Combining Smart Beta Funds May Not Be Smart

What happens if you add positive and negative exposures to the same factors?

August 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Smart beta funds offer diverse factor exposures

- When combined in a portfolio these exposures often net themselves off

- As a result, investors are left with an expensive plain beta portfolio

INTRODUCTION

In June 2024 J.P. Morgan highlighted that their strategic allocation model included an allocation to a global value and a global technology fund. For investors versed in factor investing this likely led to mental red flags going up.

Value stocks trade at low valuations as these represent companies or industries in trouble, which is typically reflected in declining sales or earnings. In contrast, technology companies trade at premium valuations and exhibit strong growth prospects. Naturally, this implies that adding a value and technology fund is the equivalent of adding hot and cold water.

Unfortunately, we frequently observe investors selecting funds with opposing factor exposures and deriving portfolios with unintended consequences.

In this research article, we will highlight the risks of combining smart beta funds.

SMART BETA & BOND PORTFOLIO

Factor investing seems like the only path to achieve outperformance based on academic research. Implementation has become easy given hundreds of smart beta products that offer investors factor exposures via low-cost ETFs.

However, this evolution has largely taken place in the equities space where U.S. smart beta products manage close to $1 trillion, while the assets under management in fixed income smart beta products are less than $5 billion, which is a rounding error considering the trillions invested in fixed income mutual funds (read Smart Beta Fixed Income ETFs).

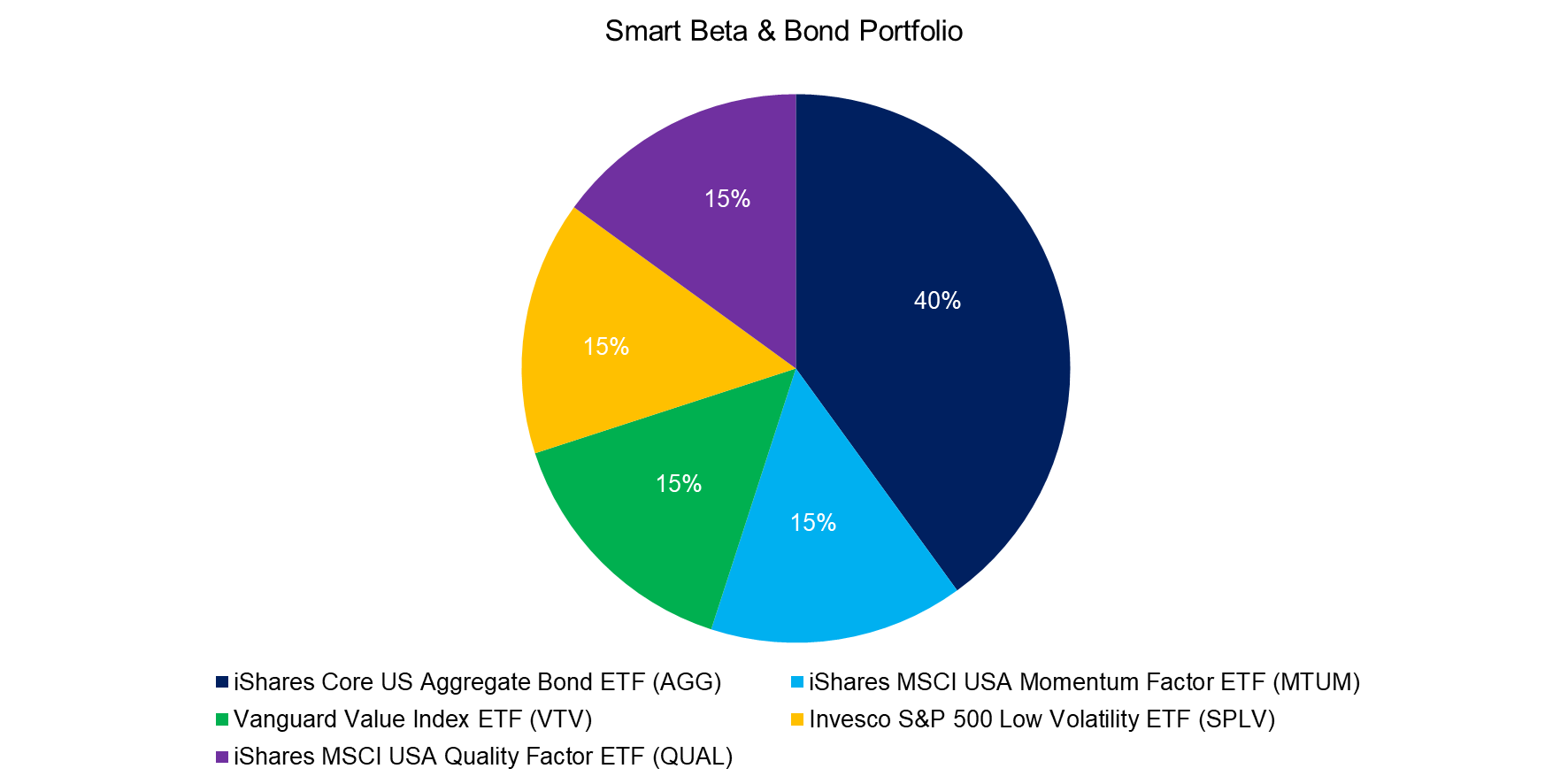

Given this, we will construct a portfolio using smart beta ETFs for equities but plain beta for fixed income. Specifically, we allocate 60% to four smart beta ETFs providing exposure to momentum, value, low volatility, and quality, and 40% to the U.S. Aggregate Bond Index.

Source: Finominal

FACTOR EXPOSURE ANALYSIS

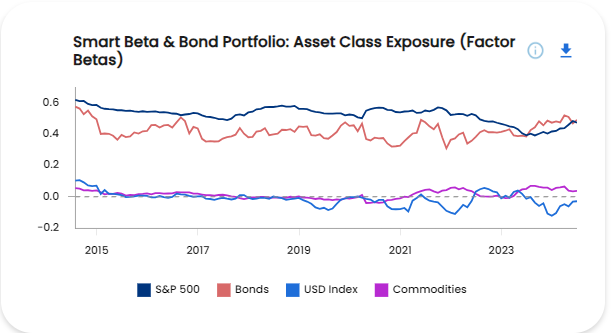

First, we run a factor exposure analysis on the entire portfolio that highlights consistent positive betas to the S&P 500 and U.S. Investment-Grade Bonds, and zero exposures to the U.S. Dollar Index and commodities. Given that this essentially represents a classic 60/40 equities/bond portfolio, these exposures are as expected.

Source: Finominal

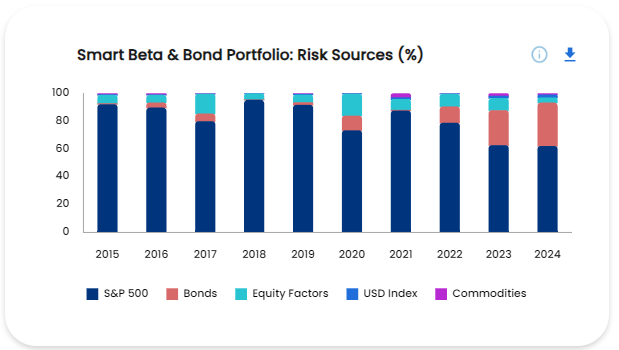

Next, we change the perspective to reviewing the risk sources of the portfolio, where we see that equities as proxied by the S&P 500 dominated in most years. The risk of a portfolio is a function of the volatility of its holdings and equities are more volatile than bonds, therefore equities contribute significantly more risk than expected given the 60% allocation.

However, we observe that in the most recent years, bonds have contributed more risk, which can be explained by these having become more volatile given rising interest rates.

Somewhat curious is that equity factors have contributed very little as risk sources, despite 60% of the portfolio being allocated to smart beta strategies.

Source: Finominal

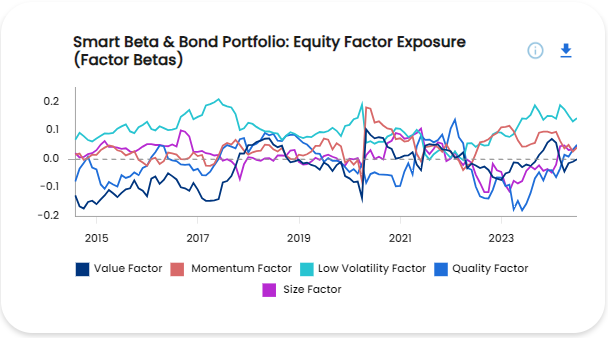

Given that the equity factors contributed little risk to the portfolio, it is worth taking a look at the betas to equity factors. The portfolio contains smart beta funds providing exposure to momentum, value, low volatility, and quality, so we would expect consistently positive betas to these four factors.

However, we only observe consistently positive exposure to the low volatility factor, time-varying exposures to momentum and quality, and negative exposure to the value factor, despite the 15% allocation to the Vanguard Value Index ETF (VTV).

Source: Finominal

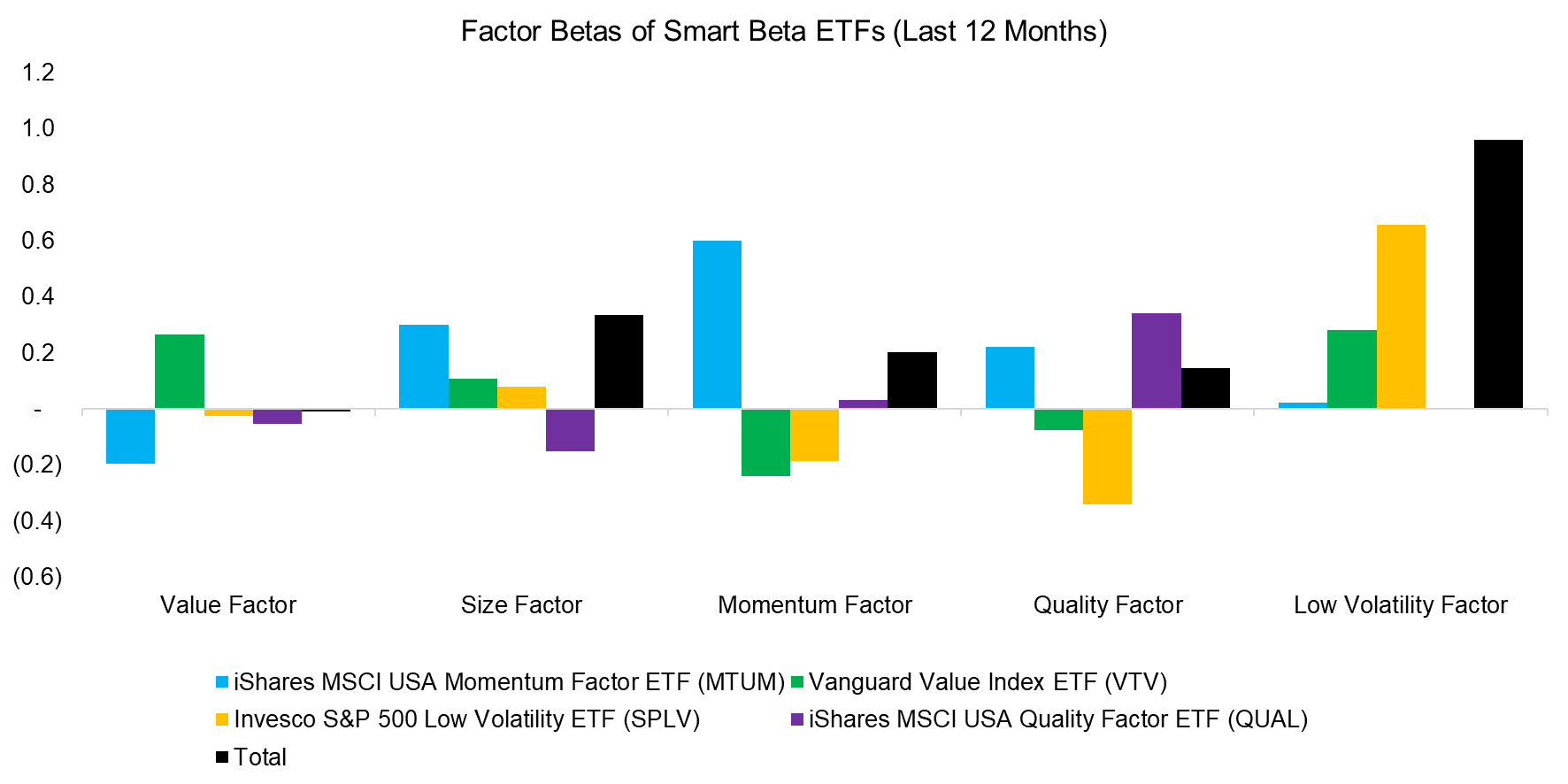

FACTOR EXPOSURE NETTING

We review the current factor betas of the four smart beta ETFs, which highlights that these have some opposing factor betas. For example, the iShares MSCI USA Momentum Factor ETF (MTUM) has a negative beta to the value factor while the Vanguard Value Index ETF (VTV) has a positive one. The sum of the betas to the value factor is close to zero.

Although we wanted exposure to four factors, the portfolio only offers meaningful positive exposure to the low volatility factor. Furthermore, there is also positive exposure to the size factor, which can be considered an unintended bet.

Source: Finominal

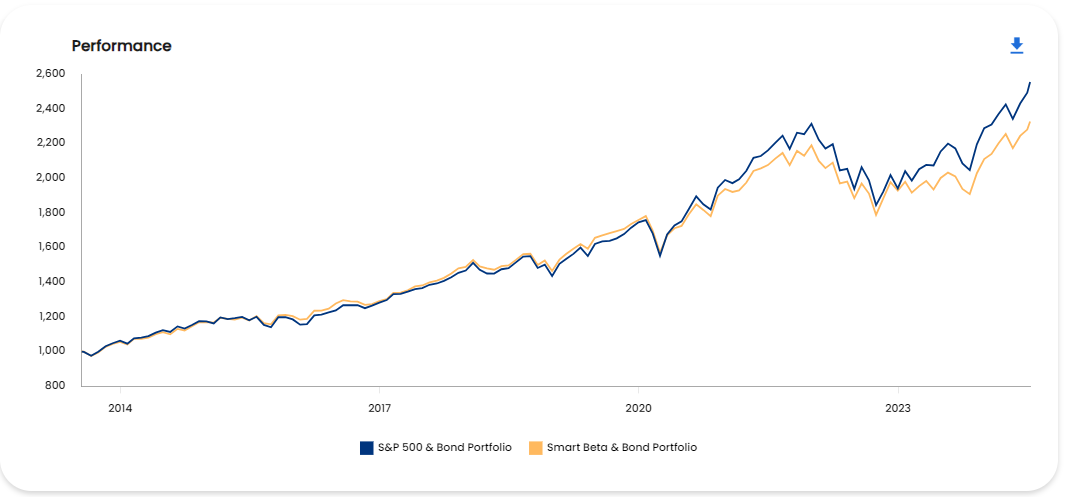

PERFORMANCE

Factor investing does provide the best shot at outperforming the stock market, or creating a portfolio with a higher Sharpe ratio, depending on the factor selection. However, combining smart beta funds with opposing factor betas can lead to a plain beta portfolio as the factor exposures are netted off.

Given that we have selected low-cost smart beta ETFs, the total portfolio cost is only 0.10% and not significantly more than a plain beta 60/40 portfolio comprised of the SPDR S&P 500 ETF Trust (SPY) and iShares Core US Aggregate Bond ETF (AGG) that costs 0.07%. However, if investors select mutual funds with opposing factor exposures, then this can result in an expensive portfolio that offers no value.

Source: Finominal

FURTHER THOUGHTS

How could investors have built a better smart beta portfolio?

- Only select funds with high factor exposures, which tend to be more concentrated, e.g. VTV has 392 holdings and therefore does not feature a high beta to the value factor (use Finominal`s Fund Explorer).

- Avoid any products that offer styles that are not backed by academic research, e.g. growth-focused funds.

- Analyze the exposures of funds to other factors and avoid any combinations that lead to factor exposure netting.

- Instead of combining multiple funds, select multi-factor products, ideally, ones that use the integrated model for stock selection (read Multi-Factor Models 101).

Finally, if possible, allocate to long-short multi-factor products rather than smart beta products as combining plain beta with factor exposure beats smart beta (read Smart Beta vs Alpha + Beta).

RELATED RESEARCH

Factor Investing Is Dead, Long Live Factor Investing!

Smart Beta vs Alpha + Beta

Factor Olympics 1H 2024

Outperformance Ain’t Alpha

How Painful Can Factor Investing Get?

Factor Exposure Analysis 102: More or Less Independent Variables?

Factor Exposure Analysis 101: Linear vs Lasso Regression

Factor Exposure Analysis 100: Holdings vs Regression-Based

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.