Combining Risk-Managed Equities and Managed Futures – II

Do you need risk management for equities in a diversified portfolio?

April 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Risk managing equities increases Sharpe ratios, but can decrease returns

- Taxation and expected returns matter

- However, the choice of diversification strategy likely matters more

INTRODUCTION

In November 2024, we published a research article exploring whether investors should apply risk management to their equity allocation within a diversified portfolio. The proposed risk-management framework utilized a straightforward trend-following strategy, shifting from equities to cash when the stock market’s one-year rolling return turned negative (read Risk-Managed Equity Exposure II). Diversification was incorporated through an allocation to managed futures funds, which capitalize on long and short trends across various asset classes. The analysis examined a portfolio spanning approximately 20 years but did not reach a definitive conclusion on whether equities should be risk-managed (read Combining Risk-Managed Equities and Managed Futures).

Recently, we expanded our data library to include returns for managed futures strategies dating back nearly a century. With this extended dataset, we will revisit the question using longer lookback periods and additional data sets.

MANAGED FUTURES VERSUS U.S. STOCKS

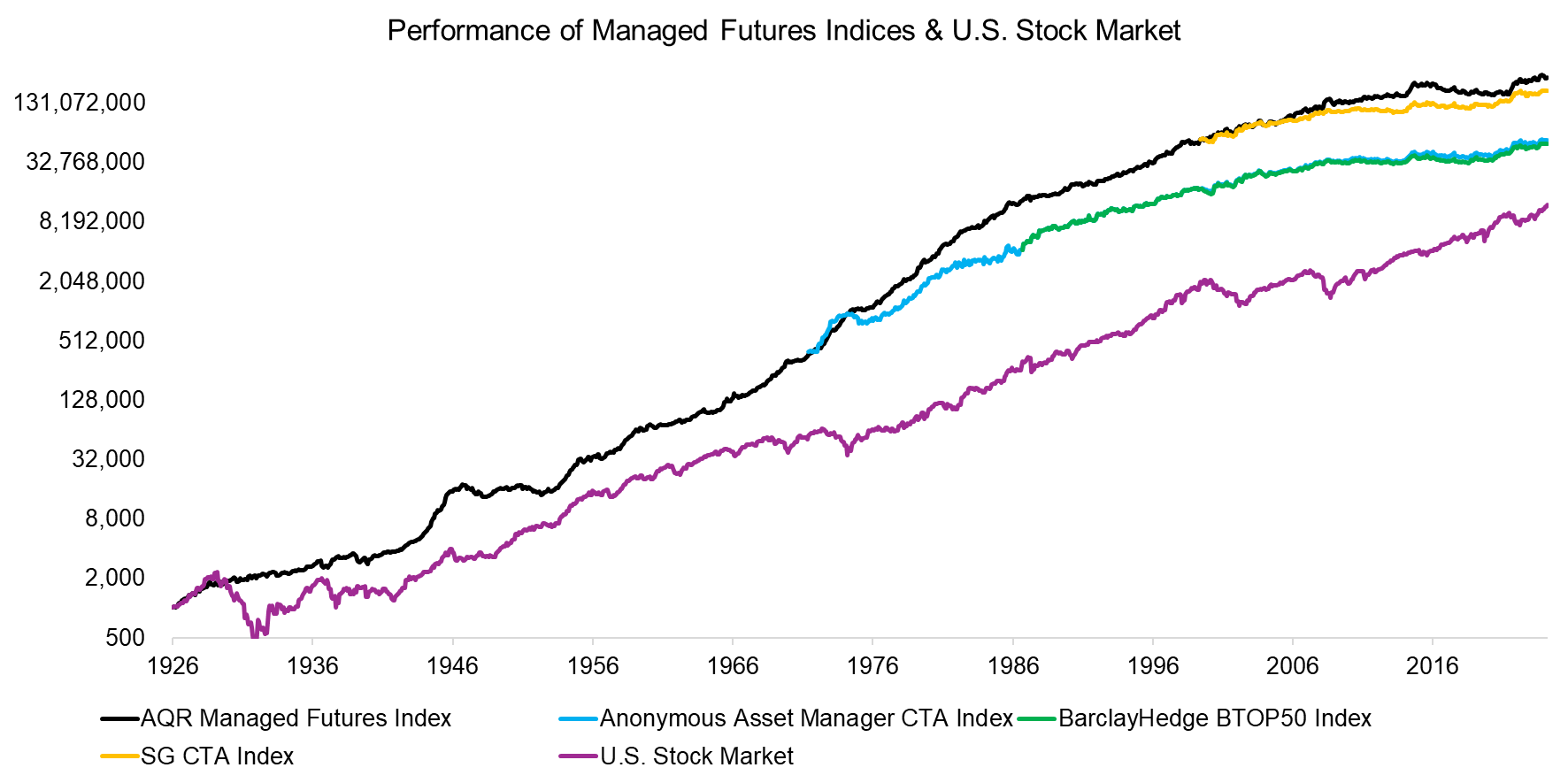

We have four different sets of data for managed futures funds. Notably, the two datasets with the longest histories – the AQR Managed Futures Index and the Anonymous Asset Manager CTA Index – are based on backtested returns rather than actual fund manager performance. As a result, these figures should be interpreted with caution, as they do not account for transaction costs, management fees, or model risk (read How Much Should You Allocate to Managed Futures?).

Although the returns of the AQR Managed Futures Index should be interpreted with caution due to their backtested nature, we will proceed with this index given its extensive historical data. Notably, all four managed futures datasets exhibited similar trends and behaved distinctly from U.S. stocks, reinforcing their diversification benefits.

Source: AQR, BarclayHedge, SG, Finominal

COMBINING RISK-MANAGING EQUITIES WITH MANAGED FUTURES

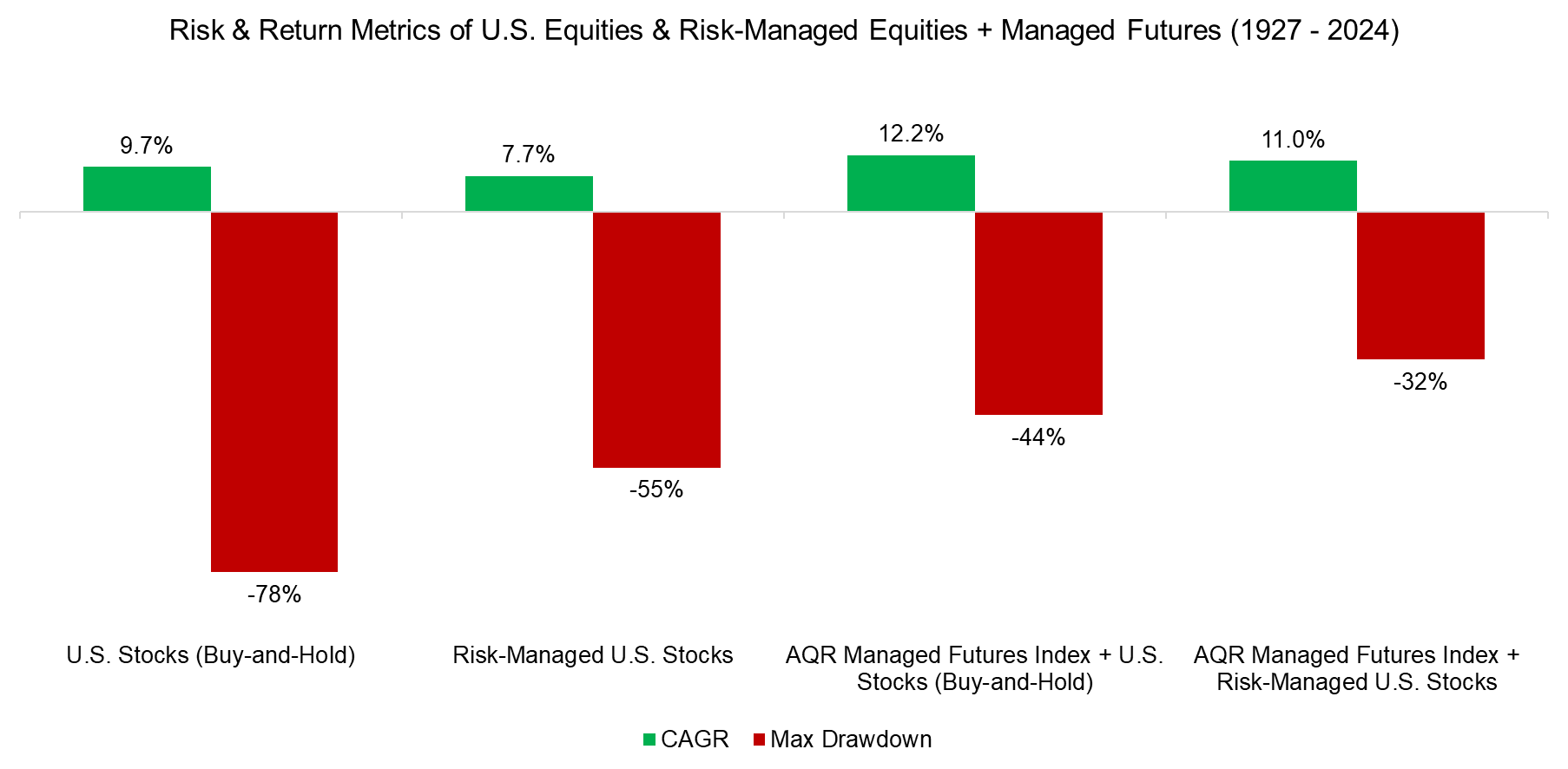

First, we compare the CAGRs and maximum drawdowns of buy-and-hold versus risk-managed U.S. stocks in the period from 1927 to 2024. This comparison reveals that while the buy-and-hold strategy offers higher returns, it also comes with a larger maximum drawdown. The primary aim of risk management, however, is to reduce risk or improve risk-adjusted returns, rather than merely maximizing absolute returns.

Next, we introduce a 50% allocation to the AQR Managed Futures Index and rebalance the portfolios annually. We observe that the CAGRs improve, and the maximum drawdowns decrease, thereby confirming the benefits of allocation to a strategy with strong diversification advantages.

Source: AQR, Finominal

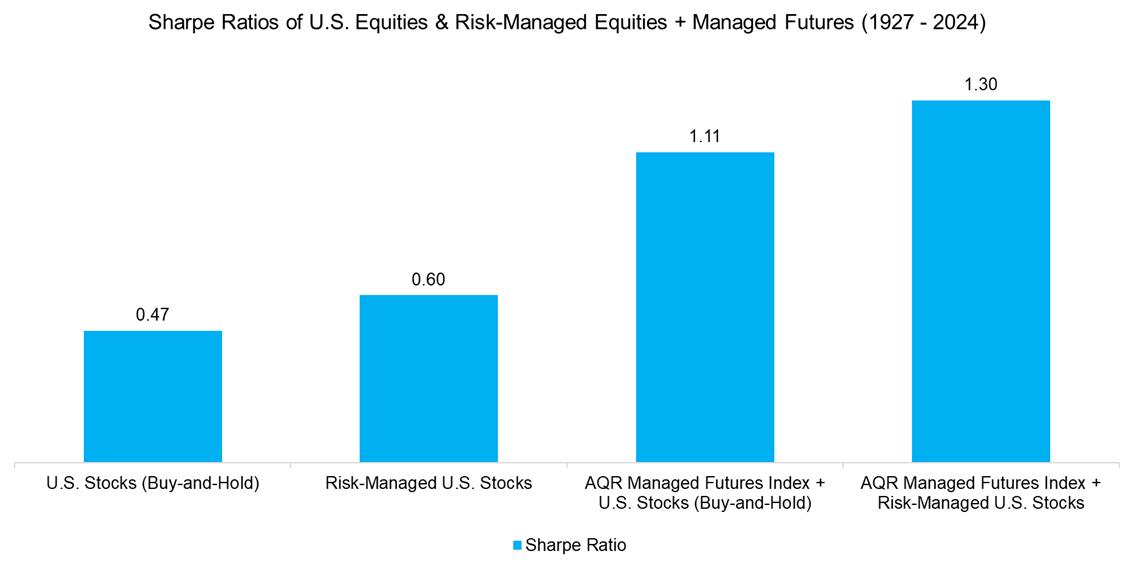

The benefits of risk-managing the equity allocation and adding managed futures become even more evident when examining the Sharpe ratios. U.S. stocks achieved a Sharpe ratio of 0.47 over the past century, but this can be increased to 1.30 through the combination of risk management and diversification.

Source: AQR, Finominal

FEES & TAXES

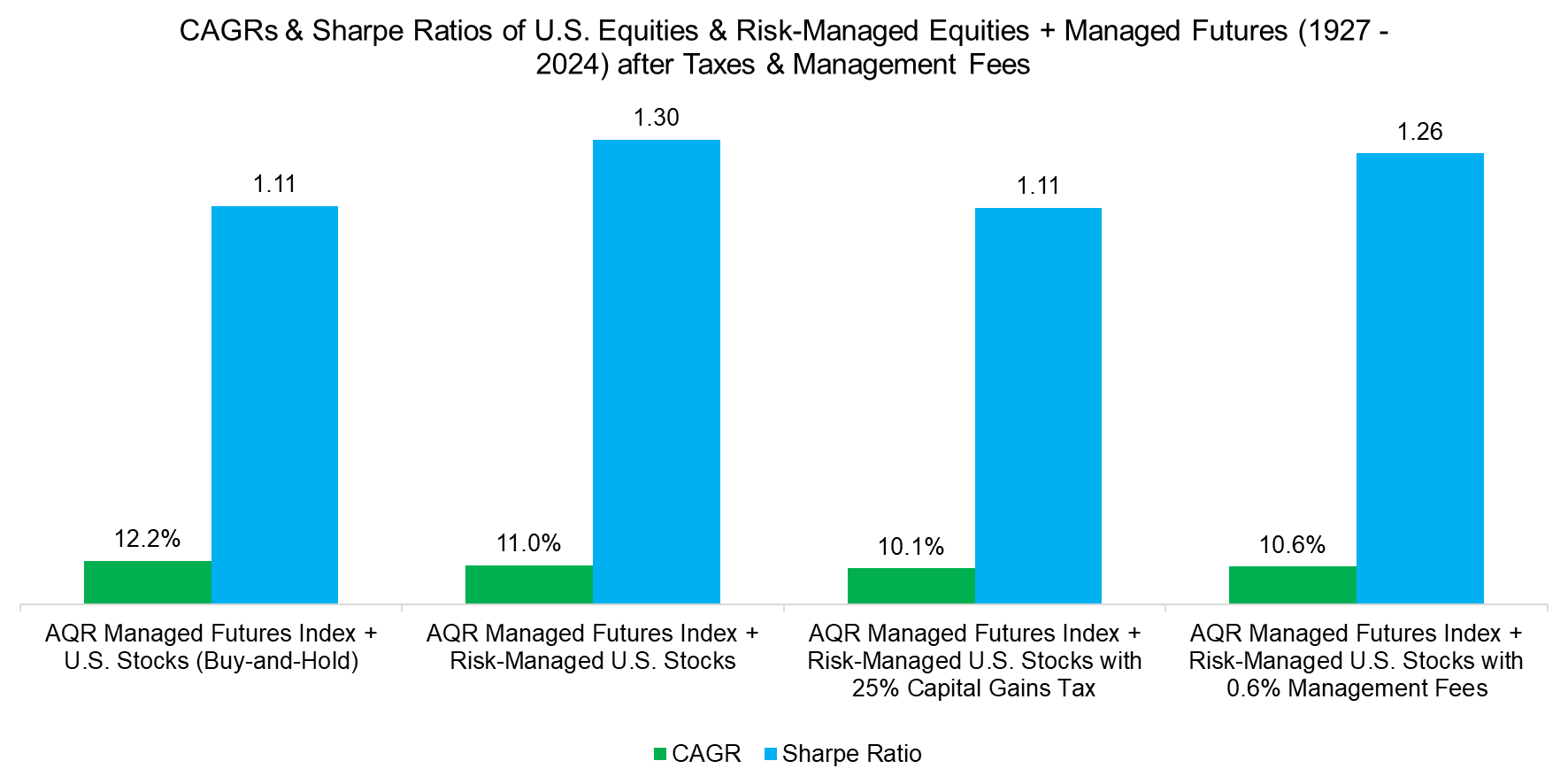

The simple risk-management framework for equities is grounded in strong theoretical principles, but it overlooks some critical real-world considerations. For example, each time the equities allocation switches from U.S. stocks to short-term U.S. Treasury Bills, capital gains taxes must be paid – assuming the equities allocation was profitable and held in a taxable account.

Assuming a 25% capital gains tax, the CAGR of the portfolio would decrease from 12.2% per annum for the buy-and-hold strategy to 10.1% per annum. However, the Sharpe ratio would remain unchanged.

Alternatively, investors could use tax-efficient ETFs that switch between U.S. equities and short-term U.S. Treasury Bills according to the same risk-management framework. While these ETFs offer tax advantages, they come at a cost. Assuming an annual management fee of 0.60%, the CAGR would decrease to 10.6% per annum, while the Sharpe ratio would remain relatively high at 1.26.

Source: AQR, Finominal

COMBINING RISK-MANAGED EQUITIES & MANAGED FUTURES IN JAPAN

The case for risk-managing U.S. stocks has not been particularly compelling, as the U.S. stock market has delivered strong performance over the past century, with an annual return close to 10%.

However, with stock valuations at high levels and the long-term economic outlook facing challenges due to record levels of debt and unfavorable demographic trends, it is unlikely that returns over the next century will match the past. As a result, risk management is likely to become more relevant moving forward, rather than less.

While we can’t predict the future, we can look at a market that has experienced less fortunate circumstances – Japan. Between 1949 and 1990, the Japanese stock market enjoyed stellar performance, only to enter a bubble that collapsed. The Nikkei declined for the next 20 years and has only recently recovered its losses.

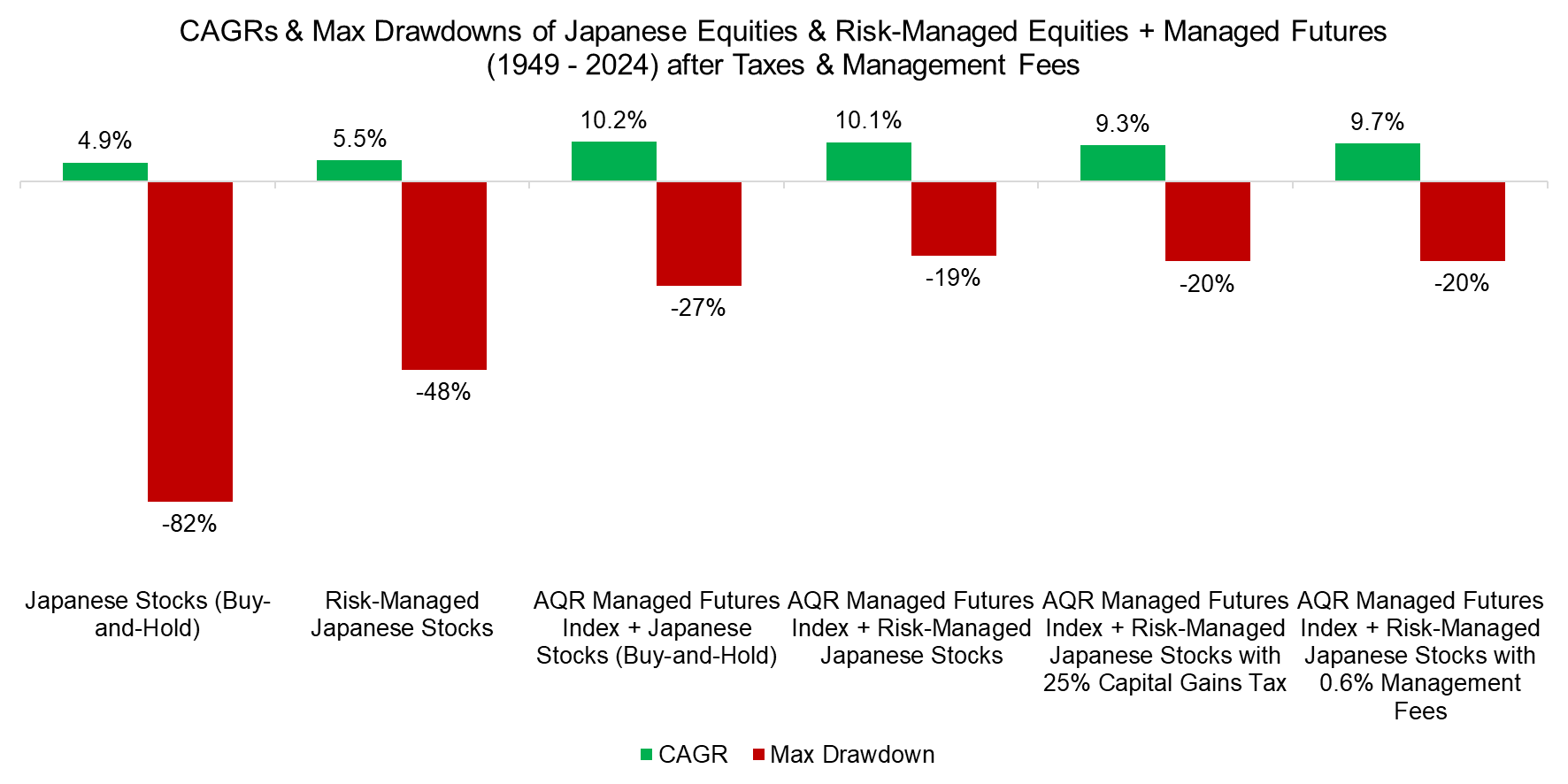

Applying the simple risk-management model to Japanese equities would have increased the CAGR from 4.9% to 5.5% during the period from 1949 to 2024, while reducing the maximum drawdown from -82% to -48%. Adding a 50% allocation to managed futures would have further boosted the CAGR to 10.2% and reduced the maximum drawdown to -27% with the buy-and-hold equities portfolio, while offering a similar annualized return but -19% maximum drawdown with risk-managed equities.

Source: AQR, Finominal

The highest Sharpe ratio in Japan would have been achieved by combining risk-managed equities with managed futures. Even after taxes or with paying a 0.6% annual management fee, this would have been more attractive than the buy-and-hold strategy for Japanese equities.

Source: AQR, Finominal

FURTHER THOUGHTS

Does our second research article answer whether the equities allocation within a diversified portfolio should be risk-managed?

It depends. If the goal is to maximize the Sharpe ratio, risk management is a clear winner. However, when optimizing for absolute return, the investor’s outlook on equities and tax considerations play a significant role.

That said, the decision of whether equities should be risk-managed is secondary to the more crucial issue of maintaining a well-diversified portfolio. While most investors rely on bonds for diversification, bonds are likely to perform poorly over the medium to long term as governments will face increasing difficulties repaying debt due to declining populations.

Playing the game of musical chairs is not a sound investing strategy (read Bonds versus CTAs for Diversification).

RELATED RESEARCH

Combining Risk-Managed Equities and Managed Futures

How Much Should You Allocate to Managed Futures?

Risk-Managed Equity Exposure II

Risk-Managed Equity Exposure

What Equity Factor Is Best Combined with Managed Futures?

Managed Futures versus Market-Neutral Multi-Factor Investing

Factor Investing Is Dead, Long Live Factor Investing!

CTAs: With or Without Trend Following in Equities?

Bonds versus CTAs for Diversification

Carry versus Trend Following

Trend Following in Equities

Trend Following in Bear Markets

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – II

CTAs vs Global Macro Hedge Funds

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.