Combining Risk-Managed Equities and Managed Futures

Do you need risk management for equities in a diversified portfolio?

November 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Combining equities and managed futures has been an attractive combination

- Applying a trend following overlay for equities has generated mixed results

- The attractiveness depends largely on the outlook for equities

INTRODUCTION

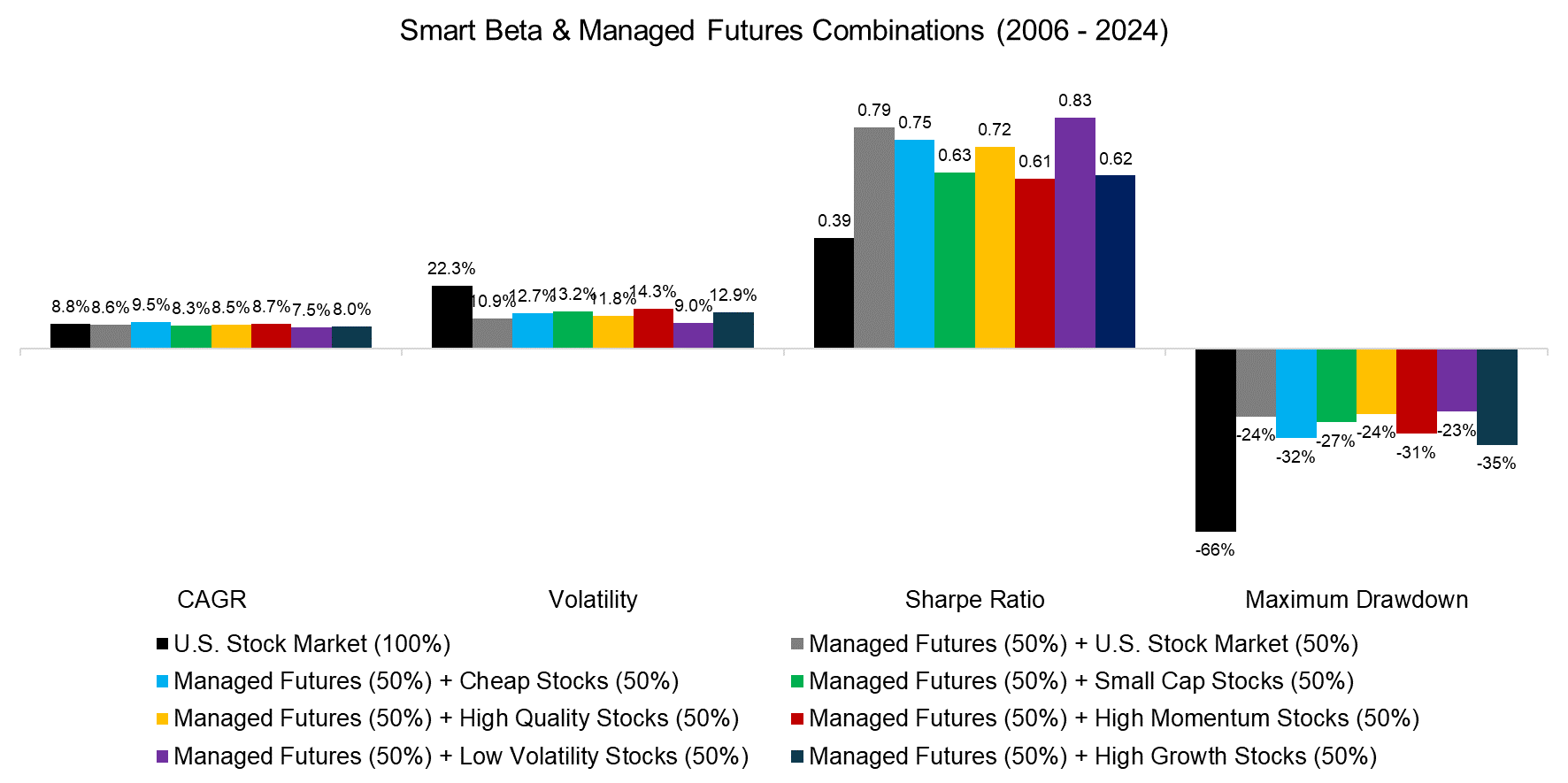

In a recent research article (read What Equity Factor Is Best Combined with Managed Futures?), we analyzed what equity style is optimal for combining equities and managed futures, which are also known as CTAs. Intuitively, the most correlated equity factor, ie momentum, should be least attractive for a combination portfolio, and the most negatively correlated factor, ie value, the most attractive.

However, this neglects that the performance of equity factors has been quite dispersed over the last two decades and the difference between theoretical long-short and practical long-only implementations. Investors also need to decide whether they prefer to focus on returns, Sharpe ratios, or drawdowns.

For example, combining value stocks and managed futures, proxied by the SG Trend Index, with equal-weighted allocations generated the highest return in the period from 2006 to 2024, however, this combination portfolio has experienced one of the larger maximum drawdowns, likely as cheap financial stocks underperformed significantly during the global financial crisis in 2009. In contrast, combining low volatility stocks with managed futures generated the highest Sharpe ratio and lowest maximum drawdown.

Source: Finominal

It is also worth highlighting that the combination with a simple market cap-weighted portfolio of U.S. stocks performed well, which questions whether investors should ignore equity styles altogether and simply buy the S&P 500 or a similar index for the equities allocation.

However, another question is why a trend following methodology is used for all asset classes traded by the managed futures strategy, but not the equities allocation, which seems inconsistent.

In this research article, we will analyze combining risk-managed equities and managed futures.

RISK-MANAGED EQUITIES

A managed future strategy aims to exploit trends across asset classes. Some CTAs exclude equities (read CTAs: With or Without Trend Following in Equities?) to increase the diversification potential of their strategy, but the general idea is the more instruments, the merrier.

Although managed futures strategies seem like black boxes to some investors, they are systematic and can be relatively easily replicated (read Replicating a CTA via Factor Exposures and Creating a CTA from Scratch – II) with simple 250-day moving averages that decide whether to go long or short an asset.

So, when we evaluate combining equities and managed futures, why not apply such a framework for the equities allocation?

Well, historically most equity markets have increased in value with long bull and short bear markets, which makes it challenging to apply a long-short trend following overlay to equities (read Trend Following in Bear Markets and Trend Following in Equities).

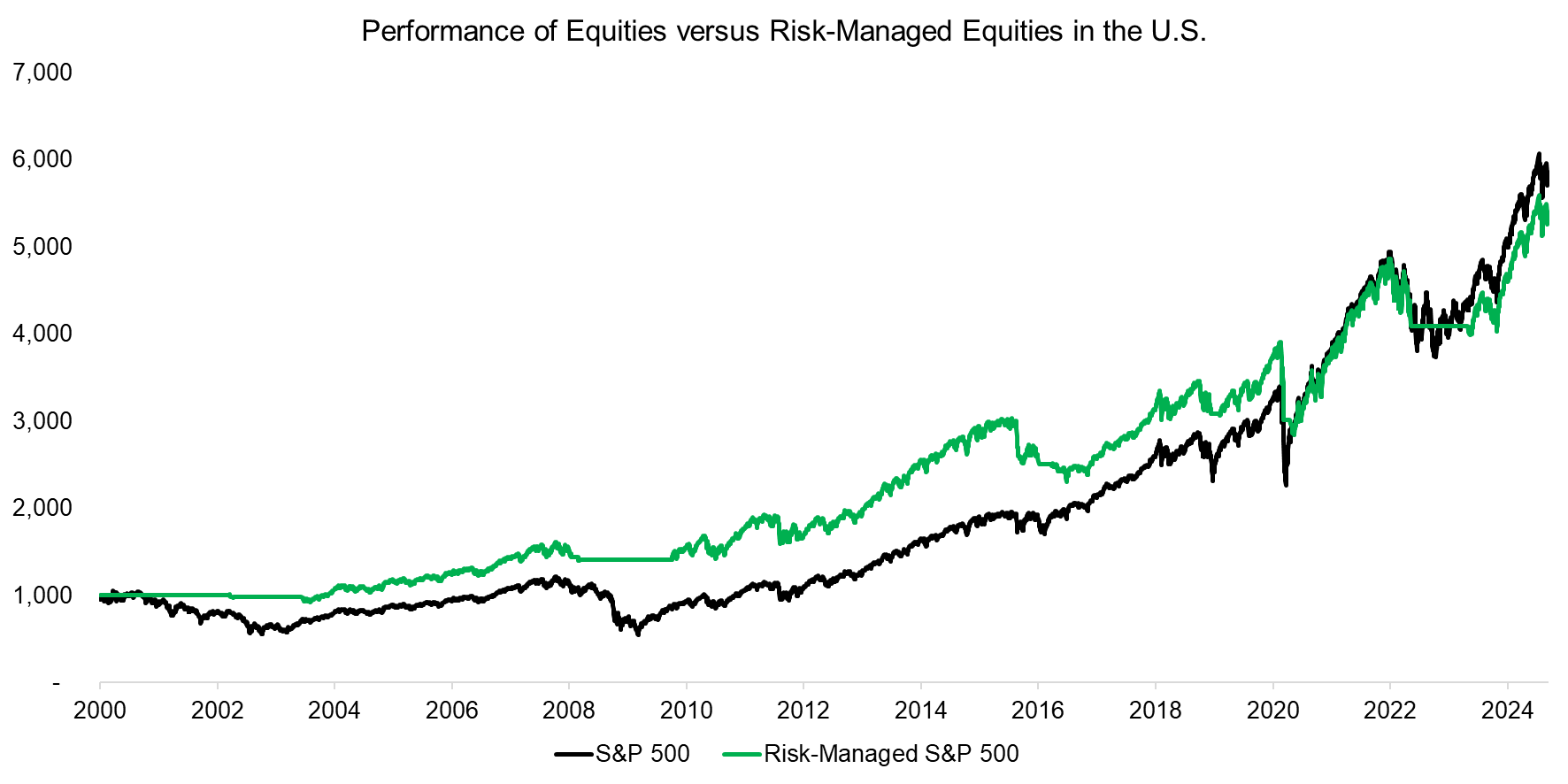

However, although making money by shorting stock markets has been difficult, there is plenty of research that supports trend following in bull markets, where the equities allocation is moved into cash when the trend turns negative. The goal of this approach is not to necessarily achieve higher returns than the stock market, but higher risk-adjusted returns by reducing volatility and drawdowns (Risk-Managed Equity Exposure II and Risk-Managed Equity Exposure).

For example, applying a simple 250-day moving average for either allocating to the S&P 500 when the return was positive, or non-interest-bearing cash when the return was negative, would have generated the same total return in the period from 2000 to 2024, albeit with much lower drawdowns.

Source: Finominal

COMBINING RISK-MANAGED EQUITIES & MANAGED FUTURES

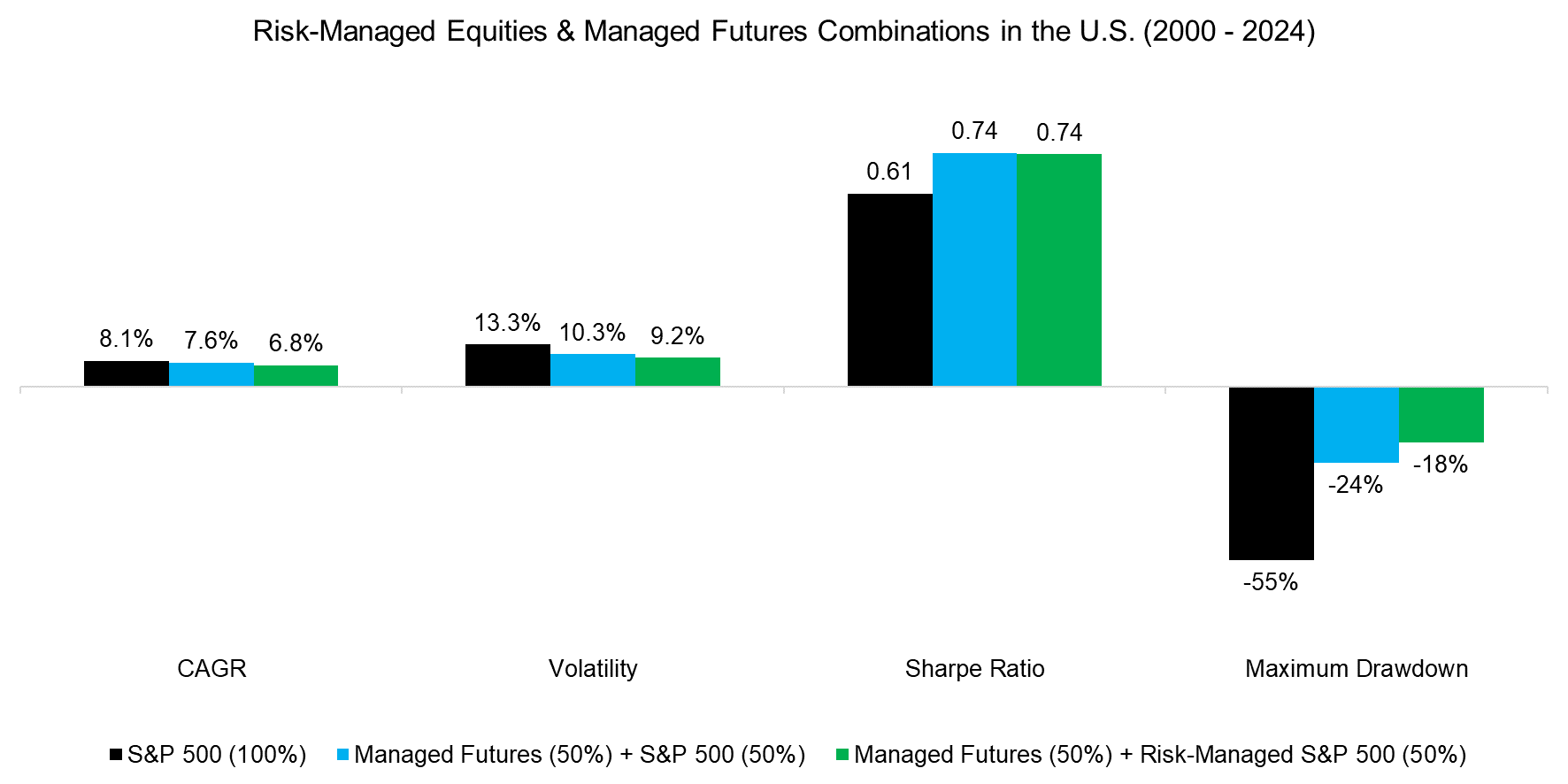

We create two portfolios consisting of the S&P 500 and managed futures with equal allocations that are rebalanced monthly. The combination portfolio would have generated a slightly lower annual return than a 100% allocation to the S&P 500, but with a significantly higher Sharpe ratio given diversification benefits from the managed futures allocation.

Next we replace the S&P 500 with a risk-managed S&P 500, which would have further reduced the annual return, but offered almost the same Sharpe ratio given lower volatility and lower drawdowns.

Source: Finominal

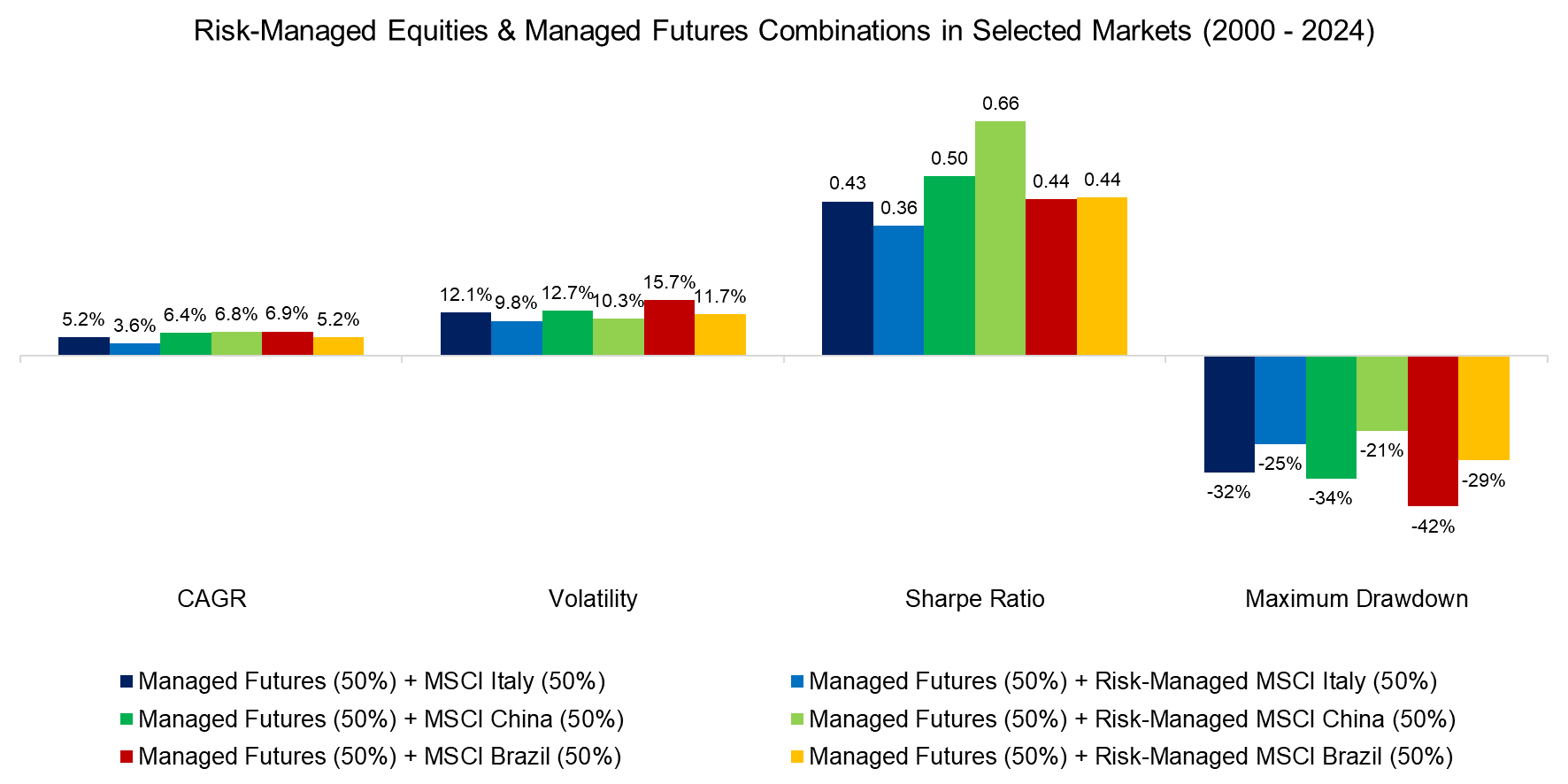

We have to consider that the S&P 500 has been one of the best-performing stock market indices over the last 24 years, but that the outlook for returns may be poor given high valuations, worsening demographics, and record levels of debt. Given this, we select three equity markets, namely Italy (CAGR: 4.3%), China (4.0%), and Brazil (7.2%) that had lower returns than the S&P 500 (7.5%) since 2000.

Comparing the results provides a mixed perspective: risk-managing the equities allocation lowered the Sharpe ratio in Italy, increased it in China, and had no impact in Brazil. CAGRs were lower in two markets, but the maximum drawdowns reduced in all three markets as expected.

Source: Finominal

FURTHER THOUGHTS

Based on this analysis, there is no clear argument for applying a trend following overlay on the equities allocation. To a degree, it all depends on investors’ return expectations: if stock markets are expected to continue to perform strongly, then the risk management will be unnecessary, if not, then it will be accretive.

Given that most investors look back, they will likely assume equity markets that structurally will increase going forward. However, it can also be argued that with negative demographics and record levels of debt, which depresses economic growth and therefore earnings, this may not be the case over the medium to long term.

Stated differently, although accidents are rare, how comfortable do you feel driving without insurance?

RELATED RESEARCH

Managed Futures versus Market-Neutral Multi-Factor Investing

Factor Investing Is Dead, Long Live Factor Investing!

CTAs: With or Without Trend Following in Equities?

Bonds versus CTAs for Diversification

Carry versus Trend Following

Trend Following in Equities

Trend Following in Bear Markets

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.