CTAs vs Global Macro Hedge Funds

Systematic versus Discretionary Masters of the Universe

- CTAs and global macro hedge funds offer attractive diversification benefits

- However, both are moderately correlated and offer similar risk exposures

- CTAs have slightly better diversification characteristics

INTRODUCTION

We recently compared the alpha generation of generalist versus sector-focused fund managers in the US equity market, which highlighted that neither was able to generate alpha on average between 2014 and 2022. Worse, there was no consistency for the few fund managers that produced positive alphas (read Alpha Generation: Equity Generalists vs Sector Specialists).

Perhaps the US stock market has just become too efficient and fund managers should seek less constrained investment mandates. There are two types of asset managers that are almost completely flexible, namely CTAs and global macro hedge funds, as they trade all asset classes. The former are systematic and specialize in identifying trends in commodities, currencies, fixed income, and other markets. The latter also take long and short positions across asset classes, but tend to invest more discretionary.

Global macro investing tends to be associated with specific fund managers like George Soros, Stanley Druckenmiller, or Paul Tudor Jones (read Global Macro: Masters of the Universe?), while CTAs are usually linked to firms like MAN AHL or Winton that have teams that code investment processes. To a degree, it is man versus machine.

In this research article, we will compare global macro hedge funds versus CTAs.

PERFORMANCE

We take two indices from Eurekahedge as proxies for the performance of CTAs and global macro funds in this analysis.

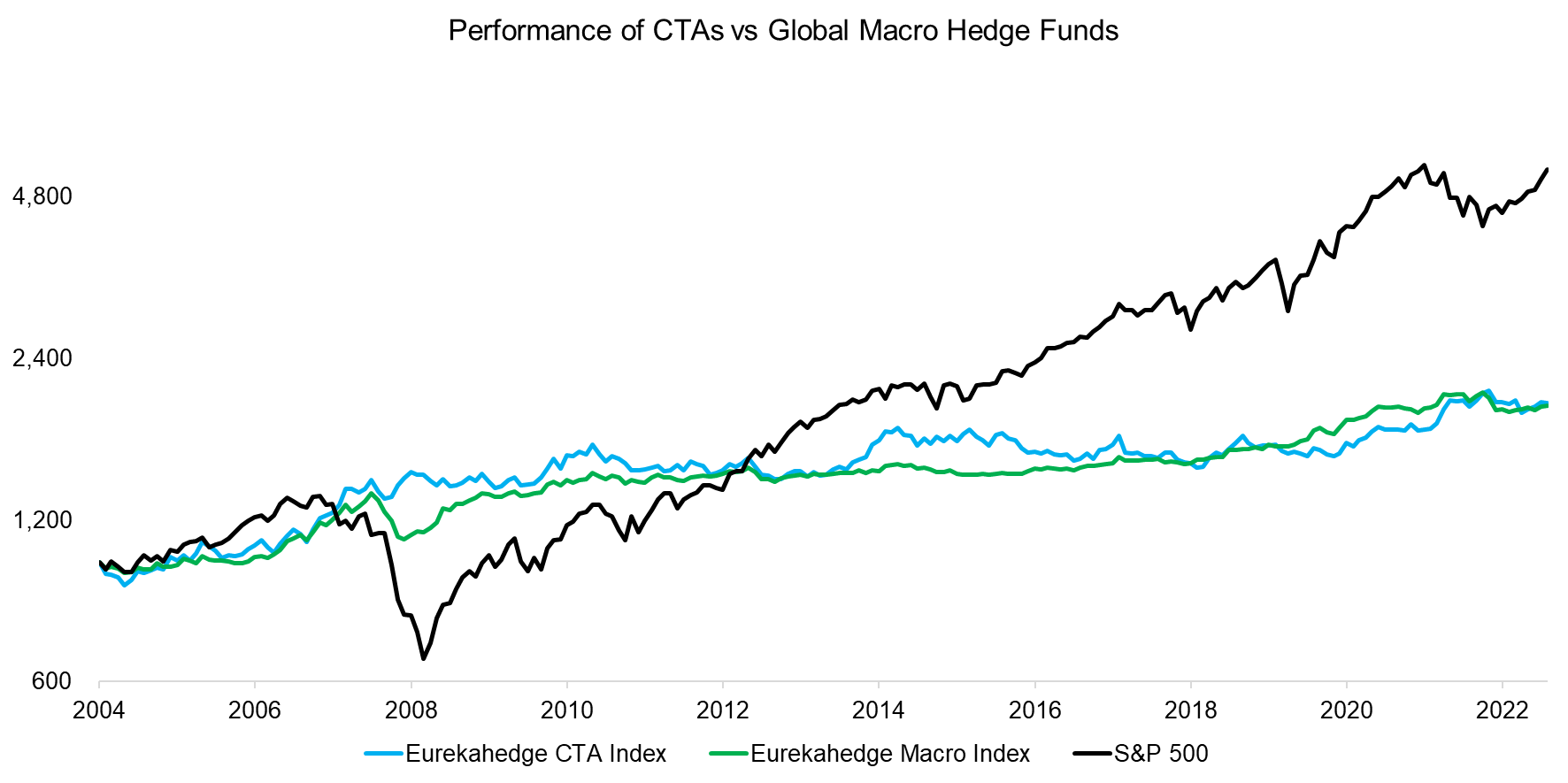

Comparing their performance from 2004 to 2023 highlights that they generated an identical return for the 19-year period, which is a remarkable coincidence. Although the average volatility of global macro funds was lower at 5.1% versus 8.5% for CTAs, these generated a larger maximum drawdown during the global financial crisis in 2009.

Source: Finominal

CORRELATION ANALYSIS

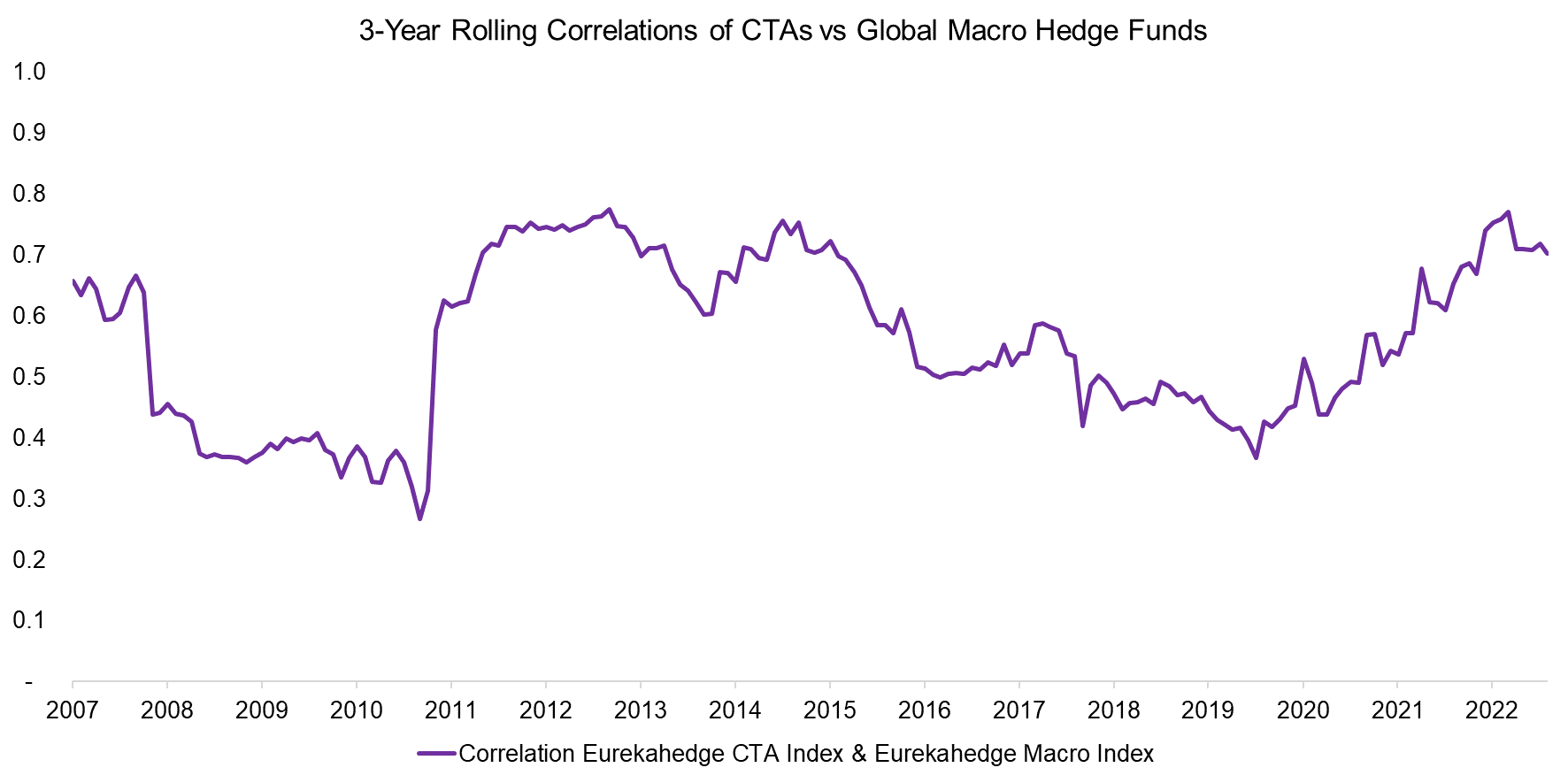

Next, we evaluate the three-year rolling correlation between CTAs and global macro funds, which was moderately positive with an average of 0.6 from 2007 to 2022. It seems that during extended periods of time, both fund types featured the same underlying trades, eg long USD/JPY, short US government bonds, long gold, etc.

However, the decision process for a trade is naturally different. CTAs enter long or short positions as soon as they measure a trend based on their systematic models, where the 12-month moving average is still a good proxy (read Replicating a CTA via Factor Exposures). In contrast, a global macro fund manager tends to have a thesis for a trade based on economic data or political changes. Portfolios are typically comprised of a few major themes, eg the new Argentinian government will strengthen the Peso, the Ukrainian war will get worse and wheat prices will increase, and so on.

Source: Finominal

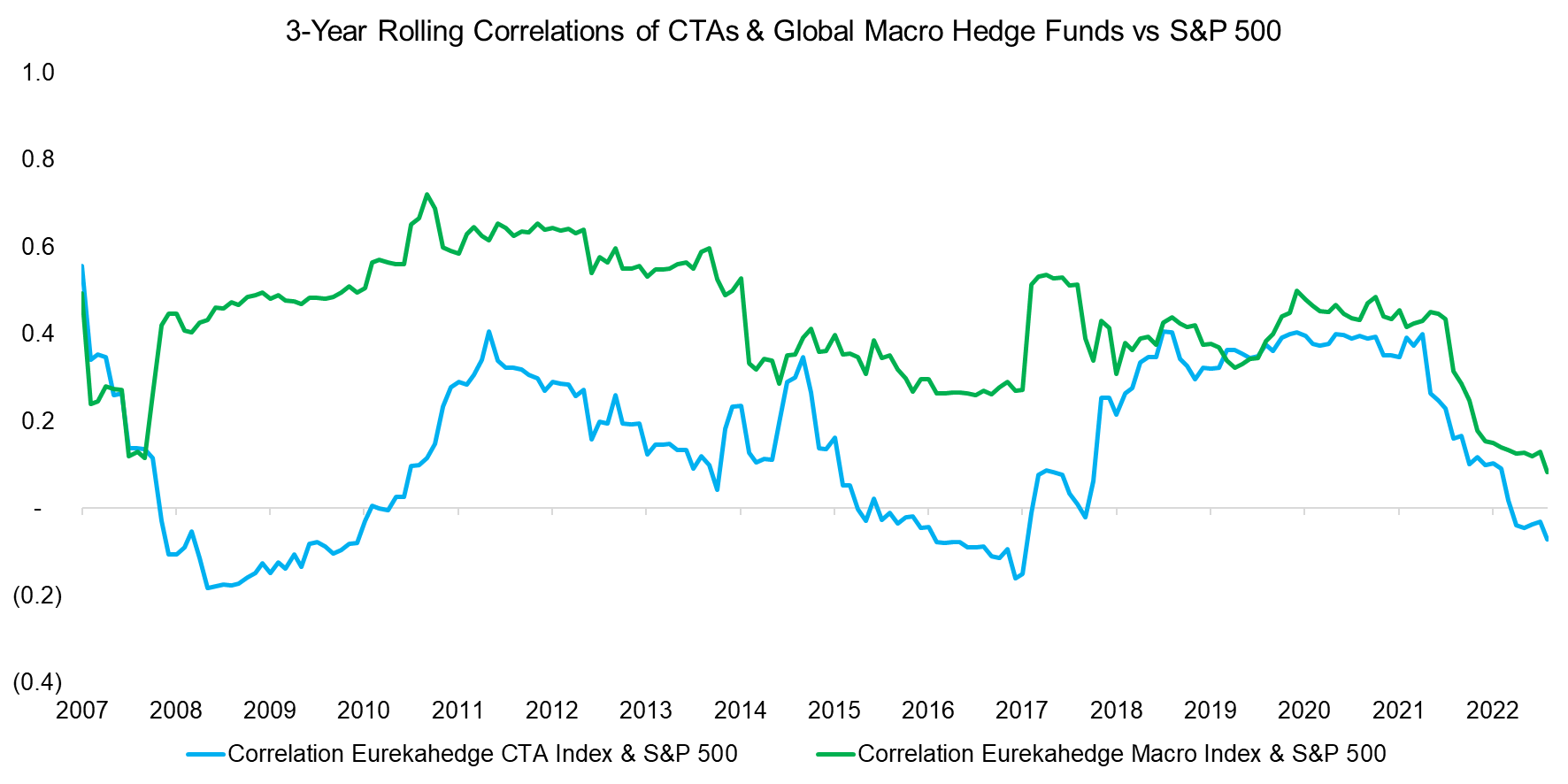

Investors consider CTAs and global macro funds as diversifying strategies that can potentially mitigate losses during stock market crashes or bear markets. We again observe that both fund types offered similar risk exposures during certain periods as their correlations to the S&P 500 frequently moved in tandem. It seems that global macro funds had more equity exposure given an average correlation of 0.4 to the S&P 500, compared to 0.1 for CTAs.

Source: Finominal

DIVERSIFICATION BENEFITS

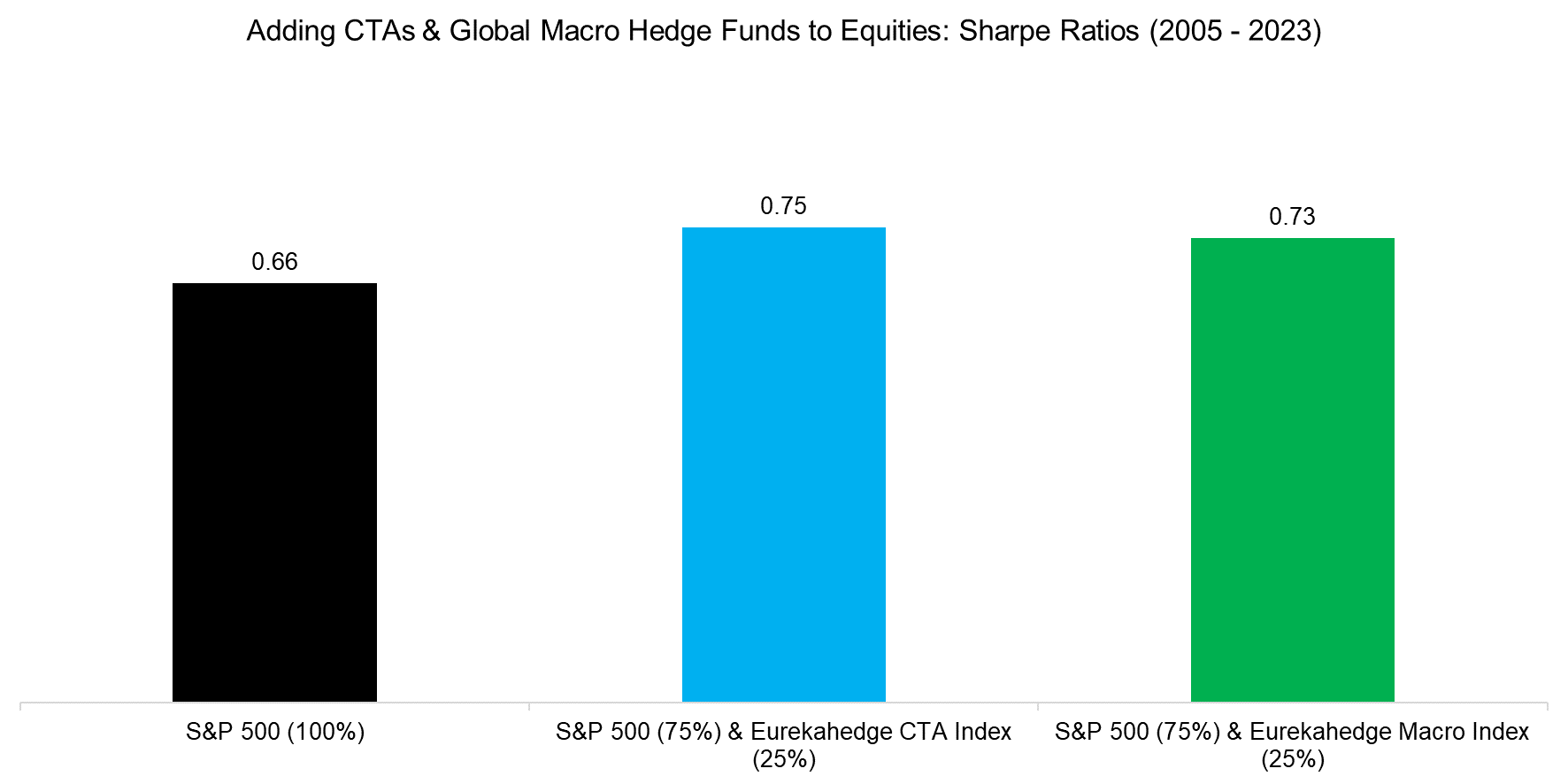

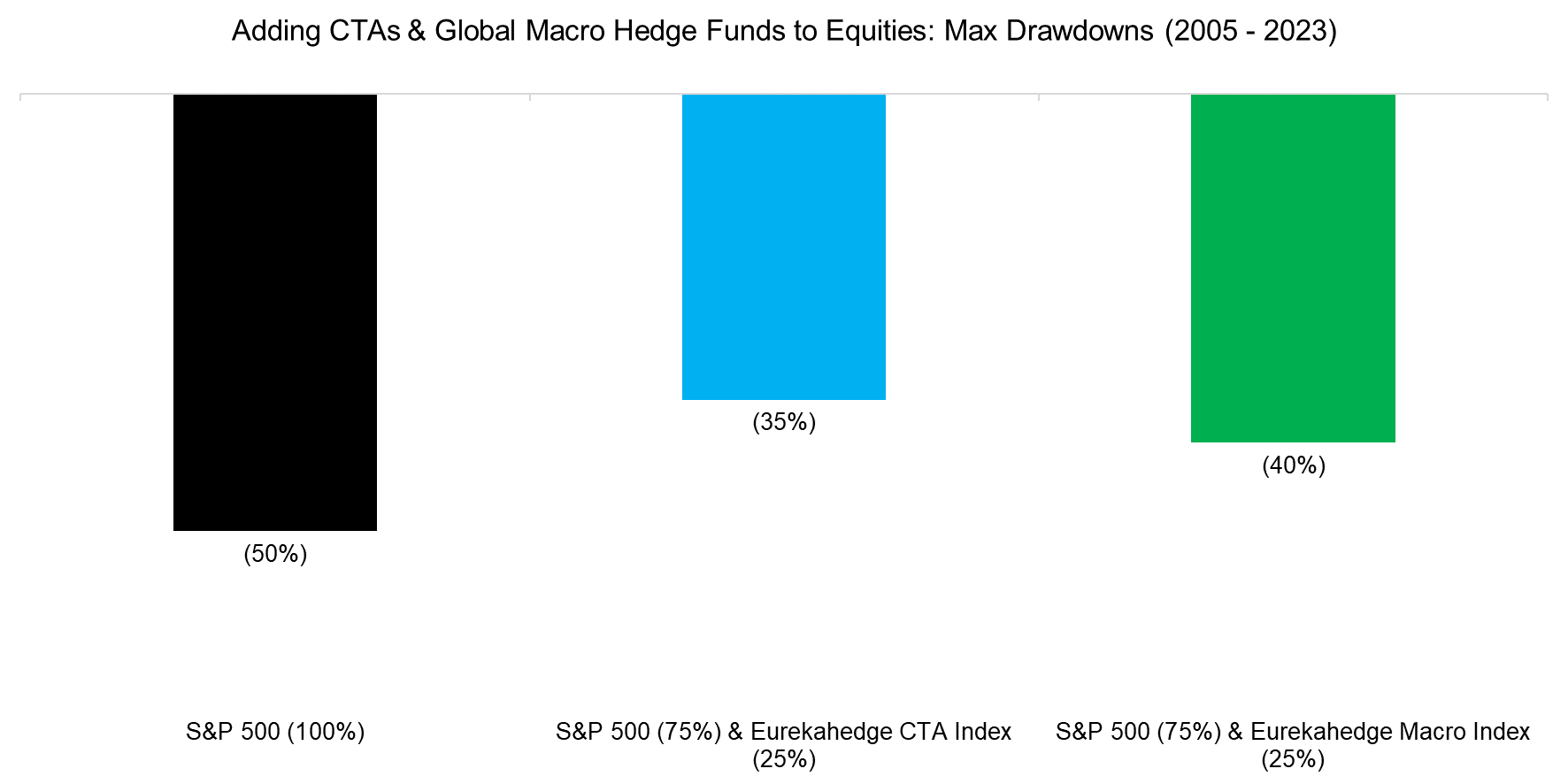

Finally, we evaluate the diversification benefits of CTAs and global macro funds. We simulate adding a 25% allocation to a portfolio solely comprised of the S&P 500, which would have increased the Sharpe ratio for either fund type in the period from 2005 to 2023. Given their low correlations and positive returns, this is not unexpected.

Source: Finominal

Allocating 25% to either strategy would have reduced the 50% maximum drawdown of the S&P 500 that occurred during the global financial crisis in 2009, although CTAs reduced that to 35%, compared with 40% when using global macro funds.

Source: Finominal

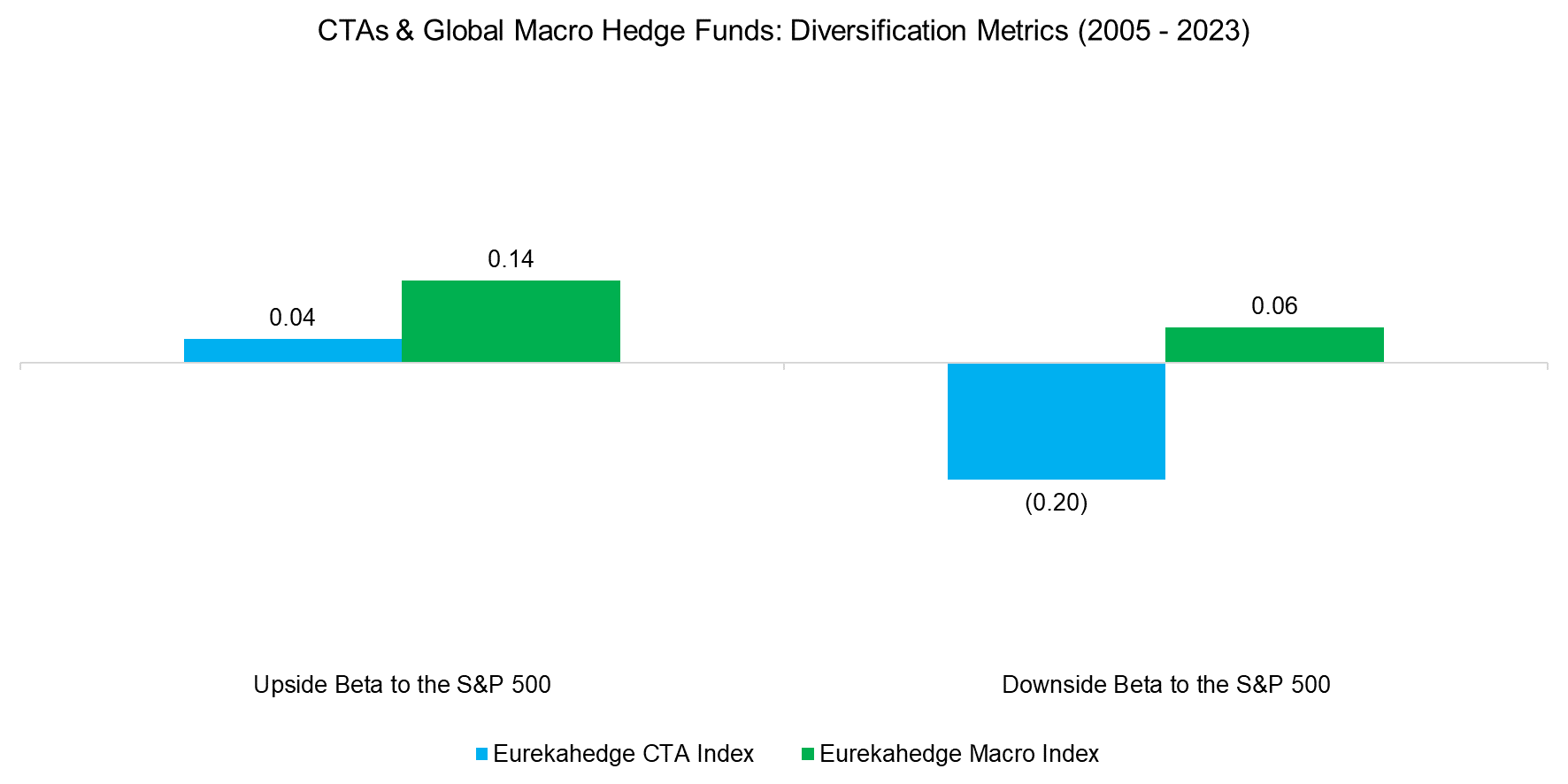

Calculating the upside and downside betas to the S&P 500 highlights that global macro funds gained more when stocks rose than they lost when stocks declined during the last 18 years, which is a favorable characteristic. However, CTAs offered a negative downside beta, which makes them a superior diversification strategy.

Source: Finominal

FURTHER THOUGHTS

CTAs and global macro hedge funds represent attractive strategies for diversifying an equities portfolio, in contrast to many alternative strategies that offer little value (read Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios). Would it make sense to allocate to both?

On average, probably not. As indicated by the moderately positive correlations between both strategies, these seem to be offering the same risk exposures, and the allocation decision can be compared to choosing between an active value fund manager and a smart beta value ETF. The former might offer higher exposure to the value factor, but there is an over-proportional risk from the manager selection process that is mitigated by the latter given a transparent stock selection process.

Despite trading various asset classes, the core value proposition of CTAs and global macro funds is to provide exposure to beta rather than generating alpha, where a systematic approach is preferable.

RELATED RESEARCH

Global Macro: Masters of the Universe?

Replicating a CTA via Factor Exposures

Creating a CTA from Scratch – I

Creating a CTA from Scratch – II

Managed Futures: The Empire Strikes Back

Managed Futures: Fast & Furious vs Slow & Steady

Diversification versus Hedging II

Trend Following in Equities

Myth Busting: Alts’ Uncorrelated Returns Diversify Portfolios

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.