Defensive & Diversifying Strategies in YTD 2022

What worked, what hasn’t?

June 2022. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Most defensive and diversifying strategies generated negative returns in YTD 2022

- The correlation of almost all of these strategies to equities was too high

- Only managed futures generated attractive diversification benefits

INTRODUCTION

Economics and investing are all about data, eg GDP has increased by 1.5% this quarter, the stock market is down 10% this month, and so on. However, despite numbers being at the core of these disciplines, some rather important concepts are surprisingly vague. For example, what is a recession and what is a bear market?

A recession is defined as a significant economic decline over several months, but the National Bureau (NBR)’s Business Cycle Dating Committee in the U.S. only determines this with hindsight, ie we might be in a recession, but won’t have official confirmation for months. Naturally people recognize a recession while it is happening as unemployment increases and consumer confidence decreases.

Similarily, a bear market describes a situation when stock markets decline, but there is no clear definition for this. The most common perception is 20% decrease from the most recent peak, but for which index? The S&P 500, the Nasdaq, or Dow Jones?

In year-to-date 2022, the Nasdaq has decreased significantly by more than 20%, while the S&P 500 has just reached that level. Given this and the overall gloomy macro environment of high inflation and rising interest rates, investors are increasingly looking for alternatives.

In this short research note, we will evaluate the performance of defensive and diversifying strategies in year-to-date 2022 (read Defensive & Diversifying Strategies: What Worked in 2020?).

PERFORMANCE OF DEFENSIVE AND DIVERSIFYING STRATEGIES

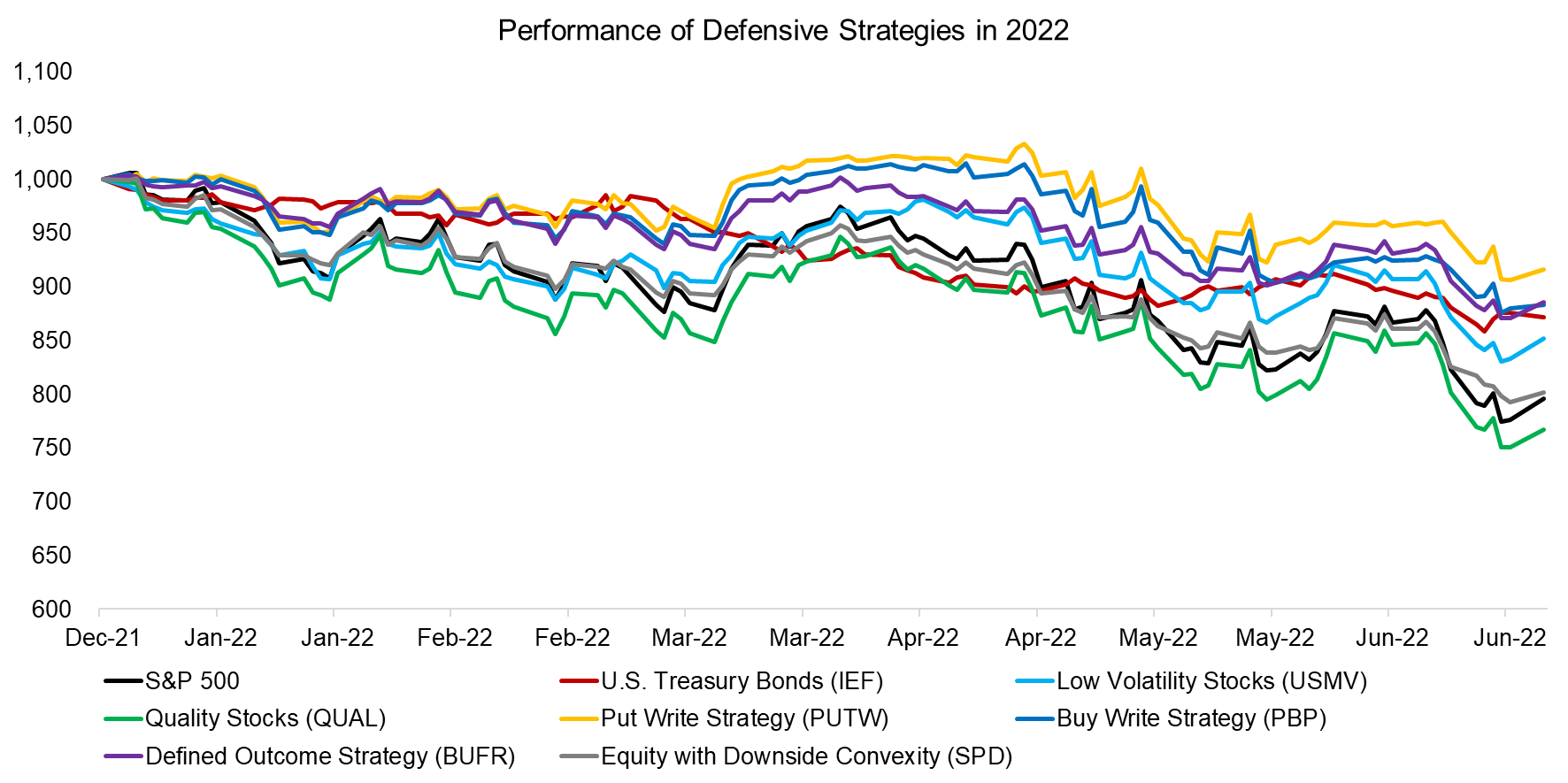

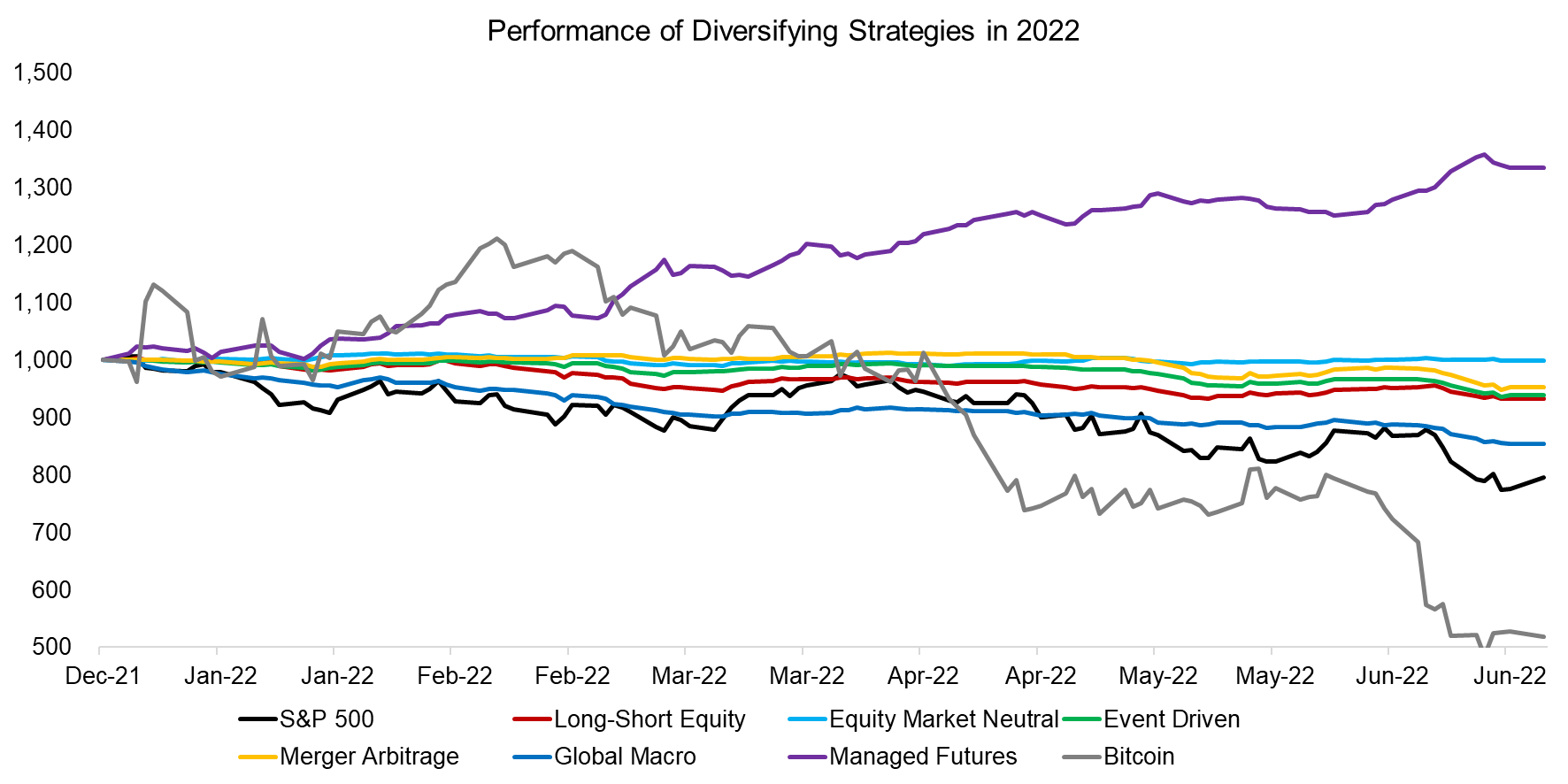

We are going to evaluate 14 diverse strategies that are frequently considered for diversifying equity portfolios. These are split into two groups namely defensive and diversifying strategies. The former are all available via ETFs, while the latter are hedge fund strategies, of which only some are available via publicly traded instruments.

- Defensive strategies include U.S. Treasury Bonds (IEF), Low Volatility Stocks (USMV), Quality Stocks (QUAL), Put Write Strategy (PUTW), Buy Write Strategy (PBP), Defined Outcome Strategy (BUFR), and Equity with Downside Convexity (SPD)

- Diversifying strategies include Long-Short Equity, Equity Market Neutral, Event Driven, Merger Arbitrage, Global Macro, Managed Futures, and Bitcoin. Data is sourced from HFRX for all strategies, except for Managed Futures, which represents the SG Trend Index, and Bitcoin.

We observe that all defensive strategies lost money in year-to-date 2022, although the loss varied from -8% for the Put Write Strategy to -23% for Quality Stocks. It might be surprising that quality stocks have underperformed, but this a reflection of a bias in the underying portfolio towards the technology sector, which performed worse than other sectors.

The trends have been identical across all defensive strategies, which highlights that these are simply mostly providing stock market exposure. The one exception is long-term U.S. Treasury Bonds, which have also lost money, but exhibited a markedly different trend (read Building a Diversified Portfolio for the Long-Term).

Source: FactorResearch

In contrast to the defensive strategies, the diversifying ones generated significantly differentiated performance in year-to-date 2022. The goal of a diversifying strategy is to generate positive and uncorrelated returns. However, this year only Managed Futures produced positive returns, while the other six strategies were negative, albeit only slightly for Equity Market Neutral.

Although most diversifying strategies failed to generate positive returns, all except Bitcoin outperformed the S&P 500. However, given that these are typical hedge fund strategies these are expected to produce less upside and downside than the stock market.

Source: UN, FactorResearch

RISK ANALYSIS OF DEFENSIVE & DIVERSIFYING STRATEGIES

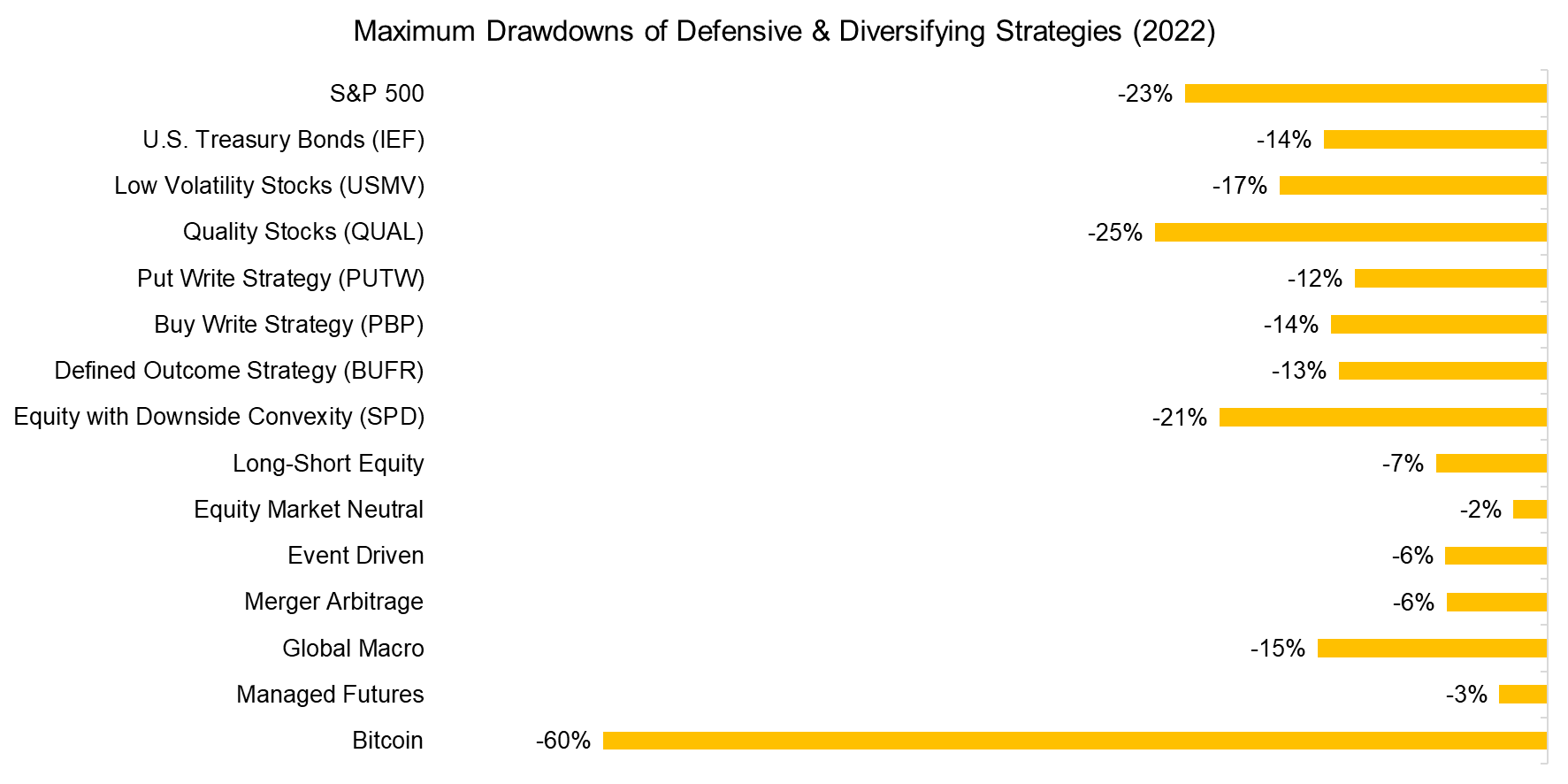

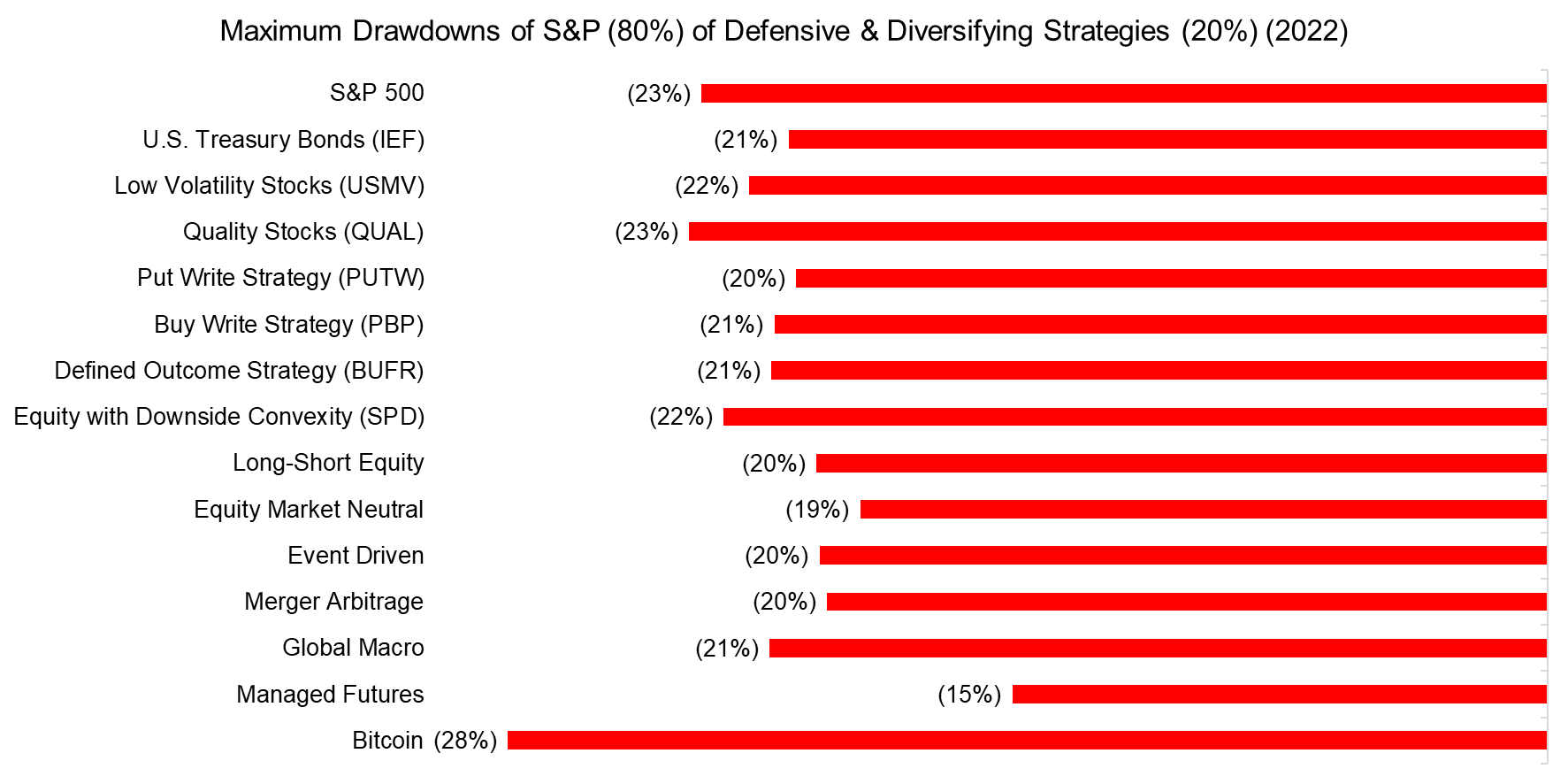

Next, we calculate the maximum drawdown achieved year-to-date 2022. Most of the defensive strategies lost less than the S&P 500, except for Quality Stocks and Equity with Downside Convexity.

The diversifying strategies easily trump the defensive ones with drawdowns of less than 10%, except for Global Macro with -15% and Bitcoin with -60%. The cryptocurrency industry has been marketing Bitcoin as a store of value for years, but the performance this year proves it is anything but.

Source: FactorResearch

DIVERSIFICATION BENEFITS WITH DEFENSIVE & DIVERSIFYING STRATEGIES

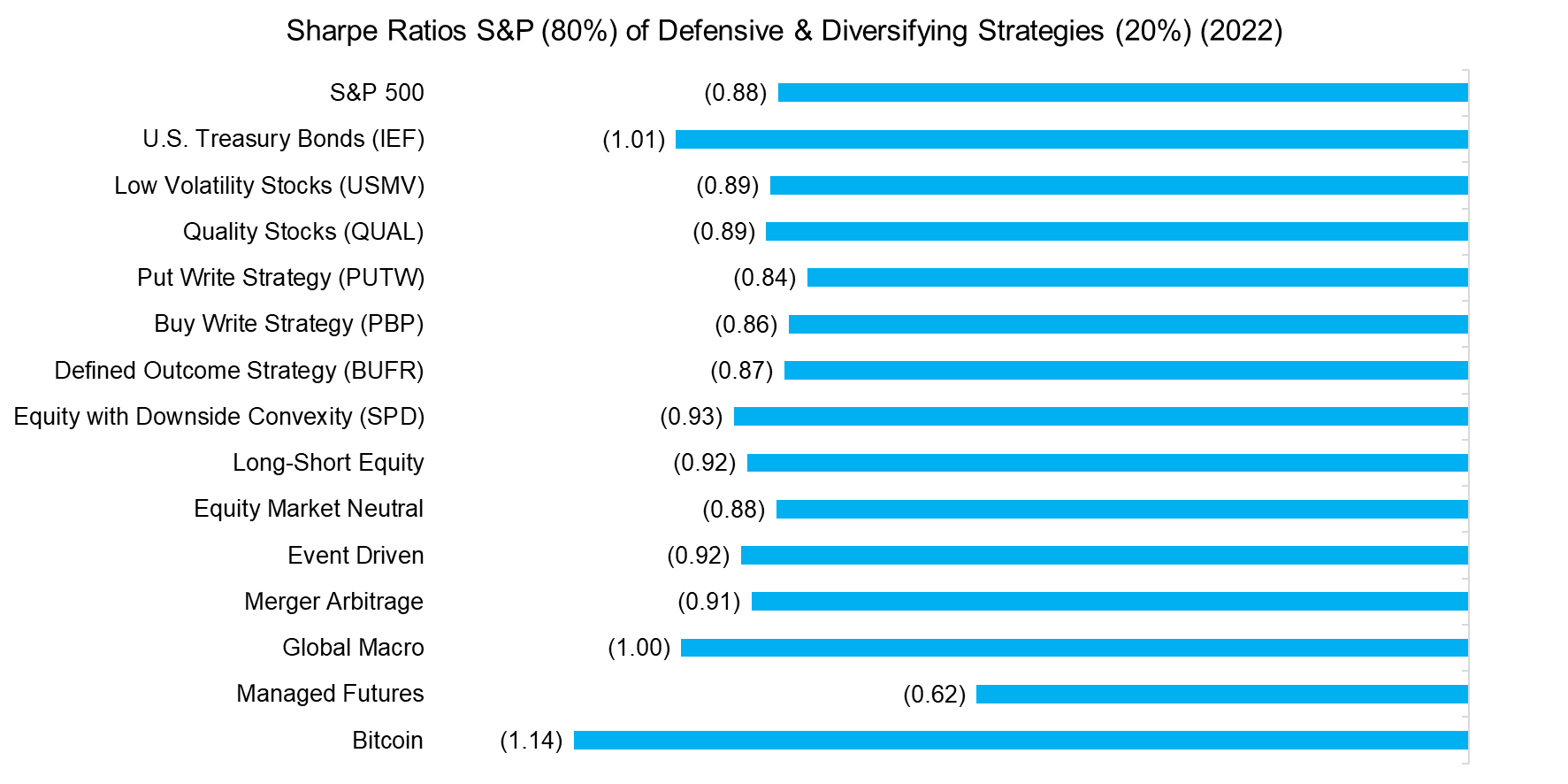

As a next step in the analysis, we evaluate the diversification benefit of adding a 20% allocation to any of these strategies for a portfolio comprised of only U.S. stocks. We calculate the Sharpe ratios and observe that only Managed Futures managed to increase the risk-adjusted returns meaningfully.

Perhaps most surprising is that bonds failed to provide diversification benefits and led to the second-worst Sharpe ratio after Bitcoin. The poor performance of bonds can be attributed to the central banks raising interest rates to battle inflation. However, given that most investors hold portfolios that are basically comprised of equities and bonds, this has made 2022 an especially challenging year.

Source: FactorResearch

We also calculate the maximum drawdown when including a 20% allocation to defensive and diversifying strategies. We observe that almost any strategy, except for Bitcoin, would have decreased the maximum drawdown of the S&P 500 to less than 23% in year-to-date 2022.

However, most of these decreases were marginal, except for Managed Futures, where the maximum drawdown was reduced to 15%.

Source: FactorResearch

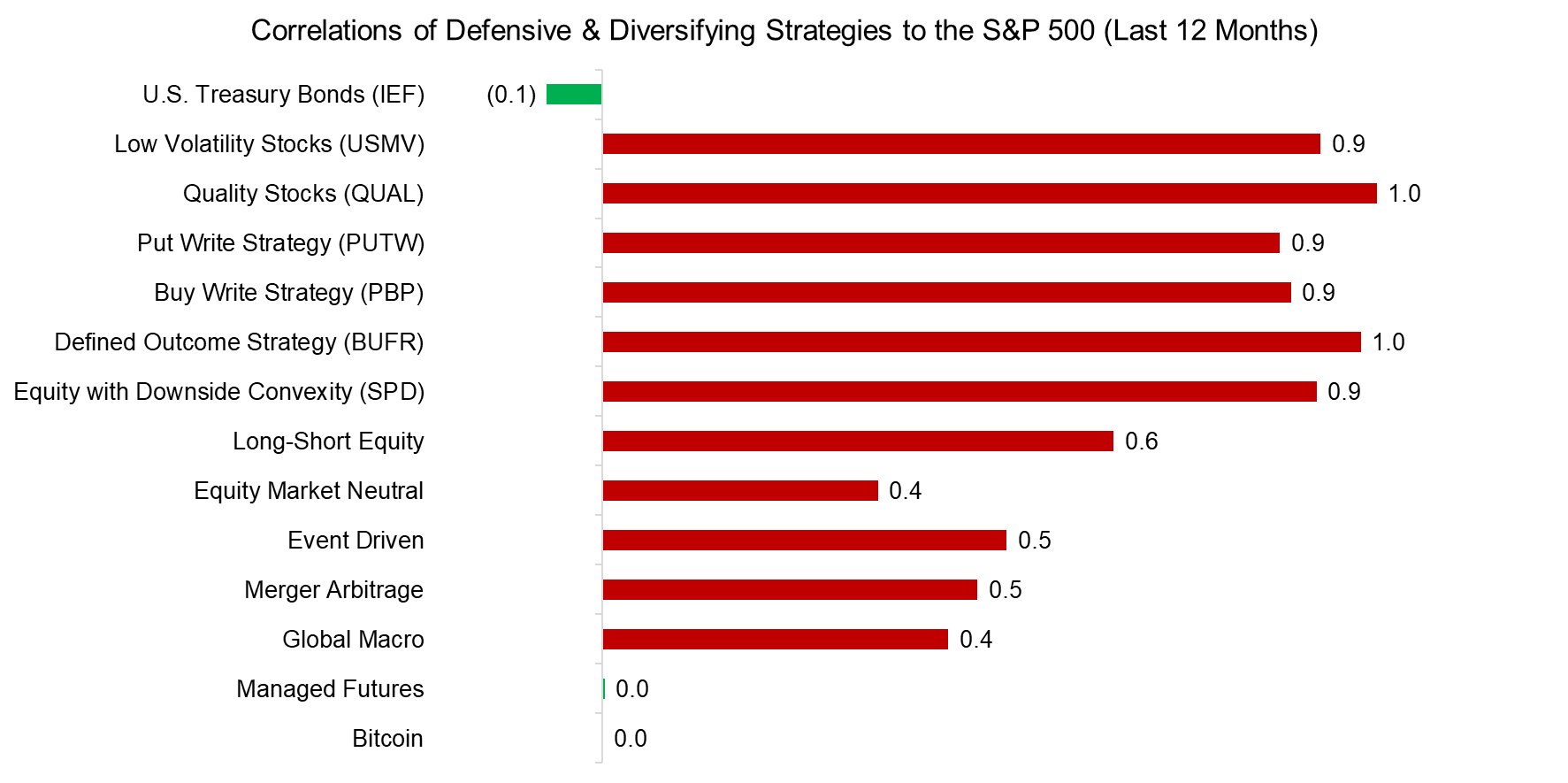

Finally, we calculate the correlations of the various strategies to the S&P 500. We observe that over the last 12 months all defensive strategies had correlations above 0.9, which implies limited diversification benefits. Given this, investors should regard these as replacements for core equity rather than complementary positions.

Some hedge fund strategies like Long-Short Equity or Event Driven are expected to be moderately positively correlated to the stock market, but this does not hold for Equity Market Neutral, Merger Arbitrage, or Global Macro. The correlation should be approximately zero, but given that it is 0.5 on average, indicates that these strategies represent watered-down equity exposure. The only strategies that exhibited low to negative correlations are U.S. Treasury Bonds, Managed Futures, and Bitcoin.

Source: FactorResearch

FURTHER THOUGHTS

Similar to 2022, most defensive and diversifying strategies failed to provide investors with diversification benefits during the global financial crisis in 2008. One of the few strategies that performed well then was Managed Futures, which is just trend following across asset classes, regardless of being long or short. Given the positive and uncorrelated returns, it quickly gained popularity with investors.

However, in the decade since then Managed Futures generated returns that disappointed most investors, and the assets under management have stalled at around $300 billion. 2022 seems like the year of redemption for Managed Futures, which is benefitting from long positions on commodities like oil and short positions like JPY / USD. Let the trend be your friend, again.

RELATED RESEARCH

Building a Diversified Portfolio for the Long-Term – Part II

Managed Futures: Fast & Furious vs Slow & Steady

Hedging via Managed Futures Liquid Alts

60/40 Portfolios Without Bonds

A Horse Race of Liquid Alternatives

Liquid Alternatives: Alternative Enough?

Hedge Fund ETFs

Market Neutral Funds: Powered by Beta?

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.