Corporate Debt in the Chinese Stock Market

How levered are Chinese stocks?

January 2019. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

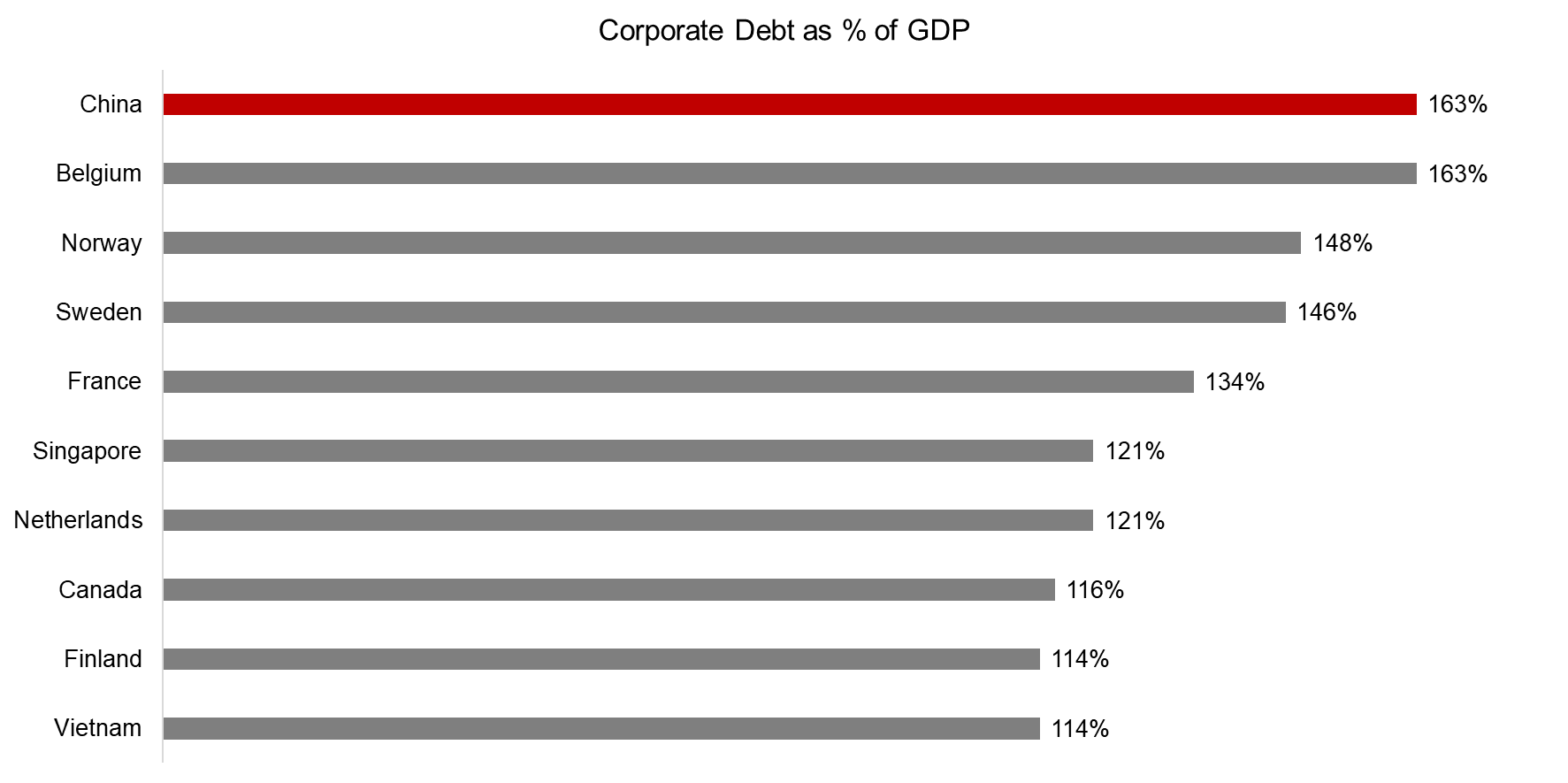

- China exhibits the world’s highest corporate debt as % of GDP

- However, Chinese stocks are not significantly more levered than U.S. stocks

- Asset and debt growth has stalled in 2018, likely indicating an economic slowdown

INTRODUCTION

The McKinsey Global Institute published an influential study in 2015 on the growth of global debt. The research note revealed that post the global financial crisis, which had its foundation in debt, the world continued to add leverage. China was featured prominently as its debt quadrupled to $28 trillion between 2007 and 2014, which equates to 282% of GDP and is more characteristically of a developed country like the United States.

The Chinese economy is expected to have grown at 6.6% in 2018 according to the IMF while growth is anticipated to slow down to 6.2% in 2019, although some analysts discount both of these numbers substantially. A decline in growth makes debt, which has been fuelling economic growth, a much more dangerous instrument (read Equity Factors & GDP Growth).

Investors were forced to increase their exposure to Chinese stocks in 2018 when MSCI increased the weight of Chinese stocks in its emerging market index, which is tracked by $1.6 trillion of assets. In this short research, we will investigate the corporate leverage of Chinese stocks.

CORPORATE DEBT IN CHINA

The growth of Chinese debt between 2007 and 2014 was split across households, the government, and corporates, although the latter group showed the strongest increase by growing its debt by 52%. This trend continued and China has become the country with the highest amount of corporate debt as a percentage of GDP as of 2017.

The corporate leverage is higher than in developed and certainly higher than in emerging markets. Corporates in emerging markets are typically unable to reach such high levels of indebtedness as lenders, especially international investors, are wary of providing too much debt given regular economic boom-and-bust cycles. However, China has shown remarkable consistency in economic growth and credit is mainly supplied by domestic banks, which are effectively controlled by the government.

Source: MGI. Non-financial corporate debt as of Q2 2017. Ireland is excluded given that a large number of foreign companies are only domiciled for tax reasons.

CORPORATE LEVERAGE IN THE CHINESE STOCK MARKET

We focus on all non-financial Chinese A shares traded in Shanghai and Shenzhen, which are mainly companies focused on mainland China. It is worth noting that some large companies like Alibaba are excluded from this universe as these chose to be listed in New York, London, or Hong Kong.

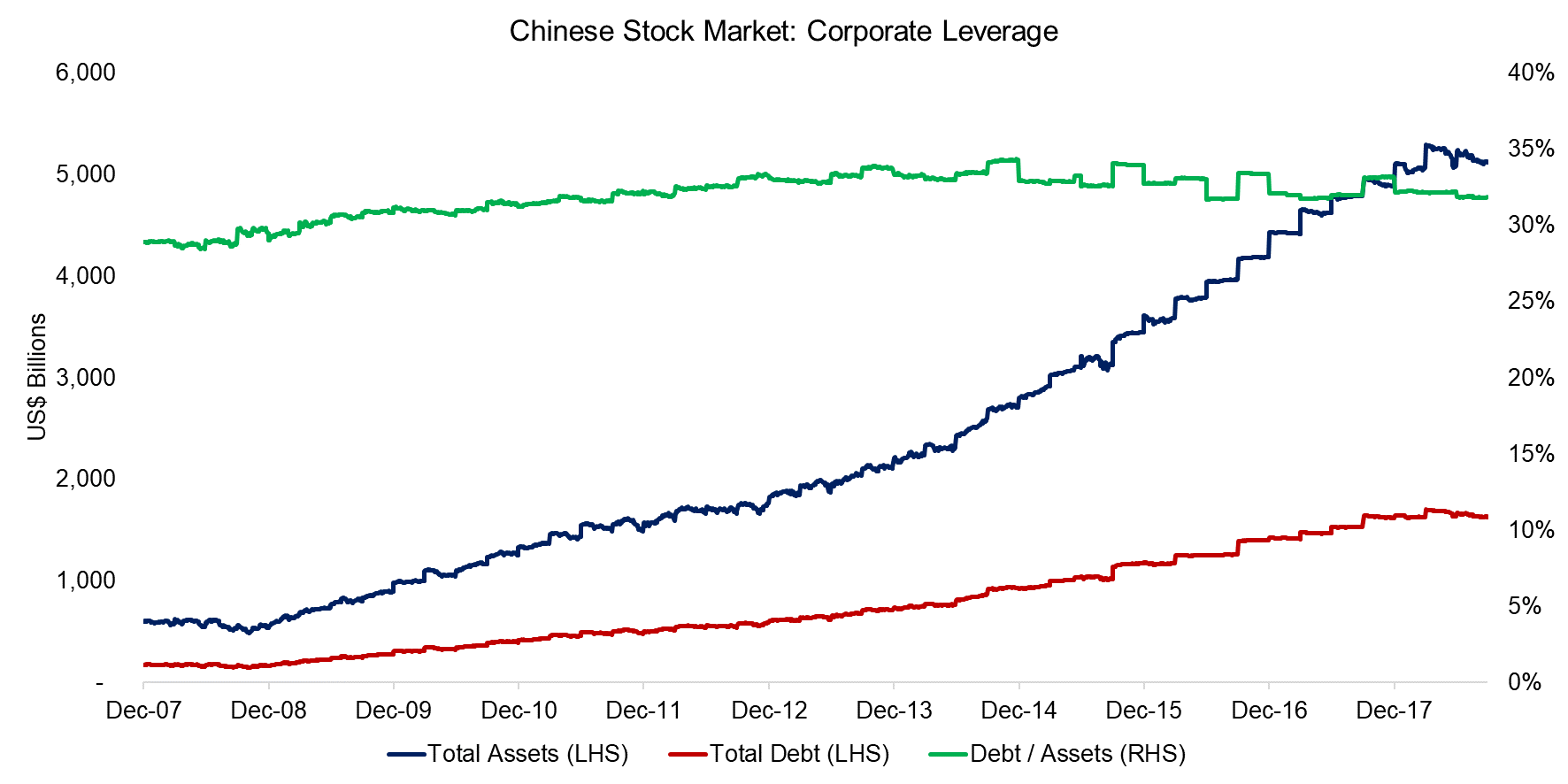

Given strong economic growth, we observe that the total assets of Chinese stocks, as well as debt, have increased significantly since 2007. However, the debt-over-assets ratio has remained relatively consistent over the last decade, indicating that Chinese stocks have not become riskier.

As corporate debt increased significantly as a percentage of GDP, this likely indicates that non-listed Chinese firms are accountable for the majority of the additional debt. Listed companies are required to publish financial statements and answer to investors and analysts, therefore face more pressure on maintaining healthy balance sheets than non-listed firms.

It is worth highlighting that total assets and debt have shown negative growth in 2018, which might be a result of corporate managers becoming more cautious on investments or that financing has become unavailable due to policy changes. Either likely indicates a slowdown of the Chinese economy.

Source: FactorResearch

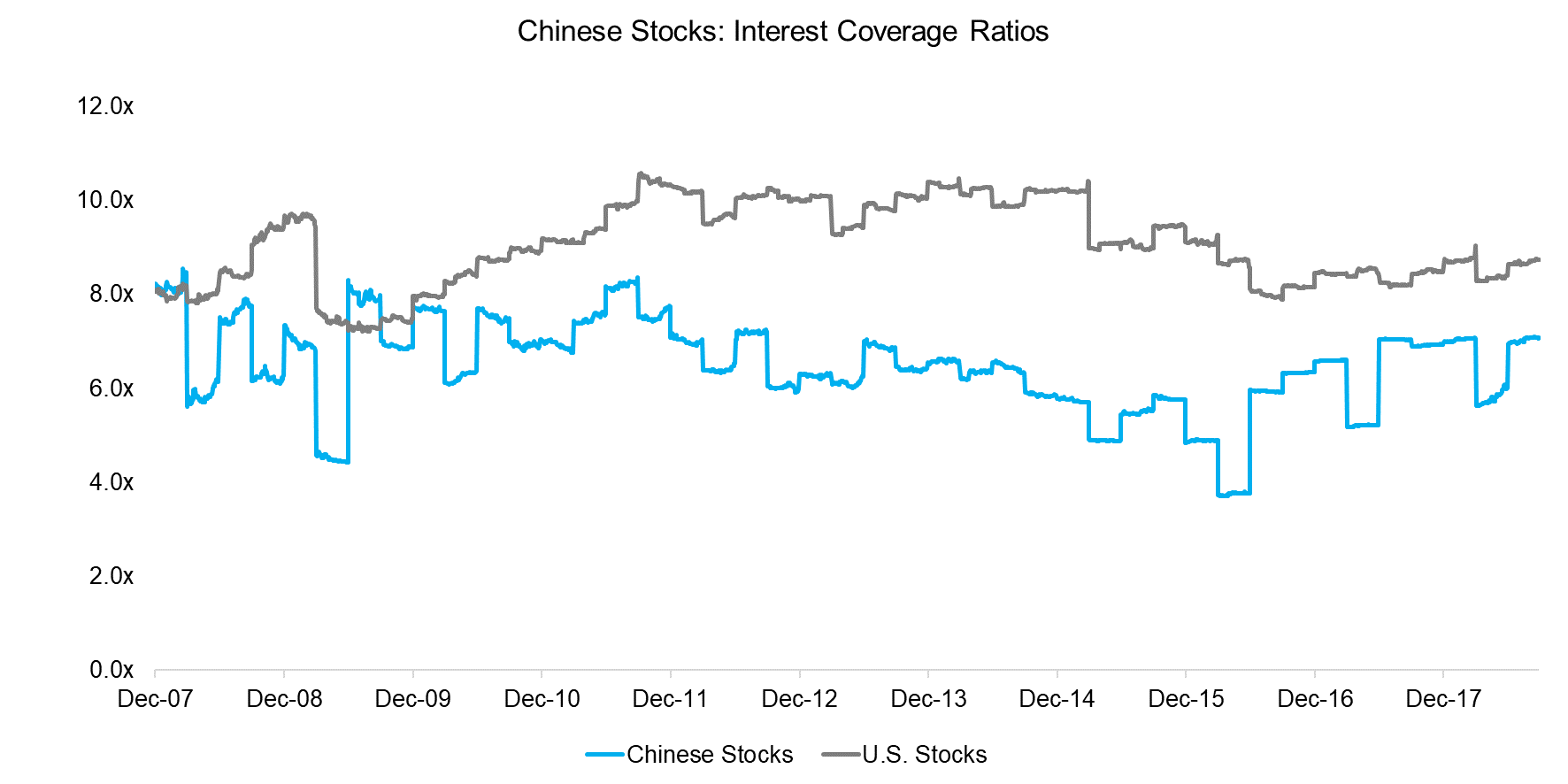

Next, we analyse the interest coverage ratios of Chinese stocks and contrast these to public equities in the U.S.. The analysis highlights that the ratios have been relatively stable across time. The interest coverage ratios are structurally lower than for U.S. stocks, indicating that Chinese stocks are slightly more risky from this perspective.

Chinese companies are basing financing decisions on historical growth rates, which likely need to be revised with the growth of the Chinese economy slowing down. Investors might question if Chinese managers will be able to adjust to the new normal of moderating growth.

Naturally this analysis ignores the characteristics of corporate debt, which can be quite diverse in nature. A larger amount of fixed, long-term debt can be less risky than a smaller amount of floating, short-term debt, depending on credit conditions.

Source: FactorResearch

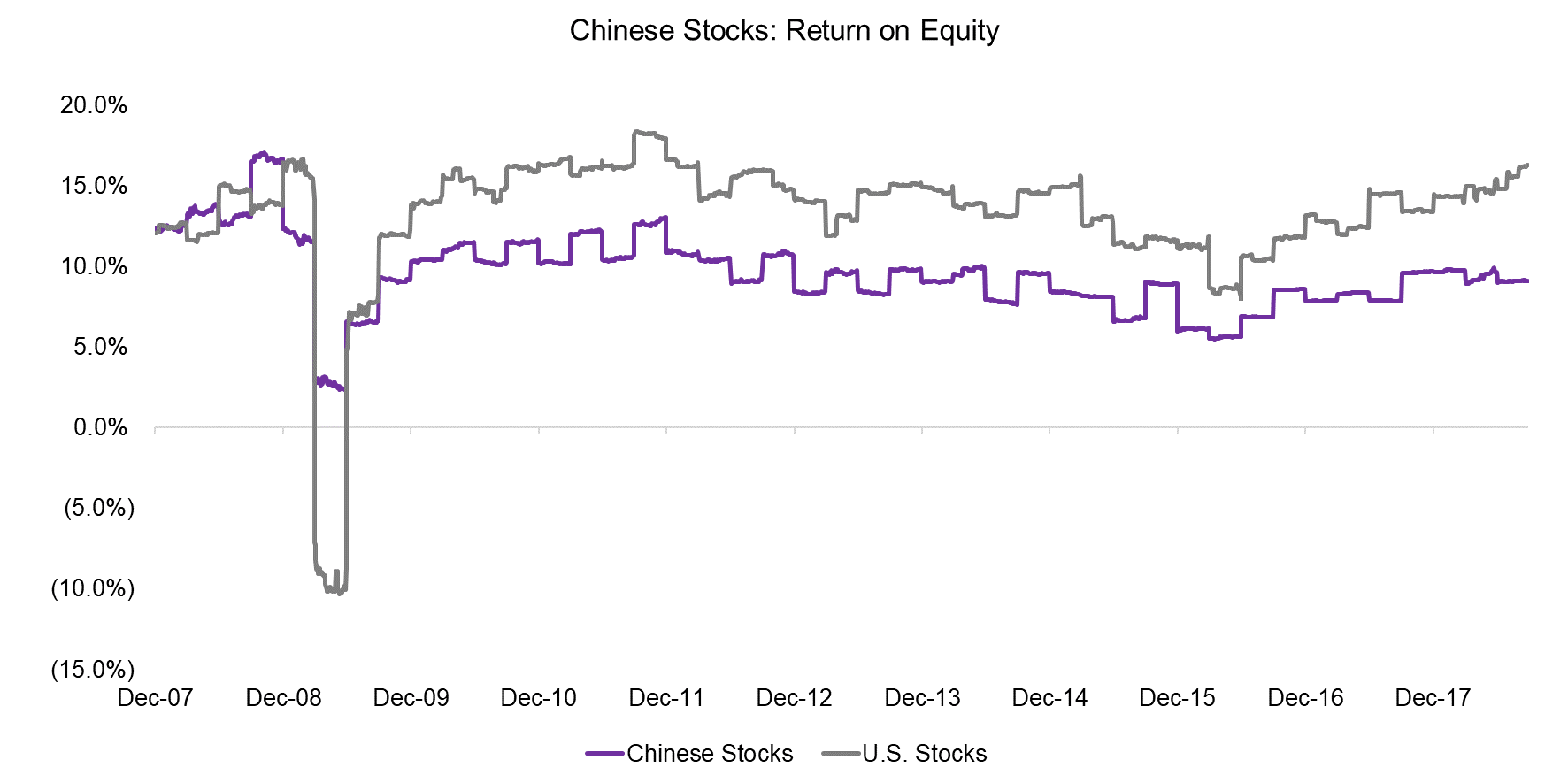

PROFITABILITY OF CHINESE STOCKS

Instead of analyzing how risky stocks are by highlighting their leverage, we can change the perspective to how healthy firms are by focusing on their profitability. The return on equity of Chinese stocks has been relatively consistent across time, except during the global financial crisis. We observe that U.S. stocks are more structurally more profitable and that profit margins in the U.S. are almost at record highs as of the end of 2018. The Chinese stock universe includes state-owned firms that operate far less efficient than purely private firms, which partially explains the lower levels of profitability.

Source: FactorResearch

CHINESE VERSUS U.S. STOCKS

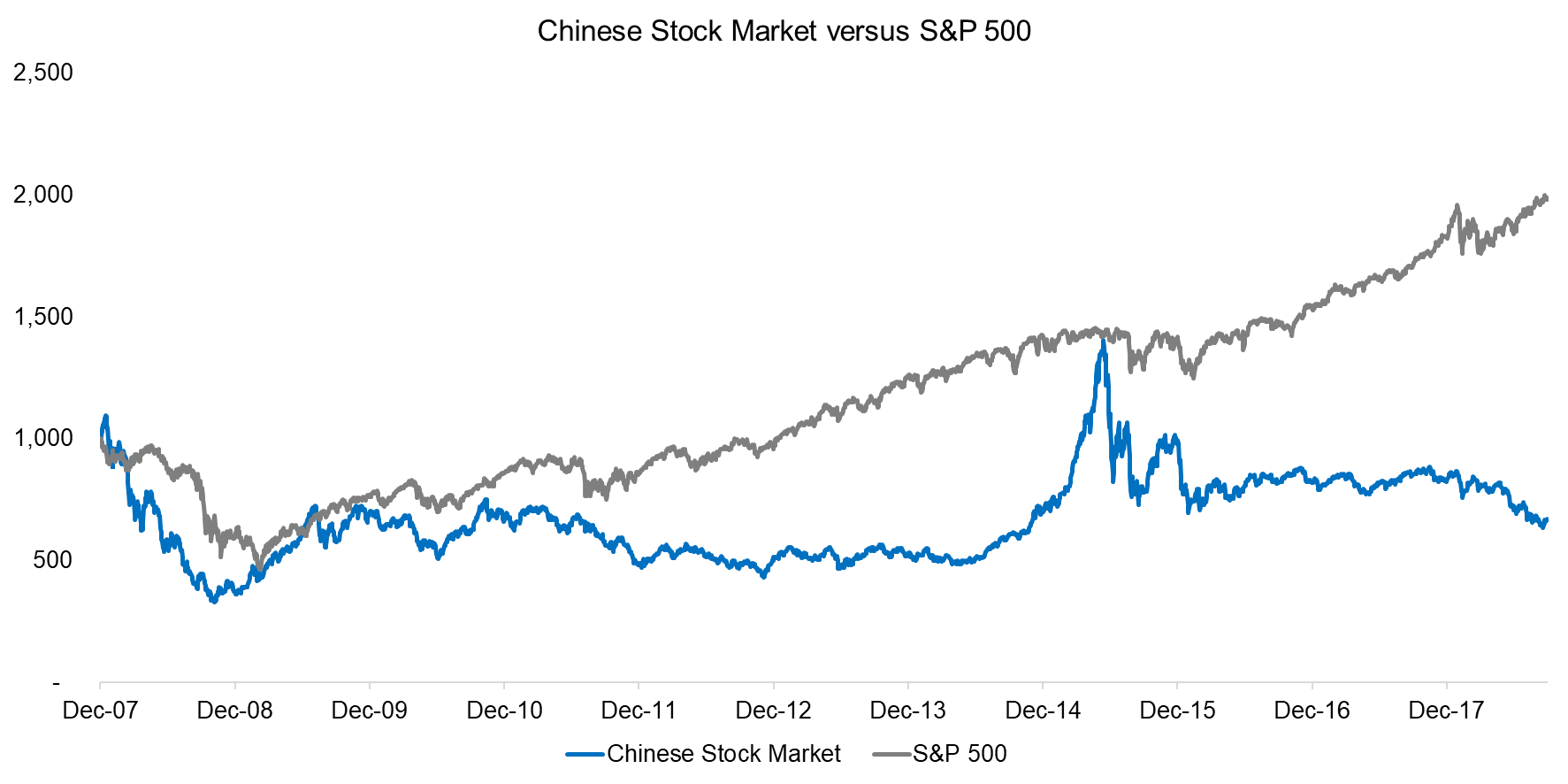

It is interesting to note that despite somewhat comparable levels of corporate leverage and profitability, Chinese and U.S. stock markets show vastly different performance (read The Odd Factors: Profitability & Investment). The return since 2007 is negative for investors in Chinese stocks while the U.S. stocks have generated highly attractive returns.

Source: FactorResearch

FURTHER THOUGHTS

Although this short research note highlights that the corporate leverage of Chinese stocks has been stable and comparable to U.S. stocks, these stocks will naturally not be immune to a Chinese debt crisis. The Chinese government has managed the economy exceptionally well and successfully mitigated crises on markets like housing.

However, the experience of trying and failing to stop the crash of the Chinese stock market in 2015 has also shown the limits of political power. China already features one of the highest ratios of debt to GDP, which requires a serious deleveraging. The economy is still growing strongly, but the working-age population has already started shrinking. Investors can look east for guidance as China is essentially the next Japan from a demographic and debt perspective.

RELATED RESEARCH

Factor Investing Made in China

REFERENCED RESEARCH

McKinsey Global Institute (MGI): Rising Corporate Debt: Peril or Promise?

McKinsey Global Institute (MGI): Debt And (Not Much) Deleveraging

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.