Chinese Stocks from a Factor Lens

Seeking greener pastures for quant strategies

August 2021. Reading Time: 10 Minutes. Author: Bill Yeskel, CFA

SUMMARY

- Foreign stock ownership is low in China and the market is dominated by retail investors

- This provides an opportunity for investors to deploy quant strategies

- Factor investing has been far more attractive in Chinese than U.S. equities in recent years

INTRODUCTION

The latest chapter in the complicated relationship between international investors and Chinese equities has interesting elements that bear some thought and analysis. First, we will talk about the current events briefly, then we will review the recent and not so recent factor performance there, and we will finish this note with a few thoughts about the future.

WHAT HAS HAPPENED RECENTLY?

Eye-catching headlines like Cathie Wood selling Chinese stocks in July 2021 as a response to Beijing’s widespread clampdown on sectors ranging from education to technology wiped out about $1 trillion of value in shares listed on the mainland, Hong Kong, and the US. For perspective, the ARK Innovation ETF reduced its Chinese holdings from 8% of its $23 billion in AUM to less than 0.2% as of the writing of this note.

The main reason behind the bearish outlook for Chinese equities is the new policy cracking down on many Chinese companies, many of them in the technology sector. Analysts speculate that Chinese leadership has been keener to make politically motivated decisions given the economic rebound earlier this year. Also, political tensions, which have remained high with the Biden administration, have provided further justification to China’s focus on security and self-sufficiency.

Against this backdrop, President Xi is moving assertively to address social, economic, and national-security priorities that in many cases have lingered unattended for years. With these elements in mind, many of the regulatory actions enacted recently have been targeting U.S.-listed companies, which explains the recently widening performance gap between onshore and offshore Chinese stocks.

FACTOR PERFORMANCE IN CHINA

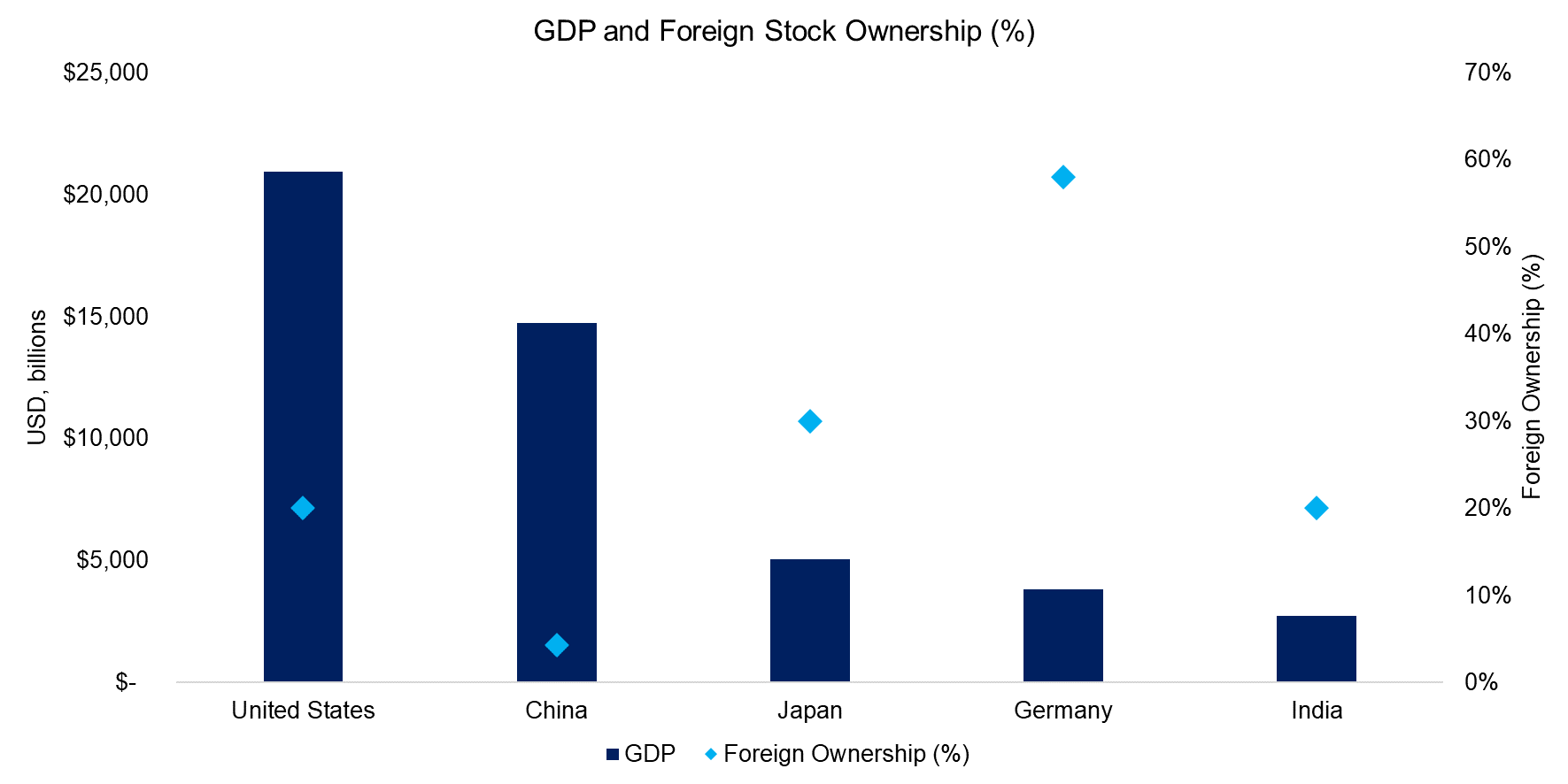

Before we analyze the factor drivers behind the performance of Chinese stocks, let’s take a moment to remind ourselves of the drivers for the demand for onshore Chinese stocks in a portfolio. First, China has the second largest GDP in the world. Second, foreign ownership of Chinese equities is very small – last year it was under 5%, whereas it was 30%, 60%, and 20% in Japan, Germany and India, respectively (read Factor Investing Made in China).

Source: FactorResearch, IMF, Bloomberg, Statista, Bundesbank, Japan Exchange Group, Bombay Stock Exchange

Of course, this gap on itself does not fully explain the demand for Chinese equities. The returns posted by the onshore market, eye-popping occasionally, are another driver for the demand, particularly given its low correlation with traditional indices (10% between Russell 1000 and the CSI 300 indices using daily data from 2002 to 2021).

CHINESE EQUITIES FROM A FACTOR LENS

China A (or onshore China) has been very attractive for quantitative investors because it did provide a researcher’s dream: an out-of-sample test. In layman terms, it allowed quant researchers to test their signals, developed over years and decades in US and global markets, in a market whose data was not available when those signals were initially researched or developed. In part due to the low participation of global investors, for a long time the Chinese onshore markets were ‘behind the quant curve’, meaning that signals with low or no performance in global markets still performed well there.

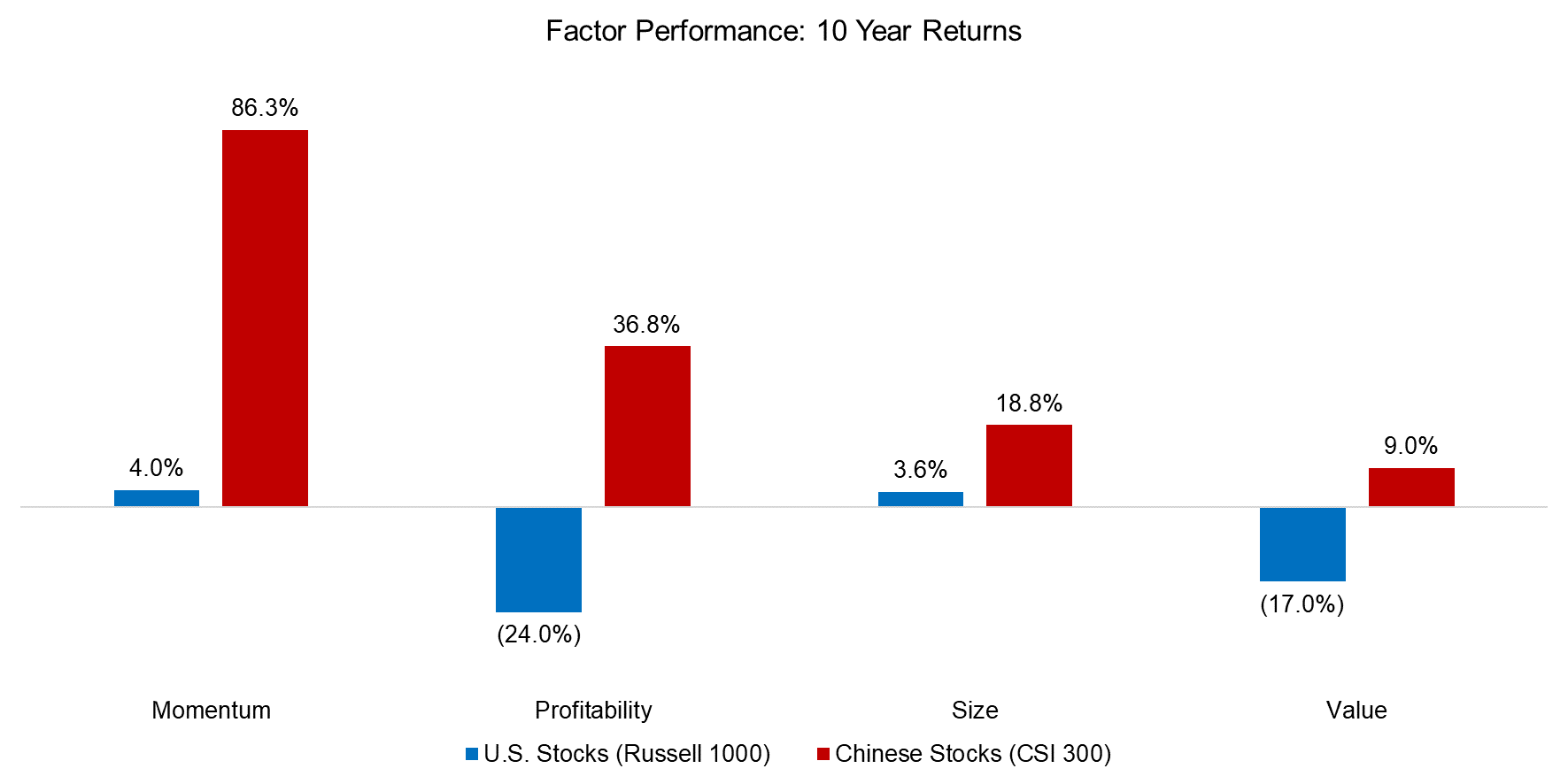

The figure below shows selected cumulative factor performance for the past 10 years. We can see that every factor had positive returns in Chinese equities, using the geometric compounding of sector-neutral, net long-short return of equal-weighted quintiles, and taking the return of Q1 – Q5 (quintile spreads). Unsurprisingly, Momentum had the best returns in Chinese stocks. Surprisingly, Value had positive returns, in contrast with its performance in the Russell 1000 universe.

Source: FactorResearch

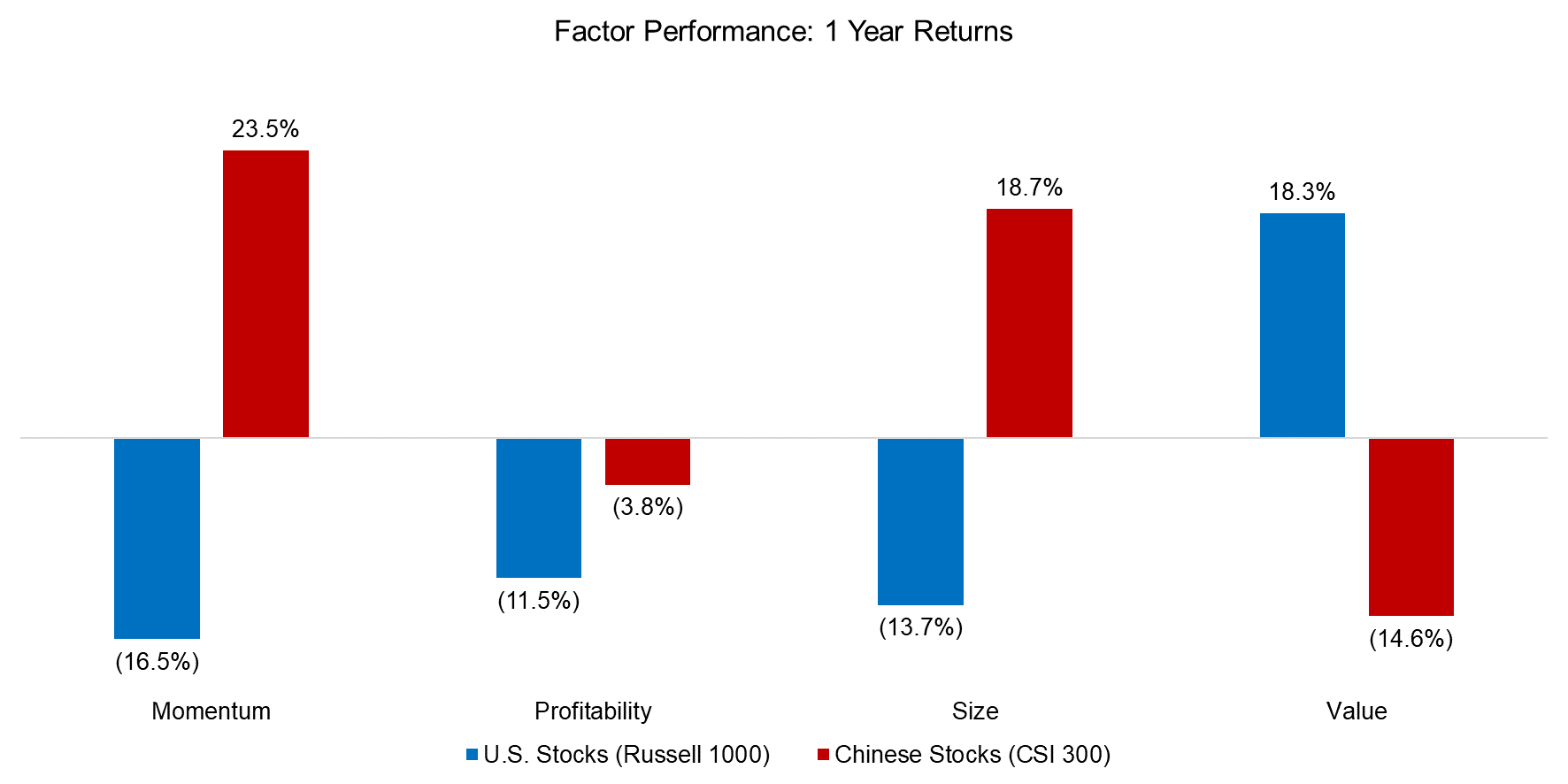

As everyone following quantitative factors knows, 2020 was annus horribilis while 2021 has been at least in the first months, annus mirabilis.

How have Chinese factors reacted? Interestingly, momentum and size increased their relative performance, while value reversed strongly, both in absolute and relative terms vs the Russell 1000. This would have been disastrous for any traditional quant model deployed in China A stocks.

There is a sliver of hope, though, for traditional factors in China because unlike in developed markets, there is ample evidence showing that quant strategies are not large players and thus they are not facing crowdedness problems like those facing traditional quant players in developed markets.

Source: FactorResearch.

THE FUTURE FOR FACTORS

What does this mean for factor performance going forward in China?

Onshore Chinese markets present very attractive opportunities for AI (artificial intelligence) since, in general, similar out-of-sample conditions exist today: models trained in highly data-rich developed markets are just starting to be applied in onshore China. As such, great opportunities exist for cloud-native quants with global expertise and access to rich local datasets in China A that have not been indiscriminately mined by machines. These strategies will have a technological edge because in AI success is a function of inputs. Local Chinese inputs are generally out of reach and/or hard to come by and can drive improved AI performance more than better engineering for many quants.

THE FUTURE FOR MACRO

In the near term, we need to be vigilant of continuing regulatory changes, particularly the potential to expand such oversight to other industries or sectors. Also, investors need to pay close attention to regulatory changes affecting the different mechanisms through which global investors can access China A stocks, i.e., the Stock Connect program and or regulation regarding ADRs or H shares listings.

In the medium term, China A current low valuations, low correlations with other emerging and developed markets and access to the (still) fastest growing economy in the world, make a very compelling investing thesis. China’s contribution to the global GDP continues to grow and so is the symbiotic economic relation between the US and China (read Corporate Debt in the Chinese Stock Market).

Further, onshore equities will remain the only vehicles to participate in sectors undergoing positive transformation, for example, recent regulation is aiming at curbing education companies which is not to limit their activities, but rather to set the foundation for an activity that will remain a top spending item for households in China as incomes continue to grow. Global investors cannot afford to ignore onshore Chinese stocks. The opportunity set is unrivaled for quants, especially for those willing to go the extra mile for rich, local datasets.

RELATED RESEARCH

EM Debt: To Hold or Not To Hold?

Factor Investing in Emerging Markets

ABOUT THE AUTHOR

Bill Yeskel is the Deputy COO of Zentific Investment Management, a Hong Kong-based equity quant boutique. Prior to Zentific, Bill was a member of the Asia Pacific and Emerging Markets Equity Group within BlackRock’s Scientific Active Equity team. Before the buy-side, Bill was an executive at Credit Suisse where his last position was Asia head of HOLT, a financial analytics software company acquired by Credit Suisse. Bill remains active in the software industry, co-founding a big data company after BlackRock and advising other data companies. He holds a bachelor of arts degree from Bard College in Religious Studies and a Master of Theological Studies from Harvard University.

Connect with me on LinkedIn.