Complexity is the Enemy of Investing

A case study of a poorly designed portfolio from the world´s largest asset manager

February 2025. Reading Time: 10 Minutes. Author: Nicolas Rabener.

- Financial experts create complex portfolios to justify their fees

- However, complexity does not necessarily make better portfolios

- In the contrary, these often led to unnecessarily expensive solutions

INTRODUCTION

In November 2024, SoFi, a comprehensive financial app catering to retail investors, unveiled a new robo-advisor platform developed in collaboration with BlackRock, the world’s largest and most sophisticated asset manager.

Given BlackRock’s ownership of iShares, one might have anticipated straightforward, low-cost portfolios designed to be easily understood by retail investors. Instead, BlackRock appears to have leveraged its expertise to create unnecessarily complex portfolios, seemingly prioritizing fee maximization over simplicity and investor benefit.

This article serves as a case study on pitfalls to avoid when designing investment portfolios.

PORTFOLIO ANALYSIS

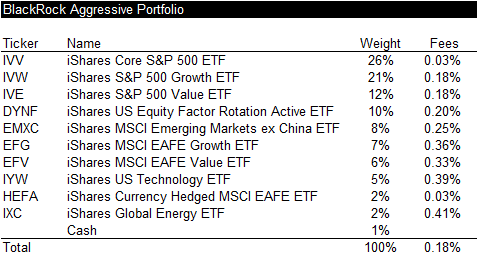

BlackRock designed a variety of portfolios for SoFi, tailored to investors’ risk tolerance and tax considerations, with sustainable investing options also available. This analysis focuses on the Aggressive Portfolio intended for retirement accounts, an all-equities portfolio.

The Aggressive Portfolio consists of 10 iShares ETFs, offering exposure to U.S. equities (77%), international equities (15%), and emerging markets equities (8%). While the management fee is 0.18%, investors must also pay SoFi an advisory fee of 0.25%, bringing the total portfolio fee to 0.43%.

Source: BlackRock, Finominal

COMBINING FUNDS WITH OPPOSING FACTOR EXPOSURES

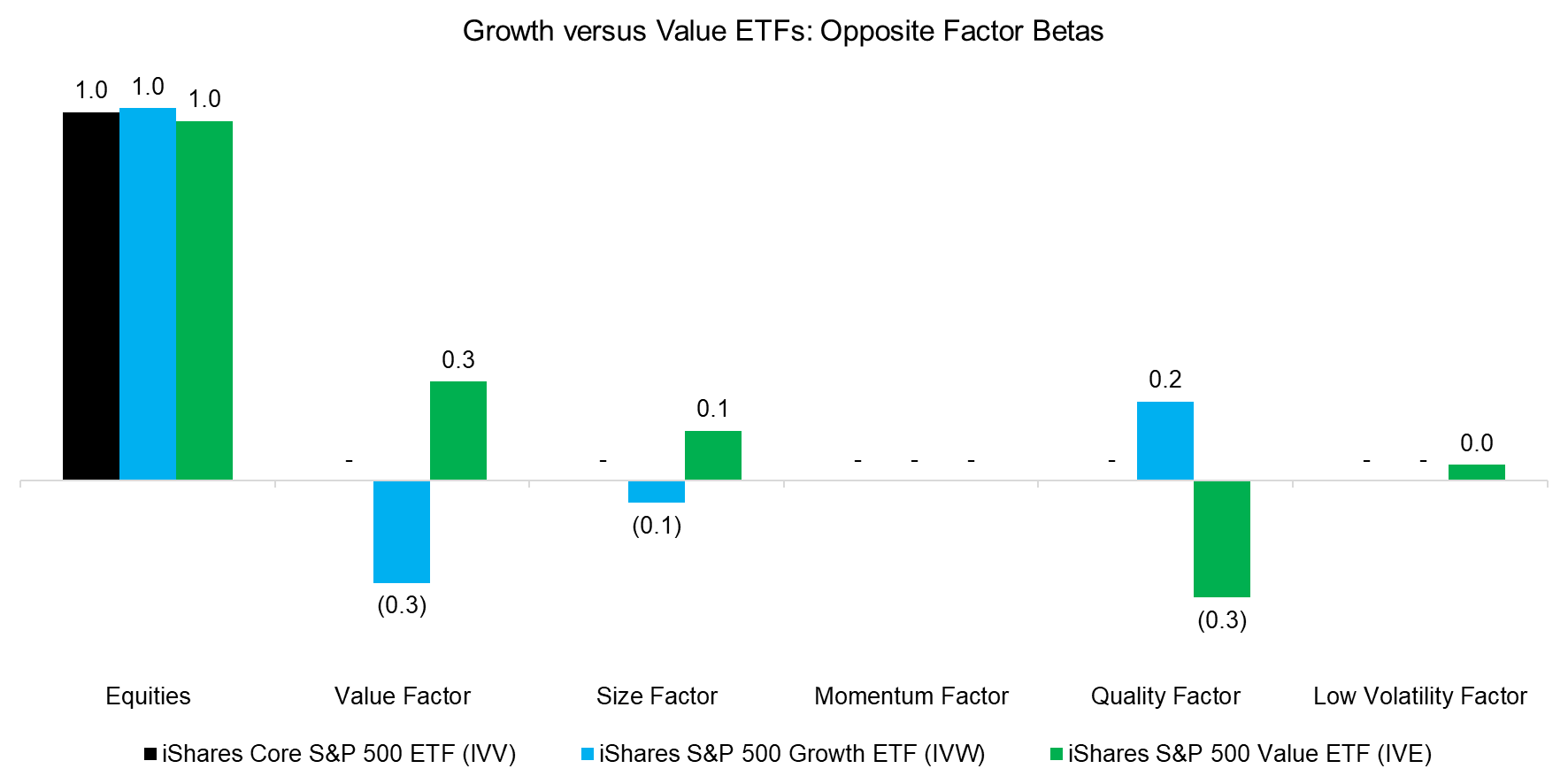

The three largest positions in the portfolio are the S&P 500, S&P 500 Growth, and S&P 500 Value ETFs. While retail investors might assume that including different investment styles enhances diversification, this assumption falls apart when the styles are highly negatively correlated.

A straightforward returns-based factor exposure analysis reveals that the S&P 500 Growth and S&P 500 Value ETFs have opposing factor exposures. When combined, these exposures effectively cancel each other out, leaving investors with a portfolio that mirrors the plain-vanilla S&P 500. However, instead of paying the low expense ratio of 0.03% for a simple S&P 500 ETF (IVV), investors are charged 0.18%.

Source: Finominal

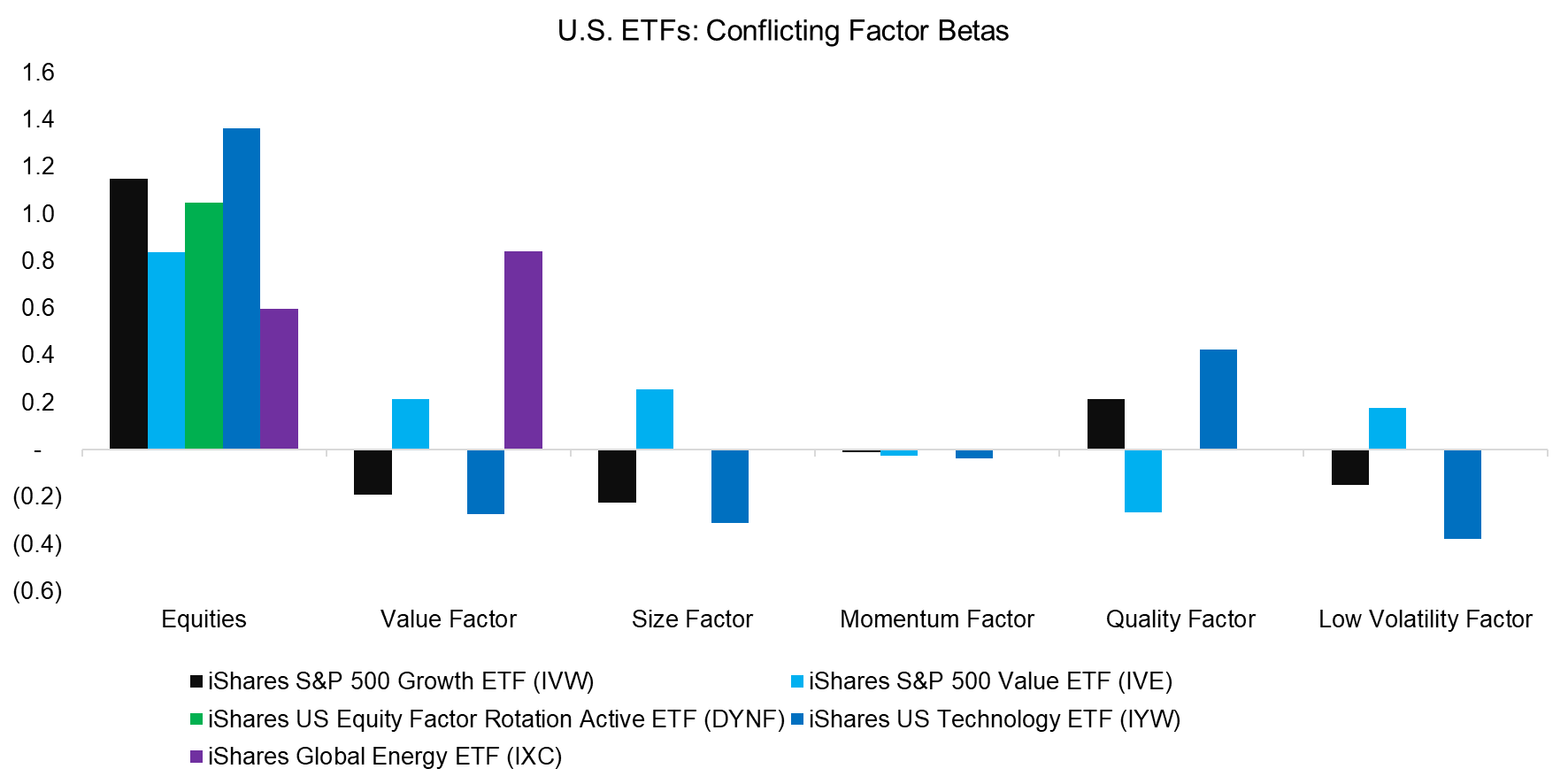

BlackRock also included the iShares US Equity Factor Rotation Active ETF (DYNF), an effort to time factor performance. However, DYNF further amplifies the issue of factor netting. The same problem arises with the iShares US Technology ETF (IYW), which has growth-oriented characteristics, and the value-focused iShares Global Energy ETF (IXC).

Source: Finominal

IMPACT OF FACTOR NETTING

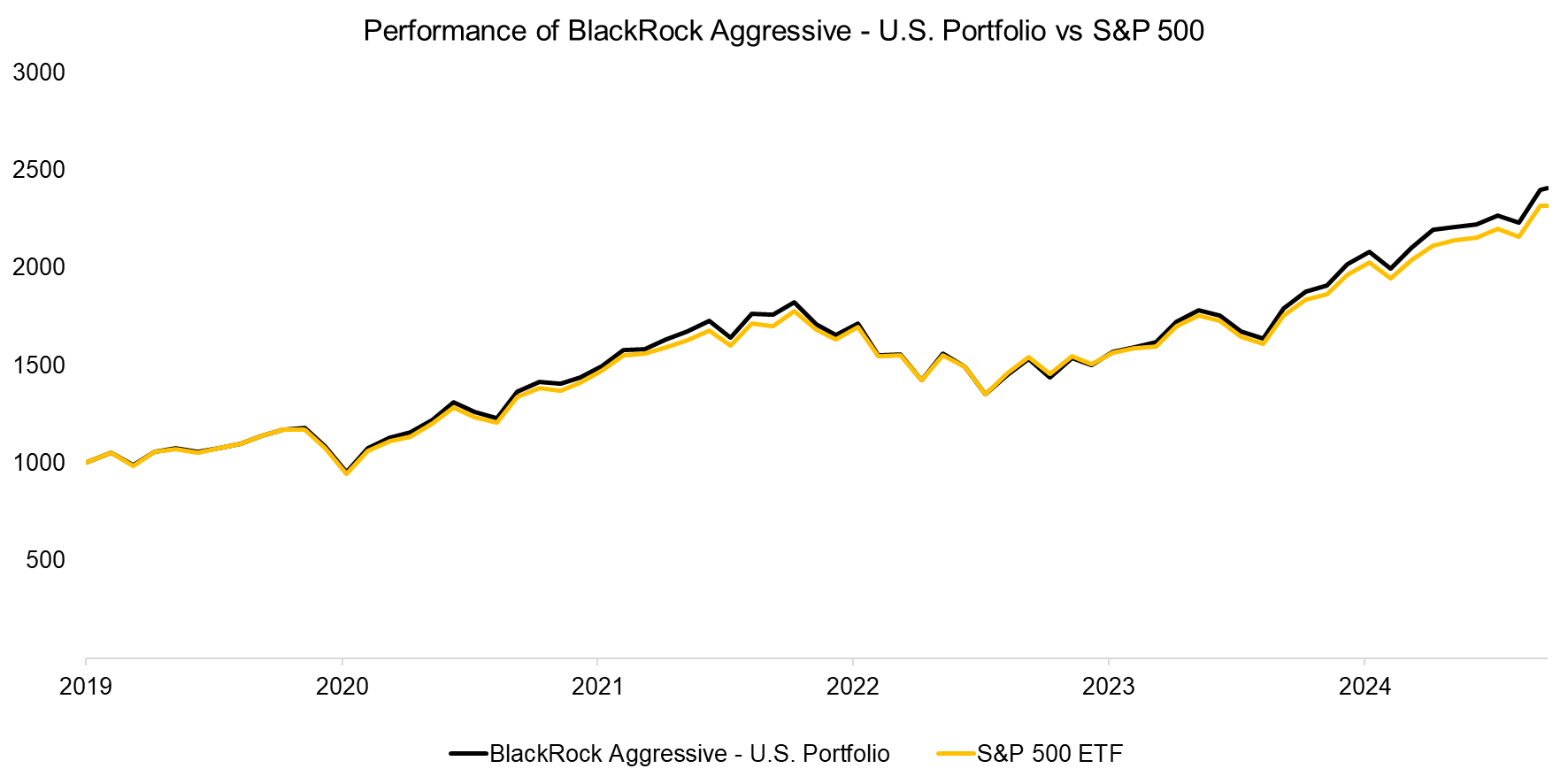

The U.S.-focused ETFs in the Aggressive Portfolio nearly cancel out their factor exposures, effectively giving investors a portfolio equivalent to the S&P 500 – but with higher fees.

BlackRock might argue that the U.S. portion of the Aggressive Portfolio has slightly outperformed the S&P 500 since 2019, justifying the complex structure and higher costs. However, this portfolio was only recently created and appears to suffer from hindsight bias, as evidenced by its elevated allocations to growth and technology ETFs.

Source: Finominal

To be clear, factors can be valuable for pursuing higher absolute or risk-adjusted returns, but portfolios must be constructed with thoughtful and coherent factor exposures.

INTERNATIONAL EQUITIES PORTFOLIO QUESTIONS

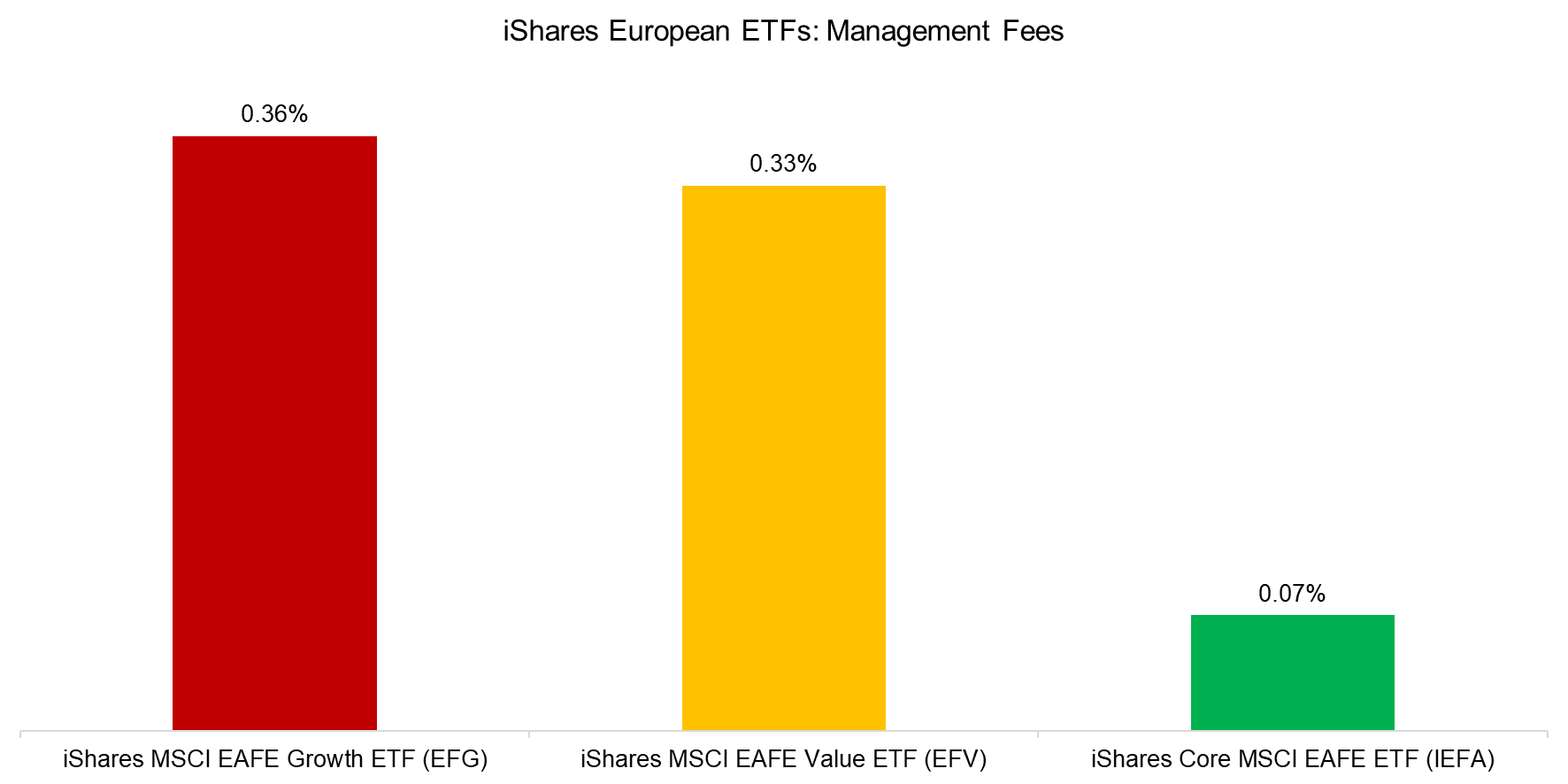

Unfortunately, BlackRock appears to be using similar portfolio construction tactics with international equities, which are largely represented by the iShares MSCI EAFE Growth ETF (EFG) and iShares MSCI EAFE Value ETF (EFV).

As with the U.S. stock market, these two ETFs have opposing factor exposures, effectively leaving investors with the equivalent of the MSCI EAFE. However, instead of paying the lower fee of 0.07% for the iShares Core MSCI EAFE ETF (IEFA), investors are charged 0.35%.

Source: BlackRock, Finominal

The portfolio also includes a 2% allocation to the iShares Currency Hedged MSCI EAFE ETF (HEFA), which has a low expense ratio of 0.03%. However, such a small allocation has virtually no impact on the portfolio’s overall performance. If BlackRock is genuinely concerned about currency risk, it would make more sense to allocate the entire 15% international equities portion to this ETF.

TOTAL PORTFOLIO CONSIDERATIONS

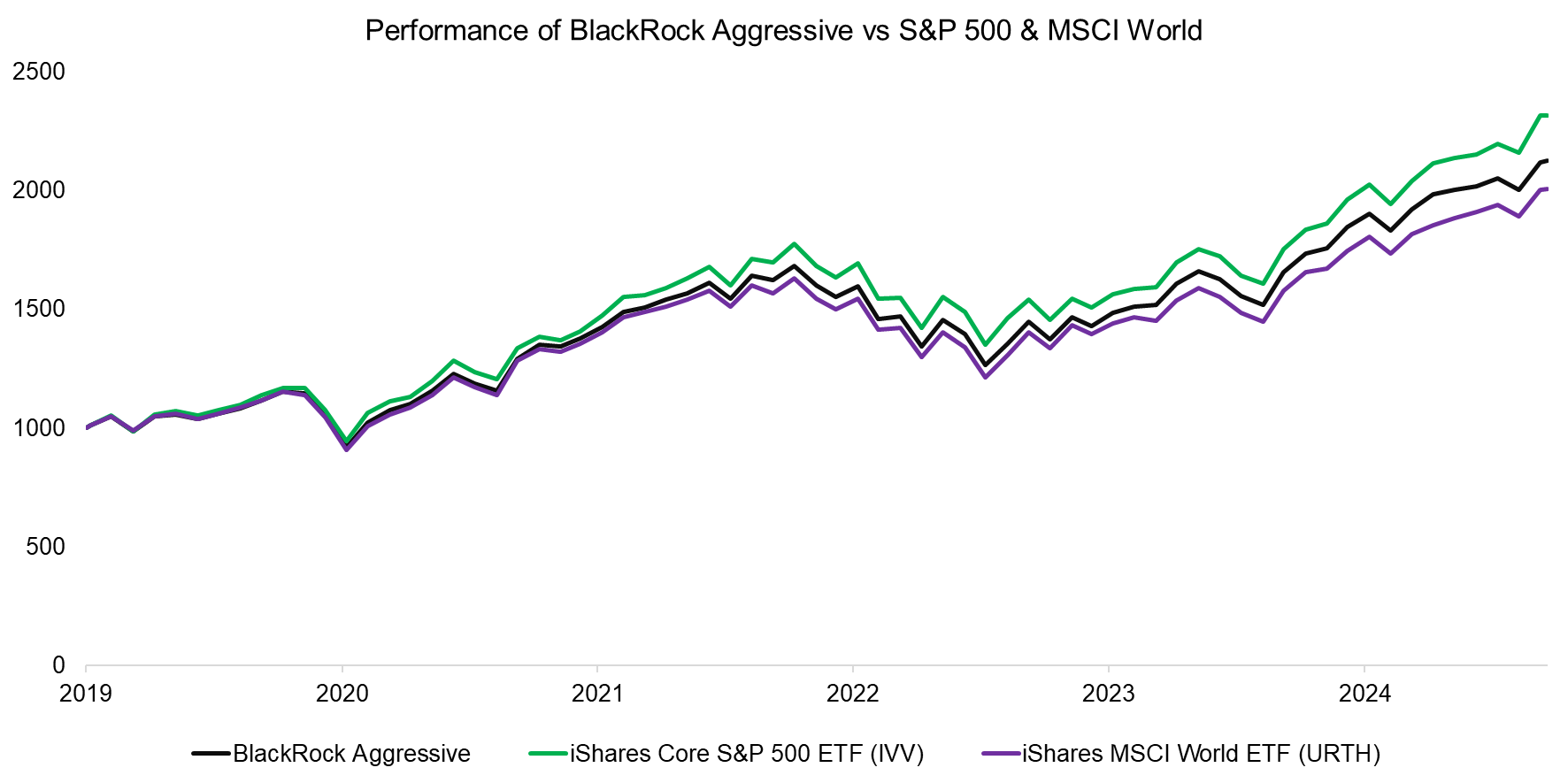

Constructing a portfolio with funds that have opposing factor exposures and allocations too small to make a meaningful impact ultimately leaves investors with a portfolio resembling a blend of the S&P 500 and the MSCI World Index.

This unnecessarily complex structure not only confuses investors but also complicates management for BlackRock. Allocations are far easier to evaluate when focused on the balance between U.S. and international exposures, rather than navigating a portfolio spread across 10 different funds. Simplifying portfolios enhances clarity and makes decision-making more straightforward.

FURTHER THOUGHTS

While it is true that BlackRock has designed an overly complex portfolio seemingly to maximize fees, investors share some responsibility due to their preference for complexity over simplicity.

Many investors mistakenly believe that greater expertise automatically translates to better outcomes. However, this assumption does not hold in the investing world, as evidenced by the fact that the majority of active fund managers – despite their expertise – fail to outperform their benchmarks across various markets and time frames.

BlackRock has undeniably delivered immense value to investors worldwide by introducing low-cost funds. However, it also has a responsibility to lead by example, simplifying portfolios and providing investors with straightforward, transparent options that are less likely to mislead.

RELATED RESEARCH

Replicating Funds via S&P 500 & Smart Beta ETFs

When Hindsight Becomes Foresight: Replicating Investment Performance

Replicating Popular Investment Strategies with Equities + Cash

Time Machines for Investors

Equal versus Market Cap-Weighted Stock Market Indices

Cap-Weighted Benchmarks: Good Momentum Bets?

Equal vs Market Cap-Weighted Portfolios in Stock Market Crashes

The Juggernaut Index

The Fallacy of Betting on the Best Stock Market

Stock Selection versus Asset Allocation

What´s Better than the S&P 500?

Outperformance via Leverage

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.