Commodities vs Commodity ETFs

Good or bad proxies?

March 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- The average correlation between oil and oil ETFs was only 0.8

- Gold ETFs provide better exposure to gold than oil ETFs to oil

- Gold mining stocks are hybrids that feature gold and equity beta

INTRODUCTION

As the war in Russia unfolded, crude oil (WTI) breached $100 per barrel, which was last seen in 2014. Inflation was already at a multi-decade-high level in most developed countries before this geopolitical catastrophe, but is now expected to rise even further.

Although investors have spent more time on how to deal with inflation in the last 12 months than in the previous decade, these new events likely require more work on portfolio construction to avoid negative real returns (read Building an Inflation Portfolio Using Asset Classes).

The traditional inflation hedge is to seek exposure to commodities, which can be achieved via a broad basket or selected assets, where oil and gold are the most-discussed candidates. Oil is typically seen as the beneficiary, sometimes also as the culprit, while gold is the hedge. Both assets are traded via futures as well as ETFs. However, do investors get the same exposure via both instruments?

In this research note, we explore the relationship between oil and gold prices versus ETFs tracking these.

OIL ETFS VS OIL

We focus on ETFs trading in the US that provide exposure to oil, which is a universe of six funds that manage a cumulative $3.9 billion of assets. The average management fee is 0.81%, which is expensive compared to equity or fixed income ETFs. The oldest ETF was launched in 2006, so there is a long track record for analysis.

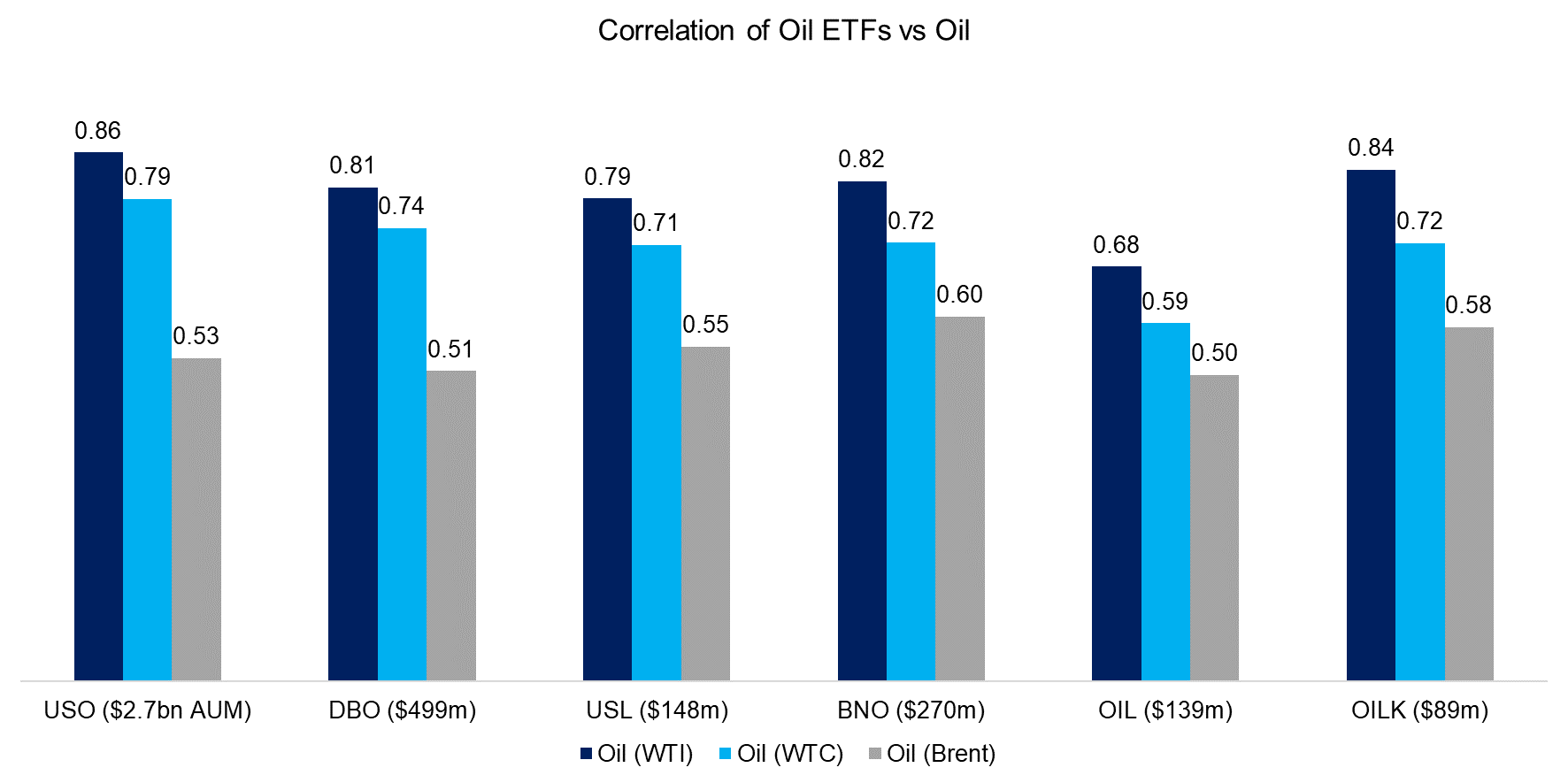

First, we investigate the relationship between the oil ETFs and the underlying commodity. We calculate the correlation to three types of oil futures: WTI, WTC, and Brent, where the average correlation was highest to WTI and lowest to Brent on average.

Source: FactorResearch

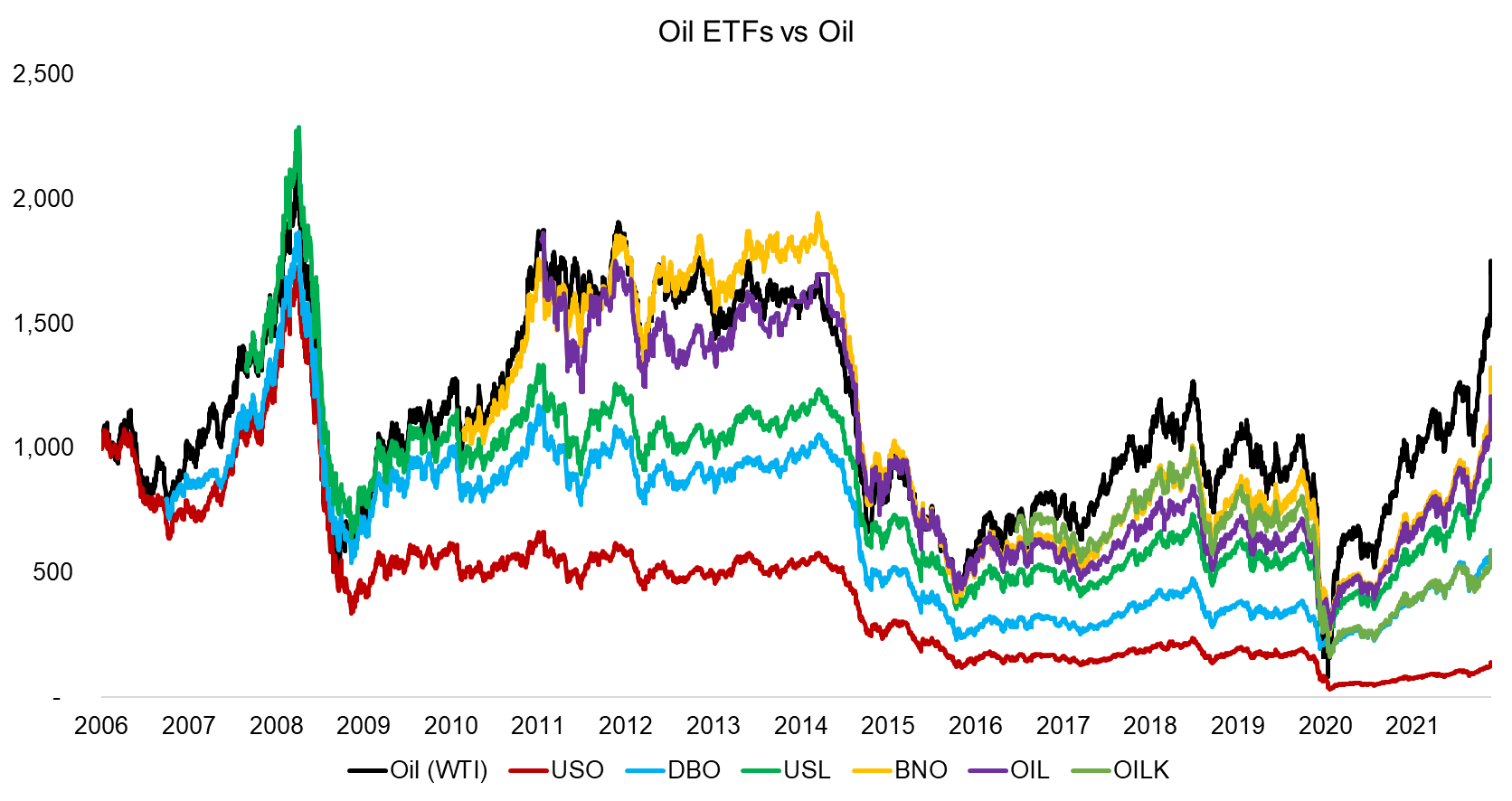

It is worth highlighting the average correlation of 0.80 of oil ETFs to oil (WTI) is not particularly high. Next, we index the performance of the ETFs to the oil price and observe that the trends in performance were similar, but annual returns were quite dispersed.

The most significant outlier is United States Oil Fund LP (USO), which is the largest ETF with $2.9 billion of assets under management and has the longest track record. An investor who would have invested at launch in 2006 would have lost more than 80% of the initial investment, despite the oil price being up almost 200% since then.

This discrepancy in performance can be explained by the portfolio construction of the ETF, which uses short-term oil futures that need to be rolled over on a monthly basis, which can incur a negative roll yield when the oil market is in contango. Given this, the ETF is more adequate for implementing a short-term tactical trading view on oil rather than as a long-term holding.

Source: FactorResearch

GOLD ETFS VS GOLD

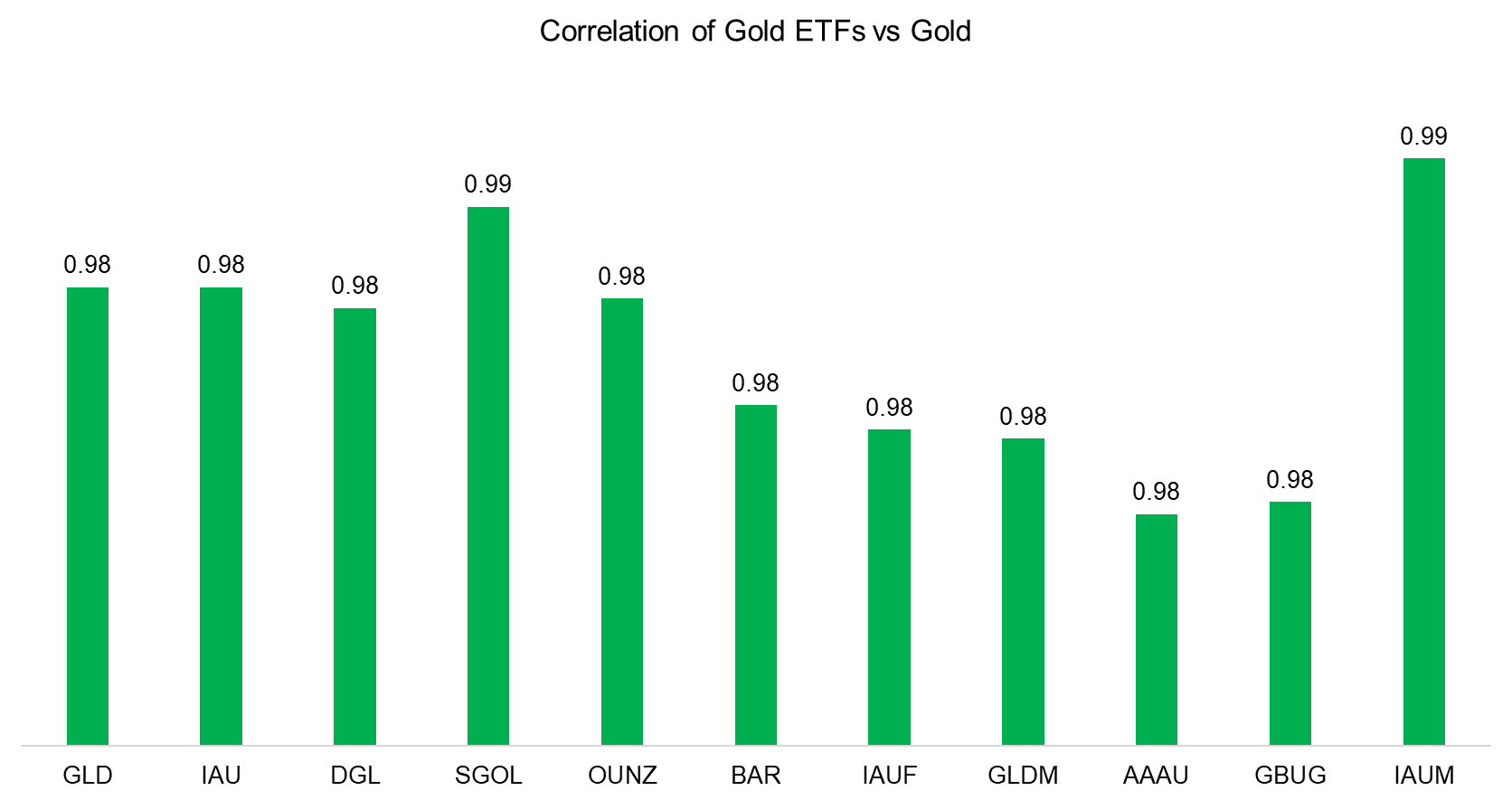

Next, we repeat our analysis for gold ETFs trading in the US, which manage $105 billion of assets and cost 0.25% on average. We calculate the correlation of gold ETFs to the gold price, which highlights a correlation of almost 1 for all 11 ETFs in our universe.

In contrast to oil ETFs, an investor can use these instruments for getting exposure to gold with fewer concerns. Some of these are also backed by physical gold rather than gold futures, which likely creates additional comfort to investors seeking an easy and economical way to invest in the metal.

Source: FactorResearch

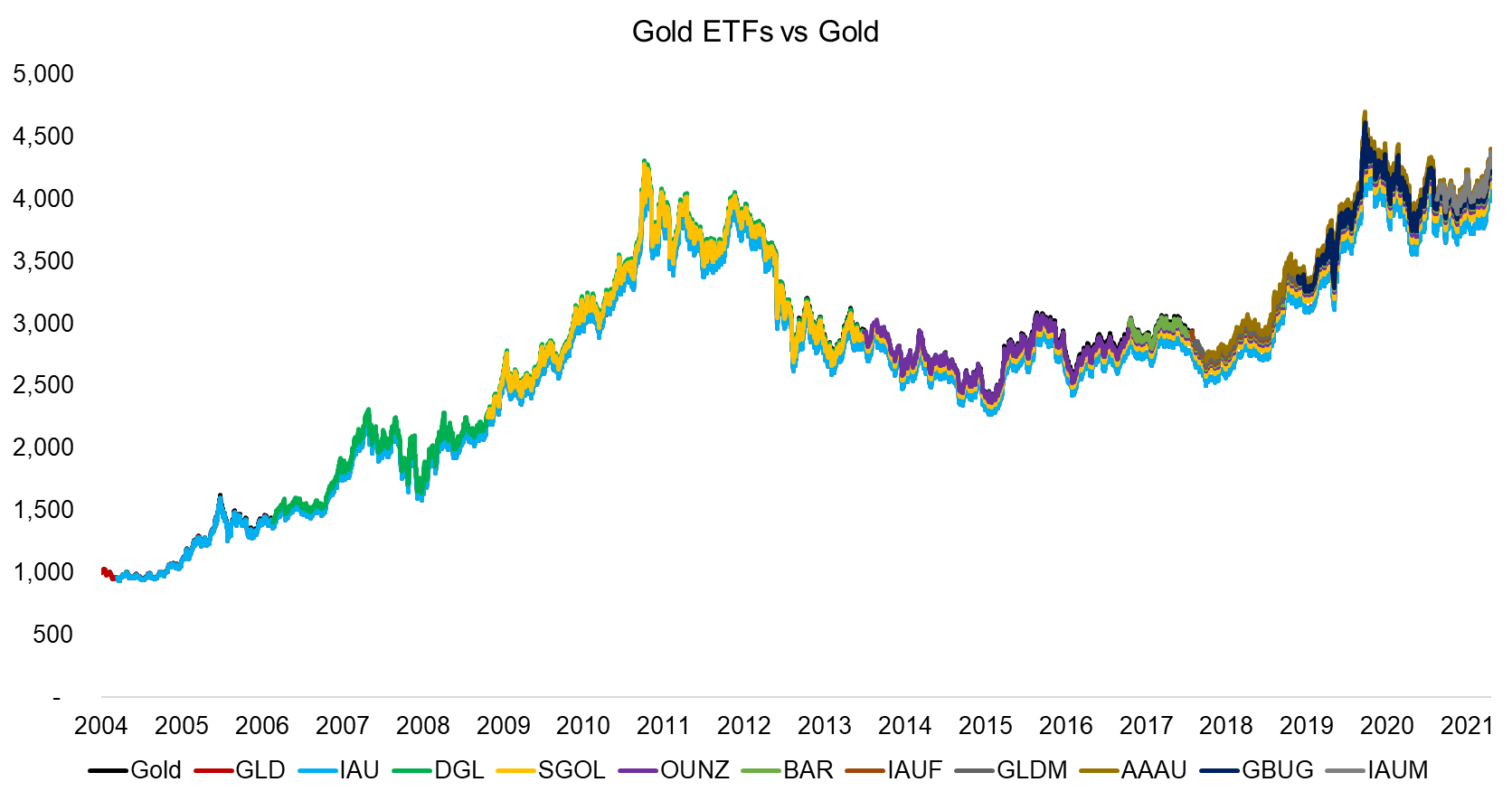

The high correlation of gold ETFs to the gold price is reflected in the performance of the ETFs and the commodity being indistinguishable in a chart, as seen below. Given this, an investor can focus on the liquidity of the ETF as well as management fees, which range from 0% for GBUG to 0.77% for DGL, when selecting an instrument.

Source: FactorResearch

GOLD MINERS VS GOLD

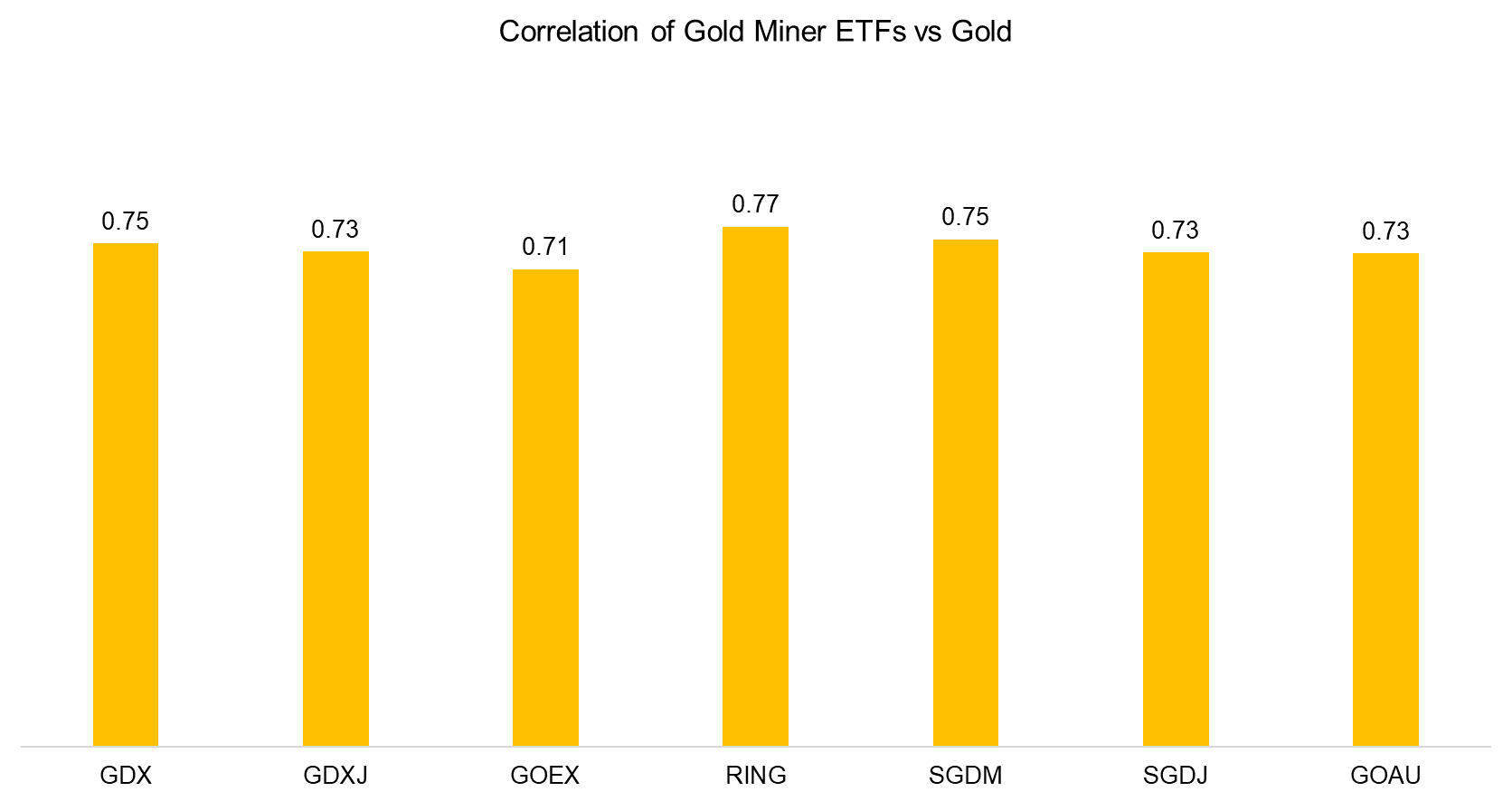

Some investors cannot hold commodity exposure directly, so are using commodity stocks as proxies. Gold mining stocks are popular and there are a few ETFs that provide exposure to this niche sector. The total assets under management of these ETFs are close to $20 billion and the average management fee is 0.52%.

However, the correlation of gold mining stocks to the gold price is only 0.75, which reflects the exposure to the general stock market as well as idiosyncratic risk. A gold mining company based in South Africa is influenced by the gold price, but also by local strikes, political turmoil, or a collapse of a single mine. Many of the companies have also entered long-term hedging contracts on gold to decrease the revenue volatility.

Source: FactorResearch

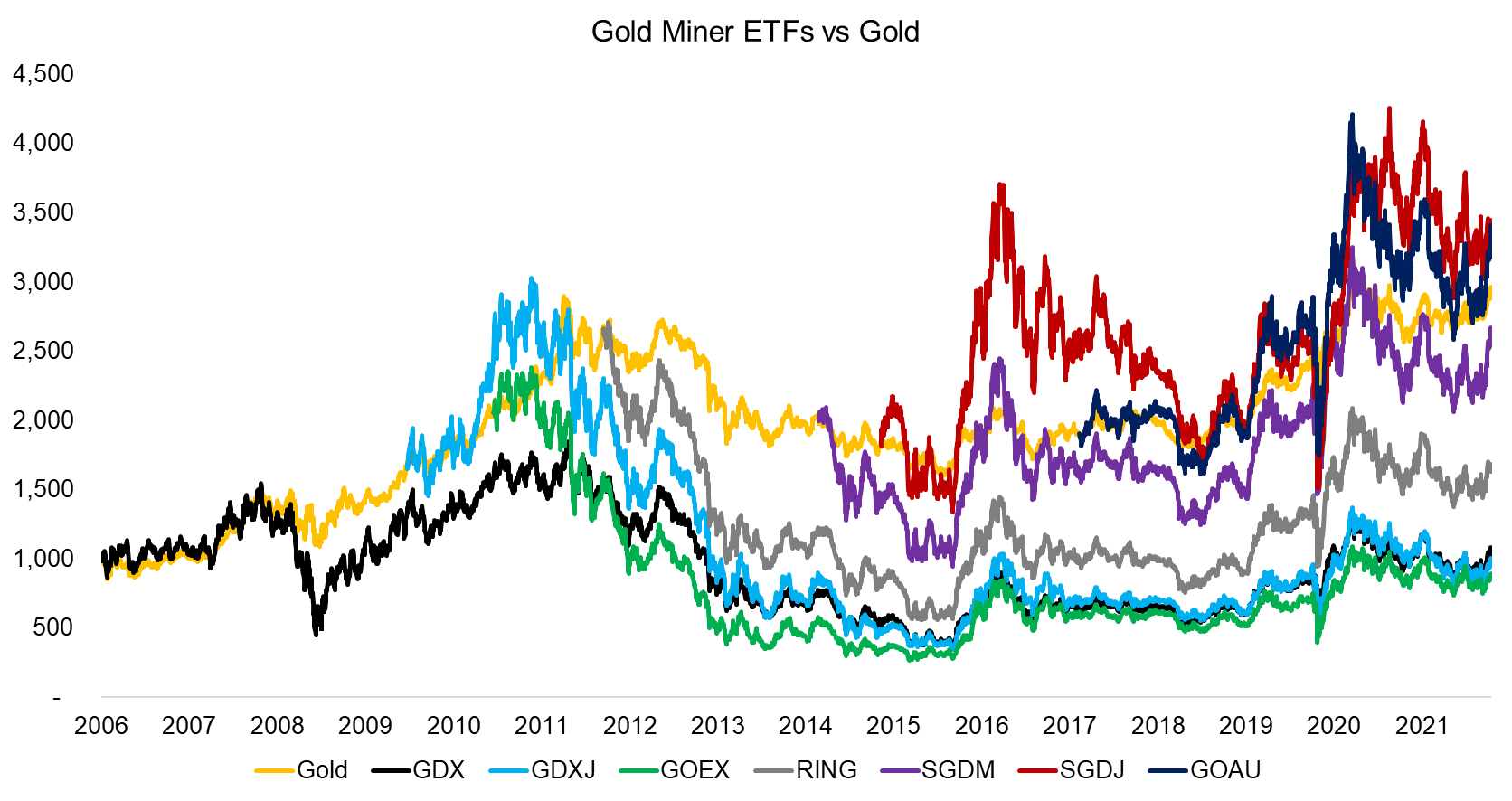

The less than perfect correlation of gold miners to the gold price is reflected in the returns that have been quite divergent from the underlying commodity. We also observe that these ETFs have different portfolios as they generated substantially different returns from each other.

Investors can compare these to other hybrid instruments like REITs, which are influenced by the stock, bond, and real estate markets. Naturally, this makes it difficult to consider gold miner ETFs in an asset allocation framework, as they partially increase existing risk exposures like equity (read The Case Against REITS).

Source: FactorResearch

FURTHER THOUGHTS

Although it is tempting for investors to jump on the inflation wagon via increasing their commodity exposure, this is essentially market timing. We can analyze the track record of global macro hedge funds, which do this style of trading for a living, and observe that their alpha has been zero since 2015.

Naturally, it is perfectly fine and sound to consider inflation when constructing an asset allocation framework, but this should be a structural rather than transitory allocation.

RELATED RESEARCH

Inflation-Themed ETFs: As Complicated as Inflation

Building an Inflation Portfolio Using Stocks

Myth-Busting: Equities are an Inflation-Hedge

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.