Defensive & Diversifying Strategies: What Has Worked in 2020?

Everyone’s true colors show eventually

June 2020. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Defensive smart beta strategies like Low Volatility did not offer much capital protection in 2020

- Long-short multi-factor investing generated negative returns, but still offered diversification benefits

- Managed futures finally found their redemption given positive & uncorrelated returns

INTRODUCTION

“The best defense is a good offense” is frequently quoted in the military (George Washington), sports (Vince Lombardi), games (Risk, Settlers of Catan), as well as in business (ask any entrepreneur). Given the high valuations of stocks and low bonds yields in the US, which implies low expected returns for both asset classes, it might indeed be argued that “the best offense is a good defense” for the coming decade.

However, constructing a defensive portfolio is easier said than done. Let us start with the definition of defensive. A defensive long-only strategy is one that allows investors to achieve index-like returns with less volatility. Additionally, many defensive products highlight their ability to experience smaller drawdowns than their non-defensive counterparts.

Traditionally, bonds were the go-to defensive instrument, however, although they still constitute a large share of investors’ portfolios, they have lost much of their value in asset allocation due to lower or negative expected returns. Alternatives like private equity or real estate are far less alternative than commonly marketed as both require economic expansion to generate positive returns, similar to equities.

Many investors are currently considering low-risk and high-quality stocks within their equity allocation given the opaque and gloomy outlook of the global economy caused by COVID-19. Some venture further and seek uncorrelated strategies in the hedge fund universe.

Fortunately, stock market crashes are rare. Unfortunately, therefore there are few data points in history for studying how well certain investment strategies have protected capital. The stock market crash in March 2020 contributes some further evidence (read Black Swans, Major Events & Factor Returns).

In this short research note, we will evaluate the year-to-date performance and benefits of selected defensive and diversifying strategies.

DEFINING DEFENSIVE & DIVERSIFYING STRATEGIES

We will focus exclusively on strategies in the US that provide daily liquidity, are available to all investors, either as mutual funds or ETFs, and include long-only as well as long-short strategies. Furthermore, we constrain ourselves to strategies that are supported by academic research, which reduces the universe dramatically to the following:

- Multi-factor long-short investing: Beta-neutral long-short portfolios, which provide exposure to a variety of factors like Value, Momentum, or Quality.

- Low Volatility smart beta: A long-only portfolio of low-risk stocks.

- Quality smart beta: A long-only portfolio of high-quality stocks, which are typically defined as companies with low leverage and high profit margins.

- PutWrite strategy: Employs a covered call approach that buys the S&P 500 and sells at-the-money calls on the index.

- BuyWrite strategy: Sells at-the-money S&P 500 puts and invests the cash in short-term Treasuries.

- Managed Futures: Trend-following across all asset classes, which includes long and short positions in futures (read Hedging via Managed Futures Liquid Alts).

Only two of these strategies, multi-factor long-short investing and managed futures, can be considered diversifying strategies as they feature low correlations to equities on average. The other four are more appropriately labeled as defensive strategies.

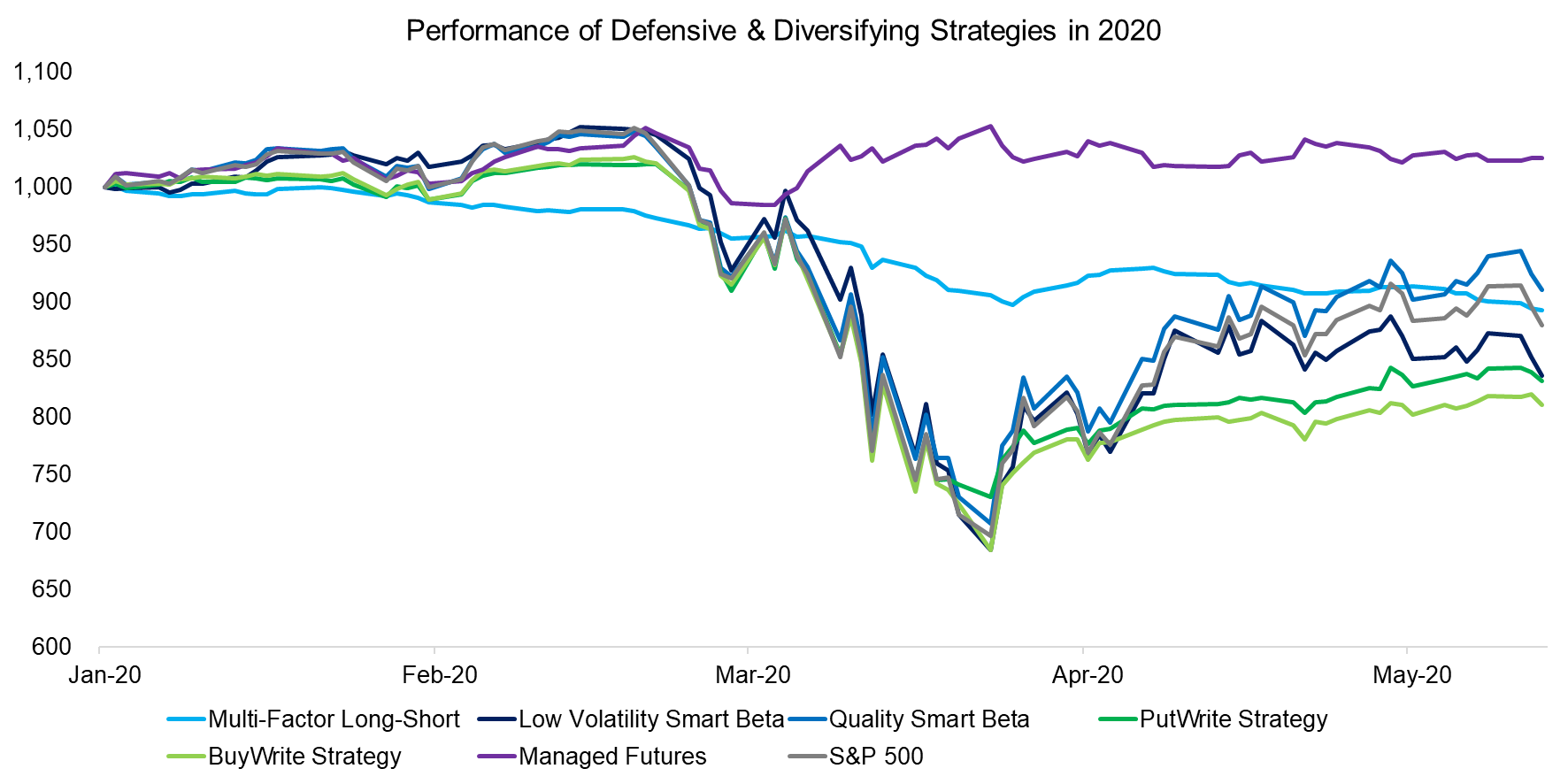

We observe that year-to-date in 2020 only managed futures generated positive returns. The performance of multi-factor long-short investing was consistently negative since the beginning of the year, which is primarily explained by the poor performance of the Value factor, which is a core component of these portfolios. All defensive strategies performed similarly to the S&P 500.

Source: FactorResearch

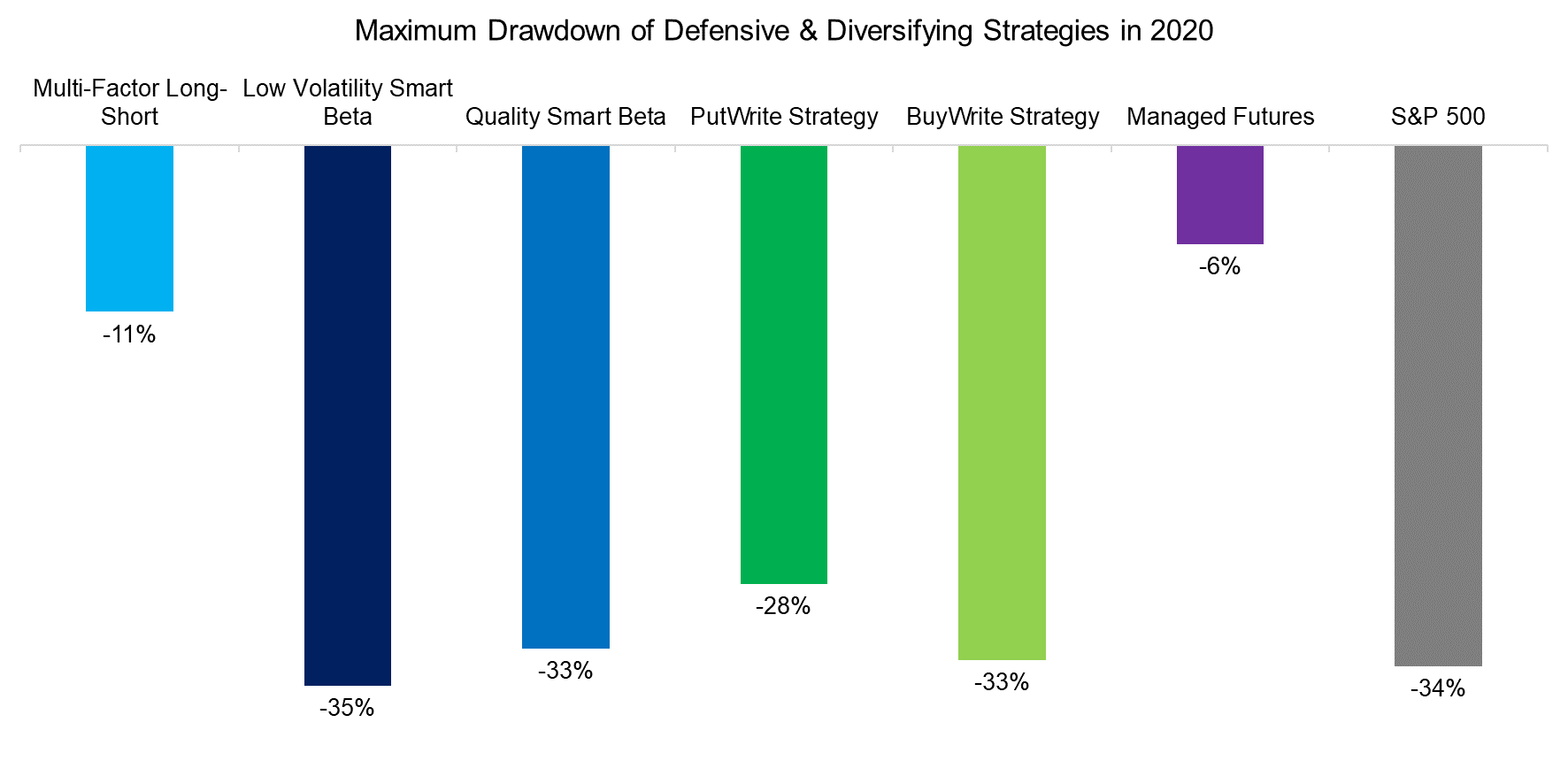

The maximum drawdown year-to-date in the S&P 500 was reached in late March 2020 before stock markets globally recovered fuelled by fiscal and monetary stimuli. Diversifying strategies performed significantly better than defensive ones, which is to be expected as the latter are long-only portfolios.

Low Volatility, particularly, disappointed investors in 2020 as low-risk stocks crashed as much as other stocks due in no small part to beta compression. Part of the heightened expectations surrounding its performance stemmed from the lower maximum drawdown it experienced during the global financial crisis in 2008, when compared to the index. This performance, which many investors perceived as a free lunch, explains its popularity thereafter.

Source: FactorResearch

DEFENSIVE VS DIVERSIFYING STRATEGIES

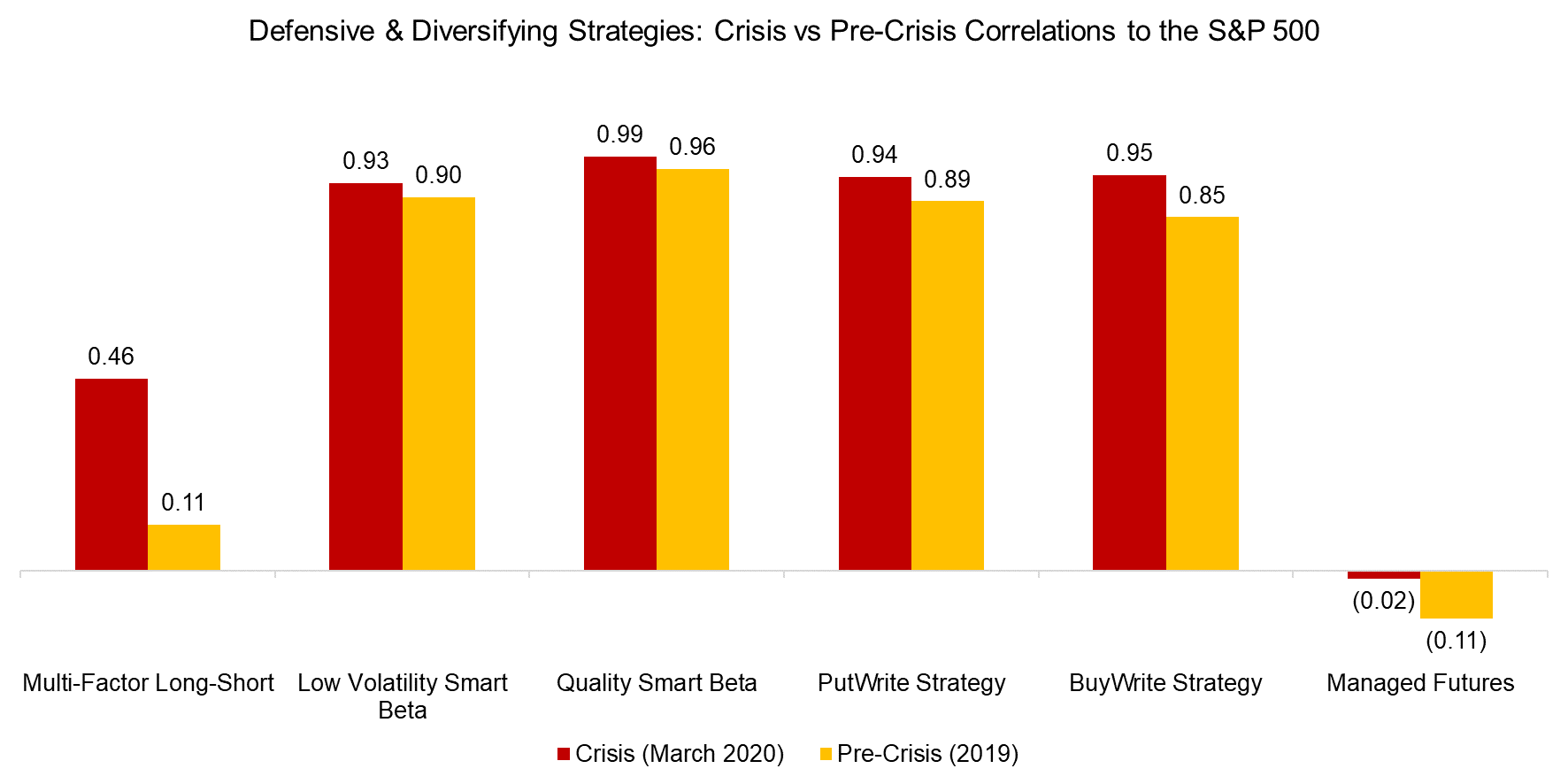

When markets crash, correlations within and between all asset classes tend to spike. Many strategies that previously seemed uncorrelated, fail to provide investors with the desired diversification benefits exactly when most needed. Calculating the correlations to the S&P 500, highlights that the defensive strategies, which are all long-only portfolios, were and are by design highly correlated to the stock market.

Long-short multi-factor portfolios are constructed beta-neutral, which implies lower correlations to equities on average. In March 2020, however, the correlation increased significantly, which is likely explained by some stocks falling more than others, e.g. cheap retailers versus expensive technology stocks. Portfolios do not typically get rebalanced on a daily basis and frequently pick up beta when markets are volatile.

In contrast, the correlation of managed futures became more negative, generating large diversification benefits. Managed futures became popular after 2009 as the strategy provided crisis alpha, but generated flattish returns since then, which made it challenging to hold an allocation to these managers. COVID-19 may be the redemption for the managed futures industry and investors will likely flock to the strategy again.

Source: FactorResearch

ADDING DEFENSIVE & DIVERSIFYING STRATEGIES TO A PORTFOLIO

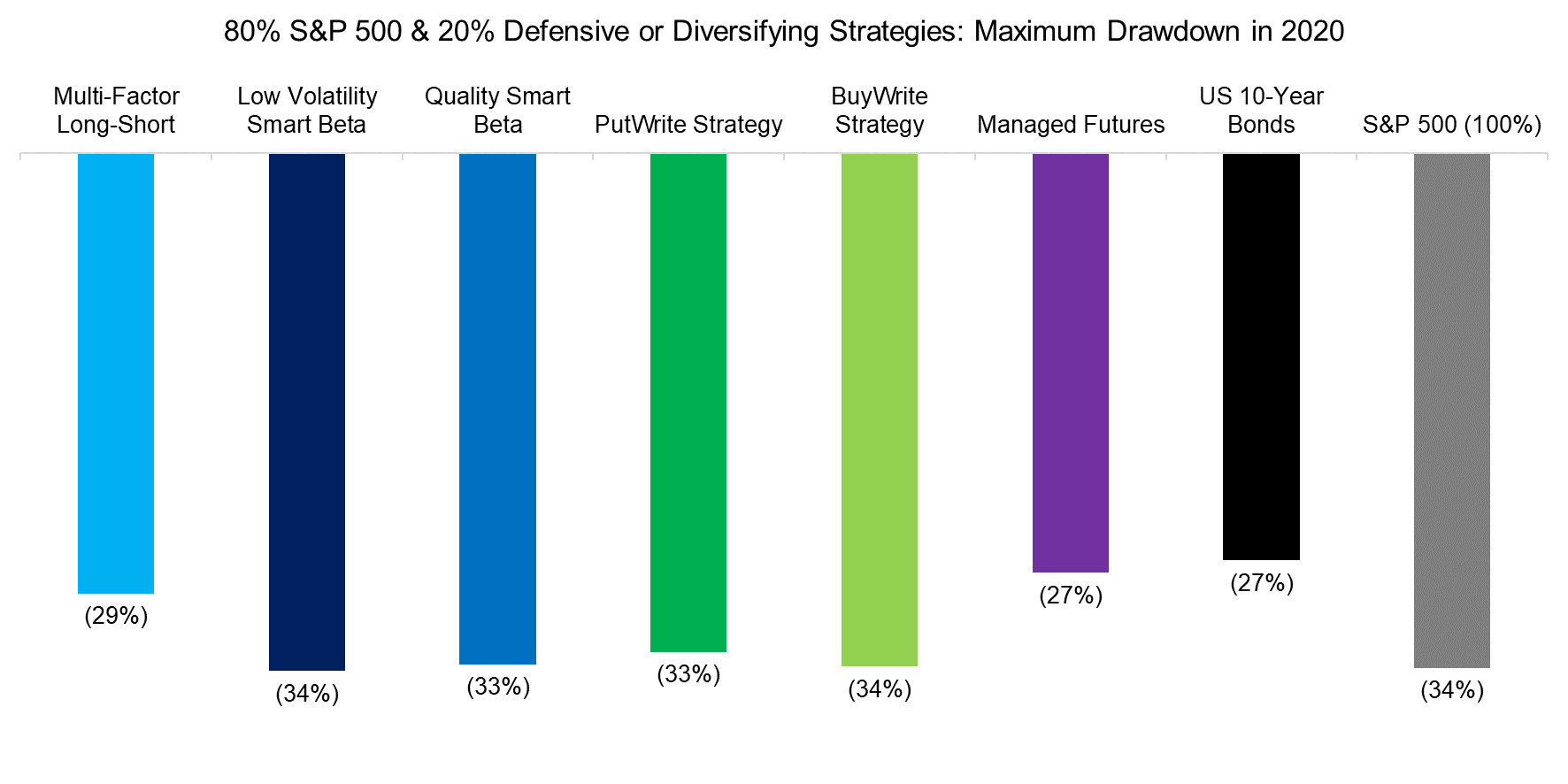

Finally, we simulate how much a 20% allocation to defensive or diversifying strategies would have reduced the drawdown of an all equities portfolio. Defensive strategies provided almost no risk reduction, which is a reflection of their high correlations to the stock market. In contrast, diversifying strategies significantly reduced the maximum drawdown.

It is interesting to note that the multi-factor long-short portfolio, despite generating negative returns in year-to-date 2020, still provided diversification benefits. Furthermore, we also show results for a 20% allocation to US 10-year government bonds, i.e. the traditional diversifier, which would not have been more effective in risk reduction than managed futures.

Source: FactorResearch

FURTHER THOUGHTS

Similar to products from Microsoft, no investment strategy works as consistently as expected. Low Volatility disappointed in 2020 given a failure to reduce risk, however, it does not necessarily mean that the strategy will not provide better risk-adjusted returns in a future stock market crash.

However, investors should recognize that baskets of low-risk or high-quality stocks are long-only strategies that can not defy the gravitational pull of the stock markets, i.e. beta exposures matter a lot.

Long-short multi-factor investing as well as managed futures are thoroughly backed by academic research and have become available as low-cost mutual funds and ETFs. Their recent performance in 2020, plus a growing body of academic evidence in favor with few arguments against, support their inclusion in asset allocation, especially in a world where bonds have lost much of their appeal as traditional diversifiers.

RELATED RESEARCH

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.