Cryptocurrency Hedge Funds

Just Bitcoin-beta plays?

January 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Cryptocurrency hedge funds generated abnormally high and uncorrelated returns since 2014

- However, the returns can be simply attributed to the performance of Bitcoin

- Many crypto-beta ETFs & ETPs have been launched, so crypto hedge funds need to move from beta to alpha

INTRODUCTION

Cryptocurrencies have reached politics far quicker than other financial instruments given their use in criminal activities and the potential to destabilize central banks and fiat currencies. In contrast, ETFs have accumulated $10 trillion of assets with minimal interest from politicians.

However, the interest from Washington likely peaked in November 2021 when a group of cryptocurrency investors raised $40 million to buy a copy of the U.S. Constitution. They were outbid by Ken Griffin, the founder of Citadel, a large multi-strategy hedge fund and market maker Citadel Securities.

The interest from hedge funds in cryptocurrencies has also been rising given that alpha on traditional markets has been almost completely arbitraged away. Essentially all classic hedge fund strategies are being deployed in the space, with quantitative ones leading (37% of hedge funds), followed by discretionary long-short (28%), discretionary long-only (20%), and multi-strategy (11%), according to the 3rd Annual Global Crypto Hedge Fund Report 2021 of PWC.

Unfortunately this likely will lead to an erosion of alpha, like in all markets. In this research note, we will evaluate the performance and characteristics of cryptocurrency hedge funds.

PERFORMANCE OF CRYPTOCURRENCY HEDGE FUNDS

As of the end of 2020, cryptocurrency hedge funds were estimated to manage close to $4 billion according to the PWC survey, which seems low compared to $3 trillion managed by the broad hedge fund industry and $2 trillion of the combined market capitalization of cryptocurrencies (read Quant Strategies in the Cryptocurrency Space).

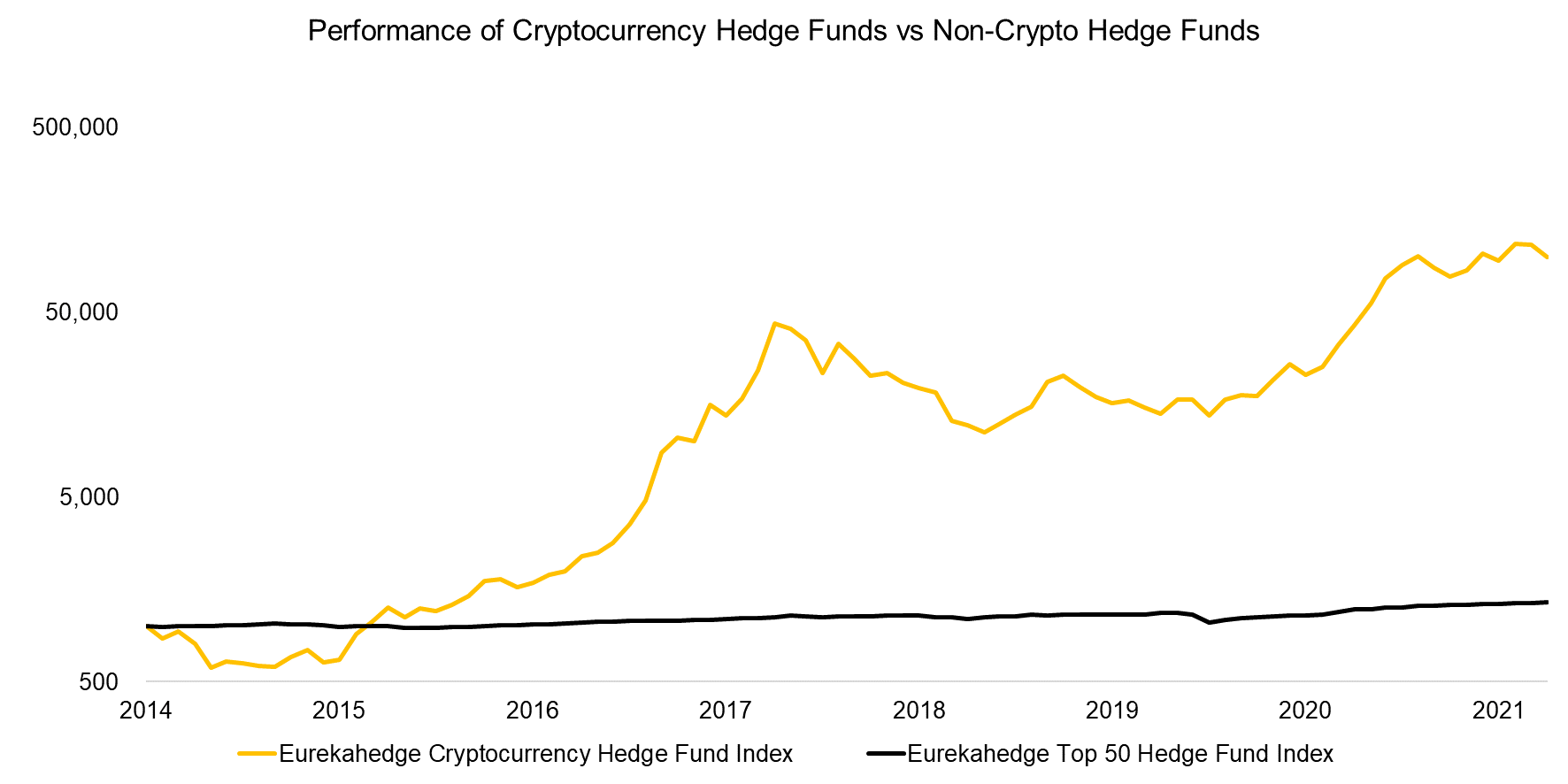

We use the Eurekahedge Cryptocurrency Hedge Fund index in this analysis. The index currently has 17 cryptocurrency hedge funds reporting returns, which are equally weighted. The performance of the index has been exceptional with a return of 11,967% since inception in 2014, compared to a mere 135% for an index comprised of the largest 50 hedge funds, and 267% for the S&P 500.

Source: Eurekahedge, FactorResearch

CORRELATION ANALYSIS

The stellar returns of cryptocurrency hedge funds have created significant interest from high net worths, family offices, and a few adventurous institutional investors. Given the high valuations and therefore low expected returns for stocks and bonds, investors are desperate for alternatives.

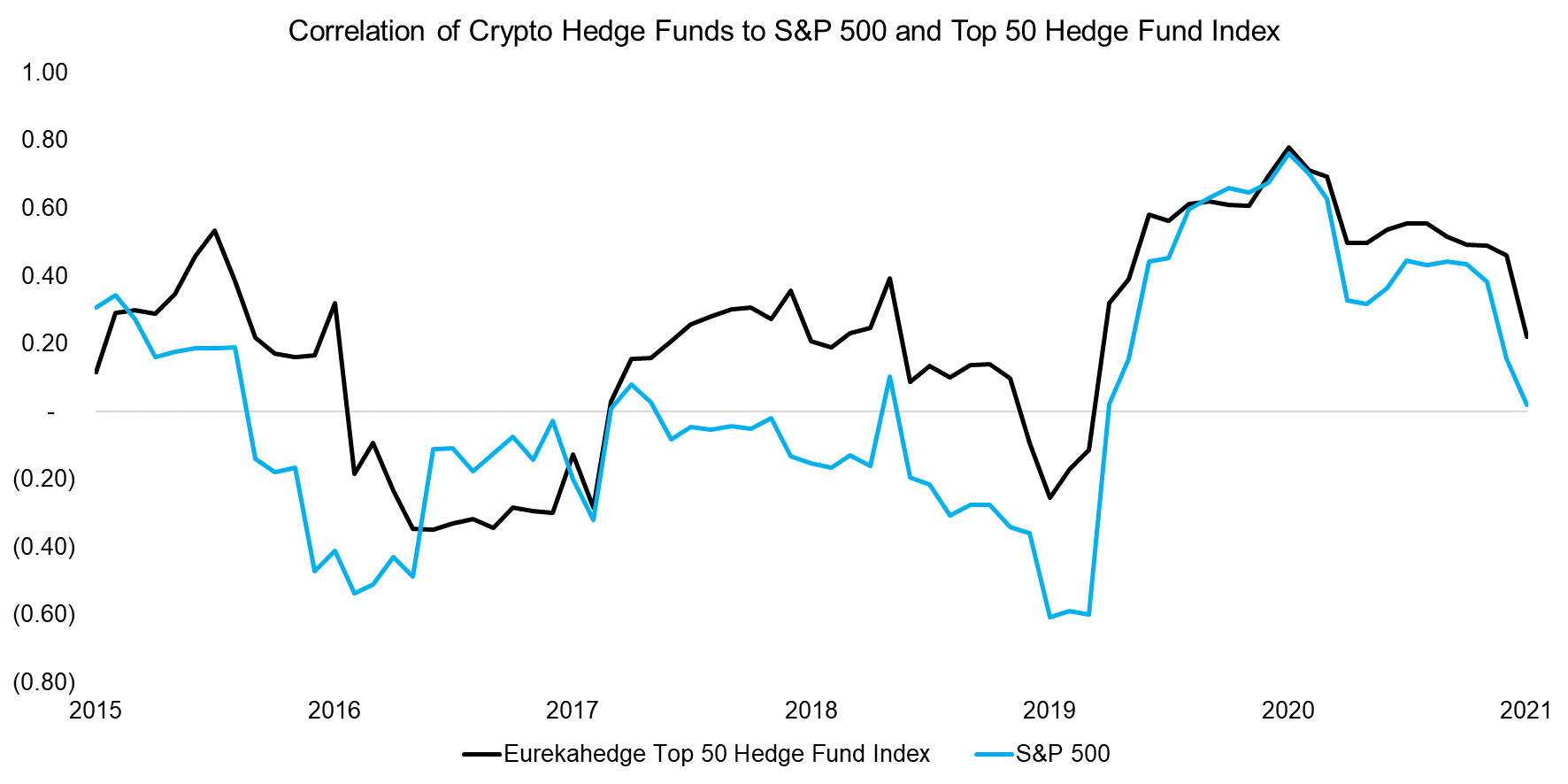

However, many alternatives have historically failed to be alternative enough and provide returns uncorrelated to traditional asset classes. We calculate the correlation of cryptocurrency hedge funds to the S&P 500 and top 50 hedge funds, which highlights 0.03 and 0.22 respectively between 2015 and 2021.

Although the correlation was not consistently low and reached 0.8 during 2020, it indicates that cryptocurrency hedge funds generated significant diversification benefits for investors.

Source: Eurekahedge, FactorResearch

DRIVERS OF CRYPTOCURRENCY HEDGE FUND PERFORMANCE

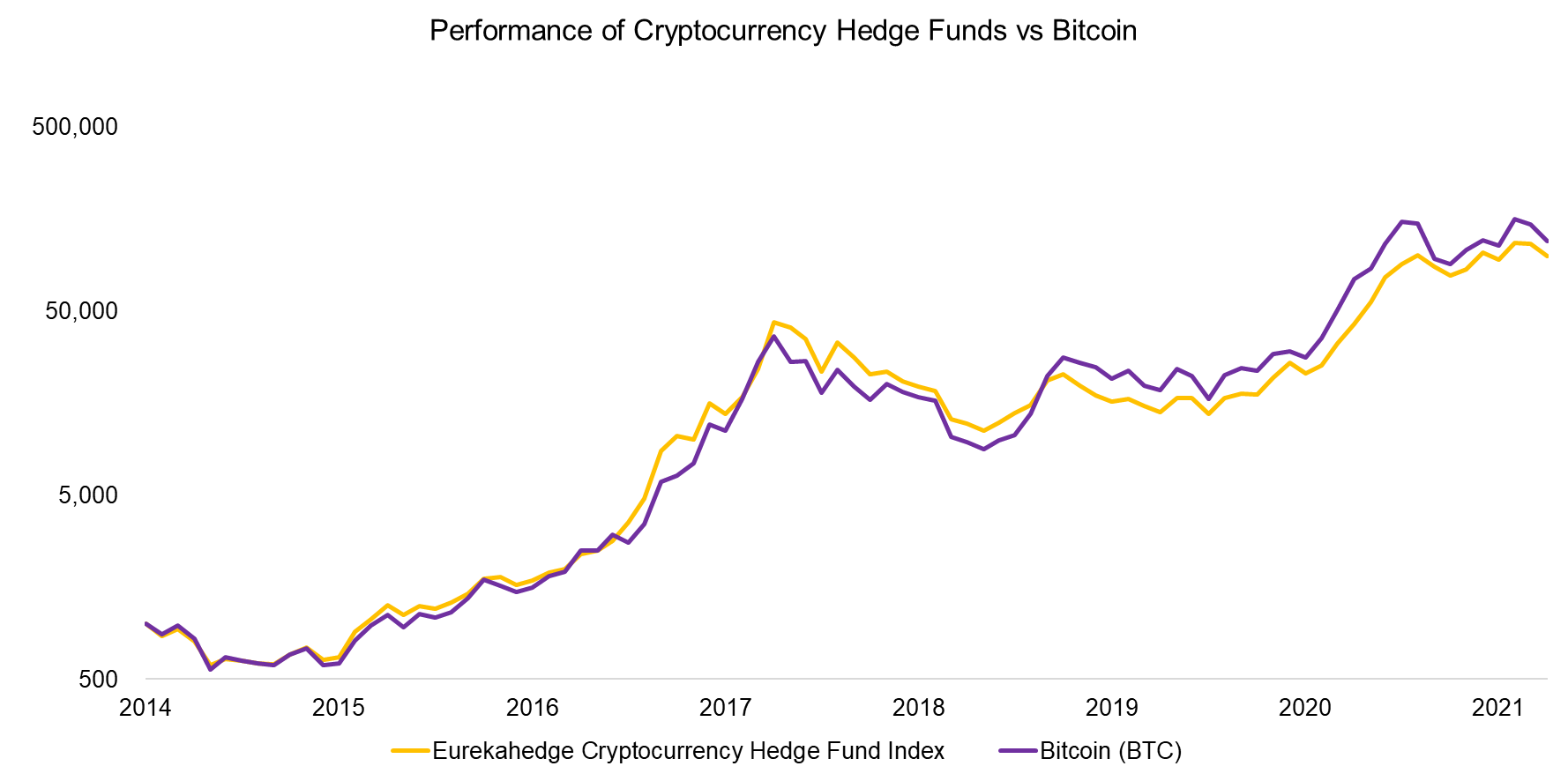

In addition to calculating the correlation of cryptocurrency hedge funds to the S&P 500 and the broad hedge fund universe, we also calculated the correlation to Bitcoin, which was 0.88 between 2015 and 2021.

Essentially this means that these funds represent crypto-currency beta rather than alpha. Comparing the performance of cryptocurrency hedge funds to Bitcoin highlights indeed an almost identical performance.

Source: Eurekahedge, FactorResearch

Given the diversity of strategies utilized by cryptocurrency hedge funds, it is somewhat disappointing that on average they provide nothing much but exposure to Bitcoin.

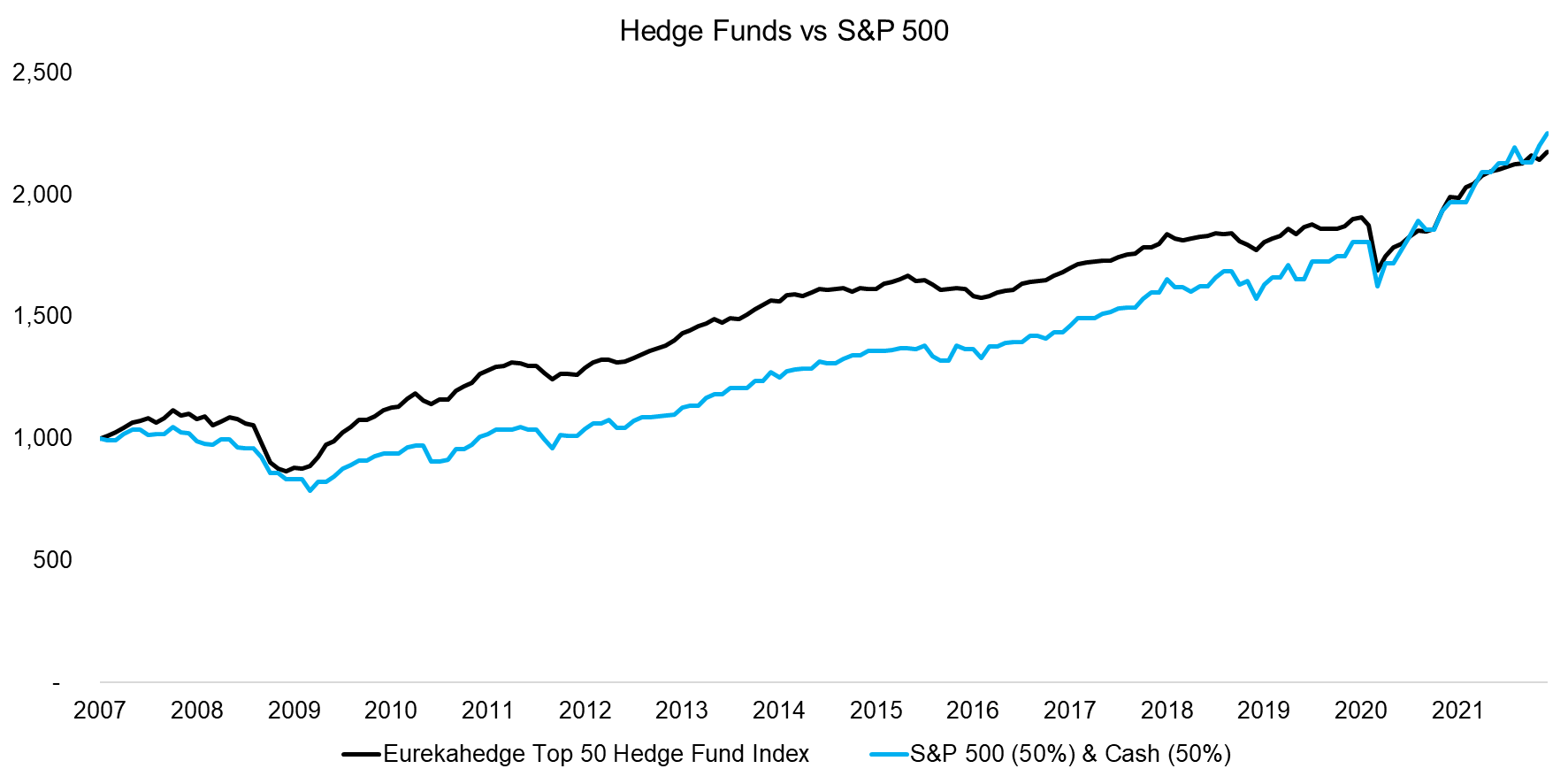

On the other hand, it is the same story for the broader hedge fund industry that has failed to generate alpha. The Credit Suisse Equity Market Neutral Index, which is the adequate index for evaluating the alpha generation of hedge funds, has generated a zero return in the 17 years between its inception in 2004 and 2021. For example, the performance of the top 50 hedge funds can be simply replicated via a 50% allocation to the S&P 500 and 50% to non-interest-bearing cash.

Source: Eurekahedge, FactorResearch

BITCOINS ETFS & ETPS

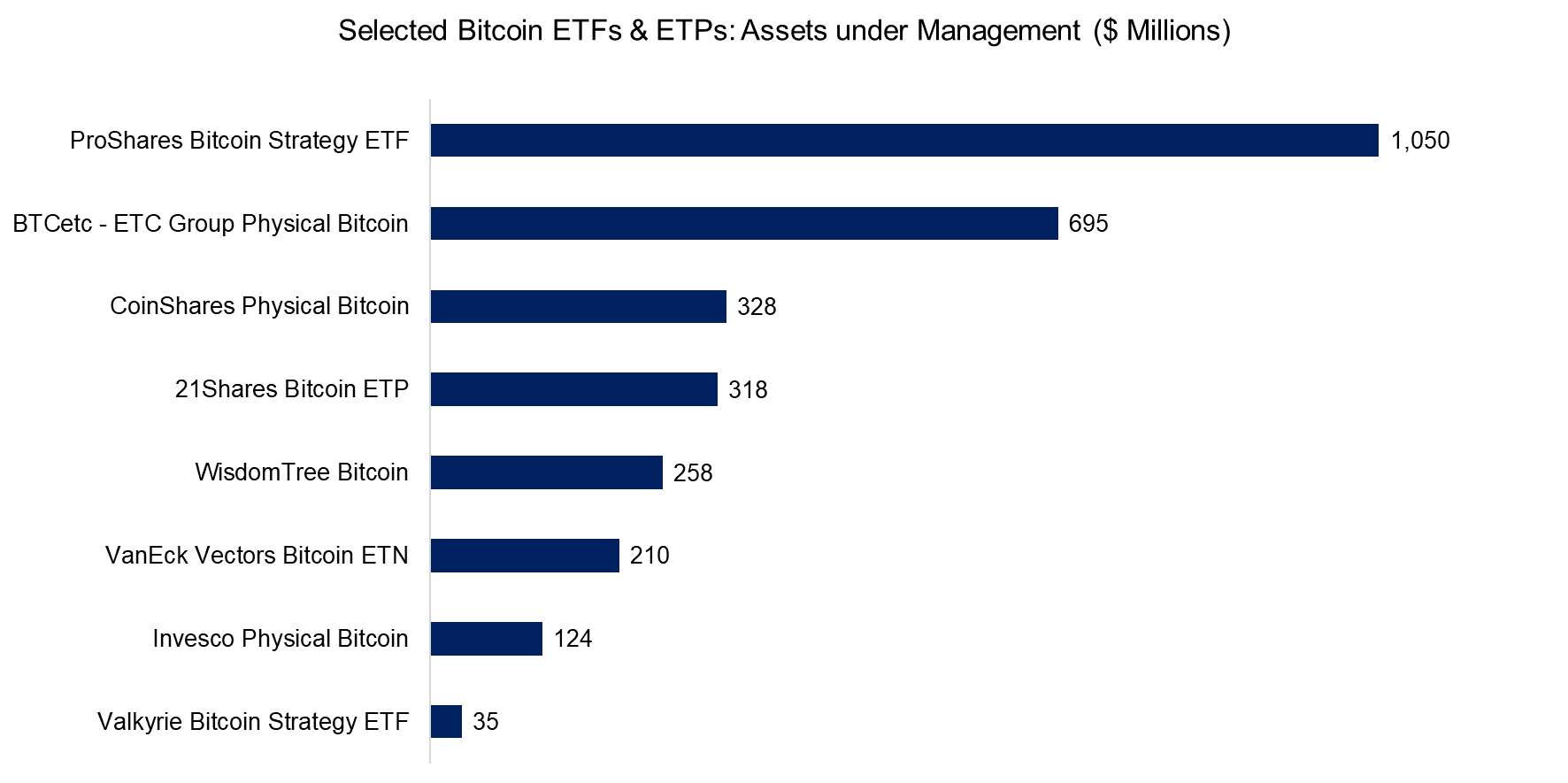

It was perhaps difficult for some investors to get exposure to Bitcoin before 2020, but since then there have been launches of multiple public instruments like ETFs and ETPs that provide this relatively cheaply to investors. These manage approximately $3 billion of assets and not all are structured efficiently given the use of futures, but investors in cryptocurrency hedge funds should not have issues allocating to European or Canadian investment products. In the US, there is also the Grayscale Bitcoin Trust with $27 billion of assets under management.

Source: FactorResearch

FURTHER THOUGHTS

Running a hedge fund is getting continuously more challenging as markets have become highly efficient with few arbitrage opportunities left for exploitation. Given this, most hedge funds have started to provide beta exposure, simply as alpha is scarce and stocks have been trending up. Unfortunately for these, investors’ analytics and data have also improved, empowering allocators to uncover most strategies as mere beta plays (read Hedge Fund Factor Exposure & Alternatives).

Moving to cryptocurrency markets seems an obvious strategy for hedge funds in search of greener pastures. However, given that most provide not much more than beta exposure, indicates that alpha is less easy to harvest than commonly perceived.

However, although there is not a compelling investment case for cryptocurrency hedge funds on average, it does not mean exposure to cryptocurrencies is unattractive. The case for diversification has rarely been stronger.

RELATED RESEARCH

Short-Term Momentum in Stocks, Commodities, and Cryptos

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.