Diversifying via Time Zones

What happens when you buy a stock from a market that is closed?

June 2024. Reading Time: 10 Minutes. Author: Nicolas Rabener.

SUMMARY

- Funds providing the same exposures trade similarly, regardless of where they trade

- On paper, investors can achieve benefits by diversifying via time zones

- In reality, this represents a form of volatility laundering like private equity

INTRODUCTION

On the 24th of January 2023, Hindenburg Research, an activist investor, published a research report on the Adani Group that accused the Indian conglomerate of stock manipulation and accounting fraud. Hindenburg Research entered short positions in U.S.-traded bonds and non-Indian-traded derivatives linked to the Adani Group and its affiliates, hoping to profit from its research report. Although the stock of Adani Enterprises Limited plummeted by more than 50% in the following weeks, it recovered substantially in the remainder of the year. It did not lead to the demise of the Adani Group.

One of the interesting aspects of this event is the difference in time zones as there is no overlap in the trading hours between the U.S. and India stock exchanges. There are ETFs trading in U.S. that own Indian stocks, but how do these react to such news? Do the ETFs decrease in value to reflect the latest news, or trade unchanged until the next day when the news will be reflected in the stock price of Adani Enterprises Limited that is traded in on the National Stock Exchange of India in Mumbai?

The impact of time zones for investors can be mind-boggling, which we will explore in this research article.

BUYING INDIAN STOCKS IN DIFFERENT TIME ZONES

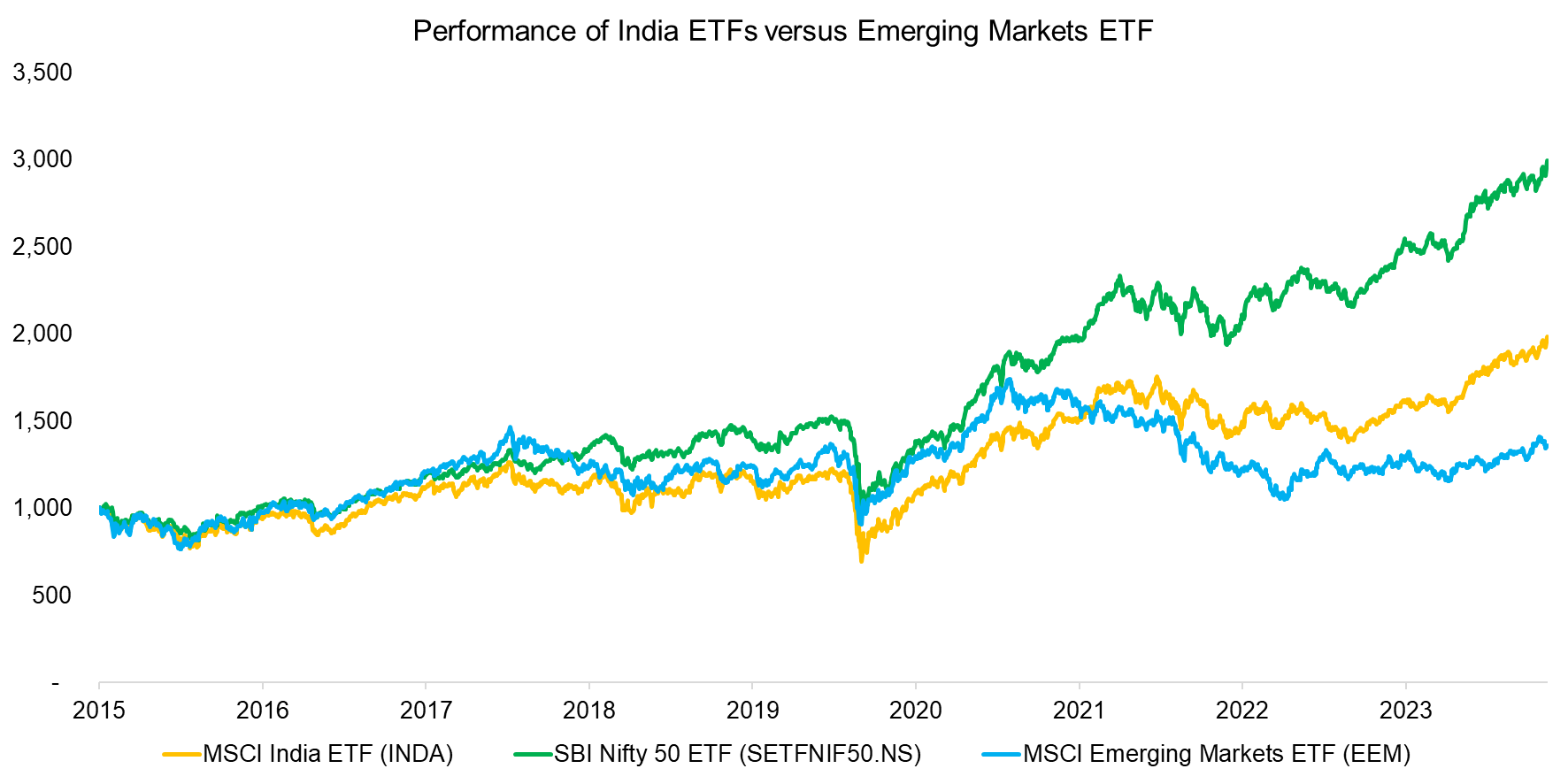

In this analysis, we use two ETFs providing exposure to the Indian stock market: the MSCI India ETF (INDA), which trades in U.S., and the SBI Nifty 50 ETF (SETNIF50.NS), which trades in India.

We benchmark these to the MSCI Emerging Markets ETF (EEM), which also trades in the U.S., and observe that the Indian ETFs exhibited similar trends as the broader emerging markets between 2015 and 2021, but outperformed thereafter, which can partially be attributed to the weak performance of the Chinese stock market that currently dominates EEM with a 27% allocation.

Source: Finominal

INDIA ETF TRADING IN INDIA VERSUS THE U.S.

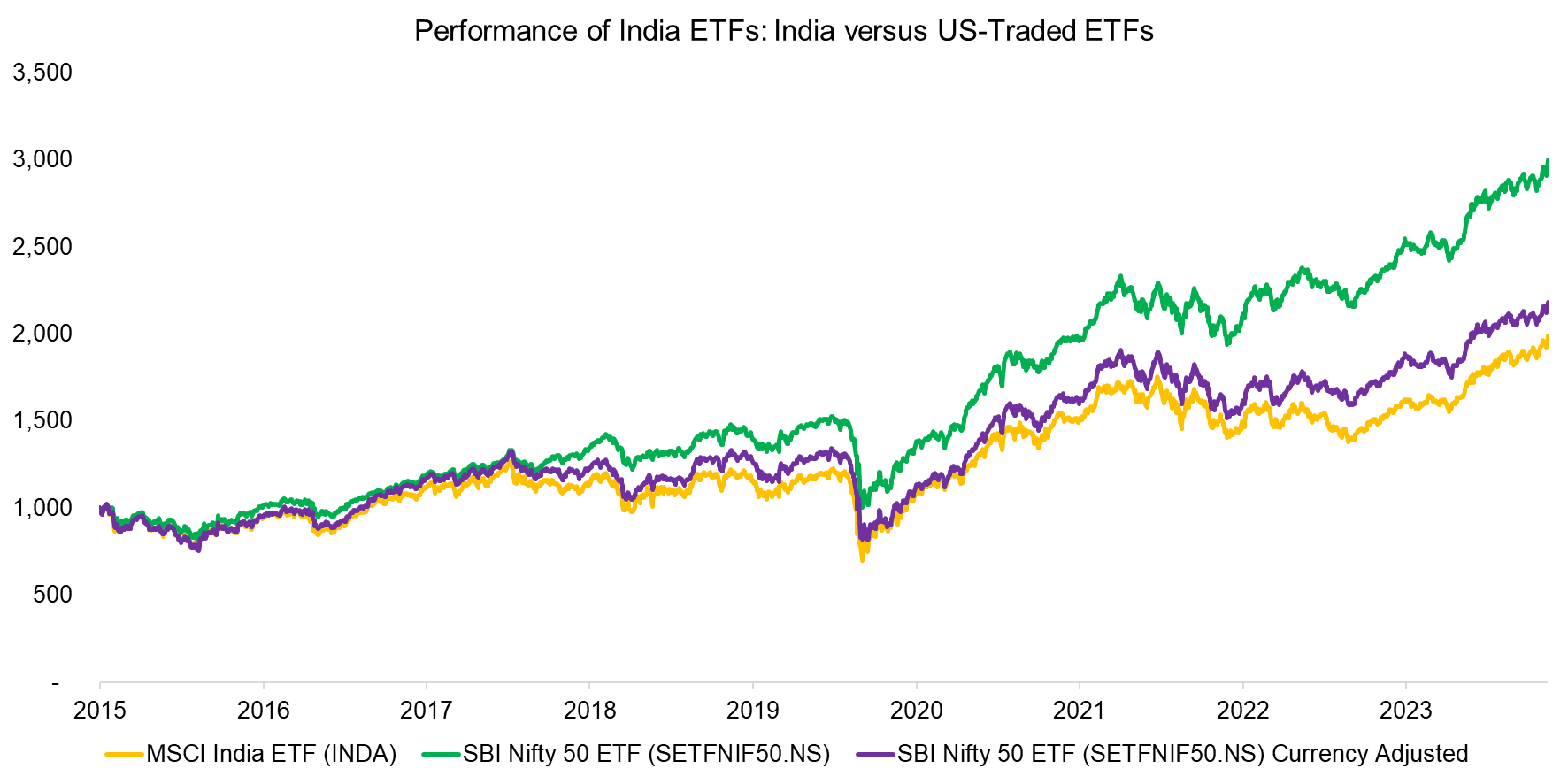

However, we also observe that the SBI Nifty 50 ETF generated a significantly higher return than the MSCI India ETF. The former is more concentrated with 50 stocks compared to approximately 150 for the latter. Although this may explain some of the difference in returns, there is another better explanation: currency depreciation.

The MSCI India ETF trades in U.S. Dollar (USD) in the U.S. while the SBI Nifty 50 ETF trades in Indian Rupees (INR) in India. The INR has been falling steadily in value to the USD, which is perhaps explained by the higher inflation in India. Given this, we can adjust the returns of the SBI Nifty 50 ETF for the depreciating INR, which significantly narrows the performance gap.

Source: Finominal

CORRELATION ANALYSIS

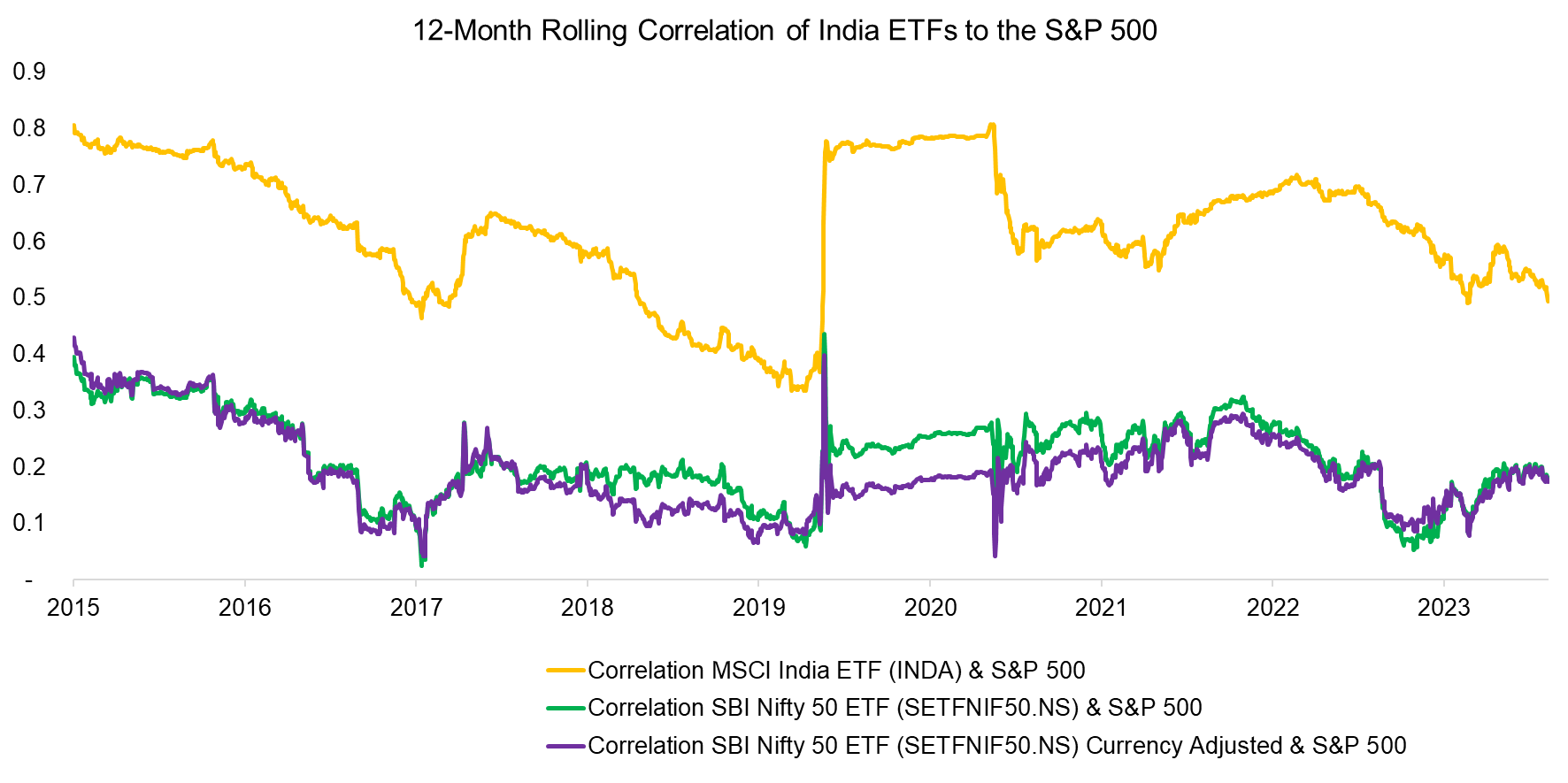

Both indices provide the same exposures to Indian equities, but only the SBI Nifty 50 ETF trades when the Indian stock market is open. So how does the MSCI India ETF trade given that the underlying stocks are not traded?

Practically the ETF market makers will estimate the portfolio’s value and reflect any major events that occur during U.S. trading hours, even if the underlying Indian stocks are not trading actively. Naturally, this means that the MSCI India ETF is more correlated to the S&P 500 than the SBI Nifty 50 ETF. The average correlation of the MSCI India ETF to the S&P 500 was 0.66 in the period from 2015 to 2024, compared to 0.24 for the SBI Nifty 50 ETF.

Source: Finominal

DIVERSIFICATION BENEFITS FROM TIME ZONES

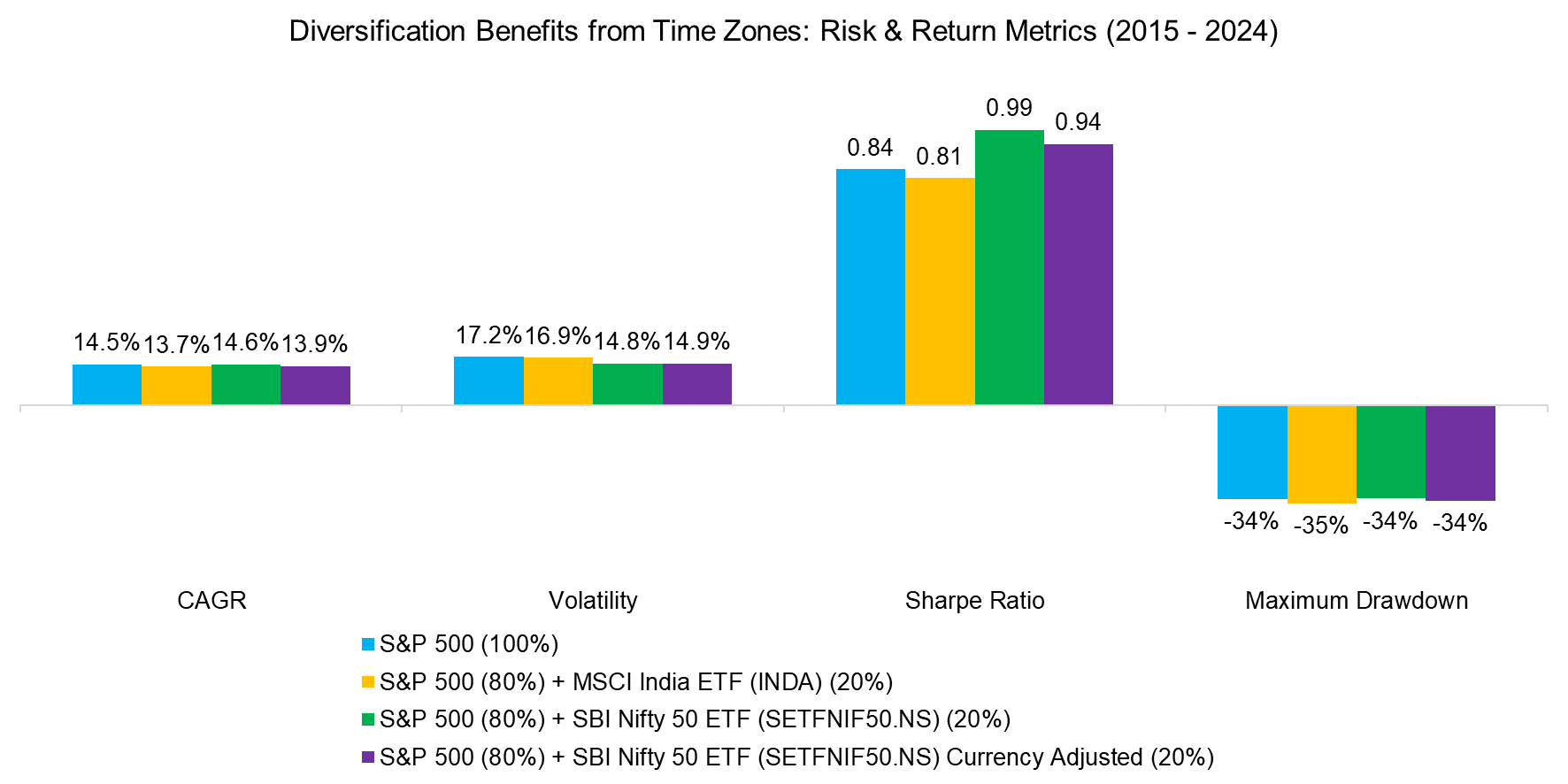

Given the low correlation of the SBI Nifty 50 ETF to the S&P 500, it could be argued that this provides much greater diversification benefits for U.S.-based investors than the MSCI India ETF.

We simulate adding a 20% allocation of either India ETF to a portfolio comprised exclusively of the S&P 500 and observe that the SBI Nifty 50 ETF generated significant diversification benefits. The CAGRs of the currency-adjusted version did not increase, but the volatility decreased substantially, leading to an increase in the Sharpe ratios in the period between 2015 and 2024.

Source: Finominal

FURTHER THOUGHTS

Should investors seek diversification via time zones?

Naturally not as this is nonsense. Investors might get a higher Sharpe ratio on paper, but the economic exposure is the same, regardless of whether they are buying the India-focused ETFs in the U.S. or India.

Unfortunately, this nonsense is exactly what is being sold by private equity firms, i.e. that private equity funds are superior to public equities given their smooth return profiles, which are only smooth as valuations are based on mark-to-model rather than mark-to-market. Stated differently, they are operating in their own time zone.

RELATED RESEARCH

The Case Against Private Markets

Have Stock Markets Changed?

Private Equity: Fooling Some People All the Time?

Private Equity: The Emperor has No Clothes

Myth-Busting: ETFs Are Eating the World

Mean-Reversion on Equity Index Level

ABOUT THE AUTHOR

Nicolas Rabener is the CEO & Founder of Finominal, which empowers professional investors with data, technology, and research insights to improve their investment outcomes. Previously he created Jackdaw Capital, an award-winning quantitative hedge fund. Before that Nicolas worked at GIC and Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (Ironman & 100km Ultramarathon).

Connect with me on LinkedIn or X.