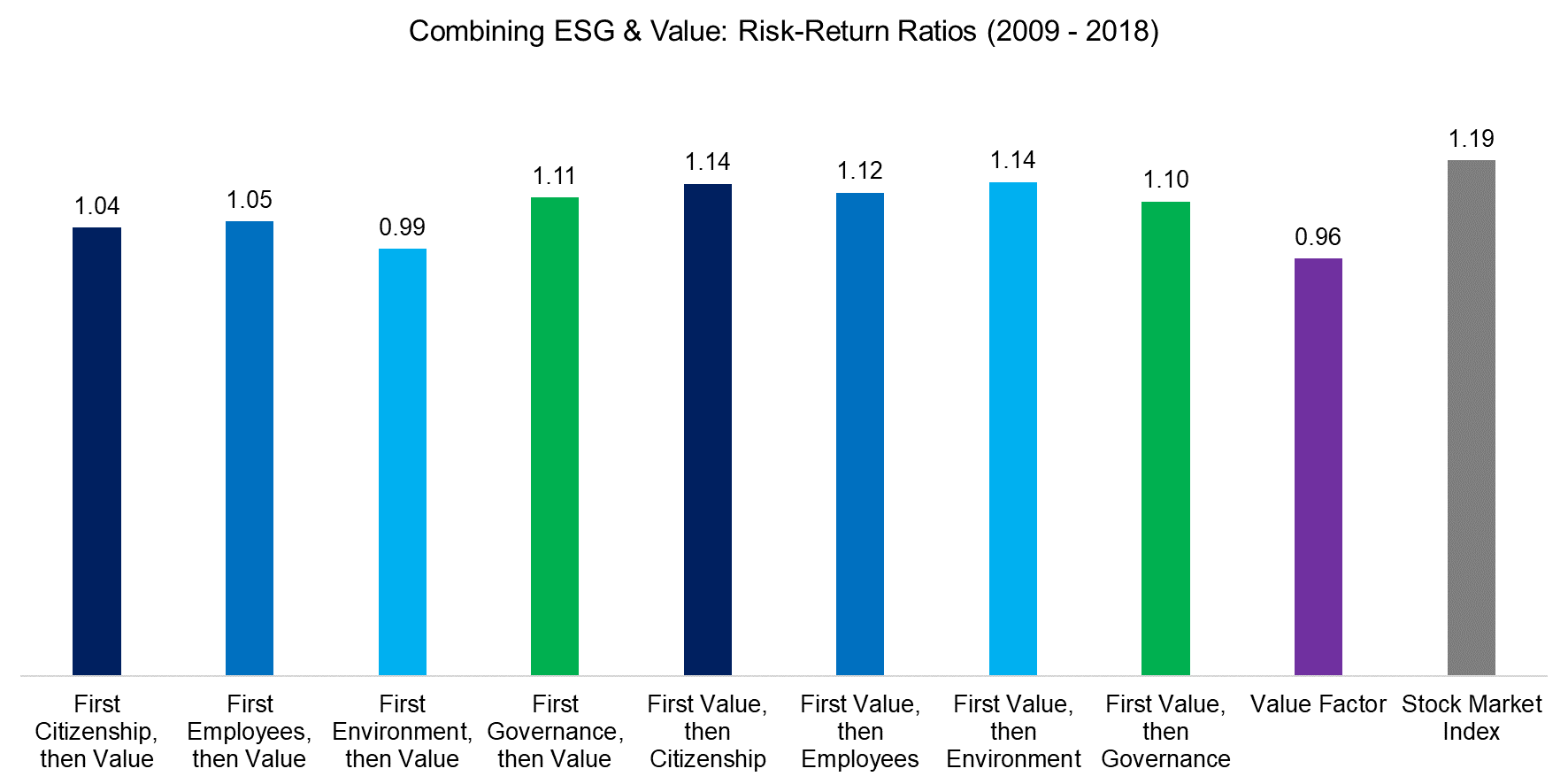

The analysis can be challenged by the relatively short lookback period of less than a decade and the starting point of 2009, which favors the Value factor on a stand-alone basis. Therefore, we analyze the risk-return ratios, which highlights that all multi-factor portfolios generated higher risk-adjusted returns than the Value factor, although still lower than that of the market. The higher risk-return ratios are likely explained by more diversified portfolios as overweights to sectors like Financials was reduced.

Source: FactorResearch

FURTHER THOUGHTS

This short research note highlights that Value investors paid a price for including ESG factors in their stock selection process. However, higher diversification led to a decrease in portfolio volatility and resulted in higher risk-adjusted returns, which creates a case for combining ESG and Value investing.

Investors should expect residual ESG factors to structurally generate negative returns as companies focused on ESG aim to satisfy all stakeholders, not only shareholders. Scoring high on ESG consumes resources and the benefits for shareholders are not clear in all cases.

Some types of investors like pension funds or retail investors are likely to accept slightly lower returns from ESG investing given that these are deeply integrated into their local communities and often experience good corporate citizenship directly, which creates an intrinsic interest in ESG. More mercenary investors like hedge funds might take the other side of the trade.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.