Creating Anti-Fragile Portfolios

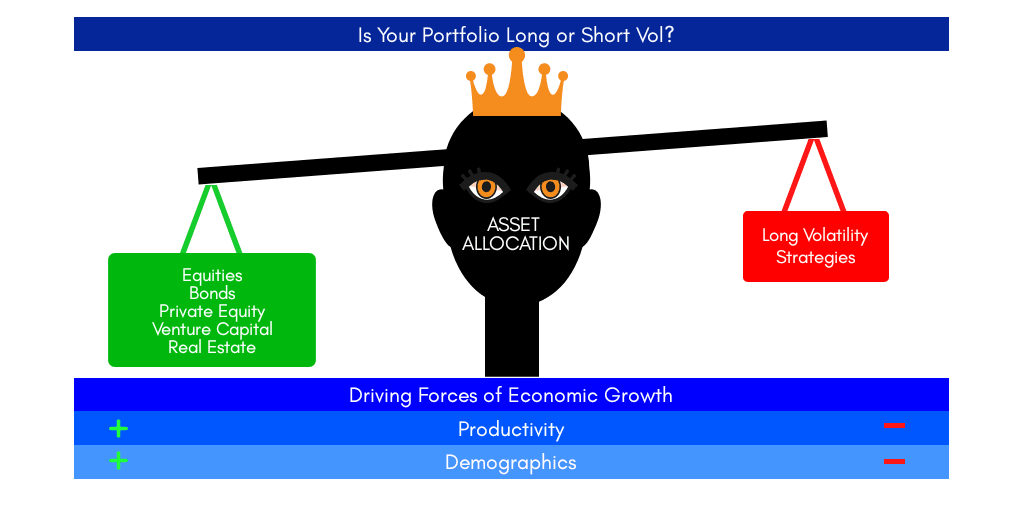

Is Your Portfolio Long or Short Vol?

August 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most asset classes are bets on economic growth

- Diversified endowment-style portfolios are essentially short volatility

- Long volatility strategies can be used to create anti-fragile portfolios

LONG OR SHORT VOLATILITY?

In what by now seems like a galaxy far far away, I once worked as an equity derivatives intern at Credit Suisse First Boston in London. As at other investment banks, the team had three distinct types of members: salespeople, traders, and structurers. The latter were almost exclusively polymaths from the top French engineering schools who had few job opportunities in Paris but surprisingly well-compensated ones across the English Channel.

Their core role was to create innovative new products that they first pitched to the team during daily 7 am meetings. In one such meeting, the managing director asked if the proposed product was long or short volatility.

The structurer was stumped and could not run through the complex derivative solution quickly enough. So he blushed and mumbled that he would revert later with an answer.

The question has stuck with me ever since. It is not a common one in the asset management industry. Most investors are pretty much the same across asset classes and their investment philosophy is relatively easy to grasp after a short conversation, whether they allocate capital to stocks, bonds, or real estate. They buy something because it is cheap, they follow trends, or invest in quality.

In contrast, speaking with someone who works on a derivatives desk is an almost alien encounter. It is all about gamma, delta-hedging, and similar terminology borrowed from the Greeks.

But after years in the investment industry in roles varying from real estate investor to hedge fund manager, I’ve found the question of whether a portfolio is long or short volatility has risen almost to the top when it comes to long-term asset allocation (read Thou Shall Not Short the VIX).

Let me make the case.

PAPER DIVERSIFICATION

Most asset classes are bets on economic growth. Companies struggle to grow earnings when growth is declining and corporate and sovereign bond default rates rise.

Some asset classes — private equity or real estate, for example — ostensibly provide diversification benefits. But that is only on paper. Their returns are calculated using lagged and smoothened valuations. Try selling that private company or commercial building at its recent valuation when the economy is falling into recession.

In what looks almost like a gigantic Ponzi scheme, everything depends on the global economy’s continued expansion.

So, what drives economic growth? Broadly speaking, it’s the change in productivity and the working-age population. The former is a vague concept, the latter crystal clear.

In theory, the technological innovations of recent years should have led to massive productivity increases. But economists haven’t been able to make a statistical case for this (read Global Macro: Masters of the Universe?).

By contrast, population trends are easy to understand. The populations of most developed countries and many emerging ones are shrinking. For example, China is expected to lose 400 million people between now and 2100. That’s more than the current population of the United States.

The lack of productivity and population growth leads to lower or maybe even negative global economic growth in the medium to long term. Japan serves as a real-life case study. To be sure, my own view may be skewed from having lived in Japan for years. But I’ve walked through entire villages that have been entirely deserted due to population declines. Against such structural headwinds, the unconventional monetary policies of recent years seem wholly inadequate.

From this perspective, endowment-style portfolios that are diversified across asset classes are more or less all the same flavor ice cream. They require economic growth and benefit from low or falling economic and market volatility.

Put another way: They are short volatility.

Source: FactorResearch

LONG VOLATILITY STRATEGIES

Naturally, some strategies do exhibit low correlations to traditional asset classes. The hedge fund universe comes to mind. But most hedge funds have either high correlations to equities (long-short equities), tend to fail in crises (merger arbitrage), provide little alpha over long time periods (equity market neutral), or are not hedged at all (distressed debt). And almost all are expensive.

The managed futures category is one notable exception. Managed futures have structurally low correlations to stocks and bonds, are supported by an abundance of academic research, and are available as low-cost mutual funds and exchange-traded funds (ETFs).

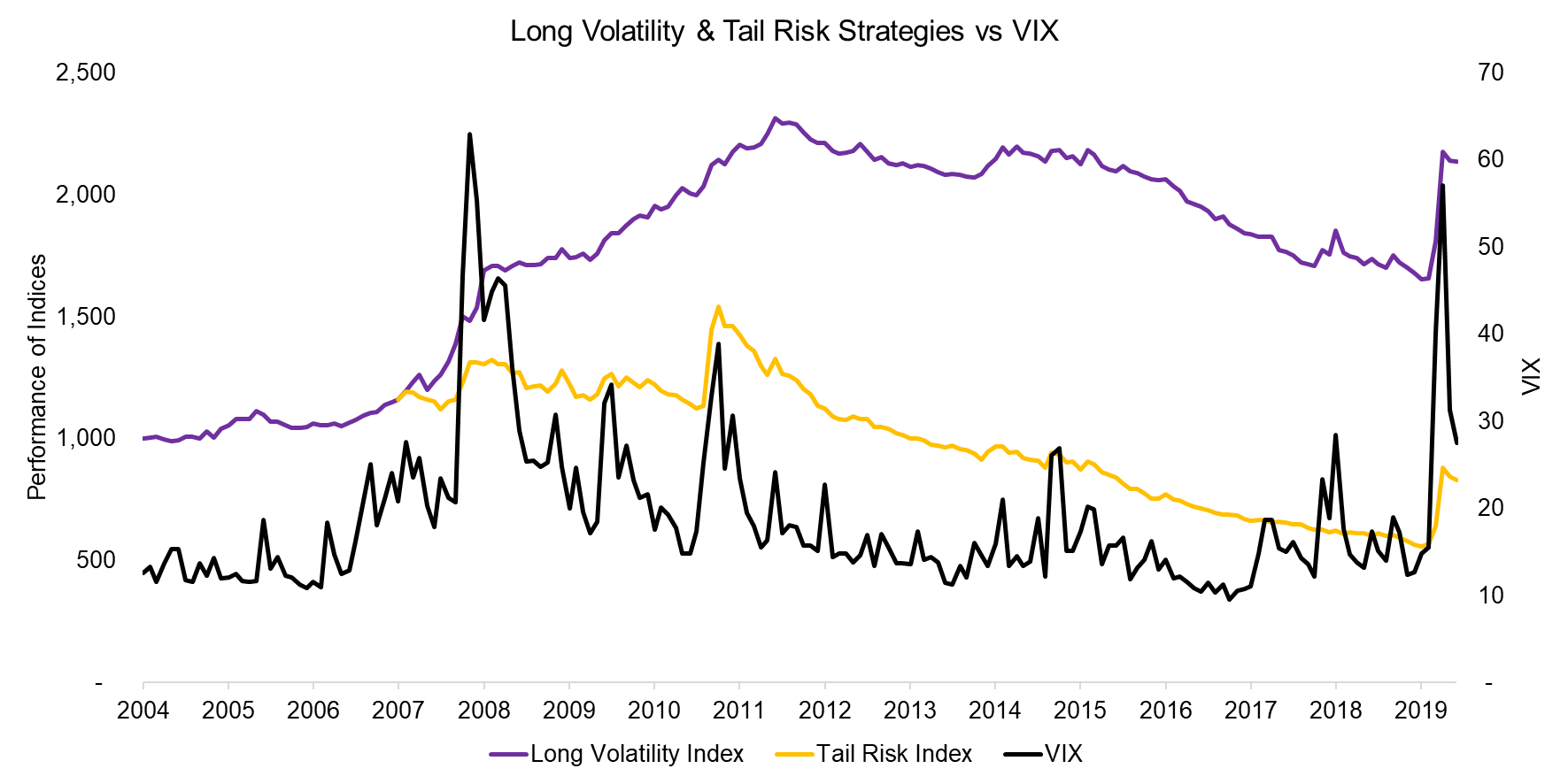

However, low correlation to equities and doing well when economic and market volatility increases or stays elevated for years are not the same thing. Eurekahedge, a hedge fund data provider, constructs indices for funds that focus on tail risk and long volatility strategies. Both strategies shared some performance trends over the last 15 years — which is to be expected given similarities in portfolio construction — but also some differences.

Tail risk and long volatility funds generated high returns during the COVID-19 pandemic in 2020 and therefore delivered crisis alpha. But long volatility strategies did better amid the global financial crisis (GFC) in 2008 and the high-volatility years that followed. Although the Long Volatility Index also lost money when volatility declined due to quantitative easing post-2011, returns were far less negative than those of tail risk funds.

Since we’re looking for a strategy that benefits from rising and structurally higher volatility rather than singular extreme market events, this analysis will focus on long volatility strategies.

Source: Eurekahedge, FactorResearch

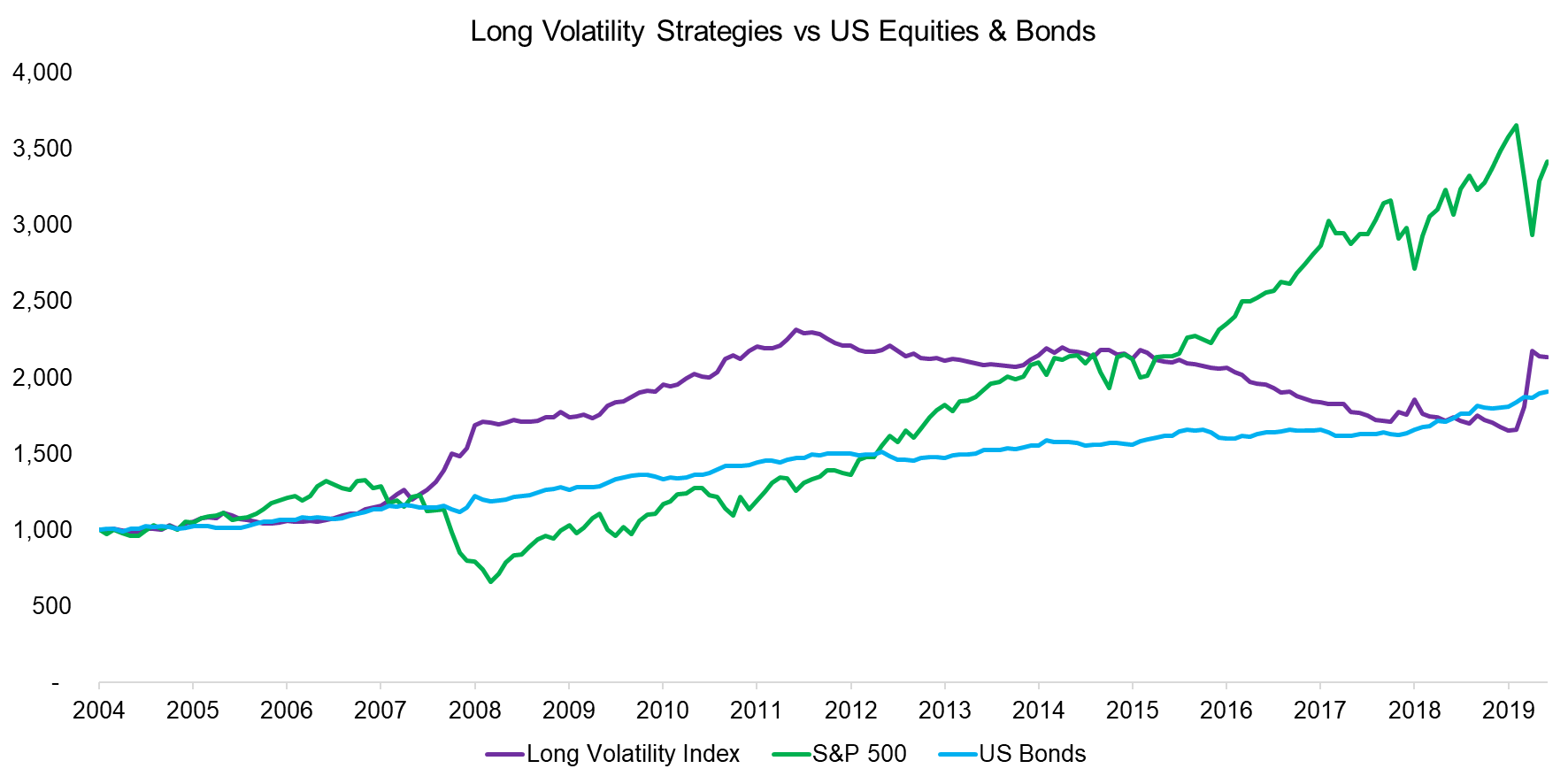

For the last 30 years, bonds offered attractive diversification benefits when equities declined. But those days are over. Bonds have become much less useful in asset allocation since yields in most developed markets are low or negative. The end of the fixed-income bull market also dampens the return outlook for such leveraged asset classes as private equity and real estate, which rode high amid declining interest rates.

But most critically, none of these asset classes can be expected to perform well in a reduced growth world. After all, they offer similar exposure to what we’ll call the economic factor. As such, portfolios diversified across these public and private asset classes are short volatility and essentially fragile.

So how do investors create anti-fragile portfolios geared for a world of reduced economic growth where fixed income no longer serves its traditional role in portfolio construction? Long volatility strategies may be an option. Their correlations to the S&P 500 and bonds were -0.32 and 0.26 between 2004 and 2020, respectively, and they delivered uncorrelated returns. Of course, their performance suffered amid periods of declining volatility. And at times they have been painful to hold. Still, the same can be said for any other asset class. Equities certainly were no picnic during the bear market of 2007 to 2009.

Source: Eurekahedge, FactorResearch

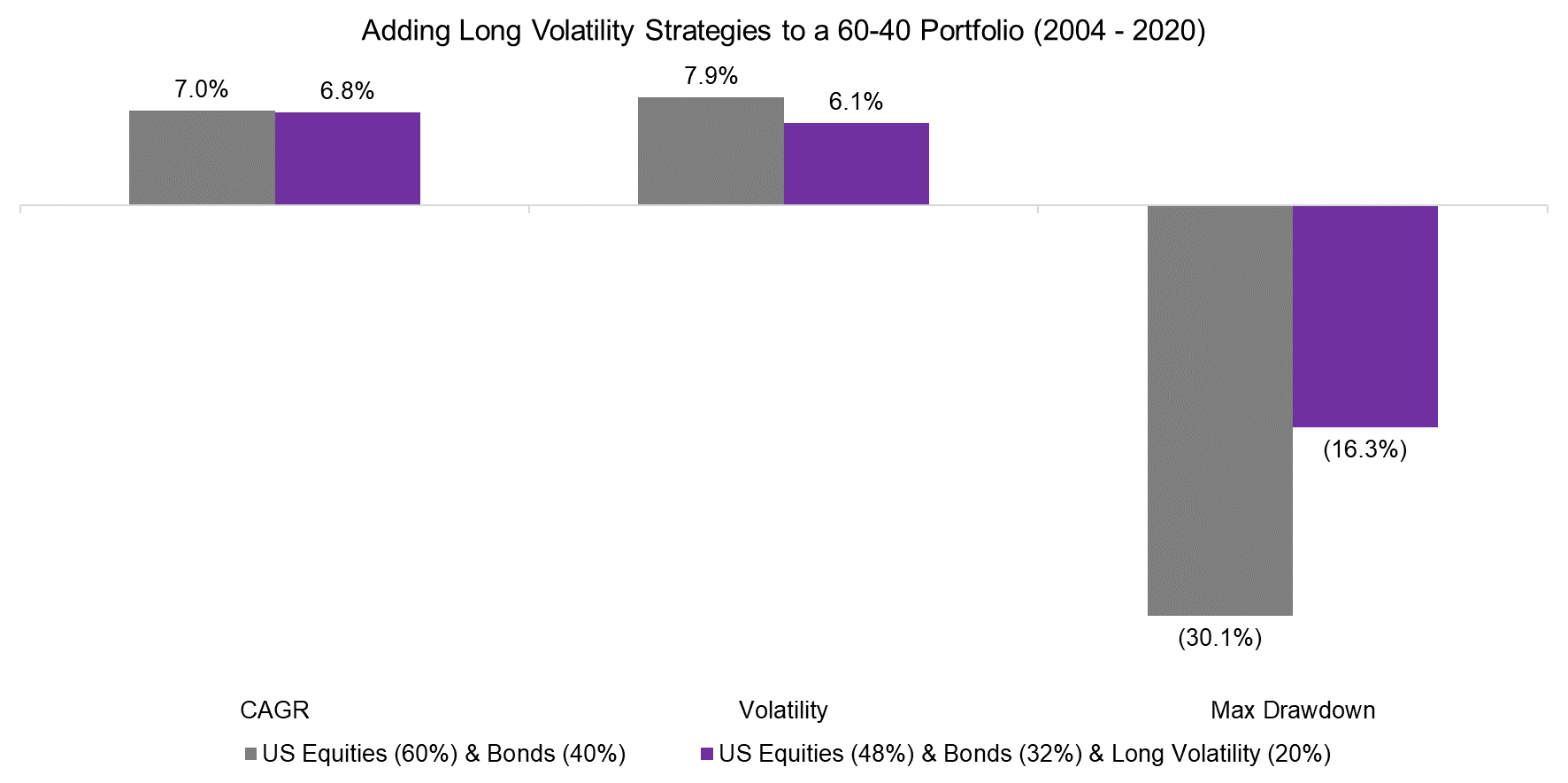

ADDING LONG-VOLATILITY STRATEGIES TO A 60-40 PORTFOLIO

How would a traditional US equities and bonds portfolio have performed with an allocation to long volatility strategies? We looked at the 16 years between 2004 and 2020, a period that includes multi-year bull markets in equities and bonds as well as two severe stock market crashes.

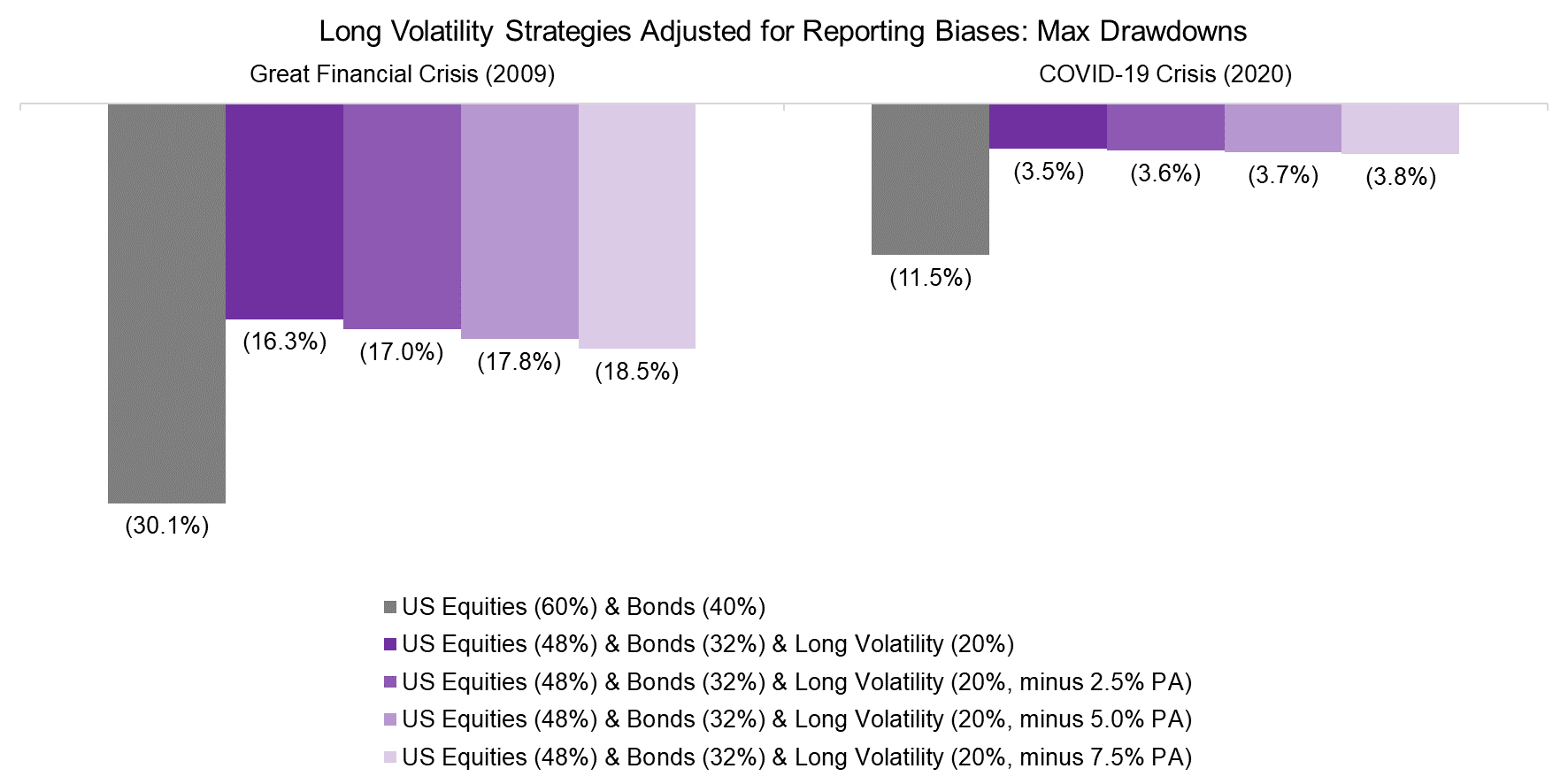

Although a 20% allocation to long volatility strategies slightly reduced the annual return of a 60-40 portfolio, volatility declined even further, therefore increasing the risk-adjusted returns. But the real benefit of a less-fragile portfolio is demonstrated by calculating the maximum drawdown, which decreased by almost 50%.

Source: FactorResearch

Constructing portfolios that are less sensitive to the economic factor makes intuitive sense and the simulated results show the attractive diversification benefits for traditional equity-bond portfolios. But hedge fund indices are prone to various biases that tend to overstate returns and understate risks. The Eurekahedge Long Volatility Index currently only has 10 constituents, which is more than it has had in the past, which means investors need to be wary of the historical returns.

Fund managers tend to start reporting their returns to databases when they’re doing well and stop when performance tails off. We can partially correct for this reporting bias by reducing the annual returns of long volatility strategies between 250 and 750 basis points (bps) per annum. Although this reduces the performance of an anti-fragile portfolio, it does not change the significant reductions in maximum drawdowns during the GFC or the coronavirus crisis.

Source: FactorResearch

However, the favorable risk characteristics of the Eurekahedge Long Volatility Index could be due to a single manager and therefore more the product of luck than skill and not captured by most other managers. We do not have the data to answer this, but it would be worth further evaluation.

FURTHER THOUGHTS

The COVID-19 crisis reminds us of just how fragile the world is. Unfortunately, other events could have similarly devastating effects. Solar bursts could take out the energy grid and satellite communications. Massive volcano outbreaks in Mexico City or Naples could envelop North America or Europe in clouds of dust for months. An earthquake could hit the Bay Area of California — the list goes on.

But protection against natural disasters isn’t the only rationale for anti-fragile portfolios. Weak demographics may inhibit global economic growth and create social unrest. What if underfunded pensions funds in the United States and Europe start declaring insolvency and cutting benefits?

And if that does not create meaningful issues for society, then there are always purely human-created disasters on the horizon. Argentina was once one of the world’s wealthiest nations, Myanmar was the richest country in Southeast Asia, and Venezuela has the largest oil reserves on earth.

The future of humanity is bright. But it won’t be a smooth ride. Over the last three decades, thanks to economic and productivity growth across the globe, investing has been like driving the German Autobahn. There have been a couple twists and turns, but it’s largely been a quick, steady, and uneventful drive.

But that is changing. The journey over the next decade will have its share of bandits, potholes, and broken glass. So better invest in some insurance and a vehicle that can handle the bumpy road ahead.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.