Checking in Buffermania

Do buffer funds protect on the downside yet participate on the upside?

February 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The AUM of buffer funds has grown from $5bn to $50bn in four years

- Somewhat surprising, as these products don´t create much value

- It seems some investors like participating in illusions

INTRODUCTION

In November 2020, we published our first article on defined outcome ETFs, commonly referred to as buffer ETFs (read Exploring Defined Outcome ETFs). At that time, the market included around 50 funds with nearly $5 billion in assets under management. Fast forward to 2025, the landscape has grown significantly, with over 200 funds managing close to $50 billion. Despite this growth, one constant has been the high average management fee, which remains around 0.80% per annum.

The origins of these funds can be traced back to the structured product space, a market managing over $7 trillion, indicating substantial growth potential. The core idea behind buffer ETFs is to provide some downside protection – for example, the Innovator Laddered Allocation Power Buffer ETF (BUFF) shields investors from the first 15% loss of the U.S. stock market. Of course, this protection comes with a reduced upside, but many investors are willing to make that trade-off.

Now that we have more data, we will revisit the performance of buffer ETFs.

PERFORMANCE OF BUFFER FUNDS

Most buffer funds use one-year options in their portfolio construction, rebalancing on an annual basis. However, there are also fund-of-funds that provide exposure to these strategies on a laddered basis, allowing for more frequent rebalancing of the overall portfolio.

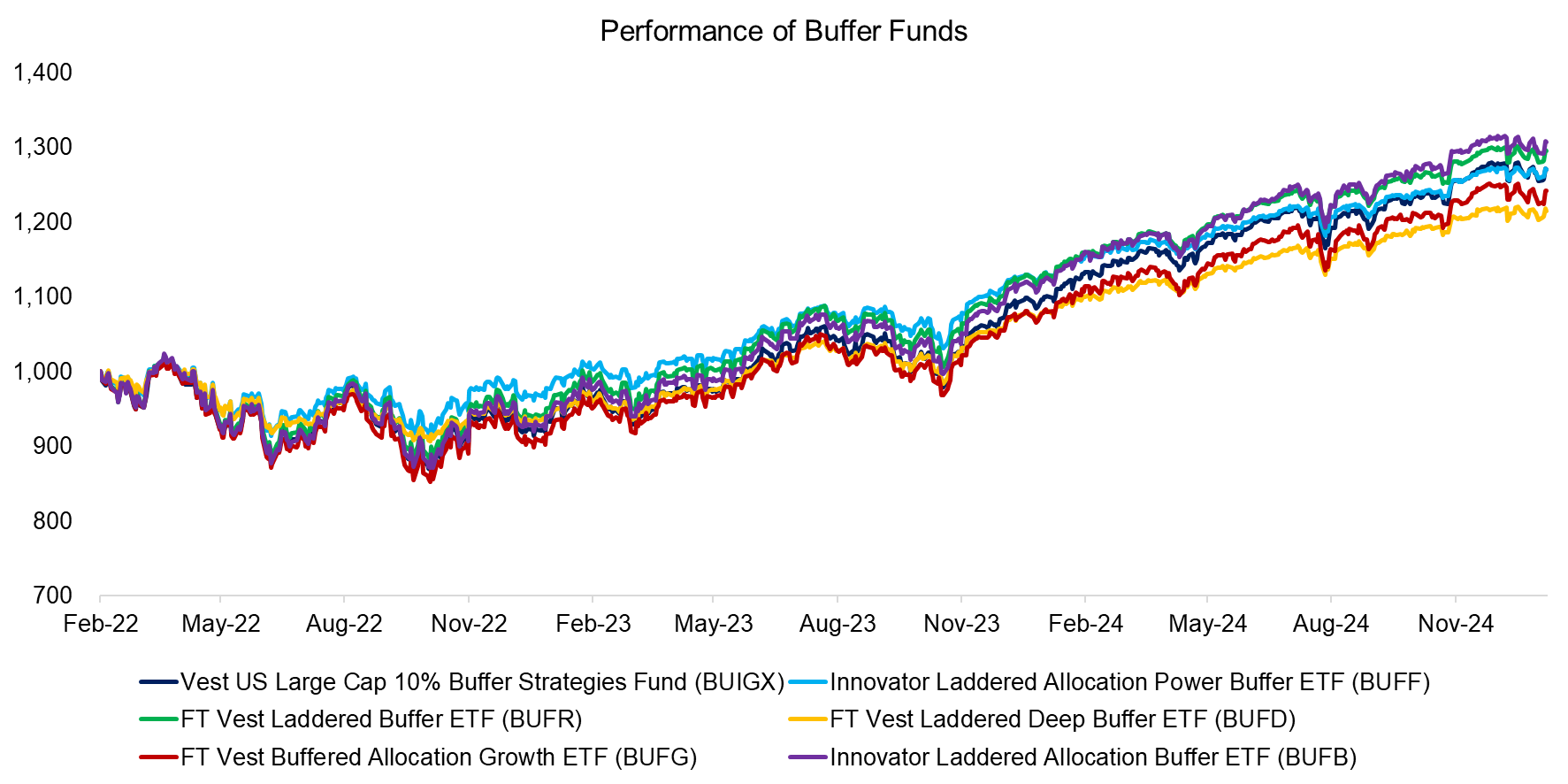

Our focus is on the latter, specifically the Vest US Large Cap 10% Buffer Strategies Fund (BUIGX), Innovator Laddered Allocation Power Buffer ETF (BUFF), FT Vest Laddered Buffer ETF (BUFR), FT Vest Laddered Deep Buffer ETF (BUFD), FT Vest Buffered Allocation Growth ETF (BUFG), and Innovator Laddered Allocation Buffer ETF (BUFB), which collectively manage around $10 billion.

We’ve included BUIGX, a mutual fund, due to its track record dating back to 2016. Notably, the performance of these funds has been nearly identical from February 2022 to January 2025.

Source: Finominal

THE LONG-TERM PERFORMANCE OF BUFFER FUNDS

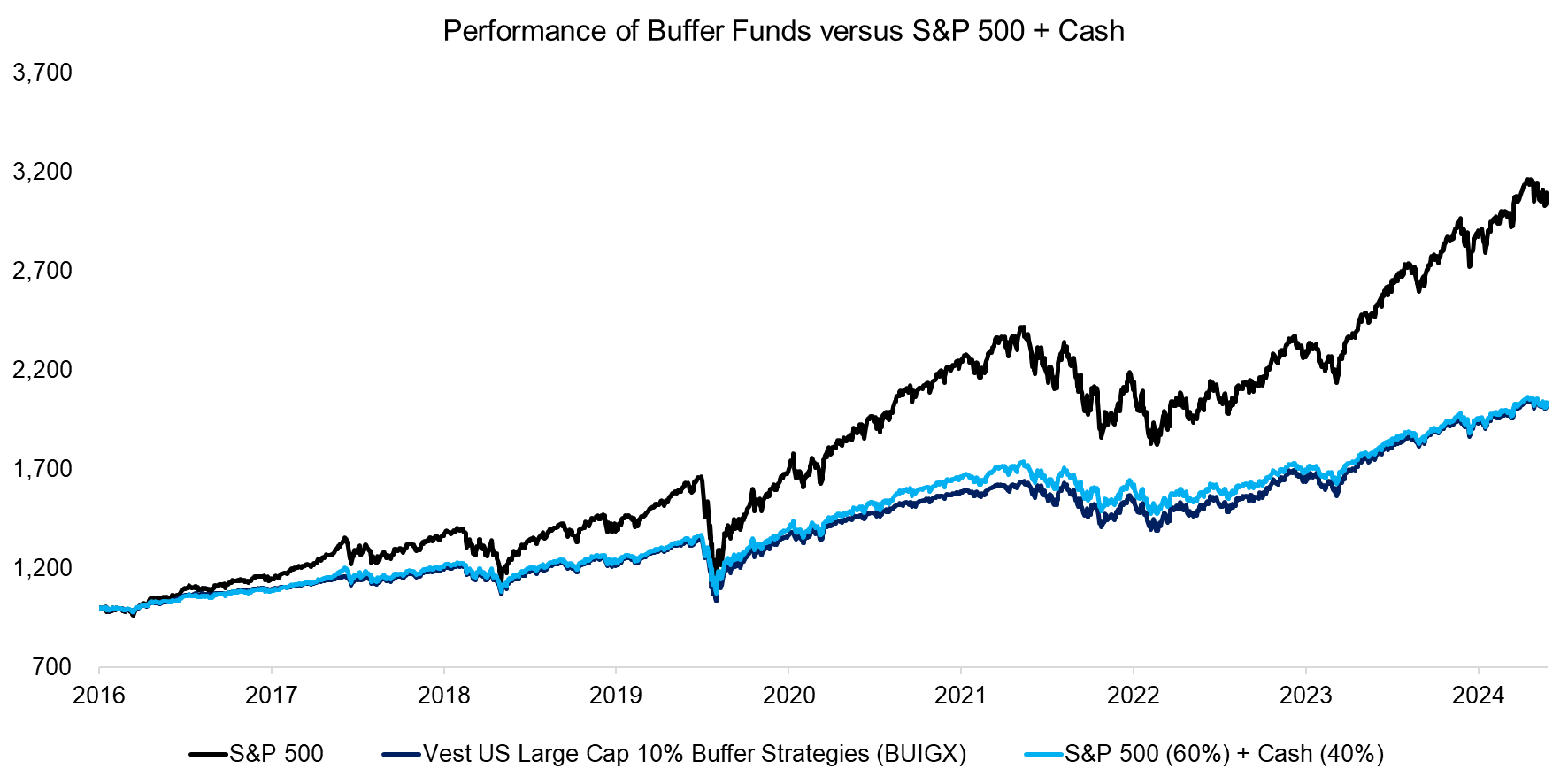

Since the laddered buffer funds exhibit high correlations, we used the Vest US Large Cap 10% Buffer Strategies Fund (BUIGX) as a proxy index for buffer funds due to its longer track record, dating back to 2016.

Comparing BUIGX to the S&P 500 reveals the expected outcome: a lower return and risk profile, but also a correlation of 0.96. Additionally, we constructed a portfolio consisting of a 60% allocation to the S&P 500 and 40% to non-interest-bearing cash, which delivered performance nearly identical to that of BUIGX. The cash could have been invested in short-term U.S. Treasuries, which would have led to a higher total return.

Source: Finominal

RISK & RETURN METRICS OF BUFFER FUNDS

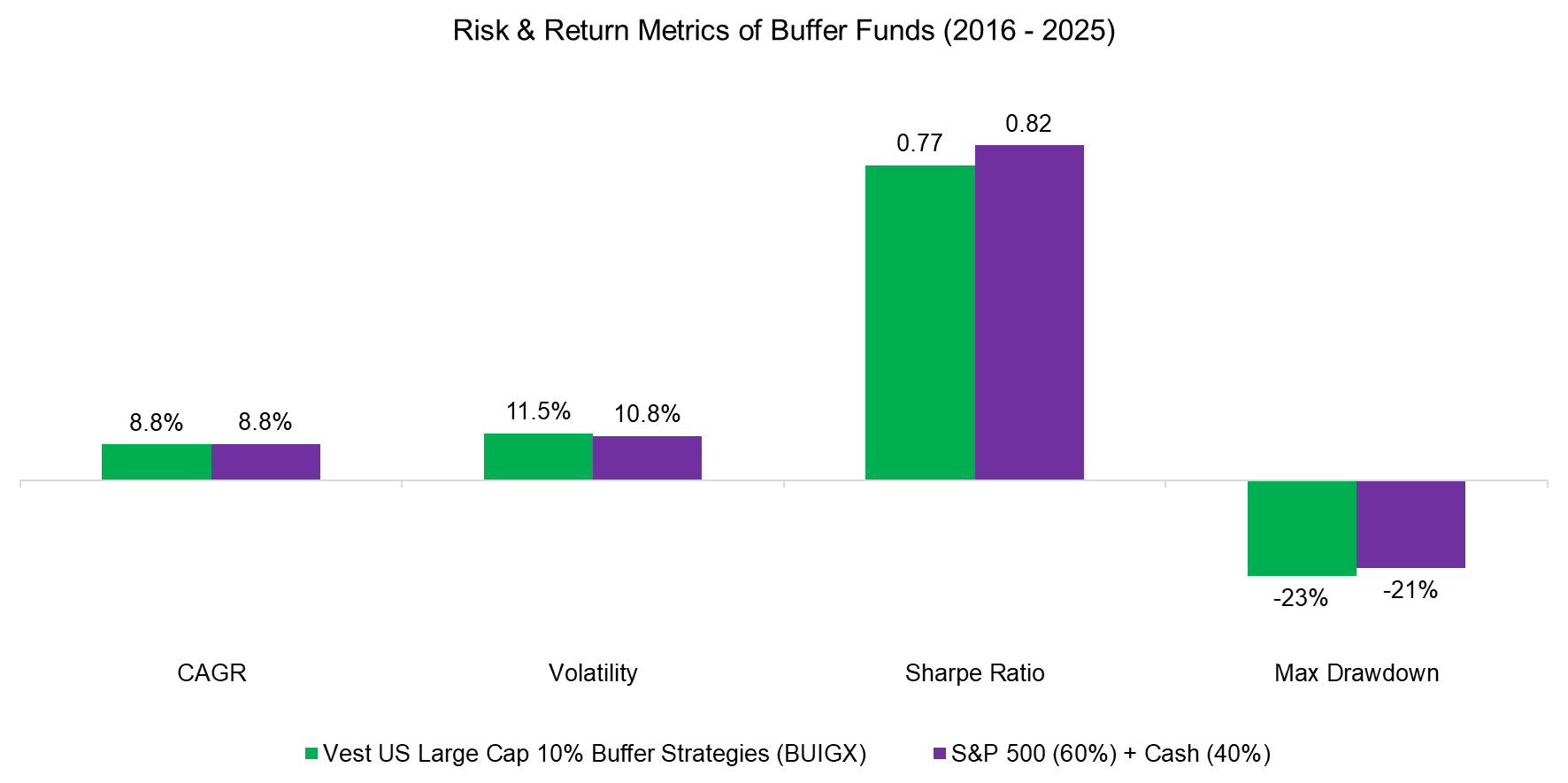

Expanding the analysis to include risk metrics reveals that BUIGX would have produced the same CAGR as the simple S&P 500 + cash portfolio. However, it exhibited higher volatility and a larger maximum drawdown, resulting in a lower Sharpe ratio.

Source: Finominal

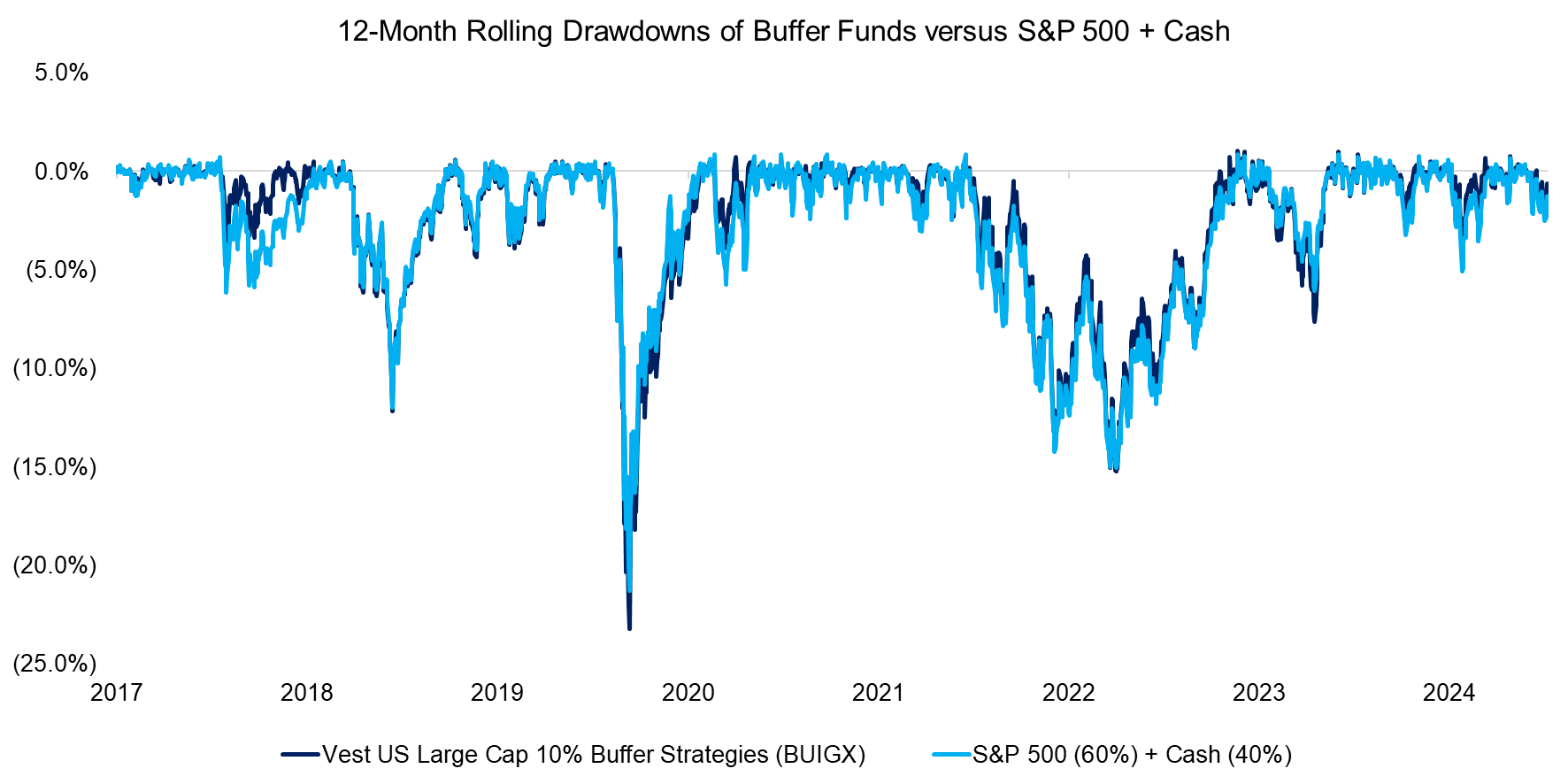

We can also compare the 12-month rolling drawdowns of BUIGX to the S&P 500 + cash portfolio, where one might expect the buffer fund to offer a more favorable profile. However, aside from the drawdown in January 2018, BUIGX provided little to no advantage. In some cases, such as during the COVID-19 crisis in March 2020, the buffer fund actually underperformed the replication portfolio.

Source: Finominal

FURTHER THOUGHTS

Buffer funds are often marketed as low-risk, alternative, or diversifying strategies. However, given their high correlation to equities, this characterization is misleading.

It shouldn’t be hard for investors to see through these strategies and recognize that they can replicate these easily themselves, making the rapid growth of buffer ETFs somewhat puzzling. Although asset managers can be criticized for issuing expensive funds that create little to no value, some investors are willing participants in the illusion. It takes two to tango.

RELATED RESEARCH

A Horse Race of Low-Beta Equity Strategies

Exploring Defined Outcome ETFs

Quality versus Low Volatility ETFs

Volatility-based Equity Allocations

Combining Risk-Managed Equities and Managed Futures

Risk-Managed Equity Exposure II

Equal versus Market Cap-Weighted Stock Market Indices

The Fallacy of Betting on the Best Stock Market

Stock Selection versus Asset Allocation

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.