Digital Asset ETFs: Not Crypto Enough?

Measuring the cryptocurrency exposure of digital asset ETFs

July 2021. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Digital asset ETFs have outperformed tech stocks in recent years

- However, they provide no exposure to cryptocurrencies

- Their returns are explained by market beta and equity factors

INTRODUCTION

Cathie Wood, the founder and CEO of Ark Invest, an ETF manager, is the latest entrant to launching a Bitcoin ETF in the US. The Winklevoss twins of Facebook fame have been trying this for years, but have been turned down by the SEC each time. Oddly enough, this has not deterred Ms. Wood or other firms, and the SEC has received at least six further Bitcoin ETF applications waiting to be reviewed.

The lack of easy access to Bitcoin via an ETF in the US has created opportunities for others. The Grayscale Bitcoin Trust (GBTC) is a listed trust that tracks Bitcoin and has more than $20 billion of assets under management. Other asset managers have launched ETFs that invest in companies that seem involved in cryptocurrencies.

However, just because a company operates in the blockchain industry does not mean it provides exposure to cryptocurrencies. In a similar fashion, there is a difference between gold miners and the gold price, or master limited partnerships (MLPs) and the oil price.

In this research note, we will investigate the exposure of digital asset ETFs to cryptocurrencies.

THE RISE OF CRYPTOCURRENCIES

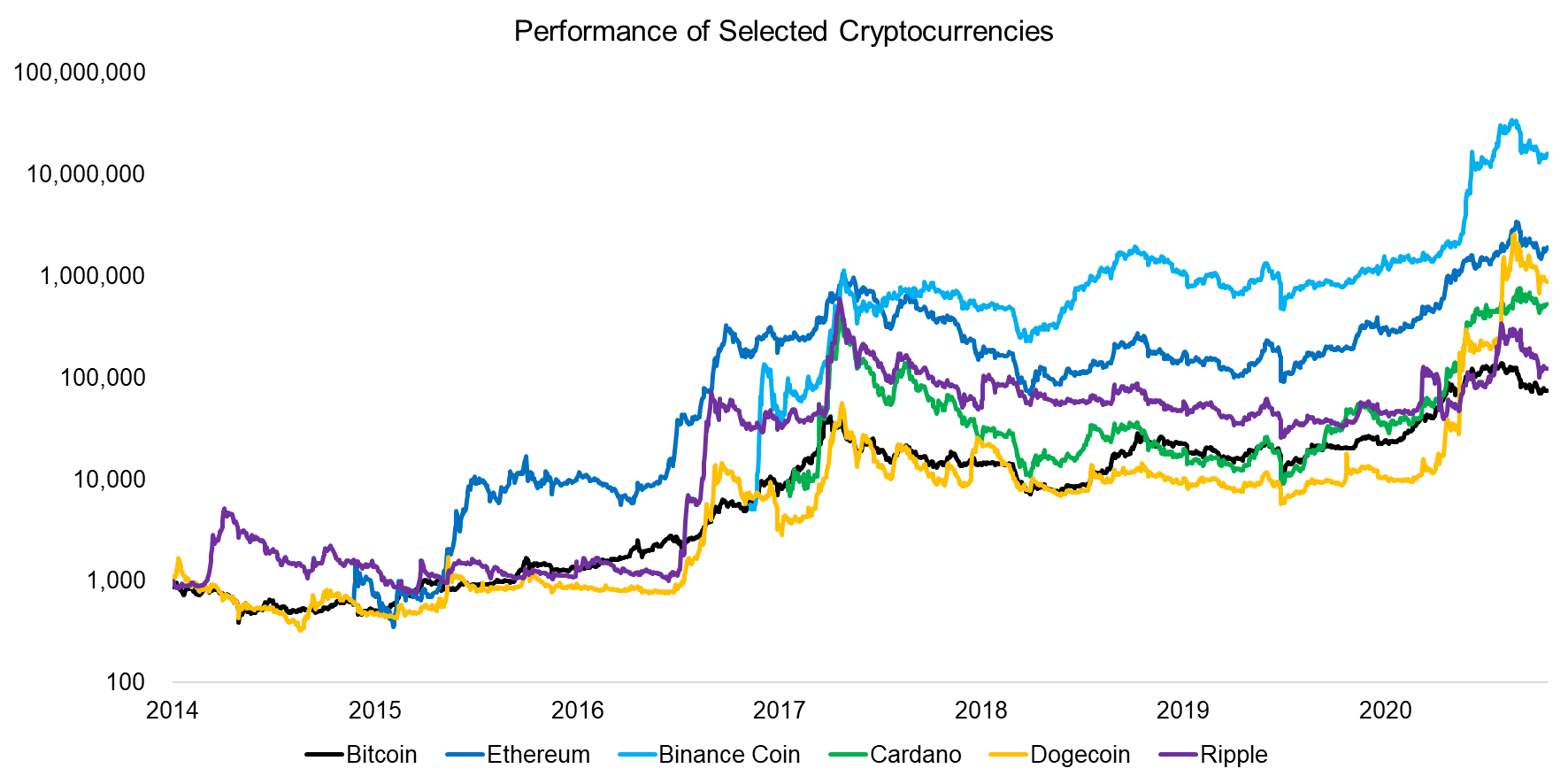

Although an investment in cryptocurrencies is usually justified as a hedge against the inflation that plague fiat currencies or general disdain for the traditional financial system, most investors are likely simply performance chasing. The returns of the S&P seem rather unexciting compared to Bitcoin’s CAGR of roughly 100% since 2014. It’s tough to resist such a siren song (read Quant Strategies in the Cryptocurrency Space).

However, the price of cryptocurrencies is anything but stable and there have been multiple 50% drawdowns in recent years. Bitcoin and other coins become popular with retail investors in 2017 after a meteoric rise, but then cryptocurrencies crashed and went into what is now called the cryptowinter. In 2020, another bull market started that took many to new record highs and started capturing the interest of a broader investor audience.

Source: FactorResearch

Countries and regulators across the globe have divergent perspectives and policies for cryptocurrencies. China started banning mining while El Salvador has made Bitcoin a legal tender in June of 2021. Most banks and asset managers have avoided cryptocurrencies in the 2017 boom, but have embraced them in the most recent boom simply for commercial reasons.

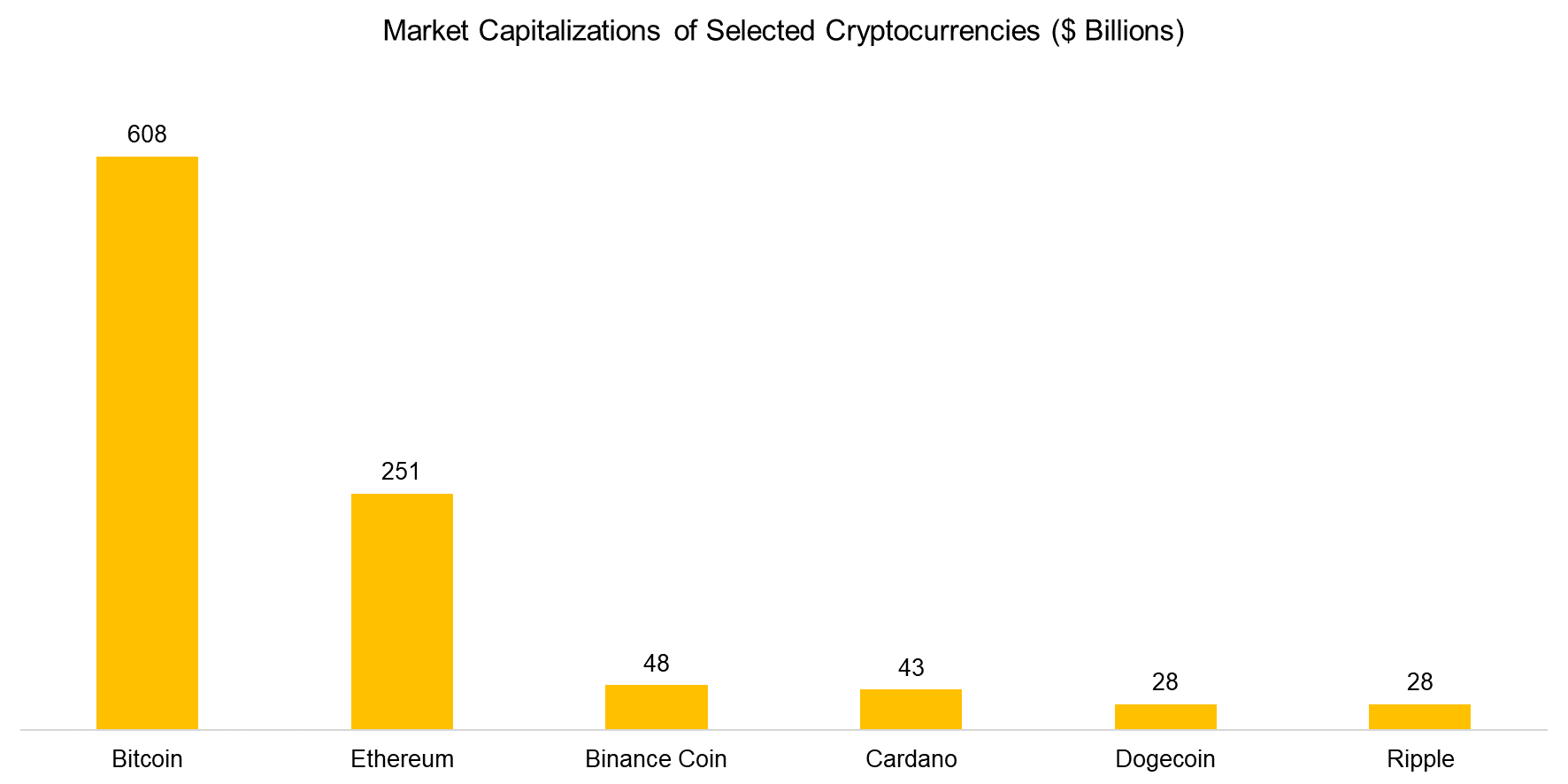

The combined market capitalization of cryptocurrencies has breached one trillion dollars, where plenty of money can be made from commissions, financing, and asset management fees. Given that primarily retail investors are investing in cryptocurrencies, it can be more lucrative than dealing with fee-conscious institutional investors in traditional markets that are brutally competitive.

Source: FactorResearch

PERFORMANCE OF DIGITAL ASSET ETFS

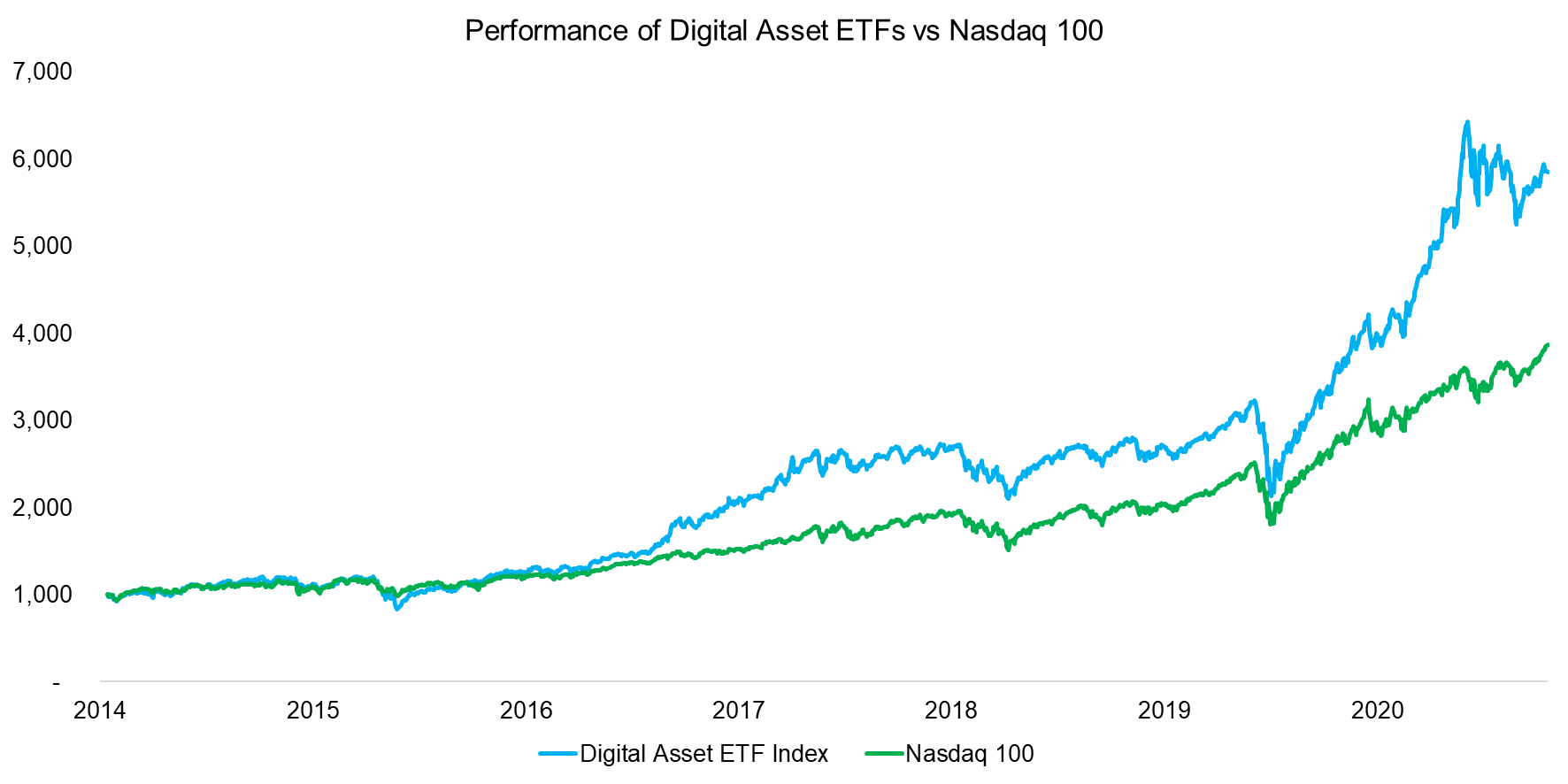

We select all ETFs trading in the US that focus on the blockchain industry, which is less than 10 securities. These have a combined market capitalization of approximately $6 billion, although 80% of these assets are managed by two ETFs. The average management fee is 76 basis points, which is expensive compared to benchmark or sector ETFs that typically charge less than half of this.

Next, we create an equal-weighted index out of the ETFs and compare its performance to that of Nasdaq 100. We observe a significant outperformance since 2017, which coincidences with the first significant bull market in cryptocurrencies.

Source: FactorResearch

CRYPTOCURRENCY EXPOSURE OF DIGITAL ASSET ETFS

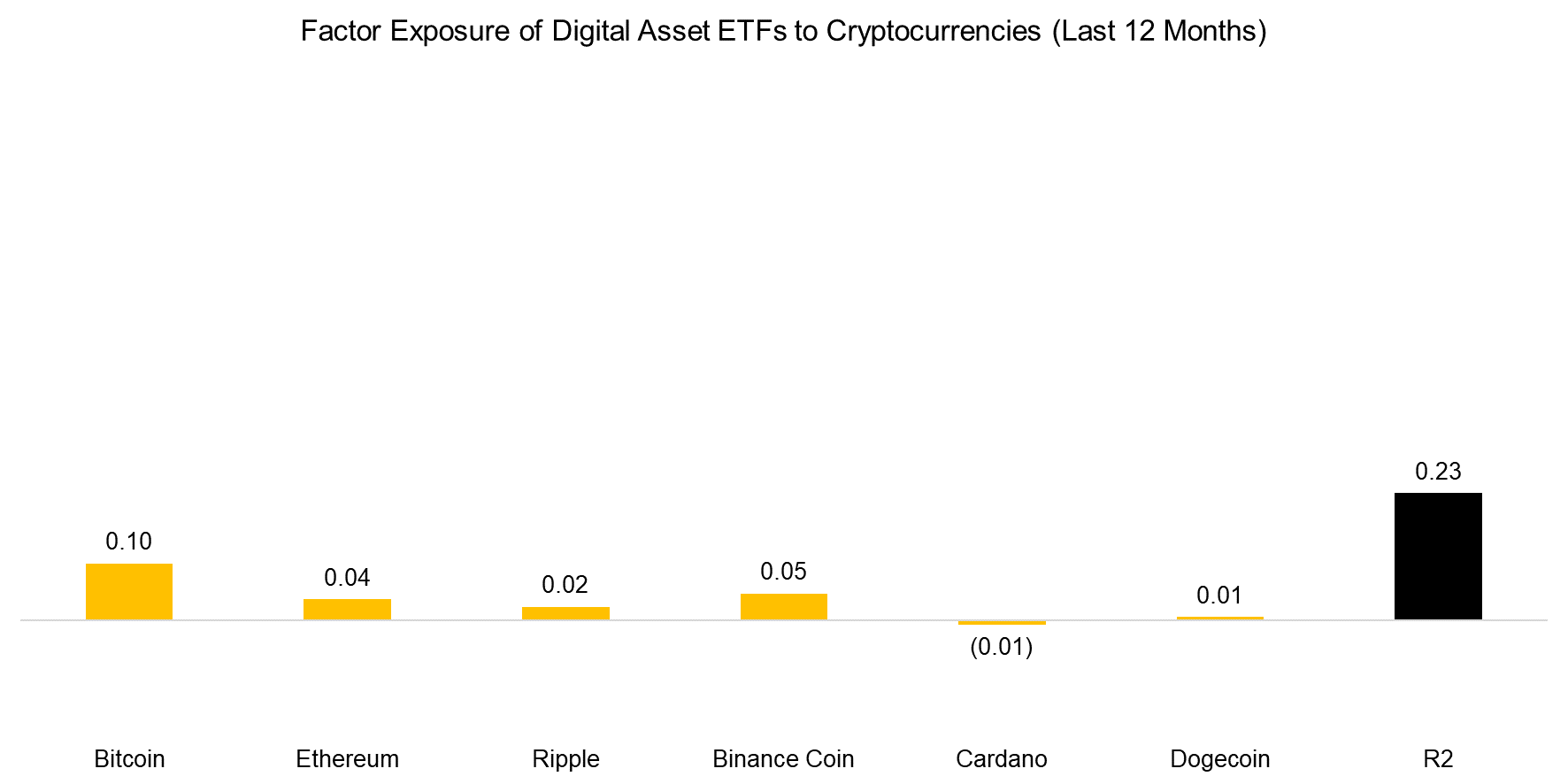

Some investors might assume that the strong performance of the digital asset ETFs is explained by their exposure to cryptocurrencies. Although one of the ETFs has direct exposure to Bitcoin via the Grayscale Bitcoin Trust, a factor exposure analysis reveals that on average the exposure to cryptocurrencies was zero over the last 12 months. Many of the constituents of these ETFs like Paypal or Square have only minor commercial exposure to cryptocurrencies.

This also becomes apparent when comparing the performance of an equal-weighted portfolio of the six cryptocurrencies highlighter earlier to that of the digital asset ETFs. The former increased by more than 2000% over the last year, largely driven by Dogecoin, compared to a mere 64% for the latter.

Source: FactorResearch

Given that cryptocurrencies do not explain the performance of the digital asset ETFs, what else might?

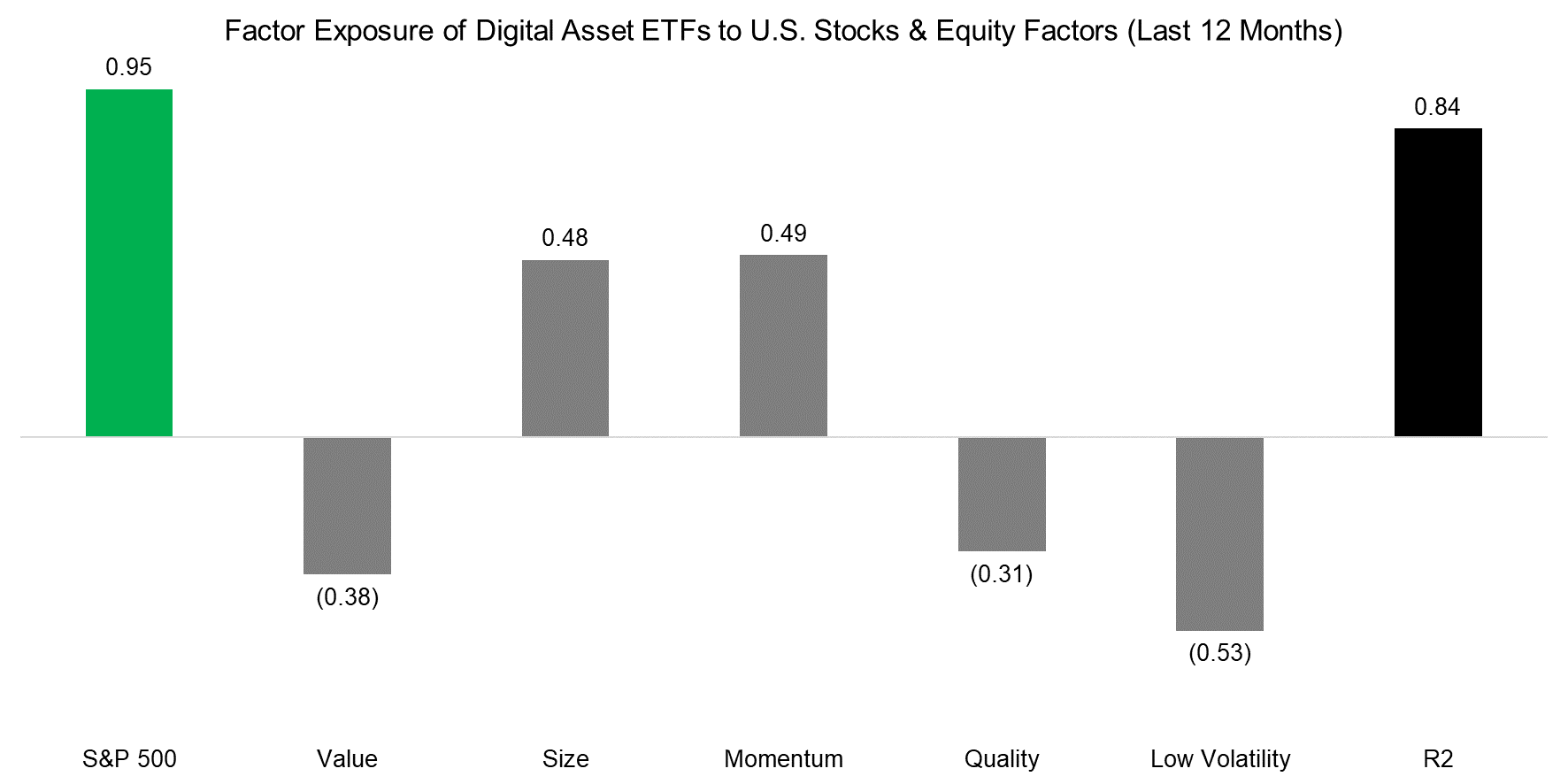

We run a regression analysis using the stock market and common equity factors, which highlights that most of the returns can be attributed to simple stock market exposure.

There is also positive exposure to the Momentum and Size factors, which is expected given that the ETF constituents largely represent emerging technology companies. These firms trade at expensive valuations, tend to be unprofitable, and have volatile share prices, which is reflected in negative exposure to Value, Quality, and Low Volatility.

Source: FactorResearch

FURTHER THOUGHTS

Investing in digital asset ETFs does not provide investors with exposure to cryptocurrencies. Based on this analysis, it should be categorized as a small-cap growth strategy or more broadly thematic investing. Both categorizations represent risk for investors.

Small-cap growth, in contrast to small-cap value, has a long track record of generating negative excess returns. Thematic investing represents buying into seductive stories that are supplemented with attractive returns when valuations have reached high levels, which typically underperform thereafter (read Thematic Investing: Thematically Wrong?).

Fortunately, it is continuously becoming easier and cheaper for US-based investors to hold cryptocurrencies directly at crypto exchanges or traditional payment providers. Furthermore, there are already Bitcoin ETFs trading in Canada and ETPs in Europe, in addition to vehicles like the Grayscale Bitcoin Trust that are available to US investors. No need to buy fools’ gold.

RELATED RESEARCH

Thematic Investing: Thematically Wrong?

Exploring Defined Outcome ETFs

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.